Escolar Documentos

Profissional Documentos

Cultura Documentos

p1 A

Enviado por

incubus_yeahDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

p1 A

Enviado por

incubus_yeahDireitos autorais:

Formatos disponíveis

National Federation of Junior Philippine Institute of Accountants

In cooperation with

Isla Lipana & Co. and CRC-ACE

National mock board examination 2014

PRACTICAL ACCOUNTING 1

Instruction: On the answer sheet provided, Shade the letter representing the best answer for each of

the following questions. Necessary computations should be made on separate sheets of paper. Avoid

making erasures. The scanning machine may invalidate your answer.

1. On July 31, 2013 New Inc. purchased for P75,000,000 a tract of land on which a decrepit office building was located. The

intention of New Inc. is to demolish the office building (wi th a remai ning useful life of 5 years) and replace it wi th a new

building. New will not use the office building prior to the demolition. The following data were collected concerning the

property:

Fair Value

7/31/13

Land P 60,000,000

Office Building 20,000,000

The new building that will be constructed in late 2014 will be classified as owner-occupied property and that New uses the

cost model of accounting i ts Property, plant and equipment. What is the amount of depreciation expense recognized for fiscal

year ended June 30, 2014 in relation to the above transaction?

a. P -0- b. P 4,000,000 c. P 3,750,000 d. P 3,437,500

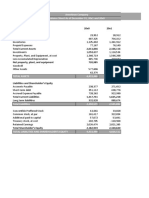

Less Outstanding checks 457

Cash per l edger, December 31, 2010 P 8,425

2. In preparing reconciliation, the adjusted cash and cash equivalents should be

a. P7,965 b. P4,833 c. P 5,933 d. P6,393

3. The cash shortage (if any) is

a. P105 b. P360 c.P555 d. P 0

4. Flu Company provided you wi th the following information in relation to its post-retirement benefit plan; current service

cost P100,000; expected return on plan assets P40,000; actual return on plan assets P45,000. Pension expense for the

period assuming further that Flu Company was classified as an SME

a. 0 b. 100,000 c. 55,000 d. 60,000

Use the following information for the next five items

UA Company was organized in January 1, 2012. Sel ected balances as of December 31, 2015 were as follows:

Land (revalued on December 31, 2014) 1,000,000

Factory building (constructed December 31, 2012) 500,000

Investment property (purchased on January 1, 2012) 800,000

Inventory 600,000

Note receivable (received January 1, 2015 200,000

The general price index had moved on December 31 of each year as follows: December 31, 2012 140; December 31, 2013

190; December 31, 2014 240; December 31, 2015 280

5. The restated amount for the factory building is

a. 500,000 b. 1,000,000 c. 1,400,000 d. 583,333

February 15-16, 2014

6. The restated amount for l and is

a. 1,000,000 b. 2,000,000 c. 1,166,667 d. 1,473,684

7. The restated amount for the investment property is

a. 800,000 b. 1,600,000 c. 933,333 d. 1,179,000

8. The restated amount for i nventory is

a. 646,154 b. 1,200,000 c. 700,000 d. 790,588

9. The fraction to be used in restating notes receivable

a. 280/280 b. 280/140 c. 280/240 d. 280/260

e.

10. ABC Company has 100,000 ordinary shares in issue. It also has 50,000 convertible bonds (face value of each bond is P1) in

issue, which may be converted into ordinary shares on the basis of one share for every five bonds. The i nterest coupon on

the bond is 8%, and the tax rate in force is 25%. It has also issued share options with respect to 12,000 shares, which are

exercisable at a price of P40. The average fair value of ABC Companys shares during the year was P60. The converti ble

bonds and options were outstanding since the beginning of the year. Basic earnings per share for the year are calculated to

be P3.97.

What is the number of shares used to compute for diluted earnings per share for ABC Company?

a. P 114,000 b. P100,000 c. P122,000 d. Not applicable

11. On March 31, 2012, Almost Paradise Co. leased a new machine from Lucky Corporation. The following data relate to the

lease transaction at the inception of the lease:

Lease term 6 years

Quarterly rental payabl e Php120,000

Estimated life of machine 6.5 years

Implicit interest rate 12%

Fair value of the machine Php2,134,800

Estimated residual value Php0

Negotiation costs pai d by lessee Php52,400

(Round off present value factor to four decimal places.)

The lease has no renewal option and the possession of the machi ne reverts to Lucky Corporation when the lease terminates.

Almost Paradise Co. applies the sum-of-the-years di gits method in depreciating its property and equipment.

What is the carrying amount of the machine on December 31, 2012?

a. P1,732,217 b. P1,824,078 c. P1,489,043 d. P1,637,947

Use the following information for the next two items

On January 1, 2010 Glen Company started construction of its own warehouse. Glen Company specifically borrowed

P1,000,000 to finance the construction of the warehouse. Interest incurred during the construction amounted to P120,000

while the income derived from its temporary investment amounted to P30, 000. Total construction cost was P1,400,000.

The warehouse expected useful life was 10 years wi th no expected residual value. Glen Company depreciates similar assets

using the strai ght-line method

On January 1, 2012 Glen Company adopted the revalued model. The sound value of the warehouse was P1,510,000.

12. The depreciation expense i n 2010, assuming that Glen Company for reporting purposes was considered an SME

a. P140,000 b. P149,000 c. P152,000 d. P240,000

13. The revaluation surplus recognized on January 1, 2012, assuming that Glen Company for reporting purposes was

classified as an SME

a. P -0- b. P390,000 c. P318,000 d. P294,000

14. Entity As plan provides a pension of 3% of final salary for each year of service. The benefits become vested after 5 years

of service. On January 1, 2013 of the year for which statements are being prepared, Entity A improved the pension to 4%

of final salary for each year of service retroactive to each employees starting date with the company. At the date of the

improvement, the present value of the addi tional benefits for service up to January 1, 2013 (the date of the plan change) is

as follows:

Employees with more than 5 years service at the date of the plan change P200,000

Employees with less than 5 years service at the date of the plan

change (average period until vesting: 2 years) P100,000

In accordance with PAS 19 Employee Benefi ts (Revised), how should Entity A account for this in its 2013 profit or loss?

a. Additional expense of P300,000 related to both fully vested benefi ts and unvested benefits

b. Additional expense of P200,000 related to fully vested benefits at the date of the plan change

c. Additional expense of P250,000, P200,000 related to fully vested benefits at the date of the plan change and P50,000

related to the 2013 portion of the unvested benefits (recognized on a strai ght line basis over the average vesti ng

period)

d. No effect to 2013 profit or loss

15. The historical comprehensive income statement of Reese Company for 2011

Sales 2,500,000

Less: Cost of sales

Inventory, January 1 175,000

Add: Purchases 1,250,000

Less: Inventory, December 31 250,000 1,175,000

Gross profit 1,325,000

Less: Operating expenses, other than depreciation 1,000,000

Depreciation expense 1,000,000

Net loss 675,000

Sales were earned, purchases other than endi ng i nventory were made and operating expenses other than

depreciation expense were i ncurred evenly throughout the year.

Ending inventory was acqui red during the last week of December 2011

Depreciable assets were acquired on January 1, 2008

General price indices were:

January 1, 2008 125

January 1, 2011 140

December 31, 2011 360

If Reese Company was operating in a hyperinfl ationary economy, the amount to be reported as net income (loss) is

a. 2,720,000 b. 2,412,000 c. 972,000 d. 675,000

16. The balance of inventory after adjusting for hyperinflation

a. 1,500,000 b. 1,350,000 c. 1,687,500 d. 1,215,000

17. The balance of property, plant and equipment after adjusting for hyperinfl ation

a. 900,000 b. 1,125,000 c. 500,000 d. 450,000

18. The balance of non-current liabilities after adjusting for hyperinflation

a. 250,000 b. 312,500 c. 500,000 d. 1,000,000

19. The balance of the share capital after adjusting for hyperi nflation

a. 600,000 b. 200,000 c. 750,000 d. 400,000

20. The balance of retained earnings after adjusting for hyperinflation

a. 1,375,000 b. 1,175,000 c. 1,470,000 d. 1,305,000

21. On December 31, 2012 Margaux Company had monetary assets of P3,000,000 and monetary liabilities of P1,200,000.

The index number on January 1, 2012 was 125; December 31, 2012 was 225

Purchasing power gain/loss in 2012

a. 3,240,000 gain b. 3,240,000 loss c. 1,800,000 loss d. 1,800,000 gain

Use the following information for the next four items

On November 20, 2012 Sunshi ne Company received an i nquiry from Moonlight Company asking if i t was interested to lease

its construction equipment. The carrying amount of the construction equipment was P12,400,000 which approximates its

fair value at this time. Because of the offer Sunshi ne Company is contemplating on l easing the equipment for 6 years the

equipments useful life and would like to have a 9% return rate over the term of the l ease. Initial direct costs for this

contract was computed at P80, 000. At the end of the lease term, Sunshine Company estimates the residual value of the

equipment to be P200,000.

On November 26, 2012 Moonlight Company sent a proposal in which it agrees with the condi tions initially conveyed by

Sunshine Company. Moonlight Company suggested that the commencement date be on January 1, 2013 and that the annual

rentals be schedul ed every December 31, starting on December 31, 2013. Furthermore Moonlight Company communi cated

that it will only guarantee 70% of the residual value computed by Sunshine Company.

On December 8, 2012, the lease agreement between Sunshine Company and Moonlight Company was signed.

(Round PV factors to 3 decimal places)

22. The annual rentals to be received by Sunshine Company is

a. 2,535,083 b. 2,745,555 c. 2,755,417 d. 2,763,388

23. Interest income in 2014 to be recognized by Sunshine Company is

a. 976,300 b. 977,188 c. 975,583 d. 996,130

24. The lease liability reported by Moonlight Company December 31, 2014 is

a. 9,605,292 b. 9,026,181 c. 8,926,902 d. 6,889,090

25. Depreciation expense for 2013 is

a. 2,040,704 b. 2,050,707 c. 2,060,124 d. 2,074,037

Use the following information for the next two items

At the end of January2013, the city government provided Hesington Company a zero interest P30,000,000 3 -year loan used

by the Company in acquiri ng a building on the same date. The prevailing market rate of interest for this type of loan is 8%.

The government imposes that the building must be used for social housing for ten years. The Company estimated that there

is reasonable assurance that i t will meet the terms of the grant. The Company will classify the building as owner occupied

property after the socialized housing project. The Company opted to use the cost model of accounting the building wi th a 15 -

year life from the date of acquisition.

(Round PV factors to 4 decimal places)

26. Applying provisions of PAS 20 Accounting for Government Grants and Disclosures of Government Assistance, what is the

amount recognized as income from the grant as of December 31, 2013?

a. P618,600 b. P 567,050 c. P 1,746,360 d. P 1,905,120

27. Applying provisions of PAS 20 Accounting for Government Grants and Disclosures of Government Assistance, what is the

net effect of the above transactions and events to the Companys profi t or loss for calendar year ended December 31,

2016?

a. (P 2,000,000) b. (P2,134,846) c. (P 3,438,930) d. (P3,589,815)

Use the following information for the next three items

Yin-Yang Company is involved in the exploration for and extraction of mineral resources. The Companys accounting policy

for recognition purpose for these types of activities is the successful effort method. On January 1, 2010 Yin -Yang Company

acquired two quarrying ri ghts. A schedule of the expendi tures made wi th respect to the quarrying sites is provided as

follows:

Site O Site X

Quarrying rights 2,300,000 1,000,000

Topographical studies 1,200,000 200,000

Exploratory drilling 1,100,000 300,000

Trenching and sampling 1,600,000 400,000

Development costs (road construction to access site) 1,400,000 100,000

Depreciation of drilling rigs used for exploration 300,000 120,000

At the end of 2010 Yin-Yang Company had decided to continue exploration and extraction activities in site O (technicall y and

commercial viable). Unfortunately, further exploratory and development plans on site X would be abandoned (not

technically feasible and viable)

On January 1, 2011 Yin-Yang started extracti ng the mineral reserves from site O. It was expected that a total of 10,000,000

tons of mineral ore would be extracted from the site and it would be totally extracted wi thin 8 years.

Yin-Yang Company acqui red an extraction equipment for P600,000. The equipment which Yin-Yang Company intends to use

in another mining site was estimated to have a useful life of 12 years with salvage value of P5,000.

Fixed installations were likewise completed at the start of 2011. The total cost incurred was P800,000. The installations

expected useful life is 10 years with no expected salvage value. Yi n-Yang Company uses the straight-line method as its

depreciation policy for its long-lived assets.

Total tons extracted in 2011 and 2012 were 1,200, 000 and 1,600,000 respectively.

28. The exploration and evaluation assets to be reported in the 2010 statement of financi al position is

a. 6,500,000 b. 7,900,000 c. 8,520,000 d. 8,620,000

29. Depletion for 2011

a. 780,000 b. 948,000 c. 876,000 d. 1,044,000

30. Depreciation for 2011

a. 145,583 b. 129,583 c. 167,400 d. 174,375

31. On November 1, 2013, Bronze Company bought 2,400 ordi nary shares of Purpl e Corporation at P90 per share. The shares

represent less than 5% ownership in Purpl e Corporation and are intended to be traded in the near term; hence,

designated as i nvestments at fair value through profit or loss. In celebration of the Valentines day, Purple Corporati on

issued a 20% bonus issue on February 14, 2014 as a gift for its shareholders. On March 15, 2014, Bronze Company sold

2,000 shares of Purple Corporation ordi nary shares at P80 per share. The market value per share of Purple ordi nary share

is P93 on December 31, 2013 and P81 on December 31, 2014. What is the carrying amount per share of the Purple

Corporation ordinary share after receipt of the bonus issue?

a. P 90.00 b. P75.00 c. P81.00 d. P 77.50

32. On 1 January 2011, Company L issues a fixed rate cumulative perpetual instrument with a face value of Php10 million at

par. Dividends on the instrument are cumulative but discretionary and therefore it is ini tially classified as equity. On 1

January 2012, L adds a new clause to the instrument so that if L is subject to a change of control, L will be required to

redeem the instrument at an amount equal to the face value plus any accumul ated unpai d dividends. This results in a

reclassification of the instrument from equi ty to liability. The fair value of the instrument on 1 January 2012 is Php12

million.How should the reclassification be accounted for?

a. The financial liability should be recorded at the original issuance amount of Php 10 million.

b. The financial liability should be at Php 12 million, with difference of Php 2 million recognized

directly in profit or loss.

c. The financial liability should be at Php 12 million, with difference of Php 2 million recognized

directly in equity.

d. The Company shall record a financial liability of Php 2 million.

33. Jessica Pearson Inc. is a wholesaler of office supplies. The activity for Model V calculators during August is shown below:

Date Balance/Transaction Units Cost

Aug. 1 Inventory 2,000 P36.00

7 Purchase 3,000 37.20

12 Sales 3,600

21 Purchase 4,800 38.00

22 Sales 3,800

29 Purchase 1,600 38.60

If Jessica Pearson Inc. uses perpetual inventory records and that said records are kept in units only, the endi ng inventory of

Model V calculators using average method at August 31, is reported as

a. P150,080 b. P152,264 c. P150,160 d. P146,400

34. Candice Company reported net income of P34,000 for the year ended December 31, 2013 which included depreciati on

expense of P8, 400 and a gai n on sale of equipment of P1,700. The equipment had an historical cost of P40, 000 and

accumulated depreciation of P24,000. Each of the following accounts increased during 2013 (Assume that the increases in

the following accounts are due to cash transactions only.):

Patent P9,800

Prepaid rent* 4,500

Available for sale investment 8,000

Bonds payable 5,000

*To be consumed wi thin 12 months from the balance sheet date

What amount should be reported as net cash provided (used) by investing activities for the year ended December 31, 2013?

a. (P 100) b. (P1,800) c. (P17, 800) d. P 16,000

Use the following information for the next two items

On October 1, 2011, DJ Company acquired land and building for a total consideration of P1,000,000. The fair value of the land

and building were P800,000 and P400,000 respectively. Immediately after acquisition, the building was demolished at a

cost of P20,000 of which P5,000 was recovered as salvage proceeds. Leveling and gradi ng costs of P115,000, as well as

excavation costs of P110,000 were incurred during the last quarter of 2011.

On January 1, 2012, DJ Company borrowed P4, 000,000 at 10% from JL Financing for its building construction. Construction

started immedi ately and was completed at December 31, 2012. Income from the temporary placement of the construction

loan amounted to P30,000.

The following expenditures for the building construction were as follows:

January 1, 2012 P 2,500,000

April 1, 2012 2,000,000

July 1, 2012 1,000,000

October 1, 2012 600,000

December 31, 2012 200,000

Total 6,300,000

DJ Companys other borrowing aside from the construction loan was a 9%, P6,500,000 3-year loan maturing on December

31, 2014.

The building was to be depreciated using the sum-of-the-years digits method. Expected useful life and salvage value was 10

years and P55,000 respectively.

At the beginning of 2018, DJ Company decided to change its depreciation method to the straight-line method. There were no

changes in the expected life or on the estimated salvage value of the building.

35. The initial cost capitalized to the land account was

a. 796,666 b. 930,000 c. 1,130,000 d. 1,250,000

36. Depreciation expense reported in the 2018 i ncome statement is

a. 371,850 b. 382,850 c. 363,850 d. 394,850

Use the following information for the next two items

Knoll Corporation, a client, requests that you compute the appropriate balance of i ts estimated liability for product warranty

account for a statement as of June 30, 2011.

Knoll Corporation manufactures television components and sells them with a 6-month warranty under which defective

components will be replaced without charge. On December 31, 2010, Estimated Liability for Product warranty had a balance

of P620,000. By June 30, 2011, this balance had been reduced to P120,400 by debi ts for estimated net cost of components

returned that had been sold in 2010.

The corporation started out in 2011 expecti ng 7% of the peso volume of sales to be returned. However, due to the

introduction of new models during the year, this estimated percentage of returns was increase to 10% on May 1. It is

assumed that no components sold during a given month are returned in that month. Each component is stamped with a date

at time of sale so that the warranty may be properly administered. The following table of percentages indicates the l ikely

pattern of sales returns duri ng the 6-month period of the warranty, starti ng wi th the month following the sale of

components.

Month Following Sale

Percentage of Total

Returns Expected

First 30%

Second 20

Third 20

Fourth through sixth 10% each month 30

100%

Gross sales of components were as follows for the first six months of 2011:

The corporations warranty also covers the payment of freight cost on defective components returned and on the new

components sent out as replacements. This freight cost runs approximately 5% of the sales price of the components

returned. The manufacturi ng cost of the components is roughly 70% of the sal es price, and the salvage value of the r eturned

components averages 10% of their sales price. Returned components on hand at December 31, 2010, were thus valued in

inventory at 10% of their ori ginal sales price.

37. Requi red Estimated Liability for Product Warranty balance at June 30, 2011

a. P301,353 b. P421,753 c. P120,400 d. P77,847

38. Requi red adjustment to liability account

a. P301,353 debit b. P301,353 credit c. P421,753 debit d. P421,753 credit

Use the following information for the next two items

Jam Company prepared the following reconciliation of income per books with income per tax return for i ts first year of

operations the year ended December 31, 2012

Month Amount

January P4,200,000

February 4,700,000

March 3,900,000

April 3,250,000

May 2,400,000

June 1,900,000

Book income before income taxes P 50,000

Add: Future deductible amounts

_____________________ ______

_____________________ ______ ( 1 )

Less: Future taxable amounts

_____________________ ______

_____________________ ______ ( 2 )

Taxable income _____

Jam Company acquired an equipment at a cost of P500, 000 on January 1, 2012. Depreciation was recorded using the

strai ght-line method wi th no expected residual value for an estimated useful life of 5 years.. For tax purposes, the doubl e-

declining balance method was used.

Sales, cost of sales, operating expenses are recognized under the accrual method for both financial and tax reporti ng

purposes, except for the following items:

Rent income is recognized for financial reporting is recognized under accrual, for tax purposes rent is recognized

when collected. In 2012, Jam Company reported rent income of P140,000, while rent collected totaled to P90,000

Warranty costs are recognized for financial reporting purposes under the accrual method and provide an expense

equal to 5% of selling price. For tax purposes, warranty costs are recognized when actual payment is made. Total

warranty expenditures for 2012 was P320,000. At year end, Jam Company reported an estimated warranty

obligation of P40,000.

Bad debts expense reported during the year for financi al reporting was P65,000. For tax purposes, bad debts are

recognized as deductions only upon write-off which amounted to P30,000 duri ng the year.

Current and future tax rates was 30%

39. The deferred tax liability reported in the December 31, 2012 statement of financial position is

a. 15,000 b. 22,500 c. 30,000 d. 45,000

40. The deferred tax asset reported in the December 31, 2012 statement of financial position is

a. 15,000 b. 22,500 c. 30,000 d. 45,000

Use the following information for the next two items

As a result of a recent acquisition, an entity plans to close a factory in ten months and, at that time, terminate the

employment of all of the remaining employees at the factory. Because the entity needs the expertise of the employees at the

factory to complete some contracts, it announces a plan of termination as follows.

Each employee who stays and renders service until the closure of the factory will receive on the termination date a cash

payment of P30,000. Employees leaving before closure of the factory will receive P10, 000.

There are 120 employees at the factory. At the time of announcing the plan, the entity expects 20 of them to leave before

closure.

41. The entity will recognize a liability of how much for the termination benefits provided in accordance with the employee

benefit plan at the earlier of when the pl an of termination is announced and when the entity recognizes the restructuri ng

costs associated with the closure of the factory?

a. P -0- b. P 1,200,000 c. P3,200,000 d. P 2,000,000

42. The enti ty will recognize an expense of how much each month duri ng the service period of ten months rel ated to short

term employee benefits?

a. P -0- b. P320,000 c. P 200,000 d. P120,000

43. On July 1, 2011 DEF Corp. acquired 60,000 shares of the 200,000 shares outstanding of ZYX Inc. at P25 per share. The

company incurred P2 transaction per share. The book value of ZYX Inc.s net assets on this date amounted to P5M. The fair

value of one of its identifiable intangible with a 5 year remaining life higher than book value by P50,000 while its

Equipment having a remaini ng life of 8 years had a fair value P160,000 higher than book value. All other identifiable

assets had fai r value approximati ng their book values.

ZYX reported total net income in 2011 at P800,000 and distributed dividends at year end at P300,000. Fair value of shares

on this date was at P30 per share while cost to sell is at P2 share.

ZYX reported total comprehensive income in 2012 at P1,250,000 which is net of an foreign translation loss amounti ng to

P150,000. It also distributed dividends at year end at P500,000. Fair value of shares on this date was at P34 per share while

cost to sell remained P2 per share.

Assume that on January 1, 2013, DEF Corp. sold 24,000 ZYX shares P32/share. What is the net effect of this transaction i n the

companys comprehensive income in calendar year (CY) 2013?

a. P 5,400 increase b. P 40,500 increase c. P 85,500 increase d. P 130,500 increase

44. ABC Company has 100,000 ordinary shares in issue. It also has 50,000 convertible bonds (face value of each bond is P1) in

issue, which may be converted into ordinary shares on the basis of one share for every five bonds. The i nterest coupon on

the bond is 8%, and the tax rate in force is 25%. It has also issued share options with respect to 12,000 shares, which are

exercisable at a price of P40. The average fair value of ABC Companys shares during the year was P60. The converti ble

bonds and options were outstanding since the beginning of the year. Basic earnings per share for the year are calculated to

be P3.97.

What is the number of shares used to compute for diluted earnings per share for ABC Company?

e. P 114,000 f. P100,000 g. P122,000 h. Not applicable

45. On January 1, 2013, AJ Company purchased several pieces of inventory for P20,000. However, SC Company, the seller,

agreed to wait for exactly two years before receiving payment. Then, on December 31, 2013, AJ Company sells all of this

inventory to BY Corporation for P30,000. AJ Company agrees to wait for exactly three years to receive the P30,000

payment. A reasonable i nterest rate for these transactions is 8% although no separate cash i nterest is to be paid on ei ther

the purchase or the sale.

For the audi t of year ended December 31, 2013, the gross profit that AJ Company should recognize is

a. P10,000 b. P7,938 c. P6,668 d. P3,815

Use the following information for the next two items

On January 1, 2011 JLO Company acqui red a trademark for P500,000. The trademark has an indefinite useful life. The net

recoverable amount of the trademark on December 31, 2011 was 480,000.

46. The amount of expense included in JLO Companys 2011 fi nancial statement is

a. P -0- b. P20,000 c. P25,000 d. P50,000

47. The amount of expense to be reported in JLO Companys 2011 financial statements, assuming that JLO Company does not

have public accountability and applied the IFRS for SMEs for reporting purposes

a. P -0- b. P20,000 c. P25,000 d. P50,000

48. A car rental company acquired vehicles for a total cost of P15,000,000 with the i ntention of holding them as rental cars for a

limited period and then selling them. The car rental company, in the ordinary course of business, routinely sells vehicles

acquired for car rental. The estimated life of the vehicles acquired was 8 years and after 6 years, the said vehicles will be

available for sale. The proceeds from the sale of the vehicles was P10,000, 000 which happened at the end of the 7th year.

What is the amount of gai n from the subsequent sal e of these vehicles recognized in the 7th year applying PAS 16?

a. P -0- b. P 6,250,000 c. P 8,125,000 d. P 10,000,000

49. Ian Co. is calculating earni ngs per share amounts for inclusion in the Ian's annual report to shareholders. Ian has obtained

the following information from the controller's office as well as shareholder services:

Net income from January 1 to December 31 P125,000

Number of outstandi ng shares:

January 1 to March 31 15,000

April 1 to May 31 12,500

June 1 to December 31 17,000

In addition, Ian has issued 10,000 incentive stock options with an exercise price of P30 to its employees and a year-end

market price of P25 per share. Ian Company's diluted earnings per share for the year ended December 31 is

a. 4.63 b. 4.85 c. 7.35 d. 7.94

50. A lessee is required to pay a refundable deposit of P100,000 to the lessor at the inception of an operating lease for whi ch no

interest is receivable. The fixed lease term is 10 years. The market interest rate is 5% (i.e., that is the interest rate the lessor

would have to pay if he borrowed P100,000 for a 10 year term from a third party). The date of i nception is February 1, 2013.

Assuming the annual lease payment is P60,000, determine the net amount recognized in l essees profit or loss as of

December 31, 2014 applying PAS 17 Leases and financial instruments standards. (Round PV factors to 4 decimal places)

a. P 52,7186 decrease b. P 55,725 decrease c. P 60,651 decrease d. P 63,861 decrease

--END OF EXAMINATION--

Você também pode gostar

- Accounting 162 - Material 006: For The Next Few RequirementsDocumento3 páginasAccounting 162 - Material 006: For The Next Few RequirementsAngelli LamiqueAinda não há avaliações

- Chapter 31SMEs Property Plant and EquipmentDocumento2 páginasChapter 31SMEs Property Plant and EquipmentDez ZaAinda não há avaliações

- AP Problems 2015Documento20 páginasAP Problems 2015Rodette Adajar Pajanonot100% (1)

- MB2 2013 Ap Set BDocumento6 páginasMB2 2013 Ap Set BMary Queen Ramos-UmoquitAinda não há avaliações

- INTACC2 Liabilities Questions ARALJPIADocumento3 páginasINTACC2 Liabilities Questions ARALJPIAKiba YuutoAinda não há avaliações

- Use The Following Information For The Next 2 QuestionsDocumento4 páginasUse The Following Information For The Next 2 QuestionsGlen JavellanaAinda não há avaliações

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocumento5 páginasIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaAinda não há avaliações

- Afar IcpaDocumento6 páginasAfar IcpaAndrea Lyn Salonga CacayAinda não há avaliações

- DocxDocumento10 páginasDocxAiziel OrenseAinda não há avaliações

- FQ 002 Book Value and Earnings Per ShareDocumento3 páginasFQ 002 Book Value and Earnings Per SharemarygraceomacAinda não há avaliações

- On January 1Documento3 páginasOn January 1Jude Santos0% (1)

- Appendix Ebleta MatsDocumento17 páginasAppendix Ebleta MatsEl Yang0% (2)

- Finacc 3Documento6 páginasFinacc 3Tong WilsonAinda não há avaliações

- Ap-100Q: Quizzer On Accounting Changes, Error Corrections, Cash/Accrual and Single EntryDocumento8 páginasAp-100Q: Quizzer On Accounting Changes, Error Corrections, Cash/Accrual and Single EntryJohn Paulo SamonteAinda não há avaliações

- Finance Lease - Lessee: Aklan Catholic CollegeDocumento9 páginasFinance Lease - Lessee: Aklan Catholic CollegeLouiseAinda não há avaliações

- MAS - Group 5Documento7 páginasMAS - Group 5beleky watersAinda não há avaliações

- Prac 1Documento9 páginasPrac 1rayAinda não há avaliações

- Current LiabilitiesDocumento9 páginasCurrent LiabilitiesErine ContranoAinda não há avaliações

- Liabs 2Documento3 páginasLiabs 2Iohc NedmiAinda não há avaliações

- Batch 19 2nd Preboard (P1)Documento10 páginasBatch 19 2nd Preboard (P1)Jericho PedragosaAinda não há avaliações

- Problem 3 LessorDocumento7 páginasProblem 3 LessorGelo Owss33% (9)

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDocumento12 páginasGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaAinda não há avaliações

- Problem 14-4 (IAA)Documento8 páginasProblem 14-4 (IAA)NIMOTHI LASE0% (1)

- SPQ 003 Employee Benefits, Leases, and Other LiabilitiesDocumento3 páginasSPQ 003 Employee Benefits, Leases, and Other LiabilitiesmarygraceomacAinda não há avaliações

- Chapter 11 Test Bank PDFDocumento29 páginasChapter 11 Test Bank PDFYing LiuAinda não há avaliações

- Investment in Associate 2Documento2 páginasInvestment in Associate 2miss independent100% (1)

- Acquisition & Interest Date Interest Earned 12% Rate Interest Income 14% Rate Discount Amortization Book ValueDocumento5 páginasAcquisition & Interest Date Interest Earned 12% Rate Interest Income 14% Rate Discount Amortization Book ValueGray JavierAinda não há avaliações

- Auditing ProblemsDocumento4 páginasAuditing ProblemsCristineJoyceMalubayIIAinda não há avaliações

- Batch 19 Final Preboard (P1)Documento12 páginasBatch 19 Final Preboard (P1)Mike Oliver Nual0% (1)

- IntangiblesDocumento15 páginasIntangiblesJ RodriguezAinda não há avaliações

- DySAS General Review Acctg6 - AnsDocumento11 páginasDySAS General Review Acctg6 - Ansyasira0% (1)

- Case No. 1: BM2008/BM2015 - Auditing and Assurance: Concepts and Application 1 & 2Documento8 páginasCase No. 1: BM2008/BM2015 - Auditing and Assurance: Concepts and Application 1 & 2Ken MateyowAinda não há avaliações

- 1 ST Quiz NGODocumento5 páginas1 ST Quiz NGOfrancesAinda não há avaliações

- PRTC AP 1405 Final PreboardDocumento14 páginasPRTC AP 1405 Final PreboardLlyod Francis LaylayAinda não há avaliações

- Auditing ProblemsDocumento8 páginasAuditing ProblemsKheianne DaveighAinda não há avaliações

- Practical Accounting - Part 1Documento17 páginasPractical Accounting - Part 1Kenneth Bryan Tegerero Tegio100% (1)

- Retained Earnings: AssignmentDocumento2 páginasRetained Earnings: Assignmentmaria evangelistaAinda não há avaliações

- Cash BasisDocumento4 páginasCash BasisMark DiezAinda não há avaliações

- QuizDocumento32 páginasQuizEloisaAinda não há avaliações

- Practical Accounting 1Documento21 páginasPractical Accounting 1Christine Nicole BacoAinda não há avaliações

- P1-PB. Sample Preboard Exam PDFDocumento12 páginasP1-PB. Sample Preboard Exam PDFAj VesquiraAinda não há avaliações

- Special Revenue Recognition Special Revenue RecognitionDocumento4 páginasSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeAinda não há avaliações

- Acctg 121Documento3 páginasAcctg 121YricaAinda não há avaliações

- RFBT AssessmentDocumento9 páginasRFBT AssessmentJirah Bernal100% (1)

- FAR-04 Share Based PaymentsDocumento3 páginasFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- Retirement Seatwork New Answer Key - With Asset CeilingDocumento25 páginasRetirement Seatwork New Answer Key - With Asset CeilingsweetEmie031Ainda não há avaliações

- Final Examination in Business Combi 2021Documento7 páginasFinal Examination in Business Combi 2021Michael BongalontaAinda não há avaliações

- Finance Lease: Demo Teaching PresentationDocumento52 páginasFinance Lease: Demo Teaching PresentationFaye Reyes100% (2)

- Cel 1 Prac 1 Answer KeyDocumento15 páginasCel 1 Prac 1 Answer KeyNJ MondigoAinda não há avaliações

- College of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMDocumento4 páginasCollege of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMPpp BbbAinda não há avaliações

- Chapter 3 - Seat Work - Assignment #3 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDocumento5 páginasChapter 3 - Seat Work - Assignment #3 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDonise Ronadel SantosAinda não há avaliações

- This Study Resource Was: C. P6,050,000 D. P53,900Documento2 páginasThis Study Resource Was: C. P6,050,000 D. P53,900Nah HamzaAinda não há avaliações

- 9.3 Debt InvestmentsDocumento7 páginas9.3 Debt InvestmentsJorufel PapasinAinda não há avaliações

- Chapter 5 System Development and Program Change Activities PT 10Documento2 páginasChapter 5 System Development and Program Change Activities PT 10Hiraya ManawariAinda não há avaliações

- FAR.2845 Statement of Profit or Loss and OCI PDFDocumento6 páginasFAR.2845 Statement of Profit or Loss and OCI PDFGabriel OrolfoAinda não há avaliações

- Practical Accounting 1 Mockboard 2014Documento8 páginasPractical Accounting 1 Mockboard 2014Jonathan Tumamao Fernandez100% (1)

- ACCExpanded Opportunity Part 1Documento4 páginasACCExpanded Opportunity Part 1Hilarie JeanAinda não há avaliações

- PA1 Mock ExamDocumento18 páginasPA1 Mock Examyciamyr67% (3)

- Prelimx No AnswersDocumento7 páginasPrelimx No Answerscarl fuerzasAinda não há avaliações

- 13th NCR Cup Series 7 SGVDocumento9 páginas13th NCR Cup Series 7 SGVrcaa04Ainda não há avaliações

- Affidavit-Two Disinterested PersonsDocumento1 páginaAffidavit-Two Disinterested Personsincubus_yeahAinda não há avaliações

- Loan, Pledge & Mortgage - Mcqs Sy 2013-14 2nd SemDocumento7 páginasLoan, Pledge & Mortgage - Mcqs Sy 2013-14 2nd Semincubus_yeahAinda não há avaliações

- Summary of GAM For NGAs Volume II PDFDocumento11 páginasSummary of GAM For NGAs Volume II PDFincubus_yeahAinda não há avaliações

- FaberCastell ArtDeco MandalaDocumento1 páginaFaberCastell ArtDeco Mandalaincubus_yeah100% (1)

- A100 Practice Aid - AssertionsDocumento2 páginasA100 Practice Aid - AssertionsHenry Waiho LauAinda não há avaliações

- Chapter 6 - Donor S Tax2013Documento12 páginasChapter 6 - Donor S Tax2013incubus_yeah100% (8)

- Financial Ratios - Formula SheetDocumento2 páginasFinancial Ratios - Formula Sheetincubus_yeahAinda não há avaliações

- Definitions and Concepts For Ethical AnalysisDocumento2 páginasDefinitions and Concepts For Ethical Analysisincubus_yeahAinda não há avaliações

- Business and Transfer Taxation by Valencia and Roxas-Solution ManualDocumento4 páginasBusiness and Transfer Taxation by Valencia and Roxas-Solution ManualFiona Manguerra81% (32)

- Chapter 4 - Deductions From Gross Estate2013Documento9 páginasChapter 4 - Deductions From Gross Estate2013incubus_yeah90% (10)

- CPW Jun2005 FriendlyDocumento42 páginasCPW Jun2005 Friendlyincubus_yeahAinda não há avaliações

- Chapter 2 - Transfer Taxes and Basic Succession2013Documento6 páginasChapter 2 - Transfer Taxes and Basic Succession2013iamjan_10150% (4)

- Chapter 3 - Gross Estate2013Documento8 páginasChapter 3 - Gross Estate2013Marvin Celedio100% (8)

- Chapter 5 - Estate Tax2013Documento12 páginasChapter 5 - Estate Tax2013Anjo Ellis100% (2)

- Corporate LiabilityDocumento6 páginasCorporate Liabilityincubus_yeahAinda não há avaliações

- Modern Treasury - Setting Up Your Payment Operations ArchitectureDocumento15 páginasModern Treasury - Setting Up Your Payment Operations Architecturefelipeap92Ainda não há avaliações

- Our Lady of The Pillar College Cauayan: Prelim Examination Accounting 1 &2Documento8 páginasOur Lady of The Pillar College Cauayan: Prelim Examination Accounting 1 &2John Lloyd LlananAinda não há avaliações

- Study Guide SampleDocumento154 páginasStudy Guide SampleBryan Seow0% (1)

- A Study On Payment and Settlement SystemDocumento100 páginasA Study On Payment and Settlement SystemRoyal Projects100% (1)

- PWC Virtual Case Experience Assurance Academy - Model Work Task 4 - 1Documento1 páginaPWC Virtual Case Experience Assurance Academy - Model Work Task 4 - 1kaddeabhijitAinda não há avaliações

- SPECTRAN Corpo-LiquidationDocumento11 páginasSPECTRAN Corpo-LiquidationJhon RenomeronAinda não há avaliações

- DOH Pre Closing Trial BalanceDocumento4 páginasDOH Pre Closing Trial BalanceEzekiel MalazzabAinda não há avaliações

- Trial BalanceDocumento1 páginaTrial BalanceFadila BungiAinda não há avaliações

- Deed of Partnership Victory Export This Deed of Partnership Executed at Erode OnDocumento7 páginasDeed of Partnership Victory Export This Deed of Partnership Executed at Erode OnsamaadhuAinda não há avaliações

- SAP Account Determination PPT RajnishDocumento29 páginasSAP Account Determination PPT Rajnishrajnish.spce84100% (1)

- Interview QueDocumento17 páginasInterview QueprayagrajdelhiAinda não há avaliações

- Workshop Accounts IntroductionDocumento41 páginasWorkshop Accounts Introductionjeya chandranAinda não há avaliações

- Bcom Law Y1 AA JAN 2022 CHDocumento43 páginasBcom Law Y1 AA JAN 2022 CHByron MabusaAinda não há avaliações

- Excel ReportDocumento10 páginasExcel ReportPT Sejahtera Inti SentosaAinda não há avaliações

- Lesson 9.4 Adjusting EntriesDocumento36 páginasLesson 9.4 Adjusting EntriesDanica Medina50% (2)

- Form A Company in USADocumento14 páginasForm A Company in USAvirdhiAinda não há avaliações

- Account Statement From 3 Aug 2019 To 3 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento15 páginasAccount Statement From 3 Aug 2019 To 3 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSanthoshkalpavally cooldudeAinda não há avaliações

- P4 5BDocumento15 páginasP4 5BAngel JAinda não há avaliações

- SUMMATIVE 4thDocumento3 páginasSUMMATIVE 4thCattleya78% (9)

- Zero Proof BookkeepingDocumento1 páginaZero Proof BookkeepingChanduAinda não há avaliações

- CH4 - Job Order Costing and Overheads ApplicationDocumento51 páginasCH4 - Job Order Costing and Overheads ApplicationYMAinda não há avaliações

- Adv Accounting by Ma GhaniDocumento107 páginasAdv Accounting by Ma Ghanimianzeeshanullah20% (5)

- Blank Sample LedgerDocumento4 páginasBlank Sample LedgerABDUL FAHEEMAinda não há avaliações

- JAMDocumento76 páginasJAMArvin AbyadangAinda não há avaliações

- 20x0 20x1 Assets: Amerbran Company Balance Sheet As of December 31, 20x1 and 20x0Documento6 páginas20x0 20x1 Assets: Amerbran Company Balance Sheet As of December 31, 20x1 and 20x0NITYA NAYARAinda não há avaliações

- Bank Audit Program-FRPDocumento20 páginasBank Audit Program-FRPHazel R. TanilonAinda não há avaliações

- Distance Education: Instructional ModuleDocumento11 páginasDistance Education: Instructional ModuleRD Suarez83% (6)

- Subsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationDocumento16 páginasSubsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationAnzas Rustamaji PratamaAinda não há avaliações

- Fatimat STMTDocumento53 páginasFatimat STMTayo.adegokeAinda não há avaliações

- Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsNo EverandBillion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsNota: 4.5 de 5 estrelas4.5/5 (52)

- High Road Leadership: Bringing People Together in a World That DividesNo EverandHigh Road Leadership: Bringing People Together in a World That DividesAinda não há avaliações

- The 7 Habits of Highly Effective People: 30th Anniversary EditionNo EverandThe 7 Habits of Highly Effective People: 30th Anniversary EditionNota: 5 de 5 estrelas5/5 (338)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersNo EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersNota: 4.5 de 5 estrelas4.5/5 (95)

- The First Minute: How to start conversations that get resultsNo EverandThe First Minute: How to start conversations that get resultsNota: 4.5 de 5 estrelas4.5/5 (57)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverNo EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverNota: 4.5 de 5 estrelas4.5/5 (186)

- The Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things HarderNo EverandThe Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things HarderAinda não há avaliações

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0No EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Nota: 5 de 5 estrelas5/5 (2)

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobNo EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobNota: 4.5 de 5 estrelas4.5/5 (37)

- Spark: How to Lead Yourself and Others to Greater SuccessNo EverandSpark: How to Lead Yourself and Others to Greater SuccessNota: 4.5 de 5 estrelas4.5/5 (132)

- Good to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tNo EverandGood to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tNota: 4.5 de 5 estrelas4.5/5 (64)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceNo EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceNota: 5 de 5 estrelas5/5 (22)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderNo EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderNota: 4.5 de 5 estrelas4.5/5 (61)

- The Introverted Leader: Building on Your Quiet StrengthNo EverandThe Introverted Leader: Building on Your Quiet StrengthNota: 4.5 de 5 estrelas4.5/5 (35)

- Transformed: Moving to the Product Operating ModelNo EverandTransformed: Moving to the Product Operating ModelNota: 4.5 de 5 estrelas4.5/5 (2)

- Management Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowNo EverandManagement Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowNota: 4.5 de 5 estrelas4.5/5 (27)

- The Effective Executive: The Definitive Guide to Getting the Right Things DoneNo EverandThe Effective Executive: The Definitive Guide to Getting the Right Things DoneNota: 4.5 de 5 estrelas4.5/5 (469)

- 7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthNo Everand7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthNota: 5 de 5 estrelas5/5 (52)

- 25 Ways to Win with People: How to Make Others Feel Like a Million BucksNo Everand25 Ways to Win with People: How to Make Others Feel Like a Million BucksNota: 5 de 5 estrelas5/5 (36)

- Leadership Skills that Inspire Incredible ResultsNo EverandLeadership Skills that Inspire Incredible ResultsNota: 4.5 de 5 estrelas4.5/5 (11)

- Sun Tzu: The Art of War for Managers; 50 Strategic RulesNo EverandSun Tzu: The Art of War for Managers; 50 Strategic RulesNota: 5 de 5 estrelas5/5 (5)

- 300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionNo Everand300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionNota: 5 de 5 estrelas5/5 (1)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andNo EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andNota: 4.5 de 5 estrelas4.5/5 (709)