Escolar Documentos

Profissional Documentos

Cultura Documentos

A Simple Tool To Help You Learn Better

Enviado por

chengadTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

A Simple Tool To Help You Learn Better

Enviado por

chengadDireitos autorais:

Formatos disponíveis

A simple tool to help you learn better

Research shows that people who follow strategy B [read ten pages at once, then close the book and write

a one page summary] remember 50 percent more material over the long term than people who follow

strategy A [read ten pages four times in a row and try to memorize them]. This is because of one of deep

practices most fundamental rules: Learning is reaching. Passively reading a booka relatively effortless

process, letting the words wash over you like a warm bathdoesnt put you in the sweet spot. Less

reaching equals less learning.

On the other hand, closing the book and writing a summary forces you to figure out the key points (one

set of reaches), process and organize those ideas so they make sense (more reaches), and write them on

the page (still more reaches, along with repetition). The equation is always the same: More reaching

equals more learning.

Update: A better idea by way of Nassim Taleb: Dont write summary, write bullet points of what comes

to mind that you can apply somewhere.

identify the tasks or knowledge that are just out of your reach, strive to upgrade your performance, monitor your

progress, and revise accordingly. Susan Cain

I never allow myself to have an opinion on anything that I dont know the other sides argument better

than they do.

Charlie Munger

We all are learning, modifying, or destroying ideas all the time. Rapid destruction of your ideas when

the time is right is one of the most valuable qualities you can acquire. You must force yourself to consider

arguments on the other side.

Charlie Munger

The ability to destroy your ideas rapidly instead of slowly when the occasion is right is one of the most

valuable things. You have to work hard on it. Ask yourself what are the arguments on the other side. Its

bad to have an opinion youre proud of if you cant state the arguments for the other side better than your

opponents. This is a great mental discipline.

Charlie Munger

In the short run, the market is a voting machine. In the long run, its a weighing machine.

Weight counts eventually. But votes count in the short term. And its a very undemocratic way of

voting.

Unfortunately, they have no literacy tests in terms of voting qualifications, as youve all learned.

What youre doing when you invest is deferring consumption and laying money out now to get more

money back at a later time. And there are really only two questions. One is how much youre going to

get back, and the other is when.

Now, Aesop was not much of a finance major, because he said something like, A bird in the hand is

worth two in the bush. But he doesnt say when. Interest ratesthe cost of borrowingBuffett

explained, are the price of when. They are to finance as gravity is to physics. As interest rates vary, the

value of all financial assetshouses, stocks, bondschanges, as if the price of birds had fluctuated.

And thats why sometimes a bird in the hand is better than two birds in the bush and sometimes two in

the bush are better than one in the hand.

Its wonderful to promote new industries, because they are very promotable. Its very hard to promote

investment in a mundane product. Its much easier to promote an esoteric product, even particularly

one with losses, because theres no quantitative guideline. This was goring the audience directly, where

it hurt. But people will keep coming back to invest, you know. It reminds me a little of that story of the

oil prospector who died and went to heaven. And St. Peter said, Well, I checked you out, and you meet

all of the qualifications. But theres one problem. He said, We have some tough zoning laws up here,

and we keep all of the oil prospectors over in that pen. And as you can see, it is absolutely chock-full.

There is no room for you.

And the prospector said, Do you mind if I just say four words?

St. Peter said, No harm in that.

So the prospector cupped his hands and yells out, Oil discovered in hell!

And of course, the lock comes off the cage and all of the oil prospectors start heading right straight

down.

St. Peter said, Thats a pretty slick trick. So, he says, go on in, make yourself at home. All the room in

the world.

The prospector paused for a minute, then said, No, I think Ill go along with the rest of the boys. There

might be some truth to that rumor after all.

Well, thats the way people feel with stocks. Its very easy to believe that theres some truth to that

rumor after all.

Buffett waved a book in the air. This book was the intellectual underpinning of the 1929 stock-market

mania. Edgar Lawrence Smiths Common Stocks as Long Term Investments proved that stocks always

yielded more than bonds. Smith identified five reasons, but the most novel of these was the fact that

companies retained some of their earnings, which they could reinvest at the same rate of return. That

was the plowbacka novel idea in 1924! But as my mentor, Ben Graham, always used to say, You can

get in way more trouble with a good idea than a bad idea, because you forget that the good idea has

limits. Lord Keynes, in his preface to this book, said, There is a danger of expecting the results of the

future to be predicted from the past.

They thought alike and had the same fascination with business as a puzzle worth spending a lifetime to

solve. Both regarded rationality and honesty as the highest virtues. Quickened pulses and self-delusion,

in their view, were the major causes of mistakes. They liked to ponder the reasons for failure as a way of

deducing the rules of success. I had long looked for insight by inversion, in the intense manner

counseled by the great algebraist Carl Jacobi, Munger said. Invert, always invert. He illustrated this

with the story of a wise peasant who said, Tell me where Im going to die so I wont go there. But

while Munger meant this figuratively, Buffett took it more literally. He lacked Mungers subtle sense of

fatalism, particularly when it came to the subject of his own mortality.

The bathtub steeplechase and the information he had collected about the hymn composers had taught

him something else, however, something valuable. He was learning to calculate odds. Warren looked

around him. There were opportunities to calculate odds everywhere. The key was to collect information,

as much information as you could find.

At the time, weight training was not the stuff of serious athletes, but it had many qualities that appealed

to Warren: systems, measuring, counting, repetition, and competing with yourself.

The art of handicapping is based on information. The key was having more information than the other

guythen analyzing it right and using it rationally.

I went to Room 300, and I was the only guy who showed up. The three professors there kept wanting to

wait. I said, No, no. It was three oclock. So I won the scholarship without doing anything.

Warren had even considered actuarial sciencethe mathematics of insuranceas a career. He could

have spent decades toiling over tables of mortality statistics, handicapping peoples life expectancies.

Besides the obvious ways this suited his personalitywhich tended toward specialization; relished

memorizing, collecting, and manipulating numbers; and preferred solitudeworking as a life actuary

would have let him spend his time pondering one of his two favorite preoccupations: life expectancy.

However, his other favorite, collecting money, had won out.

From Grahams class, Warren took away three main principles that required nothing more than the

stern discipline of mental independence:

A stock is the right to own a little piece of a business. A stock is worth a certain fraction of what you

would be willing to pay for the whole business.

Use a margin of safety. Investing is built on estimates and uncertainty. A wide margin of safety ensures

that the effects of good decisions are not wiped out by errors. The way to advance, above all, is by not

retreating.

Mr. Market is your servant, not your master. Graham postulated a moody character called Mr. Market,

who offers to buy and sell stocks every day, often at prices that dont make sense. Mr. Markets moods

should not influence your view of price. However, from time to time he does offer the chance to buy low

and sell high.

He augmented his army pay by playing poker. He found he was good at it. It turned out to be his version

of the racetrack. He said he learned to fold fast when odds were bad and bet heavily when they were

good, lessons he would use to advantage later in life.

When things went wrong, Munger would set out toward new goals rather than let himself dwell on the

negative. That could come across as pragmatic, or even callous, but he viewed it as keeping the horizon

in sight. You should never, when facing some unbelievable tragedy, let one tragedy increase into two or

three through your failure of will, he would later say.

Você também pode gostar

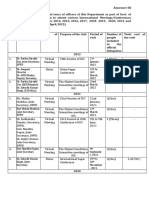

- Annexure IDocumento3 páginasAnnexure IchengadAinda não há avaliações

- Annex Ure IVDocumento2 páginasAnnex Ure IVchengadAinda não há avaliações

- Annexure IIIDocumento13 páginasAnnexure IIIchengadAinda não há avaliações

- NIT dt.23.05.19 PDFDocumento3 páginasNIT dt.23.05.19 PDFchengadAinda não há avaliações

- Food Corporation of India Regional Office: JammuDocumento3 páginasFood Corporation of India Regional Office: JammuchengadAinda não há avaliações

- Notice Inviting Financial Bids For Sale of Wheat To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionDocumento1 páginaNotice Inviting Financial Bids For Sale of Wheat To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionchengadAinda não há avaliações

- Food Corporation of India Regional Office JammuDocumento13 páginasFood Corporation of India Regional Office JammuchengadAinda não há avaliações

- Tender NoticeDocumento2 páginasTender NoticechengadAinda não há avaliações

- NIT Rice 27.08.18Documento1 páginaNIT Rice 27.08.18chengadAinda não há avaliações

- Notice Inviting Bids For Sale of Raw Rice Ga To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionDocumento1 páginaNotice Inviting Bids For Sale of Raw Rice Ga To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionchengadAinda não há avaliações

- MTF Rice 27.08.18 PDFDocumento13 páginasMTF Rice 27.08.18 PDFchengadAinda não há avaliações

- FCI Tender RepairDocumento3 páginasFCI Tender RepairchengadAinda não há avaliações

- Rice Depotwise QuantityDocumento1 páginaRice Depotwise QuantitychengadAinda não há avaliações

- MTF Wheat 03 - 10 - 2019Documento17 páginasMTF Wheat 03 - 10 - 2019chengadAinda não há avaliações

- FCI tender for AR&MO worksDocumento3 páginasFCI tender for AR&MO workschengadAinda não há avaliações

- 61 - Ee11 - 2019 NITDocumento1 página61 - Ee11 - 2019 NITchengadAinda não há avaliações

- NIT 01E 2019-20 (Electrical Work)Documento4 páginasNIT 01E 2019-20 (Electrical Work)chengadAinda não há avaliações

- Wheat MTF - 9Documento13 páginasWheat MTF - 9chengadAinda não há avaliações

- MTF Wheat Dt.14.01.16Documento11 páginasMTF Wheat Dt.14.01.16chengadAinda não há avaliações

- Food Corporation of India Regional Office: Kesavadasapuram Pattom Palace P.O: Thiruvananthapuram 695 004Documento2 páginasFood Corporation of India Regional Office: Kesavadasapuram Pattom Palace P.O: Thiruvananthapuram 695 004chengadAinda não há avaliações

- Food Corporation of India: Ph. No. 0135-2970038, 0135-2665993 e Mail: Gmukfci@gov - inDocumento1 páginaFood Corporation of India: Ph. No. 0135-2970038, 0135-2665993 e Mail: Gmukfci@gov - inchengadAinda não há avaliações

- Wheat Depotwise QuantityDocumento1 páginaWheat Depotwise QuantitychengadAinda não há avaliações

- Rice Guidelines 8Documento5 páginasRice Guidelines 8chengadAinda não há avaliações

- MTF Rice - 9Documento12 páginasMTF Rice - 9chengadAinda não há avaliações

- fci Date of NIT Last Date For Depositing EMD Starting Date and Time For Online Bidding End Date and Time For Online BiddingDocumento1 páginafci Date of NIT Last Date For Depositing EMD Starting Date and Time For Online Bidding End Date and Time For Online BiddingchengadAinda não há avaliações

- 2.MTF Rice - 6Documento18 páginas2.MTF Rice - 6chengadAinda não há avaliações

- MTF Wheat 16.08.2019Documento17 páginasMTF Wheat 16.08.2019chengadAinda não há avaliações

- MTF of Wheat - 5Documento18 páginasMTF of Wheat - 5chengadAinda não há avaliações

- 61 - Ee11 - 2019 MTFDocumento12 páginas61 - Ee11 - 2019 MTFchengadAinda não há avaliações

- Tender NIT No - 03 2017-18 Website-BSWCDocumento4 páginasTender NIT No - 03 2017-18 Website-BSWCchengadAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Generate power from solar roof tilesDocumento4 páginasGenerate power from solar roof tilesshalinthAinda não há avaliações

- Product Code Threaded Rod Size (R) Lenght (L) MM Pitch (MM) Minimum Proof Load (N) Microns ( ) Bundle QuantityDocumento1 páginaProduct Code Threaded Rod Size (R) Lenght (L) MM Pitch (MM) Minimum Proof Load (N) Microns ( ) Bundle QuantityKABIR CHOPRAAinda não há avaliações

- Noritz N-063 Installation ManualDocumento66 páginasNoritz N-063 Installation ManualbondsupplyAinda não há avaliações

- Hydro Cyclone: Centripetal Force Fluid ResistanceDocumento10 páginasHydro Cyclone: Centripetal Force Fluid ResistanceMaxwell ToffahAinda não há avaliações

- PCH (R-407C) SeriesDocumento53 páginasPCH (R-407C) SeriesAyman MufarehAinda não há avaliações

- Adss-Eke 150 (Mm12c) eDocumento7 páginasAdss-Eke 150 (Mm12c) eYuseidy Rguez PaezAinda não há avaliações

- How To Think Like Leonarda Da VinciDocumento313 páginasHow To Think Like Leonarda Da VinciAd Las94% (35)

- SDS WD-40 Aerosol-AsiaDocumento4 páginasSDS WD-40 Aerosol-AsiazieyzzAinda não há avaliações

- Barco High Performance MonitorsDocumento34 páginasBarco High Performance Monitorskishore13Ainda não há avaliações

- Noam Text ליגר טסקט םעֹנDocumento20 páginasNoam Text ליגר טסקט םעֹנGemma gladeAinda não há avaliações

- Ravindar ReddyDocumento4 páginasRavindar ReddysaanaprasadAinda não há avaliações

- Evolution of Telecommunications GenerationsDocumento45 páginasEvolution of Telecommunications GenerationsSai RamAinda não há avaliações

- ACI-439.3R-91 Mechanical Connections of Reinforcing BarsDocumento16 páginasACI-439.3R-91 Mechanical Connections of Reinforcing BarsMichi AGAinda não há avaliações

- Hybrid Electric Bike ResearchDocumento31 páginasHybrid Electric Bike Researchmerlinson1100% (5)

- Alpha 10 Mini Manual Rev1Documento2 páginasAlpha 10 Mini Manual Rev1k4gw100% (1)

- Speedface-V5L (Ti) : Face & Palm Verification and Thermal Imaging Temperature Detection TerminalDocumento2 páginasSpeedface-V5L (Ti) : Face & Palm Verification and Thermal Imaging Temperature Detection TerminalardiAinda não há avaliações

- Lesson Plan in Science 10 2nd QuarterDocumento5 páginasLesson Plan in Science 10 2nd QuarterJenevev81% (21)

- Biocompatibility and HabitabilityDocumento143 páginasBiocompatibility and HabitabilitySvetozarKatuscakAinda não há avaliações

- Probability Sampling Guide for Health ResearchDocumento5 páginasProbability Sampling Guide for Health ResearchNicole AleriaAinda não há avaliações

- Accomplishment Report - English (Sy 2020-2021)Documento7 páginasAccomplishment Report - English (Sy 2020-2021)Erika Ikang WayawayAinda não há avaliações

- Telescopic sight basics and reticle typesDocumento18 páginasTelescopic sight basics and reticle typesKoala LumpurAinda não há avaliações

- Audit ComplianceDocumento1 páginaAudit ComplianceAbhijit JanaAinda não há avaliações

- Eco 201Documento23 páginasEco 201Tâm TítAinda não há avaliações

- Slippery? Contradictory? Sociologically Untenable? The Copenhagen School RepliesDocumento10 páginasSlippery? Contradictory? Sociologically Untenable? The Copenhagen School RepliesDaniel CorrenteAinda não há avaliações

- ECOSYS FS-2100D Ecosys Fs-2100Dn Ecosys Fs-4100Dn Ecosys Fs-4200Dn Ecosys Fs-4300Dn Ecosys Ls-2100Dn Ecosys Ls-4200Dn Ecosys Ls-4300DnDocumento33 páginasECOSYS FS-2100D Ecosys Fs-2100Dn Ecosys Fs-4100Dn Ecosys Fs-4200Dn Ecosys Fs-4300Dn Ecosys Ls-2100Dn Ecosys Ls-4200Dn Ecosys Ls-4300DnJosé Bonifácio Marques de AmorimAinda não há avaliações

- ACL-PDC-01 - Rev01 (Procurement Document Control)Documento3 páginasACL-PDC-01 - Rev01 (Procurement Document Control)Mo ZeroAinda não há avaliações

- In The Shadow of The CathedralDocumento342 páginasIn The Shadow of The CathedralJoy MenezesAinda não há avaliações

- Daily Dawn Newspaper Vocabulary with Urdu MeaningsDocumento4 páginasDaily Dawn Newspaper Vocabulary with Urdu MeaningsBahawal Khan JamaliAinda não há avaliações

- BMED148 Assessment 1Documento5 páginasBMED148 Assessment 1ROMEL ALJUN TARROBALAinda não há avaliações

- Planets Classification Malefic and BeneficDocumento3 páginasPlanets Classification Malefic and Beneficmadhu77Ainda não há avaliações