Escolar Documentos

Profissional Documentos

Cultura Documentos

Maynard: Financial Reporting: Study Skills

Enviado por

Selva Bavani Selwadurai0 notas0% acharam este documento útil (0 voto)

52 visualizações3 páginasdoc

Título original

Maynard Studyskills

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentodoc

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

52 visualizações3 páginasMaynard: Financial Reporting: Study Skills

Enviado por

Selva Bavani Selwaduraidoc

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 3

Maynard: Financial Reporting

Oxford University Press, 2013. All rights reserved.

STUDY SKILLS

At this level of your studies, financial accounting gets a lot more complex.

Basic financial accounting covered by level 1 studies usually focuses on the how of

accounting, in other words the preparation of basic financial statements. This usually

requires students to learn standard formats of these statements and complete these from

financial accounting information presented in a similar manner from question-to-question.

There will be a right answer. With a certain amount of rote learning, students can

perform very well in assessments of this nature.

Level 1 studies may also include some details of underpinning concepts and principles,

often to explain the financial accounting methods that are performed for example,

accruals to explain the inclusion of accrued and prepaid expenses and depreciation and

some interpretation principally based on financial ratios. These areas are often covered at

a fairly basic level and require you to demonstrate that you know them, and have some

understanding of them.

At the level of financial accounting and reporting covered by this textbook, gone is the rote

learning of pro-formas in order to answer standard questions. The focus is on

understanding and application. Many different and detailed techniques set out in

financial reporting standards have to be mastered and be able to be applied to many

different items and areas of financial reporting. Scenarios presented are all different

what may apply in one case wont necessarily apply in another. This only reflects real

business life!

You wont be asked to prepare full sets of financial statements (except consolidated

financial statements), but instead have to know how the accounting for a particular

scenario will affect these financial statements. Gone is your security check of finding out

whether the financial statements balance or not! This may involve working through the

accounting using double-entry.

You will also have to appreciate that there may be no right answer to financial

accounting and reporting in practice, and this will be mirrored by some of the scenarios

and questions you will now meet. This doesnt mean that financial accounting is a free-

for-all; boundaries, recommendations and sometimes alternative methods are provided by

financial reporting standards and should be applied. However you may have to decide

whether a particular accounting technique is applicable or appropriate for example, does

the information provided about development expenditure incurred by a company mean

that the expenditure should be capitalised as an intangible asset or not. You will have to

weigh up the evidence presented, form a judgement and, importantly, be able to justify

why you have taken your approach.

Level 2 studies will probably include quite a lot of theory covering financial reporting

systems and frameworks and the underpinning conceptual framework to financial

reporting standards. It is worth getting to grips with these as they provide the context and

basis for the detailed accounting standards material. For example, the IASBs Conceptual

Framework sets out definitions of the elements of financial statements (assets, liabilities,

Maynard: Financial Reporting

Oxford University Press, 2013. All rights reserved.

equity, income and expenses) and provides some principles for when these should be

recognised and how they should be measured. Each financial reporting standard then

follows this approach by defining the particular asset / liability / etc. that is the topic of the

standard and then discussing when they are recognised and how they are measured.

Disclosure requirements are also always included.

Why the accounting for an item or transaction is done in the way that is, will stem from the

principles outlined in the Conceptual Framework. Thus a full understanding of the detailed

techniques can only really be gained by knowing what these principles are.

Financial reporting is ultimately about providing useful information to those who want to

use it, and thus the final main aspect of your study of financial reporting at this level is

being able to demonstrate you understand how the detailed accounting techniques may

affect the users of the financial statements. For example, how do the disclosures of

discontinued operations affect a potential investors interpretation of the financial

performance, or, if a company selects the revaluation model for its properties, what impact

will this have on financial ratios? The focus of interpretation is often the investor, as this is

considered by the IASB to be the principal user of financial statements, so you will need to

be able to demonstrate a full understanding of the techniques this user will use and what

the results of these techniques mean for him/her.

So, in order to be successful at your financial accounting and reporting studies at this

level, you have to:

Be able to picture in your mind what the statements of comprehensive income,

financial position and cash flows look like

o You need to know what line items or areas will be affected by the scenario you are

concerned with

o You need to know the simple accounting adjustments you learned at level 1 for

example, depreciation, disposals of non-current assets, accruals and

prepayments, provisions for doubtful debts without really thinking about them

o You will also need to have a good grasp of double-entry bookkeeping

Have a thorough grasp of a lot of detailed accounting techniques

o Your tutor and the textbook have included the main ones from the relevant

international accounting standards for each topic

o Read the relevant parts of the accounting standards for further details they are

reasonably easy to read you will also see that lots of examples are given

o Use the Key issues checklists at the start of each chapter to ensure you have

covered all the main areas in your learning

Practice lots of different questions in each area

o This should enable you to see how the accounting techniques applied for a

particular issue, for example, impairment of non-current assets or non-controlling

interest in consolidated financial statements, are the same, although the

scenarios may be different

o This should also give you practice in identifying the particular accounting issue

relevant to a scenario, which may not always be given

Maynard: Financial Reporting

Oxford University Press, 2013. All rights reserved.

o You will also gain practice in dealing with situations which require you to form your

own judgement

o Ensure you can deal with the simpler questions first (the Worked examples

included in the chapters and the end-of-chapter Quick tests) before you move

onto questions which take the material further

Be able to explain why the accounting techniques are what they are

o This will be in relation to underpinning concepts and principles

o It will also be in relation to the information that will be important for users to have

o Know what the IASBs Conceptual Framework covers

o Know the structure of a typical financial reporting standard

Be able to conduct a full interpretation of a set of financial statements for an

investor

o Know different interpretation techniques

o Know which are particularly relevant for an investor and for the nature of the

company / companies provided

o Be able to adapt interpretation techniques for the particular scenario / information

given

o Be able to explain what the figures resulting from the interpretation techniques

mean, including being able to bring out the inter-relationships of financial ratios

and other techniques

o Be able to write a coherent and well-structured report

o Practice writing out your interpretation

Have an understanding of other aspects of financial reporting

o The key players in the financial reporting chain

o What is required from the financial reporting framework to ensure that financial

statements are high quality

o The relevance of corporate governance and how this impacts financial reporting

o The growing significance of corporate sustainability

o Ethics as an underpinning to much of financial reporting, corporate governance and

sustainability

o Read the narrative parts of companies annual reports to gain an understanding of

what companies report on in these areas

o Questions in this area will relate to a specific issue you will need to identify what

particular aspect you need to write on, and target your answer appropriately

Você também pode gostar

- Accounting TheoryDocumento192 páginasAccounting TheoryABDULLAH MOHAMMEDAinda não há avaliações

- Chapter-1 Intainship ProjectDocumento19 páginasChapter-1 Intainship ProjectAP GREEN ENERGY CORPORATION LIMITEDAinda não há avaliações

- Chap 002Documento13 páginasChap 002wasiq999Ainda não há avaliações

- Accounting for Managerial DecisionsDocumento3 páginasAccounting for Managerial DecisionsShawn RegmAinda não há avaliações

- p2 Fmarticle Oct2012Documento3 páginasp2 Fmarticle Oct2012shan_waheedAinda não há avaliações

- Corporate Reporting Framework, Ethics and StakeholdersDocumento28 páginasCorporate Reporting Framework, Ethics and StakeholdersKat LeighAinda não há avaliações

- 1 Financial ReportingDocumento27 páginas1 Financial ReportingMeaghan FresnAinda não há avaliações

- Financial Accounting An Introduction To Concepts 14Th Full ChapterDocumento41 páginasFinancial Accounting An Introduction To Concepts 14Th Full Chapterjessica.walsh233100% (28)

- Topic 1 - Chapter 1 - 2018 SGDocumento6 páginasTopic 1 - Chapter 1 - 2018 SGMichael LightAinda não há avaliações

- Unit 1 Accounting Front CoverDocumento6 páginasUnit 1 Accounting Front Coverapi-320309588Ainda não há avaliações

- ACCT 1026 Financial Reporting ConceptsDocumento7 páginasACCT 1026 Financial Reporting ConceptsAnnie RapanutAinda não há avaliações

- Fitch Learning Cfa Level I Study PlannerDocumento2 páginasFitch Learning Cfa Level I Study PlannerpiyushbmakhijaAinda não há avaliações

- Financial Statement and AnalysisDocumento10 páginasFinancial Statement and Analysisjiao0001Ainda não há avaliações

- Diploma in Applied Finance and AccountsDocumento4 páginasDiploma in Applied Finance and AccountsKashvihaAinda não há avaliações

- COURSE PACK - ACCTG 1&2 Lesson 5.1Documento10 páginasCOURSE PACK - ACCTG 1&2 Lesson 5.1Victoria Quebral CarumbaAinda não há avaliações

- Interpreting Financial StatementsDocumento30 páginasInterpreting Financial StatementsAkshata Masurkar100% (2)

- 7110 Nos SW 10Documento3 páginas7110 Nos SW 10mstudy123456Ainda não há avaliações

- BAB I Kerangka Konseptual Ak - Keuangan.id - enDocumento13 páginasBAB I Kerangka Konseptual Ak - Keuangan.id - enSinta AriniAinda não há avaliações

- Financial Statement Analysis GuideDocumento19 páginasFinancial Statement Analysis GuideHazel Jane EsclamadaAinda não há avaliações

- Tagamabja-Cfas Caselet 1FDocumento7 páginasTagamabja-Cfas Caselet 1FBerlyn Joy TagamaAinda não há avaliações

- RICS ARC CompetencyDocumento2 páginasRICS ARC CompetencySujithAinda não há avaliações

- RICS CompetencyDocumento2 páginasRICS CompetencySujithAinda não há avaliações

- Introduction to Accounting FundamentalsDocumento10 páginasIntroduction to Accounting FundamentalsHehe Hehe50Ainda não há avaliações

- Chapter 5Documento69 páginasChapter 5verena jesselyn14Ainda não há avaliações

- Chapter 2-Textbook (Accounting An Introduction)Documento34 páginasChapter 2-Textbook (Accounting An Introduction)Jimmy MulokoshiAinda não há avaliações

- Conceptual Framework for Financial ReportingDocumento35 páginasConceptual Framework for Financial ReportingWijdan Saleem EdwanAinda não há avaliações

- Unit 1 Study GuideDocumento42 páginasUnit 1 Study GuideLina TuiloaAinda não há avaliações

- fn3092 Exc15Documento23 páginasfn3092 Exc15Chloe ThamAinda não há avaliações

- FA - SNU - Course Outline - Monsoon 2023Documento6 páginasFA - SNU - Course Outline - Monsoon 2023heycontigo186Ainda não há avaliações

- 10 Easy Ways To Improve The Quality of IFRS Financial StatementsDocumento6 páginas10 Easy Ways To Improve The Quality of IFRS Financial StatementsWshiar OmerAinda não há avaliações

- Financial ProjectionDocumento11 páginasFinancial Projectionbennia mseddikAinda não há avaliações

- Cohen Finance Workbook FALL 2013Documento124 páginasCohen Finance Workbook FALL 2013Nayef AbdullahAinda não há avaliações

- Financial & Ratio AnalysisDocumento46 páginasFinancial & Ratio AnalysisParvej KhanAinda não há avaliações

- Online Learning Module ACCT 1026 (Financial Accounting and Reporting)Documento7 páginasOnline Learning Module ACCT 1026 (Financial Accounting and Reporting)Annie RapanutAinda não há avaliações

- FA MBA Quarter I SNU Course Outline 2020Documento7 páginasFA MBA Quarter I SNU Course Outline 2020Kartikey BharadwajAinda não há avaliações

- Interpret Financial Statements (IFSDocumento30 páginasInterpret Financial Statements (IFSAkshata MasurkarAinda não há avaliações

- Fundamentals of Accountancy, Business and Management 1Documento16 páginasFundamentals of Accountancy, Business and Management 1Gladzangel Loricabv83% (6)

- Finance For Non Finance ExecutivesDocumento5 páginasFinance For Non Finance ExecutivesPahladsinghAinda não há avaliações

- Fundamentals of Accounting I Course OutlineDocumento12 páginasFundamentals of Accounting I Course OutlineChance...Ainda não há avaliações

- Fabm1 Module 1 Week 2Documento5 páginasFabm1 Module 1 Week 2Alma A CernaAinda não há avaliações

- Why Accounting Research Skills Matter for Career SuccessDocumento18 páginasWhy Accounting Research Skills Matter for Career SuccessRudy0% (1)

- Exam Technique Financial Accounting PapersDocumento2 páginasExam Technique Financial Accounting PapersLubna NaseemAinda não há avaliações

- Module Plan Corporate Accouunting INSEADDocumento11 páginasModule Plan Corporate Accouunting INSEADDeepansh KalraAinda não há avaliações

- Business Reporting and Financial Analysis CourseDocumento3 páginasBusiness Reporting and Financial Analysis CourseDapoer OmaOpaAinda não há avaliações

- MA Accounting I Spring 2011Documento3 páginasMA Accounting I Spring 2011Ahmad Malik100% (1)

- Financial Accounting and EconomicsDocumento78 páginasFinancial Accounting and EconomicsMohsin Shaukat100% (2)

- 5FA Lecture GuideDocumento14 páginas5FA Lecture GuideMyat Zar GyiAinda não há avaliações

- Financial Statement Analysis First LectureDocumento17 páginasFinancial Statement Analysis First LectureDavid Obuobi Offei KwadwoAinda não há avaliações

- Understanding Accounts: Roxanne Wright, ContributorDocumento3 páginasUnderstanding Accounts: Roxanne Wright, Contributormaxribeiro@yahoo.comAinda não há avaliações

- Interview QuestionsDocumento2 páginasInterview Questionscourage adzakloAinda não há avaliações

- Financial Statement Analysis TechniquesDocumento24 páginasFinancial Statement Analysis TechniquesMarjon DimafilisAinda não há avaliações

- COURSE PACK - ACCTG 1&2 Lesson 2Documento8 páginasCOURSE PACK - ACCTG 1&2 Lesson 2RITCHEL JOHN ARELLANOAinda não há avaliações

- Bachelor of Science in Accountancy Saint PaulDocumento16 páginasBachelor of Science in Accountancy Saint PaulJeremias PerezAinda não há avaliações

- ACN101MDocumento377 páginasACN101MTobelaNcube100% (2)

- Module 3Documento19 páginasModule 3Ryan O. MarambaAinda não há avaliações

- Basic Finance ConecptDocumento6 páginasBasic Finance ConecptmwlwajiAinda não há avaliações

- Chapter 2Documento31 páginasChapter 2Maryam AlaleeliAinda não há avaliações

- Accounting Survival Guide: An Introduction to Accounting for BeginnersNo EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersAinda não há avaliações

- Mastering Financial Accounting Essentials: The Critical Nuts and BoltsNo EverandMastering Financial Accounting Essentials: The Critical Nuts and BoltsAinda não há avaliações

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersAinda não há avaliações

- Acca BPP Study Material 2017Documento5 páginasAcca BPP Study Material 2017Selva Bavani SelwaduraiAinda não há avaliações

- Income Tax Act Section 3 ChargeDocumento1 páginaIncome Tax Act Section 3 ChargeSelva Bavani SelwaduraiAinda não há avaliações

- Computation of Audit FeesDocumento4 páginasComputation of Audit FeesmarvinceledioAinda não há avaliações

- ACCA F4 To P7 Short Notes PDFDocumento1 páginaACCA F4 To P7 Short Notes PDFSelva Bavani SelwaduraiAinda não há avaliações

- Ethics BookDocumento381 páginasEthics BookDrolytAinda não há avaliações

- IAS 23 Borrowing CostsDocumento6 páginasIAS 23 Borrowing CostsSelva Bavani SelwaduraiAinda não há avaliações

- Analysis of Factors Impacting Sales Increase and DecreaseDocumento4 páginasAnalysis of Factors Impacting Sales Increase and DecreaseSelva Bavani SelwaduraiAinda não há avaliações

- F5 AW Interactive 4966 Study GuideDocumento27 páginasF5 AW Interactive 4966 Study GuideSelva Bavani Selwadurai0% (1)

- ACCA F4 To P7 Short NotesDocumento1 páginaACCA F4 To P7 Short NotesSelva Bavani SelwaduraiAinda não há avaliações

- AREA DirectorsDocumento2 páginasAREA DirectorsSelva Bavani SelwaduraiAinda não há avaliações

- Ratio Analysis SpreadsheetDocumento1 páginaRatio Analysis Spreadsheetvinit99Ainda não há avaliações

- Question 1 Consolidated Financial Statements GuideDocumento5 páginasQuestion 1 Consolidated Financial Statements GuideSelva Bavani SelwaduraiAinda não há avaliações

- AnswersDocumento59 páginasAnswersSelva Bavani SelwaduraiAinda não há avaliações

- Rulebook Changes For 2016 IWDocumento4 páginasRulebook Changes For 2016 IWSelva Bavani SelwaduraiAinda não há avaliações

- Practical Experience RequirementDocumento12 páginasPractical Experience Requirementbikal_sthAinda não há avaliações

- IAS 16 Property, Plant and EquipmentDocumento4 páginasIAS 16 Property, Plant and EquipmentSelva Bavani SelwaduraiAinda não há avaliações

- Chapter 1 - The Concept of Audit and Other Assurance EngagementsDocumento5 páginasChapter 1 - The Concept of Audit and Other Assurance EngagementsSelva Bavani Selwadurai50% (2)

- Aca Planner 2016.ashxDocumento1 páginaAca Planner 2016.ashxSelva Bavani SelwaduraiAinda não há avaliações

- Chapter 2 Statutory Audit and RegulationDocumento1 páginaChapter 2 Statutory Audit and RegulationSelva Bavani SelwaduraiAinda não há avaliações

- Chanakya's Quotes - Worth Reading A Million TimesDocumento1 páginaChanakya's Quotes - Worth Reading A Million TimesSelva Bavani SelwaduraiAinda não há avaliações

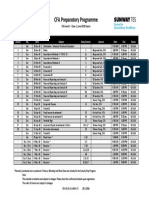

- Cfa Level 1 Jan16 v.5Documento1 páginaCfa Level 1 Jan16 v.5Selva Bavani SelwaduraiAinda não há avaliações

- Glossary - Companies Act FormsDocumento6 páginasGlossary - Companies Act FormsSelva Bavani SelwaduraiAinda não há avaliações

- Wonderful SME Sdn. Bhd. - Illustrative Financial Statements 2016Documento124 páginasWonderful SME Sdn. Bhd. - Illustrative Financial Statements 2016Selva Bavani SelwaduraiAinda não há avaliações

- CalendarDocumento12 páginasCalendarSelva Bavani SelwaduraiAinda não há avaliações

- Company Directors ResponsibilitiesDocumento12 páginasCompany Directors ResponsibilitiesmrlobboAinda não há avaliações

- Question 1 Consolidated Financial Statements GuideDocumento5 páginasQuestion 1 Consolidated Financial Statements GuideSelva Bavani SelwaduraiAinda não há avaliações

- Wonderful Malaysia Berhad - Illustrative Financial Statements 2014Documento243 páginasWonderful Malaysia Berhad - Illustrative Financial Statements 2014Selva Bavani SelwaduraiAinda não há avaliações

- Bank Audit ConfirmationDocumento4 páginasBank Audit ConfirmationSelva Bavani SelwaduraiAinda não há avaliações

- Practical Completion Certificate Profromas v4-0Documento5 páginasPractical Completion Certificate Profromas v4-0marianmariusAinda não há avaliações

- SAP Movement TypesDocumento8 páginasSAP Movement TypesEdmond ThamAinda não há avaliações

- GAIL Financial Ratios and AnalysisDocumento9 páginasGAIL Financial Ratios and Analysishari_mohan_7Ainda não há avaliações

- The Impact of HRM Practices On Organisational PerformanceDocumento20 páginasThe Impact of HRM Practices On Organisational PerformancevimalsairamAinda não há avaliações

- HOMEWORK ON CORRECTION OF ERRORS ZoomDocumento26 páginasHOMEWORK ON CORRECTION OF ERRORS ZoomJazehl Joy Valdez100% (1)

- Business Strategy PlanDocumento17 páginasBusiness Strategy PlannahiAinda não há avaliações

- MergedDocumento352 páginasMergedUsama malikAinda não há avaliações

- Costt 12Documento52 páginasCostt 12Niken PurbasariAinda não há avaliações

- STR (Rentrip) (2) Shweta Final ReportDocumento57 páginasSTR (Rentrip) (2) Shweta Final ReportShweta raghav100% (1)

- Unit 2: Unit 1 1. The Two Sides Were No Closer To A Final at Midnight Than They Were at NoonDocumento2 páginasUnit 2: Unit 1 1. The Two Sides Were No Closer To A Final at Midnight Than They Were at NoonHiểu MaiAinda não há avaliações

- BANK RECONCILIATION EXERCISE - Sheet1Documento3 páginasBANK RECONCILIATION EXERCISE - Sheet1shayndelamagaAinda não há avaliações

- 10 Steps To Start A New Rental Service - Sharefox Rental Software E-BookDocumento20 páginas10 Steps To Start A New Rental Service - Sharefox Rental Software E-BookSharefoxAinda não há avaliações

- Principles of Marketing Chapter 3Documento5 páginasPrinciples of Marketing Chapter 3Monica Laguimun100% (1)

- Strategic Management Report - Alkaram TextilesDocumento45 páginasStrategic Management Report - Alkaram TextilesHafsa Azam100% (1)

- Coca Cola Drinkable AdDocumento2 páginasCoca Cola Drinkable AdGOHAR GHAFFARAinda não há avaliações

- Finance Q1W2 ModuleDocumento10 páginasFinance Q1W2 Modulemara ellyn lacsonAinda não há avaliações

- Info@ks-Legal - In: Rating/Loan Eligibility Across The IndustryDocumento2 páginasInfo@ks-Legal - In: Rating/Loan Eligibility Across The IndustryChinmoy DeAinda não há avaliações

- Resume HaiderDocumento3 páginasResume HaiderHaider EastwoodAinda não há avaliações

- Assignment PPE PArt 2Documento7 páginasAssignment PPE PArt 2JP MirafuentesAinda não há avaliações

- 02 Operations StrategyDocumento13 páginas02 Operations StrategyannamationsAinda não há avaliações

- The Mannequins: Business Plan Ni Nyoman Sri Amandari (1091001080) Pritta Lupita (1091001145)Documento8 páginasThe Mannequins: Business Plan Ni Nyoman Sri Amandari (1091001080) Pritta Lupita (1091001145)Ni Nym S AmandariAinda não há avaliações

- Accounting For Executives - Final Paper JotDocumento48 páginasAccounting For Executives - Final Paper Jotapi-341396604100% (2)

- A Study On Working Capital Mang On Maruti SuzukiDocumento40 páginasA Study On Working Capital Mang On Maruti SuzukiDanika RajeshwariAinda não há avaliações

- MCS Group 11 Chapter 6 Transfer PricingDocumento4 páginasMCS Group 11 Chapter 6 Transfer PricingRifqi HuseinAinda não há avaliações

- Benihana of Tokyo PDFDocumento11 páginasBenihana of Tokyo PDFkarimanrlfAinda não há avaliações

- Final Exam 2Documento4 páginasFinal Exam 2HealthyYOU0% (1)

- Efficient Capital MarketDocumento3 páginasEfficient Capital MarketTaimoorKhanAinda não há avaliações

- CHAPTER 2 Introduction To AuditingDocumento15 páginasCHAPTER 2 Introduction To AuditingChristine Mae ManliguezAinda não há avaliações

- Wal-Mart's Balance Scorecard StrategyDocumento13 páginasWal-Mart's Balance Scorecard StrategyMIRAL PATELAinda não há avaliações

- Top 40 sales order SAP transactionsDocumento2 páginasTop 40 sales order SAP transactionsNarendrareddy RamireddyAinda não há avaliações

- Masterlist of Position Category Updated 10.25.2021Documento20 páginasMasterlist of Position Category Updated 10.25.2021johnmarcAinda não há avaliações