Escolar Documentos

Profissional Documentos

Cultura Documentos

M-Paisa in India

Enviado por

Gregory Wilson0 notas0% acharam este documento útil (0 voto)

20 visualizações7 páginasAbt the Icici and Vodafone collaboration

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoAbt the Icici and Vodafone collaboration

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

20 visualizações7 páginasM-Paisa in India

Enviado por

Gregory WilsonAbt the Icici and Vodafone collaboration

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 7

M Commerce is a by product of convergence process of the telecommunication

technologies (TCT) & Information Technology (IT), which is collectively referred to as

Information and Communication Technologies (ICT). Thus MCommerce may be considered as

an extended arm of Electronic Commerce (E-Commerce) to wireless mediums. This

convergence, however, enables some unique, location based services, which is very difficult to

achieve in E-Commerce. The convergence of TCT & IT has made these innovative services easily

accessible to common people. Today, the scope of M-Commerce encompasses almost every

walk of life. Mobile services have found its utility almost in every field of content, travel,

entertainment, marketing and banking. Mobile revoluation is all set to reach every corner of

India after the internet revolution and fast adoption of its use in Indian village and town.

Because of this Indian business companies have shifted their focus towards the ignored but

potential rural markets. There is a huge opportunity for mobile technologies based business

models to experiment with the rural, and convert it into a business opportunity of 75 million

potential rural customers in the country. Unlike the ecommerce, businesses based on mobile

technology have the advantage of overcoming the barriers of literacy, cost and availability.

Innovations in new mobile devices, in term of features and ease of use, have enabled an

illiterate to understand and operate. It is very difficult to define M-commerce and thus can be

interpreted in a variety of ways because M-commerce is a fairly new phenomenon and several

people define it in several ways. M-commerce can be defined as all activities related to a

(potential) commercial transaction conducted through communication networks that interface

with wireless devices. Another definition of M-commerce could be the use of wireless device

to communicate, transact and interact via high speed communication link through the internet

(Shuster, 2001, p. 2). Angsana (2002) emphasizes on three elements of Mcommerce devices ,

network types and a range of activities and explains M-commerce as all electronic based

transactions (e.g., payment, purchase and communication interaction) that Use data-enabled

wireless device connected to the internet or to a vendors private network

M-commerce in India:

In India the mobile service charges are all time low as compared to the other countries, which

has enabled even the low-income earning groups to own and operate multiple mobile phones.

To utilize the opportunities which mobile based technologies have to offer and a continuous

growth of this sector, a pro- active rather than reactive public policy and regulatory initiatives

are desired from the government of India. In mobile Commerce commercial transactions

between both B2C and B2B entities happens through mobile devices. With a gradual shift

towards modern retailing formats, Indian retail market has experienced high growth over the

last decade. Companies have shifted their focuses to plateforms based on mobile technologies

because of growing numbers of mobile devices and mammoth wireless subscriber base.

Leveraging on enhanced reach like MVAS and diverse features like of e-commerce, m-

commerce is poised for greater adoption across India, in the coming years. Although mobile

commerce market in International Journal of Technical Research(IJTR) Vol 1, Issue 2, Nov-Dec

2012 ISSN 2278-5787 Page 34 India is in nascent stage, but over the last few years m-payment

and m-banking segments have shown significant growth opportunities. The government and

other Banking and non banking financial organizations have taken strong steps to reach the

Indias population which are still deprived of financial facilities which can ensure a tremendous

growth in the latter segments. There are around 89,000 bank branches to serve the 600,000

territories that require banking facilities. This clearly shows a wide gap between what is needed

and what is being provided. As a vast segment of the Indian population who neither had a

landline nor a bank account today have made a generation leap and not only do they own a

mobile handset, but are also slowly attempting to transact on their mobile phone. Keeping this

in mind, the estimated potential market size of the m- commerce in India is pegged to be

somewhere around 400 crore. Also the potential revenue through mobile commerce can go up

to 20 billion in 2015, according to a survey conducted by IAMAI 2011 and this is just the

beginning in India. So, there is hardly any doubt that mobile commerce has emerged as a major

potential growth area for various mobile operators. Although mobile commerce market in India

is in nascent stage, m-payment and m-banking segments have shown significant growth over

the last few years. Initiatives taken by the government and financial organizations to reach

India's unbanked population can ensure tremendous growth in the latter segments. M-

commerce in India is primarily dependent on network operators who can effectively enhance

and advance the usage of its services, which has resulted in collaboration and partnership

models in domains like banks and telecom operators and technology provider. The market

expansion needs to be continuously supported in this domain, which has a huge potential of

offering a wide scope in increasing revenue for m-commerce players and telecom operators.

Although m-commerce market in India is still in its initial phase, but m-commerce has started to

gain importance in the digital marketplace with the growth of Smartphones, tablets, and

mobile devices. Mobile phone penetration in India is estimated to be 90% by 2015 which is

more than 60% as of now. Over the last few years, services like mbanking, m-trading, and m-

shopping segments have shown significant growth. A recent study shows that 45% of smart

phone owners and 53% of tablet owners plan to purchase more products on their handheld

devices in the future, predicting a huge opportunity for the service in the country.

Why M- PESA?

FINANCIAL INCLUSION

A developing country like India faces a huge shortage of physical infrastructure of the

financial institutions that means a large part of Indian population remain deprived of formal

banking system. For an example Kenya has 840 bank branches and around 1500 ATMs which

are not at all sufficient for the entire 38 million people.. M-PESA scheme helps the Micro

Finance Institutions (MFIs) to target even remote areas very quickly and with a reduced cost.

Financial inclusion has a multiplier impact on the lives of people drawn into the formal financial

system which leads to social inclusion. It is a known fact that when the poor people is provided

with financial services, they tend to manage their cash flow in a better way, they do a better

financial planning and their savings are increased. M-PESA has the capability to bring formal

financial system at the door step of people who have never used these services.

ENHANCED ECONOMIC ACTIVITY

It is always a problem from the supply side rather than demand side to provide the cash into

the hands of people who can use it. Its the ability to move money from the sender to the

receiver that is the stumbling block. Since the creation of money, the ability to move it from A

to Bthe so-called velocity of moneyhas been a fundamental cornerstone of economic

activity. But the burning issue is exactly how to facilitate the money transfer in a developing

economy where the infrastructure is poor and where very few people hold bank accounts. Due

to high penetration of mobile phones than the bank account penetration, mobile money

transfer platform can substitute the banking infrastructure in rural areas in most of the

developing countries.

M-PESA could play an instrumental role in driving growth and development. According to the

World Bank estimation a reduction in remittance commission by 2-5% could increase the flow

of formal remittances by 50-70%, which could boost local economy. In Kenya M-PESA has

resulted in higher and better remittance and higher economic activity leading to faster growth.

CGAP in its survey has found that the incomes of rural recipients increased by 5- 30% since they

started using M-PESA.

REDUCED CASH IN THE ECONOMY

In the absence of formal banking system, most of the transactions are cash based giving no

audit trail to the regulators. M-PESA brought in the transparency in the money transactions by

reducing the cash economy and digitizing the transactions. M-PESA is equivalent of credit card

or debit card which allows the regulators to monitor the trail. There is more visibility on the

money flows as the remittances move from informal channels to formal channels.

SECURITY

M-PESA provides unbanked mobile phone users with a secure platform which uses simple,

tailored menus on their phone to send fully encrypted and PIN locked messages to a thoroughly

audited financial accounting system.

It was observed by CGAP that M-PESA not only increased the MFI activity but is also used as a

medium of storage of money. Informal saving channels are much less secure than formal saving

facilities. Those who can afford it least suffer the highest risk. Both the banked as well as

unbanked customers of M-PESA are using it as storage medium as it is easily accessible. There

are many more agents of M-Pesa than bank which means that the customers need not travel

long distances to withdraw cash. With M-PESA, there is no need to carry cash and hence the

risk of the cash getting lost or stolen is not there.

CONVENIENCE

Country in which unemployment is very high people travel far from home in search of work and

they also need to be able to send money back to their families to support them. Money

remittance is very high in majority of the parts of the world which could range from 3 to as high

as 10%. This high remittance cost is one the reason why more and more people depend on

traditional and informal channels (through friends and family) to send money or physically

deliver the money. The issues with this informal channel is that it cost high, risky unregulated

services, unpredictable environment and possibly long expensive trips carrying cash in an

unsafe manner. With the introduction of M-PESA users need not to make frequent trips back

home to deliver money. Another advantage of M-PESA service that it is accessible 24X7 and

money can be sent anytime, anywhere using this service.

Cost Reduction and Efficiency:

By riding on the wave of M-PESA, institutions can achieve cost reductions because most of the

cost is borne by the customer. For example, an MFI that deals in loans through its branches

spends a large sum of money on cash insurance, cash logistics and managing the risk of carrying

cash. Even the disbursement of cheques is also costly as MFIs have current accounts and are

charged for cheque clearing. But now MFI only has to deposit money in M-PESA account and

provide a list of accounts number and the amount to be paid to each. For this service a fee is

charged from the MFI on a per transaction basis, but the charges are lower than what the MFI

would incur for any other traditional mode of disbursement. Accepting cash deposits at a bank

branch is also costly on a per transaction basis to the institution as it invests in branch

infrastructure setup, equipment and security arrangements and manpower. If customers start

depositing or repaying loans through M-PESA, the financial institution will outsource teller

activities to those M-PESA agent.

M-PESA platform allows financial institutions to decongest their offices. Removing a large chunk

of crowd from branch office gives the regular staff more time to focus on customer acquisition ,

product sales, business development and related activities. Branch member can stop worrying

about servicing the products and cash management as repayment and disbursements,

withdrawal and deposit can be done through agents. All these factors increases staff efficiency.

Customer Satisfaction:

Customers do not have to go to the often-distantly located bank branch or deal with

agents/cashiers, nor do they have to stand in a queue and complete lengthy bank forms. There

are too few actual users at this point to judge client satisfaction, but a bank which offers the

convenience of M-PESA could capitalize on positive benefits (security, product offering, and

interest payments) and minimize the inconvenience caused due to branch visit.

Advantages for Customers

The potential benefit to end customers is that they need not waste their time travelling to a

bank branch or an MFIs designated point for transacting into their accounts. They can go to

their nearest M-PESA agent and can deposit money into M-PESA account and can transfer from

M-PESA to their bank account resulting into following benefits:

Money saved on travel expenses, opportunity cost of lost wages and turnover etc.

Ease of transaction wherever/whenever: If a customer is carrying sufficient amount in

his/her M-PESA account then he/she does not even need to go to an agent also M-PESA

agents are ubiquitous.

No hassle and reduced risk of carrying cash. M-PESA agents are closer than the bank

branch.

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1091)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Exercise-5 - Genta Yusuf Madhani - 1201174352 PDFDocumento17 páginasExercise-5 - Genta Yusuf Madhani - 1201174352 PDFGentaYusufMadhaniAinda não há avaliações

- Case Solutions For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by BrunerDocumento12 páginasCase Solutions For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by BrunerGregory Wilson50% (2)

- Audit 2 - Concept Map For InvestmentsDocumento4 páginasAudit 2 - Concept Map For InvestmentsPrecious Recede100% (1)

- Manual of Engineering Economy PDFDocumento114 páginasManual of Engineering Economy PDFSanjay Kumar SahAinda não há avaliações

- The Audit of LiabilitiesDocumento3 páginasThe Audit of LiabilitiesIftekhar Ifte100% (3)

- Petitioner Respondents: MAYBANK PHILIPPINES, INC. (Formerly PNB-Republic Bank), Spouses Oscar and Nenita TarrosaDocumento6 páginasPetitioner Respondents: MAYBANK PHILIPPINES, INC. (Formerly PNB-Republic Bank), Spouses Oscar and Nenita TarrosaKim Jan Navata BatecanAinda não há avaliações

- A Project Report On Customer Perception and Attitude Towards ICICI Prudential Life InsuranceDocumento85 páginasA Project Report On Customer Perception and Attitude Towards ICICI Prudential Life InsuranceBabasab Patil (Karrisatte)100% (1)

- Time Table For Term VDocumento2 páginasTime Table For Term VGregory WilsonAinda não há avaliações

- 23 Things That They Don't Tell YouDocumento8 páginas23 Things That They Don't Tell YouGregory WilsonAinda não há avaliações

- Group 3 Section B HRMDocumento5 páginasGroup 3 Section B HRMGregory WilsonAinda não há avaliações

- MonopolyDocumento21 páginasMonopolyDhaval ShahAinda não há avaliações

- Innovating For Shared ValueDocumento16 páginasInnovating For Shared ValueGregory WilsonAinda não há avaliações

- NikhilDocumento2 páginasNikhilGregory WilsonAinda não há avaliações

- Kelsey Manufacturing CompanyDocumento7 páginasKelsey Manufacturing CompanyGregory WilsonAinda não há avaliações

- T4 PGPM 2013-15Documento2 páginasT4 PGPM 2013-15Gregory WilsonAinda não há avaliações

- CH 11Documento51 páginasCH 11Gregory WilsonAinda não há avaliações

- Basant Rakesh: Educational QualificationsDocumento13 páginasBasant Rakesh: Educational QualificationsVishalNagarkotiAinda não há avaliações

- Foreign Currency Term LoanDocumento11 páginasForeign Currency Term LoanGunner WengerAinda não há avaliações

- Transaction Review RKPL, Draft ReportDocumento13 páginasTransaction Review RKPL, Draft ReportJoni alauddinAinda não há avaliações

- AAVE (EthLend) WhitepaperDocumento56 páginasAAVE (EthLend) WhitepaperSwitchainAinda não há avaliações

- Q1FY23 - Result Update: Future Growth IntactDocumento10 páginasQ1FY23 - Result Update: Future Growth IntactResearch ReportsAinda não há avaliações

- Final PPT Adr-GdrDocumento71 páginasFinal PPT Adr-Gdr24_anuAinda não há avaliações

- ATS FormatDocumento2 páginasATS FormatZeny BernalAinda não há avaliações

- Relaxo Footwears Initiating Coverage 11062020Documento7 páginasRelaxo Footwears Initiating Coverage 11062020Vaishali AgrawalAinda não há avaliações

- Merrill Lynch Case Study - PrajDocumento19 páginasMerrill Lynch Case Study - PrajAmit Shrivastava100% (3)

- 14th Finance Commission - Report Summary PDFDocumento1 página14th Finance Commission - Report Summary PDFSourav MeenaAinda não há avaliações

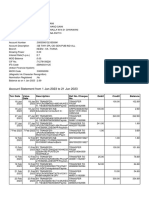

- Account Statement From 1 Jan 2023 To 21 Jun 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento6 páginasAccount Statement From 1 Jan 2023 To 21 Jun 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceKumar SunilAinda não há avaliações

- CAMPERDOWN HIGH SCHOOL - Accounting Grade 9 TestDocumento6 páginasCAMPERDOWN HIGH SCHOOL - Accounting Grade 9 TestLatoya SmithAinda não há avaliações

- H01. Conceptual Framework and Financial StatementsDocumento14 páginasH01. Conceptual Framework and Financial StatementsMaryrose SumulongAinda não há avaliações

- Taxi Proposal Form K5334Documento6 páginasTaxi Proposal Form K5334DorcasAinda não há avaliações

- Bumiputra Malaysia Finance Scandal: This Study Resource Was Shared ViaDocumento6 páginasBumiputra Malaysia Finance Scandal: This Study Resource Was Shared ViaRahimah NuryatiAinda não há avaliações

- K Kiran Kumar: Any Questions? Behavioral Finance, Netscape IPO, ReviewDocumento33 páginasK Kiran Kumar: Any Questions? Behavioral Finance, Netscape IPO, ReviewJohn DoeAinda não há avaliações

- Q. 4 There Are Three Different Phases in The History of Banking in India.Documento4 páginasQ. 4 There Are Three Different Phases in The History of Banking in India.MAHENDRA SHIVAJI DHENAKAinda não há avaliações

- Agribusiness SyllabiDocumento6 páginasAgribusiness SyllabiMerlyn HefervezAinda não há avaliações

- Luxembourg Fiduciary StructuresDocumento12 páginasLuxembourg Fiduciary StructuresDayana VelizAinda não há avaliações

- Ri Kon 6689Documento2 páginasRi Kon 6689Chetan VaishnavAinda não há avaliações

- Advanced Financial Accounting IDocumento21 páginasAdvanced Financial Accounting IAbdiAinda não há avaliações

- Partnership Deed EngDocumento3 páginasPartnership Deed EngShajana ShahulAinda não há avaliações

- Study of Organisational Structure Syndicate BankDocumento48 páginasStudy of Organisational Structure Syndicate BankJissy Shravan50% (2)