Escolar Documentos

Profissional Documentos

Cultura Documentos

Why Singapore - Why Business Trust

Enviado por

Harpott Ghanta0 notas0% acharam este documento útil (0 voto)

106 visualizações2 páginaslaw

Título original

Why Singapore- Why Business Trust

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentolaw

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

106 visualizações2 páginasWhy Singapore - Why Business Trust

Enviado por

Harpott Ghantalaw

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 2

B

urdened by substantial debt reliance communications

has for some time now wanted to unlock value in its

undersea cable business flag telecom. For a variety of

reasons, Flag could not make a vanilla global equity listing.

Now its decided to go public in Singapore via a trust

structure. Why Singapore? Why Trust? Payaswini Upadhyay

goes in search of some answers.

In 2007, Ascendas India Trust went public as Singapore's first

listed business trust holding Indian IT park assets

In 2008, Indiabulls Properties Investment Trust listed on the Singapore stock exchange with

commercial property in Mumbai as the underlying asset

J ust 2 months ago, Fortis group owned Religare Healthcare Trust received an eligibility to list

approval from the Singapore stock exchange

And this month, Reliance Communications owned Global Telecommunications Infrastructure

Trust filed an initial prospectus with the Monetary Authority of Singapore to list its undersea

cable business.

- all sign of the growing popularity of this route. Before we get to the why, heres the how. In a

typical business trust structure, the Indian company creates or uses an overseas subsidiary as

a sponsor. The sponsor incorporates a Singapore based company as trustee manager. The

trustee manager owns and manages the assets, the economic interest of which is sold via units

of the trust, also established in Singapore. The units are listed on the Singapore stock

exchange.

Evelyn Wee

Partner, Rajah & Tann

It is essentially a hybrid structure that has the elements both of a trust and a company. Like a

company, a business trust is established to run a business. However, it is not a separate legal

entity. It is actually constituted by a trust deed. Under the trust deed, the trustee manager,

which is the single responsible entity for the business trust, has the legal ownership of the

assets of the trust and also manages the assets of the trust for beneficiaries of the trust.

Yash Asher

Partner, Amarchand Mangaldas

If a company has a plan of total of 8 assets- say 8 ships- 2 ships, it already has and those are

generating revenues; 6 ships have been ordered but not yet been delivered. It would be tax

inefficient to move two ships to another company in India and try to list a company with just two

ships. But there are investors who are willing to invest and hold these two ships which are

generating regular income. And remember there is no assurance that a company which has two

ships will give you return- it finally depends on the dividend policies and the growth policies of

the company. But the business trust, by definition, tries to return money to the investors. In this

environment, investors want to ensure that their capital grows; they dont want to depend upon

the fluctuations of the market. The business trust gives them that sort of comfort. So Business

trust is able to buy out these assets as compared to a company whose shares will have to be

listed and there is no guarantee of return.

That by far is the biggest attraction a trust holds- that it can offer fixed returns.

Rahul Guptan

Partner, Clifford Chance, Asia

For a company to declare a dividend, the typical test is where you have an accounting profit.

So you could have a very lucrative cash-generating asset like a ship but you cant declare

dividends to your equity shareholders because of the accounting rules and the Companies Act

requirements that limit your ability to declare dividend because you dont have an accounting

profit for different reason. Whereas, in the context of a business trust, to the extent you meet

the Singapores Business Trust Acts solvency test, youre able to declare dividend out of the

cash flows that your assets are generating even though you may have an accounting loss at

the end of the day.

For instance, Reliance communications owned GTI trust is offering unit holders a yield of

between 9.5 to 11.5% in FY13 and 10.1 to 12.2% in FY 14. Besides fixed returns, investors are

drawn by a higher degree of governance requirements in trusts.

Evelyn Wee

Partner, Rajah & Tann

These are actually more stringent and set a higher standard of independence compared to

companies that are listed on the exchange. These will include requirements that the majority of

Directors must be independent from business and management relations of the trustee

manager; thats one. Secondly, a majority of directors have to be independent from a

substantial shareholder and finally that one-third of the Board needs to be independent from

management and business relation of the trustee manger as well as every substantial

shareholder of the trustee manager.

And the third thing going for the Singapore trust route is tax incentives.

Evelyn Wee

Partner, Rajah & Tann

In terms of tax, Business trust is subject to income tax just like a company. So where there are

Why Singapore? Why Business

Trust?

activities or businesses that are able to obtain tax incentives, these are useful businesses to

put into a business trust because the tax savings can be significant. These tax incentives would

include infrastructure as well as shipping enterprises tax incentives.

Rahul Guptan

Partner, Clifford Chance, Asia

Investors who have a specific sector focus like infrastructure or real estate, investors who are

long-term players in the market, private wealth investors who want to maximize the returns will

look at this as fairly robust kind of instrument for long-term investment on capital.

On the India end, any overseas trust structure must first pass muster with RBIs overseas direct

investment regulations. In fact thats why the need for an offshore company as sponsor

because an Indian company cannot directly establish an offshore trust.

Pratibha Jain

Partner, Nishith Desai Associates

There is a limitation of 400% of your net worth that you can invest in such an offshore

subsidiary. And thirdly, because youre setting up an offshore subsidiary which then invests into

the units of trust that would probably classify the sponsor as engaging in financial services. For

a company engaging in financial services, there are further requirements that are laid down i.e.

it needs to be an entity that is registered with a regulator in India, it needs to have taken prior

approval for engaging in such activities, it is required to meet certain prudential norms with

respect to capital adequacy etc.

Yash Asher

Partner, Amarchand Mangaldas

In creating this entire structure, I think companies and Indian promoters need to be careful

about ODI and round tripping issues. This may also depend upon where, finally, they want the

structure to be. The additional issue is from the tax perspective. All these structures will need a

detailed analysis of tax laws and how finally GAAR shapes up will also affect the future BT

structures.

Its early days- both for Indian companies and the Singapore Business Trust market as currently

only 9 such instruments are listed on the Singapore Stock Exchange. In 2007, Ascendas India

raised $325 million from its business trust IPO. For Indiabulls, it was $193 million. Fortis and

Reliance Communications are set to test the market soon- hoping to raise over $300 million

and up to $1 billion respectively questions is, will investors be enthused?

Its early days yet for Singapore Trusts and may be not the right environment to experiment in

because, ironically, right after we finished the story and just before we went on air, Reliance

Communications announced that its putting its Singapore PO on hold awaiting more

appropriate market conditions.

Copyright e-Eighteen.com Ltd. All rights reserved. Reproduction of news articles, photos, videos or any other content in whole or in part in any formor medium without express written

permission of moneycontrol.comis prohibited.

Você também pode gostar

- ANHD 2016 Economic Opportunity PosterDocumento1 páginaANHD 2016 Economic Opportunity PosterNorman OderAinda não há avaliações

- HSBC Institutional Trust (Trustee of Starhill Global REIT) V Toshin Deve...Documento34 páginasHSBC Institutional Trust (Trustee of Starhill Global REIT) V Toshin Deve...Harpott GhantaAinda não há avaliações

- Okp 080114Documento4 páginasOkp 080114Harpott GhantaAinda não há avaliações

- FileStore - Pdfstore - LectureSpeech - NUSS Professorship Lecture - FromThirdWorldToFirstDocumento26 páginasFileStore - Pdfstore - LectureSpeech - NUSS Professorship Lecture - FromThirdWorldToFirstHarpott GhantaAinda não há avaliações

- Re Wan Soon Construction Judicial Managers Entitlement to Sale ProceedsDocumento6 páginasRe Wan Soon Construction Judicial Managers Entitlement to Sale ProceedsHarpott GhantaAinda não há avaliações

- Happy Nails Fa 1Documento14 páginasHappy Nails Fa 1Harpott GhantaAinda não há avaliações

- Voidable Transactions in The Context of InsolvencyDocumento7 páginasVoidable Transactions in The Context of InsolvencyHarpott GhantaAinda não há avaliações

- Companies (Application of Bankruptcy Act) RegulationsDocumento3 páginasCompanies (Application of Bankruptcy Act) RegulationsHarpott GhantaAinda não há avaliações

- G2 - List of Videos On AdvocacyDocumento1 páginaG2 - List of Videos On AdvocacyHarpott GhantaAinda não há avaliações

- Aspen Publishers - Drafting Contracts - How and Why Lawyers Do What They Do 2E - Tina LDocumento9 páginasAspen Publishers - Drafting Contracts - How and Why Lawyers Do What They Do 2E - Tina LHarpott Ghanta20% (5)

- Asset Based Lending in Singapore Jun 2011Documento14 páginasAsset Based Lending in Singapore Jun 2011Harpott GhantaAinda não há avaliações

- SAcL IP Law SummaryDocumento15 páginasSAcL IP Law SummaryHarpott GhantaAinda não há avaliações

- Bankruptcy RulesDocumento154 páginasBankruptcy RulesHarpott GhantaAinda não há avaliações

- Hds Standards and PracticesDocumento29 páginasHds Standards and PracticesHarpott GhantaAinda não há avaliações

- (TTC) Geis - Business Statistics IIDocumento23 páginas(TTC) Geis - Business Statistics IIminh_neuAinda não há avaliações

- G2 - List of Videos On AdvocacyDocumento1 páginaG2 - List of Videos On AdvocacyHarpott GhantaAinda não há avaliações

- Rules of CourtDocumento574 páginasRules of CourtHarpott GhantaAinda não há avaliações

- Handwritingsample4 6 09Documento1 páginaHandwritingsample4 6 09Harpott GhantaAinda não há avaliações

- Ny All LocationsDocumento1 páginaNy All LocationsHarpott GhantaAinda não há avaliações

- StateBarRequest - Feb 2015 & July 2015Documento1 páginaStateBarRequest - Feb 2015 & July 2015Harpott GhantaAinda não há avaliações

- Act of Congress Establishing The Treasury DepartmentDocumento1 páginaAct of Congress Establishing The Treasury DepartmentHarpott GhantaAinda não há avaliações

- The Ultimate Bar Exam Preparation Resource GuideDocumento18 páginasThe Ultimate Bar Exam Preparation Resource GuidejohnkyleAinda não há avaliações

- Requirements to Practice Law in California for Foreign Educated Students (39 charactersDocumento4 páginasRequirements to Practice Law in California for Foreign Educated Students (39 charactersCarlo Vincent BalicasAinda não há avaliações

- Ny All LocationsDocumento1 páginaNy All LocationsHarpott GhantaAinda não há avaliações

- Bar Exams ScheduleDocumento3 páginasBar Exams ScheduleHarpott GhantaAinda não há avaliações

- NYS Bar Exam Online Application InstructionsDocumento4 páginasNYS Bar Exam Online Application InstructionsHarpott GhantaAinda não há avaliações

- Central Bank CollateralDocumento14 páginasCentral Bank CollateralHarpott GhantaAinda não há avaliações

- WTO Regulation of Subsidies To State-Owned Enterprises (SOEs) SSRN-id939435Documento47 páginasWTO Regulation of Subsidies To State-Owned Enterprises (SOEs) SSRN-id939435Harpott GhantaAinda não há avaliações

- Andenas On European Company LawDocumento74 páginasAndenas On European Company LawHarpott GhantaAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Credit Rating Agencies (1 FinalDocumento88 páginasCredit Rating Agencies (1 FinalAvtaar SinghAinda não há avaliações

- SMART BETA ETF PRESENTATIONDocumento12 páginasSMART BETA ETF PRESENTATIONRahul ChaudharyAinda não há avaliações

- IFMP Mutual Fund Distributors Certification (Study and Reference Guide) PDFDocumento165 páginasIFMP Mutual Fund Distributors Certification (Study and Reference Guide) PDFPunjabi Larka100% (1)

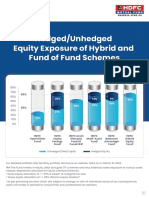

- Leaflet - Hedged and Unhedged Exposure of Hybrid FundsDocumento2 páginasLeaflet - Hedged and Unhedged Exposure of Hybrid FundsDeepakAinda não há avaliações

- Edelweiss Weekly Newsletter October 15 2021Documento2 páginasEdelweiss Weekly Newsletter October 15 2021AdityaAinda não há avaliações

- Literatur ReviewDocumento41 páginasLiteratur ReviewDevendraSarafAinda não há avaliações

- "Risk On - Risk Off" - How A Paradigm Is BornDocumento19 páginas"Risk On - Risk Off" - How A Paradigm Is BorntniravAinda não há avaliações

- Lighthouse Precious Metals Report - 2014 - AugustDocumento40 páginasLighthouse Precious Metals Report - 2014 - AugustAlexander GloyAinda não há avaliações

- Corporate Financing Decisions and Efficient Capital MarketsDocumento53 páginasCorporate Financing Decisions and Efficient Capital MarketsalexanderAinda não há avaliações

- Nondisclosure Agreement for Potential InvestorsDocumento3 páginasNondisclosure Agreement for Potential InvestorsAnthony K. HenryAinda não há avaliações

- Credit Rating Impact On Stock Prices - A Study For IndiaDocumento11 páginasCredit Rating Impact On Stock Prices - A Study For Indiaved2903_iitkAinda não há avaliações

- Market Technician No 73Documento12 páginasMarket Technician No 73ZhichaoWang100% (1)

- An Institutional Theory of Momentum and Revealsal Rev. Financ. Stud.-2013-Vayanos-1087-145Documento59 páginasAn Institutional Theory of Momentum and Revealsal Rev. Financ. Stud.-2013-Vayanos-1087-145IGift WattanatornAinda não há avaliações

- Share Khan LimitedDocumento96 páginasShare Khan LimitedMayur PrajapatiAinda não há avaliações

- HW Assignment Week 8 Student ID 1567033Documento2 páginasHW Assignment Week 8 Student ID 1567033Lưu Gia BảoAinda não há avaliações

- Professional Stock Market Training Course by Shakti Shiromani ShuklaDocumento12 páginasProfessional Stock Market Training Course by Shakti Shiromani ShuklaShakti ShuklaAinda não há avaliações

- Chap011 Exam3Documento78 páginasChap011 Exam3Huyen Vo100% (2)

- Answer: B: Cf-Multiple Choice Questions (1) - Thuhien-UehDocumento5 páginasAnswer: B: Cf-Multiple Choice Questions (1) - Thuhien-UehMinh Phạm100% (1)

- Mutual Fund Analysis ComparisonDocumento76 páginasMutual Fund Analysis ComparisonsantoshbansodeAinda não há avaliações

- Business Analysis ReportDocumento13 páginasBusiness Analysis Reporthassan_401651634Ainda não há avaliações

- Index Funds GuideDocumento17 páginasIndex Funds GuidesambhavjoshiAinda não há avaliações

- Godwin EstateDocumento32 páginasGodwin EstateEnamudu Hope TopeAinda não há avaliações

- MBA VocabularyDocumento41 páginasMBA VocabularyadjerourouAinda não há avaliações

- IIFL Multicap PMS TermsheetDocumento4 páginasIIFL Multicap PMS TermsheetRanjithAinda não há avaliações

- Explain The Sources of Funding For A Start-UpDocumento6 páginasExplain The Sources of Funding For A Start-UpChandra KeerthiAinda não há avaliações

- SPCapitalIQEquityResearch ConchoResourcesInc Feb 28 2016Documento11 páginasSPCapitalIQEquityResearch ConchoResourcesInc Feb 28 2016VeryclearwaterAinda não há avaliações

- Partners Group - FoF BenefitsDocumento8 páginasPartners Group - FoF BenefitsJose M Terrés-NícoliAinda não há avaliações

- What Is A Mutual Fund?Documento35 páginasWhat Is A Mutual Fund?Azaan KhanAinda não há avaliações

- Scenario of Indian Stock MarketDocumento12 páginasScenario of Indian Stock Marketnayak_ramesh330Ainda não há avaliações

- MCB-AH Corp Presentation Sept 12 PDFDocumento30 páginasMCB-AH Corp Presentation Sept 12 PDFlordraiAinda não há avaliações