Escolar Documentos

Profissional Documentos

Cultura Documentos

DTA State of Downtown 2014 Full Report

Enviado por

Ben Winslow0 notas0% acharam este documento útil (0 voto)

6K visualizações40 páginasA report by the Downtown Alliance on the "State of Downtown" Salt Lake City.

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoA report by the Downtown Alliance on the "State of Downtown" Salt Lake City.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

6K visualizações40 páginasDTA State of Downtown 2014 Full Report

Enviado por

Ben WinslowA report by the Downtown Alliance on the "State of Downtown" Salt Lake City.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 40

2014 STATE OF DOWNTOWN

2013-2014 Economic Benchmark Report

HOSPITALITY,

TOURISM AND

CONVENTION

24

2013 YEAR IN

REVIEW

04

RETAIL AND

RESTAURANTS

28

CURRENT

AND FUTURE

DEVELOPMENT

08

CULTURE AND

ENTERTAINMENT

30

EMPLOYMENT

12

TRANSPORTATION

32

DOWNTOWN

OFFICE

16

QUALITY OF

LIFE

36

RESIDENTIAL

20

Contents

PURPOSE OF THE STATE OF DOWNTOWN

The 2014 State of Downtown report for downtown Salt Lake City ofers a comprehensive analysis and factual

update of the downtown economy to inform decisions for key stakeholders: property owners, investors,

developers, retailers, brokers, policy makers and civic leaders.

This study collects historic data to highlight trends and compare downtown to statewide and regional economic

indicators. These comparisons are important to gauge opportunities for improvement and growth in the district.

The following economic indicators will be treated with detail in the report: current and future development,

employment, downtown of ce market conditions, housing, hospitality, tourism, conventions, retail and restaurants,

culture and entertainment, transportation and overall quality of life.

2013 YEAR IN

REVIEW

A vibrant metropolitan center is an important economic engine for the entire region.

Downtown Salt Lake City is one of the regions most dynamic and diverse economies. As such,

Salt Lake City serves as a hub for culture, commerce and entertainment and is Utahs capital

city. Economic activity and tax revenues continue to recover from the Great Recession of

2007-2009 with retail sales continuing to reach new highs. The surge in activity is augmented

by solid performance from City Creek Center with its 700,000 sq. ft. of retail space. However,

success is not only limited to the new mall; continued retail leasing activity on Main Street and

at The Gateway Mall are indicators that downtown is poised to continue growing its share of

Salt Lake Countys retail sales.

Table 1: Downtown Economic Prole-2013 (Constant 2013 Dollars)

Category Amount

Employment 69,235

Wages Paid $2,645,796,000

Available Of ce Square Footage 10,572,513 SF

Of ce Vacancy Rate 17.1%

Retail $800,304,200

Retail Square Footage 2,400,500

Hotel Occupancy 64.7%

City-wide Convention Delegates 197,809

Spending by Convention Attendees $183,962,370

Parking Spaces 33,000*

Total Downtown Property Value $3,175,981,590

Total Acreage 501.02

Total Properties within Special Assessment Area 870

* Estimate of surface level and parking structures.

Source: Bureau of Economic and Business Research, University of Utah, CBRE, Visit Salt Lake, Downtown Alliance.

Downtown retail sales

reached all-time highs

with sales reaching

over $800 million

in eating, drinking,

clothing, department

and other categories.

2013 YEAR IN REVIEW 5

2013-2014 DOWNTOWN ECONOMIC HIGHLIGHTS

HOTEL

Utah Legislature authorizes new convention

facility development incentive provisions

The legislation provides a post-performance

tax incentive to a private developer to build

public meeting room space in addition to

privately developed hotel rooms. The hotel is

expected to signicantly impact downtowns

convention business, which will in turn spill out

to existing hotels, restaurants and retail. The RFP

process will begin summer 2014.

A 24/7 lifestyle continues to grow

New retail, restaurants and bars continue to bring

additional vibrancy and liveliness to downtown.

Notable openings are BEER BAR, Brio, Whiskey

Street, Bistro 222, Bodega, Good Dog, Red Hot,

Spitz, From Scratch, Copper Common, Rocket

Fizz and the Urban Arts Gallery.

Downtown Salt Lake Citys share of retail sales

at an all-time high

Downtown retail sales reached all-time highs

of more than $800 million for eating, drinking,

clothing, department and other retail sales

categories. While countywide sales are declining,

downtowns retail performance continues to

grow with downtown representing 10.8% of total

county sales.

Bi-weekly Winter Market debuts in Rio Grande

Depot

Building on the success of the Downtown

Farmers Market, the Winter Marketfrom

November through Aprilbrought more than

24,000 people into a challenged downtown

neighborhood. Each Winter Market supported

more than 50 local businesses and family farms

while indirectly injecting positive impacts on

neighboring business and contributing to a lively

atmosphere. The Summer Downtown Farmers

Market helps to attract more than 10,000 people

weekly and acts as an incubator for as many as

300 small local businesses.

2013 YEAR IN REVIEW 6

2014-2015 DOWNTOWN OPPORTUNITIES

Depot district redevelopment

The Gateway development created a strong foundation for this burgeoning entrepreneurial and transit-oriented district.

With a public market planned, a 10-acre urban park and over 1,000 new residential units expected, this district has the

potential to be a thriving neighborhood in downtown. However, the district needs additional resources and approaches

to help service providers and their clients address issues of homelessness and vagrancy.

Nightlife economy

A vibrant nightlife is an important part of a dynamic and diverse downtown that is welcoming to locals and visitors alike.

While new restaurants and bars are opening doors downtown, current statewide liquor laws signicantly impact tourism

potential and additional development. Consensus driven policies should address issues of the Zion curtain, intent to

dine and the number of full-service restaurant licenses for downtown.

Residential development

Salt Lake City is in the midst of a dramatic transformation with new business, shopping, dining, arts and entertainment

rising throughout the district. However, it is residents that bring the life and soul to a true urban center. Downtown needs

more residential opportunities for all ages and income levels. Year-round residents help to create a livelier, more

dynamic community.

Development friendly codes and zoning

One of the biggest concerns threatening any new investment in downtown development projects are impact fees

and demolition ordinances. Roadway fees for of ce inll development and Parks impact fees for residential dwellings

undermine investments in new development. Local policies should incentivize developers in order to remain competitive

in attracting business and residents to the downtown area.

2013 YEAR IN REVIEW 7

CURRENT

AND FUTURE

DEVELOPMENT

Continued development is vital to the future success and vibrancy of downtown. New of ce, residential, hotel, and arts and entertainment

developments will continue to redene downtowns growing skyline and bring additional employees, residents, visitors and wealth into the district.

OFFICE DEVELOPMENT

101 Tower

The Boyer Companys 101 Tower is open and currently for lease on the corner of 100 South and 200 East. The building,

designed to service Class A of ce tenants, consists of a granite and glass exterior with steel frame construction. The $34

million tower has 144,000 sq. ft. of leasable space and an on-site parking structure.

111 South Main

111 South Main Tower is a new Class A development being developed by City Creek Reserve. Construction of the 24-story

of ce building adjacent to City Creek Center is underway, along with the neighboring George and Dolores Eccles Theater.

Featuring 440,452 sq. ft. of of ce space, the anticipated LEED-certied gold project will help bolster downtowns economy

with added businesses and jobs. Parking, access, functionality and design will be integrated from the foundation through the

faade so that the project as a whole will extend the investment in City Creek down Main Street and throughout the rest of

downtown.

151 State Street

The Boyer Companys 151 State Street project consists of an 18-story of ce building with a full basement and rooftop

penthouse. The building footprint is approximately 22,000 sq. ft. and the building height will be 273 feet to the oor level of

the mechanical penthouse, with the penthouse extending approximately 22 feet in height. The schedule for opening and a

time frame for construction have yet to be released. A parking structure adjacent to the development site is currently under

construction.

Broadway Media Center

Wasatch Partners is in the process of retrotting the bottom two oors of the 50 West Broadway Of ce Tower to

accommodate a full-service restaurant and Wiseguys Comedy Club, which hopes to open for business in September 2014.

The sky bridge connecting the Tower to the former Key Bank Building to the west is also being converted to house a

Broadway Media Group radio station.

RETAIL DEVELOPMENT

Three and Three Un.commons

Located on 300 East and 300 South, Three and Three Un.commons is a 16,000 sq. ft. renovated restaurant and retail space

leasing at $22 per square foot. The former antique renovation will include a market that focuses on fresh, local produce and a

restaurant featuring natural foods.

CURRENT AND FUTURE DEVELOPMENT 9

RESIDENTIAL DEVELOPMENT

Edison Quarter

La Porte Group is currently in the construction phase of a mix of 180 new market-rate residential units along with local retail,

theater space and food outlets on 237 State Street. Other planned highlights for the project include the restoration of the

Cramer House into a restaurant space and a new community piazza. The $39 million project is scheduled to be completed in 2015.

Liberty at Gateway

Cowboy Partners is the developer of the Liberty at Gateway, a 160-unit, 203 parking stall, market-rate residential apartment

project located on two acres of land directly west of The Gateway. The $25.2 million dollar project fronts most of 500 West

from South Temple to 100 South and opened spring 2014. Monthly rental rates start at $699 for studios up to $1,302 per

month for two-bedroom units. Cowboy Partners also has another apartment project that is slated to begin construction later

this spring on the west side of 200 East between 100 and 200 South.

Broadway Park Lofts

Located at 360 West 300 South, Broadway Park Lofts is an 82-unit downtown loft community adjacent to the Pioneer Park.

The project was acquired by Clearwater Homes and is currently 95% complete.

Westgate Business Center

Clearwater Homes will begin to redevelop the historical Westgate Business Center on the northwest corner of 200 South and

300 West into 38 luxury units starting in September 2014. Units will range in size from 750 to over 2,000 sq. ft. The 73,000

sq. ft. building will feature geothermal heating and cooling, as well as LEED Gold certication.

HOTEL DEVELOPMENT

Hyatt House Hotel and Courtyard by Marriott

Maryland-based Alex Brown Realty Inc., in conjunction with PEG Development and Blue Diamond Capital, is currently

building two hotels on the block directly south of the Energy Solutions Arena. The rst, a 159-room Hyatt House Hotel with a

349-space parking garage on the southwest corner of 100 South and 300 West is expected to open in fall 2014. The second

hotel will be a 175-room, select-service Courtyard by Marriott. The Marriott is scheduled to open in 2015.

AIR Hotel

AIR Hotel is a 14-story boutique hotel development by Provo-based KPB Equities. Located on the northwest corner of 400

South and West Temple, the hotel will include restaurants, a high-end nightclub, rooftop pool and club and a 350-person

multi-use entertainment space. Formerly known as the AIR Center, the project is expected to break ground in fall 2014. A

hotel operator has yet to be announced.

CURRENT AND FUTURE DEVELOPMENT 10

ARTS AND CULTURAL VENUE DEVELOPMENT

The George S. and Dolores Dor Eccles Theater

Demolition and construction for the $117 million George S. and Dolores Dor Eccles

Theater (formerly known as the New Performing Arts Center) began in spring 2014.

The 2,500-seat, Broadway-style theater is expected to be completed by summer

2016 and will be designed to enhance the cultural and economic vitality of the

region by attracting rst-run touring Broadway shows as well as other national and

local music, comedy and family entertainment acts. Located at 135 South Main, the

theater is also anticipated to continue the revitalization of Main Street and add a

dynamic new festival street component on Regent Street, bolstering investments

made by City Creek (one block north) and Salt Lake Citys Gallivan Center (one

block south). The theater is being developed in tandem with the 111 South Main

Street Of ce Tower.

Jessie Eccles Quinney Center for Dance and Capitol Theater Renovation

Ballet West and the Salt Lake County Center for the Arts have come together

in a public-private partnership to renovate the Capitol Theatre and build the

Jessie Eccles Quinney Center for Dance, which will be home to local arts groups

Ballet West and the Ballet West Academy. The $33.4 million, 5-story addition to

Capitol Theatre is currently under construction on the lot just west of the existing

facility located at 50 West 200 South. The new facility will provide additional

classrooms and rehearsal space, of ces and technical support areas for both the

company and the Ballet West Academy. The renovations to the theater itself were

completed winter 2013 and revamped the historical theater to expand the lobby

and concessions, increase restroom facilities, improve seating and sight lines, and

add a new banquet hall.

PUBLIC LANDMARK DEVELOPMENT

New United States Courthouse for the District of Utah

The new United States Courthouse is located behind the existing Frank E. Moss Federal Courthouse on 351 South West

Temple. Construction for the 10-story, 368,000 sq. ft. building began on January 19, 2011 and opened spring 2014. The

entire project cost was estimated to be $211 million, providing 1,500 to 2,000 construction jobs.

Salt Lake City Public Safety Building

Located on the boundaries of downtown at 300 East and 500 South, the new 313,662 sq. ft., 4-story public safety building

and emergency operation center houses essential emergency services, including police, re and emergency response call

centers, as well as community meeting rooms and department of ces. The $125 million project opened summer 2013.

Eccles Theater:

Economic Benets at a Glance

$200-$500 Million

Construction Value

2,500

Construction Jobs

115-168

Permanent Jobs

$1 Million

New Annual Property Tax Value

$9.4 Million Per Year

Estimated Annual Direct,

Indirect and Induced Spending

(based on theater alone)

CURRENT AND FUTURE DEVELOPMENT 11

EMPLOYMENT

A total of 660 jobs were added to the downtown core in 2013. The small growth in comparison

to 2012s increase of 3,725 jobs can be attributed to the 2012 opening of City Creek Center.

Total employment in downtown is 69,235 with an average annual wage of $42,727.

Table 2: Estimated Employment Change by Sector Downtown

1990 2001 2005 2007 2013 1990-2013 2007-2013

Of ce 42,000 51,350 51,250 53,000 55,500 32.1% 4.7%

Restaurants 3,350 7,300 7,400 7,200 7,650 128.4% 6.2%

Retail 1,550 2,700 2,600 1,800 3,350 116.1% 86.1%

Hotels 1,250 1,800 1,800 1,800 1,800 44.0% 0.0%

Manufacturing 500 500 450 50 50 -90.0% 0.0%

Miscellaneous 500 750 1,100 1,100 1,050 110.0% -4.6%

Total 49,150 64,400 64,600 64,950 69,235 40.9% 6.6%

Source: Utah Department of Workforce Services and Bureau of Economic and Business Research University of Utah, Downtown Alliance.

Of ce workers dominate employment in downtown. In fact, 80.2% of total employment

is classied as of ce jobs. Restaurant employment ranks second with 11% of all jobs. The

restaurant sector has had the highest long-term growth rate, increasing by 128.4% since 1990.

Table 3: Distribution of Employment by Sector Downtown 1990-2013

1990 2001 2007 2013

Of ce 85.5% 79.7% 81.6% 80.2%

Restaurants 6.8% 11.3% 11.1% 11.0%

Retail 3.2% 4.2% 2.8% 4.8%

Hotels 2.5% 2.8% 2.8% 2.6%

Manufacturing 1.0% 0.8% 0.1% 0.1%

Miscellaneous 1.0% 1.2% 1.7% 1.5%

Total 100.0% 100.0% 100.0% 100.0%

Source: Utah Department of Workforce Services and Bureau of Economic and Business Research University of Utah, Downtown Alliance.

Of ce, restaurant and

retail employment

account for 95% of all

jobs in downtown and

96% of the wages paid

in 2013.

EMPLOYMENT 13

Of ce, restaurant and retail employment account for 95% of all jobs in downtown and 96% of the wages paid in 2013. Downtowns 69,235

workers earned $2.9 billion in wages and salaries in 2013, with $2.6 billion paid to of ce workers. In ination adjusted dollars, total wages paid

to of ce workers since 2007 increased by 12%. This increase is due to a growing number of of ce jobs as well as an increase in real wages.

Restaurant workers were paid $125 million in wages during 2013, this gure understates total restaurant income because it does not include

gratuity payments. With the additional retail workers at City Creek Center, total wages for the retail sector are up 92% compared to 2007.

Table 4: 2013 Wages by Sector Downtown

Source: Utah Department of Workforce Services and Bureau of Economic and Business Research University of Utah, Downtown Alliance.

HOTELS

Average Annual Wage .............. $23,592

Employment ....................................... 1,800

Total Wages ......................... $42,465,600

RETAIL

Average Annual Wage ...............$31,884

Employment .......................................3,350

Total Wages ......................... $106,811,400

MANUFACTURING

Average Annual Wage ............. $40,524

Employment .............................................50

Total Wages ............................ $2,026,200

MISCELLANEOUS

Average Annual Wage ..............$33,550

Employment ....................................... 1,050

Total Wages .......................... $35,227,500

TOTALS

$42,727

Average Annual Wage

$69,235

Total Employment

$2,958,184,500

Total Wages

HOTEL

RESTAURANTS

Average Annual Wage ...............$16,452

Employment ....................................... 7,650

Total Wages .........................$125,857,800

OFFICE

Average Annual Wage ...............$47,672

Employment ....................................55,500

Total Wages ................... $2,645,796,000

EMPLOYMENT 14

HOTELS

2007 (Million) ................................... $44.4

2013 (Million) .....................................$42.5

Percent Change ................................-4.3%

RETAIL

2007 (Million) ....................................$54.6

2013 (Million) ................................... $106.8

Percent Change ............................... 95.7%

MANUFACTURING

2007 (Million) ........................................$2.1

2013 (Million) ....................................... $2.0

Percent Change ................................-4.9%

MISCELLANEOUS

2007 (Million) ..................................... $36.1

2013 (Million) ..................................... $35.2

Percent Change ................................-2.4%

TOTALS

$2,608,400,000

2007 Total Wages Paid

$2,958,200,000

2013 Total Wages Paid

13.4%

Total Change 2007-2013

The percent change in wages was most signicant in the retail sector. City Creek Center is seen as the strongest impetus for this growth,

however, the combined impact of new retail development throughout downtown cannot be ignored. With additional new of ce space coming

to the market and healthy restaurant growth, expect employment numbers to continue to grow in 2014-2015. In the long term, downtown will

benet from national trends and growing interest in urban growth and metropolitan living. Aggressive marketing and recruitment strategies will

help to put downtown ahead of its suburban competitors, particularly in the surrounding counties of Salt Lake, Utah and Davis.

Table 5: Percent Change in Wages Paid Downtown (2013 ination adjusted dollars)

Source: Utah Department of Workforce Services and Bureau of Economic and Business Research University of Utah, Downtown Alliance.

HOTEL

RESTAURANTS

2007 (Million) .................................. $108.8

2013 (Million) ................................... $125.9

Percent Change ................................ 15.7%

OFFICE

2007 (Million) ..............................$2,362.4

2013 (Million) ...............................$2,645.8

Percent Change ................................ 12.0%

EMPLOYMENT 15

DOWNTOWN

OFFICE MARKET

Salt Lake Citys downtown of ce market experienced modest improvement in 2013. Looking

ahead, a vibrant and evolving downtown will present new opportunities for businesses. In

particular, a generational shift, availability of space, amenities and access to transportation will

inuence growth and activity in the area.

The vacancy rate in downtown Salt Lake City decreased by 170 basis points to 17.1% in 2013;

demand was most concentrated among Class B properties, which accounted for the majority

of this improvement. The average asking lease rate for the downtown market increased by

$0.23 to $21.34 per sq. ft.with the largest increases occurring in Class A and B properties.

Table 6: Downtown Of ce Market Characteristics (2013)

Central Business District Base Square Feet Lease Rate (FSG) Number of Buildings

Class A 3,672,881 $27.11 15

Class B 2,656,598 $21.56 36

Class C 1,498,562 $16.96 59

Total Leasable 7,096,041 $22.11 110

*Buildings over 20,000 SF in downtown.

Source: CBRE.

Table 7: Historical Downtown Of ce Vacancy

A generational shift,

availability of space,

amenities and access

to transportation will

inuence growth and

activity in the area.

25%

20%

15%

10%

2009

5%

0%

1

4

.

6

%

1

8

.

2

%

1

0

.

7

%

1

1

.

3

%

1

1

.

7

%

1

0

.

9

%

1

7

.

5

%

1

4

.

6

%1

6

.

6

%

2

3

.

2

%

1

9

.

6

%

1

9

.

6

%

1

9

.

0

%

1

8

.

2

%2

0

.

6

%

2

2

.

0

%

2

0

.

6

%

2

0

.

1

%

1

7

.

0

%

1

6

.

8

%

1

5

.

7

%

1

8

.

8

%

1

7

.

1

%

1

6

.

7

%

2010 2011 2012 2013 2014 (YTD)

Source: CBRE.

Class A - Class B -

Class C - All Classes -

DOWNTOWN OFFICE MARKET 17

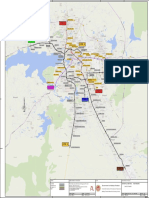

Residential

TRAX Light-Rail

TRAX Stations

GREENbike

Bike Share Stations

Future Residential

Residential

TRAX Light-Rail

TRAX Stations

GREENbike

Bike Share Stations

Future Residential

Residential

TRAX Light-Rail

TRAX Stations

GREENbike

Bike Share Stations

Future Residential

Downtown Of ce Buildings

DOWNTOWN OFFICE MARKET 18

Utahs business friendly environment, ability to

accommodate growth, and low costs will continue to

attract businesses and support growth for existing

rms. As evidenced by the latest average asking rates

for downtown of ce markets in the region, Salt Lake

remains competitive from a cost perspective.

In the coming years, downtown Salt Lake City will

benet from a generational shift. According to Nielsen

research, Salt Lake Citys concentration of Millennials

(those born between 1977 and 1995) is second in the

nation. This generation, also commonly referred to as

Gen Y, is becoming more important to employers

as they make up a larger share of the workforce. The

same research shows that almost two-thirds of this

group prefers to live in mixed-use communities in

close proximity to amenitiesthe type of environment

a downtown ofers. In fact, 40% of this group indicates

they would like to live in an urban environment in

the future. Quantitative regional research from the

Downtown Alliance indicates that 41% of Utahns

between the ages of 18 and 24 want to live downtown.

Utahs concentration of Millennials bodes well for

the future of downtown Salt Lake City. Locally, some

employers, particularly in the tech sector, are utilizing

the downtown environment as way of broadening

their appeal and attracting the best and brightest to

their rms.

As growth occurs, availability of of ce space remains

healthy. Recently completed projects have created

ample vacancies for new, large tenant leasing in

the near term. This, in addition to new and planned

construction, is ensuring the availability of space for

larger of ce users. Downtowns appeal to younger

workers, superior transportation infrastructure and

ability to accommodate growth with available real

estate give reason for continued optimism for the

areas future.

$

2

9

.

4

4

$

2

1

.

5

8

$

1

4

.

7

5

$

2

1

.

5

6

$

1

9

.

5

4

$

2

7

.

8

6

$

2

1

.

2

5

$

1

5

.

6

4

$

2

0

.

5

3

$

1

9

.

1

2

$

2

7

.

3

6

$

2

1

.

0

7

$

1

6

.

2

0

$

2

1

.

1

1

$

1

9

.

7

0

$

2

7

.

9

1

$

2

1

.

4

6

$

1

6

.

3

7

$

2

1

.

3

4

$

2

0

.

0

9

$

2

7

.

5

2

$

2

1

.

4

7

$

1

6

.

2

8

$

2

1

.

2

8

$

2

0

.

0

5

$32.50

D

o

w

n

t

o

w

n

A

s

k

i

n

g

L

e

a

s

e

R

a

t

e

s

$22.50

$30.00

$20.00

$25.00

$15.00

$10.00

Class A Class B Class C Downtown Avg. County Avg.

$27.50

$17.50

$12.50

- 2010 - 2011 - 2012 - 2013 - 2014 (YTD)

Source: CBRE.

Source: CBRE.

$35.00

$

3

1

.

0

7

$

3

0

.

1

7

$

2

3

.

8

6

$

2

1

.

2

8

$

2

1

.

0

6

Denver Portland Salt Lake City Phoenix

$15.00

$30.00

$10.00

$20.00

$0.00

$25.00

$5.00

Seattle

DOWNTOWN OFFICE MARKET 19

Table 8: Historical Of ce Lease Rates for Downtown and Salt Lake County

Table 9: Regional Downtown Lease Rates

RESIDENTIAL

The number of downtown residential properties has increased

signicantly over the past decade, with open lofts, luxury

condos and afordable single-family housing units coming

online in several sections of the district. This is part of a

nationwide trend, with most urban metro areas growing at a

faster rate than their surrounding suburbs. Driving the urban

living resurgence are young adults (18-29 year olds) interested

in living, working and playing in dense metropolitan areas.

New residential housing growth remains consistent in

downtown Salt Lake City with a total of 460 units having

opened or broken ground in 2013. There has also been a

substantial amount of residential investments just outside

of downtown. However, a signicant increase in impact

fees threatens to undermine additional needed housing

investments. Impact fees are designed to compensate a

community for the cost of extending infrastructure as required

to support new development. Impact fees are assessed to new

developments as a condition of development approval and are

calculated to cover a proportionate share of the capital costs

needed to serve the proposed development.

In 2012, Parks impact fees for multi-family dwellings

increased from $681 per unit to $3,999 in Salt Lake City, a

391% increase. After pushback from the local development

community, the Salt Lake City Council voted to set the Parks

fee at $2,875 per unit for two years with the fee returning to

$3,999 at the end of the two year period if a new plan has not

been adopted by spring 2014.

Table 10: Inventory of Condominium Units in Downtown Since 1990

Name Address Units Year Built

Belvedere* 29 South State 131 1978

American Towers 46 West 300 South 370 1983

Eagle Gate 115 East South Temple 66 1983

Warehouse Condominiums** 317 West 200 South 25 1997

Dakota Lofts** 380 West 200 South 39 1997

The Club 150 South 300 East 47 1999

Broadway Lofts** 159 West Broadway 58 1999

Pierpont Lofts** 346 West Pierpont 42 1999

Tire Town** 300 South 300 West 3 2000

Karrick Building** 236 South Main 9 2001

The Plaza 300 South State Street 5 2001

Ufens Market Place 336 West 300 South 45 2003

Library Square 226 East 500 South 29 2004

Parc at The Gateway 14 South 400 West 152 2004

Brooklyn Condominiums 700 North 300 West 36 2005

Westgate (Phase I) 200 South 238 West 73 2006

Metro Condos 350 South 200 East 117 2006

Sampson Altadena* 276 East Broadway 18 2006

35 West 300 South* 80 South 300 West 8 2007

Broadway Tower* 300 South 230 East 96 2007

Patrick Lofts 163 West 200 South 40 2008

Promontory 99 Wes South Temple 185 2011

Richards Court 45 East South Temple 90 2011

The Regent 45 East 100 South 149 2011

Liberty at Gateway 500 West South Temple 160 2014

Broadway Park Lofts 300 South 350 West 82 2014

Edison Quarter 237 South State 180 2014

Westgate Business Center 300 West 180 South 38 2015

The Cascade 90 West 100 South 115 TBD

* Converted for apartment use

Source: Downtown Alliance.

New residential growth remains

consistent in downtown. Driving the

urban living resurgence are young adults

interested in living, working, and playing

in dense metropolitan areas.

RESIDENTIAL 21

Downtown Residential Buildings

RESIDENTIAL 22

Plan as Adopted by the Council in 2012

Parks Impact fee $3,999 per unit

Roadway fee collected citywide

Roadway fee used for road construction

and other modes of transportation

Fees take efect January 2013

Salt Lake City Administrations Recommendation January 2014

Parks fee decreased to $1,752

$562 increase per year for ve years reaching $3,999

Collect Roadway fees in NW quadrant and west side

industrial areas

Refund diference in Parks fee collected in 2013

Refund Roadway fees collected outside NW quadrant and

west side industrial areas

Final Salt Lake City Council Approval 2014

Reopen the Impact Fee Facilities Plan

Reassess the Citys priorities for projects

Evaluate level of service required for City growth

Create service areas based on growth

Collect fees for roadway construction growth areas

Create separate bike and pedestrian fees

Charge Parks fees based on bedrooms or sq. ft. rather than per door

Assess fees based on geography

Parks fee decreased to $2,875 per residential unit

While the reduction in fees to $2,875 per

residential unit will help developers in the

short term, the return to the original amount

of $3,999 by 2015 could signicantly impact

future development projects. Low interest

rates combined with growing demand

have allowed developers to continue to

invest in residential apartments. If either

dynamic changes signicantly or impact fees

increase, the margins will not exist to allow

development to continue. City policy should

focus on long-term fee structures combined

with incentives for sustainable building to

foster a more stable residential development

environment in the urban center.

IMPACT FEES AT A GLANCE

2012

2013

2014

2015

RESIDENTIAL 23

HOSPITALITY,

TOURISM AND

CONVENTIONS

Annual Statewide Visitors

18,617,769

Salt Lake International Airport

7,135,076

National Park Recreation Visits

4,923,727

State Park Recreation Visits

Source: Utah Of ce of Tourism.

$930

AVERAGE CONVENTION

DELEGATE SPENDING

PER DAY

930 930

$930

AVERAGE CONVENTION

DELEGATE SPENDING

PER

25

CITYWIDE

CONVENTIONS

25 25

25

CITYW

CON

198K

TOTAL CONVENTION

DELEGATES

198 00198

198K

TOTAL CONVENTION

DELE

Utahs world-class outdoor recreation and tourism opportunities fuel the states economy and create a

great quality of life for its residents. More than 18 million passengers arrived at Salt Lake International

Airport in 2013. Visitors included 7.1 million recreational visits to Utahs ve national parks and another

4.9 million visits to Utahs 43 State Parks. Utahs 14 ski resorts hosted 4.1 million skier days, a 4%

increase over the previous year.

Just 10 minutes from an international airport, downtown Salt Lake City is a central terminus for Utahs

tourism destinations. Its also conveniently located at the base of a magnicent part of the Rocky

Mountain Range known as the Wasatch Front. Downtown is less than 45 minutes from seven world-class

ski resorts and a days drive from 48 state and 5 national parks. In addition to being a gateway to Utahs

outdoor recreation opportunities, downtown is the convention tourism destination for the entire state

and a regional leader in the convention business.

The Salt Palace Convention Center is the main driving force for Salt Lake Citys convention industry.

However, surrounding convention district hotels also attract a convention business of their own. The

conventions held in hotel meeting spaces are smaller than citywide conventions but still contribute

important revenue to downtowns economy.

In 2014, the Utah State Legislature approved legislation that established a tax credit process for a private owner of a new qualied convention

hotel in Salt Lake City. Criteria for a developer and hotel to qualify for the tax credit are as follows:

Hotel must include at least 85 sq. ft. of convention meeting space per guest room.

Hotel must be a full-service operation built after July 1, 2014.

Hotel will be located within 1,000 feet of a convention center.

Total project investment includes a minimum of $200 million in private money.

The incentive may only be used for the construction of convention, exhibit or meeting space within the qualied hotel, and the acquisition or

construction of related amenities, xtures or other improvements.

$1.8M

TOTAL SPENDING

BY CONVENTION

DELEGATES

1.8 881.8

$1.8M

TOTAL SPENDING

BY CONVENTION

DELEGATES

2013 Citywide Conventions

Source: Visit Salt Lake.

HOSPITALITY, TOURISM AND CONVENTIONS 25

Downtown Existing Hotels and Convention Center Boundary

HOSPITALITY, TOURISM AND CONVENTIONS 26

Table 11: Estimated Spending Impacts of a 1,000 Room

Convention Hotel in Salt Lake City

Type of Spending Construction Operations (annual)

Direct Hotel $335.2 million $83.7 million

Direct Convention

Delegates

- $13.9 million

Indirect and Induced $266.6 million $72.8 million

Total $601.8 million $170.4 million

Source: Strategic Advisory Group (SAG).

According to a study by Strategic Advisory Group,

moving forward with the convention hotel will net

the State and local governments approximately $500

million in additional tax resources. An approximate

$99.5 million investment compared to the $600 million

tax stream over the same time period equates to a

14.6% return on investment over a payback period of 7.5

years.

A convention center headquarter hotel will fully

leverage signicant investments in the Salt Palace

Convention Center and increase citywide economic

impacts. The hotel will also serve as a symbol of the

city, county and states organized plan for establishing

Salt Lake City as one of the countrys premier

convention and tourist destinations.

Table 12: 2013 Monthly Average Occupancy Rates, ADR*, and RevPAR** for

Salt Lake County Hotels

Month Occupancy% ADR ($) RevPAR ($)

January 61.5 104.37 64.18

February 68.5 99.97 68.49

March 69.7 97.91 68.20

April 70.5 94.92 66.89

May 63.6 90.19 57.32

June 73.8 93.72 69.16

July 71.1 97.67 69.43

August 73.3 97.60 71.58

September 68.4 93.99 64.31

October 68.5 101.63 69.59

November 52.0 89.45 45.54

December 51.0 87.99 44.85

12 Month Average 65.9 95.78 63.29

* ADR = Average daily rate

** RevPAR = Revenue per available room

Source: Visit Salt Lake, STR.

Table 13: 2013 Monthly Average Occupancy Rates, ADR, and RevPAR* for

Convention District Hotels

Month Occupancy% ADR ($) RevPAR ($)

January 58.2 126.29 73.55

February 67.2 121.23 81.51

March 65.8 119.48 78.61

April 70.2 119.42 83.88

May 60.5 111.43 67.43

June 73.6 115.34 84.89

July 68.1 119.71 81.55

August 70.2 118.32 83.11

September 69.5 115.32 80.16

October 72.1 131.05 94.54

November 51.4 109.49 56.29

December 49.8 103.37 51.45

12 Month Average 64.7 117.54 76.41

* ADR = Average daily rate

** RevPAR = Revenue per available room

Source: Visit Salt Lake, STR.

HOSPITALITY, TOURISM AND CONVENTIONS 27

RETAIL AND

RESTAURANTS

Retail sales in downtown totaled $800.3 million in 2013, an all-time high in ination adjusted dollars. The previous record, set the prior year, was

$793.3 million. City Creek Center continues to play a large role in retail sales, acting as a driving force for the surge in sales with its 700,000 sq.

ft. of retail space. While retail sales downtown have recovered from the recession, that is not the case countywide. Salt Lake Countys selected

retail sales activity is still down 20% from the peak of 2007. The downtown and county comparison includes only those categories relevant to

downtown retail. For instance, retail sales of automobiles, gasoline, building and garden were not included. These retail categories have limited

activity downtown. The broad retail categories used for comparison were: clothing, furniture, restaurants (including fast food and drinking

establishments), department stores, general merchandise and specialty retail (books, stationary, gifts, luggage, sporting goods, hobbies, etc.). In

2013, downtown captured 10.8% of sales in the county, the highest share in recent years. Due in part to City Creek Center, downtown has drawn

an increased number of retail shoppers from the suburbs.

Table 14: Selected Retail Sales in Salt Lake County and Downtown (Zip Codes 84101 and 84111: 2013 Dollars)

Year County (000) Downtown (000) Share of County

2005 $8,395,801 $675,578 8.0%

2006 $9,056,024 $727,061 8.0%

2007 $9,351,220 $791,460 8.5%

2008 $7,313,282 $685,626 9.4%

2009 $6,835,099 $698,745 10.2%

2010 $6,223,258 $643,788 10.3%

2011 $7,097,341 $580,503 8.2%

2012 $7,534,448 $793,376 10.5%

2013 $7,438,307 $800,304 10.8%

Source: Utah State Tax Commission.

Clothing and shoes sales totaled $157.5 million in 2013. This is a decrease from the record year in 2012, where total clothing and shoes sales

totaled $168.1 million. This decrease can be attributed to declining sales at one of downtowns major malls, The Gateway. Eating and drinking

remains the top-ranked retail activity in downtown with $308 million in sales (accounting for nearly 40% of retail activity). In recent years this

sectors share has been as high as 55% of retail sales. Twenty years ago, clothing and shoes accounted for as much as 45% of retail activity.

Table 15: Selected Retail Sales by Category in Downtown Salt Lake City (2013)

Retail Sales % Share

Eating and Drinking $308,971,424 38.6%

Clothing and Shoes Sales $157,572,116 19.7%

Department Store Sales $99,439,027 12.4%

Other Retail Sales $234,321,633 29.3%

Total $800,304,200 100.0%

Source: Utah State Tax Commission.

RETAIL AND RESTAURANTS 29

CULTURE AND

ENTERTAINMENT

Home to museums, performing arts and music theaters, a professional sports arena and large community spaces, downtown Salt Lake City is the

cultural and entertainment center of the region and a premier destination in the Intermountain West.

While physical brickand-mortar developments are important to downtown, signature events and festivals dene what it means to be a great

city and create emotional connections between a communitys population and their urban center. These events showcase a citys physical

and cultural identity, creating a sense of ownership and pride for residents and visitors alike. Some of the biggest signature events include the

Twilight Concert Series, Downtown Farmers Market, Dine O Round, EVE, Holiday Lights, Utah Arts Festival, Greek Festival, Living Traditions

Festival, Pride Festival, Tastemakers, Gallery Stroll, Days of 47 Parade and Rodeo, Urban Arts Fest, and Urban Flea Market.

Table 16: Arts and Cultural Venues in Downtown Salt Lake City

Location Capacity 2013 Attendance # of Events Type of Facility

Abravanel Hall 2,768 142,450 122 Performing Arts

Capitol Theatre 1,876 81,964 142 Performing Arts

Jeanne Wagner Theatre 501 70,594 237 Performing Arts

Leona Wagner Black Box 200 15,129 123 Performing Arts

Studio Theatre 75 3,040 76 Performing Arts

Of Broadway Theatre 250 N/A N/A Comedy/Performing Arts

The Depot 1,200 N/A N/A Live Music

The Complex-The Grand 850 80,000 28 Live Music

The Complex- Rockwell 2,500 80,000 15 Live Music

The Complex- Vertigo 425 80,000 52 Live Music

The Complex- The Vibe 200 80,000 52 Live Music

In the Venue 1,300 N/A N/A Live Music

Discovery Gateway 1,500 229,666 N/A Childrens Museum

The Leonardo 1,000 34,195 N/A Science Museum

Utah Museum of Contemporary Art 500 47,966 103 Contemporary Art Museum

Hope Gallery and Museum of Fine Art 300 N/A N/A Art Gallery

Clark Planetarium 900 304,180 7,060 Science Museum

Energy Solutions Arena 19,911 1.7 million 151 Sports Arena

Totals 36,256 2.9 million 8,161

Source: Salt Lake County for the Arts, Clark Planetarium, Larry Miller Sports Properties, United Concerts, Discovery Gateway, Downtown Alliance.

* Many facilities also have event space for special events.

** All of Complex facilities totaled 80,000. Facility specic numbers N/A.

CULTURE AND ENTERTAINMENT 31

TRANSPORTATION

Downtown Salt Lake Citys transportation infrastructure provides unparalleled access from all parts

of the Wasatch Front. At the core of this infrastructure are well-maintained roads, bicycle lanes and

sidewalks along with the nations fastest growing public transit networks.

Downtown is easily accessible from two of the states busiest highways, I-15 and I-80. I-15s main

entrance and exit points into downtown are located at 400 South, 500 South and 600 South, which

see an average of 94,000 vehicles per day. Other signicant roads serving downtown are Beck Street

and State Street.

Downtown is also home to the intermodal hub (250 South 600 West), which acts as a multi-modal

nexus for UTAs TRAX light rail system, FrontRunner, UTA local bus service, Amtrak, Greyhound, U Car

Share and SLC GREENbike.

Multiple transportation options play a role in attracting more businesses, residents and visitors

into downtown Salt Lake City. While the automobile still prevails as the most common mode of

transportation in and out of downtown , public transit, biking and walking are all growing in popularity.

UTA TRAX boardings at the 10 downtown stops averaged a total weekday ridership of 21,555. In

April 2013, GREENbike launched its inaugural season with a network of 10 fully automated bike

share stations and 65 bicycles. Immediately, the system garnered widespread usage necessitating

an expansion in July 2013. This included the addition of two new stations and the expansion of ve

existing stations. The bike share network of 12 stations and 75 bikes has proven to be useful for both

residents and visitors. GREENbikes 2013 season produced 26,000 bike trips, eliminated more than

52,000 vehicle miles traveled (VMT) and 12,000 vehicle cold starts. In 2014, GREENbike plans to

expand existing stations and add seven new stations (19 total stations), resulting in an estimated

45,000 trips, curtailing more than 93,000 total VMT, and more than 21,000 cold starts. Additionally,

GREENbike estimates its users eliminated more than 66,000 pounds of CO2 and burned more than 2.7

million calories in 2013.

Average Weekday Downtown

UTA TRAX Boardings

1,185

500 West and North Temple

2,627

Arena Station

3,529

City Center Station

6,388

Court House Station

2,061

Gallivan Plaza Station

665

Old Greek Town Station

1,564

Library Station

1,032

Planetarium Station

1,683

Salt Lake Central Station

1,153

Temple Square Station

21,555

GRAND TOTAL

Source: Utah Transit Authority.

TRANSPORTATION 33

Downtown Surface and Structure Parking

TRANSPORTATION 34

Table 17: Downtown Transportation Survey - Transportation Within Downtown

Purpose Percentage (%) Mode Percentage (%)

Home-Based Other 9.7% Auto - 2 Occupants 7.5%

Home-Based Personal Business 5.6% Auto - 3 Occupants 6.4%

Home-Based Shopping 7.7% Auto - Single Occupant 25.9%

Home-based Work 6.6% Bike 5.5%

Non-Home-Based Non-Work 29.0% Other 0.8%

Non-Home-Based Work 41.4% Transit 6.0%

Walk 48.1%

Source: 2012 Household Travel Survey, Salt Lake City Transportation Department.

Table 18: Downtown Transportation Survey - Transportation Into Downtown

Purpose Percentage (%) Mode Percentage (%)

Home-Based Other 18.5% Auto - 2 Occupants 16.3%

Home-Based Personal Business 3.8% Auto - 3 Occupants 11.4%

Home-Based School 1.8% Auto - Single Occupant 52.7%

Home-Based Shopping 5.0% Bike 3.3%

Home-Based Work 37.9% Other 0.6%

Non-Home-Based Non-Work 15.5% Transit 11.4%

Non-Home-Based Work 17.5% Walk 4.3%

Source: 2012 Household Travel Survey, Salt Lake City Transportation Department.

Table 19: Downtown Transportation Survey - Transportation Out of Downtown

Purpose Percentage (%) Mode Percentage (%)

Home-Based Other 18.8% Auto - 2 Occupants 16.8%

Home-Based Personal Business 4.0% Auto - 3 Occupants 12.4%

Home-Based School 1.5% Auto - Single Occupant 51.6%

Home-Based Shopping 6.5% Bike 2.5%

Home-Based Work 30.7% Other 0.8%

Non-Home-Based Non-Work 16.9% Transit 10.8%

Non-Home-Based Work 21.7% Walk 5.0%

Source: 2012 Household Travel Survey, Salt Lake City Transportation Department.

Several additional planned transportation

projects will enhance downtowns place as a

regional multi-modal hub. These include:

Separated Bike Lanes Downtown

Starting summer of 2014, 300 South and 200

West will undergo substantial infrastructure

changes to improve walkability and bicycle

access. Curbside parking will be shifted toward

the center of the streets and physical barriers

will separate auto traf c and parking from a

curbside, separated bike lane.

UTA TRAX University to Downtown

UTA is working to reintroduce the direct

University of Utah to downtown TRAX line,

which will provide transportation to all major

downtown stops for university students and

faculty as well as neighborhoods east of

downtown.

Downtown Salt Lake City Streetcar

Streetcars enhance and accelerate walkable,

transit-oriented redevelopment in urban

centers. In 2013, Envision Utah, Salt Lake City

and Utah Transit Authority began a federally

mandated alternatives analysis to catalogue

potential routes along 200 South and 300

South, stretching from downtown to the

University of Utah. This project will continue to

gain momentum in 2014 as the city determines

additional funding mechanisms.

TRANSPORTATION 35

QUALITY OF LIFE

Cities ofer unmatched possibility. They are centers for science and technology, for culture and

innovation, for individuality and collective creativity, and for proximity and ef ciency.

Anchored by an educated millennial generation, cities across the United States are growing

at unprecedented rates. In more than two-thirds of the nations 51 largest cities, the young,

college-educated population grew twice as fast within three miles of urban centers as in the

rest of the metropolitan area in the past decade.

With a median age of less than 30, Utah has the youngest median age of any state in the

country. It is also one of the most educated. 90% of Utah citizens have at least a high school

education and more than 55% have attended some college, with more than 28% having earned

a Bachelors degree. This is good news for employers. With an abundance of highly educated,

young individuals who are motivated to work and eager to succeed, and a state that is pro-

business development, business sectors are diverse and rapidly growing. Utah is a national

leader in aerospace and defense, energy, nancial services, life sciences, outdoor product and

recreation, software development and information technology industries.

The capital city, Salt Lake City, is a burgeoning metropolis and the regional center for culture,

commerce and entertainment. Whether it is business, innovative policy, arts, culture or

nightlife, the whats there question ofers limitless answers. The proximity of natural beauty

and recreation, complimented by a dynamically built work and social environment, make

Downtown Salt Lake City the ideal place for young professionals to work and play.

Salt Lake City Notable Accolades

Salt Lake City is a

burgeoning metropolis

and the regional center

for culture, commerce

and entertainment.

[ [

[ [

[ [

[ [

[ [

[ [

[ [

[ [

BEST

LEAST STRESSED

CITY

(CNN MONEY, 2014)

6

TH

AMERICAS 25 BEST

PERFORMING CITIES

(FORBES, 2012)

8

TH

12 CITIES LEADING THE

WAY IN SUSTAINABILITY

(MOYERS AND COMPANY, 2013)

5

TH

CITIES WITH THE

HAPPIEST EMPLOYEES

(GLASSDOOR, 2014)

7

TH

TOP 10 CITIES STEALING

JOBS FROM WALL ST.

(FORBES, 2014)

7

TH

19 BEST CITIES FOR

MILLENIALS

(BUSINESS INSIDER, 2014)

6

TH

10 BEST CITIES FOR

PUBLIC TRANSPORTATION

(US NEWS, 2012)

12

TH

BEST PLACES FOR

BUSINESS AND CAREERS

(FORBES, 2013)

QUALITY OF LIFE 37

Research, Writing and Compilation

Jesse Dean, Director of Urban Development

Downtown Alliance

Darin Mellott, Senior Research Analyst

CBRE

Kami Taylor, Research, Marketing and Enterprise Manager

CBRE

James Wood, Director, Bureau of Economic and Business Research

University of Utah

Design

Chris Bennett, Senior Graphic Designer

CBRE

Derrick Cox, Graphic Designer (Maps)

Salt Lake Chamber

Photography

Austen Diamond, David Newkirk, Brent Rowland, Margie Richlen,

Jason Mathis, Jesse Dean, Doug Barnes, SLC Photo Collective

Credits

Boyer Company

Bureau of Economic and

Business Research at the

University of Utah

Business Insider

Downtown Alliance

CBRE

Clark Planetarium

Clearwater Homes

The Complex

Cowboy Partners

CNN Money

Discovery Gateway

Forbes Magazine

GOED

Glassdoor

GREENbike SLC

Hamilton Partners

HKS Architects

La Porte Group

Larry Miller Sports Properties

Moyers and Company

Salt Lake Arts Council

Salt Lake City CED

Salt Lake City Transportation

Salt Lake County Center For

The Arts

Select Health

Smith Travel Research

Strategic Advisory Group

US News

United Concerts

Utah Department of

Workforce Services

Utah Of ce of Tourism

Utah State Tax Commission

Utah Transit Authority

Visit Salt Lake

Wasatch Partners

Copyright 2014, CBRE and the Downtown Alliance. The property set for this report is unique and not

equal to quarterly updates provided by CBRE. Data reects properties located within the submarkets

known as the Central Business District (CBD) and CBD/Periphery. Downtown Alliance boundaries are: 700

West to 300 East and North Temple to 400 South. This report also contains information from third party

sources we presume to be reliable.

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Railroad GlossaryDocumento29 páginasRailroad Glossarypeponis100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- ETRATA, CHRISTIAN ANGELO (Part 1,2,3 and Related Appendices)Documento62 páginasETRATA, CHRISTIAN ANGELO (Part 1,2,3 and Related Appendices)AngeloEtrataAinda não há avaliações

- Eng. Raid Arrhaibeh Route Surveying 2016Documento114 páginasEng. Raid Arrhaibeh Route Surveying 2016Stephen RayosoAinda não há avaliações

- Railway TerminologyDocumento9 páginasRailway TerminologyDraj KumarceAinda não há avaliações

- Is 14416 1996Documento20 páginasIs 14416 1996kaustavAinda não há avaliações

- Heavy Haul Guidelines Track, Civil and Structures AustraliaDocumento28 páginasHeavy Haul Guidelines Track, Civil and Structures AustraliaDave ThompsonAinda não há avaliações

- BS en 15313-2010Documento70 páginasBS en 15313-2010ginaignat100% (1)

- Train-Track-Bridge InteractionDocumento177 páginasTrain-Track-Bridge InteractionToto ToualiAinda não há avaliações

- State v. MacNeillDocumento37 páginasState v. MacNeillBen WinslowAinda não há avaliações

- Deadpool Lawsuit, Utah Attorney General's Motion For Summary JudgmentDocumento32 páginasDeadpool Lawsuit, Utah Attorney General's Motion For Summary JudgmentBen WinslowAinda não há avaliações

- Brewvies Motion To ExcludeDocumento42 páginasBrewvies Motion To ExcludeBen WinslowAinda não há avaliações

- Mike's Smoke, Cigar & Gifts v. St. GeorgeDocumento13 páginasMike's Smoke, Cigar & Gifts v. St. GeorgeBen WinslowAinda não há avaliações

- Geist Shooting RulingDocumento7 páginasGeist Shooting RulingBen WinslowAinda não há avaliações

- NSA Wayne Murphy DeclarationDocumento17 páginasNSA Wayne Murphy DeclarationBen WinslowAinda não há avaliações

- Deadpool Lawsuit Witness RulingDocumento19 páginasDeadpool Lawsuit Witness RulingBen WinslowAinda não há avaliações

- Utah Attorney General/DABC Motion To ExcludeDocumento10 páginasUtah Attorney General/DABC Motion To ExcludeBen WinslowAinda não há avaliações

- ULCT AuditDocumento16 páginasULCT AuditBen WinslowAinda não há avaliações

- Unified Fire Service Area AuditDocumento22 páginasUnified Fire Service Area AuditBen WinslowAinda não há avaliações

- Equality Utah, NCLR Injunction RequestDocumento68 páginasEquality Utah, NCLR Injunction RequestBen WinslowAinda não há avaliações

- Unified Fire Authority AuditDocumento68 páginasUnified Fire Authority AuditBen WinslowAinda não há avaliações

- State v. Martinez-CastellanosDocumento53 páginasState v. Martinez-CastellanosBen WinslowAinda não há avaliações

- Hildale, Colorado City FilingDocumento26 páginasHildale, Colorado City FilingBen WinslowAinda não há avaliações

- 10th Circuit Court Ruling On Contact Lens LawsuitDocumento40 páginas10th Circuit Court Ruling On Contact Lens LawsuitBen WinslowAinda não há avaliações

- Bistline v. Jeffs RulingDocumento24 páginasBistline v. Jeffs RulingBen WinslowAinda não há avaliações

- Brown Cert ReplyDocumento17 páginasBrown Cert ReplyBen WinslowAinda não há avaliações

- Brown v. Buhman Opposition BriefDocumento44 páginasBrown v. Buhman Opposition BriefBen WinslowAinda não há avaliações

- VidAngel RulingDocumento22 páginasVidAngel RulingBen WinslowAinda não há avaliações

- NSA Lawsuit RulingDocumento20 páginasNSA Lawsuit RulingBen WinslowAinda não há avaliações

- John Wayman Plea DealDocumento7 páginasJohn Wayman Plea DealBen WinslowAinda não há avaliações

- U.S. Attorney Response To DetentionDocumento9 páginasU.S. Attorney Response To DetentionBen WinslowAinda não há avaliações

- VidAngel CEO DeclarationDocumento8 páginasVidAngel CEO DeclarationBen WinslowAinda não há avaliações

- VidAngel Injunction StayDocumento24 páginasVidAngel Injunction StayBen WinslowAinda não há avaliações

- FLDS Labor OrderDocumento22 páginasFLDS Labor OrderBen WinslowAinda não há avaliações

- DABC Liquor Store ReportDocumento74 páginasDABC Liquor Store ReportBen Winslow100% (1)

- Feds Closing Brief in FLDS Discrimination CaseDocumento198 páginasFeds Closing Brief in FLDS Discrimination CaseBen WinslowAinda não há avaliações

- Legislative Management Committee ReportDocumento34 páginasLegislative Management Committee ReportBen WinslowAinda não há avaliações

- State Response Equality UtahDocumento27 páginasState Response Equality UtahBen WinslowAinda não há avaliações

- Bennett v. BigelowDocumento25 páginasBennett v. BigelowBen WinslowAinda não há avaliações

- IRS T - 31 - Revision 4Documento28 páginasIRS T - 31 - Revision 4priyaranjan kunwarAinda não há avaliações

- AcharapakkamDocumento3 páginasAcharapakkampanduranganraghuramaAinda não há avaliações

- The World Commuter Great Journeys by TrainDocumento400 páginasThe World Commuter Great Journeys by TrainMuluken MesfinAinda não há avaliações

- AcknowledgementDocumento5 páginasAcknowledgementAbhinay PandeyAinda não há avaliações

- A&C-4-BLT WorksDocumento2 páginasA&C-4-BLT Workshariprasad padimitiAinda não há avaliações

- Mill Handling System Hoist O&M ManualDocumento62 páginasMill Handling System Hoist O&M ManualjhanduAinda não há avaliações

- First DivisionDocumento82 páginasFirst DivisionmaechmedinaAinda não há avaliações

- Vos Produktbroschuere Sys-300 enDocumento3 páginasVos Produktbroschuere Sys-300 enShamaAinda não há avaliações

- Roller Coaster Energy WebquestDocumento2 páginasRoller Coaster Energy Webquestapi-293092810Ainda não há avaliações

- Bangladesh Railway e Ticket PDFDocumento1 páginaBangladesh Railway e Ticket PDFAmirul SakibAinda não há avaliações

- Transport Planning For Public TransportDocumento35 páginasTransport Planning For Public TransportjagatAinda não há avaliações

- SAILDocumento18 páginasSAILManak Jajoriya100% (1)

- 87.04 Baker Street RevisionsDocumento6 páginas87.04 Baker Street RevisionsMRFSAinda não há avaliações

- Line 3 Line 2: Network Bhopal Metro: Government of Madhya PradeshDocumento1 páginaLine 3 Line 2: Network Bhopal Metro: Government of Madhya PradeshAnonymous i3lI9MAinda não há avaliações

- Onward Journey Ticket Details E-Ticket Advance ReservationDocumento1 páginaOnward Journey Ticket Details E-Ticket Advance Reservationrameshanantha681Ainda não há avaliações

- Mass Transit Workers and Neoliberal Time Discipline in San FranciscoDocumento12 páginasMass Transit Workers and Neoliberal Time Discipline in San FranciscoDaniel SilvaAinda não há avaliações

- The Railway Train ChildrenDocumento7 páginasThe Railway Train ChildrenBelén BlnAinda não há avaliações

- Provisions of Accident-Manual 23Documento153 páginasProvisions of Accident-Manual 23Priya SinghAinda não há avaliações

- Manukau Bus Station Project Information Boards Low Res Oct 15 PDFDocumento10 páginasManukau Bus Station Project Information Boards Low Res Oct 15 PDFDwight mendozaAinda não há avaliações

- TBW Transport VocabularyDocumento1 páginaTBW Transport VocabularyZoe78Ainda não há avaliações

- Pomona, CaliforniaDocumento10 páginasPomona, CaliforniamanhatenAinda não há avaliações

- International Engineering ConsultantsDocumento28 páginasInternational Engineering ConsultantsAnonymous R0s0Nd6yAinda não há avaliações