Escolar Documentos

Profissional Documentos

Cultura Documentos

GOMSNO30

Enviado por

Syed IrfanuddinDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

GOMSNO30

Enviado por

Syed IrfanuddinDireitos autorais:

Formatos disponíveis

GOVERNMENT OF ANDHRA PRADESH

ABSTRACT

MINORITIES WELFARE DEPARTMENT A.P. STATE MINORITIES

FINANCE CORPN. Ltd. Hyderabad Schemes Revised guidelines

Issued.

MINORITIES WELFARE (MFC) DEPARTMENT

G.O.Ms.No. 30 Dated:23.07.2008.

Read the following:

1. Minutes of the review meeting held by the

Honble Chief Minister on 12.03.2008.

2. From the Vice Chairman/Managing Director,

A.P. State Minorities Finance Corpn. Ltd. Hyd.

Lr. No.1309/APSMFC/Loans/08, Dated 25.4.2008.

*****

ORDER:

In the meeting held on 12.03.2008 by the Honble Chief

Minister, it has been decided that, from financial year 2008-09, the

Corporation shall not implement any schemes of financial assistance

with loan component. All the schemes shall have only Subsidy

component from the Corporations with bank credited linkage. The

benefit of Pavala Vaddi scheme as applicable to Women Self Help

Groups shall be extended to the beneficiaries of the A.P. STATE

MINORITIES FINANCE CORPN. Ltd. Hyderabad.

2. The Vice Chairman/Managing Director, A.P. State

Minorities Finance Corpn. Ltd. Hyderabad vide letter 2

nd

read above,

has submitted proposals accordingly for restructuring the funding

pattern of the following schemes:

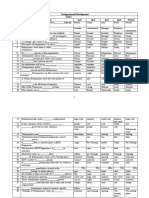

1. Economic Assistance (Bankable Scheme)

2. Micro Credit to Self Help Groups

3. Minority Artisans Development Scheme in Clusters

4. Interest Subsidy Scheme.

3. Government, after careful examination hereby approve the

restructuring the funding pattern of the schemes mentioned in para 2

above being implemented by the A.P. State

Minorities Finance Corpn. Ltd. Hyderabad from the year 2008-09

onwards as detailed below:

1) Subsidy of 50% unit cost subject to upper ceiling of

Rs.30,000/- per beneficiary.

2) 10% of the unit cost as beneficiary contribution.

3) 40% unit cost as Bank Loan.

4. The revised guidelines for implementation of the schemes

mentioned in para 2 above from the year 2008-09 are appended to

this order.

PT.O.

:: 2 ::

5. The Vice Chairman/Managing Director, A.P. State

Minorities Finance Corpn. Ltd. Hyd. shall take necessary action

accordingly.

(BY ORDER AND IN THE NAME OF THE GOVERNOR OF ANDHRA PRADESH)

LINGRAJ PANIGRAHI

PRINCIPAL SECRETARY TO GOVERNMENT

To

The Vice Chairman/Managing Director, A.P. State Minorities Finance

Corpn. Ltd. Hyderabad.

Copy to Finance (Expr.SW) Dept.

Copy to PS to Prl. Secretary to CM.

Copy to PS to Minister (E.C. & MW)

Copy to SF/SC.

//FORWARDED :: BY ORDER//

SECTION OFFICER

ANNEXURE

(G.O.Ms.No. 30 , MW (MFC) Dept. Dated:23.07.2008.)

ECONOMIC ASSISTANCE (BANKABLE) SCHEME

1. INTRODUCTION:

People belonging to notified Minority Communities either individuals or

groups whose annual income from all sources is below Rs.50,000/- are

eligible for financial assistance under the scheme. The applicants should

produce Caste, Income and nativity Certificates at the time of the selection

itself. Employees and students are not eligible for the financial assistance

under the scheme. Activities under Agriculture Allied Activities, Industries,

Small Business Service, Transport Sectors etc., will be taken up with this

financial assistance. The scheme will be implemented through individual

activity.

2. Objectives:

The broad objectives in implementation of Individual Assistance

Programme is to enable easy access for credit flow among the weaker

section of minorities at cheaper rate of interest for Bank share of loans to

establish any viable self-employment unit and to identify entrepreneurial

capabilities among minorities and facilitate them to emerge as successful

entrepreneurs in the society.

3. Eligibility for Assistance:

i) Beneficiary should belongs to Minority community

ii) Age between 18 to 55 years

iii) Annual family income below Rs.50,000/-

4. Pattern of Assistance:

The financial assistance from the A.P. State Minorities Finance

Corporation Ltd., by way of subsidy would be linked to the credit

component of Banks. The revised pattern of assistance will be:

i) Subsidy from Corporation 50% of unit cost subject to upper ceiling of

Rs.30,000/-

ii) Beneficiary Contribution 10%

iii) Bank Loan 40%

5. Repayment of Bank Loan:

Bank loan will be given at the existing priority sector lending interest

rates and will be recovered over a period of 3 years without

any moratorium.

6. Interest Subsidy (Pavala Vaddi) :

However, the Pavala Vaddi as applicable to women Self help Groups

shall be extended by the Minorities Finance Corporation to the Minority

beneficiaries under the Individual Loan scheme, in order to ensure fiscal

discipline and prompt repayment by the beneficiary.

7. Selection Process:

The Executive Directors must explain this position to the bankers and

the beneficiaries in the beneficiary identification camps, so that bankers

give consent to sanction required amount of bank loan portion. The

identification of the beneficiaries will be done at Mandal level by the team

of Officers with Mandal Parishad Development Officer as leader and

MCRDO, Banker and any genuine NGO if available as members using the

method of counseling. For identification of individual beneficiaries, the

counseling for selection will be conducted in the main village of service

area branch at the rate of not less than one Grama Sabha per Bank. A

resolution to this effect will be passed in the DCC meeting and the

:: 2 ::

schedule of identification will be given wide publicity by way of beat of

Tom Tom, press release and circular to Gram Panchayats and Mandal

Praja Parishads. The District collector & Chairman will be responsible for

the implementation of the scheme at the District level. The V.C. &

Managing Director, A.P. State Minorities Finance Corporation Ltd.,

Hyderabad and Convener, State Level Bankers Committee will monitor

the scheme at the state level.

8. Constitution of Selection of sanction Committee:

A Committee is constituted at the District Level to scrutinize the

selections made at Mandal level and finalize the list of selected

beneficiaries. The committee consisting of the District Collector as

Chairman will have the following officers as members:

1. Project Director , DRDA

2. Lead District Manager

3. Executive Director, APSMFC

9. Documentation:

The Executive Director should complete the requisite

documentations for release of subsidy.

10. Operational Guidelines:

Bank loan will be given at the existing priority sector lending

interest rates and will be recovered over a period of 3 years without any

moratorium. However, the A.P. State Minorities Finance Corporation shall

extend Pavala Vaddi as applicable to women Self Help Groups to the

Minority beneficiaries under the scheme.

11.Criteria for selection:

i) Prospective eligible minorities must be identified in the districts for

implementation of schemes

ii) Preference must be give to women particularly Widows, Divorces or

Destitute etc.

iii) Those possessing technical qualification or considerable experience in

the technical line must be preferred.

iv) Un-employed candidates must be given preference.

v) Potential and educated un-employed candidates may also be given

weightage

12. Grounding & Follow up action:

i) Proper follow-up in grounding of scheme after the release of

the subsidy to the bank.

ii) Inspection of the Unit

13. Submission of Utilization.

Every quarter the Utilization certificate along with the details of the

beneficiary should be furnished to the Head Office.

MICRO CREDIT TO SELF HELP GROUPS

1. INTRODUCTION :

To uplift Minority Women in urban and rural areas and to provide

income generating activities for becoming self employable, the Andhra

Pradesh State Minorities Finance Corporation has taken up the scheme of

Micro Credit to Self Help Groups on the lines of Velugu. These Self Help

:: 3 ::

Groups were initially provided Revolving fund and then Micro Credit based on

the credit rating after 6 months from the date of release of Revolving fund.

2. OBJECTIVE :

To reach the poorest of the poor among the targeted beneficiaries,

specially the Women who are unable to meet their small credit needs besides

matching grant the corporation is providing financial assistance by way of

Micro credit to make the group members self reliance and to improve their

financial conditions successfully.

While continuing the programmes of Economic Assistance Programme

(Bankable), the corporation is extending MICRO CREDIT SCHEME through

Banks to provide an additional dimension in the efforts of the corporation to

uplift the poor and downtrodden Minority Women. Under this scheme Micro

Credit will be provided to the target groups for income generating economic

activities. Micro Credit help in earning additional income by way of petty

business and quick rotation of revolving fund. Micro Credit also helps the

poor people to liberate from the clutches of money lenders who charge

exorbitant interest rates on small borrowings.

3. NATURE OF ASSISTANCE:

i) Initially in the first phase Micro Credit of Rs.10,000/- to each member

of the group who is found to be eligible and is having viable economic activity

and is capable of repayment of loan to the bank will only be considered.

ii) In the 2

nd

phase group will be eligible for further credit facility of

Rs.20,000/- to each member (i.e. double the earlier loan) subject to regular

& full payment of loan to the banks availed earlier and subsequently upto a

maximum of Rs.30,000 to each member subject to regular and full payment

of loan to the bank availed earlier.

4. COVERAGE :

Micro Credit to Self Help Groups will be implemented throughout the

state.

5. ELIGIBILITY FOR ASSISTANCE:

1. Minority women and must be a member in Self Help Group.

2. Self Help Groups having availed Revolving Fund from DRDA and

Municipalities are also eligible after (6) months of availment of

Revolving Fund.

3. Homogenous (Minority) groups are eligible for availing Micro

Credit from APSMFC.

4. Heterogeneous Groups (Mixed Groups) in which 80% minorities & 20%

belonging to SC, ST, BC and other OBCs are also eligible for Micro Credit.

5. Senior SHGs i.e. (2) years above groups who have not availed

revolving fund from any Government Agency are also eligible

for Micro Credit.

6. Annual Income for Minority families should be below Rs.50,000 per

annum.

Note: Self Help Groups who are having accounts in Mutually Aided Co-

Operative Societies (MACS) successfully operating are also eligible

for Micro Credit Loan subject to their operation in accordance to

the MACs. Act.

6. PATTERN OF ASSISTANCE:

i) Corporation subsidy @ 50% of the loan amount.

:: 4 ::

ii) Group savings @ 10% Total Loan

iii) Bank Share @ 40% Total Loan

7. REPAYMENT OF BANK LOAN:

Bank loan will be given at the existing priority sector lending

interest rates and will be recovered over a period of 3 years without any

moratorium.

8. INTEREST SUBSIDY (PAVALA VADDI) :

However, the Pavala Vaddi as applicable to women Self help Groups

shall be extended by the Minorities Finance Corporation to the

Minority beneficiaries under the scheme, in order to ensure fiscal

discipline and prompt repayment by the beneficiary.

9. SELECTION PROCESS :

The eligible Minority women of SHGs should approach the

E.D.APSMFC. for financial assistance . The E.D. after receipt of proposals

should place it before Selection Committee consisting of one

representative of District Collector/Chairman, P.D. DRDA or his nominee,

Banker, DMWO & E.D. APSMFC and the selection shall be made as per

the Critical Rating Index.

10. DOCUMENTATION:

To release subsidy appropriate document need to be executed duly

affixing the requisite value of stamps if any.

11. GROUNDING & FOLLOW UP ACTION:

After approval by District Selection committee, the E.D. APSMFC

should complete appropriate documentation & release the subsidy to the

bank who has accorded sanction and where the

group is having its account within 15 days under intimation to the group

member.

12. .SUBMISSION OF UTILIZATION:

Every quarter the Utilization certificate along with the details of the

beneficiary should be furnished to the Head Office.

MINORITY ARTISANS DEVELOPMENT SCHEME IN CLUSTERS:

(MADSC)

1. Introduction:

Minorities on account of low literacy rate are generally engaged in

servicing, technical trades (traditional or Modern) in order to eke out their

livelihood day after day. To name a few cluster based minority artisans

are Tailoring and Embroidery, Weaving, Goldsmithing, Blacksmithing,

Carpentry, Woodcarving, Two, Three & Four Wheeler Servicing and any

other cluster based handicrafts., The Minority Artisan are generally

engaged in these trades or still using their primitive tools and work

method due to not much vocational skills/ training. As a result the

business as a whole leads to low level of productivity and income

generation.

In order to ameliorate the working conditions of the minority artisans

working in a cluster approach the corporation designed Minority Artisans

Development Scheme in Clusters.

2. Objective:

The Primary objective of MADSC are:

:: 5 ::

i) To increase productivity level

ii) Minimum use of drudgery

iii) Improvement of product/service quality

iv) Increase of income generation level

v) Modernization of equipment operation.

vi) Increase of competitive abilities among minorities

3. Nature of Assistance:

MADSC essentially focus and targets on providing improved tool kits and

small equipments to Minority Artisans engaged in cluster approaches.

4. Coverage:

MADSC will be implemented in all the Mandals of the district wherever

Minority Artisans Cluster exists.

5. Eligibility for assistance:

i) They should belongs to Minority community

ii) Beneficiary should be a practicing Minority Artisan in the cluster

iii) Age limit between 18 to 55 years

iv) Minority families having annual income below Rs.50,000/- per annum

6. Pattern of Assistance :

i) Maximum Unit cost allowed is Rs. 60,000 /- per beneficiary

depending on actual requirement

ii) Corporation subsidy at 50% of the unit cost subject to a

maximum of Rs.30,000/- per beneficiary.

iii) 10% Beneficiary contribution

iv) Bank Share 40%

7. Repayment of Bank Loan:

Bank loan will be given at the existing priority sector lending interest

rates and will be recovered over a period of 3 years without any

moratorium.

8. Interest subsidy (Pavala vaddi) :

However, the Pavala Vaddi as applicable to women Self help Groups

shall be extended by the Minorities Finance Corporation to the Minority

beneficiaries under the scheme, in order to ensure fiscal discipline and

prompt repayment by the beneficiary

9. Selection Process:

The Beneficiaries are required to obtain or download the application

form for submission to the concerned district offices, which in turn will

forward to the bank branches depending on the areas where the

unit/residence of the beneficiaries are located. The Bank after processing

the loan application form depending on the eligibility criteria will accord

sanction of loan to the beneficiary through sanction letter. On receipt of

bank sanction letter, the beneficiary concerned will complete the process

of Documentation for release of subsidy. After this process the subsidy

will be released to the concerned bank branch for final disbursement of

the loan to the beneficiary.

:: 6 ::

10. Documentation:

To release subsidy appropriate document need to be executed duly

affixing the requisite value of stamps if any.

11.Grounding & Follow-up action:

After 15 days the Executive Director should ensure the proper

utilization of loan by the beneficiary for the purpose for which it was

sanctioned and released. He should also verify assets and take

photograph of the unit along with beneficiary in working posture. The

Executive Director should furnish a quarterly report on subsidy and loan

released and sanctioned under MADSC to Head Office.

12. Submission of Utilization:

Every quarter the Utilization certificate along with the details of the

beneficiary should be furnished to the Head Office.

INTEREST SUBSIDY SCHEME

The Government of Andhra Pradesh has decided to restructure

the system of financial assistance schemes, of the Corporation including the

loans provided in collaboration with banks. The new systems envisage

providing of subsidy component only from the year 2008-09 on wards.

The Government decided to provide interest subsidy to the Minorities for

the financial assistance availed from the banks under all schemes of the Corporation. The

Scheme will be extended to Minorities who are prompt in their repayment of loan availed

from the banks. The interest subsidy will be released to the account of the beneficiaries

upon conformation from the banks by way of loan clearance certificate, informing

the beneficiary is regular in repayment of loan.

OBJECTIVE:- To encourage the beneficiaries for prompt payment of loan

installments to the banks and to reduce their interest burden the interest

subsidy is being provided by subsidizing the interest over and above 3%

charged by the bank.

APPLICABILITY:- The scheme shall be applicable for all loans availed from

the Corporation in collaboration with banks w.e.f. 01-04-2008.

SPREAD OF INTEREST SUBSIDY:- Usually all financial institutions (Banks)

charge interest ranging from 12% to 17% depending on the quantum of loan

availed by the beneficiary under the scheme the beneficiary is expected bear

only 3% the difference in interest rate would be paid by the Corporation as

Incentive to the beneficiary for Prompt Payment.

MODE OF PAYMENT:- The beneficiary should pay the loan installments in

time along with interest charged by the banker, the beneficiary would be

reimbursed the excess interest over and above 3% paid by him to the bank

directly by the Corporation to the account of the beneficiary.

The loan amounts of individual Beneficiaries / Groups which are

classified as overdue in the books of the banks at the time of half year

closing and which are classified as non-performing assets at year end closing

are not eligible on interest subsidy.

However, if they resume on time payments and regularize

arrears they are eligible for the interest-subsidy.

OPERATING MECHANISM:- The Individual Beneficiary / Group on prompt

repayment of loan installments to the banks in stipulated time should obtain

:: 7 ::

a certificate from the bank concerned, stating that the total loan has been

repaid in stipulated time, the rate of Interest charged and the total amount

recovered towards interest.

The beneficiary after receipt of loan clearance certificate from

the bank should apply in a prescribed format directly to the Executive

Director or on-line for reimbursement of eligible interest subsidy.

The Executive Director on receipt of interest subsidy application

along with certificate of loan clearance from the bank on-line should process

and release interest subsidy directly to the account of the beneficiaries on-

line with in (15 days) from the date of registration of the application and

send intimation to the beneficiary accordingly.

PROCEDURE FOR RELEASE OF FUNDS:- Funds under interest subsidy

scheme will be released to the branch offices on quarterly basis by the Head

Office. Depending on utilization and submission of U.C certified by internal

auditors funds for subsequent quarters shall be released.

ACCOUNTING:- The Executive Director should furnish U.C on quarterly

basis i.e. the four time in a year as on July 15

th

, October 15

th

, January 15

th

and April 15

th

every year along with certification of internal auditors.

LINGRAJ PANIGRAHI

PRINCIPAL SECRETARY TO GOVERNMENT

//FORWARDED :: BY ORDER//

SECTION OFFICER

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- 3D Piping Model Reviews ProcedureDocumento7 páginas3D Piping Model Reviews ProcedureSyed IrfanuddinAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Shellmax 4 PgsDocumento4 páginasShellmax 4 PgsSyed IrfanuddinAinda não há avaliações

- Process Plant Piping OverviewDocumento133 páginasProcess Plant Piping Overviewskdalalsin100% (8)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Data Sheet Width Flange BeamDocumento32 páginasData Sheet Width Flange BeamIrvan IskandarAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Structural SteelDocumento4 páginasStructural SteelSyed IrfanuddinAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Industrial InsulationDocumento9 páginasIndustrial Insulationahad_shiraziAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Pipe Chart PDFDocumento2 páginasPipe Chart PDFCarlos Rivera0% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- RT340Documento2 páginasRT340Syed IrfanuddinAinda não há avaliações

- Societies ActDocumento12 páginasSocieties ActSyed IrfanuddinAinda não há avaliações

- Hyderabad:: - Self Employment Programme - Name of The DistrictDocumento4 páginasHyderabad:: - Self Employment Programme - Name of The DistrictSyed IrfanuddinAinda não há avaliações

- RT340Documento2 páginasRT340Syed IrfanuddinAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- SocieityDocumento2 páginasSocieityrajugs_lgAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Society Registration FormsDocumento7 páginasSociety Registration FormsSrikanth KakarapartyAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Schedule of Fees As Per Societies Registration Act (G.O.Ms - No. 475 Revenue (Regn-II) Dept, DT 25.7.12Documento1 páginaSchedule of Fees As Per Societies Registration Act (G.O.Ms - No. 475 Revenue (Regn-II) Dept, DT 25.7.12Syed IrfanuddinAinda não há avaliações

- Piping Stress AnalysisDocumento51 páginasPiping Stress Analysissandygo100% (4)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- 5.piping Dynamic Stress AnalysisDocumento3 páginas5.piping Dynamic Stress AnalysisSyed IrfanuddinAinda não há avaliações

- Elson ResumeDocumento7 páginasElson ResumeSyed IrfanuddinAinda não há avaliações

- Society FAQDocumento5 páginasSociety FAQSyed IrfanuddinAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Frequently Asked Questions-Trust DeedsDocumento1 páginaFrequently Asked Questions-Trust DeedsSyed IrfanuddinAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Prince2 2009 Process ModelDocumento2 páginasPrince2 2009 Process ModelVinod NairAinda não há avaliações

- Design Handbook MAchine DesignDocumento5 páginasDesign Handbook MAchine DesignsouravAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Edat Steel Works Div.Documento14 páginasEdat Steel Works Div.Syed IrfanuddinAinda não há avaliações

- Trenchless Portions in Contract Packages # 6 & 7Documento2 páginasTrenchless Portions in Contract Packages # 6 & 7Syed IrfanuddinAinda não há avaliações

- Ajmer & Pushkar Water Supply Project TECHDocumento164 páginasAjmer & Pushkar Water Supply Project TECHSyed IrfanuddinAinda não há avaliações

- AP SG PresentationDocumento49 páginasAP SG PresentationSyed IrfanuddinAinda não há avaliações

- Ajmer & Pushkar Water Supply Project TECHDocumento164 páginasAjmer & Pushkar Water Supply Project TECHSyed IrfanuddinAinda não há avaliações

- Process Piping Design & Engineering Per ASME B 31.3Documento16 páginasProcess Piping Design & Engineering Per ASME B 31.3naveenbaskaran1989Ainda não há avaliações

- Structure CPDocumento31 páginasStructure CPPerkresht PawarAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- CPVC CTS Products Design and Installation ManualDocumento16 páginasCPVC CTS Products Design and Installation ManualAnonymous MVHQ97KEoPAinda não há avaliações

- Tri-City Times: New Manager Ready To Embrace ChallengesDocumento20 páginasTri-City Times: New Manager Ready To Embrace ChallengesWoodsAinda não há avaliações

- A Community For All: Looking at Our Common Caribbean Information HeritageDocumento3 páginasA Community For All: Looking at Our Common Caribbean Information HeritageEmerson O. St. G. BryanAinda não há avaliações

- 2011 CIVITAS Benefit JournalDocumento40 páginas2011 CIVITAS Benefit JournalCIVITASAinda não há avaliações

- Arvind Fashions Limited Annual Report For FY-2020 2021 CompressedDocumento257 páginasArvind Fashions Limited Annual Report For FY-2020 2021 CompressedUDIT GUPTAAinda não há avaliações

- Book Building: IPO Price Discovery MechanismDocumento35 páginasBook Building: IPO Price Discovery MechanismDevyansh GuptaAinda não há avaliações

- Wind River Energy Employment Terms and ConditionsDocumento2 páginasWind River Energy Employment Terms and ConditionsyogeshAinda não há avaliações

- Split Payment Cervantes, Edlene B. 01-04-11Documento1 páginaSplit Payment Cervantes, Edlene B. 01-04-11Ervin Joseph Bato CervantesAinda não há avaliações

- Julius Caesar - Gallic War Bilingual - 10 First PagesDocumento12 páginasJulius Caesar - Gallic War Bilingual - 10 First PagesTyrex: Psychedelics & Self-improvementAinda não há avaliações

- EssayDocumento3 páginasEssayapi-358785865100% (3)

- Nampicuan, Nueva EcijaDocumento2 páginasNampicuan, Nueva EcijaSunStar Philippine NewsAinda não há avaliações

- HSN Table 12 10 22 Advisory NewDocumento2 páginasHSN Table 12 10 22 Advisory NewAmanAinda não há avaliações

- Interconnect 2017 2110: What'S New in Ibm Integration Bus?: Ben Thompson Iib Chief ArchitectDocumento30 páginasInterconnect 2017 2110: What'S New in Ibm Integration Bus?: Ben Thompson Iib Chief Architectsansajjan9604Ainda não há avaliações

- Chapter 1Documento25 páginasChapter 1Annie Basing-at AngiwotAinda não há avaliações

- Lesson 4the Retraction Controversy of RizalDocumento4 páginasLesson 4the Retraction Controversy of RizalJayrico ArguellesAinda não há avaliações

- Exclusion Clause AnswerDocumento4 páginasExclusion Clause AnswerGROWAinda não há avaliações

- Yanmar 3TNV88XMS 3TNV88XMS2 4TNV88XMS 4TNV88XMS2 Engines: Engine Parts ManualDocumento52 páginasYanmar 3TNV88XMS 3TNV88XMS2 4TNV88XMS 4TNV88XMS2 Engines: Engine Parts Manualshajesh100% (1)

- SW Agreement-Edited No AddressDocumento6 páginasSW Agreement-Edited No AddressAyu AdamAinda não há avaliações

- Setting Up Ansys Discovery and SpaceClaimDocumento2 páginasSetting Up Ansys Discovery and SpaceClaimLeopoldo Rojas RochaAinda não há avaliações

- NSF International / Nonfood Compounds Registration ProgramDocumento1 páginaNSF International / Nonfood Compounds Registration ProgramMichaelAinda não há avaliações

- Present: City Vice Mayor (Presiding Officer) Regular MembersDocumento27 páginasPresent: City Vice Mayor (Presiding Officer) Regular MembersDC SAinda não há avaliações

- Cdi 4 Organized Crime 2020 Covid ADocumento66 páginasCdi 4 Organized Crime 2020 Covid AVj Lentejas IIIAinda não há avaliações

- Philippine Laws On WomenDocumento56 páginasPhilippine Laws On WomenElle BanigoosAinda não há avaliações

- Hall 14 FOC Indemnity FormDocumento4 páginasHall 14 FOC Indemnity FormXIVfocAinda não há avaliações

- Unit - I - MCQDocumento3 páginasUnit - I - MCQDrSankar CAinda não há avaliações

- Ang vs. TeodoroDocumento2 páginasAng vs. TeodoroDonna DumaliangAinda não há avaliações

- Quick NSR FormatDocumento2 páginasQuick NSR FormatRossking GarciaAinda não há avaliações

- Obejera vs. Iga Sy DigestDocumento2 páginasObejera vs. Iga Sy DigestFairyssa Bianca Sagot100% (5)

- Consent To TreatmentDocumento37 páginasConsent To TreatmentinriantoAinda não há avaliações

- Cruz v. IAC DigestDocumento1 páginaCruz v. IAC DigestFrancis GuinooAinda não há avaliações

- NISM Series IX Merchant Banking Workbook February 2019 PDFDocumento211 páginasNISM Series IX Merchant Banking Workbook February 2019 PDFBiswajit SarmaAinda não há avaliações

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsAinda não há avaliações

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersNo EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersNota: 5 de 5 estrelas5/5 (1)