Escolar Documentos

Profissional Documentos

Cultura Documentos

Pop

Enviado por

Ashish Tagade0 notas0% acharam este documento útil (0 voto)

53 visualizações4 páginaspop

Título original

pop

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentopop

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

53 visualizações4 páginasPop

Enviado por

Ashish Tagadepop

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 4

IJSR - INTERNATIONAL JOURNAL OF SCIENTIFIC RESEARCH 89

Volume : 2 | Issue : 11 | November 2013 ISSN No 2277 - 8179

Research Paper

Commerce

N.Sathiya Assistant Professor, Sri Vijay Vidyalaya College of Arts and Science, Department of

Commerce, Nallampalli

A Study on Customer Relationship

Management Practices in Banking Sector

(with Special Reference to Salem District)

KEYWORDS : CRM, Bank, Customer

Service Management, Customer

Knowledge Management.

Banks play a vital role in the socio-economic development of

our country. Banks offer several facilities to enhance the stand-

ard of living of our citizens.Customer service management is a

key component of business today. The concept is very crucial as

it incorporates customer, customer service, customer satisfac-

tion, customer value, customer loyalty, customer retention, etc.

Customer service is an extremely dynamic concept. Customer

Relationship Management (CRM) is a fundamental business of

every enterprise and it requires a holistic strategy and process

to make it successful.Customer Relationship Management is a

vital factor to improve the performance of the banks.Customer

Relationship Management in banks can be defined as the ability

to understand, anticipate and manage the needs of the custom-

er, interaction and relationship resulting in an increased profit-

ability through revenue and marginal growth and operational

efficiencies.To serve more customers and to retain the existing

customers, banks in India have changed from the old concept of

accepting deposits and lending money to Any Time, Any Branch

and Any Bank through Any Where Banking.

A customer is the core component in the banking industry. The

business of banking can neither function without customers,

nor is the business when has been done just by acquiring a cer-

tain number of transactions culminating in a long- term bank-

er-customer relationship. Banking institutions thrive more on

keeping old customers happy, rather than getting new custom-

ers.Most of the banks in India are now turning to CRM as they

are increasingly realizing that the cost of acquiring new custom-

ers is for higher than the cost of retaining existing customers.

IMPORTANCE OF THE STUDY

The banks are facing lot of difficulties in acquiring new cus-

tomers and in retaining the existing customers. As a result

of the advancement of banking technology and computeri-

zation and networking of bank branches, the customers are

becoming more and more dynamic and less loyal in their

behaviour.

The development of the Internet is further adding to this

trend and the whole market becomes transparent and cus-

tomers are in a position to move easily from one bank to

another. In such a situation, customer satisfaction is the key

to bank marketing, which aims at retention of the old cus-

tomers and their bringing in new customers.

Most of the banks are concentrating more on retaining the

existing customers rather than going for new customers

Implementation of Customer Relationship Management

poses a greater challenge to the banks after acquiring the

customers.

OBJECTIVES OF THE STUDY

To identify various banking services offered by public and

private sector bank to consolidate their CRM strategies.

To study the customers perception on factors influencing

Customer Relationship Management in banking industry.

To classify the customers opinion on initial strategies, main-

tenance strategies, technology, service satisfaction and im-

pact of CRM.

To measure influence of demographic variable on elements

of CRM in banking industry.

To ascertain the perception of bank executives on various

aspects of CRM in their respective banks.

To construct and empirical model to ascertain the effective-

ness of CRM in public and private sector banks.

SCOPE OF THE STUDY

The study will highlight the emerging trends in the growth

of selecting banking services in the competitive scenario

and the major problems faced by the customers as well as

the banks.

In todays changing demographic economic competitive fac-

tors mean that there are fewer new customers to go around.

The costs of attracting new customers are rising.

Thus, although finding new customers remains very impor-

tant, the emphasis is shifting towards retaining profitable

customers and building lasting relationships with them.

METHODOLOGY

Research Design

The study is conducted in two stages format, with a prelimi-

nary pilot study followed by the main study. The major part

of the study is based on primary data.

Study Area

The Salem district has been chosen for the purpose of study be-

cause of the following reasons

The Salem district is one of the industrialist areas and most

of the transactions through the banks.

Salem district is the fourth place of the corporation in

Tamilnadu

Almost every bank of the state has multiple branches in the

city.

Foreign banks are also interested in establishing their

branches in the city.

Sources of Data

Primary data has been collected from the Customers and the

Employees of the

Public Sector Banks

Private Sector Banks

Secondary data is collected from various published and un-

published sources including Journals, Magazines, Publications,

Reports, Books, Dailies, Periodicals, Articles, Research Papers,

Websites, Bank Publications, Manuals, and Booklets etc.

Sampling Technique

Convenient Sampling Method is adopted to collect the pri-

mary data.

Sample Size

The bank under each category has been chosen based on mini-

mum number of two branches in the Salem District as on March

2010.

Table 1.1

Number of Sample Size in Customers and Bank Executives

S.No Name of the Bank Customers

Bank

Employees

1 State Bank of India 25 10

2 Allahabad Bank 25 10

3 Andhra Bank 25 10

4 Bank of India 25 10

5 Canara Bank 25 10

6 Central bank of India 25 10

90 IJSR - INTERNATIONAL JOURNAL OF SCIENTIFIC RESEARCH

Volume : 2 | Issue : 11 | November 2013 ISSN No 2277 - 8179

Research Paper

S.No Name of the Bank Customers

Bank

Employees

7 Corporation Bank 25 10

8 Indian Bank 25 10

9 Indian Overseas Bank 25 10

10 Punjab National Bank 25 10

11 Syndicate Bank 25 10

12 UCO Bank 25 10

13 Union Bank of India 25 10

14 Vijaya Bank 25 10

15 Catholic Syrian Bank 25 10

S.No Name of the Bank Customers

Bank

Employees

16

Centurion bank of

Punjab

25 10

17 ICICI Bank 25 10

18 Karnataka Bank 25 10

19 Karur Vysya Bank 25 10

20 Lakshmi Vilas Bank 25 10

21 South Indian Bank 25 10

22

Tamilnadu Mercantile

Bank

25 10

Total 550 220

Figure 1

A CRM Model of Banking Industry in Salem District

IJSR - INTERNATIONAL JOURNAL OF SCIENTIFIC RESEARCH 91

Volume : 2 | Issue : 11 | November 2013 ISSN No 2277 - 8179

Research Paper

Findings

Findings of CRM with respect to Bank customers

v Majority of 86.2 percent of the respondents using the over-

draft facility with the banks, most of respondents 82.4 per-

cent are not using the credit card facility with the banks,

a maximum of 62.6 percent of the respondents are using

the credit card in every month above 50,001, a maximum

of 49.8 percent of the respondents are using the card only

system.

v Most of the respondents 69.2 percent are not attended the

customer interaction programmes to the banks, majority

of 48.6 percent of the respondents are dissatisfied the cus-

tomer interaction programme to the banks, a maximum of

71.4 percent of the respondents are not CRM increased the

numbers of the customers with the banks, majority of 64.4

percent of the respondents are not presenting the customer

complaint cell to our banks, most of the respondents 47.6

percent are poor functioning customer complaint cell of the

banks.

v The customers public and private sector banks have strong

opinion about importance of loan facilities, ATM service

and time taken services of CRM in banks. They are very

much aware of initial strategies.

v The customers of banking industries strongly believed that

advertisements, reports, communication, guidance, may I

help you counter, information pamphlets and ombudsman

committee customers also admirable role to achieve the

customer satisfaction. The customer staff relationships in

CRM depend upon employees personal touch with their

customers and employees performance.

v Finally, internet services, advanced technology, core bank-

ing, and financial performance well defined strategies and

achievement of customer satisfaction directly create inci-

dental effects on customers and make them to stick on to

the same service providers.

v Factor analysis on initiation gives out three predominant

factors namely attractive services, customer retention strat-

egy and quick services.

v Strategies to maintain the customers in these selected

banking industries depend upon customer value measure-

ment, banker strategy, responsive customer service, cus-

tomer win back strategy, customers attractive services and

formidable customer relationship is an indispensable factor

for materialization of customer satisfaction.

v Technology innovation and latest developments in the elec-

tronic fields powerfully affecting the customer relationship

management. The first establishing electronic re-contact,

the second place of technology and CRM finally third place

of customer service strategy. The technologies fought with

convenient electronic devices magnetically attract the cus-

tomers.

v There are six factors included under the customer satisfac-

tion to increase the customer satisfaction, materialization

of customers, establishment of transparency, cordial rela-

tionship between the customer and staff and bankers- cus-

tomers attractive strategy.

v The analysis revealed the impact of CRM on the lines of

privilege and perfect services to the customers, the achieve-

ment of strong bonds of relationship is the main objectives

of impact of CRM to get mutual benefit to customers as well

as service providers

v Cluster analysis initial strategies of CRM classified the cus-

tomers of public and private sector banks into 3 groups

namely, meticulous customers (38.4 percent), mechani-

cal customers (41 percent), changing tendency customers

(20.6 percent).

v It is found that the CRM maintances divided the customers

of public and private sector banks into three groups namely,

demanding customers (54.4percent), expecting customers

(29.6percent) and gregarious customers (17percent).

v It is clear that the technology on CRM differentiate the

public and private sector banks customer into three groups

namely, innovative customers (36.2percent), settlement

oriented customers (46.4 percent),unaware customers

(17.4 percent).

v It is revealed that the customer satisfaction classified the

public and private sector bank customers into three groups

namely, prompt customers (42.8percent), convenient de-

manding customers (31.4 percent), and adjustable custom-

ers (41percent).

v It is concluded that the impact on CRM divided into the cus-

tomers as public and private sectors bank into three groups

namely, saturated customers (43.2 percent), caring custom-

ers (39.4 percent), and growth-oriented customers (17.4

percent).

Findings of CRM with respect to executives

v As per the education of the executives includes maximum

number of post graduate executives, executive comprising

maximum number of 21 to 30 years old, executives income

shows maximum number of executives earning ` 10,000 to

` 15,000, department of the executives indicates that, when

compared with clerical and sub staff, maximum number of

executives under the managerial department.

v Maximum numbers of executives are accepted to the fre-

quent visit of the customers and fulfill their customers

satisfaction. Maximum numbers of executives hope and

trust the CRM increased the number of customers. A CRM

strategy indicates that, least number of executives possess

the sufficient knowledge about CRM in these industry and

present in their complaint cell in their organization.

v The executives of banking industries strongly agreed that

initiation in CRM primarily depend upon identifying the po-

tential customers and that loyalty rates towards organiza-

tion.

v The selected banking industry strongly believed that the

maintenances procedures in CRM aimed to concentrate

current customers, gathering the customers grievances,

periodic evaluation, employees training, employees are re-

warded and different customers are given different treat-

ment.

v The selected banking industries are strongly accepted the

technology in CRM basically depends upon the introduction

of cost, usage of modern technology and advanced technol-

ogy and understanding the customers behaviour.

SUGGESTIONS

v The customers of banking industries preferred and except

transparency with the executives. So, customer interaction

programmes must be essential to study the characteristic

features of the customers.

v Information search place a major role in consolidating op-

timistic relationship between customers and executives. So,

meticulous care must be taken by the industries to adver-

tise their services.

v The customers are advised to the about mutual benefit.

This enables the industries to improve the quality of ser-

vices. The qualitative approach and proportionate should

be taken care for their customers.

v Since the executives are enthusiastic in initial strategies

to acquire the customers the industries may adopt certain

incentives strategies for the customers to encourage them.

This move would pave the way to maintain smooth rela-

tionship between executives and customers

v The executives of these banking industries should conduct

a survey to measure the customer preference and level of

satisfaction.

v Instead of terminating the problematic and unwanted cus-

tomers, these industries should come forward to analyze

the basic needs and expectation of the problematic custom-

ers. This move will be vital reducing the stained relation-

ship with unwanted customers.

v It is found from the research that certain groups of execu-

tive are unaware as well as unenthusiastic towards CRM

elements. So, executive training programmes must be pe-

riodically conducted to give effective responsibility to the

executives.

CONCLUSION

CRM is a powerful concept for the success of any industry. It

paves the way to maintain an optimistic relationship with cus-

tomers to increase the business and profitability. The strategies

92 IJSR - INTERNATIONAL JOURNAL OF SCIENTIFIC RESEARCH

Volume : 2 | Issue : 11 | November 2013 ISSN No 2277 - 8179

Research Paper

employed CRM is aimed at mutual benefit to the customers and

industries. It creates deep and wide impact on customers and

make in deep in roads in identifying the lucrative move of the

industries. Personal details of customers like gender, age, edu-

cation qualification are essential in determing in essential to

perform better for all the industries in fact it gives maximum

credit and gains to the industry for the future.

REFERENCE

Anton, Petouhoff (2002), Customer Relationship Management (the bottom line to optimizing your ROI), Prentice- Hall, New Delhi. | Baran,

Galka, Strunk (2008), Customer Relationship Management, South-Western Cengaga Learning India Private Limited, New Delhi. | Bray, J. H.,

and Maxwell, S. E. (1985), Multivariate Analysis of Variance, Newbury Park: Sage Publications. | Child, D. (1990), The Essentials of Factor Analysis (2 Ed.), London: Cassel

Educational Limited. | Deepak Kumar, Puja arora, Monika kansal (2007), Role of information technology in banking sector, New centuary publications, New Delhi, pp.93.

| Degroot, M. H., Ferber, R., Frankel, M. R., Seneta, E., Watson, G. S., Kotz, S., Et Al. (Eds.), (1982), Encyclopedia of Statistical Sciences. Faa' Di Bruno's Formula to Hypothesis

Testing, New York: John Wiley and Sons. | JOURNALS | Aggarwal N, Aggarwal R, Sharma P (2000), E Banking for Comprehensive E-democracy: An Indian Discernment, www.

JIBC.Com/e-banking, 2000. | Aihie Osaeenkhoe (2007), Business Process Management Journal, Vol: 13, Issue: 1, | Alok Mittal, Jayant Sonwalk and Akhilesh K. Mishra (2003),

An Exploratory Study of CRM Orientation among Bank Employees, Indian Journal of Training and Development, Jan-June, pp.34-35. | Anand U and Sohal T.S. (1981), Rela-

tionship between Some Personnel Traits Job Satisfaction and Job Performance of Employees, Indian Journal of Applied Psychology, Vol.18 (1), September, pp.11-15. | Andrew

L H Goh, A Diagnostic methodology of Evaluating Customer Relationship Management Solutions, International Journal of Applied Operations Research, Volume 1, issue1. |

Anita Chakrabarty, Barking Up the Wrong Tree Factors Influencing Customer Satisfaction in Retail Banking in the UK, International Journal of Applied Marketing Volume 1,

Issue 1. | Archana Mathur.M (1988), Customer Services in Public Sector Banks- A comparative study of SBBJ and SBI, Indian Journal Marketing, April-June, Vol XVIII, pp.3-10.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- FRM Practice Exam Part 2 NOVDocumento139 páginasFRM Practice Exam Part 2 NOVkennethngai100% (2)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Marketing Strategy of SOTCDocumento10 páginasMarketing Strategy of SOTCAshish TagadeAinda não há avaliações

- Customer Relationship Management in Retail Sector Big BazaarDocumento57 páginasCustomer Relationship Management in Retail Sector Big BazaarSaurabh Maheshwari100% (1)

- IMM MCQ ImpDocumento7 páginasIMM MCQ ImpKushagra Nigam40% (5)

- Union Bank Limited Internship ReportDocumento60 páginasUnion Bank Limited Internship Reportsaleemkhp50% (2)

- India S Foreign Trade - Composition DirectionDocumento11 páginasIndia S Foreign Trade - Composition DirectionAshish TagadeAinda não há avaliações

- EntcDocumento7 páginasEntcAshish TagadeAinda não há avaliações

- International LiquidityDocumento4 páginasInternational LiquidityAshish TagadeAinda não há avaliações

- Chapter-1 Introduction and Design of The StudyDocumento32 páginasChapter-1 Introduction and Design of The StudyAshish TagadeAinda não há avaliações

- FormatDocumento2 páginasFormatAshish TagadeAinda não há avaliações

- Determination of Exchange RateDocumento14 páginasDetermination of Exchange RateAshish Tagade100% (2)

- Customers Perception Towards SOTC Tours & TravelsDocumento68 páginasCustomers Perception Towards SOTC Tours & TravelsAshish Tagade83% (6)

- Money MarketDocumento34 páginasMoney MarketAshish TagadeAinda não há avaliações

- Letter FormsDocumento6 páginasLetter FormsAshish TagadeAinda não há avaliações

- Travel and Adventure TourismDocumento44 páginasTravel and Adventure TourismAshish TagadeAinda não há avaliações

- Management SkillsDocumento11 páginasManagement SkillsAshish TagadeAinda não há avaliações

- Case Study - Amul's MKTG StrategyDocumento26 páginasCase Study - Amul's MKTG StrategyAshish TagadeAinda não há avaliações

- Indonesia Salary Survey 2015Documento6 páginasIndonesia Salary Survey 2015July AnggrenyAinda não há avaliações

- Case Study-Service ManagementDocumento2 páginasCase Study-Service ManagementAmadea SutandiAinda não há avaliações

- Sem V Tybcom Sample MCQS All Subjects PDFDocumento51 páginasSem V Tybcom Sample MCQS All Subjects PDFHarshal Tamore100% (2)

- Financial IntermediaryDocumento10 páginasFinancial Intermediaryalajar opticalAinda não há avaliações

- MTP Nov 16 Grp-2 (Series - I)Documento58 páginasMTP Nov 16 Grp-2 (Series - I)keshav rakhejaAinda não há avaliações

- Capitol One Get With Free CheckingDocumento4 páginasCapitol One Get With Free Checkingmwaltrip0100% (1)

- Cheviot ColtdDocumento41 páginasCheviot ColtdSubscriptionAinda não há avaliações

- New Regulation in Indian Financial Sector As Per FSLRCDocumento19 páginasNew Regulation in Indian Financial Sector As Per FSLRCSantosh ParasharAinda não há avaliações

- Course Outline Investment Banking - BKFSDocumento6 páginasCourse Outline Investment Banking - BKFSAman MehtaAinda não há avaliações

- Bcom 25 04Documento278 páginasBcom 25 04Abila RevathyAinda não há avaliações

- Credit Risk Scorecard MonitoringDocumento16 páginasCredit Risk Scorecard MonitoringyogeshthakkerAinda não há avaliações

- Dd/Mm/Yyyy: Request For ReservationDocumento14 páginasDd/Mm/Yyyy: Request For ReservationSouvik BardhanAinda não há avaliações

- Account Closure RequestDocumento1 páginaAccount Closure Requestanilmourya5Ainda não há avaliações

- Billingstatement - Primo R. JulianesDocumento2 páginasBillingstatement - Primo R. JulianesMaria Judith Peña Julianes100% (1)

- Himanshu CVDocumento1 páginaHimanshu CVHimanshu KatariaAinda não há avaliações

- KW 3 Documents 01Documento40 páginasKW 3 Documents 01Chethan GowdaAinda não há avaliações

- Other Bank Services Safety Deposit BoxDocumento3 páginasOther Bank Services Safety Deposit BoxTien BernabeAinda não há avaliações

- Bibliography Financial CrisisDocumento41 páginasBibliography Financial CrisisaflagsonAinda não há avaliações

- Federal Laws of EthiopiaDocumento42 páginasFederal Laws of EthiopiaSolomon Tekalign100% (2)

- Auditing EspinillaDocumento156 páginasAuditing EspinillaMin100% (1)

- Kunhibava 2012Documento11 páginasKunhibava 2012arin ariniAinda não há avaliações

- Munger Talk at Harvard-WestlakeDocumento10 páginasMunger Talk at Harvard-WestlakeSantangel's Review100% (7)

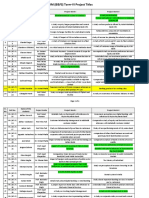

- PGDM (B&FS) Project Titles-1Documento5 páginasPGDM (B&FS) Project Titles-1PranitAinda não há avaliações

- Case Study 1234Documento2 páginasCase Study 1234Gemma RetesAinda não há avaliações

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocumento14 páginasMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionOsvaldo GonçalvesAinda não há avaliações

- Aud ProbDocumento9 páginasAud ProbKulet AkoAinda não há avaliações

- Sbi PDFDocumento5 páginasSbi PDFshweta pundirAinda não há avaliações