Escolar Documentos

Profissional Documentos

Cultura Documentos

Bacsin - Delacruz (Book 4-Book 6)

Enviado por

graceyanlee0 notas0% acharam este documento útil (0 voto)

14 visualizações18 páginasCASE DIGEST IN LABOR STANDARDS

Título original

Bacsin- Delacruz ( Book 4-Book 6)

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

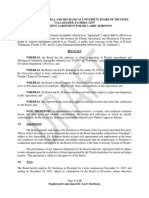

Denunciar este documentoCASE DIGEST IN LABOR STANDARDS

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

14 visualizações18 páginasBacsin - Delacruz (Book 4-Book 6)

Enviado por

graceyanleeCASE DIGEST IN LABOR STANDARDS

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 18

Yanyan 1

Bacsin vs. Wahiman April 30, 2008

FACTS:

Bacsin, a public elementary school teacher, was charged with

Misconduct for fondling the breast of his student, as was witnessed by another

student. In his defense, Bacsin claimed that the touching happened by accident.

*CSC: GUILTY of Grave Misconduct (Acts of Sexual Harassment), DISMISSED. Act

contained in the Anti-Sexual Harassment Act of 1995. MR Denied. Appealed to

CA

*CA: Affirm. Even if Bacsin was formally charged with disgraceful and immoral

conduct and misconduct, CSC found that the allegations and evidence

sufficiently proved petitioners guilt of grave misconduct, which is punishable

by dismissal from service.

ISSUE: WON MISCONDUCT (which was the charge against him) includes Grave

Misconduct, thus, he can be convicted of such even if that was not charged

HELD: YES. Petition Dismissed.

*Dadubo v. Civil Service Commission: The charge against the respondent in an

administrative case need not be drafted with the precision of an information in

a criminal prosecution. It is sufficient that he is apprised of the substance of the

charge against him; what is controlling is the allegation of the acts complained

of, not the designation of the offense.

It is clear that petitioner was sufficiently informed of the basis of the charge

against him, which was his act of improperly touching one of his students. Thus

informed, he defended himself from such charge. The failure to designate the

offense specifically and with precision is of no moment in this administrative

case.

Charges against him imputes acts covered and penalized under Anti-sexual

harassment act of 1995. Domingo v. Rayala: it is not necessary that the demand,

request, or requirement of a sexual favor be articulated in a categorical oral or

written statement. It may be discerned, with equal certitude, from the acts of

the offender.

The act of mashing the breast, in an education environment, upon a student,

who felt fear at the time Bacsin touched her, are sufficient grounds for grave

misconduct. There is grave misconduct The act of petitioner of fondling one of

his students is against a law, RA 7877, and is doubtless inexcusable. The

particular act of petitioner cannot in any way be construed as a case of simple

misconduct. Sexually molesting a child is, by any norm, a revolting act that it

cannot but be categorized as a grave offense. Parents entrust the care and

molding of their children to teachers, and expect them to be their guardians

while in school. Petitioner has violated that trust. The charge of grave

misconduct proven against petitioner demonstrates his unfitness to remain as a

teacher and continue to discharge the functions of his office.

There is no denial of due process: The essence of due process is simply an

opportunity to be heard, or, as applied to administrative proceedings, an

opportunity to explain one's side or an opportunity to seek for a

reconsideration of the action or ruling complained of. These elements are

present in this case, where petitioner was properly informed of the charge and

had a chance to refute it, but failed.

A teacher who perverts his position by sexually harassing a student should not

be allowed, under any circumstance, to practice this noble profession.

5. BOOK FOUR, ART. 156-161

OCEAN BUILDERS CONSTRUCTION CORP., AND/OR DENNIS HAO,

PETITIONERS, VS. SPOUSES ANTONIO AND ANICIA CUBACUB,

RESPONDENTS.

FACTS: Bladimir Cubacub (Bladimir) was employed as maintenance man by

petitioner company Ocean Builders Construction Corp.

Bladimir was afflicted with chicken pox. He was thus advised by the petitioner,

to rest for three days which he did at the companys barracks where he lives

free of charge.

Three days later,, Bladimir went about his usual chores of manning the gate of

the company premises and even cleaned the company vehicles. Later in the

afternoon, however, he asked a co-worker, Ignacio Silangga (Silangga), to

accompany him to his house in Capas, Tarlac so he could rest. Informed by

Silangga of Bladimirs intention, Hao gave Bladimir P1,000.00 and ordered

Silangga to instead bring Bladimir to the nearest hospital.

Along with co-workers Narding and Tito Vergado, Silangga thus brought

Yanyan 2

Bladimir to the Caybiga Community Hospital (Caybiga Hospital), a primary-care

hospital around one kilometer away from the office of the company.

The hospital did not allow Bladimir to leave the hospital. He was then confined,

with Narding keeping watch over him. The next day, a doctor of the hospital

informed Narding that they needed to talk to Bladimirs parents, hence, on

Silanggas request, their co-workers June Matias and Joel Edrene fetched

Bladimirs parents from Tarlac.

At about 8 oclock in the evening of the same day, Bladimirs parents-

respondent spouses Cubacub, with their friend Dr. Hermes Frias (Dr. Frias),

arrived at the Caybiga Hospital and transferred Bladimir to the Quezon City

General Hospital (QCGH) where he was placed in the intensive care unit and

died the following day.

The death certificate issued by the QCGH recorded Bladimirs immediate cause

of death as cardio-respiratory arrest and the antecedent cause as pneumonia.

On the other hand, the death certificate issued by Dr. Frias recorded the causes

of death as cardiac arrest, multiple organ system failure, septicemia and chicken

pox.

Bladimirs parents-herein respondents later filed on August 17, 1995 before the

Tarlac Regional Trial Court (RTC) at Capas a complaint for damages against

petitioners, alleging that Hao was guilty of negligence which resulted in the

deterioration of Bladimirs condition leading to his death.

RTC Decision: dismissed the complaint, holding that Hao was not negligent. It

ruled that Hao was not under any obligation to bring Bladimir to better tertiary

hospitals, and assuming that Bladimir died of chicken pox aggravated by

pneumonia or some other complications due to lack of adequate facilities at the

hospital, the same cannot be attributed to Hao.

CA Decision: reversed the trial courts decision, holding that by Haos failure to

bring Bladimir to a better-equipped hospital, he violated Article 161 of the

Labor Code. It went on to state that Hao should have foreseen that Bladimir, an

adult, could suffer complications from chicken pox and, had he been brought to

hospitals like St. Lukes, Capitol Medical Center, Philippine General Hospital and

the like, Bladimir could have been saved.

ISSUE: Whether or not Hao is liable for damages for the death of bladimir.

HELD: Petition is Meritorious.

The present case is one for damages based on torts, the employer-employee

relationship being merely incidental. To successfully prosecute an action

anchored on torts, three elements must be present, viz: (1) duty (2) breach (3)

injury and proximate causation. The assailed decision of the appellate court

held that it was the duty of petitioners to provide adequate medical assistance

to the employees under Art. 161 of the Labor Code, failing which a breach is

committed.

Art. 161 of the Labor Code provides:

ART. 161. Assistance of employer. It shall be the duty of any employer to

provide all the necessary assistance to ensure the adequate and immediate

medical and dental attendance and treatment to an injured or sick employee in

case of emergency.

The Implementing Rules of the Code do not enlighten what the phrase

adequate and immediate medical attendance means in relation to an

emergency. It would thus appear that the determination of what it means is

left to the employer, except when a full-time registered nurse or physician are

available on-site as required, also under the Labor Code, specifically Art. 157

which provides:

Article 157. Emergency Medical and Dental Services. - It shall be the duty of

every employer to furnish his employees in any locality with free medical and

dental attendance and facilities consisting of:

(a) The services of a full-time registered nurse when the number of

employees exceeds fifty (50) but not more than two hundred (200)

except when the employer does not maintain hazardous workplaces, in

which case, the services of a graduate first-aider shall be provided for

the protection of workers, where no registered nurse is available. The

Secretary of Labor and Employment shall provide by appropriate

regulations, the services that shall be required where the number of

employees does not exceed fifty (50) and shall determine by

appropriate order, hazardous workplaces for purposes of this Article;

(b) The services of a full-time registered nurse, a part-time physician and

dentist, and an emergency clinic, when the number of employees

exceeds two hundred (200) but not more than three hundred (300);

and

(c) The services of a full-time physician, dentist and a full-time registered

nurse as well as a dental clinic and an infirmary or emergency hospital

with one bed capacity for every one hundred (100) employees when the

Yanyan 3

number of employees exceeds three hundred (300). (emphasis and

underscoring supplied)

In the present case, there is no allegation that the company premises are

hazardous. Neither is there any allegation on the number of employees the

company has. If Haos testimony would be believed, the company had only

seven regular employees and 20 contractual employees - still short of the

minimum 50 workers that an establishment must have for it to be required to

have a full-time registered nurse.

The Court can thus only determine whether the actions taken by petitioners

when Bladimir became ill amounted to the necessary assistance to ensure

adequate and immediate medical . . . attendance to Bladimir as required under

Art. 161 of the Labor Code.

As found by the trial court and borne by the records, petitioner Haos advice for

Bladimir to, as he did, take a 3-day rest and to later have him brought to the

nearest hospital constituted adequate and immediate medical attendance that

he is mandated, under Art. 161, to provide to a sick employee in an emergency.

Chicken pox is self-limiting. Hao does not appear to have a medical

background. He may not be thus expected to have known that Bladimir needed

to be brought to a hospital with better facilities than the Caybiga Hospital,

contrary to appellate courts ruling.

AT ALL EVENTS, the alleged negligence of Hao cannot be considered as the

proximate cause of the death of Bladimir. Proximate cause is that which, in

natural and continuous sequence, unbroken by an efficient intervening cause,

produces injury, and without which, the result would not have occurred.

An

injury or damage is proximately caused by an act or failure to act, whenever it

appears from the evidence in the case that the act or omission played a

substantial part in bringing about or actually causing the injury or damage, and

that the injury or damage was either adirect result or a reasonably probable

consequence of the act or omission.

[6]

Verily, the issue in this case is essentially factual in nature. The dissent, apart

from adopting the appellate courts findings, finds that Bladimir contracted

chicken pox from a co-worker and Hao was negligent in not bringing that co-

worker to the nearest physician, or isolating him as well. This finding is not,

however, borne by the records. Nowhere in the appellate courts or even the trial

courts decision is there any such definite finding that Bladimir contracted

chicken pox from a co-worker. At best, the only allusion to another employee

being afflicted with chicken pox was when Hao testified that he knew it to heal

within three days as was the case of another worker, without reference,

however, as to when it happened.

[7]

On the issue of which of the two death certificates is more credible, the dissent,

noting that Dr. Frias attended to Bladimir during his last illness, holds that the

certificate which he issued - citing chicken pox as antecedent cause - deserves

more credence.

There appears, however, to be no conflict in the two death certificates on the

immediate cause of Bladimirs death since both cite cardio-respiratory arrest

due to complications - from pneumonia per QCGH, septicemia and chicken pox

per Dr. Frias. In fact, Dr. Frias admitted that the causes of death in both

certificates were the same.

[8]

Be that as it may, Dr. Frias could not be considered as Bladimirs attending

physician, he having merely ordered Bladimirs transfer to the QCGH after

seeing him at the Caybiga Hospital. He thereafter left Bladimir to the care of

doctors at QCGH, returning to Capas, Tarlac at 4 oclock the following morning

or eight hours after seeing Bladimir. As he himself testified upon cross-

examination, he did not personally attend to Bladimir anymore once the latter

was brought to the ICU at QCGH.

[9]

It bears emphasis that a duly-registered death certificate is considered a public

document and the entries therein are presumed correct, unless the party who

contests its accuracy can produce positive evidence establishing otherwise.

[10]

The QCGH death certificate was received by the City Civil Registrar on April 17,

1995. Not only was the certificate shown by positive evidence to be inaccurate.

Its credibility, more than that issued by Dr. Frias, becomes more pronounced as

note is taken of the fact that he was not around at the time of death.

2. Ecasinas vs. Shangri-Las Mactan , March 4, 2009

FACTS: Registered nurses Escasinas and Singco (petitioners) were engaged in

1999 and 1996, respectively, by Dr. Pepito (respondent doctor) to work in her

clinic at respondent (Shangri-la) in Cebu of which she was a retained physician.

In late 2002, petitioners filed with the NLRC, a complaint,

for

regularization, underpayment of wages, non-payment of holiday pay, night shift

differential and 13

th

month pay differential against respondents, claiming that

they are regular employees of Shangri-la. Shangri-la claimed, however, that

Yanyan 4

petitioners were not its employees but of respondent doctor whom it retained

via MOA pursuant to Article 157 of the Labor Code, as amended.

Respondent doctor for her part claimed that petitioners were already working

for the previous retained physicians of Shangri-la before she was retained by

Shangri-la; and that she maintained petitioners services upon their request.

LA Decision: declared petitioners to be regular employees of Shangri-la.

to be regular employees of Shangri-la, the Arbiter noted that they usually

perform work which is necessary and desirable to Shangri-las business; that

they observe clinic hours and render services only to Shangri-las guests and

employees; that payment for their salaries were recommended to Shangri-las

Human Resource Department (HRD); that respondent doctor was Shangri-las

in-house physician, hence, also an employee; and that the MOA between

Shangri-la and respondent doctor was an insidious mechanism in order to

circumvent [the doctors] tenurial security and that of the employees under her.

NLRC Decision: granted Shangri-las and respondent doctors appeal and

dismissed petitioners complaint for lack of merit, it finding that no employer-

employee relationship exists between petitioner and Shangri-la. the Arbiter

erred in interpreting Article 157 in relation to Article 280 of the Labor Code, as

what is required under Article 157 is that the employer should provide the

services of medical personnel to its employees, but nowhere in said article is a

provision that nurses are required to be employed; that contrary to the finding

of the Arbiter, even if Article 280 states that if a worker performs work usually

necessary or desirable in the business of the employer, he cannot be

automatically deemed a regular employee; and that the MOA amply shows that

respondent doctor was in fact engaged by Shangri-la on a retainer basis, under

which she could hire her own nurses and other clinic personnel.

Petitioners said that, it was really Shangri-la which hired them and not

respondent doctor, the NLRC noted that the applications for employment were

made by persons who are not parties to the case and were not shown to have

been actually hired by Shangri-la.

Petitioners insist that under Article 157 of the Labor Code, Shangri-la is

required to hire a full-time registered nurse, apart from a physician, hence, their

engagement should be deemed as regular employment, the provisions of the

MOA notwithstanding; and that the MOA is contrary to public policy as it

circumvents tenurial security and, therefore, should be struck down as being

void ab initio. At most, they argue, the MOA is a mere job contract.

And petitioners maintain that respondent doctor is a labor-only contractor for

she has no license or business permit and no business name registration, which

is contrary to the requirements under Sec. 19 and 20 of the Implementing Rules

and Regulations of the Labor Code on sub-contracting.

ISSUE: whether or not Article 157 of the Labor Code does not make it

mandatory for a covered establishment to employ health personnel; that the

services of nurses is not germane nor indispensable to its operations; and that

respondent doctor is a legitimate individual independent contractor who has

the power to hire, fire and supervise the work of the nurses under her.

HELD: Petition Denied. The Court holds that, Art. 157 does not require the

engagement of full-time nurses as regular employees of a company employing

not less than 50 workers.

Thus, the Article provides:

ART. 157. Emergency medical and dental services. It shall be the duty of every

employer to furnish his employees in any locality with free medical and dental

attendance and facilities consisting of:

(a) The services of a full-time registered nurse when the number of

employees exceeds fifty (50) but not more than two hundred (200) except when

the employer does not maintain hazardous workplaces, in which case the

services of a graduate first-aider shall be provided for the protection of the

workers, where no registered nurse is available. The Secretary of Labor shall

provide by appropriate regulations the services that shall be required where the

number of employees does not exceed fifty (50) and shall determine by

appropriate order hazardous workplaces for purposes of this Article;

(b) The services of a full-time registered nurse, a part-time physician and

dentist, and an emergency clinic, when the number of employees exceeds two

hundred (200) but not more than three hundred (300); and

(c) The services of a full-time physician, dentist and full-time registered

nurse as well as a dental clinic, and an infirmary or emergency hospital with one

bed capacity for every one hundred (100) employees when the number of

employees exceeds three hundred (300).

In cases of hazardous workplaces, no employer shall engage the services of a

physician or dentist who cannot stay in the premises of the establishment for at

Yanyan 5

least two (2) hours, in the case of those engaged on part-time basis, and not less

than eight (8) hours in the case of those employed on full-time basis. Where the

undertaking is nonhazardous in nature, the physician and dentist may be

engaged on retained basis, subject to such regulations as the Secretary of Labor

may prescribe to insure immediate availability of medical and dental treatment

and attendance in case of emergency. (Emphasis and underscoring supplied)

Under the foregoing provision, Shangri-la, which employs more than 200

workers, is mandated to furnish its employees with the services of a full-time

registered nurse, a part-time physician and dentist, and an emergency clinic

which means that it should provide or make available such medical and allied

services to its employees, not necessarily to hire or employ a service

provider. As held in Philippine Global Communications vs. De Vera:

[8]

x x x while it is true that the provision requires employers to engage the

services of medical practitioners in certain establishments depending on the

number of their employees, nothing is there in the law which says that medical

practitioners so engaged be actually hired as employees, adding that the law, as

written, only requires the employer to retain, not employ, a part-time

physician who needed to stay in the premises of the non-hazardous workplace

for two (2) hours. (Emphasis and underscoring supplied)

The term full-time in Art. 157 cannot be construed as referring to the type of

employment of the person engaged to provide the services, for Article 157

must not be read alongside Art. 280

[9]

in order to vest employer-employee

relationship on the employer and the person so engaged. So De Vera teaches:

x x x For, we take it that any agreement may provide that one party shall render

services for and in behalf of another, no matter how necessary for the latters

business, even without being hired as an employee. This set-up is precisely true

in the case of an independent contractorship as well as in an agency

agreement. Indeed, Article 280 of the Labor Code, quoted by the appellate

court, is not the yardstick for determining the existence of an employment

relationship. As it is, the provision merely distinguishes between two (2) kinds

of employees, i.e., regular and casual. x x

The phrase services of a full-time registered nurse should thus be taken to

refer to the kind of services that the nurse will render in the companys

premises and to its employees, not the manner of his engagement.

On the other hand, existence of an employer-

employee relationship is established by the presence of the following

determinants:

(1) the selection and engagement of the workers; (2) power of dismissal;

(3) the payment of wages by whatever means; and (4) the power to control the

worker's conduct, with the latter assuming primacy in the overall consideration.

Against the above-listed determinants, the Court holds that respondent doctor

is a legitimate independent contractor. That Shangri-la provides the clinic

premises and medical supplies for use of its employees and guests does not

necessarily prove that respondent doctor lacks substantial capital and

investment. Besides, the maintenance of a clinic and provision of medical

services to its employees is required under Art. 157, which are not directly

related to Shangri-las principal business operation of hotels and restaurants.

As to payment of wages, respondent doctor is the one who underwrites the

following: salaries, SSS contributions and other benefits of the staff

[13]

; group

life, group personal accident insurance and life/death insurance

[14]

for the staff

with minimum benefit payable at 12 times the employees last drawn salary, as

well as value added taxes and withholding taxes, sourced from herP60,000.00

monthly retainer fee and 70% share of the service charges from Shangri-las

guests who avail of the clinic services. It is unlikely that respondent doctor

would report petitioners as workers, pay their SSS premium as well as their

wages if they were not indeed her employeess

[15]

With respect to the supervision and control of the nurses and clinic staff, it is

not disputed that a document, Clinic Policies and Employee Manual

[16]

claimed

to have been prepared by respondent doctor exists, to which petitioners gave

their conformity

[17]

and in which they acknowledged their co-terminus

employment status. It is thus presumed that said document, and not the

employee manual being followed by Shangri-las regular workers, governs how

they perform their respective tasks and responsibilities.

Contrary to petitioners contention, the various office directives issued by

Shangri-las officers do not imply that it is Shangri-las management and not

respondent doctor who exercises control over them or that Shangri-la has

control over how the doctor and the nurses perform their work. The

letter

[18]

addressed to respondent doctor dated February 7, 2003 from a certain

Tata L. Reyes giving instructions regarding the replenishment of emergency kits

Yanyan 6

is, at most, administrative in nature, related as it is to safety matters; while the

letter

[19]

dated May 17, 2004 from Shangri-las Assistant Financial Controller,

Lotlot Dagat, forbidding the clinic from receiving cash payments from the

resorts guests is a matter of financial policy in order to ensure proper sharing

of the proceeds, considering that Shangri-la and respondent doctor share in the

guests payments for medical services rendered. In fine, as Shangri-la does not

control how the work should be performed by petitioners, it is not petitioners

employer.

6. BOOK SIX, POST EMPLOYMENT

a. Termination of Employment ( Arts. 278-286)

i. Classification of Employees

1. Babas vs. Lorenzo Shipping December 15, 2010

FACTS: Respondent is a duly organized domestic corporation engaged in the

shipping industry; it owns several equipment necessary for its business. LSC

entered into a General Equipment Maintenance Repair and Management Services

Agreement

[3]

(Agreement) with Best Manpower Services, Inc. (BMSI). Under

the Agreement, BMSI undertook to provide maintenance and repair services to

LSCs container vans, heavy equipment, trailer chassis, and generator sets. BMSI

further undertook to provide checkers to inspect all containers received for

loading to and/or unloading from its vessels.

Simultaneous with the execution of the Agreement, LSC leased its

equipment, tools, and tractors to BMSI.

[4]

The period of lease was coterminous

with the Agreement.

BMSI then hired petitioners on various dates to work at LSC as checkers,

welders, utility men, clerks, forklift operators, motor pool and machine shop

workers, technicians, trailer drivers, and mechanics. Six years later, or on May

1, 2003, LSC entered into another contract with BMSI, this time, a service

contract.

[5]

Thereafter, petitioners filed with the LA a complaint for regularization against

LSC and BMSI. On October 1, 2003, LSC terminated the Agreement, effective

October 31, 2003. Consequently, petitioners lost their employment.

LA DECISION: The LA found that petitioners were employees of BMSI. It was

BMSI which hired petitioners, paid their wages, and exercised control over

them.

NLRC DECISION: petitioners arguing that BMSI was engaged in labor-only

contracting. They insisted that their employer was LSC. Reversed the Decision

of LA. respondent BMSI is not engaged in legitimate job contracting. First,

respondent BMSI has no equipment, no office premises, no capital and no

investments as shown in the Agreement itself which states:

ISSUE: Whether or not the RESPONDENT WAS ENGAGED IN LABOR-ONLY

CONTRACTING TO DEFEAT PETITIONERS RIGHT TO SECURITY OF TENURE.

[13]

HELD: Petitioners vigorously insist that they were employees of LSC; and that

BMSI is not an independent contractor, but a labor-only contractor. LSC, on the

other hand, maintains that BMSI is an independent contractor, with adequate

capital and investment. LSC capitalizes on the ratiocination made by the CA.

In declaring BMSI as an independent contractor, the CA, in the challenged

Decision, heavily relied on the provisions of the Agreement, wherein BMSI

declared that it was an independent contractor, with substantial capital and

investment.

De Los Santos v. NLRC

[18]

instructed us that the character of the business, i.e.,

whether as labor-only contractor or as job contractor, should be measured in

terms of, and determined by, the criteria set by statute. The parties cannot

dictate by the mere expedience of a unilateral declaration in a contract the

character of their business.

In San Miguel Corporation v. Vicente B. Semillano, Nelson Mondejas, Jovito

Remada, Alilgilan Multi-Purpose Coop (AMPCO), and Merlyn N. Policarpio,

[19]

this

Court explained:

Despite the fact that the service contracts contain stipulations which are

earmarks of independent contractorship, they do not make it legally so. The

language of a contract is neither determinative nor conclusive of the

relationship between the parties. Petitioner SMC and AMPCO cannot dictate, by

a declaration in a contract, the character of AMPCO's business, that is, whether

as labor-only contractor, or job contractor. AMPCO's character should be

measured in terms of, and determined by, the criteria set by statute.

Yanyan 7

Thus, in distinguishing between prohibited labor-only contracting and

permissible job contracting, the totality of the facts and the surrounding

circumstances of the case are to be considered.

Labor-only contracting, a prohibited act, is an arrangement where the

contractor or subcontractor merely recruits, supplies, or places workers to

perform a job, work, or service for a principal. In labor-only contracting, the

following elements are present: (a) the contractor or subcontractor does not

have substantial capital or investment to actually perform the job, work, or

service under its own account and responsibility; and (b) the employees

recruited, supplied, or placed by such contractor or subcontractor perform

activities which are directly related to the main business of the principal.

[20]

On the other hand, permissible job contracting or subcontracting refers to an

arrangement whereby a principal agrees to put out or farm out with the

contractor or subcontractor the performance or completion of a specific job,

work, or service within a definite or predetermined period, regardless of

whether such job, work, or service is to be performed or completed within or

outside the premises of the principal.

[21]

A person is considered engaged in legitimate job contracting or subcontracting

if the following conditions concur:

(a) The contractor carries on a distinct and independent business and

undertakes the contract work on his account under his own responsibility

according to his own manner and method, free from the control and direction of

his employer or principal in all matters connected with the performance of his

work except as to the results thereof;

(b) The contractor has substantial capital or investment; and

(c) The agreement between the principal and the contractor or subcontractor

assures the contractual employees' entitlement to all labor and occupational

safety and health standards, free exercise of the right to self-organization,

security of tenure, and social welfare benefits.

[22]

Given the above standards, we sustain the petitioners contention that BMSI is

engaged in labor-only contracting.

First, petitioners worked at LSCs premises, and nowhere else. Other than the

provisions of the Agreement, there was no showing that it was BMSI which

established petitioners working procedure and methods, which supervised

petitioners in their work, or which evaluated the same. There was absolute lack

of evidence that BMSI exercised control over them or their work, except for the

fact that petitioners were hired by BMSI.

Second, LSC was unable to present proof that BMSI had substantial capital. The

record before us is bereft of any proof pertaining to the contractors

capitalization, nor to its investment in tools, equipment, or implements actually

used in the performance or completion of the job, work, or service that it was

contracted to render. What is clear was that the equipment used by BMSI were

owned by, and merely rented from, LSC.

In Mandaue Galleon Trade, Inc. v. Andales,

[23]

we held:

The law casts the burden on the contractor to prove that it has substantial

capital, investment, tools, etc. Employees, on the other hand, need not prove

that the contractor does not have substantial capital, investment, and tools to

engage in job-contracting.

Third, petitioners performed activities which were directly related to the

main business of LSC. The work of petitioners as checkers, welders, utility men,

drivers, and mechanics could only be characterized as part of, or at least clearly

related to, and in the pursuit of, LSCs business. Logically, when petitioners were

assigned by BMSI to LSC, BMSI acted merely as a labor-only contractor.

Lastly, as found by the NLRC, BMSI had no other client except for LSC, and

neither BMSI nor LSC refuted this finding, thereby bolstering the NLRC finding

that BMSI is a labor-only contractor.

The CA erred in considering BMSIs Certificate of Registration as sufficient proof

that it is an independent contractor. In San Miguel Corporation v. Vicente B.

Semillano, Nelson Mondejas, Jovito Remada, Alilgilan Multi-Purpose Coop

(AMPCO), and Merlyn N. Policarpio,

[24]

we held that a Certificate of Registration

issued by the Department of Labor and Employment is not conclusive evidence

of such status. The fact of registration simply prevents the legal presumption of

being a mere labor-only contractor from arising.

[25]

Indubitably, BMSI can only be classified as a labor-only contractor.

Consequently, the workers that BMSI supplied to LSC became regular

Yanyan 8

employees of the latter.

[26]

Having gained regular status, petitioners were

entitled to security of tenure and could only be dismissed for just or authorized

causes and after they had been accorded due process.

Petitioners lost their employment when LSC terminated its Agreement with

BMSI. However, the termination of LSCsAgreement with BMSI cannot be

considered a just or an authorized cause for petitioners dismissal. In Almeda v.

Asahi GlassPhilippines. Inc. v. Asahi Glass Philippines, Inc.,

[27]

this Court declared:

The sole reason given for the dismissal of petitioners by SSASI was the

termination of its service contract with respondent. But since SSASI was a labor-

only contractor, and petitioners were to be deemed the employees of

respondent, then the said reason would not constitute a just or authorized

cause for petitioners dismissal. It would then appear that petitioners were

summarily dismissed based on the aforecited reason, without compliance with

the procedural due process for notice and hearing.

Herein petitioners, having been unjustly dismissed from work, are entitled to

reinstatement without loss of seniority rights and other privileges and to full

back wages, inclusive of allowances, and to other benefits or their monetary

equivalents computed from the time compensation was withheld up to the time

of actual reinstatement. Their earnings elsewhere during the periods of their

illegal dismissal shall not be deducted therefrom.

2. OREGAS v. NLRC, 559 SCRA 153

FACTS: Petitioners Rommel C. Oregas, Darwin R. Hilario and Sherwin A.

Arboleda worked as valet parking and door attendants in respondent Dusit

Hotel Nikko. They have employment contracts with respondent FVA. In 2000,

FVA recalled petitioners from Dusit. Petitioners then instituted a complaint for

illegal dismissal, regularization, premium pay for holiday and rest day, holiday

pay, service incentive leave pay, 13th month pay and attorney's fees against

respondents Dusit, Philippine Hotelier's, Inc. and FVA. Petitioners alleged that

despite the length of their service, Dusit never the rank and file employees'

union of Dusit learned that petitioners were

entitled to regularization, Dusit immediately terminated their services du to

"end of contract."

On 3/6/2001, Labor Arbiter Potenciano S. Canizares, Jr. dismissed the

complaint for lack of merit. Petitioners failed to prove that they were

employees of Dusit. Petitioners admitted that they transferred to FVA after their

previous placement agencies terminated their contracts of services with Dusit.

Labor Arbiter Canizares also noted that petitioners signed application and

employment contracts with FVA and were under its payrolls and accounts.

Thus, FVA was petitioners' employer.

Finally, he ruled that petitioners were merely recalled and not dismissed from

the service by FVA.

On appeal, the NLRC issued a Resolution dated August 25, 2003, modifying the

decision of Labor Arbiter. The NLRC observed that the four-fold test in

determining the existence of an employer-employee relationship is present in

petitioners' relationship with FVA. On the matter of selection and engagement,

records showed that petitioners applied with and were employed by FVA.

Although they were required to test drive by Dusit, it was done only to verify if

they had the necessary skills and competence required by the job. On the matter

of control, it was established that petitioners maintained their daily time

records with FVA. On the matter of dismissal, FVA exercised its power to

dismiss when it recalled petitioners from Dusit. Finally, on the matter of

payment of wages, it is undisputed that petitioners were under the payrolls and

accounts of FVA.

Nevertheless, the NLRC noted that after petitioners' recall, they were no longer

given new assignments. Since more than six months have already lapsed,

petitioners were deemed to have been constructively dismissed and therefore

entitled to separation pay of one-half month pay for every year of service.

Petitioners elevated the case to the CA which affirmed the NLRC resolution.

Reconsideration having been denied, petitioners raises the instant petition.

ISSUES:

WON Respondent FVA is an independent contractor

WON there an EMPLOYER-EMPLOYEE RELATIONSHIP exists between

Petitioners and Respondent Hotel

HELD: Petition Denied

1. YES. the Labor Arbiter, NLRC and the CA were unanimous in finding that FVA

was a legitimate job contractor. Among the circumstances that established the

status of FVA as a legitimate job contractor are:

Yanyan 9

(1) FVA is registered with the DOLE and the DTI;

(2) FVA has a Contract for Services with Dusit for the supply of valet parking

and door attendant services;

(3) FVA has an independent business and provides valet parking and door

attendant services to other clients like Mandarin Oriental, Manila Hotel,

Peninsula Manila Hotel, Westin Philippine Plaza, Golden B Hotel, Pan Pacific

Manila Hotel, and Strikezone Bowling Lane; and (4) FVA's total assets from

1997 to 1999 amount to P1,502,597.70 to P9,021,335.13. In addition, it

provides the uniforms and lockers of its employees.

2. NO. By applying the four-fold test used in determining an employer-employee

relationship, the status of FVA as the employer of petitioners is indubitably

established.

a. Petitioners applied and signed employment contracts with FVA. They were

merely assigned to Dusit conformably with the Contract for Services between

FVA and Dusit.

b. FVA assigned a supervisor in Dusit to monitor petitioners' attendance, leaves

of absence, performance and conduct. Petitioners also maintained their daily

time records with FVA.

c. Petitioners were duly notified by FVA that they would be assigned to Dusit for

five months only. Thereafter, they may either be recalled for transfer to other

clients or be reassigned to Dusit depending on the result of FVA's evaluation of

their performance. In this case, FVA opted to recall petitioners from Dusit.

d. While FVA billed Dusit for the services rendered, it was actually FVA which

paid petitioners' salaries. Worthy of note, FVA registered petitioners with the

Bureau of Internal Revenue and the Social Security System as its employees.

In summary, this Court accepts as established the fact that FVA is a

legitimate job contractor and, in contemplation of law, the employer of

petitioners.

3. ALIVIADO v. PROCTER and GAMBLE PHILS

FACTS: Petitioners worked as merchandisers of P&G from various dates,

allegedly starting as early as 1982 or as late as June 1991, to either May 5, 1992

or March 11, 1993.

They all individually signed employment contracts with either Promm-

Gem or SAPS for periods of more or less five months at a time. They were

assigned at different outlets, supermarkets and stores where they handled all

the products of P&G. They received their wages from Promm-Gem or SAPS.

SAPS and Promm-Gem imposed disciplinary measures on erring merchandisers

for reasons such as habitual absenteeism, dishonesty or changing day-off

without prior notice.

P&G is principally engaged in the manufacture and production of different

consumer and health products, which it sells on a wholesale basis to various

supermarkets and distributors.[8] To enhance consumer awareness and

acceptance of the products, P&G entered into contracts with Promm- Gem and

SAPS for the promotion and merchandising of its products. In December 1991,

petitioners filed a complaint against P&G for regularization, service incentive

leave pay and other benefits with damages. The complaint was later amended

to include the matter of their subsequent dismissal.

Ruling of the Labor Arbiter: Labor Arbiter dismissed the complaint for lack of

merit and ruled that there was no employer-employee relationship between

petitioners and P&G. He found that the selection and engagement of the

petitioners, the payment of their wages, the power of dismissal and control with

respect to the means and methods by which their work was accomplished, were

all done and exercised by Promm- Gem/SAPS. He further found that Promm-

Gem and SAPS were legitimate independent job contractors.

Ruling of the NLRC: The appeal of complainants is hereby DISMISSED and the

decision appealed from AFFIRMED. Ruling of the Court of Appeals: CA likewise

denied the petition.

Petitioners Arguments: Petitioners insist that they are employees of P&G. They

claim that they were recruited by the salesmen of P&G and were engaged to

undertake merchandising chores for P&G long before the existence of Promm-

Gem and/or SAPS. They further claim that when the latter had its so-called re-

alignment program, petitioners were instructed to fill up application forms and

report to the agencies which P&G created.

Respondents Arguments: On the other hand, P&G points out that the instant

petition raises only questions of fact and should thus be thrown out as the Court

Yanyan 10

is not a trier of facts. It argues that findings of facts of the NLRC, particularly

where the NLRC and the Labor Arbiter are in agreement, are deemed binding

and conclusive on the Supreme Court.

ISSUES: (1) whether P&G is the employer of petitioners; (2) whether

petitioners were illegally dismissed; and (3) whether petitioners are entitled for

payment of actual, moral and exemplary damages as well as litigation costs and

attorneys fees.

HELD: The petition has merit. As a rule, the Court refrains from reviewing

factual assessments of lower courts and agencies exercising adjudicative

functions, such as the NLRC. Occasionally, however, the Court is constrained to

wade into factual matters when there is insufficient or insubstantial evidence on

record to support those factual findings; or when too much is concluded,

inferred or deduced from the bare or incomplete facts appearing on record.[23]

In the present case, we find the need to review the records to ascertain the facts.

In order to resolve the issue of whether P&G is the employer of petitioners, it is

necessary to first determine whether Promm-Gem and SAPS are labor-only

contractors or legitimate job contractors.

In the event that the contractor or subcontractor fails to pay the wages of his

employees in accordance with this Code, the employer shall be jointly and

severally liable with his contractor or subcontractor to such employees to the

extent of the work performed under the contract, in the same manner and

extent that he is liable to employees directly employed by him.

There is labor-only contracting where the person supplying workers to an

employer does not have substantial capital or investment in the form oftools,

equipment, machineries, work premises, among others, and the workers

recruited and placed by such person are performing activities which are directly

related to the principal business of such employer. In such cases, the person or

intermediary shall be considered merely as anagent of the employer who shall

be responsible to the workers in the same manner and extent as if the latter

were directly employed by him.

Clearly, the law and its implementing rules allow contracting arrangements for

the performance of specific jobs, works or services.

Indeed, it is management prerogative to farm out any of its activities, regardless

of whether such activity is peripheral or core in nature. However, in order for

such outsourcing to be valid, it must be made to an independent contractor

because the current labor rules expressly prohibit labor-only contracting.

In the instant case, the financial statements of Promm-Gem show that ithas

authorized capital stock of P1 million and a paid-in capital, or capital available

for operations, of P500,000.00 as of 1990. It also has long term assets worth

P432,895.28 and current assets ofP719,042.32.

Promm-Gem has also proven that it maintained its own warehouse and office

space with a floor area of 870 square meters. It also had under its name thre

registered vehicles which were used for its promotional/merchandising

business. Promm-Gem also has other clients aside from P&G. Under the

circumstances, we find that Promm-Gem has substantial investment which

relates to the work to be performed. These factors negate the existence of the

element specified in Section 5(i) of DOLE Department Order No. 18-02.

The records also show that Promm-Gem supplied its complainant-workers with

the relevant materials, such as markers, tapes, liners and cutters, necessary for

them to perform their work. Promm-Gem also issued uniforms to them. It is also

relevant to mention that Promm-Gem already considered the complainants

working under it as its regular, not merely contractual or project, employees.

This circumstance negates the existence of element (ii) as stated in Section 5 of

DOLE Department Order No. 18-02, which speaks of contractual employees.

This, furthermore, negates on the part of Promm-Gem bad faith and intent to

circumvent labor laws which factors have often been tipping points that lead

the Court to strike down the employment practice or agreement concerned as

contrary to public policy, morals, good customs or public order. Under the

circumstances, Promm-Gem cannot be considered as a labor-only contractor.

We find that it is a legitimate independent contractor.

Furthermore, the petitioners have been charged with the merchandising and

promotion of the products of P&G, an activity that has already been considered

by the Court as doubtlessly directly related to the manufacturing business,

which is the principal business of P&G. Considering that SAPS has no substantial

capital or investment and the workers it recruited are performing activities

which are directly related to the principal business of P&G, we find that the

former is engaged in labor-only contracting.

4. Sonza vs. ABS CBN

Yanyan 11

FACTS: ABS-CBN and MJMDC entered into a contract on may 1994. ABSCBN

was represented by its officers while MJMDC was represented by Sonza, as

president and general manager and Mel Tiangco, as EVP and treasurer referred

to in the agreement as agent, MJDC agreed to provide Sonzas services

exclusively ABS-CBN as talent for radio and television. The agreement listed the

services Sonza would render.

On April 1996, Sonza wrote a letter to ABS-CBNs president in regard to his

resignation in view of the events concerning his programs and career. April 30,

1996, Sonza filed a complaint against the ABS-CBN before the DOLE. Sonza

complained that the ABS-CBN did not pay his salaries, separation pay, and

service incentive, leave pay, signing bonus, travel allowances and amounts due

under the employee stock option plan (ESOP).

On July 10 1996, ABS-CBN filed a motion to dismiss on the ground that there is

no employer-employee relationship. Sonza filed an opposition to the motion on

July 19, 1996.

Meanwhile, ABS-CBN opened a account to continually remit Sonza fees under

the agreement.

Labor arbiter denied the motion to dismiss; however in his decision labor

arbiter dismissed the complaint for lack of jurisdiction and that there is not

employer-employee relationship.

On appeal, the NLRC affirmed the decision of the labor arbiter. The same was

also denied upon the motion for reconsideration.

ISSUES and RULING:

I. Whether or not Sonza is an employee or independent contractor

> The existence of an employer-employee relationship is a question of fact.

Appellate courts accord the factual findings of the labor arbiter and the NLRC

not only respect but also finality when supported by substantial evidence. Court

does not substitute its own judgment for that of the tribunal in determining

where the weight of evidence lies or what evidence is credible.

II. Essential elements of employer-employee relationship

A. Selection and engagement of employer. The specific selection and hiring of

Sonza, because of his unique skills, talent and celebrity status not possessed by

ordinary employees. Is a circumstance indicative but not conclusive of

independent contractual relationship.

B, Payment of wages whatever benefits Sonza enjoyed arose from contract

and not because of an employeremployee relationship. The power to bargain

the talent fees way above the salary scales of ordinary employees is a

circumstance indicative, but not conclusive of independent contractual

relationship.

C. Power of dismissal. Sonza failed to show that ABS-CBN

could terminate his service on grounds other than breach of contract, such as

retrenchment to prevent losses as provided

under labor laws.

D. power of control applying the control test the court held that Sonza is not

an employee but an independent contractor. The control test being the most

important test our courts apply in distinguishing an employee from an

independent contactor.ABS-CBN did not exercise control over the means and

methods of performance of Sonzas work. Moreover a radio broadcast specialist

who works under minimal supervision is an independent contractor lastly, in

broadcast industry exclusively is not necessarily the same as control.

I. Nature of Sonzas claim

Sonzas claims are all based on the may agreement and stock option plan and

not in the 1994 labor code. Clearly the present case does not call for an

application of the labor code. In effect Sonzas cause of action is for breach of

contract which is intrinsically a civil dispute cognizable by the court. Petition is

denied.

5. Garden Memories vs. NLRC

FACTS: Petitioner is engaged in the business of operating a memorial park

situated at Calsadang Bago, Pateros, Metro-Manila and selling memorial Plan

and services.

Respondent Cruz, on the other hand, worked at the Garden of Memories

Memorial Park as a utility worker from August 1991 until her termination in

February 1998. Cruz, filed for illegal dismissal, underpayment of wages, non-

inclusion in the Social Security Services, and non-payment of legal/special

holiday, premium pay for rest day, 13th month pay and service incentive leave

pay against Garden of Memories before the Department of Labor and

Employment (DOLE).

Yanyan 12

Upon motion of Garden of Memories, Requio was impleaded as respondent on

the alleged ground that she was its service contractor and the employer of Cruz.

In her position paper,

[5]

Cruz averred that she worked as a utility worker of

Garden of Memories with a salary of P115.00 per day. As a utility worker, she

was in charge, among others, of the cleaning and maintenance of the ground

facilities of the memorial park. Sometime in February 1998, she had a

misunderstanding with a co-worker named Adoracion Requio regarding the

use of a garden water hose. When the misunderstanding came to the knowledge

of Requio, the latter instructed them to go home and not to return anymore.

After three (3) days, Cruz reported for work but she was told that she had been

replaced by another worker. She immediately reported the matter of her

replacement to the personnel manager of Garden of Memories and manifested

her protest.

Cruz argued that as a regular employee of the Garden of Memories, she could

not be terminated without just or valid cause. Also, her dismissal was violative

of due process as she was not afforded the opportunity to explain her side

before her employment was terminated.

Cruz further claimed that as a result of her illegal dismissal, she suffered

sleepless nights, serious anxiety and mental anguish.

In its Answer,

[6]

Garden of Memories denied liability for the claims of Cruz and

asserted that she was not its employee but that of Requio, its independent

service contractor, who maintained the park for a contract price. It insisted that

there was no employer-employee relationship between them because she was

employed by its service contractor, Victoriana Requio (Victoriana), who was

later succeeded by her daughter, Paulina, when she (Victoriana) got sick.

Garden of Memories claimed that Requio was a service contractor who carried

an independent business and undertook the contract of work on her own

account, under her own responsibility and according to her own manner and

method, except as to the results thereof.

In her defense, Requio prayed for the dismissal of the complaint stating that it

was Victoriana, her mother, who hired Cruz, and she merely took over the

supervision and management of the workers of the memorial park when her

mother got ill. She claimed that the ownership of the business was never

transferred to her.

Requio further stated that Cruz was not dismissed from her employment but

that she abandoned her work.

[7]

On October 27, 1999, the LA ruled that Requio was not an independent

contractor but a labor-only contractor and that her defense that Cruz

abandoned her work was negated by the filing of the present case.

LA Decision: LA declared both Garden of Memories and Requio, jointly and

severally, liable for the monetary claims of Cruz,

ISSUE:

1. whether or not petitioner is engaged in labor-only contracting

2. whether or not there exist an employer-empoyee relationship

HELD: No Merit

Section 106 of the Labor Code on contracting and subcontracting provides:

Article 106. Contractor or subcontractor. - Whenever, an employer enters into a

contract with another person for the performance of the formers work, the

employees of the contractor and of the latters subcontractor shall be paid in

accordance with the provisions of this Code.

In the event that the contractor or subcontractor fails to pay the wages of his

employees in accordance with this Code, the employer shall be jointly and

severally liable with his contractor or subcontractor to such employees to the

extent of the work performed under the contract, in the same manner and

extent that he is liable to employees directly employed by him.

The Secretary of Labor may, by appropriate regulations, restrict or prohibit the

contracting out of labor to protect the rights of workers established under this

Code. In so prohibiting or restricting, he may make appropriate distinctions

between labor-only contracting and job contracting as well as differentiations

within these types of contracting and determine who among the parties

involved shall be considered the employer for purposes of this Code, to prevent

any violation or circumvention of any provision of this Code.

Yanyan 13

There is labor-only contracting where the person supplying workers to an

employer does not have substantial capital or investment in the form of tools,

equipment, machineries, work premises, among others, and the workers

recruited and placed by such persons are performing activities which are

directly related to the principal business of such employer. In such cases, the

person or intermediary shall be considered merely as an agent of the employer

who shall be responsible to the workers in the same manner and extent as if the

latter were directly employed by him.[Underscoring provided]

In the same vein, Sections 8 and 9, DOLE Department Order No. 10, Series of

1997, state that:

Sec. 8. Job contracting. There is job contracting permissible under the Code if

the following conditions are met:

(1) The contractor carries on an independent business and undertakes the

contract work on his own account under his own responsibility according to his

own manner and method, free from the control and direction of his employer

or principal in all

matters connected with the performance of the work except as to the results

thereof; and

(2) The contractor has substantial capital or investment in the form of tools,

equipment, machineries, work premises, and other materials which are

necessary in the conduct of his business.

Sec. 9. Labor-only contracting. (a) Any person who undertakes to supply

workers to an employer shall be deemed to be engaged in labor-only

contracting where such person:

(1) Does not have substantial capital or investment in the form of tools,

equipment, machineries, work premises and other materials; and

(2) The workers recruited and placed by such persons are performing activities

which are directly related to the principal business or operations of the

employer in which workers are habitually employed.

(b) Labor-only contracting as defined herein is hereby prohibited and the

person acting as contractor shall be considered merely as an agent or

intermediary of the employer who shall be responsible to the workers in the

same manner and extent as if the latter were directly employed by him.

(c) For cases not falling under this Article, the Secretary of Labor shall

determine through appropriate orders whether or not the contracting out of

labor is permissible in the light of the circumstances of each case and after

considering the operating needs of the employer and the rights of the workers

involved. In such case, he may prescribe conditions and restrictions to insure

the protection and welfare of the workers.

On the matter of labor-only contracting, Section 5 of Rule VIII-A of the Omnibus

Rules Implementing the Labor Code, provides:

Section 5. Prohibition against labor-only contracting. Labor-only contracting is

hereby declared prohibited. For this purpose, labor-only contracting shall refer

to an arrangement where the contractor or subcontractor merely recruits,

supplies or places workers to perform a job, work or service for a principal, and

any of the following elements are present:

i) The contractor or subcontractor does not have substantial capital or

investment which relates to the job, work or service to be performed and the

employees recruited, supplied or placed by such contractor or subcontractor

are performing activities related to the main business of the principal, or

ii) The contractor does not exercise the right to control over the performance of

the work of the contractual employee.

X x x x

Thus, in determining the existence of an independent contractor relationship,

several factors may be considered, such as, but not necessarily confined to,

whether or not the contractor is carrying on an independent business; the

nature and extent of the work; the skill required; the term and duration of the

relationship; the right to assign the performance of specified pieces of work; the

control and supervision of the work to another; the employers power with

respect to the hiring, firing and payment of the contractors workers; the control

Yanyan 14

of the premises; the duty to supply premises, tools, appliances, materials and

labor; and the mode, manner and terms of payment.

[15]

On the other hand, there is labor-only contracting where: (a) the person

supplying workers to an employer does not have substantial capital or

investment in the form of tools, equipment, machineries, work premises, among

others; and (b) the workers recruited and placed by such person are performing

activities which are directly related to the principal business of the employer.

[16]

The Court finds no compelling reason to deviate from the findings of the

tribunals below. Both the capitalization requirement and the power of control

on the part of Requio are wanting.

Generally, the presumption is that the contractor is a labor-only contracting

unless such contractor overcomes the burden of proving that it has the

substantial capital, investment, tools and the like.

[17]

In the present case, though

Garden of Memories is not the contractor, it has the burden of proving that

Requio has sufficient capital or investment since it is claiming the supposed

status of Requio as independent contractor.

[18]

Garden of Memories, however,

failed to adduce evidence purporting to show that Requio had sufficient

capitalization. Neither did it show that she invested in the form of tools,

equipment, machineries, work premises and other materials which are

necessary in the completion of the service contract.

Furthermore, Requio was not a licensed contractor. Her explanation that her

business was a mere livelihood program akin to a cottage industry provided by

Garden of Memories as part of its contribution to the upliftment of the

underprivileged residing near the memorial park proves that her capital

investment was not substantial. Substantial capital or investment refers to

capital stocks and subscribed capitalization in the case of corporations, tools,

equipment, implements, machineries, and work premises, actually and directly

used by the contractor or subcontractor in the performance or completion of

the job, work or service contracted out.

[19]

Obviously, Requio is a labor-only

contractor.

Another determinant factor that classifies petitioner Requio as a labor-only

contractor was her failure to exercise the right to control the performance of the

work of Cruz.

The requirement of the law in determining the existence of independent

contractorship is that the contractor should undertake the work on his own

account, under his own responsibility, according to his own manner and

method, free from the control and direction of the employer except as to the

results thereof.

[21]

In this case, however, the Service Contract Agreement clearly

indicates that Requio has no discretion to determine the means and manner by

which the work is performed. Rather, the work should be in strict compliance

with, and subject to, all requirements and standards of Garden of Memories.

Under these circumstances, there is no doubt that Requio is engaged in labor-

only contracting, and is considered merely an agent of Garden of Memories. As

such, the workers she supplies should be considered as employees of Garden of

Memories. Consequently, the latter, as principal employer, is responsible to the

employees of the labor-only contractor as if such employees have been directly

employed by it.

[22]

Notably, Cruz was hired as a utility worker tasked to clean, sweep and water the

lawn of the memorial park. She performed activities which were necessary or

desirable to its principal trade or business. Thus, she was a regular employee

of Garden of Memories and cannot be dismissed except for just and authorized

causes.

ii. Regular Employee, project/ seasonal employee, probationary, casual

557 SCRA 124

1. Goma vs. Pamplona

FACTS: Petitioner commenced the instant suit by filing a complaint for illegal

dismissal, underpayment of wages, non-payment of premium pay for holiday

and rest day, five (5) days incentive leave pay, damages and

attorney's fees, against the respondent. The case was filed with the Sub-

Regional Arbitration Branch No. VII of Dumaguete City. Petitioner claimed that

he worked as a carpenter at the Hacienda Pamplona since 1995; that he worked

from 7:30 a.m. to 12:00 noon and from 1:00 p.m. to 5:00 p.m. daily with a salary

rate of P90.00 a day paid weekly; and that he worked continuously until 1997

when he was not given any work assignment.

Yanyan 15

On a claim that he was a regular employee, petitioner alleged to have been

illegally dismissed when the respondent refused without just cause to give him

work assignment. Thus, he prayed for backwages, salary differential, service

incentive leave pay, damages and attorney's fees.

On the other hand, respondent denied having hired the petitioner as its

regular employee. It instead argued that petitioner was hired by a certain Antoy

Caaveral, the manager of the hacienda at the time it was owned by Mr. Bower

and leased by Manuel Gonzales, a jai-alai pelotari known as "Ybarra."[6]

Respondent added that it was not obliged to absorb the employees of the

former owner.

In 1995, Pamplona Plantation Leisure Corporation (PPLC) was created for the

operation of tourist resorts, hotels and bars. Petitioner, thus, rendered service

in the construction of the facilities of PPLC. If at all, petitioner was a project but

not a regular employee.

On June 28, 1999, Labor Arbiter Geoffrey P. Villahermosa dismissed the

case for lack of merit.[8] The Labor Arbiter concluded that petitioner was hired

by the former owner, hence, was not an employee of the respondent.

Consequently, his money claims were denied.

On appeal to the National Labor Relations Commission (NLRC), the

petitioner obtained favorable judgment when the tribunal reversed and set

aside the Labor Arbiter's decision.

The NLRC upheld the existence of an employer-employee relationship,

ratiocinating that it was difficult to believe that a simple carpenter from far

away Pamplona would go to Dumaguete City to hire a competent lawyer to help

him secure justice if he did not believe that his right as a laborer had been

violated.

Contrary to the NLRC's finding, the CA concluded that there was no

employer-employee relationship. The CA stressed that petitioner having raised

a positive averment, had the burden of proving the existence of an

employer-employee relationship.

ISSUE: 1) Is the petitioner a regular employee of the respondent? 2) If so, was

he illegally dismissed from employment? and 3) Is he entitled to his monetary

claims?

HELD: A thorough examination of the records compels this Court to reach a

conclusion different from that of the CA. It is true that petitioner admitted

having been employed by the former owner prior to 1993 or before the

respondent took over the ownership and management of the plantation,

however, he likewise alleged having been hired by the respondent as a

carpenter in 1995 and having worked as such for two years until 1997.

He is a project employee as he was hired - 1) for a specific project or

undertaking, and 2) the completion or termination of such project or

undertaking has been determined at the time of engagement of the employee.

In other words, as regards those workers who worked in 1995 specifically in

connection with the construction of the facilities of Pamplona Plantation Leisure

Corporation, their employment was definitely "temporary" in character and not

regular employment. Their employment was deemed terminated by operation

of law the moment they had finished the job or activity under which they were

employed.

Thus, departing from its initial stand that it never hired petitioner, the

respondent eventually admitted the existence of employer-employee

relationship before the CA. It, however, qualified such admission by claiming

that it was PPLC that hired the petitioner and that the nature of his employment

therein was that of a "project" and not "regular"

employee.

The employment relationship having been established, the next question

we must answer is: Is the petitioner a regular or project employee?

We find the petitioner to be a regular employee provided in Article 280 of the

Labor Code, as amended.

Respondent is engaged in the management of the Pamplona Plantation as well

as in the operation of tourist resorts, hotels, inns, restaurants, etc.

Petitioner, on the other hand, was engaged to perform carpentry work. His

services were needed for a period of two years until such time that the

respondent decided not to give him work assignment anymore. Owing to his

length of service, petitioner became a regular employee, by operation of law.

A project employee is assigned to carry out a specific project or

Yanyan 16

undertaking the duration and scope of which are specified at the time the

employee is engaged in the project. A project is a job or undertaking which is

distinct, separate and identifiable from the usual or regular undertakings of the

company. A project employee is assigned to a project which begins and ends at

determined or determinable times.

The principal test used to determine whether employees are project

employees as distinguished from regular employees, is whether or not the

employees were assigned to carry out a specific project or undertaking, the

duration or scope of which was specified at the time the employees were

engaged for that project.[31] In this case, apart from respondent's bare

allegation that petitioner was a project employee, it had not shown that

petitioner was informed that he would be assigned to a specific project or

undertaking. Neither was it established that he was informed of the duration

and scope of such project or undertaking at the time of his engagement.

Most important of all, based on the records, respondent did not report the

termination of petitioner's supposed project employment to the

Department of Labor and Employment (DOLE). Department Order No. 19 (as

well as the old Policy Instructions No. 20) requires employers to submit a

report of an employee's termination to the nearest public employment office

every time the employment is terminated due to a completion of a project.

Respondent's failure to file termination reports, particularly on the cessation of

petitioner's employment, was an indication that the petitioner was not a project

but a regular employee.

We stress herein that the law overrides such conditions which are

prejudicial to the interest of the worker whose weak bargaining position

necessitates the succor of the State. What determines whether a certain

employment is regular or otherwise is not the will or word of the employer, to

which the worker oftentimes acquiesces. Neither is it the procedure of hiring

the employee nor the manner of paying the salary or the actual time spent at

work.

It is the character of the activities performed by the employer in relation to the

particular trade or business of the employer, taking into account all the

circumstances, including the length of time of its performance and its continued

existence. Given the attendant circumstances in the case at bar, it is obvious that

one year after he was employed by the respondent, petitioner became a regular

employee by operation of law.

As to the question of whether petitioner was illegally dismissed, we answer in

the affirmative. Well-established is the rule that regular employees enjoy

security of tenure and they can only be dismissed for just cause and with due

process, i.e., after notice and hearing. In cases involving an employee's

dismissal, the burden is on the employer to prove that the dismissal was legal.

This burden was not amply discharged by the respondent in this case.

Obviously, petitioner's dismissal was not based on any of the just or

authorized causes enumerated under Articles 282, 283 and 284 of the

Labor Code, as amended. After working for the respondent for a period of two

years, petitioner was shocked to find out that he was not given any work

assignment anymore. Hence, the requirement of substantive due process was

not complied with.

Apart from the requirement that the dismissal of an employee be based on any

of the just or authorized causes, the procedure laid down in Book VI Rule I,

Section 2 (d) of the Omnibus Rules Implementing the Labor Code, must be

followed. Failure to observe the rules is a violation of the

employee's right to procedural due process.

Having shown that petitioner is a regular employee and that his dismissal was

illegal, we now discuss the propriety of the monetary claims of the petitioner.

An illegally dismissed employee is entitled to: (1) either reinstatement, if viable,

or separation pay if reinstatement is no longer viable, and (2) backwages.

In the instant case, we are prepared to concede the impossibility of the

reinstatement of petitioner considering that his position or any equivalent

position may no longer be available in view of the length of time that this case

has been pending. Moreover, the protracted litigation may have seriously

abraded the relationship of the parties so as to render reinstatement