Escolar Documentos

Profissional Documentos

Cultura Documentos

Main Project

Enviado por

BhavanshuSharmaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Main Project

Enviado por

BhavanshuSharmaDireitos autorais:

Formatos disponíveis

1

Chapter 1

Profile of the Company

1. Introduction

Celfrost Innovations Pvt. Ltd. is a company founded by a group of professionals who have

dedicated its formative years creating the coolest commercial refrigeration & food-service

products venture in India. The fact that today we have a very comprehensive product range;

coming from the world's leading brands; supported by a national footprint of an over 100

strong team including channel partners, and patronized by a customer list that reads like a

"who's-who" in India, humbles us.

Since its inception, Celfrost has displayed a visionary understanding of emerging

opportunities in the field of commercial refrigeration and food-service. More importantly, the

company has proven its ability to transform these opportunities through innovative value

propositions for its customers. A blend of high quality products and a dependable, nation-

wide service backbone is at the core of these value propositions.

Celfrost has been on the cutting edge of technology and conservation. The Celfrost team is

committed to providing products that not only satisfy customer needs but also add value to

the equipment investment by reducing costs, improving productivity, ensuring reliability and

emphasizing food safety. The company strives to enable its customers in upgrading their

businesses by positively impacting the way they attempt to achieve their own great purposes.

2

Companys Value Proposition:-

Contemporary products with validates quality.

A comprehensive product offering

Nation-wide service backbone with spares support

Professional management & advisory services

Care for environment, safety, ergonomic & energy efficiency.

Address:-

3rd Floor, SLV House,

Plot No. 14, Sector 44

Near Hotel Taj Vivanta, Institutional Area

Gurgaon - 122 002, Haryana, India

Phone: +91 124 4308430 / 2544555

Fax : +91 124 2544556

Email : corp@celfrost.com

Website: www.celfrost.com

3

2. Nature of the Organization

Celfrost brings to India, a truly international range of refrigeration, freezing and food-service

products & solutions for hotels, restaurants, bars, frozen yogurt stores, coffee shops, bakeries,

ice cream & beverage, food retail and the healthcare segments.

The company aims to provide, manage and continually operate a successful and sustainable

operation that provides refrigeration and cooling machine. At Celfrost innovation pvt.ltd,

safety and quality are non-negotiable. Whether it is in terms of convenience, health or

pleasure, they are able and committed to create trustworthy products, systems and services

that contribute to improving the quality of consumers lives.

The company believes that they will be successful in meeting the needs of their customers by

developing close contacts with them so that they have cordial relations with them. The

company will ensure that all their business operations are conducted in an ethical manner and

the value is added to their community by maintaining a familiar and friendly environment.

They serve their consumers by constantly challenging themselves to achieve the highest

levels of quality for their refrigeration machines, coolant machines and never compromising

on their safety standards. They do continuous improvement towards excellence as a way of

working and avoiding abrupt, one-time changes.

Celfrost Company is engaged in production i.e. producing the cooling system for

commercials purposes. Celfrost is also engaged in providing services to the world. Celfrost

has displayed a visionary understanding of emerging opportunities in the field of commercial

refrigeration and food-service.

4

Celfrost brings to India, a truly international range of refrigeration, freezing and food-service

products & solutions for hotels, restaurants, bars, frozen yogurt stores, coffee shops, bakeries,

ice cream & beverage, food retail and the healthcare segments.

Celfrost Innovation Pvt. Ltd. is currently serving at its best all over the world. Company is

direct distributor to many companies/franchises for its products (refrigeration system and

coolant machines or security safes and coffee machines). Some of them are:-

McDonald

Pizza Hut

KFC

Bikanerwala

Haldiram

Pizza Corner

Subway

Dunkin Donuts

Barista

Costa Coffee

Red mango

Cocoberry

Yogurtberry

Le Meridien

Taj

Hyatt

Park Plaza

Radisson Blu

5

Spencer, easyday, Reliance fresh,

Amul, Vadilal

Ranbaxy

Pepsi, Del Monte

Adlabs , Cinemax, Big Cinemas

Infosys

Bharat Petroleum

Functional Areas of the company:-

1. Production

2. Research and development (R & D)

3. Administration

4. Customer service

5. Distribution

6. Finance

7. Human resources

8. Marketing

9. Sales

Best functional area of the company is best in. - Refrigeration Equipment and Services for

Hospitality industry.

6

3. Vision

"To be the most

admired cooling &

food service solutions

company in India and

the markets we serve;

by offering the best

products available

globally and

making customer

service as our

differentiator."

Mission:-

The company mission is to serve the people best way and to provide the best quality to the

existing and new consumers. Company offers a wide range of product for new expected

consumers. This company tries to be as a friendly, caring and efficient organization whose

primary focus is on providing consumers with safe and convenient high quality cold storage

systems in the coming future.

7

4. Product Range

This Company offers a wide variety of systems to the big companies as follows:-

i. Deep freezers

a) Chest freezers

b) Glass Top freezers

c) Upright Freezers

d) Half Freezers Half Coolers

ii. Refrigerated Displays

a) Upright Coolers

b) Upright Freezers

c) Multideck Cabinets

d) Island Freezers

e) Ice Cream/Gelato Scooping Cabinets

f) Confectionary Showcases

iii. Professional Refrigeration

a) Reach-Ins

b) Undercounters

c) Saladettes & Prep Counters

d) Blast Freezers

iv. Ice Machines & Flakes

v. Bar Refrigeration Products

a) Wine Coolers

b) Bottle Coolers

8

c) Beer Coolers & Towers

d) Post Mix Beverage Dispensers

e) Undercounters & Black Bars

vi. Mini Bars

a) Absorption Refrigeration

b) Compressor Cooling

vii. Hotel Safes

viii. Cold Rooms

ix. Professional Coffee machines

a) Super-automatic Machines

b) Traditional Machines

c) Coffee Dosing Grinders

d) Accessories

x. Confectionary Showcases

xi. Bakery Products

xii. Food Preparation Products

xiii. Water Coolers

a) Storage Water Coolers

b) Bottled Water Dispensers

xiv. Blenders and Mixers

xv. Cold Dispensers

a) Soft Serve Ice Cream Machines

b) Juice Dispensers

c) Frozen Drink Dispensers

d) Jal Jeera Dispensers

9

xvi. Counter Top Cooking Products

xvii. Ovens

a) Microwave Combination Ovens

b) Impinger Ovens

c) Combi Steamers

xviii. Commercial Dish Washers

a) Glass Washers

b) Undercounter Dishwashers

c) Hood Type Dishwashers

d) Rack Conveyor Dishwashers

xix. Dessert ingredients

a) Frozen Yogurt

b) Gelato, Sorbets & Ice cream

c) Tenerissimo

xx. Medical Refrigeration Products

10

5. Size of the organization

In terms of Manpower

The number of employees working in the Celfrost Company is counted as 137. The focus is

on raising productivity through improved quality, efficiency and cost-reduction across their

total workforce, enabling clients to concentrate on their core business activities.

As the employees are the roots of any organization so , in order to serve them also company

provides number of utilities such as, transport, medical panel , good working condition and

refreshment on regular basis of time.

Making efficient employees directly reflects as the positive side, say, innovation, increase

growth and profit for the company.

In terms of turnover

Turnover of Celfrost Company gradually increases with the hard work of the management

and employees of the organization.

Last year the companys turnover was 115 cr.

11

6. Organization structure

Celfrost Innovations Pvt. Ltd. is a company founded by a group of professionals who have

dedicated its formative years creating the coolest commercial refrigeration & food-service

products venture in India. The organization structure of the company is like this: - It has a

Managing director who sets the objectives of the company which will be completed in the

coming future. Then there are two executive directors who set small goals which indirectly or

directly achieve the objectives of the company set by the managing director. Then the

company has a senior general manager who supervises all the actions within the

organizations well as the external factors affecting the companys working. Then we

company has a deputy general manager, Finance and Logistics manager who manages all rest

and main working factors of the organization. At the last, but the most important a customer

service manager who deals with the customers in various aspects.

12

7. Market share and position of the company in the industry

Celfrost Company enjoys being 5th position from staring in the industry of COMMERCIAL

KITCHEN And REFRGERATION.

Celfrost Company tries to keep balance on the income and expenditure and overcomes the

limitations and tries to go further in the market. As at this time its position is 5

th

. Company is

started to plan the ways how they will cover the rest 4 positions and become the 1

st

rank

company in the industry.

Celfrost Company is passionate about bringing innovative, world class products & solutions

to our customers who strive to raise the bar in their own business.

Celfrost Innovation Pvt. Ltd. believes that our employees, channel partners, vendors and each

person with whom we work are our true partners. We nurture talent. The youthful enthusiasm

and energy with which we approach each new experience drives us and our clients forward.

13

8. Present Leadership: -

Neeraj Seth, Managing director

Neeraj Seth is the Managing Director and one of the

co-promoters of Celfrost Innovations Pvt Ltd. A management graduate from University

Business School, Chandigarh he has a rich experience of over 30 years and has served

successful management stints with companies such as Blue Star, Usha International, and

Nerolac Paints. In Celfrost, he leads the strategic thinking, marketing, international sourcing

and vendor development functions and has steered the company over the last 8 years as one

of the fastest growing commercial refrigeration and food-service companies in India. He is

based out of Gurgaon.

Satish K. Dudeja, Executive director

Satish K. Dudeja joined the Celfrost board in 2006 as Executive Director, to head the

company's foray in the highly promising Cold Storage and Kitchen Projects business. He has

driven these assignments with great success and is also the technical face of Celfrost. He is a

Mechanical Engineering graduate and a Post Graduate in Marketing & Sales Management,

with a rich experience of having worked for over 21 years with companies such as Blue Star,

Frick India Limited, Freeze King Industries and CIMMCO Ltd. He is based out of Gurgaon.

14

During my summer training, in the company I have got a chance to interact with one of the

executive director of the company Mr. SATISH K. DUDEJA. He is very kind and helpful

person. He helped me to get comfortable with the companys environment. Though Human

resource department also do that but he was very gentle.

I worked under Mr. Hanuman, from Accounts Department. He helped me to get ease with the

paper work and the software they were using to manage their accounts. I have also interacted

with sales department supervisor and two more staff from accounts department. They all were

jolly in nature and welcome me in their organization. They explain me some of the working

of the company as I will assist them in their work.

9. Source of Data Collection

Nature of the organization Companys catalogue, companys website

Mission and vision of the company Companys website

Product range Companys website and employees

Size of the organization Management

Organization structure of the company Companys website

Present leadership Companys website and employees.

15

Chapter 2

SWOT Analysis

SWOT analysis (alternatively SWOT Matrix) is a structured planning method used to

evaluate the Strengths, Weaknesses, Opportunities, and Threats involved in a project or in

a business venture.

It involves specifying the objective of the business venture or project and identifying the

internal and external factors that are favorable and unfavorable to achieving that objective.

Setting the objective should be done after the SWOT analysis has been performed. This

would allow achievable goals or objectives to be set for the organization.

1. Strengths: characteristics of the business or project that give it an advantage over

others

2. Weaknesses: are characteristics that place the team at a disadvantage relative to others

3. Opportunities: elements that the project could exploit to its advantage

4. Threats: elements in the environment that could cause trouble for the business or

project.

16

SWOT Analysis of Celfrost Pvt. Ltd. Company

Strength:-

1. Strong Market Position: - Company enjoys the 5

th

position in COMMERCIAL KITCHEN

And REFRGERATION which gives positive effect to the sales as other companies get easy

access to purchase products.

2. Quality Product: - Celfrost Pvt. Ltd. always tries to satisfy its customers through good

quality products which builds goodwill for the company.

3. Skilled and Efficient Workers: - With its efficient and skilled team company maximizes

the profit by increasing sales by marketing skills satisfies customers by its good after sale

service.

4 Innovations: - Celfrost company tries innovative ideas to make customers happy and

satisfied.

5. Effective distribution channel and communication techniques: - With a team of skilled and

experienced workers company uses different techniques to communicate with new and

existing customers of the firm. They choose effective distribution channel to market their

products.

6. Customer Satisfaction/ Query handling: - With proper mechanism of assessing needs of the

customers, company tries to satisfy customers and handle the queries of the customers, thus

as a whole increase business for the company.

7. Proper management for inventories, logistics: - Having a proper team to manage the

inventories at warehouses leads to less cost and increased turnover for the company.

17

Weaknesses:-

1. LOOSE inventory control which should be tightened more.

2. There are some low profitable SKU's.,which are to be reduced

3. There are less number of brand center so less reach in the Indian market, which

should be improved.

Opportunities:-

1. People are heading towards automatic machines for all purpose which act as an

opportunity for the company. This is, nowadays, people have become used to the machines;

they have become dependent on the machines for most of the things. And there are researches

going for all of the activities to be automatic. Celfrost having automatic machines base, will

serve the country very well in the coming years.

2. Youth is becoming attracted towards the automatic working conditions which create

vacancies for new generation. As a growing company, Celfrost Pvt. Ltd. will demand more

workers to join which will create employments which directly help the economy to growth.

3. There is limited number of companies in commercial refrigeration in India so this is an

opportunity for company to expand in vertical and horizontal level. This is the time where

there is not more competition in the market, so there is a chance of expanding the business

right now. And become the number 1 company as soon as possible. This is the right time /

opportunity for the company.

18

Threats:-

1. Increasing raw material prices.

In the fast pacing life everything is going on a high pitch. So as the, prices of raw materials is

getting high. The new new technology is making the working simpler but making the cost

high. Which ultimately becomes a threat to both company as well as the customers as the

price of the commodity is also increased.

2. Growing competition in all over World.

This is a new line of operating so there is more number of companies trying to get into the

market. And when there is word of world the competition is very high because of much

developed country than India everywhere in terms of technology and manpower which is

threat to any and Celfrost Company.

3. Present economic conditions of India may create problem in company working.

This is true present state of Indian economy is very bad; the foreign currency is appreciating

with respect to ours. And in this scenario companies are facing many problems in their

working sections. These types of unavoidable conditions may become a threat to the

company.

19

20

21

22

23

24

25

26

Chapter 3

Financial Analysis of the company

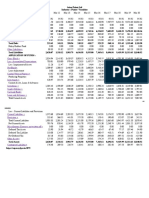

1. Debt-Equity Ratio = Total liabilities / Shareholders equity

2. Current Ratio = Current assets / current liabilities

3. Return on Investment = Net Profit after interest & tax / Total Assets

4. Quick Ratio/Acid test ratio = (Current assets - Inventory) / Current liabilities

5. Gross profit ratio = Gross Profit / Net Sales

Calculation:-

1. Debt-Equity Ratio

The debt to equity ratio is a financial metric used to assess a companys capital structure, or

capital stack. The debt to equity ratio (also called risk ratio or leverage ratio) measures the

relative proportions of the firms assets that are funded by debt or equity.

Debt-Equity Ratio = Total liabilities / Shareholders equity

27

In year 2011

Debt-Equity Ratio = Total liabilities / Shareholders equity

Shareholders equity = Total assets- Total liabilities

= 331,937,203-251631510

Shareholders equity = 80,305,693

Debt equity ratio= 251631510 / 80,305,693

= 3.133

In year 2012

Debt-Equity Ratio = Total liabilities / Shareholders equity

Shareholders equity = Total assets- Total liabilities

= 419,080,867- 309,551,133

Shareholders equity = 109,529,734

Debt equity ratio= 309,551,133 / 109,529,734

= 2.826

28

Analysis:-

This ratio determines the amount of financial leverage a company is using, and thus its

exposure to interest rate increases or insolvency. A low debt to equity ratio is preferable as it

indicates less amount of money on debt.

Company has reduced this ratio which is a good step in the working of the company.

Company has decreased the ratio to 2.826 from 3.133; a 0.307 difference.

29

2. Current Ratio

Current ratio is a measure of liquidity of a company at a certain date. It must be analyzed in

the context of the industry the company primarily relates to. Businesses must analyze their

working capital requirements and the level of risk they are willing to accept when

determining the target current ratio for their organization. Increase in current ratio over a

period of time may suggest improved liquidity of the company or a more conservative

approach to working capital management. Higher the ratio better it is for the organization.

Current Ratio = Current assets / current liabilities

In year 2011

Current Assets = 313,589,869

Current Liabilities = 221,125,110

Current Ratio = Current assets / current liabilities

Current Ratio = 313,589,869/ 221,125,110

= 1.418

30

In year 2012

Current Assets = 401,213,566

Current Liabilities = 279,710,100

Current Ratio = Current assets / current liabilities

Current Ratio = 401,213,566 / 279,710,100

= 1.434

Analysis:-

Companies aims to maintain a current ratio of at least 1 to ensure that the value of their

current assets cover at least the amount of their short term obligations. However, greater than

1 ratio provides additional cushion against unforeseeable contingencies that may arise in the

short term.

Company has increased its current ratio from 1.418 to 1.434, with not much margin but is

trying to improve periodically. 0.016 is the improvement in this ratio.

31

3. Return on Investment

Return on investment (ROI) is performance measure used to evaluate the efficiency of

investment. It compares the magnitude and timing of gains from investment directly to the

magnitude and timing of investment costs. It is one of most commonly used approaches for

evaluating the financial consequences of business investments, decisions, or actions.

Return on Investment = Net Profit after interest & tax / Total Assets

32

In year 2011

Net profit after interest and tax =24,704,876

Total assets = 331,937,203

Return on Investment = Net Profit after interest & tax / Total Assets

Return on Investment = 24,704,876/ 331,937,203

ROI = 0.074

In year 2012

Net profit after interest and tax =33,840,530

Total assets = 419,080,867

Return on Investment = Net Profit after interest & tax / Total Assets

Return on Investment = 33,840,530 / 419,080,867

ROI = 0.080

33

Analysis:-

If an investment has a positive ROI and there are no other opportunities with a higher ROI,

then the investment should be undertaken. A higher ROI means that investment gains

compare favorably to investment costs. Company though not increases at high rate but is

increasing slowly. It has shown an growth of 0.006% i.e., from 0.074 to 0.080.

4. Quick Ratio/Acid test ratio

Quick ratio or Acid Test ratio is the ratio of the sum of cash and cash equivalents, marketable

securities and accounts receivable to the current liabilities of a business. It measures the

ability of a company to pay its debts by using its cash and near cash current assets (i.e.

accounts receivable and marketable securities).

Ideal quick ratio is 1:1

34

Quick Ratio/Acid test ratio = (Current assets-Inventory)/ Current liabilities

In year 2011

Current assets = 313,589,869

Inventory = 110,449,976

Current liabilities = 221,125,110

Quick Ratio/Acid test ratio = (Current assets-Inventory)/ Current liabilities

Quick Ratio/Acid test ratio = (313,589,869 110,449,976) / 221,125,110

= 203,139,893/221,125,110

= 0.918

In year 2012

Current assets = 401,213,566

Inventory = 153,529,898

Current liabilities = 279,710,100

Quick Ratio/Acid test ratio = (401,213,566 153,529,898) / 279,710,100

= 247,683,668 / 27,910,100

= 0.885

35

Analysis:-

A quick ratio of more than one indicates that the most liquid assets of a business exceed

its total debts. On the opposite side, a quick ratio of less than one indicates that a business

would not be able to repay all its debts by using its most liquid assets. In other words, If

quick ratio is higher, company may keep too much cash on hand or have a problem collecting

its accounts receivable. A quick ratio higher than 1:1 indicates that the business can meet its

current financial obligations with the available quick funds on hand.

A quick ratio lower than 1:1 may indicate that the company relies too much on inventory or

other assets to pay its short-term liabilities.

Company decreased/ maintained this ratio around 1. i.e., in 2011-0.918 and in 2012-0.885.

36

5. Gross profit ratio

Gross profit ratio (GP ratio) is a profitability ratio that shows the relationship between gross

profit and total net sales revenue. It is a popular tool to evaluate the operational performance

of the business. The ratio is computed by dividing the gross profit figure by net sales. It is

expressed as percentage (%).

Gross profit ratio = Gross Profit / Net Sales

In year 2011

Gross Profit = 224,001,761

Net Sales = 729,730,377

Gross profit ratio = Gross Profit / Net Sales

Gross profit ratio = 224,001,761/ 729,730,377

= 0.3069

In year 2012

Gross Profit = 283,056,895

Net Sales = 936,404,385

Gross profit ratio = Gross Profit / Net Sales

Gross profit ratio = 283056895 / 936404385

= 0.3022

37

Analysis:-

Gross profit is very important for any business. It should be sufficient to cover all expenses

and provide for profit. There is no norm or standard to interpret gross profit ratio (GP ratio).

Generally, a higher ratio is considered better.

The ratio can be used to test the business condition by comparing it with past years ratio and

with the ratio of other companies in the industry. A consistent improvement in gross profit

ratio over the past years is the indication of continuous improvement. When the ratio is

compared with that of others in the industry, the analyst must see whether they use the same

accounting systems and practices.

Company ratio is decreased in comparison to the last year. From 0.3069 to 0.3022 it is

decreased. Company is doing more work to recover and mange the fault in the production or

in any department. Company will cover this gap in the coming years.

38

Chapter - 4

LESSONS LEARNT

1. Experience About The Working Environment

There was a complete different environment in the company premises. The atmosphere was

very good. I am pleased that I have got the chance of getting a hand with one of the

companys executive director. What a person he was; so humble, so helpful, I cant explain

his nature in few words. Then the department where I was putted, there also the manager

from accounts department, helps me a lot to have a good understanding with the peoples

around me. He gave me interesting and challenging tasks, asked me for my opinion, we

exchanged ideas and discussed about business related issues. I their manage the papers of

accounts from all over the India i.e., Sales vouchers, Purchase vouchers, Balance sheets,

Credit Notes, Debit Notes etc . But in all my way my supervisor always helped me, and

guided me to be on the right direction. There I got chance to see the companys insurance

papers, though I didnt get that but one of the manager just give an overview of that policy.

As good working condition is necessary in all the offices to work on a peaceful note, Celfrost

also provides the same platform so that one can easily and comfortable do the paper and

system work in the organization premises. In general, there was a friendly tone of

communication among the colleagues. The members were working as a team for the

objectives of the management so; there I also got a chance to get my hands also in it. An

important thing was that, being a trainee I was given full attention, so I was boosted with the

confidence and these kinds of things acts as an extrinsic motivation factors. Regular and

particular interval of time was given to refresh ourselves and then get back to work. The

environment was overall good.

39

2. Briefly explain the practical knowledge you gained during your summer training in terms

of practices followed by the company in different functional areas of management.

I went to Celfrost Pvt. Ltd. Deals in refrigeration, cooling plants and hospitality equipments

to gain practical knowledge in my summer training. Celfrost is having offices all over India

and head office at Gurgaon, Haryana.

To start with, I must admit experience is experience and there is no alternative.

Talent cannot be matched with experience. It was first work experience. Be it maintaining

relations with people, or focusing more on work, I tried all my book knowledge to get better

results. There I felt, what synergy is, where lot of people work together in single direction.

Though, they didnt provide us their computers for work as it would have caused some delay

in their work. I learned so many things by observing them how their finance section used to

function, how accounts were managed.

I gained many things in my personality like, feeling of work, improved my self esteem,

punctuality and dress sense improved me further. I got a different dimension in my thinking

and ethical values. What we learn in management books, I experienced that to some extent.

40

3. Difficulties

1. Practical knowledge

So far in our studies, we only get the theoretical knowledge of the business

activities, which in the company creates a problem in the beginning. The

company requires practical knowledge and at this level we dont have that, so

there is a delay to understand about the companys working. So being just a student

I go through many different kinds of problems in my training that was challenging for me.

2. Mixing in the organization

Be it someone nature, or their workload, some of the people were of reserved

nature and aggressive too. All the members cannot be same, so I also faced

another side of coin i.e., being uncomfortable in some particular situation. But

whatever the conditions may be, I worked there and coordinate with them.

3. Workload

Being just a student, a trainee, I felt some pressure of the work many times. Now I understand

the meaning of real workload. As they gave facilities to me, they gave me work too.

41

BIBLIOGRAPHY

Books:-

1. Double Entry Book Keeping: Accounting for Partnership Firms and Companies, by

T.S. Grewal, 2013 edition.

2. Analysis of Financial Statements by TS Grewal, 2013 edition.

3. Financial Accounting for Managers by Sanjay Dhamija, 2012 edition.

4. Basic Accounting by HIRO and SOFAT, 2010 edition.

5. Financial Accounting by MK.Gupta C.L. Chaturvedi.

6. Financial Accounting for BBA by V.K Goyal and Ruchi Goyal.

Link:-

1. http://www.celsiusindia.com/, accessed on 20 August, 2013 at 7:00 PM.

2. http://www.celsiusindia.com/about.php, accessed on 19 September, 2013 at 6:00 PM.

3. http://www.celsiusindia.com/products.php, accessed on 25 September, 2013 at 5:00 PM.

4. http://www.celsiusindia.com/knowledge-factory.php, accessed on 28 September, 2013 at

4:30 PM.

5. http://www.celsiusindia.com/news.php, accessed on 15 October, 2013 at 6:00 PM.

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Portable Private BankerDocumento214 páginasPortable Private BankerDavid Adeabah Osafo100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- BPI Family Savings Bank Vs SMMCIDocumento1 páginaBPI Family Savings Bank Vs SMMCIManila LoststudentAinda não há avaliações

- Persistent Systems LTD - Initiating CoverageDocumento24 páginasPersistent Systems LTD - Initiating CoverageSeema GusainAinda não há avaliações

- Home Loan - Old Application FormDocumento4 páginasHome Loan - Old Application Formabhaykat0% (2)

- Visual Basic 6.0 PracticalsDocumento27 páginasVisual Basic 6.0 PracticalsBhavanshuSharmaAinda não há avaliações

- Outreach Networks Case StudyDocumento9 páginasOutreach Networks Case Studymothermonk100% (3)

- Payback PeriodDocumento15 páginasPayback PeriodDeepankumar AthiyannanAinda não há avaliações

- Old Question Papers (BPSM)Documento8 páginasOld Question Papers (BPSM)BhavanshuSharmaAinda não há avaliações

- List of Professional Courses 2011Documento3 páginasList of Professional Courses 2011Suraj NagpalAinda não há avaliações

- Final BBA-CAM Date Sheet December 2014 Without First YearDocumento2 páginasFinal BBA-CAM Date Sheet December 2014 Without First YearBhavanshuSharmaAinda não há avaliações

- RdoDocumento8 páginasRdoBhavanshuSharmaAinda não há avaliações

- Mba (Full-Time) Brochure 8-11-2013 - v1Documento48 páginasMba (Full-Time) Brochure 8-11-2013 - v1Manish JangidAinda não há avaliações

- Human Resource ConsultingDocumento11 páginasHuman Resource ConsultingBhavanshuSharmaAinda não há avaliações

- Name Photograph: Career Objective Work Experience (If Any)Documento1 páginaName Photograph: Career Objective Work Experience (If Any)BhavanshuSharmaAinda não há avaliações

- AdoDocumento11 páginasAdoBhavanshuSharmaAinda não há avaliações

- BBA-CAM 3rd Semester) : Both. Each Student Is Required To Carry Out The Work and Submit The Report IndividuallyDocumento11 páginasBBA-CAM 3rd Semester) : Both. Each Student Is Required To Carry Out The Work and Submit The Report IndividuallyMatthew HughesAinda não há avaliações

- Summer Internship Project For Referigeration and Cooling Company (Commercial)Documento33 páginasSummer Internship Project For Referigeration and Cooling Company (Commercial)BhavanshuSharmaAinda não há avaliações

- Bank Branch Management Retail BankingDocumento5 páginasBank Branch Management Retail Bankingrgovindan123Ainda não há avaliações

- Invitation To BidDocumento1 páginaInvitation To BidGladys Bernabe de VeraAinda não há avaliações

- A Sum of Money Allocated For A Particular Purpose A Summary ofDocumento12 páginasA Sum of Money Allocated For A Particular Purpose A Summary ofsaneshonlineAinda não há avaliações

- Integrated Accounting SystemsDocumento15 páginasIntegrated Accounting SystemsSanjeev JayaratnaAinda não há avaliações

- Model Question BBS 3rd Taxation in NepalDocumento6 páginasModel Question BBS 3rd Taxation in NepalAsmita BhujelAinda não há avaliações

- A Warning To Wall Street AmateursDocumento6 páginasA Warning To Wall Street AmateursSarah Clarke100% (1)

- Seec F'orm 20Documento23 páginasSeec F'orm 20The Valley IndyAinda não há avaliações

- Tax Preparer ResumeDocumento8 páginasTax Preparer Resumec2q5bm7q100% (1)

- NJ MoneyDocumento2 páginasNJ MoneywilberespinosarnAinda não há avaliações

- Cost To CostDocumento1 páginaCost To CostAnirban Roy ChowdhuryAinda não há avaliações

- Accountancy QP 3 (A) 2023Documento5 páginasAccountancy QP 3 (A) 2023mohammedsubhan6651Ainda não há avaliações

- Ab Jaiib Capsule 2.o Paper 1 PPB PDFDocumento287 páginasAb Jaiib Capsule 2.o Paper 1 PPB PDFSubhasis MohapatraAinda não há avaliações

- Fundamental Accounting Principles Wild 19th Edition Solutions ManualDocumento54 páginasFundamental Accounting Principles Wild 19th Edition Solutions Manualmarvinleekcfnbrtoea100% (47)

- HDFC Bank's 1st Annual ReportDocumento20 páginasHDFC Bank's 1st Annual ReportTotmolAinda não há avaliações

- ChapterDocumento117 páginasChapterDipesh MagratiAinda não há avaliações

- Accounting MCQDocumento15 páginasAccounting MCQsamuelkish50% (2)

- Premier FactsheetDocumento2 páginasPremier FactsheetMaurizio CerosioAinda não há avaliações

- Econ2300A+Week+1+-Fall+2023 3Documento19 páginasEcon2300A+Week+1+-Fall+2023 3zakariaAinda não há avaliações

- For Each of The Following SituationsDocumento2 páginasFor Each of The Following Situationslo jaAinda não há avaliações

- Share Capital + Reserves Total +Documento2 páginasShare Capital + Reserves Total +Pitresh KaushikAinda não há avaliações

- Fin Aw7Documento84 páginasFin Aw7Rameesh DeAinda não há avaliações

- Preface Mutual FundDocumento38 páginasPreface Mutual Fundjkbs_omAinda não há avaliações

- Assignment 2Documento2 páginasAssignment 2Eindra Nwe100% (1)

- Capital GainsDocumento25 páginasCapital GainsanonymousAinda não há avaliações