Escolar Documentos

Profissional Documentos

Cultura Documentos

APES 210:: Conformity With Auditing & Assurance Standards Fact Sheet

Enviado por

VMRO0 notas0% acharam este documento útil (0 voto)

80 visualizações2 páginasCPA

Título original

apes-210

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoCPA

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

80 visualizações2 páginasAPES 210:: Conformity With Auditing & Assurance Standards Fact Sheet

Enviado por

VMROCPA

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 2

APES 210:

Conformity with Auditing & Assurance Standards Fact Sheet

Objective

APES 210 Conformity with Auditing and Assurance Standards (the Standard) sets out mandatory requirements and

guidance for members. Members must comply with auditing and assurance standards when they conduct assurance

assignments or assurance engagements.

Scope and application

APES 210 took effect on 30 September 2008 and was revised in November 2011. It requires members in Australia to

adhere to its mandatory requirements. For members outside of Australia the scope of the Standard must be followed as

long as it does not contravene local laws and/or regulations in the country they are working.

A member in business undertaking work, including honorary work that is within the scope of an assurance engagement, is

deemed to be a member in public practice for the purpose of APES 210. Consequently, members who are in these

circumstances must also comply with auditing and assurance standards when they perform assurance engagements (for

example, audits of a local charity or social club).

Fundamental responsibili ties of members

APES 210 requires members to observe and comply with their public interest obligations when they perform an assurance

assignment or assurance engagement. Members must adhere with the professional obligations established in APES 110

Code of Ethics for Professional Accountants in respect of:

Section 130 - Professional Competence and Due Care

Section 290 - Independence Audit and Review Engagements

Section 291 - Independence Other Assurance Engagements.

Auditing and assurance standards

APES 210 requires members to comply with auditing and assurance standards. The only exception to this requirement is

where legislation or other government authority requires a departure from such standards. In circumstances where a

departure is required, the member is required to disclose that fact in the members report and must not assert compliance

with auditing and assurance standards in the members report.

Auditing and assurance guidance

Members should follow auditing and assurance guidance issued by the AUASB.

Refer to the Standard for information concerning:

definitions.

APES 210:

Conformity with Auditing Fact Sheet

Disclaimer

The above material is only general in nature and not intended to be specific to the readers circumstances. The material does not relieve you of your

obligation, as a member of CPA Australia, to ensure that you comply with professional standards. To keep up-to-date members should visit the APESB

website at apesb.org.au.

Copyright CPA Australia Ltd (CPA Australia) (ABN 64 008 392 452), 2012. All rights reserved. All trade marks and trade names are proprietary to

CPA Australia and must not be downloaded, reproduced or otherwise used without the express consent of CPA Australia.

You may access and display these materials on your computer, monitor or other video display device and make one printed copy of any whole page or

pages for your personal use only. Other than for the purposes of and subject to the conditions prescribed under the Copyright Act 1968 (Cth) (or any

other applicable legislation throughout the world), or as otherwise provided for herein, you may not use these materials in any manner without the prior

written permission of the copyright owner.

CPA Australia and the author have used reasonable care and skill in compiling the content of these materials. However, CPA Australia makes no

warranty as to the accuracy or completeness of any information contained therein nor does CPA Australia accept responsibility for any acts or omissions

in reliance upon these materials. These materials are intended to be a guide only and no part is intended to be advice, whether legal or professional. All

persons are advised to seek professional advice to keep abreast of any legal or other reforms and developments.

To the extent permitted by applicable law, CPA Australia, its employees, agents and consultants exclude all liability for any loss or damage claims and

expenses including but not limited to legal costs, indirect special or consequential loss or damage (including but not limited to, negligence) arising out of

the information in the materials. Where any law prohibits the exclusion of such liability, CPA Australia limits its liability to the resupply of the information.

Issued November 2012

Você também pode gostar

- Wiley GAAP 2019: Interpretation and Application of Generally Accepted Accounting PrinciplesNo EverandWiley GAAP 2019: Interpretation and Application of Generally Accepted Accounting PrinciplesAinda não há avaliações

- APES 220:: Taxation Services Fact SheetDocumento2 páginasAPES 220:: Taxation Services Fact SheetVMROAinda não há avaliações

- APES 310:: Dealing With Client Monies Fact SheetDocumento2 páginasAPES 310:: Dealing With Client Monies Fact SheetVMROAinda não há avaliações

- APES 225:: Valuation Services Fact SheetDocumento2 páginasAPES 225:: Valuation Services Fact SheetVMROAinda não há avaliações

- APES 205:: Conformity With Accounting Standards Fact SheetDocumento2 páginasAPES 205:: Conformity With Accounting Standards Fact SheetVMROAinda não há avaliações

- APES 110:: Code of Ethics For Professional Accountants Fact SheetDocumento2 páginasAPES 110:: Code of Ethics For Professional Accountants Fact SheetVMROAinda não há avaliações

- APES 315:: Compilation of Financial Information Fact SheetDocumento2 páginasAPES 315:: Compilation of Financial Information Fact SheetVMROAinda não há avaliações

- English Code of Ethics and Business ConductDocumento8 páginasEnglish Code of Ethics and Business ConductM DuraiAinda não há avaliações

- Relevant Ethical RequirementsDocumento15 páginasRelevant Ethical RequirementsJerome Luna TarranzaAinda não há avaliações

- IBAZ Code of Professional ConductDocumento26 páginasIBAZ Code of Professional ConductTakunda RusereAinda não há avaliações

- Introduction of Corporate Governance: VisionDocumento5 páginasIntroduction of Corporate Governance: VisionVenu VijayAinda não há avaliações

- 1.1 Objectives of The ReportDocumento19 páginas1.1 Objectives of The Reporttasnim208Ainda não há avaliações

- Psa 250Documento14 páginasPsa 250Ranin, Manilac Melissa SAinda não há avaliações

- Fundamental PrinciplesDocumento6 páginasFundamental PrinciplesJohn Philip De GuzmanAinda não há avaliações

- Accountants and Legal ServicesDocumento20 páginasAccountants and Legal ServicesRadoslawAinda não há avaliações

- APES 325:: Risk Management For Firms Fact SheetDocumento2 páginasAPES 325:: Risk Management For Firms Fact SheetVMROAinda não há avaliações

- Britannia Industries LimitedDocumento18 páginasBritannia Industries LimitedLokesh SatiAinda não há avaliações

- KSOLVES - Terms-and-Condition-for-Appointment-of-Independent-DirectorDocumento3 páginasKSOLVES - Terms-and-Condition-for-Appointment-of-Independent-Directorwekepix890Ainda não há avaliações

- AAT Code of Professional Ethics 2014 - 0Documento47 páginasAAT Code of Professional Ethics 2014 - 0Anjum SattarAinda não há avaliações

- Understanding and Meeting Ethical ExpectationsDocumento30 páginasUnderstanding and Meeting Ethical Expectationsmiss_nobodyAinda não há avaliações

- Ra 9298Documento7 páginasRa 9298Monica Allarrey BalacaniaAinda não há avaliações

- APL Prospectus 20160620Documento100 páginasAPL Prospectus 20160620Anonymous FiAN6MiuAinda não há avaliações

- Amending T 1Documento7 páginasAmending T 1enggAinda não há avaliações

- Abbott Comprehensive Ethics and Compliance ProgramDocumento3 páginasAbbott Comprehensive Ethics and Compliance Programana cuapioAinda não há avaliações

- Abbott Comprehensive Ethics and Compliance ProgramDocumento3 páginasAbbott Comprehensive Ethics and Compliance Programana cuapioAinda não há avaliações

- Britannia: Business Conduct (COBC) For Its Employees. This Handbook Covers The CodeDocumento17 páginasBritannia: Business Conduct (COBC) For Its Employees. This Handbook Covers The CodevkvarshakAinda não há avaliações

- AAT Code of EthicsDocumento56 páginasAAT Code of EthicskbassignmentAinda não há avaliações

- Introduction - What Is AuditingDocumento29 páginasIntroduction - What Is AuditingMoinul HossainAinda não há avaliações

- Sample Audit Engagement Letter June 2015 PDFDocumento9 páginasSample Audit Engagement Letter June 2015 PDFfasdsadsaAinda não há avaliações

- Appointment Letter of Prof Jagmohan Singh RajuDocumento3 páginasAppointment Letter of Prof Jagmohan Singh RajuShanker PatnaikAinda não há avaliações

- Sox PDFDocumento10 páginasSox PDFRajesh ChoudharyAinda não há avaliações

- 1.3 Guidance For Standards I-ViiDocumento39 páginas1.3 Guidance For Standards I-ViiAlvin PhuongAinda não há avaliações

- Principles of Auditing - Chapter - 2Documento33 páginasPrinciples of Auditing - Chapter - 2Wijdan Saleem EdwanAinda não há avaliações

- Single Member LLC Operating Agreement DownloadDocumento4 páginasSingle Member LLC Operating Agreement DownloadEbony PollardAinda não há avaliações

- Code of Conduct FOR Board Members and Senior Management PersonnelDocumento9 páginasCode of Conduct FOR Board Members and Senior Management PersonnelJyothsnaAinda não há avaliações

- Chapter 3 070804Documento5 páginasChapter 3 070804Shahid Nasir MalikAinda não há avaliações

- Isa 250Documento11 páginasIsa 250baabasaam100% (1)

- Financial Planners & Advisers Code of Ethics 2019 Guide: October 2020Documento37 páginasFinancial Planners & Advisers Code of Ethics 2019 Guide: October 2020ollyAinda não há avaliações

- Regulation of The AuditorDocumento20 páginasRegulation of The AuditorPhebieon MukwenhaAinda não há avaliações

- Business CodeDocumento21 páginasBusiness CodePascalAinda não há avaliações

- Solutions Manual: 1st EditionDocumento21 páginasSolutions Manual: 1st EditionJunior Waqairasari100% (1)

- Legal Requirement of Auditing and The Professional EthicsDocumento16 páginasLegal Requirement of Auditing and The Professional EthicsyebegashetAinda não há avaliações

- Recommendations Made To Strengthen The Independent Audit Function Following The Enron Scandal.Documento3 páginasRecommendations Made To Strengthen The Independent Audit Function Following The Enron Scandal.tyro91Ainda não há avaliações

- F8 Small NotesDocumento22 páginasF8 Small NotesAnthimos Elia100% (1)

- The Assurance Analogy and The Philippine Standards On AuditingDocumento13 páginasThe Assurance Analogy and The Philippine Standards On AuditingMa. Cristel Rovi RibucanAinda não há avaliações

- Asian Paints Limited Dividend Distribution PolicyDocumento3 páginasAsian Paints Limited Dividend Distribution PolicyJaiAinda não há avaliações

- ACAPL - Appointment of Independent Directors - T&CDocumento4 páginasACAPL - Appointment of Independent Directors - T&CShashi Bhushan PrinceAinda não há avaliações

- Terms & Conditions Independent DirectorsDocumento4 páginasTerms & Conditions Independent Directorsshazans148Ainda não há avaliações

- Indian Are SH Chandra Execs UmDocumento28 páginasIndian Are SH Chandra Execs UmAshutosh SinghAinda não há avaliações

- Faq BRSRDocumento2 páginasFaq BRSRPRASHANT DASHAinda não há avaliações

- Xi. Code of Corporate Governance 35. All Listed Companies Shall Ensure Compliance of The Following Code of CorporateDocumento20 páginasXi. Code of Corporate Governance 35. All Listed Companies Shall Ensure Compliance of The Following Code of CorporateAMNA ADILAinda não há avaliações

- At&T Inc. Code of EthicsDocumento5 páginasAt&T Inc. Code of EthicsTomooTeradaAinda não há avaliações

- Introduction To Independence and GIP - Jan 2011Documento16 páginasIntroduction To Independence and GIP - Jan 2011Praveen MalineniAinda não há avaliações

- AsianPaintsLimited DividendDistributionPolicyDocumento3 páginasAsianPaintsLimited DividendDistributionPolicyCurious FacTreeAinda não há avaliações

- Chapter 3 - Solution ManualDocumento20 páginasChapter 3 - Solution Manualjuan100% (1)

- Directors DutiesDocumento3 páginasDirectors Dutiessanjay1947Ainda não há avaliações

- SA250Documento19 páginasSA250Zameer AhmadAinda não há avaliações

- 2014 1st Place in Teaching History March 2015 0Documento6 páginas2014 1st Place in Teaching History March 2015 0VMROAinda não há avaliações

- Skene Albanians 1850Documento24 páginasSkene Albanians 1850VMROAinda não há avaliações

- Whose Language? Exploring The Attitudes of Bulgaria's Media Elite Toward Macedonia's Linguistic Self-IdentificationDocumento22 páginasWhose Language? Exploring The Attitudes of Bulgaria's Media Elite Toward Macedonia's Linguistic Self-IdentificationVMROAinda não há avaliações

- SorosDocumento59 páginasSorosVMROAinda não há avaliações

- Declassified DocumentsDocumento340 páginasDeclassified DocumentsVMROAinda não há avaliações

- 2006 018 389.01.02 People To People Actions JSPFDocumento16 páginas2006 018 389.01.02 People To People Actions JSPFVMROAinda não há avaliações

- Lecture Text May 18, 2008Documento11 páginasLecture Text May 18, 2008VMROAinda não há avaliações

- This Is The Published VersionDocumento12 páginasThis Is The Published VersionVMROAinda não há avaliações

- Albanian Grammar: Studies On Albanian and Other Balkan Language by Victor A. Friedman Peja: Dukagjini. 2004Documento17 páginasAlbanian Grammar: Studies On Albanian and Other Balkan Language by Victor A. Friedman Peja: Dukagjini. 2004RaulySilvaAinda não há avaliações

- Panslavism PDFDocumento109 páginasPanslavism PDFVMROAinda não há avaliações

- Solution Question in LMSDocumento3 páginasSolution Question in LMSVMROAinda não há avaliações

- 01 GrigorievaDocumento9 páginas01 GrigorievaVMROAinda não há avaliações

- Macedonian MushroomsDocumento3 páginasMacedonian MushroomsVMROAinda não há avaliações

- IronEdge - EPR - Agenda v2Documento4 páginasIronEdge - EPR - Agenda v2VMROAinda não há avaliações

- It Mid Market ERP Vendor Landscape StoryboardDocumento59 páginasIt Mid Market ERP Vendor Landscape StoryboardVMROAinda não há avaliações

- Paskal Milo PDFDocumento9 páginasPaskal Milo PDFVMROAinda não há avaliações

- Contribution Limits To Candidates 2020 2021Documento15 páginasContribution Limits To Candidates 2020 2021Emmanuel SarahanAinda não há avaliações

- ETB CertificateDocumento22 páginasETB Certificatearies 642003Ainda não há avaliações

- Is Suicide IllegalDocumento5 páginasIs Suicide IllegalZyrenz Delante IllesesAinda não há avaliações

- People V. Feliciano GR No. 190179 October 20, 2010Documento2 páginasPeople V. Feliciano GR No. 190179 October 20, 2010nadgbAinda não há avaliações

- Alice Africa Case DigestDocumento1 páginaAlice Africa Case DigestEKANGAinda não há avaliações

- Anthony Peake v. Marlane Becker, 4th Cir. (2016)Documento2 páginasAnthony Peake v. Marlane Becker, 4th Cir. (2016)Scribd Government DocsAinda não há avaliações

- Character Statutory DeclarationDocumento4 páginasCharacter Statutory DeclarationErin GamerAinda não há avaliações

- Manila v. ColetDocumento62 páginasManila v. ColetRheacel LojoAinda não há avaliações

- Application Form To Join The Seychelles PoliceDocumento4 páginasApplication Form To Join The Seychelles PoliceAesthetic VyomAinda não há avaliações

- Section 498ADocumento111 páginasSection 498AAnkitaArora100% (1)

- PoliDocumento222 páginasPoliFai Meile100% (1)

- Application Under Order VII, R. 11Documento9 páginasApplication Under Order VII, R. 11Apoorva MaheshwariAinda não há avaliações

- UP Solid Civil Law ReviewerDocumento472 páginasUP Solid Civil Law ReviewerPaul Silab97% (37)

- Labor Finals ReviewerDocumento46 páginasLabor Finals ReviewerChic PabalanAinda não há avaliações

- KT Plantation PVT LTD and Ors Vs State of Karnataks110827COM569345Documento37 páginasKT Plantation PVT LTD and Ors Vs State of Karnataks110827COM569345Aniketa JainAinda não há avaliações

- Employment Exchange Quarterly ReturnDocumento2 páginasEmployment Exchange Quarterly Returnhdpanchal86Ainda não há avaliações

- Checks and Balances Lesson PlanDocumento6 páginasChecks and Balances Lesson Planapi-352139149Ainda não há avaliações

- Velarde Vs Court of Appeals G.R. No. 108346. July 11, 2001Documento2 páginasVelarde Vs Court of Appeals G.R. No. 108346. July 11, 2001Joshua Ouano100% (1)

- Gloria v. de Guzman JRDocumento8 páginasGloria v. de Guzman JRlovekimsohyun89Ainda não há avaliações

- Advantages and Disadvantages of NegotitationDocumento22 páginasAdvantages and Disadvantages of NegotitationAarif Mohammad Bilgrami67% (9)

- Trademarks and Patents Fall Under Intellectual Property Act of Modern LawDocumento7 páginasTrademarks and Patents Fall Under Intellectual Property Act of Modern LawMuhammadSaadAinda não há avaliações

- BRAWNER v. CHISMAR Et Al DocketDocumento2 páginasBRAWNER v. CHISMAR Et Al DocketACELitigationWatchAinda não há avaliações

- Uap Logbook 2021 Final VersionDocumento14 páginasUap Logbook 2021 Final VersionGrace PamanilagaAinda não há avaliações

- Cometa vs. CADocumento6 páginasCometa vs. CAjegel23Ainda não há avaliações

- Peralta Vs CSCDocumento4 páginasPeralta Vs CSCBec Bec BecAinda não há avaliações

- Minette Baptista Et Al. v. Rosario Villanueva Et Al.Documento5 páginasMinette Baptista Et Al. v. Rosario Villanueva Et Al.faithreignAinda não há avaliações

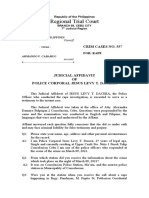

- Judicial Affidavit Rape-CaseDocumento4 páginasJudicial Affidavit Rape-CaseLevy Dacera100% (2)

- Med ArbDocumento10 páginasMed ArbRed HoodAinda não há avaliações

- Plaintiff-Appellee Vs Vs Defendants-Appellants Paulino Gullas, Attorney-General JaranillaDocumento3 páginasPlaintiff-Appellee Vs Vs Defendants-Appellants Paulino Gullas, Attorney-General JaranillasobranggandakoAinda não há avaliações

- Spouses Alfredo and Shirley Yap V IecDocumento3 páginasSpouses Alfredo and Shirley Yap V IecElah ViktoriaAinda não há avaliações