Escolar Documentos

Profissional Documentos

Cultura Documentos

ECMGL Weekly June 16-22

Enviado por

Amga KhashDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ECMGL Weekly June 16-22

Enviado por

Amga KhashDireitos autorais:

Formatos disponíveis

www.eurasiac.

com

ya

Politics and Economy

SME Equipment and Facilities Exempt from Customs Tax and VAT

Mongolian Foreign Exchange Reserves Decrease to Worrying

Level

2013 Budget Performance Submitted to Parliament

Financial Markets

Equity Market Gains 2% W-o-w

MNT Remained Flat

Securities Trading on Foreign Financial Market

Market Value of Companies Decreased

Commodity Markets

Mongolia to Export EUR3 mn Textile Products Annually

Agricultural Exchange Traded Commodities Worth MNT31.6 bn

Corporate News

Mongolia Selects GDF Suez-Led Group to Build 450MW Power

Plant

Kincora Copper Announced its Progress at Bronze Fox Project

Bank of China to Credit US$25 mn to Tuushin Hotel of Mongolia

MSE TOP-20 Index (6 months)

0,00

0,02

0,04

0,06

0,08

0,10

0,12

12 000

13 000

14 000

15 000

16 000

17 000

18 000

2

0

-

D

e

c

2

9

-

D

e

c

7

-

J

a

n

1

6

-

J

a

n

2

5

-

J

a

n

3

-

F

e

b

1

2

-

F

e

b

2

1

-

F

e

b

2

-

M

a

r

1

1

-

M

a

r

2

0

-

M

a

r

2

9

-

M

a

r

7

-

A

p

r

1

6

-

A

p

r

2

5

-

A

p

r

4

-

M

a

y

1

3

-

M

a

y

2

2

-

M

a

y

3

1

-

M

a

y

9

-

J

u

n

1

8

-

J

u

n

U

S

$

m

n

Total Trading Volume, US$ Top-20 Index

Source: MSE

Mongolia Weekly

June 16-22, 2014

Selected Worldwide Indices

Index

Close

price

Performance

w-o-w YTD

MSE TOP 20 15,420.95 1.68% -5.4%

Silk Road Composite

Index

410.47 1.30% -3.4%

Silk Road Central

Asia Index

433.29 0.79% 1.9%

Silk Road Australia 145.29 -2.69% -13.0%

Silk Road Myanmar

Index

1,451.58 -1.43% -6.2%

Silk Road Mongolia 248.77 2.53% 4.9%

Silk Road Hong Kong 8.24 -3.79% -33.3%

Silk Road Iraq 1,226.19 1.32% -10.8%

Silk Road Iraq Oil

Index

1,444.73 2.12% -9.7%

MSCI FM 685.23 -1.95% 15.3%

MSCI EM 1,043.86 -0.50% 4.1%

Dow Jones 16,947.08 1.02% 2.2%

FTSE 100 6,825.20 0.70% 1.1%

Nikkei 15,349.42 1.67% -5.8%

Hang Seng 23,194.06 -0.54% -0.5%

Shanghai 2,136.73 -1.82% -8.3%

KASE 1,116.99 2.02% 21.7%

RTS 1,358.73 -1.18% -5.8%

Top Movers on MSE

Stock

Close

price,

MNT

Performance

w-o-w YTD

Best performers

Buteelch Uils 692 32.25% 245.8%

Talkh Chikher 19,500 18.18% 40.8%

Khukh Gan 110 15.79% -15.4%

Bayangol Hotel 55,000 5.77% 5.8%

UB Hotel 116,000 5.45% 24.7%

Worst performers

Material Impex 14,500 -6.45% 2.8%

Dornod Khudaldaa 9,100 -12.08% -12.1%

Juulchin Gobi 3,600 -13.25% -19.1%

Mongol Nekhmel 5,300 -14.52% -14.5%

Durvun-Uul 1,110 -14.62% -24.7%

Major Commodities

Commodity Last price

Performance

w-o-w YTD

Copper $/t 6,840.50 2.41% -7.3%

Gold $/oz 1,314.85 2.97% 9.1%

Coal

1

$/t 99.46 -0.72% -13.3%

Iron ore

2

, $/t 101.17 -4.54% -33.8%

Uranium $/lp 35.75 0.00% 0.0%

Crude oil $/bbl 107.26 0.33% 9.0%

MNT vs Major Currencies

Name

Rate

3

,

MNT

MNT app(+) or dep(-)

w-o-w YTD

US$ 1,824.10 0.00% -9.0%

Euro 2,482.69 -0.27% -7.8%

Japanese Yen 17.9 0.06% -11.7%

Chinese Yuan 293 0.26% -6.4%

Russian Rouble 53.1 -0.13% -4.7%

1

Qinhuangdao, Steam Coal

2

China Import Price Qingdao Port

3

Central Bank Rates

Source: Bloomberg, MSE, Eurasia Capital

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 2

POLITICS AND ECONOMY

SME Equipment and Facilities Exempt from Customs Tax and VAT

According to the UB Post Newspaper, the government has approved the latest list of equipment,

facilities and parts for Small and Medium Enterprises (SME) manufacturing to be exempt from customs

taxes and VAT. Earlier, the government exempted a total of 1,065 types of SME manufacturing

equipments in accordance with resolutions approved in 2009, 2011 and 2012. However, the resolution

eliminated non-manufacturing related products such as televisions, computer monitors, printer ink,

touch screen tablets, and some IT parts brought from overseas, assembled, and sold in Mongolia.

Mongolian Foreign Exchange Reserves Decrease to Worrying Level

Morgan Stanley analysts Desmond Lee and Gaurav Singhal reported that Mongolian foreign exchange

(FX) reserves might have reduced to an anticipated US$1.7 bn by the end of April. Mongolias FX

reserves were at approximately US$2.2 bn at the end of February as reported on the statement of

Central Bank of Mongolia. The analysts highlighted, If the FX reserves stay in decline for a few more

months, Mongolia will come closer to the two-month import cover which is the same point where

Mongolia received International Monetary Fund assistance in 2009. The analysts also pointed out,

When the OyuTolgoi project dispute is not fully resolved and the FX reserves are very low, the

Government of Mongolia will have a hard time getting credit again, said on Bloomberg.

2013 Budget Performance Submitted to Parliament

On June 18, 2014, the Minister of Finance Ch.Ulaan submitted a 2013 budget performance of Mongolia

to the parliament, stated on Montsame News.

- The balanced revenue and aid results of Mongolias master budget reached MNT5,940.1 bn,

showing an increase of MNT1,076.9 bn or 22.1% against the year of 2012.

- The previous year, MNT46.9 bn were placed in the fund for stabilization in accordance with the

law on budgetary stability. The tax-revenue performance reached MNT5,072.8 bn, showing a

performance of 89.3%.

- The performance of non-tax revenue reached MNT863.9 bn, over fulfilled by 120.4% or

MNT146.5 bn. It was mainly due to increases in revenues from interests and fines (MNT70.6 bn),

from oil (MNT25.9 bn), and from own revenues of budgetary organizations.

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 3

FINANCIAL MARKETS

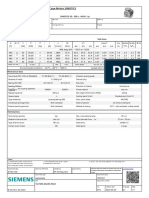

Equity Market Gains 2% W-o-w

On Friday, the benchmark index

MSE Top-20 added by 2% w-o-w

and ended the week at

15,420.95 with combined

volume of MNT39.6 mn. The

total market volume of the

week for 43 stocks was counted

as MNT85.3 mn, 46% of which

was on the Top-20.

16 companies including 10

members of the Top-20 closed

the week advancing and their

volume was MNT34.6 mn. Talkh

Chikher (TCK) advanced most

adding 18.18% and closed at

MNT19,500. Other major

gainers included Khukh Gan 15.79% to MNT110, Bayangol Hotel (BNG) 5.77% to MNT55,000, UB Hotel

(ULN) 5.45% to MNT116,000, and SUU (SUU) 5.10% to MNT103,000.

The losing group comprised of 14 stocks including 7 of the Top-20 members. Combined volume for them

was MNT37.8 mn. Remicon (RMC) fell 5.63% to MNT151, Baganuur (BAN) declined 4.23% to MNT3,304,

Hotel Mongolia (MSH) tumbled -3.66% to MNT896, BdSec (BDS) plummeted 0.70% to MNT2,680, and

Mongolia Development Resources (MDR) dropped 0.14% to MNT699.

13 stocks remained flat including Shivee Ovoo (SHV), State Department Store (UID), Mogoin Gol (BDL),

Darkhan Nekhii (NEH), and Merex (MRX).

The most actively traded stocks were Berkh Uul with MNT31.1 mn, Apu with NBT14.9 mn, UB Hotel with

MNT7.7 mn, UB BUK with MNT5.8 mn, and Gobi with MNT5.3 mn.

The benchmark index Top-20 has declined by 5% since the beginning of 2014.

MSE Top 20 Index (6 month)

0,00

0,02

0,04

0,06

0,08

0,10

0,12

12 000

13 000

14 000

15 000

16 000

17 000

18 000

2

0

-

D

e

c

2

9

-

D

e

c

7

-

J

a

n

1

6

-

J

a

n

2

5

-

J

a

n

3

-

F

e

b

1

2

-

F

e

b

2

1

-

F

e

b

2

-

M

a

r

1

1

-

M

a

r

2

0

-

M

a

r

2

9

-

M

a

r

7

-

A

p

r

1

6

-

A

p

r

2

5

-

A

p

r

4

-

M

a

y

1

3

-

M

a

y

2

2

-

M

a

y

3

1

-

M

a

y

9

-

J

u

n

1

8

-

J

u

n

U

S

$

m

n

Total Trading Volume, US$ Top-20 Index

Source: MSE

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 4

MNT Remained Flat

During the week, the MNT

softly fluctuated gaining and

weakening ever day, for w-o-

w MNT remained stable

against the US$. The official

MNT/US$ currency rate by the

Bank of Mongolia closed at

1,824.10 on Friday, June 20,

2012.

The Bank of Mongolia

informed that on Thursday

currency auction, the BOM

has received bid offer of US$

and CNY from local

commercial banks. The BOM

has sold US$7.5 mn as closing

rate of MNT 1824.00 and CNY43.0 mn as closing rate of MNT 293.00.

On June 19th, 2014, The BOM has received MNT Swap agreement bid offer in equivalent to US$40.0 mn

and US$ Swap agreement ask offer of US$25.0 mn from local commercial banks and accepted all offer.

Securities Trading on Foreign Financial Market

The newly updated financial market law took effect this year and the Financial Regulatory Commission

(FRC) made a statement recently about trading securities in foreign financial markets. In accordance

with the legislative decree No.36.36 of the financial market law, purchasing and brokering securities in

foreign financial markets must be done with the FRCs permission. According to the UB Post Newspaper,

The FRC issued a resolution No.198 and made an amendment to the regulation in order to monitor the

operations that aimed precisely at regulating securities dealing in foreign financial markets.

The FRC stated:

- One has to meet the requirements and conditions of the regulation to purchase or broker

securities, send mandatory materials along with an application to the FRC to obtain permission.

- According to the amendment to the regulation, purchasing or brokering securities in foreign

financial markets without the FRCs permission will result in fines in accordance with the law.

US$-MNT rate (6 months)

1 580

1 630

1 680

1 730

1 780

1 830

1 880

1

8

-

D

e

c

2

6

-

D

e

c

3

-

J

a

n

1

1

-

J

a

n

1

9

-

J

a

n

2

7

-

J

a

n

4

-

F

e

b

1

2

-

F

e

b

2

0

-

F

e

b

2

8

-

F

e

b

8

-

M

a

r

1

6

-

M

a

r

2

4

-

M

a

r

1

-

A

p

r

9

-

A

p

r

1

7

-

A

p

r

2

5

-

A

p

r

3

-

M

a

y

1

1

-

M

a

y

1

9

-

M

a

y

2

7

-

M

a

y

4

-

J

u

n

1

2

-

J

u

n

2

0

-

J

u

n

Bank of Mongolia Rate

Source: The Bank of Mongolia

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 5

Market Values of Companies Decreased

The National Statistical Office of Mongolia (NSO) reported:

- As of the first five months of this year, the Mongolian Stock Exchange (MSE) traded 15.8 million

securities, totaling MNT105.8 bn.

- In May, 0.6 million securities of MNT46.6 bn were traded and an average of the TOP-20 index

reached 15,407.7 points, decreased by 368.1 points from the previous month.

- During the May, the market value of securities of share-holding companies registered on the

stock market reached MNT1,516.9 bn, reduced by MNT82.7 bn, which is 5.2 percent lower than

the previous month.

After the resignation of the previous CEO, H.Altai on January, the election process began for a

replacement and the results of the selection of a new MSE CEO have not been officially announced yet.

Analysts say that in this time when the market values of registered companies stay in decline and the

stock market suffers, it is imperative to accelerate the CEO election process and take steps for the

future.

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 6

COMMODITY MARKETS

Mongolia to Export EUR3 mn Textile Products Annually

Exclusive LLC has signed a

contract with Poland-Turkey joint

company Rubin to supply annually

EUR3 mn worth of apparel, mainly

jackets, reported on the UB Post

Newspaper. The agreement was

signed during the visit of Ilhan

Erden, president of Rubin, and he

agreed to buy the first portion of

textile products in October, 2014. A

Mongolian company is now

becoming an executive company of a foreign brand and products made in Mongolia will be sold in the

international market.

At present, there are around 450 apparel factories operating in Mongolia. Before soft loans from the

Chinggis Bond for equipment and facilities were granted to textile factories since 2012, the Mongolian

textile industry had been operating without any support, the source said.

Agricultural Exchange Traded Commodities Worth MNT31.6 bn

The Agricultural Commodities Exchange of Mongolia conducted trades that worth a total of MNT31.6 bn

in the last 55 weeks, reported on Montsame News. During the period, the exchange conducted trades of

three types of animal-origin commodities - 402.7 ton of cashmere and 250 ton of fiber mill wool.

The price of unprocessed, non-white cashmere stood at MNT762,000 per bale at the end of the last

week, while white cashmere was traded at a price of MNT782,000 per unit.

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 7

CORPORATE NEWS

Mongolia Selects GDF Suez-Led Group to Build 450MW Power Plant

GDF Suez-Led (GDF) group signed a

concession agreement on June 20, 2014

with the Mongolian government to build a

US$1.2 bn power plant in Ulaanbaatar, as

Mongolia seeks to ease pressure on the

capitals Soviet-era power

infrastructure. GDF, Posco Energy

Corporation, and Mongolias Newcom

Group signed a memorandum of

understanding at the Government House to

build a combined heat and power plant,

which is scheduled for commissioning in

2017. The GDF group beat a bid from a partnership that included Samsung C&T Corp and Korea

Southern Power Corporation in selecting a winner have stretched more than a year as the government

changed the proposed location of the plant, which is now scheduled to be built 15km east of downtown

Ulaanbaatar. According to the concession agreement, the group will fund, construct and operate the

plant for 25 years, sell its power to the central grid, and then transfer the facility to the government,

reported on Bloomberg.

Kincora Copper Announced its Progress at Bronze Fox Project

Toronto-listed Kincora Copper has recently announced its progress at Bronze Fox project in Mongolia.

According to news published at www.proactiveinvestors.com on June 16, 2014, the agreement grants a

third party exclusive rights to carry out due diligence on the copper project ahead of a potential joint

venture, strategic alliance or other transaction. Sam Spring, Kincora's president and chief executive, told

investors, Kincora is the last remaining listed copper junior in Mongolia without a strategic partner and

this is despite Bronze Fox being one of the more advanced copper projects, situated in the Oyu Tolgoi

mineralization structural trend. The company has attracted interest from various existing large-scale

copper producers and welcomes advancing discussions with this particular group as we continue our

ongoing drilling and other exploration activities at Bronze Fox."

Bronze Fox has a mineral footprint of around 40 sq km and lies 140km from Rio Tinto's Oyu Tolgoi mine,

where daily production is targeted of up to 160,000 tons a day. At Bronze Fox, Kincora aims to find

shallow and deep copper-gold porphyry deposits and assess the potential for shallow gold deposits with

a view to the future development of open pit or underground mines.

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 8

Bank of China to Credit US$25 mn to Tuushin Hotel of Mongolia

Bank of China completed the US$25 mn loan

agreement with Tuushin Hotel on June 13,

2014, which was the first financing to

Mongolia by Bank of China. The Trade and

Development Bank of Mongolia, Golomt

Bank and Xacbank are also involved with the

financing, said on BdSecs website.

The Bank of China expressed its interest to offer its products and services through those banks of

Mongolia in the future. Bank of China established its representative office in Ulaanbaatar in 2013.

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 9

EURASIA CAPITAL RATINGS

MSE TOP-20 Companies (June 16-20, 2014)

Name Symbol

Eurasia Capital

Rating

Price Market Cap Performance EPS PE PB

MNT MNTmn US$mn 1W chg y-t-d 2013 2013 2013

APU APU UNDER REVIEW 3,600 267,436 146.6 0.53% -11.5% 54 66.5 3.2

Tavan Tolgoi TTL UNDER REVIEW 4,978 262,167 143.7 0.16% -17.8% 1,193 4.2 2.8

Sharyn Gol SHG UNDER REVIEW 7,400 75,712 41.5 4.23% -3.9% 113 65.4 2.0

Shivee Ovoo SHV UNDER REVIEW 5,300 71,121 39.0 0.00% -31.2% N/A N/A N/A

Baganuur BAN UNDER REVIEW 3,304 69,299 38.0 -4.23% -28.9% -437 -7.6 -1.3

Gobi GOV UNDER REVIEW 7,750 60,459 33.1 2.58% 40.1% 910 8.5 1.4

UB Hotel ULN UNDER REVIEW 116,000 38,894 21.3 5.45% 24.7% 8,278 14.0 2.9

Mongolian Telecom MCH UNDER REVIEW 1,460 37,771 20.7 0.83% -2.6% N/A N/A N/A

Suu SUU UNDER REVIEW 103,000 35,432 19.4 5.10% 15.1% 6,767 15.2 2.0

BDSec BDS UNDER REVIEW 2,680 29,480 16.2 -0.70% 11.7% 26 102.4 3.3

Bayangol Hotel BNG UNDER REVIEW 55,000 23,269 12.8 5.77% 5.8% 8,151 6.7 0.8

Talkh Chikher TCK UNDER REVIEW 19,500 19,962 10.9 18.18% 40.8% 2,178 9.0 1.0

State Department Store UID UNDER REVIEW 530 19,508 10.7 0.00% -3.5% -22 -23.9 -20.8

Mogoin Gol BDL UNDER REVIEW 15,000 12,444 6.8 0.00% -4.9% 41 369.9 8.4

Remicon RMC UNDER REVIEW 151 11,881 6.5 -5.63% -10.1% 0 482.5 1.5

Khukh Gan HGN UNDER REVIEW 110 11,145 6.1 15.79% -15.4% -3 -34.4 2.9

Silikat SIL UNDER REVIEW 225 10,425 5.7 0.00% -2.2% 0 2,840.1 2.8

Mongolia Development

Resources

MDR UNDER REVIEW 699 9,611 5.3 -0.14% -6.6% 14 48.3 0.6

Genco Tour Bureau JTB UNDER REVIEW 87 9,559 5.2 -0.11% -2.4% -2 -39.3 1.1

Hotel Mongolia MSH UNDER REVIEW 896 8,960 4.9 -3.66% -5.7% -19 -46.9 2.9

Source: MSE, Eurasia Capital Estimates

Selected 5 Non-MSE TOP-20 Member Largest Companies (June 16-20, 2014)

Name Symbol

Eurasia Capital

Rating

Price Market Cap Performance EPS PE PB

MNT MNTmn US$mn 1W chg y-t-d 2013 2013 2013

Berkh Uul BEU UNDER REVIEW 3,200 60,999 33.4 -5.88% -28.7% -276 -15.4 -11.1

Darkhan Nekhii NEH UNDER REVIEW 15,600 17,245 9.5 0.00% 35.7% 1,873 8.3 0.6

Makh Impex MMX UNDER REVIEW 3,000 11,402 6.3 -2.60% 20.3% 502 6.0 6.3

Eermel EER UNDER REVIEW 2,101 7,310 4.0 3.40% -24.9% 190 10.8 0.6

Aduunchuluun ADL UNDER REVIEW 1,800 5,672 3.1 4.59% -10.0% 169 10.5 0.6

Source: MSE, Eurasia Capital Estimates

*Note: These PE and PB ratios are not meaningful, in our view.

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 10

ECONOMIC PERFORMANCE

Indicator 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Population and income

Population, mn 2.53 2.56 2.59 2.63 2.68 2.74 2.76 2.81 2.87 2.93

GDP per capita, US$ 720 905 1,327 1,620 2,108 1,688 2,267 3,045 3,575 3,610

National accounts

Nominal GDP, MNTbn 2,152 2,780 3,715 4,599.5 6,555 6,591 8,415 10,830 13,944 17,550

Nominal GDP, US$bn 1.8 2.3 3.2 3.9 5.1 4.6 6.6 8.6 10.3 10.6

Real GDP growth, y-o-y, % 10.6 7.2 8.6 10.2 8.9 -1.3 6.4 17.3 12.3 11.7

Monetary indicators and inflation

M2 growth, y-o-y, % 20.4 34.6 34.8 56.3 -5.5 26.9 62.5 37.0 18.8 24.1

CPI, y-o-y, % 11.0 9.2 4.8 14.1 22.1 4.2 13.0 10.2 14.0 12.5

Exchange rate, MNT/US$,

end-year

1,209 1,221 1,165 1,170 1,267 1,443 1,257 1,396 1,392 1,659

International reserves,

US$mn

208 333 718 1,001 657 822 2,000 2,500 4,091 2,309

Government finance

Revenue, % of GDP 33.1 30.1 36.6 40.9 33.1 30.3 37.1 40.6 35.6 33.8

Expenditure, % of GDP 35.0 27.5 28.5 38.0 37.6 35.5 36.6 44.3 43.3 35.2

Budget balance, % of GDP -2.1 3.2 3.9 2.9 -4.5 -5.2 0.5 -3.7 -7.7 -1.4

Balance of payments

Exports, US$mn 869 1,064 1,542 1,948 2,535 1,885 2,909 4,780 4,385 4,273

Imports, US$mn 1,019 1,177 1,435 2,062 3,245 2,138 3,200 6,527 6,739 6,354

Exports, y-o-y, % 41.3 22.4 44.9 26.3 30.1 -25.6 54.3 64.3 -9.0 -2.6

Imports, y-o-y, % 28.8 15.5 21.9 43.7 57.4 -34.1 49.7 104.0 2.1 -5.7

Trade balance, US$mn -150 -113 107 -114 -710 -253 -291 -1,747 -2,354 -2,082

Net FDI, US$mn 92.9 185.3 191.1 360.0 838.5 569.8 1,629.7 4,620.1 3,750.0 2,343

Source: National Statistics Office of Mongolia, the Bank of Mongolia, the IMF, the World Bank, Eurasia Capital. *According to November 2010

Population and Housing Census

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 11

MSE AND MONGOLIA FOCUSED INTERNATIONAL MINING COMPANY

STOCKS PERFORMANCE SUMMARY

MSE TOP-20 Performance (June 16-20, 2014)

Code Name

Price Performance Market Cap

Daily Turnover

(52Wk Avg) 1Wk turnover

(MNT)

Close

52 Wk

high

52 Wk

low

w-o-w y-t-d MNTmn US$mn MNT US$

90 APU 3,600 4,395 3,230 0.53% -11.5% 267,436 146.6 186,448,725 102,214 14,984,300

458 Tavan Tolgoi 4,978 6,850 2,800 0.16% -17.8% 262,167 143.7 3,178,960 1,743 157,746

309 Sharyn Gol 7,400 9,480 6,900 4.23% -3.9% 75,712 41.5 1,896,447 1,040 232,880

460 Shivee Ovoo 5,300 8,340 4,620 0.00% -31.2% 71,121 39.0 457,736 251 2,638,800

396 Baganuur 3,304 5,010 3,241 -4.23% -28.9% 69,299 38.0 769,661 422 951,036

354 Gobi 7,750 7,750 3,804 2.58% 40.1% 60,459 33.1 1,071,218 587 5,309,350

3 UB Hotel 116,000 122,600 80,000 5.45% 24.7% 38,894 21.3 617,079 338 7,668,000

209 Mongolian Telecom 1,460 1,799 1,001 0.83% -2.6% 37,771 20.7 344,882 189 21,890

135 Suu 103,000 112,000 67,000 5.10% 15.1% 35,432 19.4 1,165,819 639 515,000

522 BDSec 2,680 3,188 2,150 -0.70% 11.7% 29,480 16.2 1,207,489 662 18,760

13 Bayangol Hotel 55,000 61,000 43,000 5.77% 5.8% 23,269 12.8 728,609 399 899,000

22 Talkh Chikher 19,500 19,500 5,250 18.18% 40.8% 19,962 10.9 410,090 225 253,200

484 State Department Store 530 700 395 0.00% -3.5% 19,508 10.7 539,825 296 359,970

444 Mogoin Gol 15,000 20,300 11,050 0.00% -4.9% 12,444 6.8 251,384 138 75,000

530 Remicon 151 196 148 -5.63% -10.1% 11,881 6.5 2,027,203 1,111 1,101,800

532 Khukh Gan 110 149 95 15.79% -15.4% 11,145 6.1 961,144 527 701,160

317 Silikat 225 260 150 0.00% -2.2% 10,425 5.7 11,771,303 6,453 -

524

Mongolia Development

Resources

699 870 500 -0.14% -6.6% 9,611 5.3 232,201 127 3,503,495

521 Genco Tour Bureau 87 96 80 -0.11% -2.4% 9,559 5.2 343,961 189 242,635

517 Hotel Mongolia 896 977 790 -3.66% -5.7% 8,960 4.9 1,856 1 4,480

Source: MSE, Bank of Mongolia, Eurasia Capital

Selected Non-MSE TOP-20 Member Leading Market Cap Companies (June 16-20, 2014)

Code Name

Price Performance Market Cap

Daily Turnover

(52Wk Avg) 1Wk turnover

(MNT)

Close

52 Wk

high

52 Wk

low

w-o-w y-t-d MNTmn US$mn MNT US$

492 Berkh Uul 3,200 6,000 3,145 -5.88% -28.7% 60,999 33.4 238,120 131 31,340,800

71 Darkhan Nekhii 15,600 18,300 6,500 0.00% 35.7% 17,245 9.5 499,106 274 733,200

208 Makh Impex 3,000 3,200 1,640 -2.60% 20.3% 11,402 6.3 366,518 201 170,422

191 Eermel 2,101 2,899 2,010 3.40% -24.9% 7,310 4.0 113,189 62 718,679

461 Aduunchuluun 1,800 2,832 1,650 4.59% -10.0% 5,672 3.1 553,198 303 432,000

Source: MSE, Bank of Mongolia, Eurasia Capital

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 12

Performance of MSE Stocks Traded (June 16-20, 2014)

Code Name

Price Performance Market Cap

Daily Turnover

(52Wk Avg) 1Wk turnover

(MNT)

Close

52 Wk

high

52 Wk

low

w-o-w y-t-d MNTmn US$mn MNT US$

90 APU 3,600 4,395 3,230 0.53% -11.5% 267,436 146.6 186,448,725 102,214 14,984,300

458 Tavan Tolgoi 4,978 6,850 2,800 0.16% -17.8% 262,167 143.7 3,178,960 1,743 157,746

309 Sharyn Gol 7,400 9,480 6,900 4.23% -3.9% 75,712 41.5 1,896,447 1,040 232,880

460 Shivee Ovoo 5,300 8,340 4,620 0.00% -31.2% 71,121 39.0 457,736 251 2,638,800

396 Baganuur 3,304 5,010 3,241 -4.23% -28.9% 69,299 38.0 769,661 422 951,036

492 Berkh Uul 3,200 6,000 3,145 -5.88% -28.7% 60,999 33.4 238,120 131 31,340,800

354 Gobi 7,750 7,750 3,804 2.58% 40.1% 60,459 33.1 1,071,218 587 5,309,350

195 UB BUK 40,000 57,000 17,700 0.00% 5.3% 45,131 24.7 752,329 412 5,784,000

3 UB Hotel 116,000 122,600 80,000 5.45% 24.7% 38,894 21.3 617,079 338 7,668,000

209 Mongolian Telecom 1,460 1,799 1,001 0.83% -2.6% 37,771 20.7 344,882 189 21,890

135 Suu 103,000 112,000 67,000 5.10% 15.1% 35,432 19.4 1,165,819 639 515,000

522 BDSec 2,680 3,188 2,150 -0.70% 11.7% 29,480 16.2 1,207,489 662 18,760

13 Bayangol Hotel 55,000 61,000 43,000 5.77% 5.8% 23,269 12.8 728,609 399 899,000

22 Talkh Chikher 19,500 19,500 5,250 18.18% 40.8% 19,962 10.9 410,090 225 253,200

379 Material Impex 14,500 17,200 11,500 -6.45% 2.8% 19,839 10.9 1,442,275 791 275,500

484 State Department Store 530 700 395 0.00% -3.5% 19,508 10.7 539,825 296 359,970

71 Darkhan Nekhii 15,600 18,300 6,500 0.00% 35.7% 17,245 9.5 499,106 274 733,200

44 Takhi Co 11,000 11,000 7,000 0.00% 3.5% 13,090 7.2 11,847 6 143,000

444 Mogoin Gol 15,000 20,300 11,050 0.00% -4.9% 12,444 6.8 251,384 138 75,000

528 Hermes 155 190 105 3.33% -4.9% 12,174 6.7 840,283 461 2,480,000

530 Remicon 151 196 148 -5.63% -10.1% 11,881 6.5 2,027,203 1,111 1,101,800

208 Makh Impex 3,000 3,200 1,640 -2.60% 20.3% 11,402 6.3 366,518 201 170,422

532 Khukh Gan 110 149 95 15.79% -15.4% 11,145 6.1 961,144 527 701,160

524

Mongolia Development

Resources

699 870 500 -0.14% -6.6% 9,611 5.3 232,201 127 3,503,495

521 Genco Tour Bureau 87 96 80 -0.11% -2.4% 9,559 5.2 343,961 189 242,635

452 Auto Impex 3,890 3,950 2,665 -0.26% 11.3% 8,999 4.9 23,967 13 38,900

517 Hotel Mongolia 896 977 790 -3.66% -5.7% 8,960 4.9 1,856 1 4,480

191 Eermel 2,101 2,899 2,010 3.40% -24.9% 7,310 4.0 113,189 62 718,679

538 Merex 112 116 106 0.00% - 7,248 4.0 22,909 13 14,830

34 Gazar Suljmel 39,000 45,000 25,500 0.00% 18.2% 7,067 3.9 255,134 140 780,000

461 Aduunchuluun 1,800 2,832 1,650 4.59% -10.0% 5,672 3.1 553,198 303 432,000

537 E-Trans-Logistics 106 125 100 0.00% -6.2% 4,897 2.7 380,161 208 31,800

25 Moninjbar 299 365 190 1.70% 37.2% 4,745 2.6 985,819 540 2,990

531 Naco Tulsh 237 276 199 0.00% 13.4% 2,990 1.6 80,930 44 6,399

2 Mongol Savkhi 1,157 1,399 954 0.09% -13.8% 2,864 1.6 100,625 55 240,656

9 Mongol Nekhmel 5,300 7,225 4,697 -14.52% -14.5% 2,513 1.4 1,045,201 573 15,900

214 Tav 19,500 44,200 19,360 0.00% -51.0% 2,237 1.2 76,378 42 2,223,000

263 Guril Tejeel Bulgan 3,500 6,000 2,000 0.00% -2.9% 1,998 1.1 28,656 16 10,500

376 Khishig Uul 1,020 1,380 852 0.00% 2.0% 886 0.5 47,435 26 44,880

311 Dornod Khudaldaa 9,100 10,350 8,000 -12.08% -12.1% 673 0.4 8,755 5 136,500

21 Durvun-Uul 1,110 1,600 850 -14.62% -24.7% 337 0.2 8,609 5 5,550

61 Juulchin Gobi 3,600 5,000 3,600 -13.25% -19.1% 267 0.1 8,885 5 21,600

239 Buteelch Uils 692 692 174 32.25% 245.8% 132 0.1 7,467 4 8,118

Source: MSE, Bank of Mongolia, Eurasia Capital

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 13

Silk Road Mongolia Index* Companies Performance (June 16-20, 2014)

Name Symbol Currency

Close

Price

MktCap Price Performance

Daily

Turnover

Multiple

US$mn 52 wk high 52 wk low w-o-w y-t-d % D/3M

MONGOLIA ENERGY CORP LTD 276:HK HKD 0.223 194.38 0.29 0.149 -6.69% -8.23 0.325

NORTH ASIA RESOURCES HOLDING 61:HK HKD 0.119 50.81 0.3 0.103 -1.65% -34.62 0.534

SOLARTECH INTERNATIONAL HOLD 1166:HK HKD 0.106 25.84 0.42 0.1 -10.92% -51.62 0.907

SOUTHGOBI RESOURCES LTD 1878:HK HKD 5.27 127.35 10.78 4.53 3.54% -23.40 0.634

PEACE MAP HOLDING LTD 2953:HK HKD 0.199 170.30 0.48 0.19 -7.44% -31.38 0.177

MONGOLIAN MINING CORP 975:HK HKD 0.53 253.33 2.15 0.52 -5.36% -48.54 0.973

WINSWAY COKING COAL HOLDINGS 1733:HK HKD 0.375 182.54 0.71 0.305 -1.32% -23.47 0.634

APU JSC APU:MO MNT 3600 146.82 4490 3230 0.53% -11.53 0.991

TAVANTOLGOI JSC TTL:MO MNT 4978 143.93 6950 2500 0.16% -17.79 0.010

BAGANUUR JSC BAN:MO MNT 3304 38.05 5200 3234 -4.23% -28.95 0.895

SHIVEE OVOO JSC SHV:MO MNT 5300 39.05 8500 4600 0.00% -31.17 1.718

Mongolian Telecom MCH:MO MNT 1460 20.74 1830 1001 0.83% -2.60 0.027

SHARYN GOL JSC SHG:MO MNT 7400 41.57 9500 6500 4.23% -3.90 0.014

BERKH UUL JSC BEU:MO MNT 3200 33.49 6000 3200 -5.88% -28.73 10.676

TURQUOISE HILL RESOURCES LTD IVN:US USD 3.85 7,747.13 4.7522 2.9527 4.90% 16.67 0.930

ASPIRE MINING LTD AKM:AU AUD 0.039 24.09 0.083 0.031 11.43% -30.36 2.543

PETRO MATAD LTD MATD:LN GBp 3 14.25 11.5 2.625 -7.69% -20.00 0.023

CENTERRA GOLD INC CG:CN CAD 4.67 1,026.27 7.2 2.82 -1.68% 8.10 14.985

EAST ASIA MINERALS CORP EAS:CN CAD 0.035 3.59 0.2 0.03 0.00% -12.50 0.011

ENTREE GOLD INC ETG:CN CAD 0.365 49.79 0.53 0.245 0.00% 17.74 2.003

PROPHECY COAL CORP PCY:CN CAD 0.045 10.43 0.145 0.04 -18.18% -43.75 0.740

ORIGO PARTNERS PLC OPP:LN GBp 7.875 47.78 10.375 6.125 0.00% 6.78 2.706

CENTRAL ASIA METALS PLC CAML:LN GBp 168.25 304.33 190 107 0.15% 19.33 1.975

HARANGA RESOURCES LTD HAR:AU AUD 0.042 9.53 0.1 0.04 5.00% -32.26 0.291

XANADU MINES LTD XAM:AU AUD 0.038 8.61 0.093 0.032 -15.56% -24.00 1.766

ERDENE RESOURCE DEVELOPMENT ERD:CN CAD 0.175 12.19 0.26 0.065 2.94% 25.00 1.546

VOYAGER RESOURCES LTD VOR:AU AUD 0.002 2.91 0.009 0.001 33.33% -50.00 0.074

KINCORA COPPER LTD KCC:CN CAD 0.06 16.96 0.08 0.02 0.00% 140.00 0.682

MONGOLIA GROWTH GROUP LTD YAK:CN CAD 2.5 80.56 3.66 1.71 -0.40% 10.13 0.273

MODUN RESOURCES LTD MOU:AU AUD 0.002 2.39 0.009 0.001 0.00% -50.00 0.046

GUILDFORD COAL LTD GUF:AU AUD 0.06 42.90 0.165 0.055 -9.09% -27.71 0.759

FEORE LTD FEO:AU AUD 0.07 34.76 0.078 0.025 -6.67% 70.73 0.869

Source: Bloomberg, Eurasia Capital

Mongolia Weekly (June 16-22, 2014) June 23 (Monday)

www.eurasiac.com 14

CONTACTS

Research:

Ulziibayar Batbuyan IB, Associate ulziibayar.batbuyan@eurasiac.com

Amgalanbileg Khash-Erdene Analyst amgalanbileg.khasherdene@eurasiac.com

Munkh-Erdene Davaasuren Analyst munkherdene.davaasuren@eurasiac.com

Sales and Trading:

Narantsatsral Batgerel Broker narantsatsral.batgerel@eurasiac.com

Buyantogtokh Myagmartseren Broker buyantogtokh.myagmartseren@eurasiac.com

Address:

MONGOLIA

Suite 314, Regency

Olympic street-16

Ulaanbaatar, Mongolia

Tel./Fax: +(976) 7711 9799

Eurasia Capital is an investment bank with a focus on Mongolia and other resource-rich Asian countries. Headquartered in

Ulaanbaatar, the Firm offers cross border M&A and advisory, capital raising, sales & trading and research services to its

international and regional clients including government agencies, major energy and resource companies, sovereign wealth

funds, private equity groups and global portfolio investors. For more info, please visit our website: www.eurasiac.com

DISCLAIMER

This Mongolia Weekly is made for information purposes only, and does not constitute an offer, solicitation of an offer to purchase, hold, sell, invest or make any

other financial decision. In making decisions, investors may rely on their own examinations of the parties and risks involved. Information contained in this research

product is obtained from the sources believed to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors such

information provided 'as is" without warranty of any kind and Eurasia Capital Ltd., in particular, make no representation or warranty, express or implied, as to

accuracy, timeliness, completeness, merchantability or fitness for any particular purpose of any such information. Under no circumstances, Eurasia Capital Ltd. have

any liability to any person or entity (-ies) for (a) any loss or damage in whole or in part caused by, resulting from, or relating to, any error (negligible or otherwise) or

other circumstances or contingency within or outside the control of any of their directors, managements, officers, employees, or agents in connection with

compilation, analysis, interpretation, communication, publication or delivery of any such information, or (b) any direct, indirect, special, consequential, compensatory

or incidental damages whatsoever (including without limitation, loss profits) even if Eurasia Capital Ltd. is advised in advance of the possibility of such damages,

resulting from the use of or inability to use, any such information.

2014 Eurasia Capital Ltd. All rights reserved.

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- New Installation Procedures - 2Documento156 páginasNew Installation Procedures - 2w00kkk100% (2)

- Introduction To Succession-1Documento8 páginasIntroduction To Succession-1amun dinAinda não há avaliações

- The SAGE Handbook of Digital JournalismDocumento497 páginasThe SAGE Handbook of Digital JournalismK JAinda não há avaliações

- TEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 16 Motivating EmplDocumento37 páginasTEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 16 Motivating Emplpolkadots939100% (1)

- DSA NotesDocumento87 páginasDSA NotesAtefrachew SeyfuAinda não há avaliações

- ARMOR Winter-Spring 2018 EditionDocumento84 páginasARMOR Winter-Spring 2018 Editionmai100Ainda não há avaliações

- Major Commodities On Global Market: Asian Stocks Drops Amid Commodities RoutDocumento4 páginasMajor Commodities On Global Market: Asian Stocks Drops Amid Commodities RoutAmga KhashAinda não há avaliações

- ECMGL Weekly Dec 30-Jan 3Documento14 páginasECMGL Weekly Dec 30-Jan 3Amga KhashAinda não há avaliações

- ECMGL Weekly October 7-13Documento14 páginasECMGL Weekly October 7-13Amga KhashAinda não há avaliações

- ECMGL Weekly December 9-15Documento13 páginasECMGL Weekly December 9-15Amga KhashAinda não há avaliações

- Callaway FinanceDocumento8 páginasCallaway FinanceAmga KhashAinda não há avaliações

- ANDRITZ Company Presentation eDocumento6 páginasANDRITZ Company Presentation eAnonymous OuY6oAMggxAinda não há avaliações

- Teleprotection Terminal InterfaceDocumento6 páginasTeleprotection Terminal InterfaceHemanth Kumar MahadevaAinda não há avaliações

- Operation Roman Empire Indictment Part 1Documento50 páginasOperation Roman Empire Indictment Part 1Southern California Public RadioAinda não há avaliações

- Create A Gmail Account in Some Simple StepsDocumento9 páginasCreate A Gmail Account in Some Simple Stepsptjain02Ainda não há avaliações

- Venturi Meter and Orifice Meter Flow Rate CalculationsDocumento2 páginasVenturi Meter and Orifice Meter Flow Rate CalculationsVoora GowthamAinda não há avaliações

- Oop Assignment # 2 Submitted By: Hashir Khan Roll #: 22f-7465 Date: 3-3-2023Documento14 páginasOop Assignment # 2 Submitted By: Hashir Khan Roll #: 22f-7465 Date: 3-3-2023Hashir KhanAinda não há avaliações

- Comparing Time Series Models to Predict Future COVID-19 CasesDocumento31 páginasComparing Time Series Models to Predict Future COVID-19 CasesManoj KumarAinda não há avaliações

- Bob Duffy's 27 Years in Database Sector and Expertise in SQL Server, SSAS, and Data Platform ConsultingDocumento26 páginasBob Duffy's 27 Years in Database Sector and Expertise in SQL Server, SSAS, and Data Platform ConsultingbrusselarAinda não há avaliações

- Civil Aeronautics BoardDocumento2 páginasCivil Aeronautics BoardJayson AlvaAinda não há avaliações

- Short Term Training Curriculum Handbook: General Duty AssistantDocumento49 páginasShort Term Training Curriculum Handbook: General Duty AssistantASHISH BARAWALAinda não há avaliações

- Theme Meal ReportDocumento10 páginasTheme Meal Reportapi-434982019Ainda não há avaliações

- Learning HotMetal Pro 6 - 132Documento332 páginasLearning HotMetal Pro 6 - 132Viên Tâm LangAinda não há avaliações

- Organisation Study Report On Star PVC PipesDocumento16 páginasOrganisation Study Report On Star PVC PipesViswa Keerthi100% (1)

- Gps Anti Jammer Gpsdome - Effective Protection Against JammingDocumento2 páginasGps Anti Jammer Gpsdome - Effective Protection Against JammingCarlos VillegasAinda não há avaliações

- Instrumentos de Medición y Herramientas de Precisión Starrett DIAl TEST INDICATOR 196 A1ZDocumento24 páginasInstrumentos de Medición y Herramientas de Precisión Starrett DIAl TEST INDICATOR 196 A1Zmicmarley2012Ainda não há avaliações

- 13-07-01 Declaration in Support of Skyhook Motion To CompelDocumento217 páginas13-07-01 Declaration in Support of Skyhook Motion To CompelFlorian MuellerAinda não há avaliações

- 9IMJan 4477 1Documento9 páginas9IMJan 4477 1Upasana PadhiAinda não há avaliações

- Mini Ice Plant Design GuideDocumento4 páginasMini Ice Plant Design GuideDidy RobotIncorporatedAinda não há avaliações

- Tata Group's Global Expansion and Business StrategiesDocumento23 páginasTata Group's Global Expansion and Business Strategiesvgl tamizhAinda não há avaliações

- Lec - Ray Theory TransmissionDocumento27 páginasLec - Ray Theory TransmissionmathewAinda não há avaliações

- 1LE1503-2AA43-4AA4 Datasheet enDocumento1 página1LE1503-2AA43-4AA4 Datasheet enAndrei LupuAinda não há avaliações

- 3 Course Contents IIIBDocumento5 páginas3 Course Contents IIIBshahabAinda não há avaliações

- 3838 Chandra Dev Gurung BSBADM502 Assessment 2 ProjectDocumento13 páginas3838 Chandra Dev Gurung BSBADM502 Assessment 2 Projectxadow sahAinda não há avaliações

- Enerflex 381338Documento2 páginasEnerflex 381338midoel.ziatyAinda não há avaliações