Escolar Documentos

Profissional Documentos

Cultura Documentos

Asia's Purchasing Power

Enviado por

Alejandro ÁvilaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Asia's Purchasing Power

Enviado por

Alejandro ÁvilaDireitos autorais:

Formatos disponíveis

May 9th 2014

PrintShare

Asia's purchasing powers

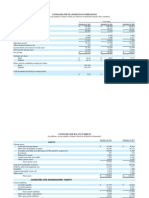

In late April the World Bank's International Comparison

Programme (ICP) published new data that highlighted that the

shift of economic weight from developed to emerging markets is

even more rapid when economic activity is measured at

purchasing power parity (PPP) exchange rates. Leading the way

were Asia's big three emerging economies (China, India and

Indonesia), which in 2011 had ranked as the world's second-,

third- and tenth-largest economies respectively, according to the

ICP's calculations. The new numbers suggest that China will

supplant the US as the world's biggest economy in 2014 on this

measure, but there are many reasons to treat the data cautiously.

The idea that China will overtake the US as the world's biggest

economy this year has provided fuel to doomsayers in the latter

country worried about the declining influence of the US on the global

stage. Previously, based on the last version of PPP exchange rates

provided by the ICP in 2005, it had looked like China would surpass

the US only in 2019. Within Asia, India has overtaken Japan to

become the world's third-largest economy measured under PPP

exchange rates. When the ICP made its last revision in 2005, it had

ranked India's economy as only the 10th-largest in PPP terms.

Is China really the world's biggest economy?

It is important to note that the ICP has not uncovered new economic

activity. The economic "power" of countries like China and India has

not risen: global economic transactions are conducted at market

exchange rates, not PPP ones. The Economist Intelligence Unit

forecasts that China's GDP at market exchange rates will reach

US$10.4trn in 2014, but this is still less than 60% of the size of the US

economy, at US$17.6trn.

In practice, the use of PPP exchange rates tends to boost the apparent

size of developing economies relative to wealthier ones. This reflects

the fact that a given amount of US dollars converted at market

exchange rates will buy more goods and services in many emerging

markets than it will in a developed country. Nonetheless, the task of

measuring economic activity at PPP exchange rates remains very

difficult. The theory behind the idea is simple: economic output in a

country includes many goods that are not tradeable across borders, so

using market exchange rates to measure GDP can be misleading if the

prices of non-tradeable goods are systematically different. Given that

non-tradeable goods, such as restaurant meals or haircuts, are often

labour-intensive, the low wages in emerging markets typically mean

that this is the case. Furthermore, market exchange rates can also

fluctuate violently from year to year, distorting comparisons between

economies. The system of PPP exchange rates seeks to produce a way

of comparing the prices of a basket of goods and services between

countries to produce a measure of performance that counts the quantity

of goods and services produced undistorted by such price differences.

There are many flaws in the idea of PPP, however. Perhaps the most

important is that finding a basket of goods and services to compare

prices between countries is virtually impossible. Countries produce

(and consume) very different types of goods and services, and

differences in quality are hard to take into account. Food in China may

be cheaper than in the US, but consumers in the US do not have to

worry to the same extent about food safety because part of the higher

price they pay goes towards maintaining a stricter regulatory and

monitoring regime. Compounding these concerns, there have been

sharp shifts in the PPP exchange rates used by the ICP between 2005

and 2011, which raises questions about the supposed greater stability

of PPP exchange rates.

So what use is PPP?

The problems involved in using PPP exchange rates mean that many

economists consider market exchange rates the only appropriate

measure to use when ranking the sizes of different economies around

the world. Certainly, for companies wanting to assess business

opportunities, market exchange rates are the ones that matter. The

Chinese government appears to share this view, and refused to co-

operate with the ICP in its work (raising further questions about the

data used for China). The Chinese administration's decision may have

been driven in part by a concern that the resulting figures might be

used by those arguing that China's growing economic weight means

that the country should do more to address global concerns such as

climate change.

PPP exchange rates are best used to compare and contrast output per

head in various countries, rather than to rank economies in terms of

their size. The economic strength of China, India and Indonesia stems

partly from their large populations. They are much weaker in terms of

output per head, which stood at US$9,202, US$4,960 and US$8,389

respectively in 2011 under the newly updated PPP figures. This

compares with US$51,605 in the US and a global average of

US$13,258.

Pointing to undervalued currencies

A further use of PPP exchange rates is to gain an idea of which

currencies are undervalued. India's and Indonesia's shares of the world

economy under PPP measurements, at 6.4% and 2.3% respectively, are

around double their shares when measured by market exchange rates.

(Both countries have experienced a significant depreciation of their

currencies against the US dollar since 2011, which will only have

widened the ratio). This suggests that prices for goods and services

that are not traded across borders are very cheap in India and

Indonesia, even compared with those in many low-income nations in

Africa. The price level for government expenditure in Indonesia was

particularly low compared with other GDP expenditure components at

PPP exchange rates, suggesting that government expenditure could be

a more effective way to reduce poverty, which remains endemic in the

country. By contrast, the price level for fixed capital formation in India

was high. This could reflect a number of factors, including problems

such as graft that raise the cost of investment.

Emerging markets come to dominate the global economy

The new PPP exchange rate data have many problems and can be

easily misconstrued. Nevertheless, whatever the merits of the figures,

they have again drawn attention to a secular trend that is evident

whether using PPP or market exchange rates. Emerging markets are

accounting for a growing share of global economic output, and Asia's

largest economies are leading the charge. Companies that wish to

succeed in this global environment will need to follow the money.

Você também pode gostar

- Classification of Economies BUSS. AND TRADEDocumento6 páginasClassification of Economies BUSS. AND TRADEFany GirlAinda não há avaliações

- Major Economic Indicators of Successful & Declining EconomiesDocumento9 páginasMajor Economic Indicators of Successful & Declining EconomiesAli Zafar0% (1)

- Making Sense of Inflation Figures: FE Editorial: Understanding InflationDocumento5 páginasMaking Sense of Inflation Figures: FE Editorial: Understanding InflationashishprrinAinda não há avaliações

- Indicators of Economic Growth LEEBDocumento12 páginasIndicators of Economic Growth LEEBNischay RathiAinda não há avaliações

- India Vs ChinaDocumento9 páginasIndia Vs ChinaArjun MalhotraAinda não há avaliações

- PurchasingPowerParities GDPDocumento3 páginasPurchasingPowerParities GDPSam WilsonAinda não há avaliações

- Quantitative Research Methodology Project Interpretation Marin Adrian Cosmin LMADocumento14 páginasQuantitative Research Methodology Project Interpretation Marin Adrian Cosmin LMAAdrian MarinAinda não há avaliações

- Unit 4 Global Business: Activity 1 Case Study: Italy and The Democratic Republic of Congo (DRC)Documento74 páginasUnit 4 Global Business: Activity 1 Case Study: Italy and The Democratic Republic of Congo (DRC)Alex ZhangAinda não há avaliações

- Term Paper On GDPDocumento5 páginasTerm Paper On GDPbzknsgvkg100% (1)

- Causes For Slow Economic Growth in IndiaDocumento10 páginasCauses For Slow Economic Growth in IndiaThakur Shobhit SinghAinda não há avaliações

- Research Papers On Exchange Rate and InflationDocumento4 páginasResearch Papers On Exchange Rate and Inflationxsykcbikf100% (1)

- Consumption and ChinaDocumento11 páginasConsumption and ChinamandybawaAinda não há avaliações

- Purchasing Power ParityDocumento11 páginasPurchasing Power ParityAbhijitAinda não há avaliações

- Indian Inflation Problem and Simulation Using IS-LM Model EdharmeshDocumento7 páginasIndian Inflation Problem and Simulation Using IS-LM Model EdharmeshPhilip LeonardAinda não há avaliações

- Economic Development in IndiaDocumento7 páginasEconomic Development in IndiaSahil ThappaAinda não há avaliações

- 2011 Chinese Consumer Report EnglishDocumento48 páginas2011 Chinese Consumer Report EnglishFeiAinda não há avaliações

- FINALYST!!Documento12 páginasFINALYST!!Anshul SoodAinda não há avaliações

- Research Paper China EconomyDocumento6 páginasResearch Paper China Economyfvhqqm3b100% (1)

- Econ MidtermDocumento2 páginasEcon MidtermCAROLYN JOY BORBONAinda não há avaliações

- Overheating: Niranjan Rajadhyaksha's Previous ColumnsDocumento5 páginasOverheating: Niranjan Rajadhyaksha's Previous ColumnsVaibhav KarthikAinda não há avaliações

- Purchasing Power Parity DissertationDocumento4 páginasPurchasing Power Parity DissertationHelpPaperCanada100% (1)

- Working Papers: Validating India's GDP Growth EstimatesDocumento32 páginasWorking Papers: Validating India's GDP Growth EstimatesRavikumar SwaminathanAinda não há avaliações

- China and India - Economic Growth and The Struggle Against InflationDocumento10 páginasChina and India - Economic Growth and The Struggle Against InflationJohn RossAinda não há avaliações

- Economic Freedom in Indonesia 2018: Review of Recent DevelopmentDocumento27 páginasEconomic Freedom in Indonesia 2018: Review of Recent DevelopmentWido Cepaka WarihAinda não há avaliações

- Economic TermsDocumento7 páginasEconomic TermsHimani MehtaAinda não há avaliações

- Random Bullshit 1Documento3 páginasRandom Bullshit 1NisHitMauryaAinda não há avaliações

- Global Weekly Economic Update - Deloitte InsightsDocumento34 páginasGlobal Weekly Economic Update - Deloitte InsightsGANGULYABHILASHAAinda não há avaliações

- Literature Review On Money Supply and InflationDocumento5 páginasLiterature Review On Money Supply and Inflationea8dpyt0100% (1)

- How Reliable Are The Leading Indicators of GDPDocumento2 páginasHow Reliable Are The Leading Indicators of GDPVishal JoshiAinda não há avaliações

- Accounting For Growth: Comparing China and India: Barry Bosworth and Susan M. CollinsDocumento37 páginasAccounting For Growth: Comparing China and India: Barry Bosworth and Susan M. CollinsChand PatelAinda não há avaliações

- Chinese Economy Research PaperDocumento4 páginasChinese Economy Research Paperafnhinzugpbcgw100% (1)

- Make Money Importing From ChinaDocumento22 páginasMake Money Importing From Chinaiansmith1100% (1)

- Mckinsey Meet The 2020 ConsumerDocumento44 páginasMckinsey Meet The 2020 ConsumerChinmay JhaveriAinda não há avaliações

- Retail Realty in India Feb2014Documento28 páginasRetail Realty in India Feb2014shahavAinda não há avaliações

- Understanding The Mystery of India's New GDP CalculationDocumento2 páginasUnderstanding The Mystery of India's New GDP CalculationRanjitAinda não há avaliações

- 15 February 2011: Please Read The Important Disclosures and Disclaimers On Pp. 9-10.glDocumento10 páginas15 February 2011: Please Read The Important Disclosures and Disclaimers On Pp. 9-10.glAquila99999Ainda não há avaliações

- The Growth Penalty of High Government Pay RatesDocumento65 páginasThe Growth Penalty of High Government Pay RatesAsian Development BankAinda não há avaliações

- Answer/Solution Case: The BRICs: Vanguard of The RevolutionDocumento3 páginasAnswer/Solution Case: The BRICs: Vanguard of The RevolutionEvan Octviamen67% (6)

- SPEX Issue 22Documento10 páginasSPEX Issue 22SMU Political-Economics Exchange (SPEX)Ainda não há avaliações

- China and Indian Econ. GrowthDocumento4 páginasChina and Indian Econ. Growthshahid ahmed laskarAinda não há avaliações

- Spring 2014 Optimal Bundle: Issue XIIDocumento2 páginasSpring 2014 Optimal Bundle: Issue XIIColennonAinda não há avaliações

- Importance of Statistics To Nigerian EconomyDocumento6 páginasImportance of Statistics To Nigerian Economyshylle412367% (3)

- Marketing Analysis of Indonesia Concerning Microwave OvensDocumento29 páginasMarketing Analysis of Indonesia Concerning Microwave OvensMindy Wiriya SarikaAinda não há avaliações

- Thesis On Chinas EconomyDocumento7 páginasThesis On Chinas Economybsr8frht100% (2)

- The Pattern and Causes of Economic Growth in IndiaDocumento2 páginasThe Pattern and Causes of Economic Growth in IndiaNehas22Ainda não há avaliações

- 3ab resPAperDocumento2 páginas3ab resPAperNehas22Ainda não há avaliações

- What is inflation? Explained in detailDocumento14 páginasWhat is inflation? Explained in detailAnkit NandawatAinda não há avaliações

- India's Economic Growth: Factors Behind ChangesDocumento2 páginasIndia's Economic Growth: Factors Behind ChangesNehas22Ainda não há avaliações

- National Income, Poverty, Income Inequality and Literacy in India: Analysis of Tax and Monetary Policies to Reduce Wealth ImbalanceDocumento12 páginasNational Income, Poverty, Income Inequality and Literacy in India: Analysis of Tax and Monetary Policies to Reduce Wealth ImbalanceAnmol AroraAinda não há avaliações

- Impact of China Slowdown On IndiaDocumento9 páginasImpact of China Slowdown On IndiabhagatvarunAinda não há avaliações

- Pest Analysis of Indusind BankDocumento3 páginasPest Analysis of Indusind BankViola33% (3)

- "India Vs China": "Business Environment"Documento15 páginas"India Vs China": "Business Environment"Gurpreet SinghAinda não há avaliações

- Table of Contents: Analysis of the Relationship Between Government Spending and InflationDocumento13 páginasTable of Contents: Analysis of the Relationship Between Government Spending and InflationBunnyAinda não há avaliações

- Mets September 2010 Ver4Documento44 páginasMets September 2010 Ver4bsa375Ainda não há avaliações

- Effects of Globalization in the Philippines: An Analysis of Its Impact on Trade, Economy, and SocietyDocumento6 páginasEffects of Globalization in the Philippines: An Analysis of Its Impact on Trade, Economy, and SocietyCedrick John MendozaAinda não há avaliações

- Growth Report - SummaryDocumento3 páginasGrowth Report - Summarybullz eyeAinda não há avaliações

- Paper 2Documento19 páginasPaper 2Satria WijayaAinda não há avaliações

- Research Paper On China EconomyDocumento4 páginasResearch Paper On China Economygz9fk0td100% (1)

- The Econometric SocietyDocumento33 páginasThe Econometric SocietyAlejandro ÁvilaAinda não há avaliações

- Barro-What Are The Odds of A DepressionDocumento3 páginasBarro-What Are The Odds of A DepressionAlejandro ÁvilaAinda não há avaliações

- ACTIVIDAD DE INGLÉS PARA 5° Y 6° (Semana 7) PDFDocumento1 páginaACTIVIDAD DE INGLÉS PARA 5° Y 6° (Semana 7) PDFAlejandro ÁvilaAinda não há avaliações

- 1905702Documento33 páginas1905702Alejandro ÁvilaAinda não há avaliações

- Maddison. (Cuadro P. 87) 20140129153101552Documento1 páginaMaddison. (Cuadro P. 87) 20140129153101552Alejandro ÁvilaAinda não há avaliações

- Baumeister - The Role of Time-Varying Price Elasticities in Accounting For Volatility Changes in The Crude Oil MarketDocumento35 páginasBaumeister - The Role of Time-Varying Price Elasticities in Accounting For Volatility Changes in The Crude Oil MarketAlejandro ÁvilaAinda não há avaliações

- Yanez - Et - Al-The Population of Latin America From Nineteenth Century To 2008. An Essay in Quantitative HistoryDocumento96 páginasYanez - Et - Al-The Population of Latin America From Nineteenth Century To 2008. An Essay in Quantitative HistoryAlejandro ÁvilaAinda não há avaliações

- Shaikh-Laws of Production and Laws of Algebra. The Humbug Production FunctionDocumento7 páginasShaikh-Laws of Production and Laws of Algebra. The Humbug Production FunctionAlejandro ÁvilaAinda não há avaliações

- BBC News-Reinhart, Rogoff... and Herndon PDFDocumento5 páginasBBC News-Reinhart, Rogoff... and Herndon PDFAlejandro ÁvilaAinda não há avaliações

- The Production Function and The Theory of Capital RobinsonDocumento28 páginasThe Production Function and The Theory of Capital RobinsonAlejandro ÁvilaAinda não há avaliações

- R. Lucas - What Economist Do (1988)Documento6 páginasR. Lucas - What Economist Do (1988)Marygracia AquinoAinda não há avaliações

- Stigler-Ricardo Labor 93Documento12 páginasStigler-Ricardo Labor 93Alejandro ÁvilaAinda não há avaliações

- Commodity Market Monthly (IMF) 2005-2013Documento8 páginasCommodity Market Monthly (IMF) 2005-2013Alejandro ÁvilaAinda não há avaliações

- Comet-La. Deliverable 3.2 12 de SeptiembreDocumento87 páginasComet-La. Deliverable 3.2 12 de SeptiembreAlejandro ÁvilaAinda não há avaliações

- Differences in Surplus-Value Rates Between Developed and Underdeveloped CountriesDocumento31 páginasDifferences in Surplus-Value Rates Between Developed and Underdeveloped CountriesAlejandro ÁvilaAinda não há avaliações

- Productive and Inproducyive Labor Wolf ResnickDocumento5 páginasProductive and Inproducyive Labor Wolf ResnickAlejandro ÁvilaAinda não há avaliações

- What Is The Relationship Between The Rates of Interest and Profit - An Empirical Note For The U.S. Ec PDFDocumento22 páginasWhat Is The Relationship Between The Rates of Interest and Profit - An Empirical Note For The U.S. Ec PDFAlejandro ÁvilaAinda não há avaliações

- Basel III Accord OverviewDocumento5 páginasBasel III Accord OverviewroshanAinda não há avaliações

- Motilal OswalDocumento12 páginasMotilal OswalRajesh SharmaAinda não há avaliações

- Britannia, 18th February, 2013Documento10 páginasBritannia, 18th February, 2013Angel BrokingAinda não há avaliações

- Group 1 Pranav Shukla Kunal Jha Navdeep Sangwan Mansi Bharadwaj Nainika Narula Company ProfileDocumento44 páginasGroup 1 Pranav Shukla Kunal Jha Navdeep Sangwan Mansi Bharadwaj Nainika Narula Company ProfileApoorv BajajAinda não há avaliações

- HLB Personal Loan TNC en BMDocumento25 páginasHLB Personal Loan TNC en BMMbatu TchalaAinda não há avaliações

- Intermediate Accounting Reporting and Analysis 2017 Update 2nd Edition Wahlen Test BankDocumento26 páginasIntermediate Accounting Reporting and Analysis 2017 Update 2nd Edition Wahlen Test BankSabrinaFloresmxzie100% (55)

- MEPCO ONLINE BILL KamiDocumento1 páginaMEPCO ONLINE BILL KamiMisali SchoolAinda não há avaliações

- Karla Company P-WPS OfficeDocumento14 páginasKarla Company P-WPS OfficeKris Van HalenAinda não há avaliações

- TVM Chapter 4 Time Value of MoneyDocumento19 páginasTVM Chapter 4 Time Value of MoneySomera Abdul Qadir100% (1)

- MARK MARTIN SETS UP BUSINESSTITLE JANET FAIRBRASS BEAUTY BUSINESS TRIAL BALANCEDocumento2 páginasMARK MARTIN SETS UP BUSINESSTITLE JANET FAIRBRASS BEAUTY BUSINESS TRIAL BALANCESam TaylorAinda não há avaliações

- Structured Flowchart of The Loan Computation: StartDocumento6 páginasStructured Flowchart of The Loan Computation: StarthalerAinda não há avaliações

- Corporate InvestmentDocumento20 páginasCorporate InvestmentJuan Manuel FigueroaAinda não há avaliações

- Capital Market CMDocumento1 páginaCapital Market CMFranzing LebsAinda não há avaliações

- Investor Education in Nepal: Krishna Prasad Ghimire & Suraj Pradhananga Securities Board of NepalDocumento16 páginasInvestor Education in Nepal: Krishna Prasad Ghimire & Suraj Pradhananga Securities Board of NepalNoufal AnsariAinda não há avaliações

- Romona Taylor Williams & Anne-Sophie Gintzburger - Examining The Impact of Economic Exclusion On Low Wealth and Communities of Color in ST - Louis, MO: A Simulation of Pay LendingDocumento15 páginasRomona Taylor Williams & Anne-Sophie Gintzburger - Examining The Impact of Economic Exclusion On Low Wealth and Communities of Color in ST - Louis, MO: A Simulation of Pay LendingFondation Singer-PolignacAinda não há avaliações

- Global IME BankDocumento29 páginasGlobal IME BankSujan Bajracharya100% (2)

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Documento5 páginasConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryAinda não há avaliações

- Viva. The Free Banking Package For Young People and StudentsDocumento3 páginasViva. The Free Banking Package For Young People and StudentsYoussef SaidAinda não há avaliações

- CURRENT TRENDS AND FUTURE SCOPE OF CRYPTOCURRENCYDocumento57 páginasCURRENT TRENDS AND FUTURE SCOPE OF CRYPTOCURRENCYHarshal MagadeAinda não há avaliações

- JourneyDocumento29 páginasJourneyprajwal sedhaiAinda não há avaliações

- Invoice 1173385957 I0119F2000029537Documento2 páginasInvoice 1173385957 I0119F2000029537Sharma PappuAinda não há avaliações

- Targets & Instruments of Monetary Policy and Tinbergen ConditionDocumento4 páginasTargets & Instruments of Monetary Policy and Tinbergen ConditionLado BahadurAinda não há avaliações

- CH 3 - Main Prohibits N Bus EthicsDocumento9 páginasCH 3 - Main Prohibits N Bus EthicsMian UsmanAinda não há avaliações

- Components of Balance of Payments I: NtroductionDocumento3 páginasComponents of Balance of Payments I: NtroductionSamuel HranlehAinda não há avaliações

- Principles of Sound Lending ExplainedDocumento2 páginasPrinciples of Sound Lending ExplainedRajat Das100% (1)

- Unit 5Documento50 páginasUnit 5ahmed sunoosyAinda não há avaliações

- Accounts Receivable and Estimation of AFBDDocumento1 páginaAccounts Receivable and Estimation of AFBDeia aieAinda não há avaliações

- Agrani Bank 2010Documento78 páginasAgrani Bank 2010Shara Binte Hamid100% (1)

- Unit 4 - Business CombinationDocumento2 páginasUnit 4 - Business CombinationJeselyn Solante AriarAinda não há avaliações

- BFIn Honours Programme OverviewDocumento17 páginasBFIn Honours Programme OverviewIkonic Yiu YiuAinda não há avaliações

- Kaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineNo EverandKaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineNota: 4.5 de 5 estrelas4.5/5 (36)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyNo EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyNota: 4 de 5 estrelas4/5 (51)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetAinda não há avaliações

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingNo EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingNota: 4.5 de 5 estrelas4.5/5 (97)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsNo EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsNota: 4.5 de 5 estrelas4.5/5 (94)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesNo EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesNota: 4.5 de 5 estrelas4.5/5 (8)

- Look Again: The Power of Noticing What Was Always ThereNo EverandLook Again: The Power of Noticing What Was Always ThereNota: 5 de 5 estrelas5/5 (3)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyNo EverandChip War: The Quest to Dominate the World's Most Critical TechnologyNota: 4.5 de 5 estrelas4.5/5 (227)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaAinda não há avaliações

- The Hidden Habits of Genius: Beyond Talent, IQ, and Grit—Unlocking the Secrets of GreatnessNo EverandThe Hidden Habits of Genius: Beyond Talent, IQ, and Grit—Unlocking the Secrets of GreatnessNota: 3.5 de 5 estrelas3.5/5 (12)

- Second Class: How the Elites Betrayed America's Working Men and WomenNo EverandSecond Class: How the Elites Betrayed America's Working Men and WomenAinda não há avaliações

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsNo EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsNota: 5 de 5 estrelas5/5 (2)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassAinda não há avaliações

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailNo EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailNota: 4.5 de 5 estrelas4.5/5 (237)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistNo EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistNota: 4.5 de 5 estrelas4.5/5 (37)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentNo EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentNota: 4.5 de 5 estrelas4.5/5 (92)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationNo EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationNota: 4.5 de 5 estrelas4.5/5 (46)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomAinda não há avaliações

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldNo EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldNota: 4 de 5 estrelas4/5 (16)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyNo EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyNota: 4.5 de 5 estrelas4.5/5 (263)

- The Finance Curse: How Global Finance Is Making Us All PoorerNo EverandThe Finance Curse: How Global Finance Is Making Us All PoorerNota: 4.5 de 5 estrelas4.5/5 (18)

- How an Economy Grows and Why It Crashes: Collector's EditionNo EverandHow an Economy Grows and Why It Crashes: Collector's EditionNota: 4.5 de 5 estrelas4.5/5 (102)

- Against the Gods: The Remarkable Story of RiskNo EverandAgainst the Gods: The Remarkable Story of RiskNota: 4 de 5 estrelas4/5 (352)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- The Ascent of Money: A Financial History of the WorldNo EverandThe Ascent of Money: A Financial History of the WorldNota: 4.5 de 5 estrelas4.5/5 (132)

- Oceans of Grain: How American Wheat Remade the WorldNo EverandOceans of Grain: How American Wheat Remade the WorldNota: 4.5 de 5 estrelas4.5/5 (3)