Escolar Documentos

Profissional Documentos

Cultura Documentos

Landmark Return Multiplier Fund: Capitalizing on Real Estate Opportunities

Enviado por

Sandeep Borse0 notas0% acharam este documento útil (0 voto)

273 visualizações37 páginasThe document provides an overview of the Landmark Return Multiplier Fund, a real estate investment fund. Some key details include:

- The fund focuses on residential real estate investments in India with experienced developers.

- It aims to provide superior risk-adjusted returns through a combination of fixed preferred returns and equity upside.

- The core team managing the fund has over 100 years of combined experience in real estate investing, development, and project management.

- The board of directors includes professionals from banking, capital markets, and real estate development with decades of relevant industry experience.

Descrição original:

land mark capital brochure

Título original

Landmark Capital - Fund Brochure

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe document provides an overview of the Landmark Return Multiplier Fund, a real estate investment fund. Some key details include:

- The fund focuses on residential real estate investments in India with experienced developers.

- It aims to provide superior risk-adjusted returns through a combination of fixed preferred returns and equity upside.

- The core team managing the fund has over 100 years of combined experience in real estate investing, development, and project management.

- The board of directors includes professionals from banking, capital markets, and real estate development with decades of relevant industry experience.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

273 visualizações37 páginasLandmark Return Multiplier Fund: Capitalizing on Real Estate Opportunities

Enviado por

Sandeep BorseThe document provides an overview of the Landmark Return Multiplier Fund, a real estate investment fund. Some key details include:

- The fund focuses on residential real estate investments in India with experienced developers.

- It aims to provide superior risk-adjusted returns through a combination of fixed preferred returns and equity upside.

- The core team managing the fund has over 100 years of combined experience in real estate investing, development, and project management.

- The board of directors includes professionals from banking, capital markets, and real estate development with decades of relevant industry experience.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 37

Landmark Return Multiplier Fund

Real Estate Fund with Superior Risk Adjusted Returns

CONTENTS

Fund Overview and Key Fund Terms

Landmark Capital Overview

Board of Directors, Team Prole and Exit Track Record

Overall Fund Theme and Funding Strategy

Fund Structure and Taxation

Investment Process and Investment Strategy

Risk, Mitigation and Protection Rights

Our Partners

FUND OVERVIEW AND KEY FUND TERMS

1

FUND OVERVIEW

Sb req.:ereo rea| e:ae |ccu:eo |uno unoer |e nev /- req.ne

-uno S.ze c| : CC crcre: v.| a Creen S|ce Cp.cn c| : CC crcre:

Super.cr reurn: v.| aoeouae ocvn:.oe prcec.cn by vay c| cc||aera|:, re:u|.nq .n |cver.nq |e .nve:nen r.:|:

signicantly

-ccu: cn cp 4 c..e: nane|y |unba., banqa|cre, C|enna. ano -une

nve:nen c be naoe v.| rencvneo eve|cper: v|c |ave a prcven rac| reccro |cr execu.cn ano :a|e:

nve:nen .n -rc[ec: v|.c| are yp.ca||y unoer ccn:ruc.cn cr apprcva|: are .n p|ace

nve:nen pr.nar.|y .n re:.oen.a| :eqnen

nve:nen .n |e ccnb.na.cn c| nezzan.ne ano eou.y

|.n.nun C c| Ccrpu: c be .nve:eo by vay c| |xeo pre|erreo reurn (nezzan.ne, par.c.pa.cn ano ba|ance by

vay c| eou.y

|e abcve p|.|c:cp|y vcu|o en:ure |xeo pre|erreo reurn a|cnqv.| any eou.y up:.oe :|ar.nq

yp.ca||y |e en.re Ccrpu: vcu|o be a||ccaeo cver o- oea|: c| :na|| c neo.un .c|e :.ze: v|.c| vcu|o en:ure aoeouae

diversication of the Portfolio and derisking

nve:nen /ov.:cr |a: a ean c| |.q||y exper.enceo prc|e::.cna|: v.| apprcx 1C oecaoe: c| cvera|| exper.ence

|e ean |a: a very un.oue b|eno c| exper.ence ccnpr.:.nq c| ea| :ae nve:nen, ea| :ae Ccn:ruc.cn ano -rc[ec

Management professionals

|e ean |a: :ucce::|u||y ex.eo :evera| prc[ec: .n pa: a arac.ve :

Curren nar|e :cenar.c .: very ccnouc.ve c -uno |e eve|cper: cn acccun c| |ac| c| |nanc.nq |rcn ban|: ano -.nanc.a|

n:.u.cn:, |.n.eo avenue: c| |uno.nq .n area: c| |ano acou.:..cn, reoeve|cpnen prc[ec:, acou.:..cn c| -S/

/cccro.nq|y, pc::.b|e c neqc.ae |e |nanc.nq :rucure ano oea| oua|.y .n |avcur c| enoer

Investment Advisors

Capitalizing

on the current

market scenario

Fund Overview

Investment Focus

and Strategy

Investment Theme

|ere nay be a var.a.cn .n nve:nen |ene oepeno.nq upcn |e nar|e ccno..cn: ano nve:nen |anaqer: :raeqy 2

KEY FUND TERMS

Key Terms Particulars

Fund Size : CC crcre: v.| a Creen S|ce cp.cn c| : CC Crcre:

Fund Life a year: (cp.cn c| exen:.cn c| vc ern: c| cne year eac|,

Minimum Commitment : 1 crcre per nve:cr

Drawdown 4C Up|rcn ano ba|ance .n vc .n:a||nen: c| C eac|

Commitment period 18 ncn|: |rcn |na| c|c:.nq oae

Hurdle Rate 11 per annun

Targeted Gross IRR* 1 - per annun

Carried Interest 1C per annun (v.|cu cac| up,

Management Fee /nnua| |anaqenen -ee - 1.a c| committed amount

Cne .ne :e up |ee c| ccnn.ed amount

Distributions Sen. annua|/ /nnua| y.e|o o.:r.bu.cn:

Capital repayment to start from second year onwards

Sponsor Commitmen a c| |e ca| Cap.a| Ccnn.nen

nerna| ae c| eurn be|cre annua| |uno nanaqenen |ee, :e up cc::, carr.eo .nere: ano axe:

3

LANDMARK CAPITAL OVERVIEW

4

LANDMARK CAPITAL OVERVIEW

anonar| Cap.a| .: a Sb req.:ereo pr.vae eou.y -uno =cu:e :e up by exper.enceo prc|e::.cna|: v.| o.ver:.|eo rea| e:ae

.nve:nen bac|qrcuno

a.n: c |everaqe |e o.ver:.|eo exper.ence c| .: ean acrc:: o.|eren a::e c|a::e: c| rea| e:ae .n .oen.|y.nq arac.ve |.q| reurn

investment oppurtunities

anonar| p|.|c:cp|y .: qeareo c prcv.oe cp.nun reurn: c |e nve:cr: ano / |e :ane .ne en:ur.nq aoeouae pc::.b|e nea:ure:

to ensure protection of investment

nve:nen |anaqer a anonar| vcu|o :r.ve c en:ure |ea| c| eac| .nve:nen |rcuq| requ|ar reurn: c |e nve:cr: ano vcu|o

en:ure ab:c|ue ran:parency c nve:cr:

anonar| vcu|o pr.nar.|y |ccu: cn re:.oen.a| :eqnen

anonar| vcu|o |c||cv oe|en:.ve .nve:nen :raeqy v|.c| vcu|o nean .nve:nen cppcrun..e: c|er.nq requ|ar arac.ve reurn

along with upside

anonar| vcu|o a|:c cppcrun.:.ca||y .nve: .n eou.y ran:ac.cn: c qenerae :uper.cr reurn:

eaoer:|.p ano Ccre ean c| anonar| |a: /pprcx 1C oecaoe: c| ccnb.neo exper.ence .n |no.nq arac.ve rea| e:ae .nve:nen

cppcrun..e:, :rucur.nq ano nurur.nq |e .nve:nen ano na|.nq prc|ab|e ex.:

|e ean |a: a qcco b|eno c| exper.ence c ccver eno c eno cyc|e c| .nve:nen: ano carr.e: v.| .:e|| |e nc: o.ver:e

ea| e:ae bac|qrcuno

ean |a: exen:.ve exper.ence acrc:: o.|eren rea| e:ae a::e c|a::e: ano |a: un.oue oea| :curc.nq ab.|.y bac|eo by :c|.o rea| e:ae

investment experience

Team

About

Landmark Capital

Philosophy

Strategy

5

BOARD OF DIRECTORS

6

BOARD OF DIRECTORS

Mr Raj Narayan Bharadwaj

=e |a: |ao an .||u:rious career spann.nq a|nc: 4 oecaoe:. x C|a.rnan ano | c| C ano curren|y, |e c|a.rnan c|

e|.qare nve:cc ru:ee Cc. |o. =e|o o.reccr:|.p: c| /ne| /uc .n.eo, C (|aur..u: ano an|a,, no.an a.|vay Caer.nq

ano cur.:n Ccrpcra.cn .n.eo, -C o, /`S ban| .n.eo (|crner|y, U ban| o,, CC ano NS. -c: Craouae eqree

in Economics form Delhi School of Economics and BE from Institute of Engineers

Mr Milind Korde

=e |a: been a Managing .reccr c| Ccore[ -rcper.e: .n.eo. Sareo |.: career v.| aa =cu:.nq ano [c.neo Ccore[

-rcper.e: .n.eo. year: c| exper.ence .n rea| e:ae oeve|cpnen ano |a: |ano|eo o.ver:e pcr|c|.c: |.|e |eqa|, nar|e.nq,

ccnnerc.a|, :ecrear.a| ano bu:.ne:: oeve|cpnen. =e .: a |av qraouae, |c|o: a bac|e|cr c| Sc.ence oeqree ano .: a

Company Secretary

Mr D.P. Roy

=e |a: experience c| ncre |an 4C year: .n ban|.nq nou:ry ano |a: been a oepuy |anaq.nq .reccr c| Sae ban| c| no.a

(Sb,. =e va: xecu.ve C|a.rnan c| Sb Cap.a| |ar|e: .n.eo ano va: a|:c |e -re:.oen ano CC c| Sb Nev `cr|. =e

carr.e: an .n-oep| |ncv|eoqe ano vcr|.nq .n:.q| .nc |e ban|.nq :eccr. |a:er c| Sc.ence ano |e||cv a::cc.ae c| no.an

Institute of Bankers

Mr Ashish Joshi

C + year: c| exper.ence .n rea| e:ae, |cq.:.c: ano e|eccn .nou:ry. =e va: |e |anaq.nq -arner ano \|c|e .ne .reccr

v.| |.|e:cne Cap.a| /ov.:cr: .n.eo, a -r.vae ou.y -uno, v|ere |e va: re:pcn:.b|e |cr rea| e:ae .nve:nen: v.| /U|

c| :. CCC Crcre:. n |.: prev.cu: exper.ence, |e |a: vcr|eo a: |e C|.e| -.nanc.a| Cmcer a -en.n:u|a ano o. ano .reccr

- bu:.ne:: /on.n.:ra.cn v.| Cernan |NC =apaq-|cyo. =e .: C|arereo /cccunan ano Cc: /cccunan by -rc|e::.cn

7

CORE TEAM PROFILE

8

CORE TEAM

ASHISH JOSHI

C + year: c| exper.ence .n rea| e:ae, |cq.:.c: ano e|eccn .nou:ry

x |anaq.nq -arner, ea| :ae nve:nen: c| |.|e:cne Cap.a| /ov.:cr:

=e va: a::cc.aeo a |.|e:cne Cap.a| :.nce .: .ncep.cn ano va: .n:runena| .n bu.|o.nq a rea| e:ae /U| c| : ,CCC

crcre: acrc:: rea| e:ae |uno:

=a: :.qn.|can ano o.ver:.|eo exper.ence acrc:: o.|eren a::e c|a::e: c| rea| e:ae v|.c| .nc|uoe: re:.oen.a|,

ccnnerc.a|, rena| y.e|o (pre |ea:eo, ano vare|cu:.nq

\a: .nvc|veo .n |uno ra.:.nq, :curc.nq ano c|c:.nq oea|: pan no.a ano na|.nq :ucce::|u| ex.: a very arac.ve :

/::cc.aeo v.| -en.n:u|a ano .n.eo a: C-C ano v.| =apaq |cyo a: .reccr, bu:.ne:: eve|cpnen

C|arereo /cccunan ano Cc: /cccunan by -rc|e::.cn

M S JAGAN

C + year: c| exper.ence .n |arqe-:ca|e rea| e:ae .nve:nen: ano execu.cn

x CC - /:cenoa: no.a (a Ccv c| S.nqapcre nerpr.:e, ano va: re:pcn:.b|e |cr :e.nq up |arqe -ar|:

e:pcn:.b|e |cr .np|enen.nq 1aCC acre nou:r.a| -ar| .n C|enna., |ncvn a: |a|.nora C.y

nvc|veo .n oeve|cpnen c| na[cr |arqe S ano a|:c na[cr -ar|:, cvn:|.p: ano |arqe Ccnocn.n.un:

\cr| .n a|| area: ranq.nq |rcn ec|n.ca| oe:.qn c |eqa| occunen: c |nanc.a| :rucur.nq |cr a|| prc[ec: .nc|uo.nq

commercial and low and high rise residential

|b/ |rcn | (/, ano b.. |rcn no.an n:.ue c| Sc.ence

9

CORE TEAM

UJWAL PAREKH

U[va| |a: c|c:e c 8 year: c| cvera|| exper.ence .n |nanc.a| :erv.ce: ano rea| e:ae .nou:ry

U[va| va: a::cc.aeo v.| |.|e:cne Cap.a| a: a par c| |e ea| :ae nve:nen ean v|ere |e va: re:pcn:.b|e |cr ea|

:curc.nq, ue o.|.qence, .nve:nen :rucur.nq, ccunena.cn, cvn:e||.nq nve:nen: a :ub:an.a| -ren.un ano

Managing Exits

U[va| va: a::cc.aeo v.| rn: c `cunq v|ere |e va: .nvc|veo .n aov.:.nq var.cu: c|:|cre ano cn:|cre -r.vae ou.y

-uno: .n Cap.a| Srucur.nq, Jur.:o.c.cn /na|y:.:, - requ|a.cn:

C|arereo /cccunan by -rc|e::.cn

RAHUL DESHPANDE

a|u| |a: 14 year: c| exper.ence .n ccn:ruc.cn, -rc[ec nanaqenen, ea| :ae

\cr|eo v.| |.|e:cne Cap.a| /ov.:cr: .n capac.y c| V.ce -re:.oen - nve:nen |anaqenen v|ere |e va: re:pcn:.b|e

|cr ec|n.ca| ue .|.qence, -rc[ec a::e::nen c |ea:.b.|.y, oea| :curc.nq, oea| c|c:ure ano ex..nq |e .nve:nen:

\cr|eo a: C| - -rc[ec: v.| -rczcne nerpr.:e:, ano va: par c| execu.cn ano ca| prc[ec nanaqenen c| cne c| |e

|arqe: ea.| |a|| .n |e ccunry a /uranqabao

C.v.| nq.neer |rcn Un.ver:.y c| |unba. ano -c: qraoua.cn .n /ovance Ccn:ruc.cn |anaqenen |rcn NC|/ -une

10

CORE TEAM

ANIL KEWALRAMANI

/n.| |a: a ca| vcr| exper.ence c| 8 year:, na[cr|y .n |e |nanc.a| :erv.ce: .nou:ry

\cr|eo v.| -|C ano -vC v|ere |e :pec.a|.zeo .n prcv.o.nq |uno :rucur.nq ano .nve:nen :rucur.nq aov.ce c

var.cu: pr.vae eou.y c|.en: enqaqeo .n rea| e:ae ano .n|ra:rucure

/n.| |a: .noepenoen|y aov.:eo cn var.cu: ccnp|ex :rucur.nq ran:ac.cn: :uc| a: Ccncepua|.z.nq ano .np|enen.nq

.nncva.ve .nve:nen :rucure: |cr ac|.ev.nq cpera.cna| |ex.b.|.y ano bu:.ne:: cb[ec.ve: .nvc|v.nq cn-:|cre ano

c|-:|cre requ|acry ano ax .np|.ca.cn:

C|arereo /cccunan, .p|cna .n Secur..e: av: ano |b/ |rcn |e no.an Sc|cc| c| bu:.ne::

SHRIRAJ BHUKHANWALA

S|r.ra[ |a: 9 year: c| exper.ence .n |nanc.a| :erv.ce: .nou:ry

\cr|eo .n |e -r.vae ou.y .nou:ry |cr |e |a: 4 year: v.| |.|e:cne ano |c.|a| C:va| -

=e|peo .n ra.:.nq .n exce:: c| : aCC crcre: a |.|e:cne Cap.a| cn |e ocne:.c :.oe

=e|peo .n ra.:.nq : CC crcre: |cr |c.|a| C:va| cn |e -r.vae ou.y :.oe

\cr|eo .n uba. v.| /bn /nrc -r.vae ban|.nq .n |e.r :u.ca:e ban|.nq o.v.:.cn.

Ccnp|eeo |b/ .n .nerna.cna| |nance |rcn Sra|cro nerna.cna| Un.ver:.y, cnocn, U

11

EXIT TRACK RECORD OF THE TEAM

12

EXIT TRACK RECORD

Asset Class Investment Location Exit Investment Exit IRR

Type Extent Date Date

Ccnnerc.a| ena| `.e|o |unba. -u|| ec CC8 /uq C1C a

e:.oen.a| |ezzan.ne CV anan Naqar, banqa|cre -u|| |ay C11 |ar C1 a

e:.oen.a| |ezzan.ne a|.na |unba. -ar.a| -eb C1C /uq C1C

e:.oen.a| ou.y C|enna. -ar.a| |ar CC8 /uq C1C

e:.oen.a| |ezzan.ne S|.va[. -ar|, |unba. -u|| Jun C1C Jun C1

e:.oen.a| |ezzan.ne a|.na |unba. -u|| Cc C1C Cc C1

e:.oen.a| |ezzan.ne Scoepur, c||aa -ar.a| /uq CC9 Ncv C1

\are|cu:e ou.y /|neoabao -u|| -eb CC8 /uq C1C 18

13

Exit Status Partial Exit

IRR 25% per annum

Jain Heights Bangalore - Philosophy at the time of Investment

Project Status Project approvals were expected shortly. Pre launch of Project

had taken place

Location Project was located in an upcoming area of Bangalore which had

a potential for capital appreciation

Developer Mid Size Developer in Bangalore known for good quality projects

Security Investment amount was collateralized with charge on

Development rights, Pledge of Shares, Personal Guarantee of

promoters and Corporate Guarantee

SELECT SUCCESSFUL DEAL EXITS - MEZZANINE

Exit Status Full Exit

IRR 23% per annum

Richa Shivaji Park - Philosophy at the time of Investment

Project Status Project was under construction with 3 oors constructed and all

approvals were in place. Partial Sales had taken place

Location Project was at premium location - Shivaji Park, Mumbai which has

good demand for residential units

Developer Developer had excellent track record in redevelopment of projects

Security Investment amount was collateralized with First Registered charge

on Project, Pledge of Shares, Personal Guarantee of promoters and

Corporate Guarantee

14

Exit Status Partial Exit

IRR 22% per annum

SELECT SUCCESSFUL DEAL EXITS - MEZZANINE

Godrej Kolkata - Philosophy at the time of Investment

Project Status Land was acquired and approvals were expected shortly. Land

was owned by the SPV in which 49% was held by the Fund

Location Project was located in an upcoming area of Kolkata which had a

potential for capital appreciation

Developer Developer is amongst the renowned Developer of the country

Security 49% Stake in the Company, Pledge of Shares, Personal Guarantee

of promoters and Corporate Guarantee

Exit Status Full Exit

IRR 22% per annum

Richa Kalina - Philosophy at the time of Investment

Project Status Project was redevelopment project and all the tenants had been

relocated, old building was demolished and construction for new

building was about to commence

Location Project was at an excellent location - Kalina, Mumbai which has

excellent connectivity and robust demand for residential apartments

Developer Developer had excellent track record in redevelopment of projects

Security Investment amount was collateralized with First Registered charge on

Project, Pledge of Shares, Personal Guarantee of promoters and

Corporate Guarantee

15

SELECT SUCCESSFUL DEAL EXITS EQUITY AND RENTAL YIELD

Exit Status Full Exit

IRR 23% per annum

Ramaniyam Stone Arc- Philosophy at the time of Investment

Project Status Project was a JDA with the land owner and hence no land cost was

to be incurred by the Developer.

All approvals were in place and construction had commenced.

Location Project was at an attractive location Thiruvanmiyur, in South of

Chennai which had good residential demand

Developer Renowned and very high repute Developer in Chennai. Had

successful track record of executing and delivering several

residential and commercial projects.

Exit Status Full Exit

IRR 25% per annum

Raheja Titanium - Philosophy at the time of Investment

Project Status Project was an A Grade Commercial Building on Western Express

and location Highway, Mumbai

Tenants AAA + Quality Tenants with 5 year lock in

Low Entry Signicantly low entry price with a huge potential for capital

and price appreciation

Yield Attractive year on year yield of 18% resulting in regular cashows to

the Investors

16

SNAPSHOT OF PAST STRATEGIC INVESTMENTS

17

BHIWANDI WAREHOUSE

PROJECT SNAPSHOT

\are|cu:e -rc[ec |ccaeo .n b|.vano. cn |e cu:|.r: c| |unba.

oC acre -|c

Jc.n Venure v.| no.an cq.:.c:

INVESTMENT RATIONALE

Srcnq |ar|e ana|y:.s at the time of investment which indicated manifold price

appreciation in near future

Srucureo a: an ou.y nve:nen v.| a |.q|er prc| :|ar.nq c reap |e bene|: c|

price escalation

oen.|ca.cn c| |e |cca| JV -arner (anocvner, v|c |ao oeep .n:.q|: c| |e

nuances of the local market

INVESTMENT SNAPSHOT

Asset Class \are|cu:e

Investment Type ou.y

Equity Stake aC

Prot Sharing oC

Amount Invested : 4 crcre:

Investment Structure nve:nen by vay c| ou.y S|are:

ano C-C a S-V eve|

Investment Tenure 4 year:

Current Expected Realizable : 8C crcre:

Value Vis a Vis Investment made

18

RICHA MULUND

PROJECT SNAPSHOT

|/=// reoeve|cpnen -rc[ec c be execueo [c.n|y v.| aa =cu:.nq by .c|a ea|cr:

Sraeq.ca||y |ccaeo cn |u|uno a:ern xpre:: =.q|vay

eve|cper c reoeve|cp |/=// :cc.ey .n |.eu c| |ree :a|e -S

INVESTMENT RATIONALE

/pprcva|: vere rece.veo |cr re|ab.|.a.cn bu.|o.nq

enan: vere re|ccaeo c ran:. Canp

-rc[ec va: c be en.re|y unoera|en by aa =cu:.nq

/: per |e ern:, |e revenue :|ar.nq beveen // ano .c|a ea|cr: .n |e ra.c c|

4o |rcn |e :a|e c| |e |ree :a|e ccnpcnen v|.c| re:u|eo .n :ub:an.a| ca:||cv

to Richa

INVESTMENT SNAPSHOT

Asset Class Residential

Investment Type |ezzan.ne

Amount Invested : aC Crcre:

Investment Structure nve:nen by vay c| C-C a a |xeo reurn c| .a

reurn v.| 1 Ccupcn

Investment Tenure year:

Security Escrow of Cashows, Pledge of Shares, Personal

Cuaranee

Current Status -ar.a| x. Unoera|en

19

HCC 247 PARK

PROJECT SNAPSHOT

/ Craoe bu.|o.nq |ccaeo cn bS |arq, |unba.

-rc[ec va: cvneo .n an S-V .n v|.c| o va: |e|o by =CC

ca| |ea:ab|e area c| 1.1 n.||.cn :o | v.| v.nq: ano 1CC car par|:

INVESTMENT RATIONALE

/ Craoe bu.|o.nq .n |e |ear c| |unba.

xce||en enan -rc||e re:u|.nq .n requ|ar ca:| |cv:

=.q| cn acccun c| arac.ve enry va|ua.cn

-rc[ec va: by =CC a very rencvneo ano / Craoe eve|cper

INVESTMENT SNAPSHOT

Asset Class Commercial

Investment Type ena| `.e|o

Enterprise Value : 8a Crcre:

Investment Structure nve:nen by vay c| ou.y :|are: ano C-C a S-V

eve| ano acou.:..cn c| 4 :a|e ano ba|ance by =CC

Investment Tenure year:

Rental Yield 11

Current Value vis a vis : 1,CCC Crcre:

Investment made

20

OVERALL FUND THEME AND FUND STRATEGY

21

THEME CHART

Overall Fund Theme Mezzanine Funding

Equity

Mezzanine

|e nve:.b|e Ccrpu: vcu|o be .nve:eo brcao|y a||ccaeo

a: unoer

- /|ea: C by vay c| |ezzan.ne -uno.nq

- Upc C by vay c| ou.y -uno.nq

|ezzan.ne -uno.nq vcu|o be pr.nar.|y |cr unoer construction

prc[ec: v|ere apprcva|: are by ano |arqe .n p|ace

ou.y -uno.nq vcu|o be u:eo |cr -rc[ec: |av.nq pcential for

capital value appreciation

|ezzan.ne -uno.nq .: |e |ybr.o |crn c| -uno.nq v|.c| |a:

|e c|aracer.:.c: c| bc| eb ano ou.y

|ezzan.ne -uno.nq enab|e: |xeo pre|erreo reurn :.n.|ar c

eb ano |a: ocvn:.oe prcec.cn by vay c| aoeouae

cc||aera||.za.cn v|.c| .nc|uoe: ncrqaqe c| -rc[ec:,

-|eoqe, :crcv ano Cuaranee:

|ezzan.ne -uno.nq a|:c prcv.oe: |cr par.c.pa.cn .n prc|: c|

|e -rc[ec by vay c| ou.y up:.oe |.c|er

ou.y -uno.nq vcu|o enab|e .n ac|.ev.nq :uper.cr reurn by

par.c.pa.nq .n prc|: c| |e -rc[ec:

n ou.y -uno.nq, |e r.q|: vcu|o be prceceo by vay c|

na[cr.y :a|e .n |e -rc[ec, bcaro Sea, Vc.nq -cver, Vec

.q|:, /mrna.ve .q|:, Ccn:en cn e:erveo |aer: ec

Equity Funding

22

Mezzanine Funding

Equity Funding

FUND STRATEGY

Security

Tenure

& Cashow

Projects

Structure

-rc[ec: v|.c| |ave pcen.a| |cr cap.a|

appreciation

nve:nen vcu|o be naoe by acou.r.nq

:a|e by vay c| ou.y/ -re|erence

S|are: par c| . c be bcuq| bac| a

xed return

nve:nen vcu|o be yp.ca||y |cr -4

years with interim cashow at regular

intervals

Investor would have conversion rights,

bcaro Sea, vc.nq r.q|:, amrna.ve

r.q|:, :ub:an.a| :a|e .n |e -rc[ec

company

Security

Tenure

& Cashow

-rc[ec: v|.c| are yp.ca||y unoer

ccn:ruc.cn cr abcu c ccnnence ano

apprcva|: are by ano |arqe .n p|ace

nve:nen vcu|o be naoe by vay c|

nezzan.ne par.c.pa.cn v|.c| vcu|o

carry a |xeo reurn c| 1- v.| an

eou.y up:.oe

nve:nen vcu|o be yp.ca||y |cr -

years with interim cashow at regular

intervals

nve:nen vcu|o be cc||aera|.:eo by

vay c| req.:ereo ncrqaqe c| prc[ec,

Pledge of Shares, Corporate and Personal

Cuaranee, :crcv c| ca:||cv:

Projects

Structure

23

FUND STRUCTURE AND TAXATION

24

FUND STRUCTURE

Investment Team

Investment Committee

Landmark Capital

Advisors Private

Limited

Landmark Return

Multiplier Fund

Adi Capital Services

Private Limited

IL&FS Trust

Company Limited

Investment

Management Services

Management Fees

Sponsor / Settlor

Trustees

Contributions Distributions

Investments

(Equity, Equity linked

Instruments / Partnership

Interests / Debt etc.)

Income (Dividends/ Share

of Prots/Interest/ Capital

Gains etc.)

Portfolio Entities

Investors

1 2 3 4 5 6

25

TAXATION*

|e -uno |a: been :e up a: a oeern.nae ru:

|e -uno vcu|o cp c be axeo a: per :ec.cn 1o1 c 1o4 c| |e nccne-ax /c. |e -uno :|a|| o.:c|arqe |e ax

|.ab.|.y cn |e :|are c| .nve:cr: .n |e .nccne c| |e -uno, cn be|a|| c| |e .nve:cr:, a |e apprcpr.ae ax rae:.

Sub:eouen o.:r.bu.cn c| :uc| .nccne cuq| nc c arac any |ur|er ax |.ab.|.y .n |e |ano: c| |e .nve:cr:

nere: .nccne ar.:.nq |rcn |e -rc[ec vcu|o be axeo a nax.nun narq.na| rae a |e -uno eve| .e .99

cnq ern Cap.a| Ca.n: vcu|o be axeo a .oo .n ca:e c| Un|.:eo Secur..e:

cnq ern Cap.a| Ca.n: vcu|o nc be axab|e .| |e :ecur..e: are |.:eo ano S |a: been pa.o

S|cr ern Cap.a| Ca.n: vcu|o be axeo a .99 .n ca:e c| Un|.:eo Secur..e:

S|cr ern Cap.a| Ca.n: vcu|o be axab|e a 1o.99a .| |e :ecur..e: are |.:eo ano S |a: been pa.o

Short Term

Capital Gains

Trust Structure

Interest Income

.v.oeno nccne (pc: o.v.oeno o.:r.bu.cn ax c| 1o.99a payab|e by -rc[ec Ccnpany, vcu|o nc be axab|e

Dividend Income

Long Term

Capital Gains

- ax rae: nen.cneo are app|.cab|e |cr /` C14-1a

26

INVESTMENT PROCESS

27

INVESTMENT PROCESS

Investment

Process

1

2

3

4

5

6

Proprietary deal ow

through network of

extensive relationships

Detailed Screening of the

deal and Presentation to

Investment Committee

Transaction Structuring

and Preparation and

Signing of the Term Sheet

Undertaking detailed

nancial, legal and

technical due diligence

Signing of Denitive

Agreements and

Closure of the Deal

Day to Day management

of the Project and

undertaking the exit

28

INVESTMENT PARAMETERS

Partner with A Grade Developers

-arner.nq v.| / Craoe eve|cper: v|c |ave prcven

rac| reccro ano exce||en execu.cn capab.|..es

eve|cper: v.| .n oep| nar|e exper.:e ano prc[ec

nanaqenen capab.|..e:

eve|cper: v|c are nc |.q||y |everaqeo

Primary Focus on Residential Segment

-r.nary -ccu: cn e:.oen.a| Seqnent

e:.oen.a| -rc[ec: are :e|| |.ou.oa.nq ano |ave

regular cashows

Identication of projects

-rc[ec: v|.c| are unoer ccn:ruc.cn ano are expeceo

c qe ccnp|eeo .n 1- year: .ne |rane

-rc[ec: v|ere apprcva|: are .n p|ace

-rc[ec: v|.c| |ave :|cr c neo.un ern |uno.nq

reou.renen

Focus on Top 4 Cities

-ccu: cn cp 4 c..e: v|.c| .nc|uoe: |unba., C|enna.,

Bangalore and Pune

.er ano .er c..e: vcu|o |arqe|y be avc.oeo un|e::

the opportunity is compelling

Investment

Strategy

29

RISKS MITIGATION AND PROTECTION RIGHTS

30

RISK AND MITIGATION

e|ay .n execu.cn

e|ay .n apprcva|:

eve|cper nc prcv.o.nq |e ex.

eve|cper / Ccnpany nc buy.nq bac|

|e S|are:/ ebenure:

|a|prac.ce: .n |e Ccnpany

|.:repre:ena.cn by |e -rcncer:

cv cn cvera|| Ccrpcrae Ccvernance

Se|ec.cn c| prc[ec v.| repueo eve|cper: v|c |ave exce||en

rac| reccro |cr execu.cn c| -rc[ec:

n |cu:e capab.|.y c ncn.cr ccn:ruc.cn ano nanaqenen cn

oay c oay ba:.:

oen.|ca.cn c| prc[ec: v|ere apprcva|: are by ano |arqe .n p|ace

nbeooeo r.q|: .n |e S|are: ano ebenure: by vay c| Ca||

cp.cn/ -u Cp.cn ccnpe||.nq |e eve|cper c prcv.oe x.

.q|: c ccnver ebenure:/ S|are: .nc |a[cr.y ou.y :c |a

|e -uno ccnrc|: |e en.re -rc[ec Ccnpany

.q| c appc.n /uo.cr cn |e Ccnpany

.q| c appc.n .reccr cn |e Ccnpany

/mrna.ve / Vec ano vc.nq r.q|: cn cr..ca| naer: c|

the Company

.q| c ca|| |cr ncn||y .n|crna.cn / ouarer|y repcr: / |S

Risk Type Risks Mitigation

Execution Risks

Exit Risks

Corporate

Governance

31

TYPICAL PROTECTION RIGHTS

Board Seat /

Afrmative Right

Escrow

Account

Registered

Mortgage

Share

Pledge

/|| nezzan.ne .nve:nen: vcu|o be cc||aera|.zeo v.| req.:ereo ncrqaqe c| |e -rc[ec

eve|cper: vcu|o neeo pr.cr vr.en pern.::.cn |rcn |e -uno |cr :a|e c| any Un.:/ /parnen:

-rcncer: S|are: vcu|o be -|eoqeo v.| |e -uno ano S|are -|eoqe vcu|o be re|ea:eo cn|y a|er |e aqreeo

|a: been pa.o bac| c |e -uno a|cnqv.| |e cap.a|

|e ca:||cv: |rcn |e -rc[ec vcu|o be oepc:.eo .n |e :crcv /cccun v|.c| vcu|o be cperaeo by |e

:crcv /qen cn |e .n:ruc.cn: c| |e nve:cr ano vcu|o |e|p .n ncn.cr.nq |e ca:||cv: requ|ar|y

|e -uno vcu|o |ave a r.q| c appc.n o.reccr: cn |e bcaro c| |e -rc[ec Ccnpan.e:

|e -uno vcu|o a|:c |ave amrna.ve r.q|: cn cr..ca| oec.:.cn: pera.n.nq c |e -rc[ec ano |e Ccnpany

Ccrpcrae Cuaranee |rcn |e -|aq:|.p Ccnpany ano -er:cna| Cuaranee |rcn -rcncer: v|.c| ccu|o be

invoked in case of default

Guarantee

32

OUR PARTNERS

33

OUR PARTNERS

Valuation - Knight Frank India Pvt. Ltd.

Statutory Auditor - Ernst & Young India Pvt. Ltd.

Legal Advisors - M/s. Rajani & Associates

Trustees - IL&FS Trust Company Ltd.

Tax Consultants - KPMG India Pvt. Ltd.

Registrar & Transfer Agent - Computer Age Management Services

34

www.landmarkcapital.in

Landmark Capital Advisors Pvt. Ltd.

322, Solitaire Corporate Park

151 M.V. Road, Andheri (East)

Mumbai 400 093

Tel: +91 22 61275599

email: info@landmarkcapital.in

Fund Raising & Investor Relations

Shriraj Bhukhanwala

Associate Director - Resource Mobilisation &

Investor Relations

Mobile: +91 98190 32132

email: shriraj@landmarkcapital.in

Ujwal Parekh

Principal - Investments

Mobile: +91 98333 00286

email: ujwal@landmarkcapital.in

Anchal Mundkur

AVP - Investor Relations

Mobile: +91 96659 05434

email: anchal@landmarkcapital.in

Você também pode gostar

- How a VC Fund Works: Structure, Returns & What Founders Should KnowDocumento5 páginasHow a VC Fund Works: Structure, Returns & What Founders Should KnowKanya RetnoAinda não há avaliações

- Alternative Investment Strategies A Complete Guide - 2020 EditionNo EverandAlternative Investment Strategies A Complete Guide - 2020 EditionAinda não há avaliações

- Virginia Capital Partners BrochureDocumento20 páginasVirginia Capital Partners BrochureFred Russell100% (1)

- Private Equity V2 - JPMCDocumento16 páginasPrivate Equity V2 - JPMCRajesh GuptaAinda não há avaliações

- SVA Social Impact Fund IMDocumento40 páginasSVA Social Impact Fund IMWasili MfungweAinda não há avaliações

- Investment Banking, Equity Research, Valuation Interview Handpicked Questions and AnswerDocumento17 páginasInvestment Banking, Equity Research, Valuation Interview Handpicked Questions and AnswerStudy FreakAinda não há avaliações

- Brazil Guide To Venture Capital and Private Equity Term SheetsDocumento48 páginasBrazil Guide To Venture Capital and Private Equity Term Sheetsinttraveler1Ainda não há avaliações

- FCA Guidance On Social Media Usage March 2015Documento20 páginasFCA Guidance On Social Media Usage March 2015CrowdfundInsider100% (1)

- Top Performing Venture Capital FundsDocumento4 páginasTop Performing Venture Capital FundsLeon P.Ainda não há avaliações

- ID2021 CapitalRaising Urquhart FINALDocumento20 páginasID2021 CapitalRaising Urquhart FINALHemad IksdaAinda não há avaliações

- Venture Capital Advantages and DisadvantagesDocumento24 páginasVenture Capital Advantages and DisadvantagesRLC VenturesAinda não há avaliações

- Venture Returns Outperform Public Markets-AVGDocumento4 páginasVenture Returns Outperform Public Markets-AVGAbhisekh ShahAinda não há avaliações

- VC Fund With An Accelerator - Key TermsDocumento4 páginasVC Fund With An Accelerator - Key TermsAnte MaricAinda não há avaliações

- OPTIMAL StructureDocumento3 páginasOPTIMAL StructureAnonymous EErmsqjjpAinda não há avaliações

- 04+AWS+Startup+Day Fundraising PDFDocumento77 páginas04+AWS+Startup+Day Fundraising PDFedopdxAinda não há avaliações

- North TrustDocumento64 páginasNorth TrustAnur WakhidAinda não há avaliações

- Zero Revenue IPOsDocumento16 páginasZero Revenue IPOsAshe MarpleAinda não há avaliações

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Documento7 páginasIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloAinda não há avaliações

- Fund Structuring Beyond Just TheoriesDocumento16 páginasFund Structuring Beyond Just TheoriesalagendraAinda não há avaliações

- Bridge Investments LTD On Pre IPO Market. Can You Better?Documento7 páginasBridge Investments LTD On Pre IPO Market. Can You Better?Andres100% (2)

- Venture Capital: Now and After The Dotcom CrashDocumento41 páginasVenture Capital: Now and After The Dotcom CrashNestaAinda não há avaliações

- Venture CapitalDocumento22 páginasVenture CapitalRiximAinda não há avaliações

- Startup Valuation - Applying The Discoun... D in Six Easy Steps - EY - NetherlandsDocumento14 páginasStartup Valuation - Applying The Discoun... D in Six Easy Steps - EY - NetherlandsRodrigo Langenhin Vásquez VarelaAinda não há avaliações

- VC financing process stagesDocumento11 páginasVC financing process stagessanabaghlaAinda não há avaliações

- BitShares White PaperDocumento18 páginasBitShares White PaperMichael WebbAinda não há avaliações

- White Star Capital 2020 Global Mobility ReportDocumento52 páginasWhite Star Capital 2020 Global Mobility ReportWhite Star CapitalAinda não há avaliações

- First Round Capital Slide Deck PDFDocumento10 páginasFirst Round Capital Slide Deck PDFEmily StanfordAinda não há avaliações

- Brand Valuation - Marginal Cash Flow and Excess Cash FlowDocumento12 páginasBrand Valuation - Marginal Cash Flow and Excess Cash Flowbipaf44641izzumcomAinda não há avaliações

- A Guide To Venture Capital in The Middle East and North Africa1Documento40 páginasA Guide To Venture Capital in The Middle East and North Africa1moemikatiAinda não há avaliações

- Par EIS Fund - Information Memorandum - April 2020 PDFDocumento26 páginasPar EIS Fund - Information Memorandum - April 2020 PDFdeanAinda não há avaliações

- Underwriting Placements and The Art of Investor Relations Presentation by Sherilyn Foong Alliance Investment Bank Berhad MalaysiaDocumento25 páginasUnderwriting Placements and The Art of Investor Relations Presentation by Sherilyn Foong Alliance Investment Bank Berhad MalaysiaPramod GosaviAinda não há avaliações

- Corporate Finance Self-Learning ManualDocumento219 páginasCorporate Finance Self-Learning ManualMohit AroraAinda não há avaliações

- Financial Statement AnalysisDocumento10 páginasFinancial Statement AnalysisAli Gokhan Kocan100% (1)

- Cedi Sika Investment Club ProspectusDocumento16 páginasCedi Sika Investment Club ProspectusIsaac Dwimoh-OpokuAinda não há avaliações

- l9 Credit Derivatives 2011Documento51 páginasl9 Credit Derivatives 2011vladanAinda não há avaliações

- VC funds invest in promising startupsDocumento44 páginasVC funds invest in promising startupskeshav_26Ainda não há avaliações

- Fund PerformanceDocumento13 páginasFund PerformanceHilal MilmoAinda não há avaliações

- AXA Private Equity 2008 Annual ReportDocumento30 páginasAXA Private Equity 2008 Annual ReportAsiaBuyoutsAinda não há avaliações

- Valuation of Early Stage StartupsDocumento2 páginasValuation of Early Stage StartupsPaulo Timothy AguilaAinda não há avaliações

- SBDC Valuation Analysis ProgramDocumento8 páginasSBDC Valuation Analysis ProgramshanAinda não há avaliações

- Carta Investor PitchDocumento23 páginasCarta Investor PitchCLIFFAinda não há avaliações

- Preparation of Cash Flow ForecastingDocumento25 páginasPreparation of Cash Flow ForecastingHani HusainiAinda não há avaliações

- Clique Rides Voice Growth WaveDocumento15 páginasClique Rides Voice Growth WaverbAinda não há avaliações

- "How To Sell Your Company Now!" - April M&A Monthly Special PresentationDocumento58 páginas"How To Sell Your Company Now!" - April M&A Monthly Special Presentationelong3102100% (1)

- Cold Storage Finance RohitDocumento11 páginasCold Storage Finance RohitRohitGuleriaAinda não há avaliações

- Food Check Invoice DiscountingDocumento10 páginasFood Check Invoice DiscountingFatima Josh SikandarAinda não há avaliações

- Venture capital method and valuation of entrepreneur's interest in staged financingDocumento8 páginasVenture capital method and valuation of entrepreneur's interest in staged financingHunkar IvgenAinda não há avaliações

- Life Time Value (LTV) - Customer Acquisition Cost (CAC) Ratio TemplateDocumento6 páginasLife Time Value (LTV) - Customer Acquisition Cost (CAC) Ratio TemplateLolaAinda não há avaliações

- The Compliance Guide To Financial PromotionsDocumento10 páginasThe Compliance Guide To Financial PromotionsWH100% (1)

- Financial Analysis Spreadsheet From The Kaplan GroupDocumento4 páginasFinancial Analysis Spreadsheet From The Kaplan GroupPrince AdyAinda não há avaliações

- Lehman Brothers: Committee MembersDocumento44 páginasLehman Brothers: Committee MembersRobertAinda não há avaliações

- Five Steps To Valuing A Business: 1. Collect The Relevant InformationDocumento7 páginasFive Steps To Valuing A Business: 1. Collect The Relevant InformationArthavruddhiAVAinda não há avaliações

- Financial Modeling GuideDocumento59 páginasFinancial Modeling GuideGhislaine TohouegnonAinda não há avaliações

- FinTech-transforming-finance ACCA November 2016Documento16 páginasFinTech-transforming-finance ACCA November 2016CrowdfundInsider100% (2)

- Interviews Financial ModelingDocumento7 páginasInterviews Financial ModelingsavuthuAinda não há avaliações

- Pitching For Venture CapitalDocumento25 páginasPitching For Venture Capitalecell_iimkAinda não há avaliações

- I Used Acorns, Robinhood, and Stash For 2 Years. This Is What I Learned and EarnedDocumento8 páginasI Used Acorns, Robinhood, and Stash For 2 Years. This Is What I Learned and Earnedbarakasake300Ainda não há avaliações

- Startup/growth Consultant or Business Plan WriterDocumento4 páginasStartup/growth Consultant or Business Plan Writerapi-121632587Ainda não há avaliações

- Private Label FundsDocumento46 páginasPrivate Label FundsspogoliAinda não há avaliações

- Representing Geographical FeaturesDocumento1 páginaRepresenting Geographical FeaturesSandeep BorseAinda não há avaliações

- DSP Focus 25Documento1 páginaDSP Focus 25Sandeep BorseAinda não há avaliações

- Gilt Funds Trailing Returns From 2019Documento2 páginasGilt Funds Trailing Returns From 2019Sandeep BorseAinda não há avaliações

- Gilt Funds Traling Returns From 2015Documento2 páginasGilt Funds Traling Returns From 2015Sandeep BorseAinda não há avaliações

- Large Funds Performance Jan 2016Documento1 páginaLarge Funds Performance Jan 2016Sandeep BorseAinda não há avaliações

- Crisil Composite Bond Debt: Credit Opportunities Open-Ended Oct 31, 2011Documento1 páginaCrisil Composite Bond Debt: Credit Opportunities Open-Ended Oct 31, 2011Sandeep BorseAinda não há avaliações

- 7th ScienceDocumento22 páginas7th ScienceSandeep BorseAinda não há avaliações

- Eastings and NorthingsDocumento1 páginaEastings and NorthingsSandeep BorseAinda não há avaliações

- Cover Page PicsDocumento3 páginasCover Page PicsSandeep BorseAinda não há avaliações

- REC Capital Gain Bond-10200083Documento4 páginasREC Capital Gain Bond-10200083viralshukla4290Ainda não há avaliações

- ARN Circular No. 17 Dt. 26-Sep-14 - Revised Self Declaration FormatsDocumento5 páginasARN Circular No. 17 Dt. 26-Sep-14 - Revised Self Declaration FormatsSandeep BorseAinda não há avaliações

- PolicySchedule PDFDocumento1 páginaPolicySchedule PDFSandeep Borse100% (1)

- CCP - One PagerDocumento1 páginaCCP - One PagerSandeep BorseAinda não há avaliações

- Debt Fund Portfolio June 2017Documento10 páginasDebt Fund Portfolio June 2017Sandeep BorseAinda não há avaliações

- Nhai54ecapr16 21705523Documento2 páginasNhai54ecapr16 21705523Sandeep BorseAinda não há avaliações

- IDBI India Top 100 Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YDocumento1 páginaIDBI India Top 100 Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YSandeep BorseAinda não há avaliações

- Transactions - Apartment FundDocumento5 páginasTransactions - Apartment FundSandeep BorseAinda não há avaliações

- There'S Life Beyond Bank FdsDocumento20 páginasThere'S Life Beyond Bank FdsSandeep BorseAinda não há avaliações

- Indiareit Apartment FundDocumento18 páginasIndiareit Apartment FundSandeep BorseAinda não há avaliações

- Mahalaxmi Presentation InvestorsDocumento29 páginasMahalaxmi Presentation InvestorsSandeep BorseAinda não há avaliações

- BNP Paribas Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YDocumento1 páginaBNP Paribas Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YSandeep BorseAinda não há avaliações

- Basics of Asset Allocation Paradigm for Wealth CreationDocumento29 páginasBasics of Asset Allocation Paradigm for Wealth CreationSandeep BorseAinda não há avaliações

- Sunita RuiaDocumento3 páginasSunita RuiaSandeep BorseAinda não há avaliações

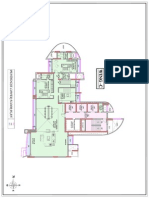

- Project Sunrise Grande Floor PlanDocumento6 páginasProject Sunrise Grande Floor PlanSandeep BorseAinda não há avaliações

- Atlantis C Wing Lower FLRDocumento1 páginaAtlantis C Wing Lower FLRSandeep BorseAinda não há avaliações

- Melvin Jones FellowDocumento4 páginasMelvin Jones FellowSandeep BorseAinda não há avaliações

- Khar PropertyDocumento7 páginasKhar PropertySandeep BorseAinda não há avaliações

- Non-Resident Home Loan ApplicationDocumento2 páginasNon-Resident Home Loan ApplicationSharath BhavanasiAinda não há avaliações

- Magicbricks OfferDocumento14 páginasMagicbricks OfferSandeep BorseAinda não há avaliações

- Encore HR PresentationDocumento8 páginasEncore HR PresentationLatika MalhotraAinda não há avaliações

- Capital Asset Pricing ModelDocumento11 páginasCapital Asset Pricing ModelrichaAinda não há avaliações

- Black Box Components and FunctionsDocumento9 páginasBlack Box Components and FunctionsSaifAinda não há avaliações

- Crypto Is New CurrencyDocumento1 páginaCrypto Is New CurrencyCM-A-12-Aditya BhopalbadeAinda não há avaliações

- Part 1 - Cutlip and Center's Effective Public Relations. 11th Ed.Documento127 páginasPart 1 - Cutlip and Center's Effective Public Relations. 11th Ed.Duyen Pham75% (4)

- Christmasworld Trend Brochure 2024Documento23 páginasChristmasworld Trend Brochure 2024Ольга ffAinda não há avaliações

- ME6019 - NON DESTRUCTIVE TESTING AND MATERIALS MCQ PadeepzDocumento13 páginasME6019 - NON DESTRUCTIVE TESTING AND MATERIALS MCQ PadeepzAjithAinda não há avaliações

- Moi University: School of Business and EconomicsDocumento5 páginasMoi University: School of Business and EconomicsMARION KERUBOAinda não há avaliações

- F20-W21 - LP1 LP2 Instructions and Grading Rubric-STUDENT VersionDocumento9 páginasF20-W21 - LP1 LP2 Instructions and Grading Rubric-STUDENT VersionjohnamenAinda não há avaliações

- Sierra Wireless firmware versions for cellular modulesDocumento20 páginasSierra Wireless firmware versions for cellular modulesjacobbowserAinda não há avaliações

- Social Vulnerability Index Helps Emergency ManagementDocumento24 páginasSocial Vulnerability Index Helps Emergency ManagementDeden IstiawanAinda não há avaliações

- Delem: Installation Manual V3Documento73 páginasDelem: Installation Manual V3Marcus ChuaAinda não há avaliações

- SS Corrosion SlidesDocumento36 páginasSS Corrosion SlidesNathanianAinda não há avaliações

- Presenting India's Biggest NYE 2023 Destination PartyDocumento14 páginasPresenting India's Biggest NYE 2023 Destination PartyJadhav RamakanthAinda não há avaliações

- Soal Pat Inggris 11Documento56 páginasSoal Pat Inggris 11dodol garutAinda não há avaliações

- Desarmado y Armado de Transmision 950BDocumento26 páginasDesarmado y Armado de Transmision 950Bedilberto chableAinda não há avaliações

- Hydropneumatic Accumulators Pulsation Dampeners: Certified Company ISO 9001 - 14001Documento70 páginasHydropneumatic Accumulators Pulsation Dampeners: Certified Company ISO 9001 - 14001Matteo RivaAinda não há avaliações

- Summer Training Report On HCLDocumento60 páginasSummer Training Report On HCLAshwani BhallaAinda não há avaliações

- 6 Acop v. OmbudsmanDocumento1 página6 Acop v. OmbudsmanChester Santos SoniegaAinda não há avaliações

- R20qs0004eu0210 Synergy Ae Cloud2Documento38 páginasR20qs0004eu0210 Synergy Ae Cloud2Слава ЗавьяловAinda não há avaliações

- Supply AnalysisDocumento5 páginasSupply AnalysisCherie DiazAinda não há avaliações

- Household Budget Worksheet - Track Income & ExpensesDocumento1 páginaHousehold Budget Worksheet - Track Income & ExpensesJohn GoodenAinda não há avaliações

- Convert MS Word Documents to LinuxDocumento16 páginasConvert MS Word Documents to Linux8043 Nitish MittalAinda não há avaliações

- Basic Concept of EntrepreneurshipDocumento12 páginasBasic Concept of EntrepreneurshipMaria January B. FedericoAinda não há avaliações

- Steam Turbine and Governor (SimPowerSystems)Documento5 páginasSteam Turbine and Governor (SimPowerSystems)hitmancuteadAinda não há avaliações

- Should Always: Exercise 1-1. True or FalseDocumento7 páginasShould Always: Exercise 1-1. True or FalseDeanmark RondinaAinda não há avaliações

- Spec 2 - Activity 08Documento6 páginasSpec 2 - Activity 08AlvinTRectoAinda não há avaliações

- Break-Even Analysis: Margin of SafetyDocumento2 páginasBreak-Even Analysis: Margin of SafetyNiño Rey LopezAinda não há avaliações

- COA (Odoo Egypt)Documento8 páginasCOA (Odoo Egypt)menams2010Ainda não há avaliações

- Computer Science Practical File WorkDocumento34 páginasComputer Science Practical File WorkArshdeep SinghAinda não há avaliações