Escolar Documentos

Profissional Documentos

Cultura Documentos

MOT 2011 WeeklyFinal-1

Enviado por

sudeshjhaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

MOT 2011 WeeklyFinal-1

Enviado por

sudeshjhaDireitos autorais:

Formatos disponíveis

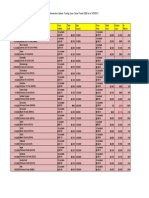

Momentum Options Trading Open Closed Trades 2011 as of 1/1/2012

Date

Opened

Company/

Option Symbol

Price

Adjustment

Total

Cost

Date

Closed

Current

Price

Total

Cost

$ Gain/

Loss

%

Return

9/13/2010

Dendreon 100 shares @ $41.96

Sold October 45 call (DNDN101016C00045000) @ $1.30 on 9/13/10

Sold December 40 call (DNDN101218C00040000) @ $1.75 on 11/11/10

Sold February 39 call (DNDN110219C00039000) @ $1.50 on 12/20/10

Sold May 43 call (DNDN110521C00043000) @ $0.80 on 4/11/11

100 shares

@ $36.61

$3,661

6/6/2011 - Stop of $40 hit

100 shares

@ $40.00

$4,000

$339

9%

12/6/2010

Patriot Coal 100 shares @ $17.80

Sold January 19 call (PCX110122C00019000) @ $0.95 on 12/6/10

100 shares

@ $16.85

$1,685

1/22/2011 stock at $23.18

called away at $19

100 shares

@ $19.00

$1,900

$215

13%

12/27/2010

Seattle Genetics 100 shares @ $15.50

Sold March 17.50 call (SGEN110319C00017500) @ $0.90 on 12/27/10

Sold June 17.50 call (SGEN110618C00017500) @ $0.75 on 4/4/11

100 shares

@ $13.85

$1,385

6/18/2011 stock at $19.50

called away at $17.50

100 shares

@ $17.50

$1,750

$365

26%

2/7/2011

Spreadtrum Communications 100 shares @ $23.43

Sold March 24 call (SPRD110319C00024000) @ $0.95 on 2/7/11

Sold May 22.50 call (SPRD110521C00022500) @ $1.00 on 4/11/11

Dividend of $0.05 paid on 7/7/11

Sold November 25 call (SPRD111119C00025000) @ $1.00 on 9/15/2011

Dividend of $0.06 paid on 10/4/11

100 shares

@ $20.38

$2,038

11/18/2011 stock at $27.21

called away at $25

100 shares

@ $25.00

$2,500

$462

23%

3/14/2011

TiVo 100 shares @ $8.80

Sold April 10 call (TIVO110416C00010000) @ $0.90 on 3/14/11

Sold May 10 call (TIVO110521C00010000) @ $0.84 on 4/18/11

100 shares

@ $7.06

$706

5/23/2011 closed at $9.47

100 shares

@ $9.47

$947

$241

34%

3/17/2011

Cisco Systems 100 shares @ $17.14

Sold May 18 call (CSCO110521C00018000) @ $0.56 on 3/17/11

Dividend of $0.06 paid on 7/5/11

Sold August 17 call (CSCO110820C00017000) @ $0.30 on 7/22/11

Sold November 17 call (CSCO111119C00017000) @0.65 on 9/9/11

Dividend of $0.06 paid on 10/4/11

100 shares

@ $15.51

$1,551

11/18/2011 stock at $18.42

called away at $17

100 shares

@ $17.00

$1,700

$149

10%

4/19/2011

Rediff.com India 100 shares @ $10.28

Sold May 10 call (REDF110521C00010000) @ $1.25 on 4/19/2011

100 shares

@ $9.03

$903

5/21/2011 stock at $11.11

called away at $10

100 shares

@ $10.00

$1,000

$97

11%

5/11/2011

Vivus 100 shares @ $7.93

Sold June 8 call (VVUS110618C00008000) @ $0.50 on 5/11/2011

Sold August 9 call (VVUS110820C00009000) @ $0.30 on 7/1/2011

100 shares

@ $7.13

$713

9/7/2011

100 shares

@ $8.38

$838

$125

18%

6/8/2011

Symantec 100 shares @ $18.77

Sold July 19 call (SYMC110716C00019000) @ $0.60 on 6/8/2011

Sold August 20 call (SYMC110820C00020000) @ $0.35 on 7/18/2011

Sold October 18 call (SYMC111022C00018000) @0.45 on 9/15/2011

100 shares

@ $17.37

$1,737

10/21/2011 stock at $18.42

called away at $18

100 shares

@ $18.00

$1,800

$63

4%

6/23/2011

Patriot Coal 100 shares @ $20.60

Sold July 21 call (PCX110716C00021000) @ $0.95 on 6/23/2011

100 shares

@ $19.65

$1,965

7/16/2011 stock at $23.48

called away at $21

100 shares

@ $21.00

$2,100

$135

7%

7/22/2011

Rambus 100 shares @ $15.60

Sold September 17 call (RMBS110917C00017000) @ $0.65 on 7/22/2011

Sold October 15 call (RMBS111022C00015000) @ $2.00 on 9/20/2011

100 shares

@ $12.95

$1,295

10/21/2011 stock at $16.69

called away at $15

100 shares

@ $15.00

$1,500

$205

16%

8/12/2011

General Electric 100 shares @ $15.98

Sold September 16 call (GE110917C00016000) @ $0.75 on 8/12/2011

100 shares

@ $15.23

$1,523

9/17/2011 stock at $16.33

called away at $16

100 shares

@ $16.00

$1,600

$77

5%

8/12/2011

Clean Energy Fuels 100 shares @ $12.53

Sold September 13 call (CLNE110917C00013000) @ $1.00 on 8/12/2011

100 shares

@ $11.53

$1,153

9/17/2011 stock at $13.17

called away at $13

100 shares

@ $13.00

$1,300

$147

13%

9/9/2011

Vivus 100 shares @ $8.45

Sold October 9 call (VVUS111022C00009000) @ $0.40 on 9/9/2011

Sold November 9 call (VVUS111119C00009000) @0.35 on 10/26/2011

100 shares

@ $7.70

$770

11/18/2011 stock at $9.84

called away at $9

100 shares

@ $9.00

$900

$130

17%

9/20/2011

Ford Motor 100 shares @ $10.63

Sold October 11 call (F111022C00011000) @ $0.35 on 9/20/2011

100 shares

@ $10.28

$1,028

10/21/2011 stock at $12.26

called away at $11

100 shares

@ $11.00

$1,100

$72

7%

11/23/2011

Vivus 100 shares @ $9.78

Sold December 10 call (VVUS111217C00010000) @ $1.00 on 11/23/2011

100 shares

@ $8.78

$878

12/16/2011 stock at $10.09

called away at $10.00

100 shares

@ $10.00

$1,000

$122

14%

Momentum Options Trading Open Closed Trades 2011 as of 1/1/2012

Note: Calculations do not include broker commissions so your mileage may vary.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE

THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES

BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION,

HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF

FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF

TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED

TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE

PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

Risk Disclosure: Options and stocks involve risk and are not suitable for all investors. Past performance does not guarantee future results. Prior to buying or selling an option, an

investor must receive a copy of "Characteristics and Risks of Standardized Options". Copies of this document are available from your broker. The information available discusses

exchange-traded options issued by the Options Clearing Corporation and is intended for educational purposes. No statement in this educational service should be construed as a

recommendation to buy or sell a security. The author and publisher of this service cannot guarantee that the strategies outlined in this educational service will be profitable and will not

be held liable for any possible trading losses related to these strategies. Trading involves the risk of loss as well as the possibility of profit. All investments and trades involve risk, and

all trading decisions of an individual remain the responsibility of that individual. Use of the material contained within this advisory service constitutes your acceptance of these terms.

Você também pode gostar

- Momentum Options Trading Results 2011Documento7 páginasMomentum Options Trading Results 2011sudeshjhaAinda não há avaliações

- Final Presentation On Investing in Uganda's Capital MarketsDocumento51 páginasFinal Presentation On Investing in Uganda's Capital MarketsSsembuya Magulu100% (1)

- Case Analysis & Exchange Rate ForecastingDocumento26 páginasCase Analysis & Exchange Rate ForecastingisratzamananuAinda não há avaliações

- Central Bank of Sri Lanka: Selected Weekly Economic IndicatorsDocumento12 páginasCentral Bank of Sri Lanka: Selected Weekly Economic IndicatorsLBTodayAinda não há avaliações

- Learn-Stock-Options-Trading: Marketclub Special ReportDocumento5 páginasLearn-Stock-Options-Trading: Marketclub Special ReportHernan DiazAinda não há avaliações

- Central Bank of Sri Lanka: Selected Weekly Economic IndicatorsDocumento12 páginasCentral Bank of Sri Lanka: Selected Weekly Economic IndicatorsLBTodayAinda não há avaliações

- Retail Sales Index December 2012Documento4 páginasRetail Sales Index December 2012Patricia bAinda não há avaliações

- Inventory As Money NewDocumento11 páginasInventory As Money New।। SultanAinda não há avaliações

- DNH Market Watch Daily 22.09Documento1 páginaDNH Market Watch Daily 22.09LBTodayAinda não há avaliações

- Solutions To Problems: Coupon Interest Market Price Current YieldDocumento4 páginasSolutions To Problems: Coupon Interest Market Price Current YieldAhmed El KhateebAinda não há avaliações

- CH 17Documento7 páginasCH 17Riya ShahAinda não há avaliações

- EmptyDocumento6 páginasEmptyAshley ParkerAinda não há avaliações

- FT Global Total ReturnDocumento2 páginasFT Global Total ReturnxninesAinda não há avaliações

- Weston Home Sales Report October 2012Documento2 páginasWeston Home Sales Report October 2012HigginsGroupREAinda não há avaliações

- Latest-Home-loan-History of Interest Rate 16102015Documento27 páginasLatest-Home-loan-History of Interest Rate 16102015Karthik ArvindAinda não há avaliações

- Summary of Five-Year Eurobond Terms Available To R.J. ReynoldsDocumento8 páginasSummary of Five-Year Eurobond Terms Available To R.J. ReynoldsRyan Putera Pratama ManafeAinda não há avaliações

- Rate Sheet January 8Documento1 páginaRate Sheet January 8Mubarra RamzanAinda não há avaliações

- Date Symbol L/S Entry Exit Gain NotesDocumento3 páginasDate Symbol L/S Entry Exit Gain NotesLana SaharovAinda não há avaliações

- SMB - Options - Tribe - 8!20!2013 (Jeff Augen - Short Butterfly)Documento8 páginasSMB - Options - Tribe - 8!20!2013 (Jeff Augen - Short Butterfly)Peter Guardian100% (4)

- DNH Market Watch Daily 14.09Documento1 páginaDNH Market Watch Daily 14.09LBTodayAinda não há avaliações

- Retail Sales IndexDocumento4 páginasRetail Sales IndexBermudanewsAinda não há avaliações

- Advanced Finance Applied PowerPoint ChapterDocumento47 páginasAdvanced Finance Applied PowerPoint ChapterasdfasfasdfasdfasdfsdafAinda não há avaliações

- DNH Market Watch Daily 27.10.2011Documento1 páginaDNH Market Watch Daily 27.10.2011LBTodayAinda não há avaliações

- Solutions To EPS Examples 1-7 For PostingDocumento12 páginasSolutions To EPS Examples 1-7 For Postingvir1672Ainda não há avaliações

- Dividend Detector - 08.01.2013 (1) - 2Documento2 páginasDividend Detector - 08.01.2013 (1) - 2ran2013Ainda não há avaliações

- Crox 20110728Documento2 páginasCrox 20110728andrewbloggerAinda não há avaliações

- 10-Year Equity Profile and Monthly Performance ChartsDocumento83 páginas10-Year Equity Profile and Monthly Performance ChartsmeibookAinda não há avaliações

- NDB Daily Market Update 14.09Documento1 páginaNDB Daily Market Update 14.09LBTodayAinda não há avaliações

- Chapter 16 Team ProblemDocumento4 páginasChapter 16 Team ProblemRachel KleinAinda não há avaliações

- Beta SecuritiesDocumento5 páginasBeta SecuritiesZSAinda não há avaliações

- First of Month AnalysisDocumento19 páginasFirst of Month AnalysisscbenderAinda não há avaliações

- ReportHistory 745520Documento3 páginasReportHistory 745520SumirJosanAinda não há avaliações

- Excel PPF CalculatorDocumento48 páginasExcel PPF CalculatorPrashant KhubchandaniAinda não há avaliações

- Analyze Restaurant Menu for Profitability Using Menu Engineering & ScoringDocumento27 páginasAnalyze Restaurant Menu for Profitability Using Menu Engineering & Scoringmtki150% (2)

- Cross Asset Technical Vista September 2011Documento21 páginasCross Asset Technical Vista September 2011anisdangasAinda não há avaliações

- Derivatives Report 24th October 2011Documento3 páginasDerivatives Report 24th October 2011Angel BrokingAinda não há avaliações

- Trading Journal Byhhh Fortradingbytraders - Com v1.0Documento10 páginasTrading Journal Byhhh Fortradingbytraders - Com v1.0Mvelo PhungulaAinda não há avaliações

- Model Portfolio: DBS Group Research - EquityDocumento12 páginasModel Portfolio: DBS Group Research - EquityFunk33qAinda não há avaliações

- Practice Questions On Fin AcctgDocumento6 páginasPractice Questions On Fin AcctgMateen HashmiAinda não há avaliações

- Treasury Bills Vs Commercial PapersDocumento17 páginasTreasury Bills Vs Commercial PapersMalek AlatrashAinda não há avaliações

- Group Savings Track Record - 2010-June 12-AllDocumento1 páginaGroup Savings Track Record - 2010-June 12-AllPrayudi Aji MurtoloAinda não há avaliações

- Global Hotel Review Media October 2011Documento6 páginasGlobal Hotel Review Media October 2011Flottes AutomobilesAinda não há avaliações

- Please Don't Get Cocky: April 2013 Volume 4, No. 7Documento6 páginasPlease Don't Get Cocky: April 2013 Volume 4, No. 7Marites Mayo CuyosAinda não há avaliações

- Nest Report Charlottesville: May 2011Documento2 páginasNest Report Charlottesville: May 2011Jonathan KauffmannAinda não há avaliações

- ACC 201 Accounting Cycle WorkbookDocumento78 páginasACC 201 Accounting Cycle Workbookarnuako15% (13)

- Market MetricsDocumento4 páginasMarket MetricsMichael KozlowskiAinda não há avaliações

- Derivatives Report 9th December 2011Documento3 páginasDerivatives Report 9th December 2011Angel BrokingAinda não há avaliações

- Derivatives Report 14th October 2011Documento3 páginasDerivatives Report 14th October 2011Angel BrokingAinda não há avaliações

- Turnover in Foreign Exchange Market #: BulletinDocumento1 páginaTurnover in Foreign Exchange Market #: BulletinSanjiva KumarAinda não há avaliações

- Fearless Prediction of The WeekDocumento11 páginasFearless Prediction of The WeekValuEngine.comAinda não há avaliações

- Wo 921 Current - InitialDocumento2 páginasWo 921 Current - Initialsrc_srcAinda não há avaliações

- IF Question BankDocumento4 páginasIF Question BankshlakaAinda não há avaliações

- Wilton Home Sales Report October 2012Documento1 páginaWilton Home Sales Report October 2012HigginsGroupREAinda não há avaliações

- Growth of ETFs in IndiaDocumento4 páginasGrowth of ETFs in IndiautkarshupsAinda não há avaliações

- ACE-AUTO January 2015 Sales AnalysisDocumento22 páginasACE-AUTO January 2015 Sales AnalysisGugirl MeowAinda não há avaliações

- Derivatives Report 11 JUNE 2012Documento3 páginasDerivatives Report 11 JUNE 2012Angel BrokingAinda não há avaliações

- Talent Tracs Employee Salary TrackerDocumento13 páginasTalent Tracs Employee Salary TrackerAnthea LamAinda não há avaliações

- Derivatives Report 13 JUNE 2012Documento3 páginasDerivatives Report 13 JUNE 2012Angel BrokingAinda não há avaliações

- Feenstra Intlecon3e SM Ch13econ Ch02macroDocumento6 páginasFeenstra Intlecon3e SM Ch13econ Ch02macroSebastian BrilAinda não há avaliações

- Bamm Candlesticks 5-3-14Documento53 páginasBamm Candlesticks 5-3-14sudeshjhaAinda não há avaliações

- How to trade bullish flag patternsDocumento27 páginasHow to trade bullish flag patternssudeshjha100% (1)

- 6 Ways To Gen Income Using Options - Fpwl14Documento11 páginas6 Ways To Gen Income Using Options - Fpwl14Anamaria SuciuAinda não há avaliações

- 07-Combining Rsi With Rsi PDFDocumento5 páginas07-Combining Rsi With Rsi PDFsudeshjhaAinda não há avaliações

- Commodities Info GlobalDocumento12 páginasCommodities Info GlobalsudeshjhaAinda não há avaliações

- Momentum Options Trading Open Closed Trades 2009 As of 1/25/2012Documento12 páginasMomentum Options Trading Open Closed Trades 2009 As of 1/25/2012sudeshjhaAinda não há avaliações

- 5 Chart Patterns To KnowDocumento15 páginas5 Chart Patterns To KnowsudeshjhaAinda não há avaliações

- MOT2008 2011final 1Documento25 páginasMOT2008 2011final 1sudeshjhaAinda não há avaliações

- Commodities Info AgriDocumento26 páginasCommodities Info AgrisudeshjhaAinda não há avaliações

- Bharat Sanchar Nigam Limited: (Regulation)Documento4 páginasBharat Sanchar Nigam Limited: (Regulation)sudeshjhaAinda não há avaliações

- Compost PDFDocumento4 páginasCompost PDFsudeshjhaAinda não há avaliações

- SP-90 Soluble Humate Powder Optimizes Plant NutritionDocumento1 páginaSP-90 Soluble Humate Powder Optimizes Plant NutritionsudeshjhaAinda não há avaliações

- Organic - Nature's Essence SEP 10-Lb - ColorDocumento1 páginaOrganic - Nature's Essence SEP 10-Lb - ColorsudeshjhaAinda não há avaliações

- Humates How They WorkDocumento5 páginasHumates How They WorksudeshjhaAinda não há avaliações

- MASDocumento4 páginasMASJoyce PajarilloAinda não há avaliações

- Chapter 8 An Economic Analysis of Financial StructureDocumento14 páginasChapter 8 An Economic Analysis of Financial Structurecoldpassion100% (2)

- Harshad Mehta Scam & Birla Committee ReportDocumento21 páginasHarshad Mehta Scam & Birla Committee ReportPratik TiwariAinda não há avaliações

- Project Report on India's Power GridDocumento11 páginasProject Report on India's Power GridNirjhar AgarwalAinda não há avaliações

- Tugas Bab 6 Jawaban P 6-3Documento2 páginasTugas Bab 6 Jawaban P 6-3Syahirul AlimAinda não há avaliações

- ACCOUNTANCY SAMPLE QUESTION PAPER ANALYSISDocumento21 páginasACCOUNTANCY SAMPLE QUESTION PAPER ANALYSISmohit pandeyAinda não há avaliações

- Meetings of Directors or Trustees, Stockholders orDocumento9 páginasMeetings of Directors or Trustees, Stockholders orAmie Jane MirandaAinda não há avaliações

- Starbucks Company ProfileDocumento2 páginasStarbucks Company Profilearaby_mhAinda não há avaliações

- Chapter 2: Financing Company Operations Practice Questions Vienna LTD General JournalDocumento8 páginasChapter 2: Financing Company Operations Practice Questions Vienna LTD General Journalsyed rahmanAinda não há avaliações

- Types of Companies at Central University of South BiharDocumento17 páginasTypes of Companies at Central University of South BiharPriyaranjan SinghAinda não há avaliações

- How To Buy Stocks Louis C EngelDocumento278 páginasHow To Buy Stocks Louis C EngelAnthony H Yang100% (1)

- Sources of Business FinanceDocumento3 páginasSources of Business FinanceNishant RavAinda não há avaliações

- Abstract On Company LawDocumento2 páginasAbstract On Company LawNitish Kumar NaveenAinda não há avaliações

- Dow's Bid For Rohm and HaasDocumento2 páginasDow's Bid For Rohm and HaasPavitraAinda não há avaliações

- Soal Akl1Documento7 páginasSoal Akl1Khazanah UmiAinda não há avaliações

- CIS - OMP Company MAIN PDFDocumento4 páginasCIS - OMP Company MAIN PDFgyAinda não há avaliações

- Kuliah I Akl 191121Documento40 páginasKuliah I Akl 191121tutiAinda não há avaliações

- Chapter 2 MCSDocumento22 páginasChapter 2 MCSRuthAinda não há avaliações

- BHP Annual Report 2017 highlights strength and productivityDocumento296 páginasBHP Annual Report 2017 highlights strength and productivityjerc1324Ainda não há avaliações

- Class 21A Technologies Private Limited: List of Shareholders As On 31st March 2019Documento1 páginaClass 21A Technologies Private Limited: List of Shareholders As On 31st March 2019archish10Ainda não há avaliações

- Ramco Cements AR 2018Documento192 páginasRamco Cements AR 2018hsk12Ainda não há avaliações

- Banking Laws SummaryDocumento26 páginasBanking Laws SummaryBill DiazAinda não há avaliações

- StudyQuestions 080118Documento6 páginasStudyQuestions 080118Jamie Ross0% (3)

- Why All Takeovers Aren't Created Equal, Roger LowensteinDocumento2 páginasWhy All Takeovers Aren't Created Equal, Roger LowensteinAslan AlpAinda não há avaliações

- DLFDocumento348 páginasDLFSIBI ARAVIND E 22Ainda não há avaliações

- Basics of Share MarketDocumento15 páginasBasics of Share MarketashutoshAinda não há avaliações

- Efgi Acquisition of Mbam FinalDocumento21 páginasEfgi Acquisition of Mbam FinalVangestaAinda não há avaliações

- BA 118.3 Problem Set FinalDocumento3 páginasBA 118.3 Problem Set FinalShin XavierAinda não há avaliações

- Sharekhan Internship ReportDocumento85 páginasSharekhan Internship ReportNikhil Shaiva SakleshpurAinda não há avaliações

- Smruthi Organics LTD 2009Documento51 páginasSmruthi Organics LTD 2009rakesh_arorajprAinda não há avaliações