Escolar Documentos

Profissional Documentos

Cultura Documentos

Boeing Has Big Tax Refund Coming From Uncle Sam - Again - Business & Technology - The Seattle Times

Enviado por

Manish Jaiswal0 notas0% acharam este documento útil (0 voto)

9 visualizações4 páginastax

Título original

Boeing Has Big Tax Refund Coming From Uncle Sam — Again _ Business & Technology _ the Seattle Times

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentotax

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

9 visualizações4 páginasBoeing Has Big Tax Refund Coming From Uncle Sam - Again - Business & Technology - The Seattle Times

Enviado por

Manish Jaiswaltax

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 4

The Seattle Times

Winner of Nine Pulitzer Prizes

Originally published March 1, 2014 at 8:03 PM | Page modified March 2, 2014 at 11:26 AM

Boeing got a $199 million federal tax refund in 2013, and over the past 12 years has accumulated tax

refunds of $1.6 billion.

By Dominic Gates

Seattle Times aerospace reporter

Boeings tax return for 2013 is complete. Although the aerospace and defense giant booked a profit

of $5.9 billion last year, the U.S. government winds up owing the company $199 million.

Boeing can either take that amount as a refund for taxes paid in the past or reduce its future

estimated tax payments by that much.

Every citizen of the state of Washington can proudly say that they pay more taxes than Boeing,

said Bob McIntyre, director of the Washington, D.C.-based tax-policy-research group Citizens for

Tax Justice (CTJ).

Boeings federal tax rate works out to negative 3.3 percent.

Its not a one-off event.

Over the past dozen years, during which Boeing reported to its shareholders a total profit of more

than $43 billion, the companys net cumulative refund of federal tax is more than $1.6 billion.

Boeing doesnt dispute those CTJ figures, which are pulled from company financial filings, although

it insists its taxes are simply deferred into the future and will be paid eventually.

Boeings recent record of negative taxes hasnt stopped the company from urging cuts in the

corporate-tax structure. On Wednesday, Boeing issued a statement from Chicago welcoming a

tax-reform proposal in Congress and said the jet maker has long supported a simplified tax code

that lowers the corporate-tax rate.

Such calls from the company havent always been well received in Congress.

During a 2011 House Ways and Means Committee hearing on tax reform, after Boeing had reported

three years of negative taxes, a Congressman incredulously asked James Zrust, Boeing vice

president of tax, How much lower rate do you need?

Taking all the federal taxes paid, or not paid, since 2002, Boeings average federal tax rate is minus

3.8 percent.

McIntyre pulled those eye-popping numbers from a series of CTJ corporate-tax reports, the latest

of which was issued last week, surveying the taxes paid by 288 major U.S. corporations over five

years from 2008 through 2012.

A total of 26 publicly traded corporations including Boeing, General Electric, Verizon and 14

energy companies paid less than zero taxes over those five years. They all got refunds.

The CTJ data is compiled from the companies financial filings with the Securities and Exchange

Commission (SEC), which are public.

The current tax expense for the year is listed in Boeings annual report, broken down by state,

federal and overseas taxes. CTJ makes just one small adjustment to factor in a figure listed on a

different page in the report, a tax benefit that Boeing gets from stock options exercised in a given

year.

Boeing spokesman Chaz Bickers accepts this adjustment as valid and said CTJs data is probably

in the ballpark.

Boeing has had a net refund of federal taxes in five of the last six years.

The exception when it actually paid taxes in those years was 2012, largely because Congress didnt

extend a research-tax credit in time. Later, Boeing was able to book the 2012 credit in 2013. Hence

another net refund last year.

How does Boeing do it? McIntyre is cynical.

Theyve done a good job of persuading Congress that they shouldnt pay taxes, he said. They have

a lot of lobbyists around this town. They work hard, and theyve been successful.

Taking the long view

Company spokesman Bickers offers a different explanation. In the airplane business, you have to

take a long view, he cautions.

Boeing books its profits using a method that amortizes its multibillion-dollar investments in new

jets over 20-plus years; for example, it averages todays actual 787 losses against expected future

787 profits.

While the 787 program is projected to continue hemorrhaging money through 2015 at least, after

that its supposed to creep gradually into the black and to start reducing the accumulated deficit

that by then will have reached $25 billion.

Spreading the programs current losses over future years is the accounting method that allows

Boeing to show a profit every quarter.

If losses were instead booked as each jet is built, company figures show, last years massive $5.8

billion profit in the Commercial Airplanes division would have flipped to a $1.6 billion loss.

But when the Internal Revenue Service comes calling the IRS has about 30 staff permanently

located at three different Boeing sites to monitor the companys finances Boeing doesnt use this

amortized-accounting approach that wows Wall Street every quarter.

The IRS deals with actual money coming in and going out.

As a result, Boeing has two categories in its tax accounting: Tax paid this year. And tax deferred

until later.

The latter is the tax it expects to pay when all that real profit rolls in sometime down the road.

In 2013, when Boeing got the refund of $199 million, it also listed deferred federal taxes of $1.53

billion.

Between 2002 and 2013, while Boeing enjoyed the refunds totaling more than $1.6 billion, it

deferred taxes totaling $12.2 billion.

As Boeing recoups the initial investment in the 787 by delivering the airplanes over two decades, it

says it will pay that money in due time.

You have to pay the taxes eventually, as you deliver the airplanes, said Bickers. Were paying the

taxes that are due now and will pay the taxes that are due as we deliver.

In the end, over the period, it all nets out the same, he said.

When Boeing states, as it does in its recent 10-K, that its effective tax rates in 2012 and 2013 were

respectively 26 percent and 34 percent, its counting those deferred taxes as well as the taxes

actually paid (or not paid) in those years.

McIntyre scoffs at this.

My personal tax rate is 137 percent, including the taxes I didnt pay, he said. It makes me feel

very patriotic.

Deferring costs

CTJ separately calculated Boeings payment of state income taxes at its locations around the U.S. It

found a cumulative negative tax paid, totaling minus $264 million over the past 12 years.

Washington state doesnt have a corporate income tax, so that isnt included in that calculation.

Corporate taxes here are based on gross receipts and so, despite the tax breaks it has been granted,

Boeing pays substantial taxes in this state.

In a report compiled for the state last year, economic-analysis firm Community Attributes

estimated that in 2012 Boeing paid just over $130 million in Washington state taxes.

In federal taxes, however, Boeing lags even its corporate peers.

The latest CTJ report, covering the years 2008-2012, shows that Boeing the nations second-

largest defense contractor with about $22 billion of revenue from government contracts last year

has a distinct tax advantage over other big defense companies.

While Boeings federal tax rate over those five years is minus 1 percent, the tax rates of rivals

Lockheed Martin, Northrop Grumman and General Dynamics are respectively plus 18.4 percent,

plus 24 percent and plus 29 percent.

Clearly, its the massive deferral of costs in the accounts on the commercial-jet side of Boeings

business that produces its sky-high reported profits at a time when its federal tax payments are

negative.

Yet, Boeings insistence it is only deferring taxes that will be paid later raises the question of when

that might happen.

Last year, Boeing delivered 648 jets, an all-time record high, and yet it still had negative federal

tax.

And if the taxes paid are supposed to even out over time, how is it that Boeings tax payments

averaged over 12 years are still in heavily negative territory?

Bickers identifies two events that suppressed Boeings taxes during that period.

He attributes much of the big refunds in 2003, 2004 and 2005 to tax relief from the approximately

$8 billion that Boeing had to pay into its employee- pension funds following the post-2001 stock-

market decline.

Then, from 2007 on, the cost of developing and building up the initial inventory for the 787 and the

747-8 resulted in current year losses which will likely continue through 2015.

McIntyre doesnt buy this argument.

Thats the joy of deferring taxes, he said. If you do it over and over, you never have to pay.

McIntyre says that CTJ will happily note the fact if Boeing eventually pays a bigger tax bill.

If it happens, well report that they paid them. Unless they have a new project starting, maybe the

797, and they do it again, McIntyre said.

For 12 years and counting though, hes still waiting for Boeings tax tide to turn.

Dominic Gates: 206-464-2963 or dgates@seattletimes.com

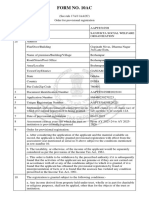

Boeing's cumulative federal tax bill: a big refund

Year Pretax U.S. profit (in millions) Federal income tax paid* Federal tax rate

2002 $2,125 $ 229 10.4%

2003 $1,037 $ -1,700 -159%

2004 $1,960 $ -454 -22.5%

2005 $2,605 $ -334 -12.4%

2006 $3,067 $ -134 -4.2%

2007 $5,901 $ 1,141 19.8%

2008 $3,794 $ -39 -1%

2009 $1,638 $ -136 -9.1%

2010 $4,310 $ -3 -0.1%

2011 $5,083 $ -641 -12.6%

2012 $5,647 $ 620 11%

2013 $5,946 $ -199 -3.3%

12 years $43,113 M $ -1,649 M -3.8%

Source: Boeings 10-K annual reports. Data compiled by Citizens for Tax Justice.* The tax paid in millions each year is

calculated by taking the current tax expense and subtracting a separate tax benefit related to stock options, both as

reported by Boeing. Citizens for Tax Justice makes an assumption that 83 percent of the separate tax benefit is federal

and the rest state.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Salary Slip Editable FormatDocumento1 páginaSalary Slip Editable FormatSoumitra Gupta83% (12)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Defence Equipment Business Has Companies Interested Like Never Before - Print View - LivemintDocumento3 páginasDefence Equipment Business Has Companies Interested Like Never Before - Print View - LivemintManish JaiswalAinda não há avaliações

- FIPB AgendaDocumento3 páginasFIPB AgendaManish JaiswalAinda não há avaliações

- Pipavav Financial ResultsDocumento1 páginaPipavav Financial ResultsManish JaiswalAinda não há avaliações

- Airbus Confirms Bribery Probe of Defence UnitDocumento1 páginaAirbus Confirms Bribery Probe of Defence UnitManish JaiswalAinda não há avaliações

- COMAC Struggles To Juggle Between ARJ21 and C919Documento1 páginaCOMAC Struggles To Juggle Between ARJ21 and C919Manish JaiswalAinda não há avaliações

- US Biggest Arms Supplier To India in Last Three Years - Defence Ministry - The Economic TimesDocumento1 páginaUS Biggest Arms Supplier To India in Last Three Years - Defence Ministry - The Economic TimesManish JaiswalAinda não há avaliações

- INdia at BaliDocumento2 páginasINdia at BaliManish JaiswalAinda não há avaliações

- 12 Stocks That Will Play in DefenceDocumento3 páginas12 Stocks That Will Play in DefenceManish JaiswalAinda não há avaliações

- Prices and Monetary Management: Rend IN InflationDocumento13 páginasPrices and Monetary Management: Rend IN InflationManish JaiswalAinda não há avaliações

- Public Finance: VerviewDocumento20 páginasPublic Finance: VerviewManish JaiswalAinda não há avaliações

- Laws of Taxation in TanzaniaDocumento508 páginasLaws of Taxation in TanzaniaRuhuro tetere100% (3)

- New Income Slab Rates CalculationsDocumento6 páginasNew Income Slab Rates Calculationsphani raja kumarAinda não há avaliações

- Impact of GST On WholesalerDocumento20 páginasImpact of GST On Wholesalerjayesh50% (2)

- Thomas Frank's Budget Modeler Template!Documento9 páginasThomas Frank's Budget Modeler Template!Norman LefortAinda não há avaliações

- Pointers in Taxation Law 2015 Bar Examinations: Chanrobles Internet Bar Review: Chanrobles Professional Review, IncDocumento19 páginasPointers in Taxation Law 2015 Bar Examinations: Chanrobles Internet Bar Review: Chanrobles Professional Review, IncBrokenAinda não há avaliações

- Screenshot 2024-02-18 at 3.12.37 AMDocumento1 páginaScreenshot 2024-02-18 at 3.12.37 AMraheemtimo1Ainda não há avaliações

- All About Annual Information Statement (AIS)Documento79 páginasAll About Annual Information Statement (AIS)NEERAJ MAURYAAinda não há avaliações

- Form No. 10acDocumento2 páginasForm No. 10acAditya NayakAinda não há avaliações

- Chap 08Documento50 páginasChap 08Huỳnh ChâuAinda não há avaliações

- Income and Business TaxationDocumento138 páginasIncome and Business Taxationjustine reine cornico100% (1)

- January: Date Name of Statue Form Name of To Be Sent To ReturnDocumento8 páginasJanuary: Date Name of Statue Form Name of To Be Sent To Returnjimit0810Ainda não há avaliações

- XIMIVOUGE - LITE - FeasibilityDocumento9 páginasXIMIVOUGE - LITE - FeasibilityPranav TubajiAinda não há avaliações

- CIR v. CitytrustDocumento2 páginasCIR v. Citytrustpawchan02Ainda não há avaliações

- Chapter 8 - Income TaxesDocumento6 páginasChapter 8 - Income TaxesHaddy GayeAinda não há avaliações

- PoT Revision 2023 Bu I 2 - HVDocumento51 páginasPoT Revision 2023 Bu I 2 - HVlinhdinhphuong02Ainda não há avaliações

- Microsoft Philippines, Inc., G.R. No. 180173Documento3 páginasMicrosoft Philippines, Inc., G.R. No. 180173Mary Joy GorospeAinda não há avaliações

- Lumbera LectureDocumento3 páginasLumbera LectureRyeAinda não há avaliações

- Finance (Supplementary) Act, 2023Documento9 páginasFinance (Supplementary) Act, 2023Umair NeoronAinda não há avaliações

- GST Question Bank MergedDocumento169 páginasGST Question Bank MergedSaloni BansalAinda não há avaliações

- Ecomomics TestDocumento1 páginaEcomomics TestHarsh ShahAinda não há avaliações

- Corporate Tax Planning and Corporate Tax Disclosure (SKIRPSI)Documento38 páginasCorporate Tax Planning and Corporate Tax Disclosure (SKIRPSI)oneAinda não há avaliações

- Satyam Sudan: Offer LetterDocumento2 páginasSatyam Sudan: Offer LetterssattyyaammAinda não há avaliações

- 1642791358CMA Inter FT Additional Topics by CA Vijay SardaDocumento29 páginas1642791358CMA Inter FT Additional Topics by CA Vijay SardaArpita JainAinda não há avaliações

- Tax Form DC - 1Documento2 páginasTax Form DC - 1Fazal MalikAinda não há avaliações

- CIR v. PNBDocumento3 páginasCIR v. PNBAngelique Padilla UgayAinda não há avaliações

- Income Tax in India - Wikipedia, The Free EncyclopediaDocumento10 páginasIncome Tax in India - Wikipedia, The Free EncyclopediakandurimaruthiAinda não há avaliações

- Example of Excel-PayrollDocumento1 páginaExample of Excel-PayrollXia SolanoAinda não há avaliações

- HR QueriesDocumento6 páginasHR Queriesfrancy_rajAinda não há avaliações

- EF2A2 HDT Budget Indirect Taxes GST PCB7 1661016598246Documento44 páginasEF2A2 HDT Budget Indirect Taxes GST PCB7 1661016598246Sikha SharmaAinda não há avaliações