Escolar Documentos

Profissional Documentos

Cultura Documentos

YE Financial Statements - Fees

Enviado por

NCCDE0 notas0% acharam este documento útil (0 voto)

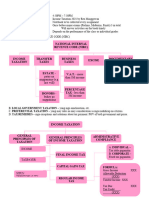

62 visualizações2 páginasThe combined investment management fees for 2012 were in excess of $200,000 and do not include the fees charged by the various mutual fund companies.

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe combined investment management fees for 2012 were in excess of $200,000 and do not include the fees charged by the various mutual fund companies.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

62 visualizações2 páginasYE Financial Statements - Fees

Enviado por

NCCDEThe combined investment management fees for 2012 were in excess of $200,000 and do not include the fees charged by the various mutual fund companies.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 2

I I I I

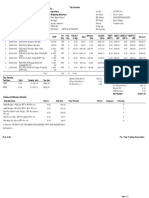

2012 Investment Report

J anuary 1, 2012 - December 31, 2012

Envel ope 920014040

1 1 1 1 1 1 ' 1 1 1 . 1 1 1 1 1 1 1 " ' 1 . 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 ' 1 ' 1 ' 1 ' 1 1 1 ' 1 1 1 . 1 1 . 1 1 1

NEW CASTLE COUNTY OPERATING ESCROW

OPERATING ESCROW

87 READS WAY

NEW CASTLE DE 19720-1648

Your Advisor

WEST CAPITAL MANAGEMENT

1818 MARKET ST

SUITE 3323

PHILADELPHIA PA 19103

Phone: (215)731-1820

~ This Investment Report summarizes activity in your Fidelity accounts for the past year. We hope you find it helpful, however, keep in mind that it is not

intended for tax reporting purposes. Adjustments often occur after this report has been created. Fidelity mails a separate (Forms 1099) Tax Reporting

Statement, if applicable, to assist you with your tax returns, in J anuary or by February 15th. That statement includes information on estimated realized

gains & losses, estimated cost basis, and Fidelity tax-exempt funds. Your Form 5498, Form 1099-R, and other forms are each mailed separately.

Brokerage 379-800872 NEW CASTLE COUNTY DE GOV

Income Summary

Taxable

Interest

U.S. Gov

Tax-exempt

Tax-Exempt Income

Total

15,941.80

$2,288,717.36

2012 Account Sum mary

Beginning value as of J an 1

Transaction costs, loads and fees

Change in investment value

Ending value as of Dec 31

$43,299,498.36

-155,998.43

2,437,317.55

$45,580,817.48

$2,260,831.18

11,944.38

Your Advisor isan independent organization and is not affiliated with Fidelity Investments. Brokerage services provided by Fidelity Brokerage Services LLC, Member NYSE, SIPC.

800-544-6666. Brokerage Accounts carried with National Financial services LLC, Member NYSE, SIPC

0001 I.'~i P J I " " ' . " j I ~J I~p,a~1 1301110004920014040

0418 000 Page 1 of 41

~ This Investment Report summarizes activity in your Fidelity accounts for the past year. We hope you find it helpful, however, keep in mind that it is not

intended for tax reporting purposes. Adjustments often occur after this report has been created. Fidelity mails a separate (Forms 1099) Tax Reporting

Statement, if applicable, to assist you with your tax retums, in J anuary or by February 15th. That statement includes information on estimated realized

gains & losses, estimated cost basis, and Fidelity tax-exempt funds. Your Form 5498, Form 1099-R, and other forms are each mailed separately.

Envel ope 920346733

1 1 1 1 1 1 '1 1 1 , 1 1 1 1 1 1 1 " '1 , 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 '1 '1 '1 '1 1 1 '1 1 1 , 1 1 , 1 1

1

. ,

NEW CASTLE COUNTY DE GOV

OPERATING ESCROW

87 READS WAY

NEW CASTLE DE 19720-1648

Your Advisor

WEST CAPITAL MANAGEMENT

1818 MARKET ST

SUITE 3323

PHILADELPHIA PA 19103

Phone: (215)731-1820

I I I I

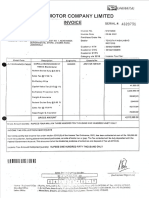

201 2 Investment Report

J anuary 1, 2012 - December 31, 2012

Brokerage 646-239577 NEW CASTLE COUNTY DE GOV

Your Advisor is an independent organization and isnot affiliated with Fidelity Investments. Brokerage services provided by Fidelity Brokerage Services LLC, Member NYSE, SIPC.

800-544-6666. Brokerage Accounts carried with National Financial Services LLC, Member NYSE, SIPC

2012 Account Summary

Beginning value as of J an 1

Additions

Withdrawals

Transaction costs, loads and fees

Net adjustments

Change in investment value

Ending value as of Dec 31

$46,166,170.88

15,000,000.00

-15,000,000.00

-46,965.53

10.25

1,115,089.65

$47.234,305.~

0001 1.".,II,III1,I,IIIIP !J IJ I,IIJ I,II,I,'~I1 301 1 1 0004920346733

Incom e Sum mary

Taxable

Ordinary Dividends

Dividends

St cap gain

Interest

Lt cap gain

Tax-exempt

Exempt Interest Dividends

Total

$821,815.98

18,935.59

122.77

15,302.07

86,463.31

$942,639.72

041 8 000 Page 1 of4

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- New Castle County Investment AuditDocumento40 páginasNew Castle County Investment AuditNCCDEAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- NCCo Council Finance Cmtee AgendaDocumento4 páginasNCCo Council Finance Cmtee AgendaNCCDEAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Current Investment Portfolio Holdings - UBSDocumento1 páginaCurrent Investment Portfolio Holdings - UBSNCCDEAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- FPA New Income (FPNIX) ProspectusDocumento3 páginasFPA New Income (FPNIX) ProspectusNCCDEAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- RiverPark High Yield Fund (RPHIX) ProspectusDocumento7 páginasRiverPark High Yield Fund (RPHIX) ProspectusNCCDEAinda não há avaliações

- 2012 YE Financial StatementDocumento4 páginas2012 YE Financial StatementNCCDEAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- IRS Publication Form 706Documento4 páginasIRS Publication Form 706Francis Wolfgang UrbanAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- 18 GSTDocumento1.042 páginas18 GSTSwetaAinda não há avaliações

- Adp Pay Stub Template 2Documento1 páginaAdp Pay Stub Template 2enudo Solomon67% (3)

- Credit Risk AnalysisDocumento1 páginaCredit Risk AnalysisPhilip JosephAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Collector Vs BautistaDocumento3 páginasCollector Vs BautistaHannah BarrantesAinda não há avaliações

- Pedigree BillDocumento5 páginasPedigree BillpeerarslanAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Chapter 1 - TBTDocumento10 páginasChapter 1 - TBTKatKat OlarteAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Payslip 4Documento1 páginaPayslip 4ahmad zakwanAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- BIR Form No. 2553Documento2 páginasBIR Form No. 2553fatmaaleahAinda não há avaliações

- INTX211 OverviewDocumento1 páginaINTX211 OverviewJemima FernandezAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Ghana Revenue Authority PAY - IN SLIP: Circle Currency (GHS, USD, GBP, EUR)Documento2 páginasGhana Revenue Authority PAY - IN SLIP: Circle Currency (GHS, USD, GBP, EUR)the4rinaAinda não há avaliações

- Short Quiz 4 Set A With AnswerDocumento3 páginasShort Quiz 4 Set A With AnswerJean Pierre IsipAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Dean Elvena - Jurisdiction To Inherent LimitationsDocumento3 páginasDean Elvena - Jurisdiction To Inherent LimitationsRik GarciaAinda não há avaliações

- Akta Cukai Pendapatan 1967 (Akta 53) Pindaan Sehingga Akta A1349 Tahun 2009Documento3 páginasAkta Cukai Pendapatan 1967 (Akta 53) Pindaan Sehingga Akta A1349 Tahun 2009HarenAinda não há avaliações

- Payslip Lyka Labs-Ramjeet PalDocumento1 páginaPayslip Lyka Labs-Ramjeet PalPankaj PandeyAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Payroll ExercisesDocumento1 páginaPayroll ExercisesMerry Grace EsquivelAinda não há avaliações

- Toyota InvoiceDocumento1 páginaToyota InvoiceRita SJAinda não há avaliações

- Items and Concept of Income Exercise 5-2. True or False QuestionsDocumento55 páginasItems and Concept of Income Exercise 5-2. True or False QuestionsMelady Sison Cequeña100% (1)

- 2000 Revenue Regulations - The Lawphil ProjectDocumento4 páginas2000 Revenue Regulations - The Lawphil ProjectCherry ursuaAinda não há avaliações

- Assignment Taxation 2Documento6 páginasAssignment Taxation 2Alexander Steven ThemasAinda não há avaliações

- Form 12 C Cum Declaration Form To Claim Housing Loan DeductionsDocumento3 páginasForm 12 C Cum Declaration Form To Claim Housing Loan DeductionsBhooma ShayanAinda não há avaliações

- Module 7 Chapter 9 Input VATDocumento7 páginasModule 7 Chapter 9 Input VATChris SumandeAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- RR No. 6-2018Documento2 páginasRR No. 6-2018Andrew Benedict PardilloAinda não há avaliações

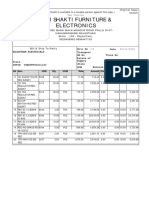

- Shri Shakti Furniture & Electronics: Credit OrginalDocumento1 páginaShri Shakti Furniture & Electronics: Credit OrginalRahul BansalAinda não há avaliações

- Income Capital ItemsDocumento2 páginasIncome Capital ItemsDeepti KukretiAinda não há avaliações

- Module in Income Taxation by Jewelyn C. Espares-CioconDocumento33 páginasModule in Income Taxation by Jewelyn C. Espares-CioconmarkbagzAinda não há avaliações

- TYBCOM Direct Tax (INTRODUCTION & DEDUCTION)Documento6 páginasTYBCOM Direct Tax (INTRODUCTION & DEDUCTION)jay prakeshAinda não há avaliações

- 7tax Administration LectureDocumento48 páginas7tax Administration LectureHawa MudalaAinda não há avaliações

- Receipt of House RentDocumento2 páginasReceipt of House RentRishi KumarAinda não há avaliações

- E-Way Bill: Government of IndiaDocumento1 páginaE-Way Bill: Government of IndiaVIVEK N KHAKHARAAinda não há avaliações