Escolar Documentos

Profissional Documentos

Cultura Documentos

The FindLaw Guide To Malpractice Insurance

Enviado por

FindLawTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

The FindLaw Guide To Malpractice Insurance

Enviado por

FindLawDireitos autorais:

Formatos disponíveis

The FindLaw Guide to Malpractice Insurance

Follow us on

Free Legal Research and Information: Law Firm Management, Legal Technology, Corporate Counsel,

Law Firm Marketing, Cases & Codes, Case Summaries

The FindLaw Guide to Malpractice Insurance

A Thomson Reuters Business

FOR LEGAL PROFESSIONALS

The FindLaw Guide to Malpractice Insurance

Follow us on

Free Legal Research and Information: Law Firm Management, Legal Technology, Corporate Counsel,

Law Firm Marketing, Cases & Codes, Case Summaries

Te FindLaw Guide to

Malpractice Insurance

Table of Contents

Should I Get Coverage?

What is the Cost?

Are Tere Any Deals Out Tere?

Frequently Asked Questions

Shoud I Get Coverage?

Yes. As a solo or small practitioner, the frst, obvious question

is whether a malpractice insurance policy is necessary for your

practice. Afer all, there may not be a line of clients waiting

outside your door for your services, and the silence of your

ofce telephone attests to this fact. So, you may be tempted to

overlook or intentionally avoid getting a malpractice insurance

policy for your practice. Dont.

Beyond the obvious wisdom in having malpractice coverage,

the long answer to this question depends on the jurisdiction

in which you practice. Some jurisdictions have a mandatory

coverage requirement, while others leave the decision up to

the lawyer. A third group of jurisdictions leaves the decision

up to the attorney, but requires a written disclosure informing

a prospective client of the fact that the attorney does not carry

coverage at the onset of an engagement. Whatever jurisdiction

you fnd yourself in, getting a malpractice insurance policy is a

smart choice.

Tis is especially the case nowadays. Ready access to infor-

mation and popular TV shows like Law and Order and

Boston Legal have enhanced clients knowledge and

awareness of legal value, leading to a greater demand for better

value with a correspondingly narrower margin of error. Te

current economic downturn and market competition have

compounded this phenomenon. Terefore, and despite best

eforts, the modern client may be more likely to repudiate an

attorneys fnal work and sue for professional malpractice.

For this reason, commonsense requires that you insure your

practice and your personal assets against legitimate and

sometimes frivolous malpractice claims.

Having a malpractice insurance policy in place:

Protects you against claims of professional negligence

Protects your staf and associates

Provides you with the peace of mind to focus on other

aspects of your practice

Managing a law practice is a business.

Like any business, the business of law is

rife with risks. One risk is the prospect of a

disgruntled client suing you for professional

malpractice. Even if the client has no case,

the reputational and economic cost of a legal

malpractice action can be heavy. To insure

against this risk, attorneys and law practices

often get legal malpractice insurance.

However, thinking about malpractice

insurance coverage as a means to mitigate

risk raises several important issues.

Page 1 of 3

The FindLaw Guide to Malpractice Insurance

Follow us on

Free Legal Research and Information: Law Firm Management, Legal Technology, Corporate Counsel,

Law Firm Marketing, Cases & Codes, Case Summaries

Could provide your practice with a means to

outsourcing risk management

Builds client confdence in your practice, thus legiti-

mating your practice

May fulfll your ethical and professional obligations

Might cover the cost of having independent legal counsel

represent you in an ethical complaint.

What is the Cost?

Annual premiums for a malpractice insurance policy vary. But,

in all likelihood, the outlay for malpractice coverage will not

be your most signifcant expense. Still, and perhaps because of

the obvious benefts, a legal malpractice insurance policy can

be pricey, particularly for a small or solo practitioner. Te cost

of an annual premium will depend on several factors including

the policy provider, your practice area, the number of years

youve been in practice, the size of your practice, and your

geographic location.

For instance, securities and real-estate lawyers may expect to

pay higher premiums as these felds are considered high-risk

areas. So too will a recent Bar admittee when compared against

an attorney with decades of experience, or a practice located

in a location with high malpractice claims as opposed to one

situated in locale with no such reputation.

Another factor that heightens your risk profle for purposes

of malpractice coverage is the size of your law practice.

Generally, large frms pay less in insurance premium per

insured than small or solo practices. Some providers even ofer

steep premium reductions for frms with a large number of

attorneys.

Are There Any Deals Out There?

Yes. Despite these various determining factors, some of which

may be out of the attorneys control, there are discounts to be

had. Membership to various voluntary and state bar associa-

tions come with discount ofers on malpractice insurance

premiums. Some of these ofers can be signifcant. In

addition, many companies ofer discounts to newly admitted

attorneys and are even amenable to special pricing breaks for

small or solo practitioners.

However, because premiums vary from one provider to the

next, the key to getting the best price and value for your

money is to begin your search for a policy early and from

a large pool of companies. Do not wait until your existing

policy expires or is about to expire to start shopping.

Frequently Asked Questions

Here are some frequently asked questions about legal

malpractice insurance.

1. Why do I need insurance?

You need insurance in order to protect yourself and your

clients. As with other types of insurance, malpractice

coverage can protect your personal assets against loss. In

addition, as attorneys cannot limit their personal liability

by agreement or entity selection, insurance provides

protection against catastrophic loss.

2. Is it mandatory?

While malpractice insurance is necessary for a growing

practice, many lawyers starting small frms choose to

start practicing without insurance. Te main reason

for this is prohibitive cost. Before making this decision,

check with your state bar to determine if malpractice

insurance is mandatory. If it is mandatory, your bar

association can ofer resources and recommendations of

insurers.

3. How much is insurance and what afects the price of

insurance?

While factors vary in each case, the following factors

generally determine price:

Jurisdiction: Each geographical area is assigned

diferent risks based on the malpractice

Page 2 of 3

The FindLaw Guide to Malpractice Insurance

Follow us on

Free Legal Research and Information: Law Firm Management, Legal Technology, Corporate Counsel,

Law Firm Marketing, Cases & Codes, Case Summaries

Page 3 of 3

litigation climate.

Practice Area: Your practice area afects the price

of your coverage. Practice areas with higher rates

of malpractice claims or greater exposure are

more expensive to insure. According to many

studies, the personal injury (plaintif) practice

area leads to the greatest number of malpractice

claims.

Attorney Record: Te disciplinary and

malpractice record of the attorney is crucial in

assessing risk.

Policy Terms: Te cost efect is similar to those

in other types of polices. Te amount of coverage

and the deductible afect costs. In addition,

negotiated terms, such as coverage of defense

costs, can afect the price dramatically.

4. How much coverage should I buy?

Te amount of coverage you should buy depends on

your practice and your fnancial circumstances. As with

any insurance policy, each party must do a risk-beneft

analysis. Assess the value of your assets. Remember to also

consider how much coverage youll need to protect your

client. Do not simply buy the cheapest or easiest insurance

on ofer.

5. Where do I go to get insurance?

Te frst step should be visiting your local bar associ-

ation. Bar associations are invaluable, and ofen neutral,

sources of information about insurance. Te association

can introduce you to diferent companies and give you a

starting point. You can also use the internet to research

options and educate yourself about insurance companies.

6. What can I do to lower the risk of malpractice claims?

Studies suggest that malpractice claims are ofen avoidable.

Te key to avoiding claims is to implement a thorough risk

management program.

7. Im a new lawyer. Can I get insurance?

All bar associations ofer insurance resources to their

members. Begin your research at the local bar association.

A number of insurance companies are eager to insure new

lawyers in order to establish a relationship they hope will

last for years.

8. What do I need to know about my insurance company?

Generally, your local bar association will be able to tell you

about the reputation of a particular company. If this infor-

mation is not available, you can conduct your own due

diligence of the company by reviewing its rating, payment

history and stability.

9. Can anyone help introduce me to diferent insurance

options?

An insurance broker is an invaluable resource. Make sure

to use an independent broker (one not afliated with

any particular company) and ask the broker to ofer you

multiple options and quotes. In addition, count on your

network when researching options. Contact colleagues

and ask them about their insurance coverage and

practices.

10. What do I need to tell the insurance company?

A good broker will guide you through the application

process. Once you make a decision on the insurance

company, you will be asked to fll out an application. Te

insurance company will use this information to prepare

your policy. Te difcult part of insurance purchasing is

the initial exploration and decision-making process. Once

you have made your decision, the application process may

take as little as a week.

Send Us Your Feedback

Were listening! Send us your feedback here.

Disclaimer: This summary is not intended to be exhaustive, as

the commentary and case law on these issues are far reaching.

You should conduct your own research or consult an attorney for

advice regarding your specic individual situation. Additionally,

cases and statutes in this area of law can change, so it is important

to conduct updated research for your case.

Disclaimer | Terms | Privacy

The FindLaw Guide to Malpractice Insurance

Follow us on

Free Legal Research and Information: Law Firm Management, Legal Technology, Corporate Counsel,

Law Firm Marketing, Cases & Codes, Case Summaries

#1 Free Legal Website

FindLaw.com is the leading and largest online resource for legal information. In addition to federal and state case law and

codes, we offer a wide variety of information to help you run your law practice, including daily case summaries, law rm

management articles, legal technology resources, and corporate counsel articles and contracts. Whether you need free

legal research, current awareness, or practical guidance to manage your law practice, FindLaw is the best place to start.

LP.FINDLAW.COM EMPOWERS

LEGAL PROFESSIONALS WITH

TRUSTED, TIMELY AND

INTELLIGENT LEGAL

INFORMATION

LAW FIRM MANAGEMENT Grow and optimize

your law practice with articles on Startup, Finance, HR,

Marketing and more.

LEGAL TECHNOLOGY CENTER FindLaw can help you

make successful law office technology decisions.

CORPORATE COUNSEL CENTER Corporate legal

professionals can access articles on critical business

topics. We also provide sample contracts from public

companies on many topics.

CASE SUMMARIES & NEWSLETTERS Get daily court

opinion summaries via email. We also offer many free

practice area newsletters.

CASES & CODES Get free access to FindLaws extensive

and constantly updated collection of federal and state

court opinions and codes.

BLOGS FindLaws Legal Professional blogs bring you

news and information covering everything from law

firm management, to the latest rulings from the federal

circuits, the Supreme Court, and more.

LAW FIRM MARKETING FindLaw helps you establish

your goals and then create an online marketing strategy

to help you achieve them.

Connect With Us

FindLaw.com has an entire social media team dedicated to providing our users with as many

options as possible to join, participate in, and learn from the FindLaw community. Some of

the social key channels are the following:

FindLaw for Legal Professionals on Facebook

Designed especially for lawyers & legal professionals with tweets relevant to the

business of law and your legal interests.

@FindLawLP on Twitter

Tweeting interesting, entertaining and informative legal news everyday

v1.0 Copyright 2013 FindLaw, a Thomson Reuters business. All rights reserved. A Thomson Reuters Business

FOR LEGAL PROFESSIONALS

Você também pode gostar

- The FindLaw Guide To Negotiating Liens in Personal Injury CasesDocumento9 páginasThe FindLaw Guide To Negotiating Liens in Personal Injury CasesFindLawAinda não há avaliações

- Not a Good Neighbor: A Lawyer’s Guide to Beating Big Insurance by Settling Your Own Auto Accident CaseNo EverandNot a Good Neighbor: A Lawyer’s Guide to Beating Big Insurance by Settling Your Own Auto Accident CaseAinda não há avaliações

- Security Litigation: Best Practices for Managing and Preventing Security-Related LawsuitsNo EverandSecurity Litigation: Best Practices for Managing and Preventing Security-Related LawsuitsAinda não há avaliações

- Dirty Little Secrets of Personal Injury Claims: What Insurance Companies Don't Want You to Know; and What Attorneys Won't Tell You, About Handling Your Own ClaimNo EverandDirty Little Secrets of Personal Injury Claims: What Insurance Companies Don't Want You to Know; and What Attorneys Won't Tell You, About Handling Your Own ClaimAinda não há avaliações

- Business Interruption: Coverage, Claims, and Recovery, 2nd EditionNo EverandBusiness Interruption: Coverage, Claims, and Recovery, 2nd EditionAinda não há avaliações

- MVD and Courts ManualDocumento0 páginaMVD and Courts ManualGracie AllenAinda não há avaliações

- United States Court of Appeals Fourth CircuitDocumento5 páginasUnited States Court of Appeals Fourth CircuitScribd Government DocsAinda não há avaliações

- Parking Letter The Co-Op 22nd May PDFDocumento4 páginasParking Letter The Co-Op 22nd May PDFmadtony4464100% (1)

- 2006FHEODocumento122 páginas2006FHEOiweb_blackAinda não há avaliações

- NY State Consumer ProtectionDocumento83 páginasNY State Consumer ProtectionThalia Sanders100% (1)

- California Employer's Guide 2011Documento136 páginasCalifornia Employer's Guide 2011Kevin LearyAinda não há avaliações

- General Contract Clauses: Representations and Warranties (OH)Documento19 páginasGeneral Contract Clauses: Representations and Warranties (OH)Filippe OliveiraAinda não há avaliações

- 10 Ideas For Equal Justice, 2016Documento40 páginas10 Ideas For Equal Justice, 2016Roosevelt Campus NetworkAinda não há avaliações

- Principles of Insurance Law by Jeffrey W. Stempel Peter N. Swisher Erik S. KnutsenDocumento1.748 páginasPrinciples of Insurance Law by Jeffrey W. Stempel Peter N. Swisher Erik S. KnutsenSarthak Chaturvedi100% (1)

- Panasonic Trial BriefDocumento10 páginasPanasonic Trial BriefSarah BursteinAinda não há avaliações

- Substantial EvidenceDocumento30 páginasSubstantial Evidencephilipslewis100% (1)

- Tort As Private Administration: Nathaniel Donahue & John Fabian WittDocumento57 páginasTort As Private Administration: Nathaniel Donahue & John Fabian WittCyntia Puspa PitalokaAinda não há avaliações

- Basic Income and Sovereign Money: The Alternative to Economic Crisis and Austerity PolicyNo EverandBasic Income and Sovereign Money: The Alternative to Economic Crisis and Austerity PolicyAinda não há avaliações

- Insurance Laws & Practices in The United States of America and South Africa Insights For NigeriaDocumento19 páginasInsurance Laws & Practices in The United States of America and South Africa Insights For NigeriaGlobal Research and Development ServicesAinda não há avaliações

- The Complete Guide To Navigating Recovery & Compensation After Being Injured in Las VegasDocumento87 páginasThe Complete Guide To Navigating Recovery & Compensation After Being Injured in Las VegasRamzy LadahAinda não há avaliações

- Letter Opposing Arbitration in Insurance PoliciesDocumento7 páginasLetter Opposing Arbitration in Insurance PoliciesTexas WatchAinda não há avaliações

- CLAIMS DetailsDocumento8 páginasCLAIMS DetailsZack TanAinda não há avaliações

- Insurance Coverage Litigation.iDocumento75 páginasInsurance Coverage Litigation.iJ.G. Gerry SchulzeAinda não há avaliações

- Petition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)No EverandPetition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)Ainda não há avaliações

- Claims Handling ProcessDocumento9 páginasClaims Handling ProcessChirisa VanleeAinda não há avaliações

- Eviction ProtectionsDocumento4 páginasEviction ProtectionsTabitha MuellerAinda não há avaliações

- Understanding Insurance BasicsDocumento25 páginasUnderstanding Insurance BasicsTewodros TeshomeAinda não há avaliações

- Municipal Bond Risk DisclosureDocumento2 páginasMunicipal Bond Risk Disclosuretonyw87dAinda não há avaliações

- Know your insurance claim process in case of major car lossDocumento3 páginasKnow your insurance claim process in case of major car lossRavi PandeyAinda não há avaliações

- Insurance Fraud Facts + Stats Key State LawsDocumento29 páginasInsurance Fraud Facts + Stats Key State LawsPranali TandelAinda não há avaliações

- Glossary of Insurance Terms A-ZDocumento23 páginasGlossary of Insurance Terms A-ZNikhil SharmaAinda não há avaliações

- Insurance LawDocumento30 páginasInsurance LawBharath GowthamAinda não há avaliações

- Lecture 2A OutlineDocumento5 páginasLecture 2A OutlineRussul Al-RawiAinda não há avaliações

- Fraud Awareness Training by The SIU GroupDocumento49 páginasFraud Awareness Training by The SIU GroupDhananjay SharmaAinda não há avaliações

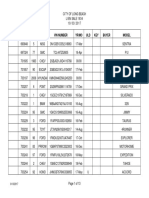

- Audit of Vehicle Lien Sales Report HighlightsDocumento65 páginasAudit of Vehicle Lien Sales Report HighlightsLong Beach PostAinda não há avaliações

- Compensation For Breach of Employment ContractDocumento31 páginasCompensation For Breach of Employment ContractIbnu HassanAinda não há avaliações

- Lien Sale Vehicles 2017Documento13 páginasLien Sale Vehicles 2017camwills2Ainda não há avaliações

- Workers Compensation and Common Law Negligence ClaimDocumento5 páginasWorkers Compensation and Common Law Negligence ClaimPersonal InjuryAinda não há avaliações

- Find Insurance Complaint HelpDocumento10 páginasFind Insurance Complaint HelpbeingviswaAinda não há avaliações

- State Farm Power Point Web1Documento10 páginasState Farm Power Point Web1api-253818494Ainda não há avaliações

- Claims Information Precedures 2013Documento7 páginasClaims Information Precedures 2013Bentang KurniaAinda não há avaliações

- Exhibit ADocumento5 páginasExhibit Akbarrier214Ainda não há avaliações

- Florida Medicaid RulingDocumento153 páginasFlorida Medicaid RulingScott FlahertyAinda não há avaliações

- Filed: United States Court of Appeals Tenth CircuitDocumento28 páginasFiled: United States Court of Appeals Tenth CircuitScribd Government DocsAinda não há avaliações

- There Are 3 Types of Car Loans Available in IndiaDocumento11 páginasThere Are 3 Types of Car Loans Available in IndiaAshis Kumar MuduliAinda não há avaliações

- Topic: Concept of Liability Criminal NotesDocumento42 páginasTopic: Concept of Liability Criminal NotesohitsMandyAinda não há avaliações

- SBI LIFE INSURANCE - Smart Wealth Brochure New VersionDocumento12 páginasSBI LIFE INSURANCE - Smart Wealth Brochure New VersionBabujee K.NAinda não há avaliações

- 2010 Bad Faith Insurance CompendiumDocumento283 páginas2010 Bad Faith Insurance CompendiumlostvikingAinda não há avaliações

- Family Child Care Legal and Insurance Guide: How to Protect Yourself from the Risks of Running a BusinessNo EverandFamily Child Care Legal and Insurance Guide: How to Protect Yourself from the Risks of Running a BusinessAinda não há avaliações

- Nick Dowse Case SummariesDocumento8 páginasNick Dowse Case SummariesOlga MuiAinda não há avaliações

- Ecf 147Documento115 páginasEcf 147himself2462Ainda não há avaliações

- SettlementDocumento11 páginasSettlementapi-256419195Ainda não há avaliações

- Trump Letter To ErdoganDocumento1 páginaTrump Letter To ErdoganFindLaw50% (2)

- CA Lawsuit Over Trump National Emergency DeclarationDocumento57 páginasCA Lawsuit Over Trump National Emergency DeclarationHarry CherryAinda não há avaliações

- White House Letter To Speaker Pelosi, Et Al. 10.08.2019Documento8 páginasWhite House Letter To Speaker Pelosi, Et Al. 10.08.2019blc8897% (35)

- Virginia House of Delegates v. Bethune-Hill OpinionDocumento22 páginasVirginia House of Delegates v. Bethune-Hill OpinionFindLawAinda não há avaliações

- Secretary Mnuchin Response Re Trump Tax ReturnsDocumento1 páginaSecretary Mnuchin Response Re Trump Tax ReturnsFindLawAinda não há avaliações

- Butina Plea Hearing MotionDocumento2 páginasButina Plea Hearing MotionFindLawAinda não há avaliações

- Kentucky Abortion ClinicDocumento14 páginasKentucky Abortion ClinicFindLawAinda não há avaliações

- Census Citizenship Question RulingDocumento277 páginasCensus Citizenship Question RulingFindLawAinda não há avaliações

- Assange Espionage IndictmentDocumento37 páginasAssange Espionage IndictmentFindLawAinda não há avaliações

- Trump Emoluments Subpoenas (1 of 2)Documento255 páginasTrump Emoluments Subpoenas (1 of 2)FindLawAinda não há avaliações

- Alabama 2019 HB314 Abortion BanDocumento10 páginasAlabama 2019 HB314 Abortion BanFindLaw100% (2)

- Lyft Assault Class ActionDocumento29 páginasLyft Assault Class ActionFindLawAinda não há avaliações

- Google+ Leak LawsuitDocumento28 páginasGoogle+ Leak LawsuitFindLawAinda não há avaliações

- Trump Asylum OrderDocumento37 páginasTrump Asylum OrderFindLawAinda não há avaliações

- CNN V TrumpDocumento18 páginasCNN V TrumpStephen Loiaconi100% (1)

- Seattle v. Trump Sanctuary Cities OrderDocumento2 páginasSeattle v. Trump Sanctuary Cities OrderFindLawAinda não há avaliações

- Trump Emoluments Subpoenas (2 of 2)Documento237 páginasTrump Emoluments Subpoenas (2 of 2)FindLawAinda não há avaliações

- Human Synergistics V GoogleDocumento45 páginasHuman Synergistics V GoogleFindLawAinda não há avaliações

- Migrant Caravan Class ActionDocumento80 páginasMigrant Caravan Class ActionFindLawAinda não há avaliações

- Sessions Resignation LetterDocumento1 páginaSessions Resignation LetterFindLawAinda não há avaliações

- Crowd Siren V FacebookDocumento28 páginasCrowd Siren V FacebookFindLawAinda não há avaliações

- Zero Gravity Chair Bed Bath Beyond ComplaintDocumento11 páginasZero Gravity Chair Bed Bath Beyond ComplaintFindLawAinda não há avaliações

- SEC Lawsuit Against Elon MuskDocumento23 páginasSEC Lawsuit Against Elon MuskFindLawAinda não há avaliações

- Free Speech Systems V PayPalDocumento15 páginasFree Speech Systems V PayPalFindLawAinda não há avaliações

- Hines V QuillivanDocumento36 páginasHines V QuillivanFindLawAinda não há avaliações

- Citizenship Backlog ComplaintDocumento14 páginasCitizenship Backlog ComplaintFindLawAinda não há avaliações

- Manafort Plea DealDocumento38 páginasManafort Plea DealFindLawAinda não há avaliações

- DOJ V CA Net NeutralityDocumento12 páginasDOJ V CA Net NeutralityFindLawAinda não há avaliações

- Dow Jones V Contessa BourbonDocumento11 páginasDow Jones V Contessa BourbonFindLawAinda não há avaliações

- SEC V Cone Phony Pot FarmDocumento11 páginasSEC V Cone Phony Pot FarmFindLawAinda não há avaliações

- Philippine Civil Service Disciplinary ProcessDocumento4 páginasPhilippine Civil Service Disciplinary ProcessYmer VT0% (1)

- Open Source Business Models 2015 PDFDocumento16 páginasOpen Source Business Models 2015 PDFmin parkAinda não há avaliações

- Majlis Peguam v Sunil Singh Gill 2004 CA ruling upholds Samantha Murthi precedentDocumento2 páginasMajlis Peguam v Sunil Singh Gill 2004 CA ruling upholds Samantha Murthi precedentNURUL HIDAYATAinda não há avaliações

- Thomas Hobbes' Leviathan and the Social Contract TheoryDocumento11 páginasThomas Hobbes' Leviathan and the Social Contract TheoryAhmad HasanAinda não há avaliações

- Form 27 C FormatDocumento4 páginasForm 27 C FormatYash KediaAinda não há avaliações

- Lambeth Contract Standing Orders PDFDocumento23 páginasLambeth Contract Standing Orders PDFAshley ElizabethAinda não há avaliações

- United States Court of Appeals, Second Circuit.: No. 524, Docket 72-2093Documento12 páginasUnited States Court of Appeals, Second Circuit.: No. 524, Docket 72-2093Scribd Government DocsAinda não há avaliações

- PP vs. MondigoDocumento3 páginasPP vs. MondigoElaine Aquino Maglaque0% (1)

- Preliminary Change of Ownership (Rev. 10-2005)Documento2 páginasPreliminary Change of Ownership (Rev. 10-2005)Juxv9dTct8Ainda não há avaliações

- Primetime Eula PDFDocumento2 páginasPrimetime Eula PDFWilfredo VásquezAinda não há avaliações

- Commission On Bar Discipline: Integrated Bar of The Philippines Pasig CityDocumento16 páginasCommission On Bar Discipline: Integrated Bar of The Philippines Pasig CityLeo LigutanAinda não há avaliações

- Public Corporations Cases and PrinciplesDocumento20 páginasPublic Corporations Cases and PrinciplesKirsten Denise B. Habawel-Vega100% (1)

- People v. O'CochlainDocumento46 páginasPeople v. O'CochlainGerald Javison LudasAinda não há avaliações

- Case Digest Art. 82Documento30 páginasCase Digest Art. 82Claire RoxasAinda não há avaliações

- Delhi Development Authority VS D.S. SharmaDocumento2 páginasDelhi Development Authority VS D.S. SharmaRuta PadhyeAinda não há avaliações

- Review of HUD's Disbursement of Grant Funds Appropriated For Disaster Recovery and Mitigation Activities in Puerto RicoDocumento52 páginasReview of HUD's Disbursement of Grant Funds Appropriated For Disaster Recovery and Mitigation Activities in Puerto RicoMiami HeraldAinda não há avaliações

- UGANDA Computer Misuse Act No. 2 of 2011Documento24 páginasUGANDA Computer Misuse Act No. 2 of 2011Gregory KagoohaAinda não há avaliações

- CIR V Central LuzonDocumento2 páginasCIR V Central LuzonAgnes FranciscoAinda não há avaliações

- Judicial Reform BillDocumento13 páginasJudicial Reform BillPennLiveAinda não há avaliações

- Lead Free SolderingDocumento307 páginasLead Free SolderingAaron RobbinsAinda não há avaliações

- Application for Schengen VisaDocumento6 páginasApplication for Schengen VisaElie DiabAinda não há avaliações

- Quituar Lecture Notes On Sharia ProcedureDocumento11 páginasQuituar Lecture Notes On Sharia Procedureshambiruar100% (3)

- Civil Structural Permit (FORM)Documento2 páginasCivil Structural Permit (FORM)Ar Hanz Gerome Suarez100% (3)

- Alvin EJS With Sale LordanDocumento3 páginasAlvin EJS With Sale LordanAron JaroAinda não há avaliações

- Principles of TaxationDocumento7 páginasPrinciples of TaxationNishant RajAinda não há avaliações

- City Manager Report: EDRP Recommendations (10-21)Documento18 páginasCity Manager Report: EDRP Recommendations (10-21)WVXU NewsAinda não há avaliações

- Insurance offer letter summaryDocumento8 páginasInsurance offer letter summaryDivya SinghAinda não há avaliações

- Nominee Directors - Corp LawDocumento21 páginasNominee Directors - Corp LawJasween Gujral100% (2)

- DECS Service ManualDocumento8 páginasDECS Service ManualMoira SarmientoAinda não há avaliações

- Taxation of Compensation Received for Expropriated LandDocumento24 páginasTaxation of Compensation Received for Expropriated LandJozele DalupangAinda não há avaliações