Escolar Documentos

Profissional Documentos

Cultura Documentos

Mid-Year Ends With New Highs On The Nasdaq, Nasdaq 100 and Dow Utilities!

Enviado por

Richard Suttmeier0 notas0% acharam este documento útil (0 voto)

8 visualizações2 páginasThe Nasdaq and Nasdaq 100 set new multiyear intraday highs on June 30 at 4417.46 and 3860.65, respectively. The Dow Utility Average set a new all-time intraday high at 576.98.

The first half performance winner was the PHLX Semiconductor Index (SOX) with a gain of 18.9% followed by utilities with a gain of 17.4% the Transports up 10.8%.

The weekly charts are positive for all five major equity averages with overbought conditions on Dow Industrials, S&P 500, Nasdaq and Dow Transports and with the Russell 2000 with rising stochastics.

The five-week modified moving averages are 16720 Dow industrials, 1925.1 S&P 500, 4275 Nasdaq, 8006 Dow Transports and 1159.15 Russell 2000.

A weekly value level is 1174.78 on the Russell 2000 with weekly risky levels at 16987 Dow Industrials, 1974.6 S&P 500, 4407 Nasdaq and 8405 Dow Transports.

Título original

Mid-year ends with new highs on the Nasdaq, Nasdaq 100 and Dow Utilities!

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe Nasdaq and Nasdaq 100 set new multiyear intraday highs on June 30 at 4417.46 and 3860.65, respectively. The Dow Utility Average set a new all-time intraday high at 576.98.

The first half performance winner was the PHLX Semiconductor Index (SOX) with a gain of 18.9% followed by utilities with a gain of 17.4% the Transports up 10.8%.

The weekly charts are positive for all five major equity averages with overbought conditions on Dow Industrials, S&P 500, Nasdaq and Dow Transports and with the Russell 2000 with rising stochastics.

The five-week modified moving averages are 16720 Dow industrials, 1925.1 S&P 500, 4275 Nasdaq, 8006 Dow Transports and 1159.15 Russell 2000.

A weekly value level is 1174.78 on the Russell 2000 with weekly risky levels at 16987 Dow Industrials, 1974.6 S&P 500, 4407 Nasdaq and 8405 Dow Transports.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

8 visualizações2 páginasMid-Year Ends With New Highs On The Nasdaq, Nasdaq 100 and Dow Utilities!

Enviado por

Richard SuttmeierThe Nasdaq and Nasdaq 100 set new multiyear intraday highs on June 30 at 4417.46 and 3860.65, respectively. The Dow Utility Average set a new all-time intraday high at 576.98.

The first half performance winner was the PHLX Semiconductor Index (SOX) with a gain of 18.9% followed by utilities with a gain of 17.4% the Transports up 10.8%.

The weekly charts are positive for all five major equity averages with overbought conditions on Dow Industrials, S&P 500, Nasdaq and Dow Transports and with the Russell 2000 with rising stochastics.

The five-week modified moving averages are 16720 Dow industrials, 1925.1 S&P 500, 4275 Nasdaq, 8006 Dow Transports and 1159.15 Russell 2000.

A weekly value level is 1174.78 on the Russell 2000 with weekly risky levels at 16987 Dow Industrials, 1974.6 S&P 500, 4407 Nasdaq and 8405 Dow Transports.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 2

Richard Suttmeier is the Chief Market Strategist at www.ValuEngine.com.

ValuEngine is a fundamentally-based quant research firm in Melbourne, FL. ValuEngine

covers over 8,000 stocks every day.

A variety of newsletters and portfolios containing Suttmeier's detailed research, stock picks,

and commentary can be found http://www.valuengine.com/nl/mainnl

To unsubscribe from this free email newsletter list, please click

http://www.valuengine.com/pub/Unsubscribe?

Jul y 1, 2014 Mi d-year ends w i t h new hi ghs on t he Nasdaq, Nasdaq 100 and Dow Ut i l i t i es!

The Nasdaq and Nasdaq 100 set new multiyear intraday highs on J une 30 at 4417.46 and 3860.65,

respectively. The Dow Utility Average set a new all-time intraday high at 576.98.

The first half performance winner was the PHLX Semiconductor Index (SOX) with a gain of 18.9%

followed by utilities with a gain of 17.4% the Transports up 10.8%.

The weekly charts are positive for all five major equity averages with overbought conditions on Dow

Industrials, S&P 500, Nasdaq and Dow Transports and with the Russell 2000 with rising stochastics.

The five-week modified moving averages are 16720 Dow industrials, 1925.1 S&P 500, 4275 Nasdaq,

8006 Dow Transports and 1159.15 Russell 2000.

A weekly value level is 1174.78 on the Russell 2000 with weekly risky levels at 16987 Dow Industrials,

1974.6 S&P 500, 4407 Nasdaq and 8405 Dow Transports.

Regardless of the upside potential there is risk to annual value levels in the second half of 2014 at

14835 and 13467 Dow Industrials, 1539.1 and 1442.1 S&P 500, 3471 and 3063 Nasdaq, 6249 and

5935 Dow Transports and 966.72 and 879.39 Russell 2000.

Note the new monthly, quarterly and semiannual risky levels.

Dow Industrials: (16827) Semiannual and annual value levels are 16301, 14835 and 13467 with a

daily pivot at 16836, the J une 20 all-time intraday high at 16978.02 and weekly, monthly, quarterly and

semiannual risky levels at 16987, 17364, 17753 and 18552.

S&P 500 (1960.2) Semiannual and annual value levels are 1789.3, 1539.1 and 1442.1 with a daily

pivot at 1961.5, the J une 24 all-time intraday high at 1968.17 and weekly, monthly, quarterly and

semiannual risky levels at 1974.6, 1994.2, 2052.3 and 2080.3.

NASDAQ (4408) Semiannual and annual value levels are 3972, 3471 and 3063 with daily and

weekly pivots at 4397 and 4407, the J une 30 multiyear intraday high at 4417.46 and monthly, quarterly

and semiannual risky levels at 4529, 4569 and 4642.

NASDAQ 100 (NDX) (3849) Semiannual and annual value levels are 3515, 3078 and 2669 with a

daily pivot at 3841, the J une 30 multiyear intraday high at 3860.65, and weekly, quarterly, monthly and

semiannual risky levels at 3883, 3894, 3936 and 4105.

Dow Transports (8202) Semiannual and annual value levels are 7423, 6249 and 5935 with a daily

pivot at 8165, the J une 9 all-time intraday high at 8256.79 and quarterly, monthly, weekly and

semiannual risky levels at 8256, 8365, 8405 and 8447.

Russell 2000 (1192.96) Weekly, semiannual and annual value levels are 1174.78, 1139.81, 966.72

and 879.39 with a daily pivot at 1187.86, the March 4 all-time intraday high at 1212.82 and monthly,

semiannual and quarterly risky levels at 1215.89, 1285.37 and 1293.11.

The SOX (635.93) Daily, quarterly, semiannual and annual value levels are 631.54, 626.96, 608.02,

512.94, 371.58 and 337.74 with the J une 24 multiyear intraday high at 637.91 and weekly and monthly

risky levels at 642.33 and 642.34.

Dow Utilities: (575.98) Monthly, weekly, annual, quarterly, semiannual and annual value levels are

563.44, 558.20, 548.70, 536.44, 523.72 and 497.53, with a daily pivot at 575.65, the J une 30 all-time

intraday high at 576.98 and semiannual risky level at 612.49.

10-Year Note (2.521) Monthly and quarterly value levels are 2.787 and 3.048 with daily and weekly

pivots at 2.539 and 2.530 and annual and semiannual risky levels at 2.263, 1.999 and 1.779.

30-Year Bond (3.347) Daily, weekly, monthly and quarterly value levels are 3.381, 3.423, 3.486 and

3.971 with annual and semiannual risky levels at 3.283, 3.107 and 3.082.

Comex Gold ($1329.0) Weekly, quarterly and monthly value levels are $1281.1, $1234.6 and

$1233.8 with daily, semiannual and annual risky levels at $1366.3, $1613.0, $1738.7, $1747.4 and

$1818.8.

Nymex Crude Oil ($105.41) No value levels with monthly and daily pivots at $105.23 and $105.74

and semiannual, annual, weekly and quarterly risky levels at $106.48, $107.52, $108.45 and $113.12..

The Euro (1.3692) Weekly, annual and semiannual value levels are 1.3415, 1.3382 and 1.2203 with

a daily pivot at 1.3675 and monthly, quarterly, semiannual and annual risky levels at 1.3819, 1.4079,

1.4617 and 1.5512.

The Dollar versus Japanese Yen (101.31) My annual value level is 93.38 with daily and weekly

pivots at 101.48 and 101.42 and monthly and quarterly risky levels at 106.47 and 112.83.

The British Pound (1.7111) Weekly, quarterly and annual value levels are 1.6935, 1.6874 and

1.6262 with a daily pivot at 1.7087 and semiannual and monthly risky levels at 1.7302 and 1.7438.

To learn more about ValuEngine check out www.ValuEngine.com. Any comments or questions contact

me at RSuttmeier@gmail.com.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Richard Suttmeier's Weekly Market BriefingDocumento4 páginasRichard Suttmeier's Weekly Market BriefingRichard SuttmeierAinda não há avaliações

- Suttmeier Weekly Market Briefing, March 9, 2015Documento4 páginasSuttmeier Weekly Market Briefing, March 9, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier, Weekly Market BriefingDocumento4 páginasSuttmeier, Weekly Market BriefingRichard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, February 3, 2015Documento1 páginaSuttmeier Morning Briefing, February 3, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Weekly Market BriefingDocumento2 páginasSuttmeier Weekly Market BriefingRichard SuttmeierAinda não há avaliações

- Suttmeier Weekly Market Briefing, February 2, 2015Documento4 páginasSuttmeier Weekly Market Briefing, February 2, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Weekly Market BriefingDocumento1 páginaSuttmeier Weekly Market BriefingRichard SuttmeierAinda não há avaliações

- Suttmeier Weekly Market BriefingDocumento4 páginasSuttmeier Weekly Market BriefingRichard SuttmeierAinda não há avaliações

- Suttmeier Weekly Markets Briefing, February 23, 2015Documento4 páginasSuttmeier Weekly Markets Briefing, February 23, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Weekly Market BriefingDocumento1 páginaSuttmeier Weekly Market BriefingRichard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, February 3, 2015Documento1 páginaSuttmeier Morning Briefing, February 3, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, February 3, 2015Documento1 páginaSuttmeier Morning Briefing, February 3, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, January 30, 2015Documento1 páginaSuttmeier Morning Briefing, January 30, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, February 3, 2015Documento1 páginaSuttmeier Morning Briefing, February 3, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, January 27, 2015Documento1 páginaSuttmeier Morning Briefing, January 27, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, January 13, 2015Documento1 páginaSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Weekly Market BriefingDocumento3 páginasSuttmeier Weekly Market BriefingRichard SuttmeierAinda não há avaliações

- 1412229SuttmeierWeeklyBriefinSuttmeier Weekly Briefing, Dec. 29, 2014Documento2 páginas1412229SuttmeierWeeklyBriefinSuttmeier Weekly Briefing, Dec. 29, 2014Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, January 13, 2015Documento1 páginaSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, January 13, 2015Documento1 páginaSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, January 13, 2015Documento1 páginaSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, January 13, 2015Documento1 páginaSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Weekly Briefing, January 12, 2015Documento3 páginasSuttmeier Weekly Briefing, January 12, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Weekly Briefing, January 19, 2015Documento3 páginasSuttmeier Weekly Briefing, January 19, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, January 13, 2015Documento1 páginaSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, 01/07/2015Documento1 páginaSuttmeier Morning Briefing, 01/07/2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, January 13, 2015Documento1 páginaSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, January 13, 2015Documento1 páginaSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, 01/07/2015Documento1 páginaSuttmeier Morning Briefing, 01/07/2015Richard SuttmeierAinda não há avaliações

- Suttmeier Morning Briefing, 01/07/2015Documento1 páginaSuttmeier Morning Briefing, 01/07/2015Richard SuttmeierAinda não há avaliações

- ทำความรู้จักกับ FTSE SET Index Series revised 20080314Documento23 páginasทำความรู้จักกับ FTSE SET Index Series revised 20080314jojoAinda não há avaliações

- Index Movement:: National Stock Exchange of India LimitedDocumento27 páginasIndex Movement:: National Stock Exchange of India LimitedjanuianAinda não há avaliações

- MCQ Index Numbers With Correct AnswersDocumento5 páginasMCQ Index Numbers With Correct AnswersJunaid Subhani86% (14)

- World Air Quality Index (AQI) Ranking - AirVisualDocumento7 páginasWorld Air Quality Index (AQI) Ranking - AirVisualAmmar QureshiAinda não há avaliações

- 12 Global Indices INDEXDocumento31 páginas12 Global Indices INDEXjudas1432Ainda não há avaliações

- Weightage: S.No Fund Name Aum Size Expense Ratiotracking ErrorDocumento16 páginasWeightage: S.No Fund Name Aum Size Expense Ratiotracking ErrortestAinda não há avaliações

- List of Least Developed Countries (LDCs) by RegionDocumento3 páginasList of Least Developed Countries (LDCs) by RegionshailaaminAinda não há avaliações

- CPI2017 FullDataSetDocumento92 páginasCPI2017 FullDataSetEdmilson ValoiAinda não há avaliações

- Measuring The Cost of LivingDocumento4 páginasMeasuring The Cost of LivingAmna NawazAinda não há avaliações

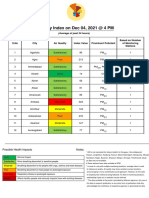

- Air Quality Index On Dec 04, 2021 at 4 PMDocumento13 páginasAir Quality Index On Dec 04, 2021 at 4 PMJITANSHUCHAMPAinda não há avaliações

- 2022 QS World University Rankings Results Public VersionDocumento37 páginas2022 QS World University Rankings Results Public VersionBeren SertAinda não há avaliações

- Chapter 11: Index NumberDocumento7 páginasChapter 11: Index NumberHayati Aini AhmadAinda não há avaliações

- Calcultion of Shannon-Wiener Diversity Index and Simpson's Diversity Index For Given CommunitiesDocumento7 páginasCalcultion of Shannon-Wiener Diversity Index and Simpson's Diversity Index For Given CommunitiesSankalp MishraAinda não há avaliações

- NIFTY Auto Index OverviewDocumento2 páginasNIFTY Auto Index OverviewPrabhakar DalviAinda não há avaliações

- CAPE Biology Unit 1 MCQ Answers PDFDocumento1 páginaCAPE Biology Unit 1 MCQ Answers PDFCute cookie DoughAinda não há avaliações

- R CodeDocumento3 páginasR CodebhaskkarAinda não há avaliações

- Asad RehmanDocumento14 páginasAsad RehmanilyasAinda não há avaliações

- Leksikon Ko Je KoDocumento32 páginasLeksikon Ko Je KoAnonymous xcA6nFVAinda não há avaliações

- Econ 102Documento5 páginasEcon 102Zhanerke NurmukhanovaAinda não há avaliações

- Major World Indices ComparisonDocumento2 páginasMajor World Indices ComparisonAnubrata_MullickAinda não há avaliações

- Mcqs On Index NumbersDocumento17 páginasMcqs On Index NumbersAnnapoorna Avula100% (1)

- Contracts 2023 01 03Documento25 páginasContracts 2023 01 03Alok PrataapAinda não há avaliações

- UntitledDocumento71 páginasUntitledIsaque Dietrich GarciaAinda não há avaliações

- AP 9 LAS Quarter 3Documento71 páginasAP 9 LAS Quarter 31111111111gfg67% (3)

- Ninjatrader Futures CommissionsDocumento3 páginasNinjatrader Futures CommissionsJorge RochaAinda não há avaliações

- CH 24Documento28 páginasCH 24lbengtson1100% (1)

- PSE1Documento67 páginasPSE1pmellaAinda não há avaliações

- Stopwatch 3 Unit 5 Reading 1 (3.5.R1)Documento1 páginaStopwatch 3 Unit 5 Reading 1 (3.5.R1)jaime aguilarAinda não há avaliações