Escolar Documentos

Profissional Documentos

Cultura Documentos

Published Result Q-1-10 Print

Enviado por

s natarajan0 notas0% acharam este documento útil (0 voto)

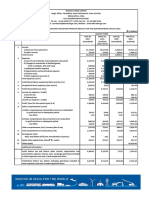

8 visualizações1 página- The document reports financial information for Bata India Limited for years 2010, 2009, and the first quarter of 2010. It includes information on turnover, expenses, profits, segment revenue, capital employed, and earnings per share.

- For the first quarter of 2010, net sales increased 11.2% over the same period of the previous year. Profit after tax for the quarter was Rs. 1,433 lacs, an increase of 38.7% over the first quarter of the previous year.

- The company operates in two segments: footwear and accessories, and investment in a joint venture for surplus property development.

Descrição original:

bata results

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documento- The document reports financial information for Bata India Limited for years 2010, 2009, and the first quarter of 2010. It includes information on turnover, expenses, profits, segment revenue, capital employed, and earnings per share.

- For the first quarter of 2010, net sales increased 11.2% over the same period of the previous year. Profit after tax for the quarter was Rs. 1,433 lacs, an increase of 38.7% over the first quarter of the previous year.

- The company operates in two segments: footwear and accessories, and investment in a joint venture for surplus property development.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

8 visualizações1 páginaPublished Result Q-1-10 Print

Enviado por

s natarajan- The document reports financial information for Bata India Limited for years 2010, 2009, and the first quarter of 2010. It includes information on turnover, expenses, profits, segment revenue, capital employed, and earnings per share.

- For the first quarter of 2010, net sales increased 11.2% over the same period of the previous year. Profit after tax for the quarter was Rs. 1,433 lacs, an increase of 38.7% over the first quarter of the previous year.

- The company operates in two segments: footwear and accessories, and investment in a joint venture for surplus property development.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

Sl No

Year ended 31st

December

2010 2009 2009 (Audited)

1 a Turnover 26,360.3 23,963.3 111,111.1

b less: Excise duty 444.9 660.1 2,093.6

Net Sales/Income from Operations 25,915.4 23,303.2 109,017.5

c Other Operating Income 241.6 69.8 594.8

2 Expenditure

a (Increase)/Decrease in stock in trade and work in progress (2,595.6) (3,138.2) 746.0

b Consumption of Raw Materials 5,498.3 6,572.9 23,677.8

c Purchase of Traded Goods 9,071.9 7,278.1 26,921.9

d Employees cost 4,213.4 4,154.9 16,831.1

e Rent 2,707.3 2,233.7 10,123.0

f Depreciation 639.2 533.4 2,792.3

g Amortisation of VRS 153.1 156.9 612.4

h Other Expenditure 4,422.8 3,947.1 17,869.4

Total 24,110.4 21,738.8 99,573.9

3 Profit from Operations before Other Income, Interest and Tax (1-2) 2,046.6 1,634.2 10,038.4

4 Other Income 86.3 117.8 395.1

5 Profit before Interest and Tax (3+4) 2,132.9 1,752.0 10,433.5

6 Interest 29.2 128.5 407.2

7 Profit after Interest but before Tax (5-6) 2,103.7 1,623.5 10,026.3

8 Tax Expense

- Current Tax 842.6 692.2 4,017.6

- Deferred Tax (Credit)/ Charge (171.9) (131.7) (663.6)

- Fringe Benefit Tax - 30.0 17.2

- Tax for earlier years - - (67.6)

9 Net Profit for the Period 1,433.0 1,033.0 6,722.7

10 Paid up Equity Share Capital (Rs 10/- per share) 6,426.4 6,426.4 6,426.4

11 Reserves excluding Revaluation Reserves 23,384.4

12 EPS (Basic & Diluted) Rs. 2.23 1.61 10.46

13 Public Shareholding:

- Number of Shares (Lacs) 314.8 314.8 314.8

- Percentage of Shareholding 49% 49% 49%

14 Promoters and Promoter Group Shareholding:

a Pledged/ Encumbered

- Number of Shares (Lacs) Nil Nil Nil

- Percentage of Shares (as a % of the total shareholding of promoter and promoter group) Nil Nil Nil

- Percentage of Shares (as a % of the total share capital of the company) Nil Nil Nil

b Non-encumbered

- Number of Shares (Lacs) 327.8 327.8 327.8

- Percentage of Shares (as a % of the total shareholding of promoter and promoter group) 100% 100% 100%

- Percentage of Shares (as a % of the total share capital of the company) 51% 51% 51%

UNAUDITED FINANCIAL RESULTS FOR THE Ist QUARTER ENDED 31ST MARCH, 2010

Particulars

Quarter 1 ended 31st March

(Rs. in Lacs except EPS figure)

BATA INDIA LIMITED

REGD. OFFICE: 6A, S.N. BANERJEE ROAD, KOLKATA 700013

- Percentage of Shares (as a % of the total share capital of the company) 51% 51% 51%

Sl No

Year ended 31st

December

2010 2009 2009 (Audited)

1 SEGMENT REVENUE

Net Sale / Income from each Segment(Including Other operating Income and Other Income)

a. Footwear & Accessories 26,243.3 23,490.8 110,007.4

b Investment in Joint Venture for Surplus Property Development - - -

TOTAL REVENUE 26,243.3 23,490.8 110,007.4

2 SEGMENT RESULT

Profit before Tax & Interest from each Segment

a. Footwear & Accessories 2,119.0 1,753.1 10,412.6

b Investment in Joint Venture for Surplus Property Development - - -

TOTAL 2,119.0 1,753.1 10,412.6

Less :

I Interest Expense 29.2 128.5 407.2

II Interest Income (64.8) (48.9) (216.1)

III Un-allocable Expenditure 50.9 50.0 195.2

Total Profit Before Tax 2,103.7 1,623.5 10,026.3

3 CAPITAL EMPLOYED

Segment Assets - Segment Liabilites

a. Footwear & Accessories 33,491.3 28,882.1 32,506.4

b Investment in Joint Venture for Surplus Property Development 1,291.0 1,239.7 1,239.7

c Unallocated 79.5 9.0 (470.4)

TOTAL 34,861.8 30,130.8 33,275.7

Notes :

1

2

3

4

5

6

Gurgaon SHAIBAL SINHA MARCELO VILLAGRAN

29.04.2010 DIRECTOR FINANCE MANAGING DIRECTOR

The above results were reviewed by the Audit Committee and approved by the Board of Directors at their meeting held on 29th April, 2010. Limited

Review of these results, as required under clause 41 of the Listing Agreement, has been completed by the Auditors. Figures of the previous year/ quarter

have been regrouped , wherever necessary.

BATA INDIA LIMITED

Net Sales for first three months of the year has increased by 11.2% over the corresponding period last year.

In terms of clause 41 of the listing agreement, detail of number of investor complaints for the quarter ended 31st March, 2010 : beginning - Nil, received - 2,

resolved - Nil and pending 2.

The Company operates in two segments - i) Footwear & Accessories ii) Investment in Joint Venture for Surplus Property Development.

While retaining the legal title over the land at Batanagar Project and shares in the Joint Venture Company, Riverbank Developers Private Limited (RDPL),

Bata India Limited has restructured the agreements with revised terms & conditions for the development of the modern integrated township project at

Batanagar. In consideration of the restructured agreement, the Company shall receive an aggregate upfront amount of Rs.100 Crores for future transfer of

shares in the JV Company and variation of the development rights. In addition, the Company will also receive 640,000 sq feet of constructed space free of

cost in the project over a defined period of time. This Agreement has been entered on 28th April 2010.

Particulars

Quarter 1 ended 31st March

Profit after tax for first three months of the year of Rs. 1,433 lacs has increased by 38.7% over the corresponding period last year.

SEGMENTWISE REVENUE, RESULT AND CAPITAL EMPLOYED

29.04.2010 DIRECTOR FINANCE MANAGING DIRECTOR

NEW RANGE . GREAT PRICES

Você também pode gostar

- Oxgen Sensor Cat WEBDocumento184 páginasOxgen Sensor Cat WEBBuddy Davis100% (2)

- 3d Control Sphere Edge and Face StudyDocumento4 páginas3d Control Sphere Edge and Face Studydjbroussard100% (2)

- Astm D7928 - 17Documento25 páginasAstm D7928 - 17shosha100% (2)

- PeopleSoft Security TablesDocumento8 páginasPeopleSoft Security TablesChhavibhasinAinda não há avaliações

- Kathy Davis - Dancing Tango - Passionate Encounters in A Globalizing World-New York University Press (2015)Documento236 páginasKathy Davis - Dancing Tango - Passionate Encounters in A Globalizing World-New York University Press (2015)Csongor KicsiAinda não há avaliações

- JM Financial: L Indi N L 1 LDocumento9 páginasJM Financial: L Indi N L 1 LPiyush LuthraAinda não há avaliações

- Corporate Actions: A Guide to Securities Event ManagementNo EverandCorporate Actions: A Guide to Securities Event ManagementAinda não há avaliações

- Lewis Corporation Case 6-2 - Group 5Documento8 páginasLewis Corporation Case 6-2 - Group 5Om Prakash100% (1)

- Template WFP-Expenditure Form 2024Documento22 páginasTemplate WFP-Expenditure Form 2024Joey Simba Jr.Ainda não há avaliações

- Consolidated Q4Documento6 páginasConsolidated Q4Qazi MudasirAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Consol Result Mar23Documento16 páginasConsol Result Mar23Amit KumarAinda não há avaliações

- Icici 2009Documento4 páginasIcici 2009Anudeep ReddyAinda não há avaliações

- Q1-Results Bal 2019-20Documento5 páginasQ1-Results Bal 2019-20Krish PatelAinda não há avaliações

- Mahindra & Mahindra Limited: Rs. in CroresDocumento4 páginasMahindra & Mahindra Limited: Rs. in CroresGeorge Chalissery RajuAinda não há avaliações

- Q1FY22Documento8 páginasQ1FY22Anjalidevi TAinda não há avaliações

- Financial Results of Hardwyn India Sept 2023Documento9 páginasFinancial Results of Hardwyn India Sept 2023prashant_natureAinda não há avaliações

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocumento9 páginasBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARAinda não há avaliações

- Standalone Results - Mar'23 - 0Documento5 páginasStandalone Results - Mar'23 - 0Honey SinghalAinda não há avaliações

- 2000 5000 Corp Action 20220525Documento62 páginas2000 5000 Corp Action 20220525Contra Value BetsAinda não há avaliações

- Performance of Infosys For The Third Quarter Ended December 31Documento33 páginasPerformance of Infosys For The Third Quarter Ended December 31ubmba06Ainda não há avaliações

- Digitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Documento5 páginasDigitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Mahesh hamneAinda não há avaliações

- 2022 04 Q4-2022 PR2-New-roomDocumento10 páginas2022 04 Q4-2022 PR2-New-roomTejpal SainiAinda não há avaliações

- Results Trident16446Documento6 páginasResults Trident16446mohitAinda não há avaliações

- Castrol India Limited: Statement of Audited Financial Results For The Quarter and Year Ended 31 December 2018Documento3 páginasCastrol India Limited: Statement of Audited Financial Results For The Quarter and Year Ended 31 December 2018Sona DuttaAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For December 31, 2016 (Result)Documento6 páginasStandalone Financial Results, Auditors Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Unaudited Quarterly Results Alok IndustriesDocumento2 páginasUnaudited Quarterly Results Alok IndustriesAbhijeet PimpalgaonkarAinda não há avaliações

- Financial Profile: Cipla Reports 3.6% Domestic Growth in Q1Documento4 páginasFinancial Profile: Cipla Reports 3.6% Domestic Growth in Q1thelostbardAinda não há avaliações

- Scrip Code: MSUMI Scrip Code: 543498 Ref.: Un-Audited Financial Results For The Quarter Ended June 30, 2022Documento3 páginasScrip Code: MSUMI Scrip Code: 543498 Ref.: Un-Audited Financial Results For The Quarter Ended June 30, 2022Amruta TarmaleAinda não há avaliações

- Kotak Mahindra Bank Q4 FY19 standalone resultsDocumento9 páginasKotak Mahindra Bank Q4 FY19 standalone resultsSumit SharmaAinda não há avaliações

- MRF Limited reports Rs 288 crore net profit for Q3Documento2 páginasMRF Limited reports Rs 288 crore net profit for Q3Preeti KhatwaAinda não há avaliações

- Published Results 31 March 2010Documento2 páginasPublished Results 31 March 2010Ravi ChaturvediAinda não há avaliações

- Standalone Financial Results for Q4 and FY 2016Documento7 páginasStandalone Financial Results for Q4 and FY 2016Headshot's GameAinda não há avaliações

- Bharat Forge Q3 FY22 ResultsDocumento7 páginasBharat Forge Q3 FY22 ResultsPratik PatilAinda não há avaliações

- Bajaj Auto Limited: Page 1 of 7Documento7 páginasBajaj Auto Limited: Page 1 of 7DPH ResearchAinda não há avaliações

- Latest Financials - DR Agarwals May 2022Documento11 páginasLatest Financials - DR Agarwals May 2022Mr SmartAinda não há avaliações

- Standalone Financial Results For The Quarter / Year Ended On 31st March 2012Documento9 páginasStandalone Financial Results For The Quarter / Year Ended On 31st March 2012smartashok88Ainda não há avaliações

- Q3 Results Bal - 2022-23Documento5 páginasQ3 Results Bal - 2022-23dewerAinda não há avaliações

- Q2 Results Bal 2021 22Documento11 páginasQ2 Results Bal 2021 22Suraj PatilAinda não há avaliações

- 63 Moon Q3 ResultsDocumento16 páginas63 Moon Q3 Resultsdownloads.xaAinda não há avaliações

- ICICI Financial StatementsDocumento9 páginasICICI Financial StatementsNandini JhaAinda não há avaliações

- Q1 20 - DhunseriDocumento4 páginasQ1 20 - Dhunserica.anup.kAinda não há avaliações

- Apollo Tyres Ltd.Documento3 páginasApollo Tyres Ltd.Nishant HardiyaAinda não há avaliações

- SPIL Q2FY22 Financial ResultsDocumento10 páginasSPIL Q2FY22 Financial ResultsKARANAinda não há avaliações

- HawkinsDocumento1 páginaHawkinsNatarajAinda não há avaliações

- IEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021Documento13 páginasIEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021seena_smile89Ainda não há avaliações

- Tata Steel LTD: Audited Financial Results For The Year Ended On 31st March 2010Documento6 páginasTata Steel LTD: Audited Financial Results For The Year Ended On 31st March 2010fifa05Ainda não há avaliações

- q209 - Airtel Published FinancialsDocumento7 páginasq209 - Airtel Published Financialsmixedbag100% (2)

- GHCL Limited (CIN: L24100GJ1983PLC006513)Documento10 páginasGHCL Limited (CIN: L24100GJ1983PLC006513)soumyasibaniAinda não há avaliações

- Q4 Results of Bal 2022-23Documento11 páginasQ4 Results of Bal 2022-23dewerAinda não há avaliações

- Ashwin 2070Documento2 páginasAshwin 2070nayanghimireAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- ACC Limited Reports 21% Rise in Consolidated SalesDocumento12 páginasACC Limited Reports 21% Rise in Consolidated SalesKKVSBAinda não há avaliações

- Standalone Result Mar23Documento9 páginasStandalone Result Mar23Amit KumarAinda não há avaliações

- Devyani International Q3 ResultsDocumento9 páginasDevyani International Q3 ResultsSaurabh AggarwalAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Web Standalone Sep23Documento7 páginasWeb Standalone Sep23coolstiffler08Ainda não há avaliações

- Dolat: Algoieg-IlimitedDocumento14 páginasDolat: Algoieg-IlimitedPãräs PhútélàAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Tata Motors Limited reports loss of Rs 4,871 crore in Q4 FY20Documento10 páginasTata Motors Limited reports loss of Rs 4,871 crore in Q4 FY20Anil Kumar AkAinda não há avaliações

- Data To Use - Detail InformationDocumento44 páginasData To Use - Detail InformationAninda DuttaAinda não há avaliações

- Finance Department Analysis of Dabur LimitedDocumento15 páginasFinance Department Analysis of Dabur LimitedradhikaAinda não há avaliações

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Documento4 páginasUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloAinda não há avaliações

- Time Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210Documento13 páginasTime Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210WeR1 Consultants Pte LtdAinda não há avaliações

- Sep '19 Jun '19 Mar '19 Dec '18 Sep '18Documento3 páginasSep '19 Jun '19 Mar '19 Dec '18 Sep '18subhas sahaAinda não há avaliações

- 4.varroc Consolidated Result Sheet June 2021 SignedDocumento3 páginas4.varroc Consolidated Result Sheet June 2021 SignedA kumarAinda não há avaliações

- Appendix 1Documento21 páginasAppendix 1Saravanan AnnamalaiAinda não há avaliações

- Kingdom of NokiaDocumento276 páginasKingdom of NokiaPriya Tiwari0% (1)

- Kingdom of NokiaDocumento276 páginasKingdom of NokiaPriya Tiwari0% (1)

- ARM Architecture & Programmer ModelDocumento15 páginasARM Architecture & Programmer Models natarajanAinda não há avaliações

- W.D Gann The Basis of My Forecasting MethodDocumento33 páginasW.D Gann The Basis of My Forecasting Methods natarajan100% (4)

- Link Ratio MethodDocumento18 páginasLink Ratio MethodLuis ChioAinda não há avaliações

- Critical Methodology Analysis: 360' Degree Feedback: Its Role in Employee DevelopmentDocumento3 páginasCritical Methodology Analysis: 360' Degree Feedback: Its Role in Employee DevelopmentJatin KaushikAinda não há avaliações

- British Universal Steel Columns and Beams PropertiesDocumento6 páginasBritish Universal Steel Columns and Beams PropertiesjagvishaAinda não há avaliações

- Letter From Attorneys General To 3MDocumento5 páginasLetter From Attorneys General To 3MHonolulu Star-AdvertiserAinda não há avaliações

- Baobab MenuDocumento4 páginasBaobab Menuperseverence mahlamvanaAinda não há avaliações

- Reading Comprehension Exercise, May 3rdDocumento3 páginasReading Comprehension Exercise, May 3rdPalupi Salwa BerliantiAinda não há avaliações

- Role of PAODocumento29 páginasRole of PAOAjay DhokeAinda não há avaliações

- Inborn Errors of Metabolism in Infancy: A Guide To DiagnosisDocumento11 páginasInborn Errors of Metabolism in Infancy: A Guide To DiagnosisEdu Diaperlover São PauloAinda não há avaliações

- Condition Based Monitoring System Using IoTDocumento5 páginasCondition Based Monitoring System Using IoTKaranMuvvalaRaoAinda não há avaliações

- Indian Journal of Natural Products and Resources Vol 1 No 4 Phytochemical pharmacological profile Cassia tora overviewDocumento8 páginasIndian Journal of Natural Products and Resources Vol 1 No 4 Phytochemical pharmacological profile Cassia tora overviewPRINCIPAL BHILWARAAinda não há avaliações

- Easa Management System Assessment ToolDocumento40 páginasEasa Management System Assessment ToolAdam Tudor-danielAinda não há avaliações

- Wheeled Loader L953F Specifications and DimensionsDocumento1 páginaWheeled Loader L953F Specifications and Dimensionssds khanhAinda não há avaliações

- Get Oracle Order DetailsDocumento4 páginasGet Oracle Order Detailssiva_lordAinda não há avaliações

- PEDs and InterferenceDocumento28 páginasPEDs and Interferencezakool21Ainda não há avaliações

- Alignment of Railway Track Nptel PDFDocumento18 páginasAlignment of Railway Track Nptel PDFAshutosh MauryaAinda não há avaliações

- Steps To Christ AW November 2016 Page Spreaad PDFDocumento2 páginasSteps To Christ AW November 2016 Page Spreaad PDFHampson MalekanoAinda não há avaliações

- Public Private HEM Status AsOn2May2019 4 09pmDocumento24 páginasPublic Private HEM Status AsOn2May2019 4 09pmVaibhav MahobiyaAinda não há avaliações

- Crystallizers: Chapter 16 Cost Accounting and Capital Cost EstimationDocumento1 páginaCrystallizers: Chapter 16 Cost Accounting and Capital Cost EstimationDeiver Enrique SampayoAinda não há avaliações

- Consumers ' Usage and Adoption of E-Pharmacy in India: Mallika SrivastavaDocumento16 páginasConsumers ' Usage and Adoption of E-Pharmacy in India: Mallika SrivastavaSundaravel ElangovanAinda não há avaliações

- Correlation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesiDocumento8 páginasCorrelation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesimuqfiAinda não há avaliações

- Returnable Goods Register: STR/4/005 Issue 1 Page1Of1Documento1 páginaReturnable Goods Register: STR/4/005 Issue 1 Page1Of1Zohaib QasimAinda não há avaliações

- Money Laundering in Online Trading RegulationDocumento8 páginasMoney Laundering in Online Trading RegulationSiti Rabiah MagfirohAinda não há avaliações

- Bala Graha AfflictionDocumento2 páginasBala Graha AfflictionNeeraj VermaAinda não há avaliações