Escolar Documentos

Profissional Documentos

Cultura Documentos

9 Point Project Summary English

Enviado por

Abel HasballahDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

9 Point Project Summary English

Enviado por

Abel HasballahDireitos autorais:

Formatos disponíveis

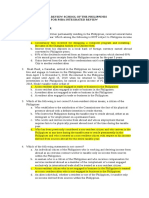

NINE POINT PROJECT SUMMARY

for

NEW CONSTRUCTION / REFINANCE / ACQUISITION FINANCING OPPORTUNITIES

1)

PRESENTATION OF PROJECT OWNER/BORROWER:

Company name:

Address:

Telephone:

Fax:

E-mail:

Website:

Main Activities: (Example Hotel or Housing Developer/Management, Building

Company, Manufacturer, etc., give brief description)

Authorized Capital in Local Currency:

Paid up Capital in Local Currency:

....................................

Shareholders Names with Percentage of Shareholding:

Mr./Mrs.

Mr./Mrs.

Mr./Mrs.

.%

.%

.%

100 %

Board of Directors and Officers Names:

Mr./Mrs. .

Mr./Mrs. .

Mr./Mrs. .

Mr./Mrs. .

Chairman/President/CEO

Director/.Vice President

Director/Secy/Treasurer

Director

NINE POINT EURO BOND LOAN PROJECT SUMMARY

PAGE TWO OF FOUR

2)

3)

PROJECT DESCRIPTION, LOCATION AND SITE:

Name of Project: ...

Description of Project: (Give complete but concise description of Project. Note this

may take a page or more if necessary.)

Land Area: (Example 5.4 hectares or 54,000 square meters or 13.34 acres, etc. of

approved, zoned area, land use permits, etc.)

Exact Location and Address: ....

...

...

...

BREAKDOWN OF MAIN PROJECT COMPONENTS:

LOCAL CURRENCY U.S. DOLLARS

Current Property Value as presently is

Infrastructure Cost

Construction Cost

FF&E Cost

All Fees and Expenses

Working Capital (if applicable)

Unforeseen/Contingencies

Interest on Loan During Development Period

Financial Charges *

. ...

. ...

. ...

. ...

. ...

. ..

. ...

. ...

. ...

TOTAL COST OF PROJECT

* Note Financial Charges range from 3.0% to 3.75% depending on the amount of the

loan and the complexity of the project

BREAKDOWN OF EXISTING DEBTS/LOANS:

(Give complete breakdown and to whom/banks/lenders owed)

NINE POINT EURO BOND LOAN PROJECT SUMMARY

PAGE THREE OF FOUR

4)

TYPE OF LOAN REQUESTED: PROJECT FINANCING or REFINANCING or

PURCHACE / ACQUISITION FINANCING

5)

LOAN AMOUNT REQUESTED:

(Give amount in Local Currency, if applicable, and in U. S. Dollars)

USE OF LOAN PROCEEDS (as may be applicable). Note The LOAN AMOUNT

MUST equal the TOTAL DISBURSEMENTS :

LOCAL CURRENCY U.S. DOLLARS

6)

Pay Off Existing Debts/Loans (if any)

Infrastructure Cost

Construction Cost

FF&E Cost

Working Capital (if applicable)

All Fees and Expenses

Unforeseen/Contingencies

Interest on Loan During Development Period

Financial Charges

.. .

. ...

. ...

. ....

. .

.. ...

.. ...

.. ...

.. ...

TOTAL DISBURSEMENTS

..

...

LOAN PERIOD REQUESTED:

(Example: A maximum of TEN (10) YEARS including a construction and equalization

period of up to THIRTY SIX (36) months)

7)

AVAILABILITY OF EQUITY:

AMOUNT OF AVAILABLE EQUITY:

LOCAL CURRENCY

U.S. DOLLARS

..

(Note Compute as Total Cost of Project Less Loan in Local Currency and U.S. Dollars)

NINE POINT EURO BOND LOAN PROJECT SUMMARY

PAGE FOUR OF FOUR

BREAKDOWN OF EQUITY PRESENTLY AVAILABLE:

Current as presently is Property Valuation

.

Less Existing Debts/Loans

- .

Net Equity in Property

.

Plus Cash Already Invested, if any*)

+ .

Plus Cash Injection, from Borrowers, if intended + .

TOTAL EQUITY PRESENTLY AVAILABLE

BREAKDOWN OF CASH ALREADY INVESTED:

..

..

..

..

..

8)

9)

.

.

.

.

.

SECURITY/GUARANTEES/GUARANTOR/COLLATERAL OFFERED:

First Charge Position on All Projects (First Mortgage)

Corporate Guarantee

Personal Guarantee(s) of Major Shareholder(s)

EXISTING FEASIBILITY/VIABILITY STUDY AND UPDATED APPRAISAL:

Date and Author

Updated Valuation of the Property as presently is

LOCAL CURRENCY

U.S. DOLLARS

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Blake and Scott FS AnalysisDocumento38 páginasBlake and Scott FS AnalysisFaker PlaymakerAinda não há avaliações

- Toppamono Cap.2Documento24 páginasToppamono Cap.2rhidalgo0% (1)

- Module: Competing in The Network EconomyDocumento32 páginasModule: Competing in The Network EconomyKirti KiranAinda não há avaliações

- Ubte 2013 Entrepreneurship: Universiti Tunku Abdul Rahman (Utar)Documento18 páginasUbte 2013 Entrepreneurship: Universiti Tunku Abdul Rahman (Utar)Jyiou YimushiAinda não há avaliações

- Paper LBO Model Example - Street of WallsDocumento6 páginasPaper LBO Model Example - Street of WallsAndrewAinda não há avaliações

- Questionnaire Revised 2Documento7 páginasQuestionnaire Revised 2Anish MarwahAinda não há avaliações

- Cpa Review School of The Philippines For Psba Integrated ReviewDocumento13 páginasCpa Review School of The Philippines For Psba Integrated ReviewKathleenCusipagAinda não há avaliações

- Employee Details Payment & Leave Details: Arrears Current AmountDocumento1 páginaEmployee Details Payment & Leave Details: Arrears Current AmountswapnilAinda não há avaliações

- CashflowDocumento3 páginasCashflowsikandar aAinda não há avaliações

- NSS Central Audit Report User Manual - 16.032020Documento48 páginasNSS Central Audit Report User Manual - 16.032020Manoj TribhuwanAinda não há avaliações

- Brand ExtensionDocumento6 páginasBrand Extensionmukhtal8909Ainda não há avaliações

- All Sections of Companies Act 2013Documento66 páginasAll Sections of Companies Act 2013RICHA SHARMAAinda não há avaliações

- SubPrime Crisis and 911Documento55 páginasSubPrime Crisis and 911Eye ON CitrusAinda não há avaliações

- UNI DRFT - Duty - Apsara - 31.07.2023Documento1 páginaUNI DRFT - Duty - Apsara - 31.07.2023praneeth jayeshaAinda não há avaliações

- Auditing Chapters 1,2,17 ExamDocumento4 páginasAuditing Chapters 1,2,17 Examaprilkathryn2_954243Ainda não há avaliações

- Techno 2023Documento34 páginasTechno 2023John Lester PaltepAinda não há avaliações

- FIN444 Part2 (Final)Documento22 páginasFIN444 Part2 (Final)A ChowdhuryAinda não há avaliações

- سلطات الضبط في مجال النشاطات المالية والطاقوية والشبكاتية ودورها في الترخيـص بالاستـثمارDocumento30 páginasسلطات الضبط في مجال النشاطات المالية والطاقوية والشبكاتية ودورها في الترخيـص بالاستـثمارIlhem BelabbesAinda não há avaliações

- Advanced Accounting MCQ Part-IDocumento8 páginasAdvanced Accounting MCQ Part-ISavani KibeAinda não há avaliações

- International Business: Gaurav DawarDocumento22 páginasInternational Business: Gaurav Dawarsarathnair26Ainda não há avaliações

- Session 1 - Introduction To Islamic Banking & FinanceDocumento22 páginasSession 1 - Introduction To Islamic Banking & FinanceMohamed Abdi LikkeAinda não há avaliações

- Final Project Report of Summer Internship (VK)Documento56 páginasFinal Project Report of Summer Internship (VK)Vikas Kumar PatelAinda não há avaliações

- Test Bank For Financial Accounting Theory and Analysis Text and Cases 11th Edition Richard G Schroeder Myrtle W Clark Jack M Cathey DownloadDocumento11 páginasTest Bank For Financial Accounting Theory and Analysis Text and Cases 11th Edition Richard G Schroeder Myrtle W Clark Jack M Cathey Downloadbriannacochrankaoesqinxw100% (23)

- UNIBIC Foods India PVT LTDDocumento8 páginasUNIBIC Foods India PVT LTDkalimaniAinda não há avaliações

- Invoice Template Side TiltDocumento1 páginaInvoice Template Side TiltNAEEM MALIKAinda não há avaliações

- Chapter 5 - Fund Flow Statement (FFS)Documento36 páginasChapter 5 - Fund Flow Statement (FFS)T- SeriesAinda não há avaliações

- 2624 Saipem Sem 13 Ing FiDocumento116 páginas2624 Saipem Sem 13 Ing FiRoxana ComaneanuAinda não há avaliações

- ComputationDocumento4 páginasComputationIshita shahAinda não há avaliações

- OSD Siemens Case StudyDocumento15 páginasOSD Siemens Case StudyAnurag SatpathyAinda não há avaliações

- 9 2023 1 06 27 AmDocumento1 página9 2023 1 06 27 Amowei prosperAinda não há avaliações