Escolar Documentos

Profissional Documentos

Cultura Documentos

Sharekhan Top Picks

Enviado por

Laharii MerugumallaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Sharekhan Top Picks

Enviado por

Laharii MerugumallaDireitos autorais:

Formatos disponíveis

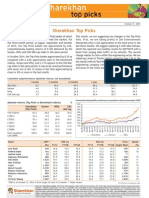

Sharekhan Top Picks

With the major event of the general election results ahead, the

equity market has turned volatile and lost most of the gains

registered in the first three weeks of April this year. Consequently,

the benchmark indices, Nifty and Sensex, have closed flat since

our last revision in the Top Picks basket whereas the Top Picks

basket itself has ended the month with a marginal gain of 0.5%.

This month, we are replacing Sun Pharmaceutical Industries (Sun

Pharma) with another large-cap, ITC. Sun Pharma appreciated

sharply (by close to 10%) in the last month on the back of an

initiative to acquire majority interest in Ranbaxy Laboratories.

On the other hand, ITC has underperformed and corrected by

close to 6% since we downgraded the stock at Rs362 and removed

it from the Top Picks basket at Rs354.

Having added ITC from the fast moving consumer goods (FMCG)

space, we are removing Jyothy Laboratories (a mid-cap FMCG

May 02, 2014 Visit us at www.sharekhan.com

For Private Circulation only

Absolute outperformance

Constantly beating Nifty and Sensex (cumulative returns) since April 2009

Name CMP* PER (x) RoE (%) Price Upside

(Rs) FY13 FY14E FY15E FY13 FY14E FY15E target (Rs)# (%)

Apollo Tyres 163 13.8 9.5 8.9 19.1 22.8 19.9 189 16

Crompton Greaves 165 126.9 42.3 20.4 -1.0 6.7 12.7 ** -

Federal Bank 92 9.4 9.4 8.1 13.9 12.6 13.3 110 20

HCL Tech 1,426 25.0 16.2 14.2 35.6 40.0 34.7 1,700 19

ICICI Bank 1,252 17.3 14.7 13.2 13.1 14.0 14.2 1,425 14

ITC 340 36.2 31.5 26.2 35.4 35.8 34.7 369 9

Larsen & Toubro 1,263 26.1 23.8 20.5 14.4 14.1 14.7 1,385 10

Lupin 1,010 34.4 24.7 21.6 25.3 26.9 24.0 ** -

Reliance Industries 928 14.3 13.3 12.3 11.3 11.0 11.0 1,060 14

Zee Entertainment 269 35.9 28.6 24.9 19.6 21.3 21.7 335 25

*CMP as on May 02, 2014 # Price target for next 6-12 months ** Under review (will revise in post result update)

Consistent outperformance (absolute returns; not annualised) (%)

1 month 3 months 6 months 1 year 3 years 5 years

Top Picks 0.5 9.1 12.6 25.3 40.7 176.2

Sensex 0.1 9.3 5.7 15.0 21.5 87.6

Nifty -0.1 10.0 5.9 12.9 21.5 85.4

CNX Mid-cap 2.5 17.0 15.8 12.9 9.2 118.9

stock) from the Top Picks folio and adding Crompton Greaves to

maintain the weightage of the FMCG sector and increase the folios

exposure to the cyclical sector. We have been positive on

Crompton Greaves fundamentally due to the reduction in the

losses of its overseas subsidiaries and the expectations of an

improvement in the domestic business environment. On the other

hand, the slowdown in demand for consumer products, forecast

of a below-average monsoon and rising input cost pressure could

limit the upside in the mid-cap FMCG stocks.

Lastly, we are booking profit in Selan Exploration Technology

(which has gained 70% in the last six months; which was added to

the Top Picks folio at Rs308) to generate some cash before the

major event (election outcome) ahead. We would use this cash

to make an intra-month addition to the portfolio depending upon

the evolving scenario.

10.2% 12.4%

35.1%

16.8%

116.1%

237.0%

-20.5%

-50.0%

0.0%

50.0%

100.0%

150.0%

200.0%

250.0%

CY2014 CY2013 CY2012 CY2011 CY2010 CY2009 Since

Inception

(Jan

2009)

Sharekhan (Top Picks) Sensex Nifty

100%

150%

200%

250%

300%

350%

A

p

r

-

0

9

J

u

l

-

0

9

O

c

t

-

0

9

J

a

n

-

1

0

A

p

r

-

1

0

J

u

l

-

1

0

O

c

t

-

1

0

J

a

n

-

1

1

A

p

r

-

1

1

J

u

l

-

1

1

O

c

t

-

1

1

J

a

n

-

1

2

A

p

r

-

1

2

J

u

l

-

1

2

O

c

t

-

1

2

J

a

n

-

1

3

A

p

r

-

1

3

J

u

l

-

1

3

O

c

t

-

1

3

J

a

n

-

1

4

A

p

r

-

1

4

Shar ekhan Sens ex Nif ty

Sharekhan Ltd, Regd Add: 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East),

Mumbai 400042, Maharashtra. Tel: 022 - 61150000; Fax: 6748 1899; E-mail: publishing@sharekhan.com; Website: www.sharekhan.com; CIN:

U99999MH1995PLC087498. Sharekhan Ltd.: SEBI Regn. Nos. BSE-Cash-INB011073351 ; F&O-INF011073351 ; NSE INB/INF231073330; CD - INE231073330 ; MCX

Stock Exchange: INB/INF-261073333 ; CD - INE261073330 ; United Stock Exchange: CD - INE271073350 ; DP-NSDL-IN-DP-NSDL-233-2003 ; CDSL-IN-DP-CDSL-

271-2004 ; PMS-INP000000662 ; Mutual Fund-ARN 20669 ; Commodity trading through Sharekhan Commodities Pvt. Ltd.: MCX-10080 ; (MCX/TCM/CORP/

0425) ; NCDEX -00132 ; (NCDEX/TCM/CORP/0142) ; For any complaints email at igc@sharekhan.com ; Disclaimer: Client should read the Risk Disclosure

Document issued by SEBI & relevant exchanges and Dos & Donts by MCX & NCDEX and the T & C on www.sharekhan.com before investing.

sharekhan top picks

2 Sharekhan

May 2014

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY13 FY14E FY15E FY13 FY14E FY15E target (Rs) (%)

Apollo Tyres 163 13.8 9.5 8.9 19.1 22.8 19.9 189 16

Remarks: Apollo Tyres is one of the leading tyre manufacturers in India having a strong presence in the truck & bus as well

as the passenger car tyre segment. Its European subsidiary, ie Vredeistein, operating out of the Netherlands, is a

renowned brand in the winter passenger car tyre segment. The company had a consolidated turnover of over

Rs12,500 crore in FY2013.

Natural rubber prices have continued to soften and are currently quoting at about Rs140/kg, which is a five-year

low. The soft rubber prices translated into a 160-BPS margin expansion in M9FY2014 despite an increase in the

prices of the other raw materials such as carbon black and tyre cord. We expect the low natural rubber prices to

continue to boost profitability in H1FY2015.

The company has revived plans for a greenfield expansion in light of the failure of the Cooper Tire deal and is

looking at Eastern Europe and South East Asia for expansion. Its European operations are currently running at 90%

plus utilisation rate. Hence, a new plant in Eastern Europe would aid volume growth going forward.

The stock is currently trading at 7.7x FY2016E earnings of Rs20.9. Given the prolonged weakness in natural

rubber prices we continue to remain positive on the stock with a Buy recommendation and a price target of

Rs189.

Crompton Greaves 165 126.9 42.3 20.4 -1.0 6.7 12.7 ** -

Remarks: Crompton Greaves deals in industrial and power systems, which hold high potential, given the investment

opportunities in the power transmission & distribution sector. It also has a strong presence in domestic consumer

products and the business is expected to witness a high growth, thanks to brand leverage and stable demand.

Though the power system business in the USA and the subsidiaries in Canada are still not out of the woods, the

overall performance of the international subsidiaries would improve backed by a recovery in the European business,

which was hit by a restructuring exercise. A reversal in the outlook for domestic demand would improve sentiment.

Consequently, we expect a sharp improvement in its margin, earnings and return ratios which would be the key

driver of a re-rating. We remain positive on the stock.

3 May 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY13 FY14E FY15E FY13 FY14E FY15E target (Rs) (%)

Federal Bank 92 9.4 9.4 8.1 13.9 12.6 13.3 110 20

Remarks: Federal Bank had turned cautious in view of a slowdown in the economy (advances growth was below the industry

average) and preferred to strengthen its balance sheet. In the mean time the bank undertook structural changes

in the balance sheet, viz increasing the proportion of the better rated assets and the retail deposit base. As the

economy is gradually showing signs of a revival, the bank is much better capitalised (tier-1 capital adequacy ratio

of 14%) compared with its peer banks to expand the balance sheet.

In the recent quarters the non-performing assets (NPAs) declined and the slippages from small medium enterprises

(SME) and retail sectors have also been significantly lower in the past three to four quarters. Higher provision

coverage of 84% and a possibility of recovery from one large-ticket account (likely in the next two to three

quarters) would further increase the comfort on asset quality.

The valuation of 0.9x FY2016 BV is attractive when compared with the regional banks and other old private

banks. The expansion in the return on equity (RoE) led by a better than industry growth (FY2014-16) will lead to

an expansion in the valuation multiple. We have a Buy rating on the stock with a price target of Rs110.

HCL Tech 1,426 25.0 16.2 14.2 35.6 40.0 34.7 1,700 19

Remarks: HCL Technologies (HCL Tech) is an information technology (IT) services company providing software-led IT solutions,

remote infrastructure management services and business process outsourcing (BPO) services. The company has a

leading position in remote infrastructure management services which has helped it win large IT outsourcing

contracts. Through the Axon PLC acquisition, the company has gained a strong SAP consulting footing.

In the current environment, we believe HCL Tech is well placed in terms of its business strategy of consciously

targeting the re-bid market. The results of the same are evident in its consistent outperformance in terms of

volume and revenue growth. The company has allayed the apprehensions on the margin front by consistently

improving its margins despite head winds.

The management acknowledged the potential threat of the impending US immigration bill and expressed concern

over the outplacement clause in the current form (we, therefore, hope for some dilution in the final bill).

Nevertheless, among the top four IT companies, HCL Tech is relatively better placed, as around 50% of its total

workforce in the USA holds the H1-L1 visa against a higher percentage of such visa holders for TCS, Infosys and

Wipro.

In view of an improved operating environment coupled with decent earnings predictability driven by a $4-billion-

plus order book, stable margins and sustainable momentum in the IMS vertical, we continue to recommend a Buy

on it with a price target of Rs1,700.

4

May 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY13 FY14E FY15E FY13 FY14E FY15E target (Rs) (%)

ICICI Bank 1,252 17.3 14.7 13.2 13.1 14.0 14.2 1,425 14

Remarks: With an improvement in the liability profile, ICICI Bank is better positioned to expand its market share especially

in the retail segment. We expect its advances to grow at 18.5% compound annual growth rate (CAGR) over

FY2014-16 leading to a CAGR of 16.9% in the net interest income.

ICICI Banks asset quality has shown some stress in recent results due to rise in restructured loans. However, the

banks asset quality is significantly better than public sector banks (PSBs) and has improved in the past few

years. We believe the strong operating profits should help the bank to absorb the stress which anyways should be

within the manageable limits.

Led by a pick-up in the advance growth and a significant improvement in the margin, the RoE is likely to expand

to 15.5% by FY2016 while the return on assets (RoA) is likely to improve to 1.7%. This would be driven by a

15.2% growth (CAGR) in the profit over FY2014-16.

The stock trades at 1.6x FY2016E BV. Moreover, given the improvement in the profitability led by lower NPA

provisions, a healthy growth in the core income and improved operating metrics, we recommend a Buy with a

price target of Rs1,425.

ITC 340 36.2 31.5 26.2 35.4 35.8 34.7 369 9

Remarks: ITCs cigarette business, which contributes around 60% of revenues, continues to be the cash cow. ITC endeavours

to make a mark in the Indian FMCG market and with successful brands, such as Bingo, Sunfeast and Aashirwaad,

it is already reckoned among the best in the industry. With the new portfolio of personal care products gaining

market share, its FMCG business promises to compete with that of Hindustan Unilever and Procter & Gamble.

The government had increased the excise duty on cigarettes by about 20% in the finance budget for 2013-14. ITC

has already taken a price increase of about 18% in its cigarette portfolio which aided the cigarette business to

post margins above 30%. On the other hand, the central government and the governments of some of the key

states have not hiked the tax on cigarettes in their respective interim budgets for 2014-15. This will help improve

ITCs volumes in the near term.

ITCs other businesses of hotels, agri-products, and paper, paperboard and packaging are expected to provide a

good support to the revenues and profitability in the long run.

An increase in the taxation and the governments intention to curb the consumption of tobacco products remain

the key risks to ITCs cigarette business over the longer term.

We expect ITCs bottom line to grow at a CAGR of close to 18% over FY2013-16. At the current market price, the

stock trades at 21.3x its FY2016E earnings, which is lower than the current valuation of some of the mid-cap

FMCG stocks and a substantial discount to some of its closest large-cap peers. We like ITC from a longer-term

perspective and retain it as one of our top picks in the FMCG space.

5 May 2014

Sharekhan

sharekhan top picks

Lupin 1,010 34.4 24.7 21.6 25.3 26.9 24.0 ** -

Remarks: A vast geographical presence, focus on niche segments like oral contraceptives, ophthalmic products, para-IV

filings and branded business in the USA are the key elements of growth for Lupin. The company has remarkably

improved its brand equity in the domestic and international generic markets to occupy a significant position in

the branded formulation business. Its inorganic growth strategy has seen a stupendous success in the past.

Lupin is expected to see stronger traction in the US business on the back of the key generic launches in recent

months and a strong pipeline in the US generic business (over 91 abbreviated new drug approvals pending approval

including 86 first-to-files) to ensure the future growth. The key products that are going to provide a lucrative

generic opportunity for the company, include Nexium (market size $2.2 billion), Lunesta (market size $800

million) and Namenda (market size $1.75 billion) that will be going out of patent protection in FY2015.

While most of the geographies have recorded an impressive growth for the company, Japan (due to restructuring

at the step-down subsidiary, Irom Pharma) and India (due to the impact of the new drug pricing policy) saw a

weaker performance in M9FY2014. However, we expect the Indian business to bounce back, as the pricing related

issues are gradually getting settled.

The stock is currently trading at 24.7x and 21.6x earnings for FY2014E and FY2015E respectively.

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY13 FY14E FY15E FY13 FY14E FY15E target (Rs) (%)

Larsen & Toubro 1,263 26.1 23.8 20.5 14.4 14.1 14.7 1,385 10

Remarks: Larsen & Toubro (L&T), the largest engineering and construction company in India, is a direct beneficiary of the

strong domestic infrastructure development and industrial capital expenditure (capex) boom.

L&T continues to impress us with its good execution skills, reporting decent numbers throughout despite the

slowdown in the industrial capex cycle. Also, we have seen order inflow traction in recent quarters which enhances

the revenue visibility.

As the economy is looking up, we believe a player like L&T would be a major beneficiary. Moreover, monetisation

of assets would help the company to improve the RoE.

A sound execution track record, a healthy order book and a strong performance of its subsidiaries reinforce our

faith in L&T.

At the current market price (CMP), the stock is trading at 20.5x its FY2015E stand-alone earnings and it is one of

the best bets to play the cyclicals now.

6

May 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY13 FY14E FY15E FY13 FY14E FY15E target (Rs) (%)

Reliance Industries 928 14.3 13.3 12.3 11.3 11.0 11.0 1,060 14

Remarks: Reliance Industries Ltd (RIL) has a strong presence in the refining, petrochemical and upstream exploration

businesses. The refining division of the company is the highest contributor to the companys earnings and is

operating efficiently with a better gross refining margin (GRM) compared with its peers in the domestic market

due to the ability of its plant to refine more of heavier crude. However, the gas production from the Krishna-

Godavari-D6 (KG-D6) field has fallen significantly in the last two years. With the government approval for additional

capex in its allocated gas fields; we believe production will improve going ahead.

Though there is uncertainty prevailing on gas production and pricing of gas from the KG-D6, the traction in

volume from shale gas assets is playing positively for the company. Moreover, the upcoming incremental capacities

in the petrochemical and refinery businesses are going to drive the earnings growth in future as the downstream

businesses are in the driving seat and contributing the lions share of the profitability. Hence, the uncertainty

related to the domestic gas production and pricing is likely to limit the impact.

In recent past there have been signs of improvement in the benchmark GRM, which suggests that there could be

a healthy improvement in the GRM of RIL too in the coming quarter.

At the CMP the stock is trading at a PE of 12.3x FY2015E earnings per share (EPS).

Zee Entertainment 269 35.9 28.6 24.9 19.6 21.3 21.7 335 25

Remarks: Among the key stakeholders of the domestic TV industry, we expect the broadcasters to be the prime beneficiary

of the mandatory digitisation process initiated by the government. The broadcasters would benefit from higher

subscription revenues at the least incremental capex as the subscriber declaration improves in the cable industry.

On completion of 20 years of operations, Zee Entertainment Enterprises Ltd (ZEEL) has issued redeemable

preference shares (RPS) aggregating Rs2,000 crore (6% preference dividend) for eight years. The RPS will be

issued at a ratio of 21 RPS for every equity share. The RPS will be redeemable from the fourth year till the eighth

year.

ZEELs management acknowledged that the recent Telecom Regulatory Authority of India (TRAI) recommendation

of capping the advertisement time at 12 minutes per hour would have an adverse impact on its advertisement

volume. The company will take adequate hikes in the advertisement rates in order to negate the impact of

reduced volumes. Thus, we expect a very minimal impact on the blended advertisement growth in FY2014 and

FY2015.

The recent demerger of the media business of Diligent Media Corporation Ltd (DMCL; a publishing joint venture

between DB Corp and Essel Group) and the vesting of the business with ZEEL is a positive development for the

company. First, the demerger scheme will provide ZEEL with an additional GEC licence (obtaining a GEC licence

is cumbersome) with a minimal pay-out of Rs2.6 crore related to the preferential allotment. Second, DMCLs

balance sheet has deferred tax assets to the tune of Rs314 crore which over the next two to three years will

ultimately help ZEEL to lower its effective tax rate from 33% currently.

We believe ZEEL will be the major beneficiary of the digitisation process in the years to come which coupled with

a strong balance sheet and high return ratios makes it a compelling long-term growth story. We maintain our Buy

rating on ZEEL with a price target of Rs335.

7 May 2014

Sharekhan

Disclaimer

This document has been prepared by Sharekhan Ltd.(SHAREKHAN) This Document is subject to changes without prior notice and is intended only for the person or entity to which it is addressed to and may contain

confidential and/or privileged material and is not for any type of circulation. Any review, retransmission, or any other use is prohibited. Kindly note that this document does not constitute an offer or solicitation for

the purchase or sale of any financial instrument or as an official confirmation of any transaction.

Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is from publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its

subsidiaries and associated companies, their directors and employees (SHAREKHAN and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or

other reasons that may prevent SHAREKHAN and affiliates from doing so. We do not represent that information contained herein is accurate or complete and it should not be relied upon as such. This document is

prepared for assistance only and is not intended to be and must not alone betaken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this

document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks

involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities described

herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such

restriction.

SHAREKHAN & affiliates may have used the information set forth herein before publication and may have positions in, may from time to time purchase or sell or may be materially interested in any of the securities

mentioned or related securities. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no

event shall SHAREKHAN, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. Any comments or statements made

herein are those of the analyst and do not necessarily reflect those of SHAREKHAN.

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

Você também pode gostar

- Sharekhan Top Picks: January 01, 2013Documento7 páginasSharekhan Top Picks: January 01, 2013Rajiv MahajanAinda não há avaliações

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocumento7 páginasSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180Ainda não há avaliações

- Sharekhan recommends Axis Bank, BHEL, Cadila Healthcare in October 2012 Top PicksDocumento7 páginasSharekhan recommends Axis Bank, BHEL, Cadila Healthcare in October 2012 Top PicksSoumik DasAinda não há avaliações

- Finolex Cables Poised for Growth on Derivative Losses CleanupDocumento9 páginasFinolex Cables Poised for Growth on Derivative Losses CleanupsanjeevpandaAinda não há avaliações

- Sharekhan Top Picks Analysis and Stock RecommendationsDocumento7 páginasSharekhan Top Picks Analysis and Stock RecommendationsAnonymous W7lVR9qs25Ainda não há avaliações

- SharekhanTopPicks 31082016Documento7 páginasSharekhanTopPicks 31082016Jigar ShahAinda não há avaliações

- Sharekhan Top Picks: November 30, 2012Documento7 páginasSharekhan Top Picks: November 30, 2012didwaniasAinda não há avaliações

- Sharekhan Top Picks: October 01, 2011Documento7 páginasSharekhan Top Picks: October 01, 2011harsha_iitmAinda não há avaliações

- Top PicksDocumento7 páginasTop PicksKarthik KoutharapuAinda não há avaliações

- Sharekhan top picks outperform in FY2010Documento6 páginasSharekhan top picks outperform in FY2010Kripansh GroverAinda não há avaliações

- Stock Market Today Tips - Book Profit On The Stock CMCDocumento21 páginasStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedAinda não há avaliações

- SharekhanTopPicks 070511Documento7 páginasSharekhanTopPicks 070511Avinash KowkuntlaAinda não há avaliações

- Top Picks: Research TeamDocumento30 páginasTop Picks: Research TeamPooja AgarwalAinda não há avaliações

- Sharekhan Top Picks: August 06, 2009Documento5 páginasSharekhan Top Picks: August 06, 2009Thamim MuhamedAinda não há avaliações

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocumento7 páginasSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriAinda não há avaliações

- RHB Equity 360° - 02/03/2010Documento4 páginasRHB Equity 360° - 02/03/2010Rhb InvestAinda não há avaliações

- India Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesDocumento20 páginasIndia Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesNarnolia Securities LimitedAinda não há avaliações

- India Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Documento23 páginasIndia Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Narnolia Securities LimitedAinda não há avaliações

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocumento7 páginasSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaAinda não há avaliações

- Sharekhan Top Picks for February 2013Documento7 páginasSharekhan Top Picks for February 2013nit111Ainda não há avaliações

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocumento7 páginasSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapchetanjecAinda não há avaliações

- Jamna AutoDocumento5 páginasJamna AutoSumit SinghAinda não há avaliações

- Stock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Documento20 páginasStock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Narnolia Securities LimitedAinda não há avaliações

- India Equity Analytics Today: Buy Stock of KPIT TechDocumento24 páginasIndia Equity Analytics Today: Buy Stock of KPIT TechNarnolia Securities LimitedAinda não há avaliações

- Investment Funds Advisory Today - Buy Stock of ACC LTD, INGVYSYA BANK and Neutral View On Bajaj Corp, PNB, Ambuja Cements LTDDocumento26 páginasInvestment Funds Advisory Today - Buy Stock of ACC LTD, INGVYSYA BANK and Neutral View On Bajaj Corp, PNB, Ambuja Cements LTDNarnolia Securities LimitedAinda não há avaliações

- SharekhanTopPicks 030811Documento7 páginasSharekhanTopPicks 030811ghachangfhuAinda não há avaliações

- Market Outlook 11th October 2011Documento5 páginasMarket Outlook 11th October 2011Angel BrokingAinda não há avaliações

- Top Picks Sep 2012Documento15 páginasTop Picks Sep 2012kulvir singAinda não há avaliações

- IEA Report 23rd DecemberDocumento24 páginasIEA Report 23rd DecembernarnoliaAinda não há avaliações

- Fresh Capacities To Drive Growth Buy: Rating: Buy Target Price: 1,310 Share Price: 970Documento10 páginasFresh Capacities To Drive Growth Buy: Rating: Buy Target Price: 1,310 Share Price: 970Vidhi MehtaAinda não há avaliações

- Market Outlook Market Outlook: I-Direct Top PicksDocumento9 páginasMarket Outlook Market Outlook: I-Direct Top PicksAnonymous W7lVR9qs25Ainda não há avaliações

- First Source Solutions LTD - Karvy Recommendation 11 Mar 2016Documento5 páginasFirst Source Solutions LTD - Karvy Recommendation 11 Mar 2016AdityaKumarAinda não há avaliações

- Top Recommendation - 140911Documento51 páginasTop Recommendation - 140911chaltrikAinda não há avaliações

- La Opala RG - Initiating Coverage - Centrum 30062014Documento21 páginasLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaAinda não há avaliações

- Astra International: All's Still in OrderDocumento11 páginasAstra International: All's Still in OrdererlanggaherpAinda não há avaliações

- IEA Report 31st JanuaryDocumento24 páginasIEA Report 31st JanuarynarnoliaAinda não há avaliações

- Deepak Nitrite - Initiation ReportDocumento20 páginasDeepak Nitrite - Initiation Report9avinashrAinda não há avaliações

- MID-CAP CORNER: Automotive recovery to aid Amtek Auto; Firstsource turns around; Indiabulls Power to gain from plantsDocumento1 páginaMID-CAP CORNER: Automotive recovery to aid Amtek Auto; Firstsource turns around; Indiabulls Power to gain from plantspuneetdubeyAinda não há avaliações

- Market Outlook Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Investment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysDocumento25 páginasInvestment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysNarnolia Securities LimitedAinda não há avaliações

- Wealth Creator StocksDocumento18 páginasWealth Creator Stocksshishir_ghatgeAinda não há avaliações

- Indoco Remedies Initiation Report with REDUCE Rating (INDREMDocumento19 páginasIndoco Remedies Initiation Report with REDUCE Rating (INDREMMAinda não há avaliações

- Good Bearing Ahead For The IndustryDocumento7 páginasGood Bearing Ahead For The IndustryAbhishek MaakarAinda não há avaliações

- ApolloTyres Event UpdateDocumento5 páginasApolloTyres Event UpdateAngel BrokingAinda não há avaliações

- Two-Wheelers Update 27aug2014Documento12 páginasTwo-Wheelers Update 27aug2014Chandreyee MannaAinda não há avaliações

- Hero Motocorp Limited: Icra Equity Research ServiceDocumento7 páginasHero Motocorp Limited: Icra Equity Research ServiceArunkumar PalanisamyAinda não há avaliações

- Ambit - Highest Conviction Buys & Sells From AmbitDocumento11 páginasAmbit - Highest Conviction Buys & Sells From Ambitmaamir2000Ainda não há avaliações

- Performance Highlights: Company Update - AutomobileDocumento13 páginasPerformance Highlights: Company Update - AutomobileZacharia VincentAinda não há avaliações

- Nivesh Stock PicksDocumento13 páginasNivesh Stock PicksAnonymous W7lVR9qs25Ainda não há avaliações

- Sector Update Automobiles: IndexDocumento6 páginasSector Update Automobiles: IndexSwetha Rakesh AdigaAinda não há avaliações

- Hitachi Home & Life Solutions: Performance HighlightsDocumento13 páginasHitachi Home & Life Solutions: Performance HighlightsAngel BrokingAinda não há avaliações

- 2013-5-13 Big OcbcDocumento5 páginas2013-5-13 Big OcbcphuawlAinda não há avaliações

- TU539 ACC Limited 080619Documento5 páginasTU539 ACC Limited 080619Deepika BhatiaAinda não há avaliações

- Small Caps: Singapore Small-Cap ConferenceDocumento12 páginasSmall Caps: Singapore Small-Cap ConferenceventriaAinda não há avaliações

- RHB Equity 360° - 3 August 2010 (PLUS, Semicon, Notion Vtec, Unisem, Axiata, AMMB Technical: MPHB, KNM)Documento4 páginasRHB Equity 360° - 3 August 2010 (PLUS, Semicon, Notion Vtec, Unisem, Axiata, AMMB Technical: MPHB, KNM)Rhb InvestAinda não há avaliações

- Nonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryNo EverandNonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryAinda não há avaliações

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Steering & Steering Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNo EverandSteering & Steering Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryAinda não há avaliações

- Collection Agency Revenues World Summary: Market Values & Financials by CountryNo EverandCollection Agency Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Shock Absorbers, Dampers, Springs & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo EverandShock Absorbers, Dampers, Springs & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryAinda não há avaliações

- 1385824263home EssentialsDocumento19 páginas1385824263home EssentialsLaharii MerugumallaAinda não há avaliações

- Calling Off Agitational Programmes - To CMD 09-04-14Documento2 páginasCalling Off Agitational Programmes - To CMD 09-04-14Laharii MerugumallaAinda não há avaliações

- Camera GuideDocumento34 páginasCamera GuideLaharii MerugumallaAinda não há avaliações

- Lastrank Engg Final 2012Documento80 páginasLastrank Engg Final 2012Madhu ChandanapalliAinda não há avaliações

- Eamcet 2010 - Admission Details PDFDocumento70 páginasEamcet 2010 - Admission Details PDFprk74Ainda não há avaliações

- Computer-Based Firewall GuideDocumento13 páginasComputer-Based Firewall GuidewilsonbpintoAinda não há avaliações

- Encumbrance Form306Documento1 páginaEncumbrance Form306Laharii MerugumallaAinda não há avaliações

- MOU Between BSNL and DOT For 2014-2015Documento27 páginasMOU Between BSNL and DOT For 2014-2015Laharii MerugumallaAinda não há avaliações

- CPSU - United Front - LetterDocumento3 páginasCPSU - United Front - LetterKabul DasAinda não há avaliações

- Top Equity Fund PicksDocumento4 páginasTop Equity Fund PicksLaharii MerugumallaAinda não há avaliações

- Hdfclife Click 2 Protect Plan BrochureDocumento4 páginasHdfclife Click 2 Protect Plan BrochureLaharii MerugumallaAinda não há avaliações

- 440 Letter Call OffDocumento1 página440 Letter Call OffLaharii MerugumallaAinda não há avaliações

- Andhra Pradesh Public Service Commission:: Hyderabad Departmental Tests: November - 2013 Session Notification No. 09/2013 Language Test - Viva - VoceDocumento1 páginaAndhra Pradesh Public Service Commission:: Hyderabad Departmental Tests: November - 2013 Session Notification No. 09/2013 Language Test - Viva - VoceLaharii MerugumallaAinda não há avaliações

- Top SIP fund picks for disciplined long-term investingDocumento4 páginasTop SIP fund picks for disciplined long-term investingLaharii MerugumallaAinda não há avaliações

- India Top Picks 5 June 2014Documento21 páginasIndia Top Picks 5 June 2014Laharii MerugumallaAinda não há avaliações

- CPSU Cadre Hierarchy050913Documento3 páginasCPSU Cadre Hierarchy050913Laharii MerugumallaAinda não há avaliações

- MFSSDocumento2 páginasMFSSLaharii MerugumallaAinda não há avaliações

- Reference Material For E2-E3 TrainingMLDocument)Documento36 páginasReference Material For E2-E3 TrainingMLDocument)deepikamahendraAinda não há avaliações

- DGM Eligibility OrderDocumento3 páginasDGM Eligibility OrderLaharii MerugumallaAinda não há avaliações

- LDCE - Posting Modification - Retention Order 13-08-13Documento2 páginasLDCE - Posting Modification - Retention Order 13-08-13Laharii MerugumallaAinda não há avaliações

- Views On HTD-DS's ResignationDocumento2 páginasViews On HTD-DS's ResignationLaharii MerugumallaAinda não há avaliações

- Micromax User GuideDocumento22 páginasMicromax User GuideBhalamurugan RajaramanAinda não há avaliações

- Justified Strength 31-12-2012Documento1 páginaJustified Strength 31-12-2012Laharii MerugumallaAinda não há avaliações

- Glance of Court Cases: S.No Cader PlaceDocumento2 páginasGlance of Court Cases: S.No Cader PlaceLaharii MerugumallaAinda não há avaliações

- Understanding Business Organization and ManagementDocumento38 páginasUnderstanding Business Organization and ManagementLaharii MerugumallaAinda não há avaliações

- Sanchar Award 2013Documento1 páginaSanchar Award 2013Laharii MerugumallaAinda não há avaliações

- Bba 104Documento418 páginasBba 104Alma Landero100% (1)

- Project Work On: Object ClauseDocumento19 páginasProject Work On: Object ClauseShashi RanjanAinda não há avaliações

- Confirmation (AR) PDFDocumento8 páginasConfirmation (AR) PDFWaye EdnilaoAinda não há avaliações

- Union and Organization ContactsDocumento220 páginasUnion and Organization ContactsPalak AngelAinda não há avaliações

- Solved Continue With The Facts Presented in Question 7 in AdditionDocumento1 páginaSolved Continue With The Facts Presented in Question 7 in AdditionAnbu jaromiaAinda não há avaliações

- Artikel Ksa-Telaah Kritis Adopsi Ifrs Di IndonesiaDocumento11 páginasArtikel Ksa-Telaah Kritis Adopsi Ifrs Di Indonesiasuhita whini setyahuniAinda não há avaliações

- Demand Letter-4.10.19Documento2 páginasDemand Letter-4.10.19Rosan PrietoAinda não há avaliações

- PK Actual Rates For October 2019Documento3 páginasPK Actual Rates For October 2019Awais KhalidAinda não há avaliações

- Final Internship PPT HIMANSHU VARDHANDocumento9 páginasFinal Internship PPT HIMANSHU VARDHANGaurav SinghAinda não há avaliações

- Logistic ADocumento47 páginasLogistic ACristian Alejandro Reyes JuarezAinda não há avaliações

- Cost of Business Setup in DubaiDocumento9 páginasCost of Business Setup in DubaiShiva kumarAinda não há avaliações

- Cashflow Statements - ACCA GlobalDocumento3 páginasCashflow Statements - ACCA GlobalRith TryAinda não há avaliações

- Tugas Alk-Adi Benowo Priyo M-1111000023Documento2 páginasTugas Alk-Adi Benowo Priyo M-1111000023Dia MilikkuAinda não há avaliações

- Voucher Payable System Report 2Documento10 páginasVoucher Payable System Report 2Krssh Kt DgAinda não há avaliações

- Composition of Micro Enterprises Facilitation CouncilDocumento3 páginasComposition of Micro Enterprises Facilitation CouncilelabagsAinda não há avaliações

- Bi012735 00 enDocumento608 páginasBi012735 00 enretrete100% (3)

- Study of Marketing Mix of Maruti Suzuki - BBA Marketing Summer Training Project Report PDFDocumento95 páginasStudy of Marketing Mix of Maruti Suzuki - BBA Marketing Summer Training Project Report PDFRj Bîmålkümãr75% (4)

- IC KPI Business Dashboard Template 8673Documento2 páginasIC KPI Business Dashboard Template 8673JacobAinda não há avaliações

- Corporate Social Responsibility 12Documento10 páginasCorporate Social Responsibility 12Md Mozakker Talukder RumiAinda não há avaliações

- Coca ColaDocumento23 páginasCoca ColaSally GrahamAinda não há avaliações

- Subscription Agreement MSTIDocumento2 páginasSubscription Agreement MSTIZhanika Marie CarbonellAinda não há avaliações

- Malaysia Director DutiesDocumento11 páginasMalaysia Director DutiesNur Afiza TaliAinda não há avaliações

- Is Your MONEY in A 'PROBLEM BANK' ?Documento85 páginasIs Your MONEY in A 'PROBLEM BANK' ?LevitatorAinda não há avaliações

- History of Manila Electric CompanyDocumento6 páginasHistory of Manila Electric CompanyJollybelleann MarcosAinda não há avaliações

- Financial Statements-Schedule-III - Companies Act, 2013 PDFDocumento13 páginasFinancial Statements-Schedule-III - Companies Act, 2013 PDFCA Ujjwal KumarAinda não há avaliações

- Antalis Merger HECDocumento31 páginasAntalis Merger HECGanesanDurairajAinda não há avaliações

- Tax PlanningDocumento20 páginasTax PlanningMagenthran KuppusamyAinda não há avaliações

- Investment 06Documento51 páginasInvestment 06Hang VeasnaAinda não há avaliações

- New Microsoft Office Word DocumentDocumento4 páginasNew Microsoft Office Word DocumentakucintakamuuuuuuAinda não há avaliações

- Google Translate document on sacral adjustment techniquesDocumento1 páginaGoogle Translate document on sacral adjustment techniquesArgleydsson Mendes DurãesAinda não há avaliações

- NSE 2019 trading holidaysDocumento2 páginasNSE 2019 trading holidayskishore SIMHAAinda não há avaliações