Escolar Documentos

Profissional Documentos

Cultura Documentos

Uncertainty, Risk Aversion and Risk Management in Agriculture.

Enviado por

Paola AndreaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Uncertainty, Risk Aversion and Risk Management in Agriculture.

Enviado por

Paola AndreaDireitos autorais:

Formatos disponíveis

2210-7843 2010 Published by Elsevier B.V.

doi:10.1016/j.aaspro.2010.09.018

Agriculture and Agricultural Science Procedia 1 (2010) 152156

Available online at www.sciencedirect.com

International Conference on Agricultural Risk and Food Security 2010

Uncertainty, Risk Aversion and Risk Management in

Agriculture

Hao Aimin

*

Zhengzhou Institute of Aeronautical industry management, Zhengzhou 450015, China

Abstract

Uncertainty and risk are quintessential features in agriculture. After an overview of the main sources of agricultural risk, this

paper tries to reveal whether farmers decision is risk averse or not through census data , and then the elements which affect

farmer s decision under risk so as to produce the efficiency o f crop planting,. This is followed by a basic analysis of farmers

decision on the selection of agricultural products under risk, including some comparative static results from stylized models.

Selected empirical topics are surveyed, with emphasis on risk analyses as they pertain to production decisions at the farm level.

We draw conclusion as follows: farmers decision under risk can cause the increase of intercropping of the farm products and

reduce the quantity of agricultural product the price of which fluctuates greatly, and farmers decision under risk can also hinder

the adoption of new agricultural technology. Finally, risk management is then discussed; we put forward some countermeasure

of risk management and government interference which can help farmers to reduce the negative effects of farmers decision

under risk.

2010 Published by Elsevier B.V.

KeywordsFarmer; Uncertainty; Risk Aversion; Risk Management

1Introduction

Risk and uncertainty are two terms which are basic to any decision- making framework. Risk can be defined as

imperfect knowledge where the probabilities of the possible outcomes are known, and uncertainty exists when these

probabilities are not known (Hardaker). It would be difficult to imagine an industry where risk and uncertainty are

more important than in agriculture. Considerable research has been devoted to exploring questions connected with

the effects of uncertainty and risk in agriculture, and these efforts have paralleled the related developments in the

general economic literature.

For an individual farmer, risk management involves finding the preferred combination of activities with uncertain

outcomes and varying levels of expected returns (Harwood, et. al.).

In this paper we set out to review a number of these studies, especially as they relate to farm-level production

decisions. It was discussed previously that agricultural producers are most concerned about the probability of an

* Corresponding author. Tel.: +8613838255173;

E-mail address: ham126@163.com.

Hao Aimin / Agriculture and Agricultural Science Procedia 1 (2010) 152156 153

adverse outcome. In short this directly relates to the farm's risk-bearing ability. The farm's risk-bearing ability is

directly related to liquidity and solvency measures.

2. Main sources of uncertainty and risk in agriculture

The sources of uncertainty and risk in agriculture are numerous and diverse, ranging from events related to

climate and weather conditions to animal diseases; from changes of prices in agriculture products to fertilizer and

other input; and from financial uncertainties to policy and regulatory risks. Agricultural risks are not independent,

but rather are linked to each other and as part of a system which includes all available instruments, strategies and

policies designed to manage risk. A holistic approach is thus necessary.

First, farmers face considerable natural uncertainty and risk. This uncertainty and risk are due to the

uncontrollable elements, such as weather, plague of insects, disease, and play a fundamental role in agricultural

production.

Second, there is what can be broadly defined as market uncertainty and risk in agriculture. Decisions on

Agriculture production have to be made far in advance, so the market price for the output is typically not known at

the time when these decisions have to be made. Market uncertainty, of course, is all the more relevant because of the

inherent volatility of agricultural markets.

Third is family risk. Family risk is the loss of labor for the family members because of disease or accident etc.

Fourth, policy uncertainty and risk also play an important role in agriculture. Economic policies have impacts

on all sectors through their effects on such things as taxes, interest rates, exchange rates, regulation, provision of

public goods, and so on.

The risk and main behavior of uncertainty are around: (1) Rural market growth esteems insufficiency. Because of

the insufficiency and asymmetry in information, the ability for the peasants to face the strain of marketplace risk still

needs to improve. (2) Non-agricultural undertaking has an uncertainty. Returning to rural area if city unemployment

may bring about a peasant laborer would make income of the peasant household gains come down. (3) Social

security system in rural area is far from being perfect.

3. Theoretical analysis on decision making under uncertainty and risk

According to the differences in risk preference, the peasants can be divided into three types: risk-loving,, risk-

averse, and risk-neutral. There are great differences among theses three types in their supply response.

There exit high-risk features in the production of agriculture, but ordinary farmers does not have the experience

and ability to cope with market risk. Dujon, 1997.

Based on the principle of risk-returns reciprocity, the planting of high-yield combinations require higher

investment, and correspond to the higher risk. In the case of imperfect insurance markets, considering risk aversion,

ordinary farmers will choose the planting of low-investment, low-reward, and low-risk planting combinations

thereby reducing the possibility to increase investment. Rosenzweig and Binswanger (1993) found that small

farmers will choose to lower the risk of crop combination in order to reduce risk, cropping patterns that bring a

higher income than the optimal combination of income from cultivation of lower 45% in India. The research on the

family land system to St.Lucia indicates that, for small farms, it is the property rights of the land to determine their

stability, and the level of investment is not the key factor. Low level of investment in land is to avoid risks, to avoid

losing their land position.

We can use graphics to explain risk market. As is shown in Figure 3-4, the horizontal axis refers to agricultural

production inputs, the vertical axis output. Farmers face two situations: a good year and bad year for. ,

1

Y

2

Y respectively, in good times and bad year for the output curve; EY is a comprehensive considering two possible

years for the expectations of yield curve, Tc is the total cost curve. When the total cost curve slope and the slope of

the curve is equal to total output, ( MC MR ), farmers achieve profit maximization. If farmers are risk- neutral,

they will choose

E

X factor inputs, and then expect the greatest revenue which is equal to gh. However, in

the

E

X input, since there is risk market, once a bad year for truly becomes a reality, hi the farmers get income . In

this case, farmers may not be able to survive (survival of the level of the farmers here, in fact assuming zero income).

Thus, risk-averse farmers will choose

2

X factor inputs, when expected income is less than gh, that is, farmers do

not maximize profits.

154 Hao Aimin / Agriculture and Agricultural Science Procedia 1 (2010) 152156

Figure 1: Farmers behaviour under the Market-risk

4. Some survey evidence on decision making under uncertainty and risk

This section is focused on empirical analysis based on the preceding theoretical analysis and framework. This

part is mainly about farmers decision-making features under risk.

The analysis here is mainly based on census data which we get from gaoyangdian town in Pingyu County and

guandu town in Zhongmu County and Daling town in Zhengyang of Henan Province in 2007-2008. We are based on

a survey of 200 households in the three places, and a total of 189 valid questionnaires on the decisionmaking

behaviour of farmers were obtained.

4.1. The analysis on Farmers planting decision under risk

Table 1 planting proportion of project selection decision-making Unit: %

To keep

abreast of the

market price

over the

previous year

To make

decision

Empirically

To see other

peoples

To Read

government

guidance decision

To continue growth despite of a

sharp price fluctuations in

agricultural products over recent

years,

.1 Pingyu b.?? b1.?3 ?.?? ?3.?

8.33 Zhengyang b8.33 8.b ?1.33 ?.3

88.?3 Zhongmou 19.?? 3.b8 !b. ?b.89

80.8

Average

b0.3? !.3? ??. ?.!?

Note: This item is a number of options, the sum of proportion may exceed 100%

We can see from the table the market price has become the main basis for farmers planting decision. At the

same time, if price fluctuations in agricultural products are sharp in recent years, that is, market risk is large, the

farmers will choose to decline the planting proportion of this agricultural product. It also indicates that a subjective

judgment in its decision-making also plays a very important role. The next is just simple imitation. Some farmers

planting decisions are risk-averse and lack rationality, and from the three comparisons, it is indicated that the more

developed an area is, the more market-oriented the farmers decision-making tend to be. Empirical evidence implies

that planting proportion is increasing if prices of agricultural products are stable in recent years.

C

D

E

G

H

I

Y

Output

s

X (Input)

Y

1

TC

Y

2

EY

X

2

X

E

X

1

Hao Aimin / Agriculture and Agricultural Science Procedia 1 (2010) 152156 155

4.2. Technology adoption under risk

Table 2 The reasons for farmers not adopting new technologies. Unit: %

Fear of risks No guidance Lack of funds Too little arable land Others

Pingyu 64.14 9.23 26.34 6.78 1.51

Zhengyang 59.33 9.89 22.69 3.45 4.63

Zhongmou 36.78 6.78 4.34 50.99 1.11

Average 53.45 8.98 19.34 16.08 2.15

I

Price instability has several negative consequences (see chapter 1). While prices higher than expected can be

partly saved by farmers as protection against future price declines, these possibilities for self-insurance are generally

limited - most farmers simply have too much stress on their cash flow. So when prices are lower than expected, they

hardly have the means to make up for the deficit out of their savings. The result is economic hardship, making it

difficult, for example, to prepare for the next crop season. Price risk management, also called hedging, is a way to

reduce the consequences of price instability on a farmers cash flow - he will be able to plan his business better.

When hedging short-term price movements will no longer have a major impact on his business - it has happened in

some countries that farmers burned down their coffee trees in response to exceptionally low prices, with the result

that they were unable to benefit from the tripling of coffee prices which occurred just a few years later. With price

risk management, one can take a longer-term perspective. The farmer will also be able to ensure others (such as

banks) of the value of his products, which improves his access to credit. Hedging is the use of marketing or financial

tools in order to counterbalance the effects of an unfavourable commodity price movement on ones anticipated

income. It is the opposite of speculation. For a producer or a buyer, speculation consists of doing nothing to hedge

n the survey, we note that farmers generally consider it unnecessary to adopt new technologies because of its

higher risk. In Pingyu , as the average household income is the lowest, farmers are comparatively conservative. It

can also be indicated from the table that what prevents the use of agricultural technology is the lack of funding.

When the government provides subsidies and low-interest loans, farmers willing to adopt new technologies will

increase by 40%.Therefore, a risk-averse farmer will use less new technologies than a risk-neutral farmer.

5 Results and discussion

5.1 Governments might be necessary to help the formation of risk-sharing markets

Risks can and do create inefficiencies in markets. Having effective risk-sharing markets is important for

improving the efficiency of the farm sector. Governments should be responsible for helping the formation of risk-

sharing markets

Society can gain from insurance (and other contingent claims) markets. When decision makers are risk-averse,

they are willing to give up some income to protect themselves from future events that may cause them to lose large

amounts of income. Well functioning risk-sharing markets allow firms to protect themselves from risk and pursue

the advantages that come from specialization. Since Adam Smith, it has been a fundamental argument among

economists that society gains from the specialization of firms. In fact,that the markets are built with subsidies, like

other subsidies, insurance subsidies will not reach the ultimate objective. Over time, the beneficiaries are

landowners, who are in many cases not family farmers. Further, farmers will take on more risk to reach a level of

risk that is similar to what they had before the risk subsidies were introduced.

5.2 The necessity of future markets to help farmers manage market risks

There has been significant progress in making the risk-sharing markets more efficient. The key is to turn risks

that have been previously considered nondiversifible into diversifiable risks that can be spread around the world. For

example, if the United States has crop losses, it is unlikely that some other parts of the world will be experiencing

the same problems.

156 Hao Aimin / Agriculture and Agricultural Science Procedia 1 (2010) 152156

his price risk. If the price goes up, the seller will make profit; and if not, he will make a loss. Different tools are

available on the physical market and commodity exchanges, and some tools are also offered by banks.

6 Conclusions

It is abundantly clear that considerations of uncertainty and risk cannot be escaped when addressing most

agricultural economics problems. Reform in agriculture policy has been difficult. Recent changes in the price-

support mechanisms for basic commodities were touted as moving agriculture toward markets. In this paper we have

emphasized theoretical and applied analyses as they pertain to production decisions at the farm level. Now it seems

that everyone thinks we can fix the problems in agriculture with risk-management instruments like crop and revenue

insurance. Insofar as the set of relevant markets is not complete, then this market failure has the potential of

adversely affecting resource allocation, as well as resulting in less than optimal allocation of risk-bearing. Indeed,

the incompleteness of risk markets for agricultural producers has often been cited as a motivation for agricultural

policies in many developed countries. But arguably neither existing markets nor government policies have solved

the farmers risk exposure problems, and risk continues to have the potential of adversely affecting farmers welfare,

as well as carrying implications for the long-run organization of agricultural production and for the structure of

resource ownership in the agricultural sector. This paper reviews the transition from past policies and describes

current approaches that distinguish between the trade-related fiscal consequences of commodity market volatility

and the consequences of price and production risks for vulnerable rural households and communities. Current

policies rely more heavily on markets, even though markets for risk are incomplete in numerous ways. The benefits

and limitations of market-based instruments are examined in the context of risk management strategies, and

innovative approaches to extend the reach of risk markets are discussed.

References

Babcock, B.A. and D.A. Hennessy. 1996. Input Demand under Yield and Revenue Insurance. American Journal of

Agricultural Economics 78(2): 416-427.

Giancarlo Moschini and David A. Hennessy. Uncertainty, Risk Aversion and Risk Management for Agricultural Producers.

Handbook of Agricultural Economics Amsterdam, Elsevier Science Publishers, 2000: 231-326.

Anderson, R. and J-P. Danthine, 1983, The time pattern of hedging and the volatility of futures prices,Review of Economic

Studies 50, 249-66.

Anscombe, F. and R. Aumann, 1963, A definition of subjective probability, Annals of Mathematical Statistics 34, 199-205.

Antle, J.M., 1987, Econometric estimation of producers risk attitudes, American Journal of AgriculturalEconomics 69, 509-22.

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Group 10 Informal Financial InstitutionsDocumento56 páginasGroup 10 Informal Financial InstitutionsRoxanne LutapAinda não há avaliações

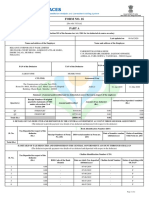

- Form No. 16: Part ADocumento8 páginasForm No. 16: Part AParikshit ModiAinda não há avaliações

- Annuity DueDocumento2 páginasAnnuity DueJsbebe jskdbsj50% (2)

- Insurance For Specific EventsDocumento1 páginaInsurance For Specific Eventsihsan nawawiAinda não há avaliações

- LIQUIDITY A-Z SMC For BeginnersDocumento5 páginasLIQUIDITY A-Z SMC For BeginnersCaser TOtAinda não há avaliações

- Gap Thesis and The Survival of Informal Financial Sector in NigeriaDocumento6 páginasGap Thesis and The Survival of Informal Financial Sector in NigeriaMadiha MunirAinda não há avaliações

- FirstStrike PlusDocumento5 páginasFirstStrike Plusartus14Ainda não há avaliações

- AFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSDocumento5 páginasAFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSrain suansingAinda não há avaliações

- Deber 3Documento5 páginasDeber 3MartinAinda não há avaliações

- Financial Liabilities Accounts Payable - Practice SetDocumento3 páginasFinancial Liabilities Accounts Payable - Practice Setroseberrylacopia18Ainda não há avaliações

- Chapter 4 Accounts Receivable Learning Objectives: Receivables."Documento4 páginasChapter 4 Accounts Receivable Learning Objectives: Receivables."Misiah Paradillo JangaoAinda não há avaliações

- Twelve-Month Cash Flo YEAR 1: Jan-18 Fiscal Year BeginsDocumento1 páginaTwelve-Month Cash Flo YEAR 1: Jan-18 Fiscal Year BeginsTun Izlinda Tun BahardinAinda não há avaliações

- IA2 Chapter 20 ActivitiesDocumento13 páginasIA2 Chapter 20 ActivitiesShaina TorraineAinda não há avaliações

- Transactions History: Account HolderDocumento3 páginasTransactions History: Account Holder13KARATAinda não há avaliações

- Eduardo Tabrilla Business Plan AssignmentDocumento4 páginasEduardo Tabrilla Business Plan AssignmentJed Jt TabrillaAinda não há avaliações

- Accounting For Income TaxDocumento14 páginasAccounting For Income TaxJasmin Gubalane100% (1)

- Business Plan For Machinery Rental and Material SupplyDocumento8 páginasBusiness Plan For Machinery Rental and Material SupplyAbenetAinda não há avaliações

- Admission of PartnersDocumento30 páginasAdmission of Partnersvansh gandhiAinda não há avaliações

- Online Application Form JAT Holdings Limited 32Documento2 páginasOnline Application Form JAT Holdings Limited 32cpasl123Ainda não há avaliações

- Lesson Title: Business Combination (Part 1) : Learning Targets: MDocumento4 páginasLesson Title: Business Combination (Part 1) : Learning Targets: MjhammyAinda não há avaliações

- Application For Tata Genuine Parts Distributorship For Commercial VehiclesDocumento17 páginasApplication For Tata Genuine Parts Distributorship For Commercial VehiclesNayaz UddinAinda não há avaliações

- Chapter 9: Consolidation: Controlled Entities: ACCT6005 Company Accounting Tutorial QuestionsDocumento5 páginasChapter 9: Consolidation: Controlled Entities: ACCT6005 Company Accounting Tutorial QuestionsujjwalAinda não há avaliações

- Ramo 1-2019Documento74 páginasRamo 1-2019Donato Vergara IIIAinda não há avaliações

- Financial Report (October 2017)Documento2 páginasFinancial Report (October 2017)Marija DukićAinda não há avaliações

- Auditing MCQs Multiple Choice Questions and Answers 2023 - Auditing MCQs For B.Com, CA, CS and CMA ExamsDocumento38 páginasAuditing MCQs Multiple Choice Questions and Answers 2023 - Auditing MCQs For B.Com, CA, CS and CMA Examsvenakata3722Ainda não há avaliações

- Tax Avoidance and Coporate Capital Structure (Cristine Harrington)Documento20 páginasTax Avoidance and Coporate Capital Structure (Cristine Harrington)Risa Nadya SafrizalAinda não há avaliações

- World Bank (IBRD & IDA)Documento5 páginasWorld Bank (IBRD & IDA)prankyaquariusAinda não há avaliações

- Bhavesh Jadav BB 1Documento7 páginasBhavesh Jadav BB 1bhaveshjadavAinda não há avaliações

- Accounting Midterm ExamDocumento3 páginasAccounting Midterm ExamJhon OrtizAinda não há avaliações

- Mamis Last LetterDocumento10 páginasMamis Last LetterTBP_Think_Tank100% (3)