Escolar Documentos

Profissional Documentos

Cultura Documentos

John Ireland Affidavit

Enviado por

Fortune0 notas0% acharam este documento útil (0 voto)

95 visualizações11 páginasJohn Ireland Affidavit in Crumbs bankruptcy

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoJohn Ireland Affidavit in Crumbs bankruptcy

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

95 visualizações11 páginasJohn Ireland Affidavit

Enviado por

FortuneJohn Ireland Affidavit in Crumbs bankruptcy

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 11

52486/0001-10107478v6

COLE, SCHOTZ, MEISEL,

FORMAN & LEONARD, P.A.

A Professional Corporation

Court Plaza North

25 Main Street

P.O. Box 800

Hackensack, New J ersey 07602-0800

Michael D. Sirota, Esq.

David M. Bass, Esq.

Felice R. Yudkin, Esq.

(201) 489-3000

(201) 489-1536 Facsimile

Proposed Attorneys for Crumbs Bake Shop, Inc., et al.,

Debtors-in-Possession

In re:

CRUMBS BAKE SHOP, INC., et al.,

1

Debtors-in-Possession.

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF NEW J ERSEY

CASE NO. 14-

Chapter 11

(J oint Administration Pending)

AFFIDAVIT OF JOHN D. IRELAND IN CONNECTION

WITH THE DEBTORS CHAPTER 11 CASES

STATE OF MARYLAND )

)SS.

COUNTY OF TALBOT )

J OHN D. IRELAND, of full age, being duly sworn according to law, upon his oath,

deposes and states:

1. On the date hereof (the Filing Date), Crumbs Bake Shop, Inc. et al., as debtors

and debtors-in-possession herein (collectively, the Company or the Debtors), each

commenced in this Court a case under Chapter 11 of title 11 of the United States Code,

1

The Debtors in these Chapter 11 cases, along with the last four digits of each Debtors tax identification number are: Crumbs Bake Shop, Inc.

(5274); Crumbs Holdings LLC (8045); Crumbs 42

nd

Street II, LLC (5913); Crumbs Broad Street, LLC (5319); Crumbs Broadway LLC (2653);

Crumbs Federal Street, LLC (9870); Crumbs Garment Center LLC (5142); Crumbs Grand Central LLC (5030); Crumbs Greenvale LLC (6562);

Crumbs Greenwich, LLC (3097); Crumbs Hoboken, LLC (5808); Crumbs II, LLC (5633); Crumbs Larchmont, LLC (8460); Crumbs Lexington

LLC (0286); Crumbs Park Avenue LLC (5273); Crumbs Retail Bake Shops, LLC (f/k/a Crumbs Fulton Street, LLC) (0930); Crumbs Stamford,

LLC (8692); Crumbs Third Avenue LLC (6756); Crumbs Times Square LLC (1449); Crumbs Union Square LLC (8629); Crumbs Union Station

LLC (6968); Crumbs West Madison, LLC (5017); Crumbs Woodbury LLC (2588)

2

52486/0001-10107478v6

11 U.S.C. 101-1532, as amended (the Bankruptcy Code). I am the Chief Financial Officer

of Crumbs Bake Shop, Inc. (CBS) and have served in that capacity since May 2011. I am also

the Chief Financial Officer of Crumbs Holdings, LLC (Holdings) and have served in that

capacity since May 2008 . I am fully familiar with the Debtors business and financial affairs,

and am duly authorized to make this Affidavit on the Debtors behalf.

2. I submit this Affidavit to assist the Court and other parties-in-interest in

understanding the circumstances that compelled the commencement of these Chapter 11 cases

and in connection with the Debtors voluntary Chapter 11 petitions and various motions and

applications that will be filed with the Court during these Chapter 11 cases. Except as otherwise

indicated, all facts set forth in this Affidavit are based upon my personal knowledge, my

discussions with other members of the Debtors senior management and the Debtors

professional advisors, my review of relevant documents, or my opinion based upon my

experience, knowledge, and information concerning the Debtors operations and financial affairs.

If I were called upon to testify, I would testify competently to the facts set forth in this Affidavit.

I submit this Affidavit to assist the Court and other parties-in-interest in understanding the

circumstances that compelled the commencement of these Chapter 11 cases and in connection

with the Debtors voluntary Chapter 11 petitions and various motions and applications that will

be filed with the Court during these Chapter 11 cases. Except as otherwise indicated, all facts set

forth in this Affidavit are based upon my personal knowledge, my discussions with other

members of the Debtors senior management and the Debtors professional advisors, my review

of relevant documents, or my opinion based upon my experience, knowledge, and information

concerning the Debtors operations and financial affairs. If I were called upon to testify, I would

testify competently to the facts set forth in this Affidavit.

3

52486/0001-10107478v6

3. This Affidavit is divided into (3) parts. Part I describes the Debtors business,

history, and the Debtors prepetition organizational and debt structure. Part II describes the

circumstances leading to the Chapter 11 filings. Part III sets forth the purpose of the Chapter 11

cases.

I. FACTUAL BACKGROUND

A. The Debtors Organizational History

4. CBS is a Delaware corporation originally organized in October 2009 under the

name 57

th

Street General Acquisition Corp. (57

th

Street). 57

th

Street was organized as a

blank check company for the purpose of acquiring, through a merger, capital stock exchange,

asset acquisition, stock purchase, reorganization, exchangeable share transaction or other similar

business transaction, one or more operating businesses or assets.

5. On J anuary 9, 2011, CBS (then known as 57

th

Street), 57

th

Street Merger Sub

LLC, a Delaware limited liability company and wholly-owned subsidiary of CBS (Merger

Sub), Holdings, a Delaware limited liability company, and the members of Holdings, among

others, entered into a Business Combination Agreement, as amended on February 18, 2011,

March 17, 2011 and April 7, 2011 (the Business Combination Agreement) pursuant to which

Merger Sub merged with and into Holdings with Holdings surviving the merger as a non-wholly

owned subsidiary of CBS (the Merger). Following the Merger, in October 2011, 57

th

Street

changed its name to Crumbs Bake Shop, Inc. to reflect the nature of its business more

accurately.

6. Pursuant to the Business Combination Agreement, in February 2011, CBS

commenced a tender offer, as amended, to ultimately purchase up to 1,803,607 shares of its

issued and outstanding common stock. On May 4, 2011, 57

th

Street purchased all 1,594,584

4

52486/0001-10107478v6

shares of its common stock validly tendered and not withdrawn for an aggregate purchase price

of approximately $15,914,000.

7. CBS is a holding company and does not conduct business operations except

through its subsidiary Holdings. CBSs common stock was until recently listed on the NASDAQ

Capital Market under the symbol CRMB.

2

8. Holdings has 50 subsidiaries (the Subsidiaries), including 29 that are not

included in this filing. Each of those Subsidiaries is a limited liability company that was formed

as the Debtors opened new retail locations throughout the United States.

B. The Debtors Business Before Ceasing Operations on July 7, 2014

9. Before J uly 7, 2014 when the Debtors ceased operations (described herein), the

Debtors were one of the largest, most recognizable brand name cupcake specialty retailers in the

United States. While cupcakes comprised a majority of their sales, the Debtors also offered

other baked goods, including push up pops, cakes, cookies, pastries, scones, croissants, brownies

and muffins as well as hot and cold beverages. The Debtors offered these products through retail

stores, an e-commerce division, catering services and a wholesale distribution business.

10. The Debtors headquarters are located in New York City. They also maintain

offices in Preston, Maryland.

11. The Debtors sales were substantially conducted through their retail stores

consisting of street, mall and kiosk locations. The Debtors first retail bake shop was opened in

2

On J une 20, 2014, CBS received a letter from the Listing Qualifications Department of

the NASDAQ Stock Market notifying it that it has determined to deny CBSs request for

continued listing of CBSs common stock on the Nasdaq Capital Market. Nasdaq suspended the

trading of CBSs common stock effective J uly 1, 2014. Nasdaqs determination was based on

CBSs failure to comply with the minimum $2.5 million stockholders equity requirement for

continued listing, coupled with the fact that the company did not meet at least one of the

alternative minimum listing requirements.

5

52486/0001-10107478v6

2003 on the Upper West Side of Manhattan, New York. By 2013, and before the Debtors

embarked on their restructuring plan (as described below), the Debtors had expanded their

operations to include 78 locations across 12 states and Washington, D.C. As of March 31, 2014,

there were 65 Crumbs Bake Shop stores operating in 12 states and Washington, D.C., including

17 stores in Manhattan, New York. As of J uly 7, 2014, the Debtors operated 49 stores in New

York, New J ersey, California, Illinois, Washington, D.C., Connecticut, Massachusetts, Delaware,

Pennsylvania, Rhode Island, Maryland and Virginia. The Debtors, through the Subsidiaries, are

parties to leases for the premises at which some of these retail stores were located.

12. The Debtors generated a small percentage of sales through their other divisions.

Through their e-commerce division at www.crumbs.com, the Debtors sold their baked goods

nationwide for delivery to homes and businesses. In addition, the Debtors had a wholesale

distribution business with accounts in the New York City area that purchased the Debtors

products, for sale in their respective businesses as CRUMBS BAKE SHOP cupcakes. The

Debtors also generated sales through their catering business which they operated predominantly

in New York.

3

13. Beginning in early 2014, the Debtors launched a new and expanded licensing

program by, among other things, introducing Crumbs Bake Shop products in all 201 BJ s

Wholesale Club (BJ s) locations in 15 eastern states. In connection with that licensing

program, BJ s sold cupcakes, ice cream cupcakes, ice cream sheet cakes and Crumbnuts (a

cross between a croissant and a donut) under the Crumbs Bake Shop brand. In addition to those

3

During 2013, cupcakes represented 78.4% of net sales. Sales of candy and other baked goods (i.e. , cakes,

cookies, brownies, muffins and assorted pastries) in 2013 represented 9.5% of net sales. The stores also sold

beverages including drip coffees, espresso-based drinks, whole-leaf teas and hot chocolate. In 2013, beverages

represented 11.4% of Crumbs net sales.

6

52486/0001-10107478v6

products sold at BJ s, the Debtors had signed licensing agreements with, among others, White

Coffee for coffee beans, ground coffee and single serve cups, Pelican Bay for bake mixes, hot

chocolate mixes and related novelty gift items, PKP for bake ware and baking tools and

Pop!Gourmet Popcorn for flavored popcorn and popcorn bars. The Debtor's licensed products

were also beginning to be sold through big-box retailers such as Target and Macy's. Before

ceasing operations, the Debtors were continuing to pursue other licensing opportunities and

distribution channels to expand their presence and enhance the Crumbs brand beyond their own

brick and mortar stores.

14. The Debtors intellectual property and confidential and proprietary information

were material to the conduct of their business. As set forth above, to maximize cash flow, the

Debtors pursued licensing and franchising opportunities. The Debtors business plan focused on

their ability to build further brand recognition using their trademarks, service marks and other

proprietary intellectual property, including their name and logos.

15. The Debtors baked goods were shipped daily from local bakers on a regional

basis to their stores. The Debtors have exclusive production agreements with two (2)

independent commercial bakers for the manufacture and daily delivery of their baked goods in

the New York metropolitan, Chicago, Boston and Washington, D.C. area markets.

16. As of J uly 7, 2014, the Debtors had approximately 455 employees consisting of

full-time salaried and hourly employees, of which approximately 68 were full time salaried

employees and 387 were hourly employees. As of the Filing Date, however, the Debtors have 9

full-time salaried employees. All of the Debtors current employees are employed in general or

administrative functions, primarily in the Debtors offices in New York City and Maryland.

7

52486/0001-10107478v6

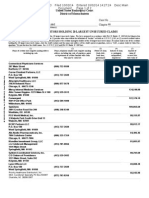

17. As of December 31, 2013, CBS and the subsidiaries had consolidated assets of

$20 million and liabilities of $19 million. Net sales in 2013 from the Debtors retail operations

were $47.2 million, an increase of 9.7% over $43.0 million in 2012. Net sales from Crumbs

catering services, e-commerce division and wholesale distribution business in 2013 were $1.9

million, an increase of 6.7%, compared to the $1.7 million recorded in 2012.

18. For the three months ended March 31, 2014, (a) net sales from the Debtors retail

operations were $9.1 million, representing a decrease of 24.8% when compared to $12.1 million

for the three months ended March 31, 2013 and (b) net sales from Crumbs catering services, e-

commerce division and wholesale distribution business for the three months ended March 31,

2014 were $0.5 million, an increase of 8.1% compared to the three months ended March 31,

2013.

C. Capital Structure

i. Secured Debt

19. On J anuary 20, 2014, CBS and Holdings entered into a Senior Secured Loan and

Security Agreement (the Secured Loan Agreement) with Fischer Enterprises, L.L.C.

(Fischer) whereby Fischer agreed to make a term loan in the original principal amount of

$5 million (the Fischer Loan). The Fischer Loan consisted of two tranches. The first tranche,

in the original principal amount of $3.5 million, was funded on J anuary 21, 2014, and the second

tranche, in the original principal amount of $1.5 million, was funded on April 1, 2014. Each

tranche is evidenced by a promissory note (the Fischer Notes).

20. Pursuant to the terms of the Secured Loan Agreement, the Fischer Notes are

senior to all other indebtedness of CBS and Holdings and are secured by all assets of CBS and

Holdings, including equity in the Subsidiaries. The Fischer Notes are scheduled to mature on

J uly 1, 2016. The Fischer Notes are convertible into shares of CBS common stock.

8

52486/0001-10107478v6

21. On J uly 10, 2014, the outstanding obligations under the Fischer Notes were

assigned to Lemonis Fischer Acquisition Company, LLC (the Lender) as evidenced by that

certain Assignment of Loan and Loan Documents dated as of J uly 10, 2014. After the

assignment of the Fischer Loan, the Lender advanced the Debtor $317,000 in connection with

the Debtors Chapter 11 filings, and the Debtors executed (a) an Amended and Restated Note

dated as of J uly 10, 2014, in favor of the Lender and (b) that certain First Amendment to Senior

Secured Loan and Security Agreement, dated J uly 10, 2014.

22. As of the Filing Date, $5,514,245.30 is due and outstanding to the Lender.

ii. Unsecured Debt

23. On May 10, 2013, the Debtors sold and issued $7.0 million in aggregate principal

amount of Senior Convertible Notes that will mature on May 10, 2018. On J une 11, 2013, the

Debtors sold an additional $3.0 million in aggregate principal amount of Senior Convertible

Notes that will mature on J une 11, 2018 (collectively, the Notes). Interest on the unpaid

principal balance of the Notes accrues at 6.5% per annum and is payable quarterly in arrears. As

permitted by the Notes, the Debtors have elected to convert all accrued interest through J uly 1,

2014 into common stock. Therefore, as of the Filing Date, the principal amount of the Notes and

accrued and unpaid interest for the period J uly 1, 2014 through the Filing Date remains

outstanding totaling approximately $9.3 million.

24. As of the Filing Date, the Debtors also estimate they have approximately $5

million of unsecured trade debt and other outstanding operating expenses including liabilities to

certain of their landlords.

II. FACTORS THAT PRECIPITATED THE DEBTORS CHAPTER 11 FILING

25. Over the last decade, cupcakes became a cultural and economic phenomenon with

gourmet cupcake shops proliferating across the United States. Consistent with this so-called

9

52486/0001-10107478v6

cupcake craze, the Debtors experienced rapid growth in their store base and revenue from

2003 through 2011. The Debtors, however, were unable to sustain their early success and

suffered declining revenue and increased operating losses during 2012 and 2013. For the year

ended December 31, 2013, the Debtors recorded a loss from operations of $15.4 million

compared to a net loss of $10.5 million for the year ended December 31, 2012.

26. The Debtors business became increasingly competitive. The Debtors competed

with well-established bakeries, cupcake-specific bakeries and other companies providing baked

goods. Some of those competitors were in close proximity to the Debtors retail locations

negatively impacting the Debtors sales. Additionally, the Debtors growth simply outpaced the

demand for cupcakes. The Debtors business had been focused almost exclusively on cupcakes,

a small niche in the retail baked goods industry. For various reasons, demand for cupcakes has

waned. With limited product offerings in addition to cupcakes, the Debtors sales suffered,

dropping approximately 15% in 2013 in same store sales compared to 2012.

27. The Debtors also attributed their underperformance, reduced margins and lack of

liquidity, in part, to a series of unsuccessful strategic, financial and operating decisions made in

years prior, relating to the Debtors growth strategy and leasehold obligations. The Debtors

rapid expansion during its early years led to substantial excess capacity and competition among

the Debtors own stores. Many of the Debtors stores, especially those in Manhattan, Chicago

and Washington, D.C. were located close to one another. As a result, many of those stores

attracted customers within a common trading area thereby decreasing the same store sales at a

pre-existing store. Moreover, many of the leases executed before 2012 had lengthy initial terms

(generally between 10 and 15 years) with onerous provisions, rendering the Debtors ability to

relocate or close underperforming locations nearly impossible.

10

52486/0001-10107478v6

28. The Debtors profitability and operating results were also negatively impacted by

increased cost of sales. The Debtors cost of sales continued to rise and comprised 46% of their

net sales for the year ended December 31, 2013. The Debtors increased cost of sales were

caused, in part, by the delay in implementing a centralized automated ordering system. Before

implementing that system, each of the stores were required to estimate and order sufficient

inventory daily. Because stores were unable to predict the demand accurately, profitability and

operating results were adversely affected. With the implementation of the centralized automated

ordering system, the Debtors tried to focus their efforts on additional opportunities to increase

efficiency and reduce cost of sales. Increased cost of sales were also negatively impacted by

changing coffee vendors to Starbuck brand in September of 2012.

29. Before the Filing Date, the Debtors critically evaluated their long term business

model. The Debtors initiated and explored alternative means to increase cash flow including

licensing and franchising opportunities while at the same time implementing aggressive

measures to control expenses and maximize cash flow. The Debtors closed ten (10)

underperforming locations in 2013. In 2014, nineteen (19) additional underperforming stores

were closed. The Debtors, however, were unable to resolve their liquidity issues quickly enough.

30. Given their severe liquidity constraints, the Debtors explored all means for

obtaining financing to ensure they did not accrue liabilities to creditors and employees beyond

their means to pay. The Debtors engaged in negotiations with their existing lenders and solicited

other financing alternatives as well. Despite their best efforts, the Debtors were unable to secure

sufficient financing to continue operations in the ordinary course. With limited available cash

and the Debtors continuing to incur liabilities they could not pay, the Debtors were forced to

cease operations on J uly 7, 2014.

31. After the Debtors shut down their operations, the Debtors renewed their

negotiations with Fischer and others for financing in a last-ditch effort to maximize value of the

Debtors' assets through a sale thereof. On July 10,2014, the Debtors and the Lender (who had

since taken assignment from Fischer) reached an agreement whereby the Lender would provide

$1,133,000 of debtor-in-possession financing to the Debtors that will enable them to pursue an

expedited sale of the Debtors' assets pursuant to Section 363 of the Bankruptcy Code. With that

agreement in place, the Debtors commenced these bankruptcy cases.

III. THE PURPOSE OF THE CHAPTER 11 FILINGS

32. Essentially out of available funds, these Chapter 11 cases were commenced to

maximize value for the benefit of all stakeholders. The Chapter 11 will provide the Debtors with

access to sufficient financing to pursue an expedited sale of their assets The Debtors believe

these Chapter 11 filings, and the pursuit of an expedited sale process involving substantially all

of the Debtors' assets under Section 363 is in the best interest of the Debtors' creditors and other

stakeholders.

11

52486/000 1-1 0 I 074 78v6

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Secured Transactions OutlineDocumento103 páginasSecured Transactions OutlineJason Henry100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Buckley Secured Transactions Spring 2010Documento90 páginasBuckley Secured Transactions Spring 2010tspencer28Ainda não há avaliações

- Bankruptcy 101 - An Overview of BankruptcyDocumento16 páginasBankruptcy 101 - An Overview of BankruptcyDerek Prosser100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Distressed Debt Course SyllabusDocumento4 páginasDistressed Debt Course SyllabusDave Li100% (1)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Bain Capital LP LetterDocumento1 páginaBain Capital LP LetterFortune100% (1)

- Rep 3110072849Documento2.537 páginasRep 3110072849graceenggint8799Ainda não há avaliações

- Relativity SuitDocumento56 páginasRelativity SuitFortune100% (1)

- Cals TrsDocumento6 páginasCals TrsFortuneAinda não há avaliações

- Omega Advisors Inc. Letter To Investors 9.21.16Documento5 páginasOmega Advisors Inc. Letter To Investors 9.21.16Fortune100% (1)

- Cals TrsDocumento6 páginasCals TrsFortuneAinda não há avaliações

- Omega Advisors Inc. Letter To Investors 9.21.16Documento5 páginasOmega Advisors Inc. Letter To Investors 9.21.16Fortune100% (1)

- Utimco ActiveDocumento20 páginasUtimco ActiveFortune100% (4)

- Washington State Investment Board Portfolio Overview by Strategy December 31, 2015Documento7 páginasWashington State Investment Board Portfolio Overview by Strategy December 31, 2015FortuneAinda não há avaliações

- Pe Irr 06 30 15Documento4 páginasPe Irr 06 30 15Fortune100% (1)

- Foia q1 2016 OperfDocumento7 páginasFoia q1 2016 OperfFortuneAinda não há avaliações

- PrimDocumento6 páginasPrimFortuneAinda não há avaliações

- EEOC Decision Sexual Orientation Title VIIDocumento17 páginasEEOC Decision Sexual Orientation Title VIIFortuneAinda não há avaliações

- Fanduel v. SchneidermanDocumento17 páginasFanduel v. SchneidermanFortuneAinda não há avaliações

- Caspersen Andrew ComplaintDocumento14 páginasCaspersen Andrew ComplaintFortuneAinda não há avaliações

- UberDocumento33 páginasUberTechCrunch67% (3)

- Square FilingDocumento21 páginasSquare FilingFortuneAinda não há avaliações

- Lisa Lee CVC ComplaintDocumento23 páginasLisa Lee CVC ComplaintFortune100% (1)

- Herington v. Milwaukee Bucks ComplaintDocumento20 páginasHerington v. Milwaukee Bucks ComplaintFortuneAinda não há avaliações

- EEOC v. UPS 071515Documento16 páginasEEOC v. UPS 071515Fortune100% (1)

- University of Texas Investment Management Company Private Investments Fund Performance (Active Relationships)Documento18 páginasUniversity of Texas Investment Management Company Private Investments Fund Performance (Active Relationships)FortuneAinda não há avaliações

- 50 Cent BankruptcyDocumento5 páginas50 Cent BankruptcyFortuneAinda não há avaliações

- Yair V MattesDocumento19 páginasYair V MattesFortuneAinda não há avaliações

- Daskalasis v. Forever 21 ComplaintDocumento19 páginasDaskalasis v. Forever 21 ComplaintFortuneAinda não há avaliações

- SEC Complaint vs. Ifty AhmedDocumento25 páginasSEC Complaint vs. Ifty AhmedFortuneAinda não há avaliações

- Ifty Ahmed ChargesDocumento15 páginasIfty Ahmed ChargesFortuneAinda não há avaliações

- Growing Movement For 15 DollarsDocumento39 páginasGrowing Movement For 15 DollarsFortuneAinda não há avaliações

- Cory Disotell Bankruptcy FilingDocumento5 páginasCory Disotell Bankruptcy FilingErin LaviolaAinda não há avaliações

- Corporate: Restructuring & TurnaroundsDocumento15 páginasCorporate: Restructuring & TurnaroundsNathaniel AnumbaAinda não há avaliações

- Notice of Expedited Hearing: L B 99999/9999/L0576287.DOCDocumento17 páginasNotice of Expedited Hearing: L B 99999/9999/L0576287.DOCChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court For The District of DelawareDocumento30 páginasIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsAinda não há avaliações

- Et AlDocumento13 páginasEt AlChapter 11 DocketsAinda não há avaliações

- Suzuki Schedules and StatementDocumento788 páginasSuzuki Schedules and StatementChapter 11 DocketsAinda não há avaliações

- Home JoyDocumento30 páginasHome JoyChapter 11 DocketsAinda não há avaliações

- Waller Street News 2007Documento7 páginasWaller Street News 2007Dentist The MenaceAinda não há avaliações

- In Re Hostess BrandsDocumento71 páginasIn Re Hostess BrandsDealBookAinda não há avaliações

- Certification of Counsel With Respect To Order Authorizing Retention of Millstream Energy, LLCDocumento19 páginasCertification of Counsel With Respect To Order Authorizing Retention of Millstream Energy, LLCChapter 11 DocketsAinda não há avaliações

- Investing in Chapter 11 Stocks: Trading, Value, and PerformanceDocumento28 páginasInvesting in Chapter 11 Stocks: Trading, Value, and PerformancexiyaxoAinda não há avaliações

- Westwood Community v. John P. Barbee, 293 F.3d 1332, 11th Cir. (2002)Documento8 páginasWestwood Community v. John P. Barbee, 293 F.3d 1332, 11th Cir. (2002)Scribd Government DocsAinda não há avaliações

- Joinder TemplateDocumento4 páginasJoinder TemplateergodocAinda não há avaliações

- Greentex Greenhouses, BV v. Pony Express Greenhouse Et Al - Document No. 14Documento2 páginasGreentex Greenhouses, BV v. Pony Express Greenhouse Et Al - Document No. 14Justia.comAinda não há avaliações

- Robert Moore Declaration in Support of Murray Energy Chapter 11 BankruptcyDocumento39 páginasRobert Moore Declaration in Support of Murray Energy Chapter 11 BankruptcyEmily AtkinAinda não há avaliações

- United States Bankruptcy Court District of NevadaDocumento4 páginasUnited States Bankruptcy Court District of NevadaChapter 11 DocketsAinda não há avaliações

- Bankruptcy OutlineDocumento5 páginasBankruptcy OutlineElle Allen0% (2)

- Restitution of ServerPronto AssetsDocumento16 páginasRestitution of ServerPronto Assetsjaybobby007Ainda não há avaliações

- WMI - Plan (With Signed Order)Documento807 páginasWMI - Plan (With Signed Order)kevinipAinda não há avaliações

- Q12 KeyDocumento3 páginasQ12 KeyMuhammad AbdullahAinda não há avaliações

- Patterson Park CDC Files For BankruptcyDocumento21 páginasPatterson Park CDC Files For Bankruptcycitypaper100% (1)

- Hampden County Physican Associates CreditorsDocumento2 páginasHampden County Physican Associates CreditorsJim KinneyAinda não há avaliações

- BCBG Max AzriaDocumento25 páginasBCBG Max AzriaZerohedgeAinda não há avaliações

- 2 23 2011 Disclosure Statement OrderDocumento308 páginas2 23 2011 Disclosure Statement Orderbomby0Ainda não há avaliações

- The Archdiocese of St. Paul and Minneapolis Disclosure StatementDocumento78 páginasThe Archdiocese of St. Paul and Minneapolis Disclosure StatementMinnesota Public RadioAinda não há avaliações