Escolar Documentos

Profissional Documentos

Cultura Documentos

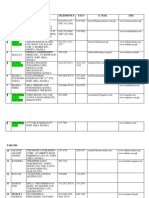

Manila Standard Today - Business Daily Stocks Review (July 22, 2014)

Enviado por

Manila Standard TodayDireitos autorais

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Manila Standard Today - Business Daily Stocks Review (July 22, 2014)

Enviado por

Manila Standard TodayDireitos autorais:

MST Business Daily Stocks Review

M

S

T

Tuesday, July 22, 2014

52 Weeks

High Low

STOCKS

3.74

91

93.5

105.2

73

2.28

3.5

19.92

33.3

2.98

35.95

0.4

121

1.86

30

75

99

141

415

60.2

175

1535

143.4

2.8

2.12

56

66.2

82.5

50

1.85

0.95

14.7

37.85

2.5

16

0.175

69.35

1.26

21.6

58

65

111

279.4

40.75

105.1

1045

110

2.25

AG Finance

Asia United Bank

Banco de Oro Unibank Inc.

Bank of PI

China Bank

BDO Leasing & Fin. Inc.

Bright Kindle Resources

COL Financial

Eastwest Bank

I-Remit Inc.

Macay Holdings

MEDCO Holdings

Metrobank

Natl Reinsurance Corp.

PB Bank

Phil Bank of Comm

Phil. National Bank

Phil. Savings Bank

PSE Inc.

RCBC `A

Security Bank

Sun Life Financial

Union Bank

Vantage Equities

42.6

6.39

1.66

2.26

19

113

85

7.5

17.2

4.6

16.7

46

4.57

39.5

10.12

16.46

6.6

14.2

17

22.6

88.5

27.4

0.017

15.74

6.8

0.83

192

11.3

79

5.2

37.7

21.7

341

6.75

45

6.34

15.1

15

6.69

6.68

8.1

275

2.65

5.58

2.02

0.191

2.5

2.81

5.5

0.96

1.66

30

3.85

0.88

1.2

9.9

40.2

15

5

14.6

2.62

9.82

21.5

0.82

20

5.8

8.48

4.25

8.68

8.61

12.2

48.9

12.5

0.0097

12

1.81

0.32

124.7

8.55

48.5

1.93

20.35

10.1

246

3.56

11.3

4

11.42

9.94

4.33

4.12

2.28

200

0.9

4

1.7

0.102

1.6

1.37

1.55

0.550

1.25

Aboitiz Power Corp.

Agrinurture Inc.

Alliance Tuna Intl Inc.

Alsons Cons.

Asiabest Group

Bogo Medellin

C. Azuc De Tarlac

Calapan Venture

Century Food

Chemrez Technologies Inc.

Cirtek Holdings (Chips)

Concepcion

Da Vinci Capital

Del Monte

DNL Industries Inc.

Emperador

Energy Devt. Corp. (EDC)

EEI

Federal Res. Inv. Group

First Gen Corp.

First Holdings A

Ginebra San Miguel Inc.

Greenergy

Holcim Philippines Inc.

Integ. Micro-Electronics

Ionics Inc

Jollibee Foods Corp.

Lafarge Rep

Liberty Flour

LMG Chemicals

Manila Water Co. Inc.

Megawide

Mla. Elect. Co `A

Panasonic Mfg Phil. Corp.

Pancake House Inc.

Pepsi-Cola Products Phil.

Petron Corporation

Phinma Corporation

Phoenix Petroleum Phils.

RFM Corporation

Roxas Holdings

San MiguelPure Foods `B

Seacem

SPC Power Corp.

Splash Corporation

Swift Foods, Inc.

TKC Steel Corp.

Trans-Asia Oil

Victorias Milling

Vitarich Corp.

Vulcan Indl.

0.7

61.6

31.85

2.16

7.3

6.3

2.06

2.05

660

11.42

81

3.3

5.34

899

8.29

53.05

8.9

5.29

5.58

0.9

25.25

0.81

5.69

7.65

0.0540

2.9

94.5

3.5

1.650

1135

2.2

1.39

104.9

0.285

0.245

0.470

0.46

40

20.25

1.6

6.3

2.800

0.99

1.04

485

7.470

44

2.51

3.9

685

5.7

34

4.96

3

3.95

0.58

12.96

0.500

4.06

4.8

0.027

2.36

54.5

1.5

0.260

605

1.04

0.85

58.05

0.136

0.150

0.270

Abacus Cons. `A

Aboitiz Equity

Alliance Global Inc.

Anglo Holdings A

Anscor `A

Asia Amalgamated A

ATN Holdings A

ATN Holdings B

Ayala Corp `A

Cosco Capital

DMCI Holdings

F&J Prince A

Filinvest Dev. Corp.

GT Capital

House of Inv.

JG Summit Holdings

Jolliville Holdings

Keppel Holdings `A

Lopez Holdings Corp.

Lodestar Invt. Holdg.Corp.

LT Group

Mabuhay Holdings `A

Metro Pacific Inv. Corp.

Minerales Industrias Corp.

Pacifica `A

Republic Glass A

San Miguel Corp `A

Seafront `A

Sinophil Corp.

SM Investments Inc.

Solid Group Inc.

South China Res. Inc.

Top Frontier

Unioil Res. & Hldgs

Wellex Industries

Zeus Holdings

9.03

2.23

2.07

0.355

33.3

6.15

6.75

5.6

7.1

2

2.51

1.5

0.103

0.98

1.09

0.370

2.15

1.93

1.73

3.1

4.88

0.127

0.74

4.45

24.3

2.58

3.93

19.62

0.94

5.71

2.4

6.5

5.51

0.99

1

0.182

23

4.25

5

2.8

4.6

1.08

1.21

0.97

0.067

0.47

0.9

0.175

1.22

1.18

1.12

2.5

2.75

0.070

0.4

2.5

18.54

1.45

2.71

14.1

0.58

3.05

0.57

4.37

8990 HLDG

A. Brown Co., Inc.

Araneta Prop `A

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Cebu Prop. `A

Cebu Prop. `B

Century Property

City & Land Dev.

Cityland Dev. `A

Crown Equities Inc.

Cyber Bay Corp.

Empire East Land

Ever Gotesco

Global-Estate

Filinvest Land,Inc.

Interport `A

Keppel Properties

Megaworld Corp.

MRC Allied Ind.

Phil. Realty `A

Primex Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

1.92

42

1.43

0.81

12.9

12.52

0.1720

3.98

76

12.3

3.28

1260

1833

9.04

2.02

114

12.5

0.020

6.99

2.6

4.32

1.97

2.45

14.46

0.62

1.040

22.8

2.85

150

15.4

3110

0.590

48.5

72

0.9

11.46

0.41

1.6

1.5

27

0.92

0.59

10

8.28

0.1090

2.97

44.8

10.14

1.99

1103

1360

7.18

1.2

77.5

8.72

0.012

0.01

1.15

1.9

0.49

1.42

7.5

0.3

0.36

13.94

1.85

89

4.89

2572

0.250

32.3

48

0.59

8.6

0.305

1.04

2GO Group

ABS-CBN

Acesite Hotel

APC Group, Inc.

Asian Terminals Inc.

Bloomberry

Boulevard Holdings

Calata Corp.

Cebu Air Inc. (5J)

Centro Esc. Univ.

Discovery World

FEUI

Globe Telecom

GMA Network Inc.

Harbor Star

I.C.T.S.I.

IPeople Inc. `A

IP E-Game Ventures Inc.

Jackstones

Liberty Telecom

Macroasia Corp.

Manila Bulletin

Manila Jockey

Melco Crown

MG Holdings

NOW Corp.

Pacific Online Sys. Corp.

Paxys Inc.

Phil. Seven Corp.

Philweb.Com Inc.

PLDT Common

PremiereHorizon

Puregold

Robinsons RTL

STI Holdings

Travellers

Waterfront Phils.

Yehey

0.0056

4

17.22

25

0.310

12.7

1.2

1.73

10.98

0.7

0.730

0.040

0.040

5.41

29.45

3.92

0.550

2.4

0.021

0.023

7

12.52

15

0.043

419

0.019

0.0028

1.72

11.48

9.43

0.225

6

0.5

0.76

4.93

0.3000

0.2950

0.012

0.014

1.400

14.22

1.47

0.220

1.16

0.016

0.018

4.02

7.8

7.05

0.033

222.6

0.0087

Abra Mining

Apex `A

Atlas Cons. `A

Atok-Big Wedge `A

Basic Energy Corp.

Benguet Corp `B

Century Peak Metals Hldgs

Coal Asia

Dizon

Lepanto `A

Lepanto `B

Manila Mining `A

Manila Mining `B

Marcventures Hldgs., Inc.

Nickelasia

Nihao Mineral Resources

Omico

Oriental Peninsula Res.

Oriental Pet. `A

Oriental Pet. `B

Petroenergy Res. Corp.

Philex `A

PhilexPetroleum

Philodrill Corp. `A

Semirara Corp.

United Paragon

46.5

26.3

535

504

60

30

116

102

9.88

7.1

112

101.5

79

74.5

77.5

73

82

74.95

1072

1000

ABS-CBN Holdings Corp.

Ayala Corp. Pref B

Benguet Corp. Con. Pref

First Gen F

First Gen G

GMA Holdings Inc.

PCOR-Preferred

SMC Preferred A

SMC Preferred B

SMC Preferred C

SMPFC Preferred

10.96

4

35

2.4

2.25

7.74

Double Dragon

Makati Fin. Corp.

IRipple E-Business Intl

111

94

First Metro ETF

Previous

Close

High

Low

FINANCIAL

2.81

2.94

2.94

72.3

72.35

71.95

90.90

91.00

90.75

96.00

96.35

95.75

55.65

55.75

55.55

2.12

2.15

2.11

2.56

2.54

2.50

15

15

14.5

29.95

29.95

29

2.53

2.50

2.49

41.35

41.40

41.00

0.370

0.370

0.325

89.8

89.9

89.00

1.28

1.29

1.28

23.30

23.45

23.05

61.50

64.70

64.00

90.35

90.50

90.20

134.50

134.00

134.00

280

282

280

54.5

54.75

54.4

118.6

120

118.5

1450.00

1445.00

1445.00

119.00

119.50

118.90

2.83

2.83

2.8

INDUSTRIAL

36.3

36.85

36.25

4.37

4.15

4

1.35

1.35

1.31

2.1

2.11

2.08

10.38

10.64

10.5

70.00

70.00

66.05

83.10

84.00

82.50

6.7

6.7

6.5

15.92

15.94

15.9

4.53

4.85

4.53

15.2

14.3

14

46.9

46.9

45.5

3.19

3.25

3.12

19.9

19.84

19.6

10.800

10.800

10.6

11.52

11.60

11.52

6.19

6.20

6.14

11.06

11.14

11.02

10.88

13.00

10.84

21.05

21.8

21.1

73

73.85

73

20.50

20.50

19.70

0.0110

0.0110

0.0100

13.46

13.48

13.40

5.84

5.85

5.82

0.740

0.750

0.730

180.00

79.90

177.20

9.6

9.75

0.44

54.05

55.00

55.00

3.01

3.01

3.01

26.2

26.3

26.15

12.680

12.680

12.620

254.00

255.00

252.00

4.00

4.80

4.06

61.00

62.00

60.00

4.9

4.9

4.8

12.32

12.36

12.26

10.44

10.44

10.44

6.15

6.25

6.09

5.75

5.80

5.70

6.5

6.84

6.5

231.2

232

231

2.40

2.62

2.35

4.320

4.320

4.320

1.87

1.9

1.87

0.147

0.145

0.142

2.04

1.96

1.95

2.44

2.44

2.42

4.76

4.76

4.76

1.05

1.07

1.04

1.54

1.55

1.52

HOLDING FIRMS

0.520

0.530

0.520

55.80

56.00

54.60

27.55

27.50

26.70

1.83

1.84

1.83

7.00

7.16

6.99

1.96

1.94

1.93

2.05

2.25

2.04

2.12

2.31

2.1

661.5

664

658

9.9

9.97

9.8

75.80

76.00

74.80

3

3.05

3.05

4.70

4.70

4.70

880

881.5

878

5.54

5.53

5.37

52.00

52.30

51.95

5.5

5

5

4.81

5.5

5.3

4.9

5

4.87

0.72

0.73

0.7

16.7

16.8

16.08

0.68

0.68

0.68

5.09

5.13

5.08

4.75

4.75

4.63

0.0410

0.0410

0.0410

2.64

2.64

2.6

81.45

82.45

80.50

2.95

2.93

2.93

1.720

1.720

1.680

771.00

785.00

768.50

1.47

1.50

1.45

1.06

1.07

1.05

153.50

156.00

150.10

0.2340

0.2340

0.2340

0.1850

0.1850

0.1790

0.385

0.385

0.380

PROPERTY

8.050

8.050

7.980

1.43

1.53

1.43

1.650

1.670

1.640

0.310

0.310

0.305

30.70

30.80

30.65

5.22

5.23

5.14

5.17

5.18

5.17

6

6.1

6.1

6.15

6.15

6.15

1.36

1.36

1.32

1.66

1.65

1.65

1.07

1.08

1.04

0.093

0.101

0.093

0.64

0.64

0.62

0.930

0.930

0.930

0.260

0.270

0.265

2.07

2.11

2.03

1.57

1.58

1.56

1.37

1.39

1.35

5.03

5.39

5.03

4.62

4.64

4.5

0.1010

0.0990

0.0970

0.6000

0.6100

0.6100

3.24

3.26

3.01

22.55

22.60

22.40

1.82

1.87

1.81

3.22

3.30

3.22

15.78

15.80

15.70

0.9

0.91

0.89

6.48

6.5

6.47

1.280

1.330

1.270

5.920

5.960

5.890

SERVICES

2.55

2.51

2.5

37

37

37

1.25

1.25

1.21

0.870

0.870

0.860

11

10.7

10.52

11.40

11.68

11.30

0.1370

0.1410

0.1370

3.4

3.57

3.4

57.95

58

57.5

11

10.9

10.9

1.82

1.82

1.82

1240

1270

1270

1718

1730

1719

7.38

7.38

7.30

1.77

1.78

1.77

111.7

112

111.9

11.98

11.8

11.8

0.014

0.015

0.014

4.3

4.3

4.3

2.20

2.21

2.15

2.12

2.13

2.08

0.910

0.920

0.910

2

2

2

11.16

11.6

11.04

0.510

0.500

0.480

0.730

0.730

0.710

15.3

16

15.12

2.35

2.34

2.34

82.95

83.50

82.60

4.79

4.80

4.39

3040.00

3042.00

3014.00

0.490

0.495

0.465

42.10

43.60

42.15

66.80

67.55

66.80

0.81

0.80

0.80

8.56

8.57

8.45

0.335

0.345

0.325

1.330

1.320

1.320

MINING & OIL

0.0046

0.0047

0.0047

4.50

4.48

4.34

15.40

15.42

15.40

16.62

16.60

16.60

0.285

0.280

0.280

11.02

11.02

11

0.87

0.9

0.87

1.47

1.53

1.46

8.70

8.70

8.42

0.385

0.390

0.385

0.400

0.400

0.400

0.0190

0.0190

0.0180

0.0200

0.0190

0.0190

4.9

4.94

4.82

36.75

36.95

34.55

2.56

2.65

2.54

0.6600

0.6600

0.6400

2.250

2.260

2.210

0.0170

0.0170

0.0170

0.0180

0.0180

0.0180

6.72

6.74

6.71

12.22

12.22

12

7.96

8.55

8.03

0.037

0.036

0.036

360.00

365.80

357.40

0.0130

0.0130

0.0130

PREFERRED

38.15

38

38

502

502

501

34

30

30

104

104

104

105.5

105.1

105

7.38

7.32

7.3

103.3

103.6

103.4

75

75.15

74.85

75

75.15

75

77.5

77.5

76.85

1010

1010

1008

SME

7.56

7.65

7.53

8

9.2

8

34.25

36.8

34

EXCHANGE TRADED FUNDS

111.1

110.9

110.2

Close Change Volume

Net Foreign

Trade/Buying

2.94

72.3

91.00

95.80

55.75

2.11

2.50

14.9

29.95

2.50

41.35

0.335

89.8

1.28

23.15

64.00

90.35

134.00

280

54.7

119

1445.00

119.50

2.83

4.63

0.00

0.11

-0.21

0.18

-0.47

-2.34

-0.67

0.00

-1.19

0.00

-9.46

0.00

0.00

-0.64

4.07

0.00

-0.37

0.00

0.37

0.34

-0.34

0.42

0.00

5,000

67,770

4,411,510

347,180

246,040

596,000

603,000

14,800

123,600

40,000

50,700

860,000

2,175,640.00

102,000

36,100

10,500

1,094,890

10

3,180

278,180.00

2,337,210

100

11,150

237,000

36.7

4

1.35

2.11

10.5

66.05

82.50

6.5

15.9

4.85

14.2

46

3.18

19.84

10.800

11.56

6.14

11.08

13.00

21.65

73.5

19.70

0.0110

13.48

5.84

0.730

179.30

9.65

55.00

3.01

26.3

12.660

252.40

4.06

61.00

4.81

12.32

10.44

6.09

5.75

6.5

231.2

2.57

4.320

1.87

0.145

1.95

2.43

4.76

1.05

1.53

1.10

-8.47

0.00

0.48

1.16

-5.64

-0.72

-2.99

-0.13

7.06

-6.58

-1.92

-0.31

-0.30

0.00

0.35

-0.81

0.18

19.49

2.85

0.68

-3.90

0.00

0.15

0.00

-1.35

-0.39

0.52

1.76

0.00

0.38

-0.16

-0.63

1.50

0.00

-1.84

0.00

0.00

-0.98

0.00

0.00

0.00

7.08

0.00

0.00

-1.36

-4.41

-0.41

0.00

0.00

-0.65

3,063,800

181,000

81,000

911,000

5,200

600

6,320

6,200

99,300

1,735,000

42,700

3,600

1,180,000

36,100

2,347,000

3,731,200

26,085,000

1,593,900

1,317,500

5,736,000

88,430

14,800

64,200,000

77,400

394,900

489,000

277,460

1,627,900

50,000

8,000

1,781,900

6,136,800

884,340

1,187,000

7,650

17,000

3,309,400

500

597,900

279,500

33,500

8,240

5,271,000

5,000

83,000

530,000

60,000

2,835,000

242,000

1,251,000

317,000

0.520

56.00

26.75

1.83

7.07

1.94

2.23

2.17

661

9.8

75.80

3.05

4.70

880.5

5.46

52.30

5

5.5

4.91

0.72

16.38

0.68

5.1

4.75

0.0410

2.64

80.50

2.93

1.700

777.00

1.45

1.05

150.10

0.2340

0.1850

0.380

0.00

0.36

-2.90

0.00

1.00

-1.02

8.78

2.36

-0.08

-1.01

0.00

1.67

0.00

0.06

-1.44

0.58

-9.09

14.35

0.20

0.00

-1.92

0.00

0.20

0.00

0.00

0.00

-1.17

-0.68

-1.16

0.78

-1.36

-0.94

-2.21

0.00

0.00

-1.30

1,524,000.00

1,277,380.00

17,753,700

145,000

42,700

28,000

521,000

553,000

338,330

3,684,100

1,984,740

90,000

5,000

64,760

1,206,900

1,303,810

10,000

22,000

8,513,000

301,000

7,848,300

50,000

6,969,500

124,000

700,000

16,000

183,270

10,000

18,772,000

261,180

227,000

200,000

37,120

10,000

270,000

400,000

8.000

1.49

1.670

0.305

30.75

5.18

5.18

6.1

6.15

1.32

1.65

1.08

0.101

0.63

0.930

0.265

2.09

1.56

1.35

5.39

4.5

0.0980

0.6100

3.23

22.60

1.82

3.30

15.74

0.9

6.5

1.290

5.920

-0.62

4.20

1.21

-1.61

0.16

-0.77

0.19

1.67

0.00

-2.94

-0.60

0.93

8.60

-1.56

0.00

1.92

0.97

-0.64

-1.46

7.16

-2.60

-2.97

1.67

-0.31

0.22

0.00

2.48

-0.25

0.00

0.31

0.78

0.00

1,252,800

1,614,000

29,000

300,000

4,350,500

1,740,600

101,000

10,000

1,000

5,670,000

1,000

17,000

70,700,000

718,000

830,000

800,000

7,335,000

11,154,000

1,351,000

43,500

30,982,000

3,130,000

10,000

97,000

3,089,300

140,000

13,000

7,284,600

1,674,000

144,000

551,000

26,949,300

2.5

37

1.25

0.870

10.7

11.48

0.1370

3.45

57.85

10.9

1.82

1270

1720

7.30

1.77

112

11.8

0.015

4.3

2.20

2.11

0.910

2

11.5

0.480

0.710

15.12

2.34

82.95

4.40

3038.00

0.485

42.60

67.45

0.80

8.5

0.345

1.320

-1.96

0.00

0.00

0.00

-2.73

0.70

0.00

1.47

-0.17

-0.91

0.00

2.42

0.12

-1.08

0.00

0.27

-1.50

7.14

0.00

0.00

-0.47

0.00

0.00

3.05

-5.88

-2.74

-1.18

-0.43

0.00

-8.14

-0.07

-1.02

1.19

0.97

-1.23

-0.70

2.99

-0.75

20,000

1,000

103,000

2,547,000

140,200

12,828,200

37,080,000

245,000

171,970

10,000

2,000

5

73,155

314,500

85,000

2,185,690

5,000

131,200,000

58,000

148,000

120,000

307,000

20,000

7,498,400

2,153,000

938,000

78,700

29,000

4,010

4,913,000

112,365

6,310,000

1,604,300

773,100

405,000

15,244,800

620,000

51,000

0.0047

4.35

15.42

16.60

0.280

11.02

0.89

1.5

8.70

0.385

0.400

0.0190

0.0190

4.88

34.55

2.58

0.6500

2.240

0.0170

0.0180

6.73

12.12

8.08

0.036

360.00

0.0130

2.17

-3.33

0.13

-0.12

-1.75

0.00

2.30

2.04

0.00

0.00

0.00

0.00

-5.00

-0.41

-5.99

0.78

-1.52

-0.44

0.00

0.00

0.15

-0.82

1.51

-2.70

0.00

0.00

1,000,000

106,000

55,100

1,000

1,820,000

6,500

876,000

4,741,000

14,400

8,410,000

1,060,000

62,300,000

2,800,000

1,211,000

13,193,300

403,000

215,000

2,097,000

22,100,000

1,400,000

146,200

12,185,900

4,152,200

7,300,000

34,020

2,400,000

38

501

30

104

105

7.3

103.4

75.15

75

77.5

1008

-0.39

-0.20

-11.76

0.00

-0.47

-1.08

0.10

0.20

0.00

0.00

-0.20

5,000

19,920

100

23,110

25,550

34,400

24,430

1,293,950

182,700

50,250

5,930

38,000.00

-5,021,740.00

7.62

8

34.25

0.79

0.00

0.00

688,100

1,600

4,500

2,049,975.00

110.8

-0.27

11,700

4,549,601.00

-2,579,457.50

-10,970,274.00

-13,332.00

19,350.00

72,870.00

14,500.00

-212,615.00

-45,065,725.50

-130,590.00

18,229,097.00

-394,800.00

-5,137,067.00

-231,262,830.00

11,099,050.00

20,000.00

2,080.00

1,084,382.00

2,570,120.00

71,000.00

30,930.00

-636,996.00

7,080,988.00

9,005,610.00

-45,903,749.00

9,939,966.00

-21,827,325.00

-2,297,797.00

-159,650.00

16,500.00

-681,436.00

-156,576.00

621,045.00

8,936,185.00

-510,212.00

-4,269,876.00

417,096.00

-28,729.00

-19,750.00

1,146,314.00

-256,000.00

89,700.00

99,630.00

105,000.00

22,383,244.00

-327,299,175.00

-54,900.00

88,200.00

-385,515.00

30,953,707.00

91,150,670.00

14,713,845.00

-547,636.00

10,548,211.50

-16,350,290.00

70,167,538.00

-267,338.00

-13,200.00

-6,912,004.50

29,300.00

339,000.00

-74,137,945.00

-1,408,178.00

19,690.00

-3,069,120.00

1,498,735.00

865,163.00

-333,675.00

-543,260.00

-170,100.00

3,590,020.00

-7,171,760.00

952,000.00

-53,439,880.00

29,100.00

24,158,980.00

-5,398,728.00

38,574,438.00

304,028.00

-24,241,064.00

482,170.00

1,232,619.50

50,957,900.00

-164,004,607.00

59,000.00

10,994,444.00

-42,742.00

-15,199.00

-7,356,690.00

138,048,500.00

48,500.00

-6,126,945.00

-13,359,312.00

322,400.00

-75,193,132.00

616,600.00

-7,200.00

-10,710.00

-92,730.00

1,664,700.00

15,255,205.00

18,560.00

25,200.00

86,495.00

54,032,798.00

113,100.00

-4,723,130.00

21,020.00

-58,647,555.00

-12,953,650.00

-1,581,967.50

Você também pode gostar

- The Standard - Business Daily Stocks Review (June 4, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Standard - Business Daily Stocks Review (June 2, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Standard - Business Daily Stocks Review (June 5, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Standard - Business Daily Stocks Review (June 8, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (June 3, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Standard - Business Daily Stocks Review (May 26, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Documento1 páginaManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Standard - Business Daily Stocks Review (May 7, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Standard - Business Daily Stocks Review (May 7, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 25, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Standard - Business Daily Stocks Review (May 22, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Standard - Business Daily Stocks Review (May 20, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Standard - Business Daily Stocks Review (May 18, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Standard - Business Daily Stocks Review (May 11, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Standard - Business Daily Stocks Review (May 13, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 6, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Documento1 páginaManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 4, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (April 28, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 5, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (April 22, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (April 17, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayAinda não há avaliações

- Manila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Documento1 páginaManila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (April 30, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Standard - Business Daily Stocks Review (April 29, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Weekly Stocks Review (April 19, 2015)Documento1 páginaThe Standard - Business Weekly Stocks Review (April 19, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (April 23, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (April 16, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 16, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (April 24, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Labor Finals Digest ListDocumento2 páginasLabor Finals Digest ListWednesday AbelgasAinda não há avaliações

- Quotation: TO: Mr. Bryan Mayoralgo Municipality of Alicia, IsabelaDocumento4 páginasQuotation: TO: Mr. Bryan Mayoralgo Municipality of Alicia, IsabelaBryan MayoralgoAinda não há avaliações

- Room Assignments - Secondary-Biological Science (Pagadian) PDFDocumento15 páginasRoom Assignments - Secondary-Biological Science (Pagadian) PDFPhilBoardResultsAinda não há avaliações

- Affidavit of Attachment SidecarDocumento1 páginaAffidavit of Attachment SidecarDumz BernAinda não há avaliações

- AERO1115ra Mla e PDFDocumento15 páginasAERO1115ra Mla e PDFPhilBoardResultsAinda não há avaliações

- RA RME MANILA Apr2018 PDFDocumento76 páginasRA RME MANILA Apr2018 PDFPhilBoardResultsAinda não há avaliações

- List of Famous Filipino Brand Names and SlogansDocumento3 páginasList of Famous Filipino Brand Names and SlogansKlaribelle VillaceranAinda não há avaliações

- Dj-Expenses Mar 2023Documento18 páginasDj-Expenses Mar 2023Yt premiumAinda não há avaliações

- Architects 01-2019 Room AssignmentDocumento6 páginasArchitects 01-2019 Room AssignmentPRC BaguioAinda não há avaliações

- Tuguegarao Major in Physical Sciences PDFDocumento4 páginasTuguegarao Major in Physical Sciences PDFPhilBoardResultsAinda não há avaliações

- REE0914ra MlaDocumento102 páginasREE0914ra MlaBoris CaluzaAinda não há avaliações

- Professional Regulation Commission: Legazpi CityDocumento25 páginasProfessional Regulation Commission: Legazpi CityNonoyTaclinoAinda não há avaliações

- Secondary (Agri & Fishery Arts) - Masbate - 9-2019 PDFDocumento7 páginasSecondary (Agri & Fishery Arts) - Masbate - 9-2019 PDFPhilBoardResultsAinda não há avaliações

- Tuguegarao Major in Filipino PDFDocumento11 páginasTuguegarao Major in Filipino PDFPhilBoardResultsAinda não há avaliações

- DirectoryDocumento13 páginasDirectoryDyan Sheryl CarolinoAinda não há avaliações

- ENG0916ra Tugue e PDFDocumento31 páginasENG0916ra Tugue e PDFPhilBoardResultsAinda não há avaliações

- The Economy and The Demand Side: Macroeconomic and Industry Analysis Macroeconomic AnalysisDocumento21 páginasThe Economy and The Demand Side: Macroeconomic and Industry Analysis Macroeconomic AnalysisJohn Paul SiodacalAinda não há avaliações

- Ra 040119 Social Worker Koronadal City 9 2023 1Documento55 páginasRa 040119 Social Worker Koronadal City 9 2023 1Paula KanakanAinda não há avaliações

- Merc CasesDocumento6 páginasMerc CasesMara VinluanAinda não há avaliações

- RA RME CEBU Apr2018 PDFDocumento26 páginasRA RME CEBU Apr2018 PDFPhilBoardResults0% (1)

- Philippines Overview of Economy, Information About Overview of Economy in PhilippinesDocumento5 páginasPhilippines Overview of Economy, Information About Overview of Economy in PhilippinesFrance TolentinoAinda não há avaliações

- Top 10 Richest Businessman in The PhilippinesDocumento5 páginasTop 10 Richest Businessman in The PhilippinesJon Lester De VeyraAinda não há avaliações

- List of Shopping Malls in The PhilippinesDocumento14 páginasList of Shopping Malls in The PhilippinesKatherine ReyesAinda não há avaliações

- Davao City NLE 2011 Room AssignmentsDocumento215 páginasDavao City NLE 2011 Room AssignmentsdabawnarsAinda não há avaliações

- List of Attendees Agency Name PositionDocumento2 páginasList of Attendees Agency Name PositionInNa RiveraAinda não há avaliações

- Rdo 27 - 2023Documento2 páginasRdo 27 - 2023abroguenaanneAinda não há avaliações

- Values NCRDocumento17 páginasValues NCRproffsgAinda não há avaliações

- Company Profile 11-6-17 v2 PDFDocumento139 páginasCompany Profile 11-6-17 v2 PDFromelleAinda não há avaliações

- Tomas Del Rosario College: Economic History of The PhilippinesDocumento6 páginasTomas Del Rosario College: Economic History of The PhilippinesMyles Ninon LazoAinda não há avaliações

- 1st Quarter-Lesson 59 - Reading and Writing MoneyDocumento37 páginas1st Quarter-Lesson 59 - Reading and Writing MoneyROCHELLE100% (3)

- Free & Clear, Standing & Quiet Title: 11 Possible Ways to Get Rid of Your MortgageNo EverandFree & Clear, Standing & Quiet Title: 11 Possible Ways to Get Rid of Your MortgageNota: 2 de 5 estrelas2/5 (3)

- Legal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemNo EverandLegal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemNota: 4 de 5 estrelas4/5 (16)

- Bank Asset and Liability ManagementNo EverandBank Asset and Liability ManagementAinda não há avaliações

- Lucifer's Banker Uncensored: The Untold Story of How I Destroyed Swiss Bank SecrecyNo EverandLucifer's Banker Uncensored: The Untold Story of How I Destroyed Swiss Bank SecrecyNota: 5 de 5 estrelas5/5 (4)