Escolar Documentos

Profissional Documentos

Cultura Documentos

Int'l Islamic Banking (UMT Sample)

Enviado por

AbdulAzeem0 notas0% acharam este documento útil (0 voto)

15 visualizações6 páginasIslamic Banking system has emerged as a competitive and a viable substitute for the conventional banking system during the last three decades. It is especially true for Muslim world where presently Islamic Banking strides at two separate fronts. Efforts are also underway to cover the entire financial systems in accordance to Islamic laws (Shariah) at the other side, separate Islamic banks are allowed to operate in parallel to conventional interest based banks.

Descrição original:

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoIslamic Banking system has emerged as a competitive and a viable substitute for the conventional banking system during the last three decades. It is especially true for Muslim world where presently Islamic Banking strides at two separate fronts. Efforts are also underway to cover the entire financial systems in accordance to Islamic laws (Shariah) at the other side, separate Islamic banks are allowed to operate in parallel to conventional interest based banks.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

15 visualizações6 páginasInt'l Islamic Banking (UMT Sample)

Enviado por

AbdulAzeemIslamic Banking system has emerged as a competitive and a viable substitute for the conventional banking system during the last three decades. It is especially true for Muslim world where presently Islamic Banking strides at two separate fronts. Efforts are also underway to cover the entire financial systems in accordance to Islamic laws (Shariah) at the other side, separate Islamic banks are allowed to operate in parallel to conventional interest based banks.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 6

Course Outline Page 1

University of Management and Technology

Course Outline

Course Code: IB -655 Course Title: International Islamic Banking

Program

MS Islamic Banking and Finance (MS IBF)

Credit Hours

03

Duration

15 weeks (15 sessions)

Prerequisites

N/A

Resource Person

Mr. Muhammad Mahmood Shah Khan

Counseling Timing

(Room# 1N-11)

Monday Thursday (11:00 AM 3:00 PM)

Contact

Chairman/Director signature.

Deans signature Date.

Course Outline Page 2

Learning Objective:

The recent turbulence in the global financial markets has drawn attention to an alternative

system of financial intermediation: Islamic banking and finance. The rise of Islamic Banking

is a welcome sign. Islamic banking system has emerged as a competitive and a viable

substitute for the conventional banking system during the last three decades. It is

especially true for Muslim world where presently Islamic banking strides at two separate

fronts. At one side, efforts are also underway to cover the entire financial systems in

accordance to Islamic laws (Shariah). At the other side, separate Islamic banks are allowed

to operate in parallel to conventional interest based banks. Pakistan, Indonesia and

Malaysia and other Gulf countries are the good examples of above mentioned approaches.

In this elective course, the first part we will make emphasis on is basic terms and concepts

which shape the foundation for international banking like Balance of Payments, exchange

rate systems and its determinations, factor affecting the trade and capital flows. Secondly

we will go through the financing and investing activities of commercial banks in the

international money and capital markets, the role international financial institutions in

flow of funds.

The next part of the outline will take start from emergence and early development of

Islamic banking in the world. The spreading of Islamic banking in Islamic world i.e. Middle

East, South East Asia, and Far East, will be discussed next. After that the regional centers

(Bahrain, Malaysia and UK) will be discussed.

The third part will comprise the standardization of international Islamic banking functions

with respect to IFSB and AAOFI. After that all types of financing and investing opportunities

available for Islamic banks in the international money and capital market will be discussed.

It will cover all possible money and capital market instruments, in which the whether the

Islamic bank does provide, may provide or may not provide banking facilities to its

national/international clients.

The fourth part of the outline will encompass the role of multilateral agencies like IDB, IMF,

IBRD/World Bank with respect to Islamic banking and Finance. Beside that different

countrys models will be discussed.

The general objective of the course is to provide the students with the knowledge of the

growth and development of Islamic banking among Muslims and the values inherent in this

system of banking. It will also expose the students to the evils in the riba-based banking

system. At the end of the course therefore, the students will be able to:

identify the principles of Islamic economic and banking system;

describe the origin, growth and development of Islamic banking system ;

identify some differences between Islamic and conventional banking systems;

explain the value of Islamic banking;

identify the prospect of Islamic banking in Saudi Arabia, UAE, Indonesia and Pakistan

Course Outline Page 3

Role of multinational agencies in Islamic Banking system

Standardization and Services IFSB and AAOFI

Learning Methodology:

The above-mentioned course objectives will be materialized through different modes of class

interactions i.e.

1. Class Lectures and Handouts

2. Class Discussions, Presentations, Group Activities

3. Case Studies, Seminars and Events Participation

4. Projects/ Term Papers

Assignments/Presentations

All assignments for formal evaluation must be typed and submitted by the specified due dates.

Topics of assignments would be assigned by the course instructor from the given topics. Each

student will be required to make fifteen minutes class presentation on the topic assigned.

Plagiarism is not allowed.

Plagirism

The UMT policy regarding academic honesty and discipline will be strictly enforced. Students who

violate academic integrity in any manner including Plagiarism will necessarily fails the assignment

/ examination in question and may go through further disciplinary procedures. Tardiness and

casual attitude shall be strongly discouraged.

Course Outline Page 4

Grade Evaluation Criteria

Following is the criteria for the distribution of marks to evaluate final grade in

a semester.

Marks Evaluation Marks in percentage

Quizzes 10

Assignments 10

Mid Term 25

Attendance & Class Participation 10

Term Project

Presentations 10

Final exam 35

Total 100

Recommended Text Books:

Reference Books:

Course Outline Page 5

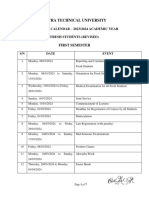

Calendar of Course contents to be covered during semester

Course Code: IB - 655 Course Title: International Islamic Banking

Session #

Lecture Contents

Chapter #

&

Handouts

1 What is Islamic Banking To know about the philosophy and concept of

Islamic Banking and Finance?

Emergence and Role of Islamic Banking and Finance To discuss

that Islamic banking system has emerged as a competitive and a viable

substitute for the conventional banking system during the last three

decades.

Islamic and Conventional Banking: A Comparative Analysis To

differentiate between the Islamic and conventional banking systems

with a view to appreciating the extent of their relevance to economic

growth.

2 Foundation for Islamic Banking To know the foundations for

international banking like International Flow of Funds, Balance of

payment, International Trade Flows, Factors affecting International

Trade Flows, International capital Flows, motives for using international

financial markets and exchange rate systems.

3 International Flow of Funds To know the financing and investing

activities of commercial banks in the international money and capital

markets, and the role international financial institutions in flow of

funds.

4 The Origin, Growth and Development of Islamic Banking System - To

explain the historical background of Islamic banking system and the

level of its development in some countries and regions.

Role of Middle East, South East Asia, and Far East

History of Islamic Banking in Pakistan

History of Islamic Banking in Malaysia

History of Islamic Banking in Bahrain

History of Islamic Banking in UK

5 The Role of Malaysia in Islamic Banking - To identify the roles played by

Malaysia in the development of Islamic Banks. Particular reference shall

be made to Malaysia whose contribution could not be forgotten in the

history of Islamic banking throughout the world. Her Tabung Hajj,

establishment of College of Islamic Banking and Finance, The Kuala

Lumpur Stock Exchange, and the Islamic Capital market shall be vividly

discussed.

6 The Development of Islamic Banking System in some selected

Course Outline Page 6

countries - To identify the rate at which Islamic banking system is being

embraced in some countries like UK and Bahrain, and the extent of

development of the bank in those countries. It is interesting to note that

Islamic banking system has been adopted not only in Muslim dominated

countries, but as well in the UK, Africa, Bahrain and other European

countries.

7 Challenges of Operation of Islamic Banking

The objective of the lecture is to expose students to the problems facing

the operation of Islamic banking system especially in a multi-religious

society. Many challenges and obstacles face the operation of Islamic

banks. Such include lack of a supportive environment, inadequate

regulation and the infant stage of Islamic banking. Others include

absence of liquidity instruments, lack of qualified professionals and non

developed risk analysis and measurement. Also, many banking

regulations which are meant to control the requirements of

conventional banks may pose difficulties for Islamic banks. These and

some other challenges will be discussed with the students.

8 Standardization of International Islamic Banking - To standardization

and harmonization of international Islamic finance practices and

financial reporting in accordance to Shariah standards (AAOFI and IFSB)

9 Standardization of International Islamic Banking - To guide IFs markets

operation and financial reporting on Shariah principle and rules. To

provide IF markets with a standard that can support growth of the

industry.

10 Role of Multilateral Agencies To encompass the role of multilateral

agencies like with respect to Islamic banking and Finance. Beside that

different countrys models will be discussed.

11 Role of Islamic Development Bank (IDB)

12 Role of International Monetary Fund (IMF)

13 Role of IBRD/World Bank

14 Group Presentations

15 Group Presentations

Você também pode gostar

- 2020 - Managerial Acquisitiveness and Corporate Tax AvoidanceDocumento28 páginas2020 - Managerial Acquisitiveness and Corporate Tax AvoidanceAbdulAzeemAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Fall 2012 - Old SFMDocumento4 páginasFall 2012 - Old SFMAbdulAzeemAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Fishing Industry: Introduction, Aquaculture, Uses, Types, Methods, and Areas of FishingDocumento68 páginasFishing Industry: Introduction, Aquaculture, Uses, Types, Methods, and Areas of FishingAbdulAzeemAinda não há avaliações

- Financial LiteracyDocumento16 páginasFinancial LiteracyAbdulAzeemAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Short Term Decision Making: Question No. 1Documento2 páginasShort Term Decision Making: Question No. 1AbdulAzeemAinda não há avaliações

- SHORT TERM DECISION MAKING TESTsolutionDocumento1 páginaSHORT TERM DECISION MAKING TESTsolutionAbdulAzeemAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- 2005 - Long Run Corporate Tax Avoidance - 2040 CitationsDocumento48 páginas2005 - Long Run Corporate Tax Avoidance - 2040 CitationsAbdulAzeemAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Determinants of EVADocumento19 páginasDeterminants of EVAAbdulAzeemAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- SBL by Sir Ashraf RehmanDocumento1 páginaSBL by Sir Ashraf RehmanAbdulAzeemAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- 1996 - Dennis Et Al. - EVA For Banks - Value Creation, Risk Management and Profitability Measurment - 326 CitationsDocumento22 páginas1996 - Dennis Et Al. - EVA For Banks - Value Creation, Risk Management and Profitability Measurment - 326 CitationsAbdulAzeemAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- 1995 - Stern and Stewart - EVADocumento17 páginas1995 - Stern and Stewart - EVAAbdulAzeemAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Course Content Schedule For SBL by Sir Muhammad Ashraf RehmanDocumento8 páginasCourse Content Schedule For SBL by Sir Muhammad Ashraf RehmanAbdulAzeemAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Writing Effective Literature ReviewDocumento5 páginasWriting Effective Literature ReviewAbdulAzeemAinda não há avaliações

- Shareholder Value in BanksDocumento107 páginasShareholder Value in BanksAbdulAzeemAinda não há avaliações

- Examples & Practice Questions For Capital Gains & Other SourcesDocumento11 páginasExamples & Practice Questions For Capital Gains & Other SourcesAbdulAzeemAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Examples & Practice Questions For Income From PropertyDocumento8 páginasExamples & Practice Questions For Income From PropertyAbdulAzeemAinda não há avaliações

- Visvesvaraya Technological University BelagaviDocumento10 páginasVisvesvaraya Technological University BelagaviVasavi VaasuAinda não há avaliações

- Ordinance VIIDocumento2 páginasOrdinance VIIkthesmart4Ainda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Academic Calendar For FreshersDocumento7 páginasAcademic Calendar For FreshersmarylovelacedadziebonneyAinda não há avaliações

- Ramandeep Kaur OBU Conditional Offer PDFDocumento4 páginasRamandeep Kaur OBU Conditional Offer PDFHarpal SinghAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Pokhara University Office of The Controller of Examinations Semester End Examinations Schedule (Fall Semester 2021)Documento5 páginasPokhara University Office of The Controller of Examinations Semester End Examinations Schedule (Fall Semester 2021)KushalAinda não há avaliações

- Government of Gujarat: Student Basic DetailsDocumento3 páginasGovernment of Gujarat: Student Basic DetailsBoricha AjayAinda não há avaliações

- Move Ahead PlusDocumento22 páginasMove Ahead PlusNancy Bedros100% (1)

- 2021 22 Academic Calendar FinalDocumento2 páginas2021 22 Academic Calendar FinalesayasAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Office of The Registrar Policies PDFDocumento38 páginasOffice of The Registrar Policies PDFAnonymous aJvyrriTWjAinda não há avaliações

- 18 Mechanical EngDocumento133 páginas18 Mechanical EngGabriel GunasegaranAinda não há avaliações

- Academic Calendar For Pilani Campus First Semester 2020-2021 Continuing StudentsDocumento3 páginasAcademic Calendar For Pilani Campus First Semester 2020-2021 Continuing StudentsHarsh TiwariAinda não há avaliações

- Academic Calendar (2013-2015)Documento3 páginasAcademic Calendar (2013-2015)vincent02hk_57881301Ainda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Open University of Mauritius Undergraduate Programme SpecificationDocumento17 páginasOpen University of Mauritius Undergraduate Programme SpecificationMuse ManiaAinda não há avaliações

- Estudiar y Trabajar en Canada y Quedarse TrabajandoDocumento11 páginasEstudiar y Trabajar en Canada y Quedarse TrabajandoJosé JiménezAinda não há avaliações

- MODEL SYLLABI FOR UG Civil Engg PDFDocumento132 páginasMODEL SYLLABI FOR UG Civil Engg PDFVishakha PatelAinda não há avaliações

- Montessori T T Edu CourseDocumento4 páginasMontessori T T Edu CourseHarris Paul0% (1)

- New York Kids ClubDocumento4 páginasNew York Kids ClubQueens PostAinda não há avaliações

- Ri RD142019Documento2 páginasRi RD142019HamidullahAinda não há avaliações

- Guidelines On Flexible and Alternative Modes of Teaching and Learning PDFDocumento16 páginasGuidelines On Flexible and Alternative Modes of Teaching and Learning PDFTrisha Marie Bustria MartinezAinda não há avaliações

- M - A - English III & IV Sem - 2013-14Documento23 páginasM - A - English III & IV Sem - 2013-14Jatin GandhiAinda não há avaliações

- Kalendar Akademik Sesi 2022 2023 BiDocumento2 páginasKalendar Akademik Sesi 2022 2023 BiSuhail AhmedAinda não há avaliações

- Corrigendum Sem 5 6 FTD PTD Programs AY2023 24Documento2 páginasCorrigendum Sem 5 6 FTD PTD Programs AY2023 24SACHIN GAUTAMAinda não há avaliações

- Kongu Engineering College: Regulations, Curriculum & Syllabi - 2020Documento82 páginasKongu Engineering College: Regulations, Curriculum & Syllabi - 2020HARI B SAinda não há avaliações

- Structure of The Chinese Education SystemDocumento6 páginasStructure of The Chinese Education SystemElmira NiadasAinda não há avaliações

- National Institute of Technology, RourkelaDocumento7 páginasNational Institute of Technology, RourkelaShadul RazviAinda não há avaliações

- Handbook of Information AY 2023-24 - Final - VersionDocumento69 páginasHandbook of Information AY 2023-24 - Final - VersionSantosh KumarAinda não há avaliações

- Internship IBS Checklist Procedure Notes Fin040222Documento4 páginasInternship IBS Checklist Procedure Notes Fin040222aliAinda não há avaliações

- Fall 11 Bio 1AL Lab SyllabusDocumento5 páginasFall 11 Bio 1AL Lab SyllabusMatthew FongAinda não há avaliações

- Final Principals Ayer Tena Health Science and Business College TvetDocumento4 páginasFinal Principals Ayer Tena Health Science and Business College TvetKiya AbdiAinda não há avaliações

- Syllabus MBAT 2020-2021Documento5 páginasSyllabus MBAT 2020-2021sourav gangulyAinda não há avaliações