Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Markets

Enviado por

PREETAM2525Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Markets

Enviado por

PREETAM2525Direitos autorais:

Formatos disponíveis

Chapter 2

Global Financial Instruments

2

Major Classes of

Financial Assets/Securities

Debt

Money market instruments

Bonds

Common stock

Preferred stock

Derivative securities

3

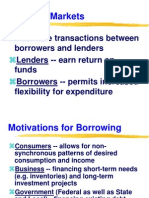

Financial Markets

Financial

Markets

Foreign Exchange

Market

Derivatives

Traditional

Financial

Markets

(Long-term)

Capital

Market

(Short-term)

Money

Market

T-ills

CD

C!

"

#epos$#everses

Federal %&nds

L'(# market

onds

Stocks

T-)otes$onds

M&nicipal *onds

Corporate onds

"S$MS

+hole sales market

#etail market

For,ard

F&t&res

(ption

S,ap

4

Money Market Instruments 1

!ort"term# marketable# lo$"risk securities

Cas! e%uivalents

&reasury bill '&"Bill(

!ort"term 'less t!an one year( )ov*t securities sold at a

discount and +ayin) off t!e face value at maturity

Discount rate needs to be converted to a bond e%uivalent yield

'ee e,am+le later(

&a,"e,em+t from all state and local ta,es# but not from fed ta,es

Issued in auction markets- Com+etitive vs. noncom+etitive bids

Certificates of de+osit 'CD(

&ime de+osit $it! a bank# +ayin) off interest and +rinci+al at

maturity# and ne)otiable before maturity

&reated as a bank de+osit by t!e FDIC 'insured for u+ to

/011#111(

2

Money Market Instruments 2

3urodollars

Dollar"denominated time de+osits at forei)n banks# $it! a

maturity less t!an 4 mont!s

3urodollar CD is a variation t!at is ne)otiable before maturity

Commercial Pa+er 'CP(

!ort"term unsecured debt issued by a lar)e cor+. in

denomination of /011#111

Fairly safe# but can default.

5ated by a ratin) a)ency suc! as 6P# Moody*s# etc.

Bankers* 7cce+tances 'B7(

8idely used in forei)n trade 'im+ort9e,+ort(

7 customer*s order acce+ted by a bank to make a +ayment at a

future date

ells at a discount in secondary markets

4

Money Market Instruments 3

5e+urc!ase 7)reements '5Ps( and 5everse 5Ps

!ort"term 'overni)!t( sales of )ov*t securities by dealers $it! an

a)reement to re+urc!ase t!em later at a !i)!er +rice

It is like a 9& lo$"risk loan $it! t!e securities !eld as collateral

7 reverse re+o $orks in t!e o++osite direction

Federal Funds

Banks* de+osits at t!e Federal 5eserve Bank to maintain a

re%uired minimum balance

Banks $it! e,cess funds lend to t!ose $it! a s!orta)e at a rate

of t!e Federal fund rate 'Fed fund rate(

:IB;5 Market

:IB;5- lendin) rate amon) lar)e banks in :ondon

erve as a reference rate for a $ide ran)e of transactions

<

Discount Rate vs.

on! "#uivalent $iel!

Discount 5ates on money market instruments

are not directly com+arable to Bond 3%uivalent

=ield 'B3=(

&!ey need to be converted into B3= to be

com+arable $it! ot!er bond yields

341 vs. 342 days assumed in a year

>

ank Discount Rate %&'ills(

r

r

D D

- *ank disco&nt rate

- *ank disco&nt rate

!

!

- market price o% the T-*ill

- market price o% the T-*ill

n

n

- n&m*er o% days to mat&rity

- n&m*er o% days to mat&rity

r

r

D D

?

?

01#111

01#111

"

"

!

!

01#111

01#111

x

x

341

341

n

n

./-day T-*ill0 ! - 1.0234

./-day T-*ill0 ! - 1.0234

r

r

D D

?

?

01#111

01#111

"

"

@#><2

@#><2

01#111

01#111

x

x

341

341

@1

@1

?

?

2A

2A

(Example)

(Example)

@

on! "#uivalent $iel!

! - market price o% the T-*ill

! - market price o% the T-*ill

n - n&m*er o% days to mat&rity

n - n&m*er o% days to mat&rity

r

r

E5 E5

?

?

01#111

01#111

"

"

!

!

!

!

x

x

342

342

n

n

r

r

E5 E5

?

?

01#111

01#111

"

"

@#><2

@#><2

@#><2

@#><2

x

x

342

342

@1

@1

r

r

E5 E5

- 6/783 x 96/44: - 6/47; - 467;<

- 6/783 x 96/44: - 6/47; - 467;<

Example &sing the sample T-ill=

Example &sing the sample T-ill=

Convert t!e bank discount rate into B3= to

make it com+arable $it! ot!er bond yields

01

Ca)ital Market *

Fi+e! Income Instruments 1

B &reasury Cotes and Bonds

Debt of t!e federal )ov*t $it! maturities of 0 year or more# +ayin)

off semiannual interests and +rinci+al at maturity

Price %uoted in units of 0932 of a +oint

'3,( 001-14 ? 001 4932 ? 001.0><2 'A( of +ar B/0 mil

=ield"to"maturity '=&M( is an annualiDed rate of return# based on

an annual +ercenta)e rate '7P5( or also called B3=

'3,( =&M ? semiannual yield 2

Mort)a)e"Backed ecurities 'Federal 7)ency(

;$ners!i+ claim to cas! inflo$s from a mort)a)e +ool

Interest and +rinci+al +ayments from borro$ers are +assed to

+urc!asers# and are called E+ass"t!rou)!sF

GCM7 +ass"t!rou)!s 'since 0@<1(# and ot!ers 'FCM7# FG:MC(

Market siDe is com+arable to cor+orate and &"bond markets

00

Ca)ital Market *

Fi+e! Income Instruments 2

Munici+al bond 'EmunisF(

Issued by state and local )ov*t# and interest income is e,em+t

from federal and sometimes state and local ta, 'but ca+ital )ains

are ta,able(

&o com+are yields on ta,able securities# $e com+ute a &a,able

3%uivalent =ield as follo$s

r

m

r =

1 t

r

m

= muni bond yield

r - taxa*le e>&ivalent yield

t = marginal tax rate

r

m

= r(1 t)

02

Ca)ital Market *

Fi+e! Income Instruments 3

Cor+orate bonds

:on)"term debt issued by +rivate cor+orations# +ayin) ty+ically

semiannual interests and +rinci+al at maturity

ecured 'mort)a)e or collateral( vs. unsecured 'Debenture(

Guaranteed vs. strai)!t bond

;+tion"embedded bonds- Callable# +uttable# convertible# etc.

Current yield ? 7nnual cou+on 9 Current +rice

=ield"to"maturity ? current yield H ca+ital )ain yield

International Bonds

3urobond- denominated in a currency ot!er t!an t!e issuin)

country# e.).# dollar"denominated bond issued in :ondon

=ankee bond# amurai bond

03

Ca)ital Market ' "#uity

Common stock

;$ners!i+ s!ares of a +ublicly !eld cor+oration

3ntitled to )et votin) ri)!t and dividend +ayments

5esidual claim

:imited liability

Dividend yield ? 7nnual dividend 9 Current +rice

P3 ratio ? Price 9 3P

Preferred stock

Convotin) s!ares# usually +ayin) fi,ed dividends 'usually

cumulative(# like an infinite"maturity bond or a +er+etuity

Priority over common stock !olders

ometimes# callable and convertible

04

International "#uity

Global markets continue develo+in)# and more

o++ortunities of investin) abroad are available

7D5s '7merican De+ository 5ecei+ts(

Mutual funds like country funds or 83B '8orld

3%uity Benc!mark !ares(

Direct +urc!ase of forei)n securities

Provides diversification benefits# but are

e,+osed to forei)n e,c!an)e risk

Global information and analysis skills are re%uired

02

&otal nominal return in t,e -.S.

04

"#uity Risk .remium

0<

.erformance /y market sectors

0>

Risk vs. Return /y market sectors

0@

International Stock Returns

21

International Stock an! on! Returns

20

5e+resent t!e +erformance of t!e stock market as a

$!ole# e.).# DII7# 6P211# 8ils!ire 2111# etc.

Bseful to track avera)e returns of t!e stock market

Bseful as a benc!mark for t!e +erformance of fund mana)ers

Bsed as base of derivatives

Many kinds of stock inde,es e,ist

5e+resentativeJ Broad or narro$J Go$ is it $ei)!tedJ

Price"$ei)!ted inde,

K

Do$ Iones Industrial 7vera)e '31 blue"c!i+ stocks(

Market value"$ei)!ted inde,

K

tandard 6 Poor*s 211# C7D7L Com+osite# 8ils!ire 2111

3%ually $ei)!ted inde,

K

Malue :ine Inde,

Stock In!e+es

22

Stock In!e+es ' Int0l

Cikkei 222 '+rice"$ei)!ted# lar)est &3 stocks(

Cikkei 311 'value"$ei)!ted# lar)est &3 stocks(

F&3 'value"$ei)!ted# lar)est 011 :3 stocks(

D7N 'German stock inde,(

5e)ional and Country Inde,es by MCI

37F3 '3uro+e# 7ustralia# Far 3ast(

Far 3ast

3M '3mer)in) markets(

B..# B.O.# etc. 'over 21 country inde,es(

23

1ils,ire 2333 In!e+

24

&o) 23 com)anies in S4.233 In!e+

22

Derivatives Securities

;+tions

Basic Positions

Call '5i)!t to Buy(

Put '5i)!t to ell(

&erms

3,ercise 'trike( Price

3,+iration Date

Bnderlyin) 7ssets

Futures

Basic Positions

:on) 'Commitment to Buy(

!ort 'Commitment to ell(

&erms

Futures +rice

Delivery 'Maturity( Date

Bnderlyin) 7ssets

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Consumer Protection Act, ProjectDocumento17 páginasConsumer Protection Act, ProjectPREETAM252576% (171)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Experimental Nucleonics PDFDocumento1 páginaExperimental Nucleonics PDFEricAinda não há avaliações

- A REPORT ON MIMO IN WIRELESS APPLICATIONS - FinalDocumento11 páginasA REPORT ON MIMO IN WIRELESS APPLICATIONS - FinalBha RathAinda não há avaliações

- Mediated Read Aloud Lesson PlanDocumento4 páginasMediated Read Aloud Lesson PlanMandy KapellAinda não há avaliações

- Financial+Markets 123Documento34 páginasFinancial+Markets 123PREETAM2525Ainda não há avaliações

- Financial MarketDocumento25 páginasFinancial MarketPREETAM2525Ainda não há avaliações

- Has Biscuit Manufacturer Britannia Industries Found ADocumento6 páginasHas Biscuit Manufacturer Britannia Industries Found Akarix0888Ainda não há avaliações

- Financial MarketsDocumento49 páginasFinancial MarketsPREETAM2525Ainda não há avaliações

- Channel DevelopmentDocumento66 páginasChannel Developmentalkanm750Ainda não há avaliações

- Project On Job EvalutionDocumento10 páginasProject On Job EvalutionPREETAM2525Ainda não há avaliações

- The Importance of MoneyDocumento9 páginasThe Importance of MoneyLinda FeiAinda não há avaliações

- The Tamil Nadu Commercial Taxes ServiceDocumento9 páginasThe Tamil Nadu Commercial Taxes ServiceKumar AvelAinda não há avaliações

- Spouses Benatiro V CuyosDocumento1 páginaSpouses Benatiro V CuyosAleli BucuAinda não há avaliações

- Anguyo Emmanuel Research ReportDocumento51 páginasAnguyo Emmanuel Research ReportTendo PaulAinda não há avaliações

- MA in Public Policy-Handbook-2016-17 (KCL)Documento14 páginasMA in Public Policy-Handbook-2016-17 (KCL)Hon Wai LaiAinda não há avaliações

- Cambridge International Advanced Subsidiary LevelDocumento12 páginasCambridge International Advanced Subsidiary LevelMayur MandhubAinda não há avaliações

- Graph Theory and ApplicationsDocumento45 páginasGraph Theory and Applicationssubramanyam62Ainda não há avaliações

- Power Semiconductor DevicesDocumento11 páginasPower Semiconductor DevicesBhavesh Kaushal100% (1)

- APQP TrainingDocumento22 páginasAPQP TrainingSandeep Malik100% (1)

- How Cooking The Books WorksDocumento27 páginasHow Cooking The Books WorksShawn PowersAinda não há avaliações

- International Accounting Standard 36 (IAS 36), Impairment of AssetsDocumento10 páginasInternational Accounting Standard 36 (IAS 36), Impairment of AssetsMadina SabayevaAinda não há avaliações

- MailEnable Standard GuideDocumento53 páginasMailEnable Standard GuideHands OffAinda não há avaliações

- Condition Monitoring 021711 v3Documento40 páginasCondition Monitoring 021711 v3Kevin_IAinda não há avaliações

- Data ListDocumento239 páginasData Listpriyanka chithran100% (1)

- Form No. 61: (See Proviso To Clause (A) of Rule 114C (1) )Documento1 páginaForm No. 61: (See Proviso To Clause (A) of Rule 114C (1) )Vinayak BhatAinda não há avaliações

- Introduction To The Philosophy of The Human PersonDocumento21 páginasIntroduction To The Philosophy of The Human Personanon_254928515Ainda não há avaliações

- Concrete Batching and MixingDocumento8 páginasConcrete Batching and MixingIm ChinithAinda não há avaliações

- Application of Schiff Base Ligamd ComplexDocumento7 páginasApplication of Schiff Base Ligamd Complexrajbharaths1094Ainda não há avaliações

- Quarter 4 Week 4 Parallel Lines Cut by A TransversalDocumento26 páginasQuarter 4 Week 4 Parallel Lines Cut by A TransversalZaldy Roman MendozaAinda não há avaliações

- Problems of Alternative Dispute Resolution Mechanisms and Proposals For Improvement: A Study in BangladeshDocumento12 páginasProblems of Alternative Dispute Resolution Mechanisms and Proposals For Improvement: A Study in BangladeshssfsdsdAinda não há avaliações

- Key Influence Factors For Ocean Freight Forwarders Selecting Container Shipping Lines Using The Revised Dematel ApproachDocumento12 páginasKey Influence Factors For Ocean Freight Forwarders Selecting Container Shipping Lines Using The Revised Dematel ApproachTanisha AgarwalAinda não há avaliações

- Food and Medicine Label 1-50Documento11 páginasFood and Medicine Label 1-50Muthia KumalaAinda não há avaliações

- Tugas Pak Hendro PoemDocumento24 páginasTugas Pak Hendro PoemLaila LalaAinda não há avaliações

- Blue Ocean Strategy: Case Study: Quick DeliveryDocumento29 páginasBlue Ocean Strategy: Case Study: Quick DeliveryKathy V. Chua-GrimmeAinda não há avaliações

- Mercado Vs Manzano Case DigestDocumento3 páginasMercado Vs Manzano Case DigestalexparungoAinda não há avaliações

- Batallon de San PatricioDocumento13 páginasBatallon de San PatricioOmar Marín OropezaAinda não há avaliações

- Law 431 Course Outline (Aug 22-23)Documento3 páginasLaw 431 Course Outline (Aug 22-23)Precious OmphithetseAinda não há avaliações