Escolar Documentos

Profissional Documentos

Cultura Documentos

Top SIP fund picks for disciplined long-term investing

Enviado por

Laharii MerugumallaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Top SIP fund picks for disciplined long-term investing

Enviado por

Laharii MerugumallaDireitos autorais:

Formatos disponíveis

Sharekhans top SIP fund picks

Why SIP?

Disciplined investing

Being disciplined is a key to investing success. Through

a systematic investment plan (SIP) you can choose to

invest fixed amounts in a mutual fund scheme which

could be as low as Rs500 at regular intervals (like every

month) for a chosen period of time (say for a year).

The amount you invest every month or every quarter

will be used to purchase units of a SIP of a mutual

fund scheme. Small amounts set aside every month

towards well performing SIP mutual fund schemes can

make an investor achieve his financial goals in future.

Invest in instruments that beat Inflation

Equity investing can help you combat rising inflation

that diminishes the value of your savings.

SIP over a longer period can reduce the cost per unit

Example (see table below): An investment of Rs24,000

in a mutual fund resulted in a value of Rs25,200 after

12 months; whereas a SIP mutual fund investment of

Rs2,000 per month grew to Rs27,095 after the same

period.

Fewer efforts to opt for SIP

The procedure to invest through SIP is easy. All you

need to do is give post-dated cheques or opt for an

auto debit of a specific amount towards SIP from your

bank account. SIP plans are completely flexible. One

can even start a SIP just by placing an order by logging

into Sharekhans online mutual fund page. One can

invest for a minimum of six months or for a long tenure.

Also, there is an option of choosing the investment

interval which could be monthly or quarterly.

Illustrative example

Price per unit One-time investment SIP

Month (Rs) Amount Units Amount Units

invested (Rs) purchased invested (Rs) purchased

Jan-10 20 24,000 1,200 2,000 100.0

Feb-10 18 -- 2,000 111.1

Mar-10 14 -- 2,000 142.9

Apr-10 22 -- 2,000 90.9

May-10 26 -- 2,000 76.9

Jun-10 20 -- 2,000 100.0

Jul-10 18 -- 2,000 111.1

Aug-10 17 -- 2,000 117.7

Sep-10 15 -- 2,000 133.3

Oct-10 18 -- 2,000 111.1

Nov-10 20 -- 2,000 100.0

Dec-10 21 -- 2,000 95.2

Total investment (Rs) 24,000 24,000

Average price (Rs) 20 19

Total units purchased 1,200 1,290

Value of investment after 25,200 27,095

12 months (Rs)

*NAV as on the 1st of every month. These are assumed NAVs in a volatile market.

May 12, 2014 Visit us at www.sharekhan.com

For Private Circulation only

Sharekhan Ltd, Regd Add: 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East),

Mumbai 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos. BSE-Cash-INB011073351 ; F&O-INF011073351 ; NSE INB/INF231073330;

CD - INE231073330 ; MCX Stock Exchange: INB/INF-261073333 ; CD - INE261073330 ; United Stock Exchange: CD - INE271073350 ; DP-NSDL-IN-DP-NSDL-

233-2003 ; CDSL-IN-DP-CDSL-271-2004 ; PMS-INP000000662 ; Mutual Fund-ARN 20669 ; Commodity trading through Sharekhan Commodities Pvt. Ltd.:

MCX-10080 ; (MCX/TCM/CORP/0425) ; NCDEX -00132 ; (NCDEX/TCM/CORP/0142) ; For any complaints email at igc@sharekhan.com ; Disclaimer: Client

should read the Risk Disclosure Document issued by SEBI & relevant exchanges and Dos & Donts by MCX & NCDEX and the T & C on www.sharekhan.com

before investing.

Mutual Funds mutual gains

2 Sharekhan May 12, 2014

Data as on May 06, 2014

(*invested on 2nd day of every month)

We will be showing compounded annualised returns for three years and five years from now on.

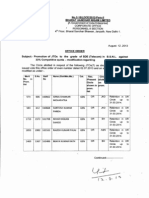

SIP investment (monthly Rs1,000)* 1 year 3 years 5 years

Total amount invested (Rs) 12,000 36,000 60,000

Funds would have grown to NAV Present Compounded Present Compounded Present Compounded

value annualised value annualised value annualised

(Rs) return (%) (Rs) return (%) (Rs) return (%)

Large-cap funds

Birla Sun Life Top 100 Fund 30.9 13,796.3 16.5 46,521.4 9.2 82,621.7 6.7

Reliance Top 200 Fund 16.3 13,740.4 16.0 44,605.1 7.6 77,565.3 5.4

UTI Leadership Equity Fund 19.1 13,350.6 12.4 44,287.7 7.4 75,781.8 4.9

UTI Top 100 Fund 35.2 13,174.5 10.7 42,848.7 6.2 74,504.2 4.5

UTI Wealth Builder Fund - Series II 23.8 12,813.9 7.4 39,930.8 3.6 72,511.1 3.9

BSE Sensex 22,508.4 13,212.4 11.1 43,553.8 6.7 74,511.9 4.5

Multi-cap funds

ICICI Prudential Value Discovery Fund 71.9 14,940.3 27.1 50,021.6 11.9 91,658.5 9.0

Mirae Asset India Opportunities Fund - Reg 22.4 13,923.4 17.6 46,627.0 9.3 84,547.6 7.2

Tata Ethical Fund - Plan A 89.9 13,350.8 12.4 45,978.0 8.7 82,993.5 6.8

LIC Nomura Equity Fund 30.8 13,533.9 14.0 43,347.2 6.6 72,720.1 4.0

Templeton India Growth Fund 134.6 13,540.0 14.1 42,663.1 6.0 72,537.5 3.9

BSE 500 8,372.7 13,379.6 12.6 42,697.5 6.0 72,069.0 3.8

Mid-cap funds

UTI Mid Cap Fund 45.9 15,256.5 30.0 50,622.7 12.4 90,042.9 8.6

HDFC Mid-Cap Opportunities Fund 23.7 14,987.8 27.5 49,805.7 11.8 94,090.6 9.6

Religare Invesco Mid N Small Cap Fund 21.9 14,588.5 23.8 49,700.9 11.7 94,073.2 9.6

Reliance Long Term Equity Fund 20.4 15,086.1 28.4 48,146.8 10.5 83,165.1 6.9

HSBC Midcap Equity Fund 23.5 16,037.7 37.3 47,365.3 9.9 74,381.6 4.5

BSE Midcap 7,370.7 14,127.4 19.5 42,043.9 5.5 68,403.7 2.7

Tax saving funds

ICICI Prudential Taxplan 190.7 14,170.9 19.9 47,195.5 9.7 84,638.7 7.3

HSBC Tax Saver Equity Fund 19.3 13,918.2 17.6 46,262.2 9.0 80,533.0 6.2

IDFC Tax Advantage (ELSS) Fund - Reg 26.3 13,505.5 13.8 45,948.6 8.7 81,529.6 6.4

SBI Magnum Tax Gain Scheme 93 78.9 13,849.4 17.0 45,863.7 8.7 79,247.4 5.8

Franklin India Taxshield 279.9 13,686.9 15.5 44,980.8 7.9 81,695.6 6.5

CNX Nifty 6,715.3 13,222.4 11.2 43,172.7 6.4 74,044.9 4.4

Mutual Funds mutual gains

3 Sharekhan May 12, 2014

8.0

7.5

9.2

13.8

7.8

15.6

15.4

14.0

13.8 13.7

14.7

15.0

8.9

11.9

5.7

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

18.0

6 Months 1 Year 3 Years 5 Years Since

Inception

Reliance top 200 Fund Large Cap Category Average BSE 200

Reliance Top 200 Fund

With about six years of experience, the fund has been a decent performer in comparison with both the benchmark index, BSE

200, and the category average. Despite the volatility and uncertainties in the market, the fund performed better than its peers,

giving returns of 14.7% over one year as against that of 11.9% and 13.8% given by the benchmark index and the category average

respectively in the same period. Over the longer time horizon of three years, the fund has grown at 8% compounded annual

growth rate while the BSE Sensex and the category average have grown at 6.7% and 7.8% respectively. In the recent months, the

fund has garnered returns of 13.7% compared with the 8.9% return posted by the benchmark index and the 9.2% returns from the

large-cap funds category average.

The fund currently has about 34 stocks in its portfolio. It has nearly 98.7% of its net assets exposed to equity while the rest is

exposed to other money-market instruments. The top ten stocks form about 53% of the portfolio. The fund has invested nearly

24.5% of its funds in the banking sector followed by software and capital goods sectors with 17.4% and 11.6% allocations

respectively.

Key features

Fund category Large-cap fund category

Launch date August 8, 2007

Minimum investment Rs5,000

Load structure Entry load is nil/If redeemed bet. 0 year

to 1 year exit Load is 1%

Fund manager Ashwani Kumar, Sailesh Raj Bhan

Latest NAV (gr.) Rs16.3

Latest NAV (div.) Rs12.3

Expense ratio (%) Rs2.61( 30-Sep-13 )

AUM Rs745 crore (31-Mar-2014)

Benchmark index S&P BSE 200

Holding by market cap

Particular %

BSE Sensex 49.5

BSE Midcap 14.3

BSE Small cap

BSE 200 94.0

Top 5 holdings 31.3

Top 10 holdings 53.3

Top 10 stock holdings (total no. of scrips: 34)

Company name % of net assets

Larsen & Toubro 7.7

ICICI Bank 7.1

Infosys 6.1

Divis Laboratories 5.3

Tata Consultancy Services 5.0

State Bank of India 4.9

Reliance Industries 4.7

Bharat Forge 4.3

HDFC Bank 4.3

Maruti Suzuki India 3.8

Style box analysis

Fact sheet

The primary investment objective of the scheme is to seek long-

term capital appreciation by investing in equity and equity

related instruments of companies whose market capitalisation

is within the range of the highest and the lowest market

capitalisation of S&P BSE 200 Index.

Top 5 sectors

Scheme analysis

Scheme performance

Large-cap

Mid-cap

Small-cap

Growth blend value

Returns (point to point) < 1 yr: Absolute, >1yr: CAGR

24.5

17.4

11.6

9.1

8.5

0.0 5.0 10.0 15.0 20.0 25.0 30.0

Banks

Sof tware and Consultancy Services

Engineering and Capital Goods

Petroleum, Gas and petrochemical products

Auto & Auto Ancillaries

Mutual Funds mutual gains

4 Sharekhan May 12, 2014

Disclaimer

This document has been prepared by Sharekhan Ltd.(SHAREKHAN) This Document is subject to changes without prior notice and is intended only for the person or entity to which it is addressed to and may contain confidential and/

or privileged material and is not for any type of circulation. Any review, retransmission, or any other use is prohibited. Kindly note that this document does not constitute an offer or solicitation for the purchase or sale of any financial

instrument or as an official confirmation of any transaction.

Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is from publicly available data or other sources believed to be reliable. While we would Endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated

companies, their directors and employees (SHAREKHAN and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and

affiliates from doing so. We do not represent that information contained herein is accurate or complete and it should not be relied upon as such. This document is prepared for assistance only and is not intended to be and must not alone

be taken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent

evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment

discussed or views expressed may not be suitable for all investors. We do not undertake to advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different

conclusion from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or

use would be contrary to law, regulation or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all

jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

SHAREKHAN & affiliates may have used the information set forth herein before publication and may have positions in, may from time to time purchase or sell or may be materially interested in any of the securities mentioned or related

securities. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates

or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. Any comments or statements made herein are those of the analyst and do not necessarily reflect those

of SHAREKHAN.

Disclaimer: Sharekhan provides non-advisory / order execution services for Mutual Funds. Nothing in this report constitutes investment

advice or tax advice in any form and these products may or may not be suitable for you. Investors should make independent judgment

taking into account specific investment objectives, financial situations and needs before taking any investment decision. Mutual fund

investments are subject to market risk. Please read the offer document carefully before investing. Past performance may or may not be

sustained in the future.

Você também pode gostar

- Sharekhan's Top SIP Fund PicksDocumento4 páginasSharekhan's Top SIP Fund PicksKabeer ChawlaAinda não há avaliações

- Sharekhan's Top SIP Fund PicksDocumento4 páginasSharekhan's Top SIP Fund PicksrajdeeppawarAinda não há avaliações

- 20YR Track Record Balanced FundDocumento4 páginas20YR Track Record Balanced FundJ.K. GarnayakAinda não há avaliações

- Invest in Emerging Companies of TomorrowDocumento4 páginasInvest in Emerging Companies of Tomorrowsachin_sac100% (1)

- Sip 06 May 201010Documento5 páginasSip 06 May 201010Sneha SharmaAinda não há avaliações

- Sharekhan's Top Equity Mutual Fund Picks: April 20, 2012Documento4 páginasSharekhan's Top Equity Mutual Fund Picks: April 20, 2012rajdeeppawarAinda não há avaliações

- Axis Factsheet February 2015Documento20 páginasAxis Factsheet February 2015Sumit GuptaAinda não há avaliações

- Top Equity Fund PicksDocumento4 páginasTop Equity Fund PicksLaharii MerugumallaAinda não há avaliações

- Assignment - Corporate FinanceDocumento9 páginasAssignment - Corporate FinanceShivam GoelAinda não há avaliações

- Birla Sun Life Cash ManagerDocumento6 páginasBirla Sun Life Cash ManagerrajloniAinda não há avaliações

- HDFC Arbitrage Fund RatingDocumento6 páginasHDFC Arbitrage Fund RatingagrawalshashiAinda não há avaliações

- Fundcard DWSCashOpportunitiesRegDocumento4 páginasFundcard DWSCashOpportunitiesRegYogi173Ainda não há avaliações

- Value Research: FundcardDocumento4 páginasValue Research: FundcardYogi173Ainda não há avaliações

- Fundcard L&TCashDocumento4 páginasFundcard L&TCashYogi173Ainda não há avaliações

- Future DRDocumento34 páginasFuture DRarpitimsrAinda não há avaliações

- Original Hard Copy of Mutual FundsDocumento26 páginasOriginal Hard Copy of Mutual FundsjasmineebanAinda não há avaliações

- Badi Badi Khushiyaan, Chotti Chotti Kishton Se Banayen.: Systematic Investment PlanDocumento20 páginasBadi Badi Khushiyaan, Chotti Chotti Kishton Se Banayen.: Systematic Investment PlanTallam Sudheer KumarAinda não há avaliações

- Daily Derivatives: January 25, 2017Documento3 páginasDaily Derivatives: January 25, 2017choni singhAinda não há avaliações

- Fundcard MiraeAssetEmergingBluechipRegular 2014feb26Documento4 páginasFundcard MiraeAssetEmergingBluechipRegular 2014feb26Yogi173Ainda não há avaliações

- Quick Reference Guide For Financial Planning Aug 2012Documento7 páginasQuick Reference Guide For Financial Planning Aug 2012imygoalsAinda não há avaliações

- Sundaram Select MidcapDocumento2 páginasSundaram Select Midcapredchillies7Ainda não há avaliações

- Religare Invesco Active Income Fund ReviewDocumento4 páginasReligare Invesco Active Income Fund ReviewYogi173Ainda não há avaliações

- Mirae Asset Funds Speak April 2014Documento15 páginasMirae Asset Funds Speak April 2014Prasad JadhavAinda não há avaliações

- PLTVF Factsheet October 2015Documento4 páginasPLTVF Factsheet October 2015gadiyaranandAinda não há avaliações

- SIP Returns On MF Ready Reckoner Schemes: Retail ResearchDocumento6 páginasSIP Returns On MF Ready Reckoner Schemes: Retail ResearchumaganAinda não há avaliações

- Kotak Banking and PSU Debt Fund AnalysisDocumento4 páginasKotak Banking and PSU Debt Fund AnalysisYogi173Ainda não há avaliações

- HDFC Prudence Fund PDFDocumento21 páginasHDFC Prudence Fund PDFaadhil1992Ainda não há avaliações

- ELSS Invest Long Term HorizonDocumento8 páginasELSS Invest Long Term HorizonTamil KannanAinda não há avaliações

- Systematic Investment Plan (SIP) - An Investment Mantra For Growth of Your WealthDocumento2 páginasSystematic Investment Plan (SIP) - An Investment Mantra For Growth of Your WealthHaresh NavadiyaAinda não há avaliações

- Flex STP LeafletDocumento2 páginasFlex STP LeafletvinorpatilAinda não há avaliações

- Boost savings and returns with Axis Long Term Equity FundDocumento2 páginasBoost savings and returns with Axis Long Term Equity FundAmandeep SharmaAinda não há avaliações

- Fund Performance ScorecardDocumento25 páginasFund Performance ScorecardSatish DakshinamoorthyAinda não há avaliações

- Daily Derivatives SnapshotDocumento3 páginasDaily Derivatives Snapshotchoni singhAinda não há avaliações

- Sharekhan Top Mutual Fund Picks May 2015Documento14 páginasSharekhan Top Mutual Fund Picks May 2015Siddhant PardeshiAinda não há avaliações

- ValueResearchFundcard DSPBRTop100EquityReg 2011jun22Documento6 páginasValueResearchFundcard DSPBRTop100EquityReg 2011jun22Aditya TipleAinda não há avaliações

- Quick Reference Guide For Financial Planning July 2012Documento7 páginasQuick Reference Guide For Financial Planning July 2012imygoalsAinda não há avaliações

- Deccan Cements (DECCEM: Value PlayDocumento5 páginasDeccan Cements (DECCEM: Value PlayDinesh ChoudharyAinda não há avaliações

- Why Mutual Funds Beat InflationDocumento30 páginasWhy Mutual Funds Beat InflationPuneet SinghAinda não há avaliações

- Why Invest in Mutual Fund AMFIDocumento30 páginasWhy Invest in Mutual Fund AMFIsrammohanAinda não há avaliações

- One From Everyone NEWDocumento14 páginasOne From Everyone NEWPratik KathuriaAinda não há avaliações

- Daily Derivatives: November 19, 2015Documento3 páginasDaily Derivatives: November 19, 2015choni singhAinda não há avaliações

- Comparison of Equity Mutual FundsDocumento29 páginasComparison of Equity Mutual Fundsabhishekbehal5012Ainda não há avaliações

- Chapter 7 PDFDocumento7 páginasChapter 7 PDFBaldhariAinda não há avaliações

- CIMB Islamic Sukuk Fund PerformanceDocumento2 páginasCIMB Islamic Sukuk Fund PerformanceAbdul-Wahab Abdul-HamidAinda não há avaliações

- SBI Securities Morning Update - 13-01-2023Documento7 páginasSBI Securities Morning Update - 13-01-2023deepaksinghbishtAinda não há avaliações

- Daily Derivatives: December 1, 2016Documento3 páginasDaily Derivatives: December 1, 2016Rajasekhar Reddy AnekalluAinda não há avaliações

- ValueResearchFundcard ICICIPrudentialDiscovery 2012may20Documento6 páginasValueResearchFundcard ICICIPrudentialDiscovery 2012may20Dinanath DabholkarAinda não há avaliações

- Market Outlook 12th March 2012Documento4 páginasMarket Outlook 12th March 2012Angel BrokingAinda não há avaliações

- NCL Industries (NCLIND: Poised For GrowthDocumento5 páginasNCL Industries (NCLIND: Poised For GrowthDinesh ChoudharyAinda não há avaliações

- Factsheet August 2012 V10Documento13 páginasFactsheet August 2012 V10Roshni BhatiaAinda não há avaliações

- Equity / Growth Fund Debt/ Income FundDocumento6 páginasEquity / Growth Fund Debt/ Income FundChiunnu JanuAinda não há avaliações

- Innovative Investments in MalaysiaDocumento30 páginasInnovative Investments in MalaysiaNavin RajagopalanAinda não há avaliações

- Capital Letter August 2011Documento5 páginasCapital Letter August 2011marketingAinda não há avaliações

- PLTVF Factsheet February 2014Documento4 páginasPLTVF Factsheet February 2014randeepsAinda não há avaliações

- L&T Tax Saver Fund Application FormDocumento32 páginasL&T Tax Saver Fund Application FormPrajna CapitalAinda não há avaliações

- Investment in Equities Versus Investment in Mutual FundDocumento37 páginasInvestment in Equities Versus Investment in Mutual FundBob PanjabiAinda não há avaliações

- Value Research: FundcardDocumento6 páginasValue Research: FundcardAnonymous K3syqFAinda não há avaliações

- Mutual Fund Category Analysis - Equity Diversified Small-Cap FundsDocumento6 páginasMutual Fund Category Analysis - Equity Diversified Small-Cap FundsGauriGanAinda não há avaliações

- 1385824263home EssentialsDocumento19 páginas1385824263home EssentialsLaharii MerugumallaAinda não há avaliações

- Camera GuideDocumento34 páginasCamera GuideLaharii MerugumallaAinda não há avaliações

- Computer-Based Firewall GuideDocumento13 páginasComputer-Based Firewall GuidewilsonbpintoAinda não há avaliações

- Eamcet 2010 - Admission Details PDFDocumento70 páginasEamcet 2010 - Admission Details PDFprk74Ainda não há avaliações

- Andhra Pradesh Public Service Commission:: Hyderabad Departmental Tests: November - 2013 Session Notification No. 09/2013 Language Test - Viva - VoceDocumento1 páginaAndhra Pradesh Public Service Commission:: Hyderabad Departmental Tests: November - 2013 Session Notification No. 09/2013 Language Test - Viva - VoceLaharii MerugumallaAinda não há avaliações

- MOU Between BSNL and DOT For 2014-2015Documento27 páginasMOU Between BSNL and DOT For 2014-2015Laharii MerugumallaAinda não há avaliações

- Top Equity Fund PicksDocumento4 páginasTop Equity Fund PicksLaharii MerugumallaAinda não há avaliações

- Calling Off Agitational Programmes - To CMD 09-04-14Documento2 páginasCalling Off Agitational Programmes - To CMD 09-04-14Laharii MerugumallaAinda não há avaliações

- Encumbrance Form306Documento1 páginaEncumbrance Form306Laharii MerugumallaAinda não há avaliações

- Lastrank Engg Final 2012Documento80 páginasLastrank Engg Final 2012Madhu ChandanapalliAinda não há avaliações

- MFSSDocumento2 páginasMFSSLaharii MerugumallaAinda não há avaliações

- CPSU - United Front - LetterDocumento3 páginasCPSU - United Front - LetterKabul DasAinda não há avaliações

- Hdfclife Click 2 Protect Plan BrochureDocumento4 páginasHdfclife Click 2 Protect Plan BrochureLaharii MerugumallaAinda não há avaliações

- India Top Picks 5 June 2014Documento21 páginasIndia Top Picks 5 June 2014Laharii MerugumallaAinda não há avaliações

- Sharekhan Top PicksDocumento7 páginasSharekhan Top PicksLaharii MerugumallaAinda não há avaliações

- Reference Material For E2-E3 TrainingMLDocument)Documento36 páginasReference Material For E2-E3 TrainingMLDocument)deepikamahendraAinda não há avaliações

- LDCE - Posting Modification - Retention Order 13-08-13Documento2 páginasLDCE - Posting Modification - Retention Order 13-08-13Laharii MerugumallaAinda não há avaliações

- 440 Letter Call OffDocumento1 página440 Letter Call OffLaharii MerugumallaAinda não há avaliações

- Views On HTD-DS's ResignationDocumento2 páginasViews On HTD-DS's ResignationLaharii MerugumallaAinda não há avaliações

- Understanding Business Organization and ManagementDocumento38 páginasUnderstanding Business Organization and ManagementLaharii MerugumallaAinda não há avaliações

- Glance of Court Cases: S.No Cader PlaceDocumento2 páginasGlance of Court Cases: S.No Cader PlaceLaharii MerugumallaAinda não há avaliações

- CPSU Cadre Hierarchy050913Documento3 páginasCPSU Cadre Hierarchy050913Laharii MerugumallaAinda não há avaliações

- Justified Strength 31-12-2012Documento1 páginaJustified Strength 31-12-2012Laharii MerugumallaAinda não há avaliações

- Sanchar Award 2013Documento1 páginaSanchar Award 2013Laharii MerugumallaAinda não há avaliações

- Micromax User GuideDocumento22 páginasMicromax User GuideBhalamurugan RajaramanAinda não há avaliações

- Bba 104Documento418 páginasBba 104Alma Landero100% (1)

- DGM Eligibility OrderDocumento3 páginasDGM Eligibility OrderLaharii MerugumallaAinda não há avaliações

- Initiative and Responsive Activities in The Market Profile - LinkedInDocumento1 páginaInitiative and Responsive Activities in The Market Profile - LinkedInShahbaz SyedAinda não há avaliações

- Alternative Beta Matters 2017 Q2 NewsletterDocumento13 páginasAlternative Beta Matters 2017 Q2 NewsletterLydia AndersonAinda não há avaliações

- Pruden-Life Cycle Model of Crowd BehaviorDocumento10 páginasPruden-Life Cycle Model of Crowd BehaviorLongterm YeungAinda não há avaliações

- Chapter 9 Multiple Choice QuestionsDocumento32 páginasChapter 9 Multiple Choice Questionsmistermakaveli0% (1)

- Exchange Rates Against UAE Dirham For VAT Related Obligations. December 2019Documento36 páginasExchange Rates Against UAE Dirham For VAT Related Obligations. December 2019azizAinda não há avaliações

- TYBFM A 36 Vignesh Khandelwal Black BookDocumento74 páginasTYBFM A 36 Vignesh Khandelwal Black Bookpreet doshiAinda não há avaliações

- Madoff: A Flock of Red Flags that Should Have Been NoticedDocumento10 páginasMadoff: A Flock of Red Flags that Should Have Been NoticedSillyBee1205Ainda não há avaliações

- HSL Looking Glass: Retail ResearchDocumento4 páginasHSL Looking Glass: Retail ResearchumaganAinda não há avaliações

- End Term Examination MMS - Financial Regulation (2019-21)Documento3 páginasEnd Term Examination MMS - Financial Regulation (2019-21)akshu kumarAinda não há avaliações

- Video Lecture 7 On ES10Documento22 páginasVideo Lecture 7 On ES10jerromecymouno.garciaAinda não há avaliações

- 25 Random Accounting QuestionsDocumento11 páginas25 Random Accounting QuestionsAccounting GuyAinda não há avaliações

- Precision Based Trading King. D Boateng IG@kingboatengofficialDocumento24 páginasPrecision Based Trading King. D Boateng IG@kingboatengofficialnicholasAinda não há avaliações

- How To Clear FRM Part 2 ExamDocumento11 páginasHow To Clear FRM Part 2 ExamTung Ngo100% (1)

- Module 3 - PMM 103 Pricing StrategyDocumento4 páginasModule 3 - PMM 103 Pricing StrategyMarion Kiel OrigenesAinda não há avaliações

- E Trade ApplicationDocumento4 páginasE Trade Applicationtunlinoo100% (1)

- Bnidirect-Excel Template v1.9.2Documento435 páginasBnidirect-Excel Template v1.9.2Achmad WidodoAinda não há avaliações

- Mutual Funds: Rajinder S Aurora PHD Professor in FinanceDocumento33 páginasMutual Funds: Rajinder S Aurora PHD Professor in FinanceRahulJainAinda não há avaliações

- Global Family Office Report 2023.pdf - CoredownloadDocumento102 páginasGlobal Family Office Report 2023.pdf - Coredownloadpderby1Ainda não há avaliações

- Indian Currency SystemDocumento13 páginasIndian Currency SystemSumitGehlot100% (1)

- Rder Anagement Ystems: Chris Cook Electronic Trading Sales 214-978-4736Documento26 páginasRder Anagement Ystems: Chris Cook Electronic Trading Sales 214-978-4736Pinaki MishraAinda não há avaliações

- Final Marketing - 230711 - 015710Documento3 páginasFinal Marketing - 230711 - 015710Hamisah SyahirahAinda não há avaliações

- Itad Bir Ruling No. 168-12Documento7 páginasItad Bir Ruling No. 168-12Karla TigaronitaAinda não há avaliações

- Blue Chip Stocks TipsDocumento16 páginasBlue Chip Stocks TipsPinal MehtaAinda não há avaliações

- Eversend Account Statement - 2023 - 03!03!2023!04!03Documento3 páginasEversend Account Statement - 2023 - 03!03!2023!04!03Darius Murimi NjeruAinda não há avaliações

- 7 Steps To Understanding The Stock Market Ebook v6Documento32 páginas7 Steps To Understanding The Stock Market Ebook v6Afsal Mohamed Kani 004Ainda não há avaliações

- Lecture17 PDFDocumento27 páginasLecture17 PDFkate ngAinda não há avaliações

- AAT Free EbookDocumento70 páginasAAT Free EbookHorvath KriszAinda não há avaliações

- Hasil Abnormal ReturnDocumento6 páginasHasil Abnormal ReturnSurya KeceAinda não há avaliações

- Etextbook PDF For Financial Markets and Institutions 7th Edition by Anthony SaundersDocumento61 páginasEtextbook PDF For Financial Markets and Institutions 7th Edition by Anthony Saundersronald.allison470100% (36)

- Corporate Finance Problem Set 5Documento2 páginasCorporate Finance Problem Set 5MAAinda não há avaliações