Escolar Documentos

Profissional Documentos

Cultura Documentos

A Project Report Completed 1222

Enviado por

sauravsood0 notas0% acharam este documento útil (0 voto)

49 visualizações47 páginasprocedure for trading in stock exchange

Título original

A Project Report Completed 1222 (1)

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoprocedure for trading in stock exchange

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

49 visualizações47 páginasA Project Report Completed 1222

Enviado por

sauravsoodprocedure for trading in stock exchange

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 47

SUMMER TRAINING REPORT ON

PROCEDURE FOR TRADING IN LISTED SECUTRITIES IN STOCK EXCHANGE AND

COMPETETIVE POSITION OF ALANKIT ASSIGNMENT LTD , DELHI .

DECLARATION

I Saurav Sood , a student of University Business School , Panjab University

Chandigarh of hereby declare that the project work, presented in this report

is my own and has been carried out under supervision of

This work has not been previously submitted to any other

university For any examination .

Date :-

Place:-

Signature: Saurav Sood

ACKNOWLEDGEMENT

I hereby take this opportunity to thank M/s ALANKIT ASSIGNMENT LTD ,

for providing me a corporate exposure through the course of my summer

internship.

I would like to express my sincere gratitude towards my company guide

for providing me great insights about mechanism of stock exchange, procedure for

listing of securities in stock exchange and other ventures , for guiding me all

throughout and for being a great support.

I would like to extend my gratitude to UBS Chandigarh, for providing me such a

platform.

Last but not the least all my friends and family for their support and co-operation.

Thanking You,

Saurav Sood

EXECUTIVE SUMMARY

The market in which shares of publicly held companies are issued and traded

either through exchanges or over-the-counter markets. Also known as the equity

market, the stock market is one of the most vital components of a free-market

economy, as it provides companies with access to capital in exchange for giving

investors a slice of ownership in the company. The stock market makes it possible

to grow small initial sums of money into large ones, and to become wealthy

without taking the risk of starting a business or making the sacrifices that often a

company a high-paying career.

Thus this project is focused to study and analyze procedure for dealing in

securities in stock exchange . Researcher has also study some of the demand

drivers and supply factors that provide ALANKIT ASSIGNMENT LTD a

competitive edge over other players in the market.

SL

NO.

CONTENTS PAGE

NO.

01 Declaration

02 Acknowledgement

03 Certificate

04 Executive summary

05 Review of Literature

a Objective of project

06 Company Overview

a Mission, Vision & Corporate Philosophy

b Product and Services

c Group Companies

d Milestones

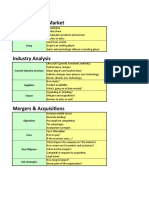

07 Comparative analysis of Broking Services of Alankit

Assignment Limited With other Broking Firms

08 SWOT analysis

09 Competitive Advantage OF Alankit Assignments

Limited Brokerage Services

10 PESTEL analysis of Firm

11 Procedure for Trading Listed Securities in stock

exchange

a Introduction and Requirements For Listing of

Securities

b Compliances Under Listing Agreement

c Procedure For Trading of Securities in BSE

d Procedure For Trading of Securities in NSE

12 Conclusions

13 Bibliography

Review Of Literature

Al Ries and Jack Trout, in his work said differentiate or die, too many less

differentiated products creates a kind of information overload, and in this clutter

of too much information, products which are not properly differentiated or

advertised just end up becoming a me too product. To avoid it every marketer

needs to position his/ her products in a way that makes a specific image in the

minds of consumers.

Jack Miller, in his work published on June 03, 2010, talked about how investors

make investment decisions. He broke the process of decision making in pulling

the buy or sell trigger. According to him investors made the investment decisions

in the ways like simple screening, then lateral recommendation, followed by piggy

bank investing.

According to U.S. Securities and Exchange Commissions, one of the articles:

investors first evaluate their current financial roadmap, and then they evaluate

their comfort zone in taking on risk. Consider an appropriate mix of investments,

create and maintain an emergency fund, consider dollar averaging, consider

rebalancing portfolio occasionally, and in the process also try to avoid the

circumstances that can lead to fraud.

Objectives of the study:

Study was conducted to find out the services provided by

ALANKIT ASSIGNMENT LTD In relation to :

1. Listing of securities of companies with designated Stock Exchanges in

India

2. Trading of securities in Stock exchange having nationwide

Terminals viz. National and Bombay Stock exchange on

Behalf of its clients

3. Competitive position of Alankit Assignments ltd In financial market

COMPANY PROFILE

Alankit Assignments Ltd., the flagship company was incorporated in 1991 by

a talented visionary entrepreneur, Mr Alok K Agarwal. Under his able guidance

and management, the company has made unhindered steady progress since then.

The Company has its headquarter in Delhi with 25 Regional Offices in Mumbai,

Kolkata, Chennai, Ahmadabad, Bangalore, Hyderabad, Jaipur, Lucknow,

Chandigarh, Indore, Bareilly, Kochi, Amritsar, Ludhiana, Patna, Bhubaneswar,

Guwahati, Pune, Ranchi, Visakhapatnam, Raipur, Mysore & Nagpur. Alankit

Assignments Ltd. has expanded its footprint in global arena with its overseas

offices in London, Singapore and Dubai. With a consistent expansion of Alankits

business, the Company has evolved from largely Financial & Share Broking

Company into a diversified Business House.

. Vision:

"To be a unique service provider in the sectors we serve

Mission:

To become a customer centric organization with focus on building trust by our

unmatched standards

CORE VALUES

Customer Centric

With our committed workforce we develop relationship that makes a positive

difference in our customers lives

Trustworthy

We uphold clients trust, commitment & privacy for all our actions

Quality

We work together, and provide unsurpassed services to deliver premium value to

our customers

Stewardship

Think future oriented; act & invest to build a stronger firm for tomorrow.

Alankit Assignments ltd further commits itself to focus on the following as a part

of corporate social responsibility initiatives:

.

Quality in all its activities Ethical and Moral conduct at

all times and in all its

relationships

Practicing socially and

environmentally responsible

behavior

Providing productive, healthy

and safe work place for all its

employees

Growth And Strategy

Covering India through Aadhar

Geographical expansion of business

Expand product portfolio

Strengthen research capabilities

Product and Services

Financial Services

Equities

Derivatives

Currency derivatives

Arbitrage

Registrar Transfer Agent (RTA)

New pension scheme

Initial public offer

Depositary participant

Mutual funds

Insurance

Institutional equities

Wealth Management

Portfolio Management

Research services

Financial planning

E-Governance

.Tin Facilitation Centre

-PAN

-TAN

-AIR

-E-TDS

-PAN Authorization

.E-Return

.CRA-Facilitation Centre

.Unique Identification Authority

.National insurance Policy Repository (NIR)

Health Care

. Third Party Administration

. Rx Pharmacy

Group Companies

Alankit Assignments Limited

Alankit Imaginations Limited

Alankit Health Care TPA Limited

Alankit Insurance Brokers Limited

Alankit Technologies Limited

Alankit Life Care Limited

Alankit Finsec Limited

Milestone

1995 to 2000

Registrar & Share Transfer Agent (RTA)

Trading & Clearing Member - NSE, OTCEI, NSE- F&O

Depository Participant- NSDL & CDSL

2002

Member commodity Exchange

Third Party Administrator (TPA)

2003

Insurance Broker

2004

e-Governance TIN

2005

Member of: Dubai Gold & Commodity Exchange (DGCX)

Bombay Stock Exchange (BSE)

2007

Member of Indian Energy Exchange (IEX)

2008

Member of Currency Exchange

e-Governance- CRA

2009

Member of: Indian Commodity Exchange (ICEX)

Delhi Stock Exchange (DSE)

2010

Appointed as POP-SP for New Pension System

Aggregator- NPS LITE

Enrollment Agency for UIDAI

2011

Launch of recordxpert.com

(Health record portal)

2012

Online issue of General Insurance

Policies of National Insurance Co. Ltd.

2013

AP of NIR

Comparative Analysis of Broking Services of Alankit Assignment

Limited With other Broking Firms:

1. IIFL

The IIFL group, comprising the holding company, IIFL and its wholly-

owned subsidiaries, straddle the entire financial services space with offerings

ranging from equity research, equities and derivatives trading, commodities

trading, portfolio management services, mutual funds, life insurance, fixed deposits

and other small savings instruments to loan products and investment banking. IIFL

has a network of over 2100 business locations (branches and sub-brokers) spread

across more than 450 cities and towns. the group caters to approximately a million

customers. At present, IIFL is operating into USA, SINGAPORE and DUBAI.

Product & service:

o Equity trading

o Commodity trading

o Insurance solution

o Asset management

o Online investment portal

o Loans

A/c opening charge 550Rs.

Annual Maintenance charges 300Rs.

Minimum Margin Required 10,000Rs.

Client wise exposure

up to 4 times in delivery

up to 10 times in intraday

Upfront Subscription Plan Yes

Brokerage

4 paise in delivery

.04 paise in intraday

DP selling charges Nil

Advisory services

Free to clients

80 Rs. p.a. sub-broker

Software installation charges Free

Name of software Vconnect, Rapideal, Rapitrade

Table 2.1: Table showing Services and charges of IIFL

.

Kotak Securities Limited

Kotak Securities Limited, a subsidiary of Kotak Mahindra Bank, is the stock

broking and distribution arm of the Kotak Mahindra Group. One of the oldest

broking houses in India, its operations include stock broking and distribution of

various financial products. It is a corporate member of both the Bombay Stock

Exchange and the National Stock Exchange of India. Kotak Securities was founded

in 1994 and is headquartered in Mumbai, India.

Kotak Mahindra is one of India's leading banking and financial services

organizations, offering a wide range of financial services that encompass every

sphere of life. From commercial banking, to stock broking, to mutual funds, to life

insurance, to investment banking, the group caters to the diverse financial needs of

individuals and corporate sector.

Products & Services

o Equity

o Derivatives

o Currency Futures

o IPO

o Mutual Funds

o ETF

o Fixed Deposits

o Loans

o Tax Services,

o New Pension Systems and Insurance.

Table 2.2: Table showing Services and charges of Kotak Securities

A/c opening charge 550Rs.

Annual Maintenance charges 300Rs.

Minimum Margin Required 10,000Rs.

Client wise exposure

up to 4 times in delivery

up to 10 times in intraday

Prepaid scheme available Yes

Brokerage

4 paise in delivery

.04 paise in intraday

DP selling charges Nil

Advisory services

Free to clients

80 Rs. p.a. sub-broker

Software installation charges Free

Name of software Vconnect, Rapideal, Rapitrade

3. Share Khan

Incorporated in February 2000, Sharekhan is India's 2

nd

largest stock

broker providing brokerage services through its online trading website

Sharekhan.com and 1950 Share shops which includes branches & Franchises in

more than 575 cities across India. Sharekhan has seen incredible growth over last

10+ years though it's very successful online trading platform and the chain of

franchises located in almost every part of India. Sharekhan has over 10 lakh

retail and institutional customers.

Sharekhan.com is the finest investment portal for India stock market. The well

designed website provides wide range on investment options, latest stock market

updates and many tools for investors. Sharekhan also offers 'Sharekhan Trade

Tiger', one of the most popular trading terminals, for retail investors.

Product & service:

o Equity trading

o Commodity trading

o Insurance solution

o Asset management

o Online investment portal

o Loans

o Wealth management spectrum

Table 2.3: Table showing Services and charges of Sharekhan

A/c opening charge 550Rs.

Annual Maintenance charges 300Rs.

Minimum Margin Required 10,000Rs.

Client wise exposure

up to 4 times in delivery

up to 10 times in intraday

Prepaid scheme available Yes

Brokerage

4 paise in delivery

.04 paise in intraday

DP selling charges Nil

Advisory services

Free to clients

80 Rs. p.a. sub-broker

Software installation charges Free

Name of software Vconnect, Rapideal, Rapitrade

SWOT analysis of Alankit Assignment Limited

Strengths

Diversified Services

Experienced Management

PAN India Presence

18 Years of Services

24 Services

8 Group Companies

25 Regional Offices

Online trading platform.

Diverse branches and networks provide a great opportunity to cater tapped and

untapped market as well.

Provides competitive brokerage and DP charges.

Equity analysis reports to support its clients.

Both online and offline trading facility.

Weakness

Position to answer the questions of the clients in their fields.

It does not provide indices on major world markets, ADR prices of Indian scripts.

Lacks banking arm

Lack of awareness among customers because of non-aggressive promotional

strategies (Print media, newspapers etc.)

OPPORTUNITIES:

Can easily tap the retail investor s with small saving through promotional

channels like print media, electronic media, etc.

More & more small investors are entering into share market

Focuses more on HNIs than retail investors which results in meager market-

share as compared to close competitors.

ATM facility should be provided for easy withdrawals.

Tie-ups with third party companies for selling products.

High client base will help for cross sales of its products

Threats

Companies like Sharekhan, ICICI Direct, Kotak Securities, and private brokers are

major threats.

Banks with demat facilities are jockeying for position.

Local brokers capable of charging lower brokerage.

Changes in SEBI guidelines and other tax implications.

Government regulations

Competitive Advantage Of Alankit Assignments Limited Brokerage

Services

One of the lowest brokerage charge in the industry (currently).

Best software in the industry.

Listed company and aggressive in brand promotion.

Mobile trading tie ups with Blackberry and other phones, where one can trade with

ease.

Both online and offline facilities are provided.

Competitive commissions and service support at fair price (value for money).

Relationship manager facility to assist customers as and when they need assistance

and guidance.

Easy access to customers of the snap shots of their account statement

and portfolio statements and to digital contract notes.

PESTEL analysis of firm

Political and Legal

Heavy regulations and tough regulations by SEBI to avoid major scams like

Harshad Mehta and ketan Parekh.

Settlement period and Settlement Cycle

Know Your Customer Norms

Economic Environment

Limited FDI and Foreign Institutional Investor Inflows

Rigid RBI Guidelines and Foreign Exchange Management Provisions

Limited Trade and heavy regulations in currency trade

Social Environment

Apprehensiveness of investments in stocks and shares

Less Expertise and more dependence on speculation

Festivals

Technological and Environmental

Techonological Advances , The stock exchanges , improved trading, hardware

and software and software enabling nearly 15 Millions trades per day.

Satellite communication techonologies

Online and Mobile Trading facilities

Procedure for Trading Securities in stock exchange(National and Bombay stock

exchange)

As we know stock exchange provides a platform for sale and purchase of existing

securities of companies.

Only such securities can be traded on floor of stock exchange which are listed

with stock exchange. In order to ensure that securities of a public limited

company are listed in a stock exchange a company has to appoint a compliance

officer which will ensure that all clauses of listing agreement framed by stock

exchange are duly compiled.

Listing means permission from stock exchange for trading securities on trading

floor of stock exchange.

Following are main clauses of listing agreement and compliances

BOOK CLOSURE FOR DECLARATION OF DIVIDEND ETC.- Clause 16

Event

To close the transfer books for declaration of dividend at the time of the AGM.

Books will also be closed for issue of right/bonus shares or issue of shares for

conversion of debentures etc. in the same manner by giving notices.

The minimum time gap between the two closures and / or record dates would be

at least 30 days.

Time Limit

Advance Notice of at least 7 days. The exchange must be given the dates and

purpose of closing the transfer of books.

The company on whose stocks, derivatives are available or whose stocks form

part of an index on which derivatives are available, shall give a notice

period of 7 days to stock exchanges for corporate actions like merger, de-

mergers, splits and bonus shares.

Clause 19(a), (b) & (d)

Prior intimation to stock exchange for calling Board Meeting for some

specified Business

If the company is planning for

Proposal for buy back

Declaration of dividend

Right issue

Bonus Issue (in this case simultaneous notice to stock exchange has to be given on

the date when the proposal is communicated to Board of Directors as a part of

agenda papers.)

Issue of convertible debentures.

Passing over of dividend.

Then prior intimation to the Exchange is required before the Board considers the

same.

Time Limit

At least 2 working days in advance of the date of the Board Meeting

ISSUE OF SHARES OR SECURITIES Clause 24

The company making a new issue has to agree

To obtain in principal approval for listing of the new securities

To make true, fair and adequate disclosure in the offer documents

To get the offer documents vetted by SEBI

To submit to the exchange:

Copy of the acknowledgment card so vetted by SEBI and

Compliance certificate from merchant banker reporting positive compliance of

guidelines on disclosure and investor protection.

Company to submit any scheme/petition under sections 391, 394 and 101

proposed to be submitted to the court or tribunal at least one month in

advance for getting it approved from the stock exchange and shall also:

Submit an auditors certificate to the effect that the accounting treatment

contained in such scheme is in compliance with all the applicable Accounting

standards (requirement introduced w.e.f. 5

th

April, 2010.)

Assure to the stock exchange that the said scheme of

arrangement/amalgamation/merger etc does not in any way violate, override or

circumscribe the provisions of the securities laws or stock exchange

requirements.

Disclose the pre and post arrangement capital structure, shareholding pattern

and the fairness opinion obtained from independent merchant bankers on

valuation of assets / shares in the explanatory statement forwarded to the

shareholders u/s 393 or accompanying the resolution to be passed under section

100

Clause 23 (e).

Event

Time to be given to right issue shareholders to decide

Time Limit

Not less than 4 weeks, within which they will have to exercise their rights.

Clause 23 (e)

Event

Time limit to issue letters of allotment or letters of rights

Time Limit

Within 6 weeks of the Record date / reopening of transfer books /

submission of letters of renunciation / applicable of new securities.

FORWARDING OF ANNUAL ACCOUNTS TO THE EXCHANGE, FILING OF

SHAREHILDING PATTERN clause 31

The company will forward to the Exchange promptly and without application: -

6 copies of the Annual report / periodical report / special report as soon as they

are issued to the shareholders to all the recognized stock exchanges:

6 copies of all notices, resolutions and circulars relating to new issue of capital

prior to their dispatch to the shareholders:

3 Copies of all the notices, call letters or any other circulars including notices of

the meeting convened under section 391 or 394 at the same time as they are sent

to the shareholders or debenture holders or advertised in the Press:

Copy of the proceedings at all AGM / EGM of the company;

3 copies of all notices, circulars, etc, issued or advertised in the press regarding

any proposal to merge or amalgamate, re-construction, reduction of capital,

scheme or arrangement etc. and copies of the proceedings at all such meetings.

Time limit

Should be send when mailed to shareholders.

Should be send prior to dispatch to shareholders.

Should be send when sent to shareholders.

Should be send after the Chairman of the meetings has signed the minutes.

Promptly.

ANNUAL REPORT- clause 32

Company to supply a copy of the complete B/S, P/L Account and the Directors

Report to each Shareholder.

Company may supply a single copy to all the shareholders having same unless

requested. However the company will supply abridged Balance sheet to all the

shareholders in the same household.

Company has to give cash flow statement prepared as per AS-3 along with

Consolidated Financial Statement (CFS) duly audited by the Statutory Auditors.

Filling of such CFS is mandatory.

It shall also disclose:

Related party transactions

Fact of delisting, together with reasons thereof in its Directors Report

In case the securities are suspended from trading, the reasons thereof

The name and address of each stock exchange at which the issuers securities are

listed and also a confirmation that the Annual Listings Fees has been paid to each

of the exchange.

If company changes its name suggesting new line of business after 1

st

January,

1998 then company will have to disclose the turnover and income, etc. from such

new activities separately in the annual results for a period of 3 years from the

date of change in the name of the company.

SHARHOLDING PATTERN clause 35

Shareholding pattern to be filled on a quarterly basis in the form that has been

prescribed in the agreement itself.

The reporting format of shareholding pattern as provided in clause 35 of the

Listing Agreement shall be indicated in 3 categories, viz., shares held by

promoters and promoter group, shares held by public and shares held by

custodians and against which Depository Receipts have been issued. Additional

details with respect to no. of shareholders no. of shares held in demat form etc.

will be given for all the 3 categories. Disclosure of shareholding of persons holding

more than 1% of the total number of shares and Depository Receipts will also be

required to be furnished.

The format of disclosure of shareholding pattern also includes details of shares

pledged by promoters and promoter group. Such pattern shall be disclosed for

each class of security separately and an additional format for disclosure of voting

rights pattern in the company has been prescribed.

Time limit

Within 21 days of end of the quarter

Clause 40 A

The company agrees to comply with the requirements specified in Rule 19(2) and

Rule 19A of the Securities Contracts (Regulation) Rules, 1957.

Where the company is required to achieve the minimum level of public

shareholding specified in Rule 19(2)(b) and/or Rule 19A of the Securities

Contracts (Regulation) Rules, 1957, it shall adopt any of the following

methods to raise the public shareholding to the required level:-

(a) issuance of shares to public through prospectus; or

(b) offer for sale of shares held by promoters to public through prospectus; or

(c) sale of shares held by promoters through the secondary market.

Clause 41

Quarterly financial results approved by the Board/ or by a committee thereof,

other than the audit committee Along with Limited review report within 45 days

from end of the quarter (other than the last quarter).

In respect of the last quarter, the company has an option either to submit

unaudited financial results for the quarter within forty-five days of end of the

financial year or to submit audited financial results for the entire financial year

within sixty days of end of the financial year, subject to the provision.

Atleast 7 clear calendar days in advance of the Board meeting fixed for taking Un

audited / Audited results on record. (excluding date of intimation and date of

meeting)

Advertise atleast 7 days in advance in atleast one national newspaper in English

and in regional language, the day of Board meeting.

Fax the results to the stock exchange with in 15 minutes.

Recently amended to include the details of pledge shares of the Promoters and

Promoter group.

Clause 49

Clause 49 of listing agreement deals with corporate governance

The Board must have an optimum combination of executive director and non

executive director.

In case of executive chairman then board shall comprise of independent

directors which will be equal to 2/3 of total strength of board

Where in case board have a non executive chairman, then the board must

consist of 50% of independent directors.

Definition of independent director

independent director shall mean non-executive director of the company who

a. apart from receiving directors remuneration, does not have any material

pecuniary relationships or transactions with the company, its promoters, its

senior management or its holding company, its subsidiaries and associated

companies;

b. is not related to promoters or management at the board level or at one level

below the board;

c. has not been an executive of the company in the immediately preceding three

financial years;

d. is not a partner or an executive of the statutory audit firm or the internal

audit firm that is associated with the company, and has not been a partner or an

executive of any such firm for the last three years. This will also apply to legal

firm(s) and consulting firm(s) that have a material association with the entity.

e. is not a supplier, service provider or customer of the company. This should

include lessor-lessee type relationships also; and

f. is not a substantial shareholder of the company, i.e. owning two percent or

more of the block of voting shares.

Remuneration committee

All remuneration paid to non-executive directors, including independent

directors, shall be fixed by the Board of Directors and shall be agreed to by

shareholders in general meeting. Limits shall be set for the maximum number of

stock options that can be granted to non-executive directors, including

independent directors, in any financial year and in aggregate.

Meeting of Audit Committee

The audit committee should meet at least four times in a year and not more than

four months shall elapse between two meetings. The quorum shall be either two

members or one third of the members of the audit committee whichever is

greater, but there should be a minimum of two independent members present.

Role of the audit committee

The role of the audit committee shall include the following:

Oversight of the companys financial reporting process and the disclosure of its

financial information to ensure that the financial statement is correct, sufficient

and credible.

Recommending the appointment and removal of external auditor, fixation of

audit fee and also approval for payment for any other services.

Reviewing with management the annual financial statements before submission

to the board, focusing primarily on;

Any changes in accounting policies and practices.

Major accounting entries based on exercise of judgment by management.

Qualifications in draft audit report.

Significant adjustments arising out of audit.

The going concern assumption.

Compliance with stock exchange and legal requirements concerning financial

statements

Any related party transactions

Reviewing with the management, external and internal auditors, the adequacy of

internal control systems.

Reviewing the adequacy of internal audit function, including the structure of the

internal audit department, staffing and seniority of the official heading the

department, reporting structure coverage and frequency of internal audit.

Discussion with internal auditors any significant findings and follow up there on.

Reviewing the findings of any internal investigations by the internal auditors into

matters where there is suspected fraud or irregularity or a failure of internal

control systems of a material nature and reporting the matter to the board.

Discussion with external auditors before the audit commences about nature and

scope of audit as well as post-audit discussion to ascertain any area of concern.

Reviewing the companys financial and risk management policies.

To look into the reasons for substantial defaults in the payment to the

depositors, debenture holders, shareholders (in case of non payment of declared

dividends) and creditors.

Whistle Blower Policy

The intention of this clause is that management establishes a mechanism for

employees to report concerns about unethical behavior, actual or suspected fraud

or violation of the companys code of conduct or ethics policy. The exact details of

such a mechanism should be left to each company, through its Board of Directors,

to decide but the existence and implementation must be reviewed by the audit

committee. The mechanism must have adequate provisions to ensure there is no

victimization of employees who avail of this procedure..

TRADING MECHANISM IN BOMBAY STOCK EXCHANGE

Established in 1875, BSE Ltd , Earlier it was known as The Native Share and Stock

Brokers' Association").

BSE provides an efficient and transparent market for trading in equity, debt

instruments, derivatives, and mutual funds.

It also has a platform for trading in equities of small-and-medium enterprises

(SME).

Its main index Is SENSEX.

It is the one of the stock exchange who has firstly introduced Bombay Online

Trading System (BOLT) in india .

The scrips traded in Bse have been classified into various groups.

Bse has for guidance and benefit of the investor ,classified the scrips in the

equity segment into A , B , T , AND Z groups on Certain

qualitative and quantitative parameters .

The F group represents Fixed Income Securities.

The T represents Government Securities which are settled on trade to trade to

basis as a surveillance measure

Trading in government securities by the retail investor is done under the G

GROUP

The Z group was introduced by BSE in july 1991 and includes companies

which have failed to comply with listing agreement and failed to redress

investor grievances and /or have not made the required arrangements with

depository participants both CDSL and NSDL for dematerialization of shares.

BSE also provides a facility to the market participants for online trading of odd

lot securities in physical form in A ,B, T , AND Z groups and in rights

renunciations in all groups of scrips in equity segment

The, Mumbai Exchange has initiated a number of measures aimed at providing

quality products and services and expanding its network using cutting edge

information technology. The BSE made its transition from an 'outcry' system of

trading to a completely electronic trading system.BSE has introduced electronic

trading system known as BOLT ( Bombay Online Trading System)

Trading system displays on a continuous basis scrip and market-related

information required supporting traders. (Information includes best five bids and

offers, last traded quantity and price, total buy and sell depth (irrespective of

rates), open, high, low and close price, total number of trades, volume and value,

and index movement. Other company-related information is also displayed)2.

As soon as an order is matched, the confirmation of the trade is generated on-

line.

The order matching logic is based on best price and time priority.

The BSE On line Trading Platform has a capacity of conducting 2 million trades

per day

The latest state of the art technology infrastructure with Trader Work Stations

located in more than 400 cities all over the country.

Trading on the BOLT system is conducted from Monday to Friday between 9: 30

a.m. and 3:30p.m.

Trading can also be conducted through the BSE Internet Trading System -

www.bsewebx.comthe first Exchange enabled Internet Trading System.8.

BSE aims to provide trading any where and at anytime. With this endeavor in

mind, the exchange continuously upgrades the hardware, software and

networking systems so as to enable it to enhance the quality and standards of

service to its members and other market intermediaries

PRICE DISCOVERY MECHANISMS

During the pre-opening period (9.15a.m.-9.30a.m.), brokers input the bids and

offers they receive from investors into the system until they match.

The mechanism for which the price of equities is determined is as follows:

The best price (price priority): The transaction is executed for the best price.

Type of order: If an order is conditional, precedence of execution is given to

orders that are un-conditional. For example, if there are two orders with the same

price, the system will give precedence to the un-conditional order.3.

Source of order: The sources of order are given precedence of execution as

follows:

Priority 1 =>

clients order, foreign investors order, market controls order

Priority 2 =>

mutual funds order, the issuing companys order, specialists order

Priority 3 =>

insiders order

Time of order priority: In case the price and type are the same, precedence is

given to the orders entered into the system first.5.

Cross priority: Cross priority is implemented if the one with the priority is on

the active side .Trading in cross priority takes precedence over other house, then

against the same house order.

Random factor priority: In case two orders are received in the same time,

precedence is given to the random factor.

CLEARING AND SETTLEMENT

The settlement of transactions was earlier done in the weekly settlement

environment, where the exchange had a carry forward facility. The exchange

commenced exchange of trades on rolling basis where the trades are settled on

T+ 2 basis. Undelivered quantities of securities in settlement is promptly

auctioned or closed out as per the well-laid procedure. Two depositories, namely

the Central Depository Services (India) Ltd. and National Securities Depository of

India Ltd. operate in the Indian Market place. The Clearing House of the exchange

has well- structured linkages with both the depositories. Direct transfer of

securities to and from the Beneficial Owner Accounts is facilitated at the

Clearinghouse level only, making for the seamless movement of securities in the

settlement system .The settlement of transactions in the depositories mode is

based on the ISIN codes of the securities. The exchange Rules, Bylaws and

regulations have clearly laid down the default handling procedure.

National Stock Exchange

National Stock Exchange (NSE) was established in the mid 1990s as a

demutualised electronic exchange. NSE provides a modern, fully automated

screen-based trading system, with over two lakh trading terminals . across the

country.

The exchange was incorporated in 1992 as a tax-paying company and was

recognized as a stock exchange in 1993 under the Securities Contracts

(Regulation) Act, 1956.

NSE commenced operations in the Wholesale Debt Market (WDM) segment in

June 1994. The Capital market (Equities) segment of the NSE commenced

operations in November 1994, while operations in the Derivatives segment

commenced in June 2000.

The Objectives of the NSE are:

To establish a nation wide trading facility for equities, debt instruments and

Hybrids .

To ensure equal access to investors all over the country through an appropriate

Communication network.

To provide a fair, efficient and transparent securities market to investors using

Electronic trading systems.

To enable shorter settlement cycles and book entry settlement system.

To meet the current international standards of securities markets.

The trading system of the NSE, known as NEAT (National Exchange for

Automated Trading), is a fully automated screen based trading system that

enables members across the Country to trade simultaneously with enormous

ease and efficiency. In one stroke it has done away with the need for people to

congregate on the floor of an exchange to trade and done away with the need for

people to congregate on the floor of an exchange to trade and has instead taken

the exchange floor to the investors doorstep.

The telecommunications network is the backbone of any automated trading

system and the same is true for NSE also . Each Trading Member trades on the

NSE with other members through a computer that may be located at the Trading

Members office or anywhere in India.

The Trading Members of the exchange trade through VSATs (Very Small Aperture

Terminals)..

The Exchange provides a facility for screen based trading with automated order

matching

The trading system operates on a price time priority. Orders are matched

automatically by the computers keeping the system transparent, objective and

fair. Where an order does not find a match, it remains in the system and is

displayed to the whole market till a fresh order comes in or the earlier order is

cancelled or modified

The trading system also provides complete on-line market information through

various inquiry facilities. The various screens on the Trading System provide

comprehensive information like the total order depth in a security, the best buys

and sells available in the market, the quantity traded in that security, the high

price, the low price and the last traded price etc

It is thus possible for investors to know the actual position of the market before

placing orders. Investors can also know the fate of the orders almost as soon as

they are placed by the Trading Members on the NEAT system.

EXCHANGE OPERATIONS

The Exchange currently operates three market segments, namely Capital Market

Segment, Futures and Options Segment and the Wholesale Debt Market

Segment.

The Exchange currently operates three market segments, namely Capital Market

Segment,

Futures and Options Segment and the Wholesale Debt Market Segment.

CAPITAL MARKET SEGMENT

The Capital Market segment provides trading facilities in equities, convertible

debentures etc. This segment commenced trading on November 3, 1994.

The clearing and settlement operations in CM segment of the Exchange are

managed by its wholly owned subsidiary, namely the National Securities

Clearing Corporation Limited (NSCCL)

The NSCCL operates a settlement fund with a corpus of over Rs.1,200 crores.

This settlement fund works like a self insurance mechanism

The members contribute to the settlement fund and in the unlikely event of

member default or their failure to meet settlement obligations , the fund is used

to complete the settlement. This virtually eliminates the counterparty default on

NSE.

To further reduce the systemic risk, NSE has arranged a comprehensive insurance

scheme covering the major Systemic risks of all Trading members in the Capital

Market Segment.

FUTURES & OPTIONS (F & O) SEGMENT

NSE has introduced firstly trading in derivatives in India.

This segment facilitates trades in derivative products such as stock index based

futures, stock index based options, stock options, stock futures, and interest rate

derivative products. Trading facilities in Futures & Options Segment of the

Exchange are available at all centers where Capital Market operations have

been extended. All clearing and Settlement functions for the F&O market

segment are handled by NSCCL.

Securities Available in WDM Segment:

All Government securities and Treasury bills are automatically deemed to be

listed as and when they are issued. Other securities, either publicly issued or

privately placed could be listed if eligible as per exchange rules.

Procedure and Conditions for listing of securities on WDM segment:

1. All Listing are subject to compliance with Byelaws, Rules and other

requirements framed by the Exchange from time to time in addition to the SEBI

and other statutory requirements.

2. The Issuer of security proposed for listing has to forward an application in the

format prescribed in Annexure I of this booklet

along with application, such supporting documents/information as specified in

Annexure I of this booklet and as prescribed by the Exchange from time to time.

4. On getting an in-principle approval t of the exchange the issuer has to enter

into a listing agreement in the prescribed format under its common seal.

5. Upon listing, the Issuer has to comply with all requirements of law, any

guidelines/directions of Central Government, other Statutory or local authority

6. The Issuer shall also comply with the post listing compliance as laid out in the

listing agreement and shall also comply with the rules, bye-laws, regulations

and any other guidelines of the Exchange as amended from time to time.

7. Listing on WDM segment does not imply a listing on CM segment also or vice

versa.

8. . If the equity shares of an issuer are listed on other stock exchanges but not

listed on Capital Market segment of the Exchange, though eligible, then the

debt securities of the said issuer will not be permitted to be listed on the

WDM segment.

Clearing and Settlement

Trades on the Wholesale Debt Market are settled gross on a trade for trade basis

i.e. each transaction is settled individually and cumulating or netting of

transactions is not allowed.

Each trade has a unique settlement date specified upfront at the time of order

entry and used as a matching parameter. It is mandatory for trades to be settled

on the predefined settlement date . The Exchange currently allows settlement

periods ranging from same day (T+0) settlement to a maximum of three (T+2)

days. Exchange also permits Repurchase (REPO) trades for a repo term upto 14

days for eligible securities and participants.

The Clearing Corporation of India Limited (CCIL), promoted by the banks and

financial institutions, was incorporated in April 2001 to support and facilitate

clearing and institutions, was incorporated in April 2001 to support and facilitate

clearing and settlement of trades in government securities (and also trades in

forex and money markets).

It facilitates settlement of transactions in government securities (both outright

and repo) on gross basis and settlement of funds on net basis simultaneousl

It acts as a central counterparty for clearing and settlement of government

securities transactions done on NDS.

It provides guaranteed settlement for transactions in government securities

including repos through improved risk management practices viz, daily mark to

market margin and Dealer/Mutual Fund or a Statutory Corporation or body

corporate which is a member of NDS and which has opened an SGL Account and

a Current Account with RBI can apply

NDS and which has opened an SGL Account and a Current Account with RBI can

apply for CCIL's membership for the Securities segment.In case of securities other

than government securities, there is a bilateral settlement between the parties

to the trade. Settlements of transactions are closely monitored by the Exchange

through obtaining settlement details by trading members and participants. In

case of deferment of settlement or cancellation of trade, trading members and

participants are required to seek prior or cancellation of trade, trading members

and participants are required to seek prior approval from the Exchange .

Conclusions And Findings

After working into a Alankit Assignment Ltd , Trainee has got a clear

understanding of procedure for trading of securities in stock exchange and major

compliance made by above said firm on behalf of its clients under Listing

agreement .

After analyzing the books of firm ,the trainee has find out the competitive

advantage available to firm against its competitors in the Market .

Bibliography

WWW.Alankit.com

www.BSE.com

WWW.NSE.com

ISCI JOURNALS

ICSI Study Materials- Securities law and Compliances

WWW.kotak .com

WWW.Share khan.com

Alankit Assignment Ltd Prospectus

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Ivy Case SystemDocumento4 páginasIvy Case SystemHari ChandanaAinda não há avaliações

- Atlantic Computer - A Bundle of Pricing OptionsDocumento6 páginasAtlantic Computer - A Bundle of Pricing OptionsAashi JainAinda não há avaliações

- Tool and Die Industry Project ReportDocumento18 páginasTool and Die Industry Project ReportMoazzam AliAinda não há avaliações

- The 4as of MarketingDocumento2 páginasThe 4as of MarketingAmandeep Dahiya100% (2)

- Jean-Louis Tourne PresentationDocumento20 páginasJean-Louis Tourne PresentationeatnutesAinda não há avaliações

- Northeastern University ECON 1115 Principles of Macro Fall 2021 HomeworkDocumento5 páginasNortheastern University ECON 1115 Principles of Macro Fall 2021 HomeworkSamarth BajpaiAinda não há avaliações

- Ambler 2004Documento26 páginasAmbler 2004Tú Vũ QuangAinda não há avaliações

- SM7 Ch07 PromotionDocumento38 páginasSM7 Ch07 PromotionGavin SkullAinda não há avaliações

- Sustainability in The Sporting Goods Industry - How Nike, Adidas and Puma Have Developed Company SustainabilityDocumento61 páginasSustainability in The Sporting Goods Industry - How Nike, Adidas and Puma Have Developed Company SustainabilityWesley SupervilleAinda não há avaliações

- Financial Markets: Hot Topic of The EconomyDocumento8 páginasFinancial Markets: Hot Topic of The EconomyOtmane Senhadji El RhaziAinda não há avaliações

- TCHE 303 - Money and Banking Tutorial QuestionsDocumento2 páginasTCHE 303 - Money and Banking Tutorial QuestionsTường ThuậtAinda não há avaliações

- Final Best Research Chapter One-FiveDocumento108 páginasFinal Best Research Chapter One-FivealeAinda não há avaliações

- IIM-UDR-FIS-2020-Outline - Will Be ModifiedDocumento6 páginasIIM-UDR-FIS-2020-Outline - Will Be Modifiedim masterAinda não há avaliações

- Call Money MarketDocumento21 páginasCall Money MarketAakanksha SanctisAinda não há avaliações

- Money Market InstrumentsDocumento121 páginasMoney Market InstrumentsUmang JagadAinda não há avaliações

- How We Organize Ourselves: 1. What Is Our Purpose?Documento6 páginasHow We Organize Ourselves: 1. What Is Our Purpose?rana100% (1)

- Fundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. HoustonDocumento32 páginasFundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. HoustonixisusjhsAinda não há avaliações

- ZoomX EV Market Entry Strategy for IndiaDocumento3 páginasZoomX EV Market Entry Strategy for Indiaaditya khandelwalAinda não há avaliações

- Determinants of Equity Share Prices in The Indian Corporate SectorDocumento96 páginasDeterminants of Equity Share Prices in The Indian Corporate SectorRikesh Daliya100% (2)

- Case Analysis Direction: Analyze The Case and Answer The Given QuestionsDocumento2 páginasCase Analysis Direction: Analyze The Case and Answer The Given QuestionsZednem JhenggAinda não há avaliações

- Hubble Contact Lenses PDFDocumento8 páginasHubble Contact Lenses PDFKAVYA MAHESHWARI100% (1)

- Cost of Capital ExplainedDocumento4 páginasCost of Capital ExplainedMaximusAinda não há avaliações

- Non-Exclusive Property ListingDocumento1 páginaNon-Exclusive Property Listingjayson100% (1)

- St. Vincent de Ferrer College Financial Management 2 Exam ReviewDocumento4 páginasSt. Vincent de Ferrer College Financial Management 2 Exam ReviewNANAinda não há avaliações

- Strategic management-S/W PrintingDocumento76 páginasStrategic management-S/W PrintingamirrajaAinda não há avaliações

- Asics Chasing A 2020 VisionDocumento57 páginasAsics Chasing A 2020 Visionfalguni33% (3)

- Transport Logistics Trendbook 2019 en PDFDocumento40 páginasTransport Logistics Trendbook 2019 en PDFNavin JollyAinda não há avaliações

- Concept of Reach-FrequencyDocumento2 páginasConcept of Reach-Frequencyutcm77100% (1)

- Jungle Island Hotel Market Rent Study Rev1Documento102 páginasJungle Island Hotel Market Rent Study Rev1None None NoneAinda não há avaliações

- Pas 21 The Effects of Changes in Foreign Exchange RatesDocumento2 páginasPas 21 The Effects of Changes in Foreign Exchange RatesRaven BermalAinda não há avaliações