Escolar Documentos

Profissional Documentos

Cultura Documentos

Alpha + Beta - It Just Makes Sense - (JPMorgan)

Enviado por

QuantDev-MTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Alpha + Beta - It Just Makes Sense - (JPMorgan)

Enviado por

QuantDev-MDireitos autorais:

Formatos disponíveis

FOR INSTITUTIONAL AND PROFESSIONAL INVESTOR USE ONLY | NOT FOR RETAIL USE OR DISTRIBUTION

INVESTMENT

INSIGHTS

January 2013

PORTFOLI O DI SCUSSI ON

Alpha + Beta

It just makes sense

The case for enhanced indexing

INVESTMENT

INSIGHTS

PLEASE VISIT

jpmorganinstitutional.com

for access to all of our Insights

publications.

The advantages of passive management, aka indexing, are well known and obvious.

Indexing is cheap, maintains the full risk diversification benefits derived from a plans

asset allocation decisions and holds few surprises beyond what the market delivers.

The disadvantages are also well known: One can do no better than the benchmark;

stock selections are determined by the index providers; and stock weights are deter-

mined by the market.

What if there was a way to potentially outperform the benchmark after fees and to

do so with a risk profile very similar to the benchmark? JPMorgan Research Enhanced

Index (REI) strategies are designed to offer just such a solution and have been

managed to meet that objective for over 25 years.

Actively managed to a passive risk profile

Besides being low cost and low relative risk (i.e., low tracking error), one of the

unsung benefits of passive management is that is does not override a clients asset

allocation decisionone of the greatest harms any manager can bring to a client

portfolio. Diversification, and the corresponding reduction in risk, is the bedrock

upon which asset allocation decisions are made. While active managers may be able

to outperform a given index, one always needs to assess the risk cost paid in terms

of the overall asset allocation.

Each of our enhanced index strategies is designed to outperform its respective bench-

mark and to do so with risk characteristics similar to that benchmark. Like an index

Piera Elisa Grassi

Global REI Client Portfolio Manager

pieraelisa.grassi@jpmorgan.com

Joshua Feuerman

Senior Equity Client Portfolio Manager

joshua.feuerman@jpmorgan.com

AUTHORS

IN BRIEF

JPMorgan Research Enhanced Index (REI) strategies are designed to consistently

outperform a given index after fees, while maintaining a risk prole closely

resembling that of the index.

REI strategies have been managed by J.P. Morgan Asset Management for over

25 years.

In-depth stock-specific insights from our global network of fundamental analysts,

leveraged by experienced and disciplined portfolio managers, create the

opportunity for enhanced returns.

Rigorous risk managementdesigned to maintain region, sector and style

neutrality and a high correlation with the benchmarkleaves investor portfolio

allocation strategies virtually undisturbed.

REI ofers an alternative to passive equity management (indexing) that, in our view,

just makes sense.

2 | Alpha + Beta It just makes sense: The case for enhanced indexing

PORTFOLIO DISCUSSION: Title Copy Here

INVESTMENT

INSIGHTS

Alpha + Beta It just makes sense

fund, our strategies are close to fully invested at all times, so

we do not engage in market timing. Our sector weights are

tightly controlled relative to the indexs sector weights and we

continually monitor our risk factor exposures relative to the

index. This rigorous risk management results in portfolios that

look like the index in terms of risk, yet are designed to offer

potential excess return. Additionally, our focus is on delivering

consistent outperformance which minimizes our active risk

(i.e., tracking error).

Exhibit 1 shows the correlation and performance of our REI

strategies relative to their respective indexes. All of our strate-

gies are highly correlated with their benchmarks, which results

in virtually the same diversification benefits one would receive

from an index fund. Additionally, our strategies have provided

consistent value added within a risk-controlled framework,

producing the information ratios (excess return per unit of

active risk) also shown below.

The long-term excess performance of our REI strategies is

attributable to the ability of our fundamental research analysts

to deliver in-depth, stock-specific investment insights and to our

portfolio managers who manage portfolios maximizing expo-

sure to our analysts insights while keeping a benchmark-like

skeleton (i.e., maintaining region, sector and style neutrality).

Our breadth of research coverage allows us to analyze almost

all of the names in most benchmarks, which is vital to being a

successful enhanced indexer. The stocks we find attractive we

overweight relative to their weight in the benchmark and we

underweight the unattractive stocks.

Correlation with

benchmark*

5-year

annualized net

excess return

Tracking

error

Information

ratio

Global REI 0.999 1.00 0.77 1.30

U.S. REI 0.998 1.09 0.78 1.40

EAFE REI 0.999 1.05 1.15 0.91

EXHIBIT 1: JPMORGAN REI STRATEGIES EXHIBIT HIGH CORRELATION TO

THEIR UNDERLYING INDEXES AND CONSISTENT EXCESS RETURNS

(5 YEARS ENDING 11/30/12)

Source: J.P. Morgan Investment Management.

* Benchmarks of reference: Global REIBenchmark changed from MSCI World

(NDR) to MSCI ACWII (NDR) on May 31, 2010; U.S. REIS&P 500; EAFE REI

MSCI EAFE.

Information advantage + rigorous active

risk budgeting

Our REI strategies leverage the expertise of our global

network of fundamental research analysts in New York,

London, Tokyo and Singapore. Our analysts insights are

captured via a disciplined valuation methodology, applied

consistently across regions and sectors. Risk control is an

integral part of our enhanced index investment methodology.

Our rigorous process allocates the active risk budget (or

tracking error) not to market timing or sector bets, but rather,

to stock selectionour information advantage. Enhanced

indexing equity portfolios hold a much larger number of

stocks than traditional active portfolios and active positions

are typically smaller. Our portfolios also benefit from near

symmetry in over/underweight positions; therefore, risk is

widely spread across the names in the portfolio. As seen in

Exhibit 1, we offer very high correlation with the benchmarks,

which helps us to maintain the diversification benefits our

clients seek.

The view from the efficient frontier

Combining these risk diversification benefits with our excess

returns results in the efficient frontiers depicted on the next

page. Exhibits 2A to 2C compare efficient frontiers using solely

index returns for both stocks and bonds (shown in orange) and

the corresponding efficient frontiers when our enhanced index

strategies are substituted for their respective index funds

(shown in blue). In each instance, the inclusion of our

enhanced index strategies raises the aggregate return with

only a small corresponding increase in the aggregate risk.

We believe this increase in risk is a small price to pay for the

increase in returns.

In each efficient frontier, we have marked the standard 60%

stocks/40% bonds allocation point for both the passive stock

allocation and our enhanced indexing strategy. Regardless of

the strategy, there is a significant improvement in return with

a minimal corresponding increase in risk.

J.P. Morgan Asset Management | 3

5.4

5.6

5.8

6.0

6.2

6.4

6.6

0.0 5.0 10.0 15.0 20.0

R

e

t

u

r

n

(

%

)

Standard deviation (%)

U.S. REI

S&P 500

60% S&P 500 Index/

40% U.S. Bonds

60% U.S. REI/

40% U.S. Bonds

100% U.S. REI

100% S&P 500

EXHIBIT 2B: U.S. REI VS. PASSIVE EQUITY INDEX

5.4

5.6

5.8

6.0

6.2

6.4

6.6

6.8

7.0

0.0 5.0 10.0 15.0 20.0

R

e

t

u

r

n

(

%

)

Standard deviation (%)

100% Global REI Global REI

MSCI ACWI

60% Global REI/

40% Global Bonds

100% MSCI ACWI

60% ACWI Index/

40% Global Bonds

5.0

5.5

6.0

6.5

7.0

7.5

7.0 12.0 17.0 22.0

EAFE REI

MSCI EAFE

60% EAFE REI/

40% Global Bonds ex-U.S.

R

e

t

u

r

n

(

%

)

Standard deviation (%)

100% EAFE REI

100% MSCI EAFE

60% EAFE Index/

40% Global Bonds ex-U.S.

EXHIBIT 2C: EAFE REI VS. PASSIVE EQUITY INDEX

Raising the efficient frontier with equity Research Enhanced

Investing (REI) versus passive equity indexes

EXHIBIT 2A: GLOBAL REI VS. PASSIVE EQUITY INDEX

Sources: J.P. Morgan Asset Management, MSCI, S&P and Barclays.

Gross of fees. Monthly Return periods for: Global REI vs. Passive = 10/01/2003

to 11/30/2012; U.S. REI vs. Passive = 06/30/2002 to 11/30/2012; and EAFE REI

vs. Passive = 06/30/2002 to 11/30/2012.

Experience suggestsit just makes sense

The American football player, Neon Deion Sanders once said,

If it dont make dollars, it dont make sense. This truism

holds for most profit seeking ventures including enhanced

indexing. If an active manager cannot enhance the indexs

return over time, above and beyond management fees, then it

does not make sense to hire the manager. Sometimes it is

easier to think of value added in terms of dollars added rather

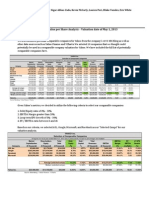

than in excess return space. Exhibit 3 (on the next page)

allows you to compute the potential value added you may

receive from shifting an allocation from a passive mandate to

an enhanced index mandate with J.P. Morgan Asset

Management. The exhibit shows the excess returns net of fees

for our U.S., Global and EAFE REI strategies, relative to their

respective indexes over the past 1-, 3- and 5-year periods, for

allocations ranging from $50 million to $500 million.

Regardless of the size of your allocation, there is an opportu-

nity to garner extra cash and, to paraphrase Deion Sanders,

that just makes sense.

Conclusions

Many clients and prospects are interested in boosting the

return component of their passive allocation without signifi-

cantly boosting the risk component. JPMorgan Research

Enhanced Index strategies have been helping clients achieve

this goal for over 25 years.

jpmorganinstitutional.com

FOR INSTITUTIONAL AND PROFESSIONAL INVESTOR USE ONLY | NOT FOR RETAIL USE OR DISTRIBUTION

PORTFOLIO DISCUSSION: Title Copy Here

INVESTMENT

INSIGHTS

Title (Regular 16/19)

PORTFOLIO DISCUSSION: Title Copy Here

INVESTMENT

INSIGHTS

Alpha + Beta It just makes sense

FOR INSTITUTIONAL AND PROFESSIONAL CLIENTS ONLY. NOT FOR RETAIL USE OR PUBLIC DISTRIBUTION.

This material is intended to report solely on the investment strategies and opportunities identied by J.P. Morgan Asset Management. Additional information is available upon

request. Information herein is believed to be reliable but J.P. Morgan Asset Management does not warrant its completeness or accuracy. Opinions and estimates constitute our

judgment and are subject to change without notice. The material is not intended as an ofer or solicitation for the purchase or sale of any nancial instrument. J.P. Morgan Asset

Management and/or its afliates and employees may hold a position or act as market maker in the nancial instruments of any issuer discussed herein or act as underwriter,

placement agent, advisor or lender to such issuer. The investments and strategies discussed herein may not be suitable for all investors; if you have any doubts you should

consult your J.P. Morgan Asset Management Client Adviser, Broker or Portfolio Manager. The material is not intended to provide, and should not be relied on for, accounting,

legal or tax advice, or investment recommendations. You should consult your tax or legal adviser about the issues discussed herein. The investments discussed may uctuate in

price or value. Investors may get back less than they invested. Changes in rates of exchange may have an adverse efect on the value, price or income of investments.

Diversication does not guarantee investment returns and does not eliminate the risk of loss.

Global Equity Risks: The strategy is subject to management risk and may not achieve its objective if the advisers expectations regarding particular securities or markets are not

met. The price of equity securities may rise or fall because of changes in the broad market or changes in a companys nancial condition, sometimes rapidly or unpredictably.

These price movements may result from factors afecting individual companies, sectors or industries selected for a portfolio or the securities market as a whole, such as

changes in economic or political conditions. When the value of a portfolios securities goes down, your investment will decreases in value. Investments in foreign issuers are

subject to additional risks, including political and economic risks, greater volatility, currency uctuations, higher transaction costs, delayed settlement, possible foreign controls

on investment, and less stringent investor protection and disclosure standards of foreign markets. These risks are magnied in countries in emerging markets. The manager

may use derivatives in connection with its investment strategies. Derivatives may be riskier than other types of investments because they may be more sensitive to changes in

economic or market conditions than other types of investments and could result in losses that signicantly exceed the strategys original investments. Certain derivatives may

give rise to a form of leverage. As a result, the strategy may be more volatile than if the strategy had not been leveraged because the leverage tends to exaggerate the efect

of any increase or decrease in the value of the portfolios securities. Derivatives are also subject to the risk that changes in the value of a derivative may not correlate perfectly

with the underlying asset, rate or index. The use of derivatives for hedging or risk management purposes or to increase income or gain may not be successful, resulting in

losses to a portfolio, and the cost of such strategies may reduce a portfolios returns. Derivatives would also expose a portfolio to the credit risk of the derivative counterparty.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and diferences in accounting and taxation policies outside

the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations. The Funds investments

in emerging markets could lead to more volatility in the value of the Fund. As mentioned above, the normal risks of investing in foreign countries are heightened when investing

in emerging markets. In addition, the small size of securities markets and the low trading volume may lead to a lack of liquidity, which leads to increased volatility. Also, emerging

markets may not provide adequate legal protection for private or foreign investment or private property.

The MSCI ACWI Index is a free oat-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging

markets. The MSCI EAFE (Europe, Australasia, Far East) Index is a free oat-adjusted market capitalization weighted index that is designed to measure the equity market

performance of developed markets, excluding the U.S. and Canada. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies

in the U.S. stock.

J.P. Morgan Institutional Investments Inc., placement agent, member FINRA/SIPC.

J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co. Those businesses include, but are not limited to,

J.P. Morgan Investment Management Inc., Security Capital Research & Management Incorporated and J.P. Morgan Alternative Asset Management, Inc.

270 Park Avenue, New York, NY 10017

2013 JPMorgan Chase & Co. | INSIGHTS_The case for enhanced indexing

Allocation to REI Product ($)

50,000,000 100,000,000 200,000,000 500,000,000

U.S. REI EXCESS RETURN NET OF FEES VS. S&P 500 (%)

1 Year 0.77 387,000 773,000 1,550,000 3,870,000

3 Year 0.32 160,000 321,000 642,000 1,600,000

5 Year 1.09 544,000 1,090,000 2,170,000 5,440,000

5-Year cumulative value added, net of fees 2,905,000 5,810,000 11,620,000 29,050,000

GLOBAL REI EXCESS RETURN NET OF FEES VS. MSCI ACWI (%)

1 Year 1.12 560,000 1,120,000 2,240,000 5,600,000

3 Year 0.76 380,000 760,000 1,520,000 3,800,000

5 Year 1.00 500,000 1,000,000 2,000,000 5,000,000

5-Year cumulative value added, net of fees 2,205,000 4,410,000 8,820,000 22,050,000

EAFE REI EXCESS RETURN NET OF FEES VS. MSCI EAFE (%)

1 Year 0.75 375,000 750,000 1,500,000 3,750,000

3 Year 0.91 455,000 910,000 1,820,000 4,550,000

5 Year 1.05 525,000 1,050,000 2,100,000 5,250,000

5-Year cumulative value added, net of fees 2,855,000 5,710,000 11,420,000 28,550,000

EXHIBIT 3: ANNUAL EXCESS VALUE ADDED FOR JPMORGAN REI STRATEGIES* (AS OF NOVEMBER 30, 2012)

Source: J.P. Morgan Investment Management.

* Annual excess value added, net of fees ($)

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- 2018 Eye On The Market Outlook - The Decline of Western Centralization - (J.P. Morgan Asset Management)Documento45 páginas2018 Eye On The Market Outlook - The Decline of Western Centralization - (J.P. Morgan Asset Management)QuantDev-MAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Ey 2015 Global Hedge Fund and Investor SurveyDocumento40 páginasEy 2015 Global Hedge Fund and Investor Surveydkishore28Ainda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Investing in Private Equity - (J.P. Morgan Asset Management)Documento6 páginasInvesting in Private Equity - (J.P. Morgan Asset Management)QuantDev-MAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Cisco Model DPC3941T DOCSIS 3.0 24x4 Wireless Residential Voice Gateway - User Guide - (Cisco)Documento80 páginasCisco Model DPC3941T DOCSIS 3.0 24x4 Wireless Residential Voice Gateway - User Guide - (Cisco)QuantDev-MAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- CleanSweep Red Team Report - August 2011 - (Sandia National Laboratories)Documento18 páginasCleanSweep Red Team Report - August 2011 - (Sandia National Laboratories)QuantDev-MAinda não há avaliações

- Cisco Model DPC3941B DOCSIS 3.0 24x4 Wireless Business Gateway - Data Sheet - (Cisco)Documento7 páginasCisco Model DPC3941B DOCSIS 3.0 24x4 Wireless Business Gateway - Data Sheet - (Cisco)QuantDev-MAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Democratization of Hedge Funds - (J.P. Morgan Asset Management)Documento4 páginasThe Democratization of Hedge Funds - (J.P. Morgan Asset Management)QuantDev-MAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- 2018 Long-Term Capital Market Assumptions - (J.P. Morgan Asset Management)Documento8 páginas2018 Long-Term Capital Market Assumptions - (J.P. Morgan Asset Management)QuantDev-MAinda não há avaliações

- Private Credit - Time To Consider Special Situations - (J.P. Morgan Asset Management)Documento4 páginasPrivate Credit - Time To Consider Special Situations - (J.P. Morgan Asset Management)QuantDev-MAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- Inside The Black Box - Revealing The Alternative Beta in Hedge Fund Returns - (J.P. Morgan Asset Management)Documento10 páginasInside The Black Box - Revealing The Alternative Beta in Hedge Fund Returns - (J.P. Morgan Asset Management)QuantDev-MAinda não há avaliações

- Memex DARPA BAA 14 21 February 4, 2014 (Defense Advanced Research Projects Agency)Documento42 páginasMemex DARPA BAA 14 21 February 4, 2014 (Defense Advanced Research Projects Agency)QuantDev-MAinda não há avaliações

- Private Equity - Addressing The Benchmarking Challenge - (J.P. Morgan Asset Management)Documento8 páginasPrivate Equity - Addressing The Benchmarking Challenge - (J.P. Morgan Asset Management)QuantDev-MAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Lecture 8 - Github and Contributing To Open Source - (CMU)Documento10 páginasLecture 8 - Github and Contributing To Open Source - (CMU)QuantDev-MAinda não há avaliações

- A Lawyer's View On Brexit - 5 February 2016 - (Allen & Overy LLP)Documento30 páginasA Lawyer's View On Brexit - 5 February 2016 - (Allen & Overy LLP)QuantDev-MAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- IPL Electronic Trading Training and Information Pack - December 2015 - (Instinet Pacific LTD.)Documento70 páginasIPL Electronic Trading Training and Information Pack - December 2015 - (Instinet Pacific LTD.)QuantDev-MAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Covert Channels Within Irc - (Air Force Institute of Technology)Documento112 páginasCovert Channels Within Irc - (Air Force Institute of Technology)QuantDev-MAinda não há avaliações

- Assessing The Attack Threat Due To IRC Channels - (University of Maryland, College Park)Documento6 páginasAssessing The Attack Threat Due To IRC Channels - (University of Maryland, College Park)QuantDev-MAinda não há avaliações

- Informed Trading Vol. 1 - Toward Informed Equity Trading - (Instinet, LLC)Documento6 páginasInformed Trading Vol. 1 - Toward Informed Equity Trading - (Instinet, LLC)QuantDev-MAinda não há avaliações

- BlockMatch Rulebook September 2015 (Instinet)Documento15 páginasBlockMatch Rulebook September 2015 (Instinet)QuantDev-MAinda não há avaliações

- Can A Highly Shorted ETF Collapse - 05 January 2011 - (CSFB)Documento4 páginasCan A Highly Shorted ETF Collapse - 05 January 2011 - (CSFB)QuantDev-MAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Hong Kong Electronic Trading Minimum Client Requirements ForDMA and Algorithms - December 2015 - (Instinet Pacific Limited)Documento4 páginasHong Kong Electronic Trading Minimum Client Requirements ForDMA and Algorithms - December 2015 - (Instinet Pacific Limited)QuantDev-MAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Appendix 17A - Some Useful Formulas of Financial Structure - (McGraw-Hill)Documento1 páginaAppendix 17A - Some Useful Formulas of Financial Structure - (McGraw-Hill)QuantDev-MAinda não há avaliações

- EFF's Guide To The Internet, V. 3.21 - Adam Gaffin - December 11, 1996 - (Minor Edit, June 13, 1999) - (Electronic Frontier Foundation)Documento157 páginasEFF's Guide To The Internet, V. 3.21 - Adam Gaffin - December 11, 1996 - (Minor Edit, June 13, 1999) - (Electronic Frontier Foundation)QuantDev-MAinda não há avaliações

- A Market Impact Model that WorksDocumento29 páginasA Market Impact Model that WorksQuantDev-MAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- A Closer Look at The Revised Lease Accounting Proposal - May 2013 - (EY)Documento7 páginasA Closer Look at The Revised Lease Accounting Proposal - May 2013 - (EY)QuantDev-MAinda não há avaliações

- General Computer Science Kevin Wayne Spring 2009 (Princeton University)Documento36 páginasGeneral Computer Science Kevin Wayne Spring 2009 (Princeton University)QuantDev-MAinda não há avaliações

- Appendix 17B - The Miller Model and The Graduated Income Tax - (McGraw-Hill)Documento3 páginasAppendix 17B - The Miller Model and The Graduated Income Tax - (McGraw-Hill)QuantDev-MAinda não há avaliações

- Asset Retirement Obligations Revised June 2011 (EY)Documento57 páginasAsset Retirement Obligations Revised June 2011 (EY)QuantDev-MAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Mock SFM Answer MarchDocumento12 páginasMock SFM Answer MarchMenuka SiwaAinda não há avaliações

- Yahoo! Inc. Valuation ProjectDocumento8 páginasYahoo! Inc. Valuation ProjectNigar_AbbasAinda não há avaliações

- Stock AnalysisDocumento5 páginasStock AnalysisArun Kumar GoyalAinda não há avaliações

- 8909 - Special LawsDocumento30 páginas8909 - Special LawsElaine Joyce GarciaAinda não há avaliações

- NR7 Forex Trading StrategyDocumento5 páginasNR7 Forex Trading Strategyrachad5100% (1)

- Lampiran II Fintech Ilegal SP 31 Oktober 2019 PDFDocumento29 páginasLampiran II Fintech Ilegal SP 31 Oktober 2019 PDFHendraBorneoAinda não há avaliações

- Actuary - India - November - 2010Documento28 páginasActuary - India - November - 2010varunsingh279Ainda não há avaliações

- Strategy Name Number of Option Legs Direction: Short Straddle 2 Market NeutralDocumento4 páginasStrategy Name Number of Option Legs Direction: Short Straddle 2 Market NeutralGupta JeeAinda não há avaliações

- Binomial Option Pricing ModelDocumento12 páginasBinomial Option Pricing Modelmiku hrshAinda não há avaliações

- Capital Structure TheoriesDocumento17 páginasCapital Structure Theoriesvijayjeo100% (1)

- LTCM Final PresentationDocumento16 páginasLTCM Final PresentationAtul JainAinda não há avaliações

- Question 1Documento11 páginasQuestion 1Jason StevetimmyAinda não há avaliações

- TIME: 2!110VJR: 4. E Uit ShareholdersDocumento10 páginasTIME: 2!110VJR: 4. E Uit ShareholdersAditi VengurlekarAinda não há avaliações

- CMPT 16103Documento289 páginasCMPT 16103Pratheesh KurupAinda não há avaliações

- My MPRDocumento58 páginasMy MPRVasundhara BansalAinda não há avaliações

- Indian Capital MarketsDocumento122 páginasIndian Capital MarketsVivek100% (4)

- The Great American Bubble Machine PDFDocumento12 páginasThe Great American Bubble Machine PDFPaul MayAinda não há avaliações

- Libor Euribor Prime RatesDocumento16 páginasLibor Euribor Prime RatessabbathmailerAinda não há avaliações

- Tau Fu Fa PresentationDocumento9 páginasTau Fu Fa PresentationTanusia ArumugamAinda não há avaliações

- Stock ExchangeDocumento43 páginasStock ExchangeGaurav JindalAinda não há avaliações

- CFA Study PrepDocumento5 páginasCFA Study Prepsiddhant jenaAinda não há avaliações

- 3M India Share Price, Financials and Stock AnalysisDocumento9 páginas3M India Share Price, Financials and Stock AnalysisGaganAinda não há avaliações

- Course Outline.Documento2 páginasCourse Outline.Oumer ShaffiAinda não há avaliações

- 5 Powerful Bearish Candlestick Patterns: Technical AnalysisDocumento18 páginas5 Powerful Bearish Candlestick Patterns: Technical Analysiswolf1Ainda não há avaliações

- Module-3 IFSS-NoteDocumento29 páginasModule-3 IFSS-NoteAbhisekAinda não há avaliações

- BDL Management Trainee FinanceDocumento31 páginasBDL Management Trainee FinanceravinderAinda não há avaliações

- Technical Analysis Guide: Trends, Indicators & Trading RulesDocumento13 páginasTechnical Analysis Guide: Trends, Indicators & Trading RulesmahrukhAinda não há avaliações

- Indian Accounting Standard (Ind AS) 32 Financial Instruments: PresentationDocumento12 páginasIndian Accounting Standard (Ind AS) 32 Financial Instruments: PresentationGnana PrasunaAinda não há avaliações

- DAO Maker WhitepaperDocumento48 páginasDAO Maker WhitepaperYusanYPAinda não há avaliações

- Convenience Yields and Risk Premium in The EU ETSDocumento28 páginasConvenience Yields and Risk Premium in The EU ETSLorenzoAinda não há avaliações

- Value: The Four Cornerstones of Corporate FinanceNo EverandValue: The Four Cornerstones of Corporate FinanceNota: 4.5 de 5 estrelas4.5/5 (18)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- Joy of Agility: How to Solve Problems and Succeed SoonerNo EverandJoy of Agility: How to Solve Problems and Succeed SoonerNota: 4 de 5 estrelas4/5 (1)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000No EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Nota: 4.5 de 5 estrelas4.5/5 (86)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)