Escolar Documentos

Profissional Documentos

Cultura Documentos

Succession Notes

Enviado por

Jefferson Pond VictorianoDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Succession Notes

Enviado por

Jefferson Pond VictorianoDireitos autorais:

Formatos disponíveis

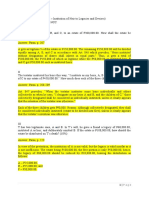

Articles 864-875: Fideicommissary and Conditional Testamentary Dispositions Prepared by: P.A.

Canada

1

Art. 864. A fideicommissary substitution

can never burden the legitime.

Situation: Ts only property is a house and lot in

Forbes park worth 20M

T instituted FS: A, only son (1

st

heir); B(2

nd

heir),

son of A

Q: Is the FS valid?

A: No. 10M legitime, 10M free portion

Rule: Legitime is reserved for compulsory heir

thus, no substitution allowed.

Art. 865. Every fideicommissary

substitution must be expressly made in

order that it may be valid. The fiduciary

shall be obliged to deliver the

inheritance to the second heir, without

other deductions than those which arise

from legitimate expenses, credits and

improvements, save in the case where

the testator has provided otherwise.

2 Parts:

1. FS must be EXPRESS to be valid

Reasons: a. not favored by law because

it limits the disposition of property

b. Under NCC on Succession,

one of objectives is socialization of

ownership and FS does not socialize

ownership of property because it is

limited to certain persons or within the

confines of the family.

2. Obligations of Fiduciary:

a. Obligation to Preserve the property;

b. Obligation to deliver the property to

2

nd

heir; and

c. Obligation to make inventory of the

property

3. Obligation to make inventory - implied

from the duty of fiduciary to make an account

(under 2

nd

par.).

Deductions the fiduciary make out of the

property:

1. Legitimate expenses- these are limited

only to NECESSARY expenses

2. Credits- refer to advances made by

fiduciary in nature of expenses which are

necessary.

3. Improvements- refer to necessary and

useful improvements.

Note: the amount of improvement is not

the one deductible, it is the increase of

the value of the property by reason of

the improvement.

Art. 866. The second heir shall acquire a

right to the succession from the time of

the testator's death, even though he

should die before the fiduciary. The right

of the second heir shall pass to his heirs.

Rule: Both 1

st

and 2

nd

heir must be alive at

the time of the death of testator. Whether

the 2

nd

heir dies ahead or after the 1

st

heir,

still this would not defeat the right of 2

nd

heir

to inherit.

Illustration:

T died in 1990, in the will it is

provided A shall deliver the property after

10 years to B. But in 1991, B died. (wala

niabot 10years)

Q: Can heirs of B get the property even

before 10years?

A: You have to observe 10 years

Q: But after 10 years, can A refuse to

deliver the property to heirs of B because

the latter dies before the expiration of 10

years.

A: No because B acquires right to

inheritance from the time of testators death

even though he should die before the

fiduciary. So Bs right shall pass to his own

heirs.

Articles 864-875: Fideicommissary and Conditional Testamentary Dispositions Prepared by: P.A. Canada

2

Art. 867. The following shall not take

effect:

(1) Fideicommissary substitutions which

are not made in an express manner,

either by giving them this name, or

imposing upon the fiduciary the absolute

obligation to deliver the property to a

second heir;

(2) Provisions which contain a perpetual

prohibition to alienate, and even a

temporary one, beyond the limit fixed in

article 863;

(3) Those which impose upon the heir

the charge of paying to various persons

successively, beyond the limit

prescribed in article 863, a certain

income or pension;

(4) Those which leave to a person the

whole part of the hereditary property in

order that he may apply or invest the

same according to secret instructions

communicated to him by the testator.

Illustrations:

(1) Lord Stark instuted Robb as his 1st heir.

His will states "I hereby institute Robb

as heir to my property and then later on

Sansa succeeds also to my property."

Q: Is there FS?

A: No because there is no obligation to

preserve and deliver although it may be

another kind of institution but not FS.

(2) When the right to inherit is successive: "

I hereby institute Jaime Lannister as

heir to my palace and all those who may

inherit from Jaime are prohibited from

alienating my property forever."

Q: Is the institution valid?

A: The institution is valid but the period

is not valid. (ArticI2 870)

In this case forever should only mean

20 years.

Another Illustration:

Lord Stark (Testator)

Jaime Lannister

Joffrey

Arya

So JL inherits after death of LS. After 15 years JL

died, naturally Joffrey inherits the property. During the

lifetime of JL he cannot dispose because it is

prohibited for 20 years but he died after 15 years.

Is Joffrey prohibited from disposing the property?

A: Yes because the testastor expressly provides that

JL and those who may inherit from him are prohibited

from alienating the property forever. So Jaime cannot

dispose the property for 5 years but after 5 years he

can now dispose the property.

Q: What if Jaime died after 3 years? So Arya now will

inherit, is Arya prohibited from alienating property for

2 years?

A: NO. it cannot go beyond 1 degree.( Note the

limitations under par.2)

(3) Situation: T institutes A as heir and A

has the obligation of paying to B

pension 10T/month. After B, C the child

of B 10T, and D the child of C 10/month.

Q: Is this allowed?

A: Yes, Article 867(3)

Requisites:

1. One degree apart

2. Both are living at the time of

testators death

Note: the counting must start

from B, so from B there is one degree to

C. If it comes from A there is no

successive payment.

Q: How about payment to D?

A: No longer allowed because this is

beyond the limit prescribed under Art

863.

Articles 864-875: Fideicommissary and Conditional Testamentary Dispositions Prepared by: P.A. Canada

3

(4) SECRET INSTRUCTIONS

"I hereby institute Pnoy as my heir for

the sole purpose of giving to some

person the 10M, the identity of such

person was already revealed by me to

Pnoy."

Rule: Institution as well as acquisition of

property is not valid for following

reasons:

a. Not all persons are

capacitated to inherit. As in

the case of concubine.

b. If instruction is secret how

would we know that heir

really disposed of the

property according to the

instruction of the testator?

Art. 868. The nullity of the

fideicommissary substitution does not

prejudice the validity of the institution of

the heirs first designated; the

fideicommissary clause shall simply be

considered as not written.

Example:

Lord Tywin instituted Joffrey as the 1st heir in

FS and after 10 years Joffrey will deliver to Lord

Varys, his friend.

Q: Is this valid FS?

A: NO, Lord Varys is a friend not qualified as 1st

degree (generation).

Q: Therefore, is Joffrey disallowed to inherit?

A: No. Only considered not written (Article 868).

It shall not prejudice the validity of the institution

of the heirs first designated.

Art. 869. A provision whereby the

testator leaves to a person the whole or

part of the inheritance, and to another

the usufruct, shall be valid. If he gives

the usufruct to various persons, not

simultaneously, but successively, the

provisions of Article 863 shall apply.

Example: "I hereby give to A the naked

ownership over my house and lot then the

usufruct to B and when B dies, C will succeed

the usufruct, and when C dies, D will succeed to

the usufruct."

From B-C is valid.

From C-D not valid because beyond the limit

under Article 863. If they are all best friends, all

are not valid because they are not 1 degree.

Note: Always measure under Art. 863

Cf: Art. 564, NCC

Art. 870. The dispositions of the testator

declaring all or part of the estate

inalienable for more than twenty years

are void.

Examples:

" I hereby give my property to A and A cannot

alienate the property AS LONG AS HE LIVES."

If A lives for 50 years, how long would be the

prohibition?

A: For 20 years only.

Q: What if A dies after 5 years? Should the heirs

of A be prohibited for an additional 15 years?

A: No because as long as he lives meaning

limited only to the lifetime of A.

Rules:

a. If 20 years valid

b. If more than 20 years, what is void is merely

the excess

c. If prohibition is silent still it is considered as 20

years. Same is true if the prohibition is forever.

Note: This cannot apply to legitime.

Cf: Art. 904(2

nd

par.), NCC

Articles 864-875: Fideicommissary and Conditional Testamentary Dispositions Prepared by: P.A. Canada

4

SECTION 4. - Conditional Testamentary

Dispositions

and Testamentary Dispositions With a

Term

Art. 871. The institution of an heir may be

made conditionally, or for a certain

purpose or cause.

Kinds of Institutions:

1. Simple or Pure- that which is absolute

not subject to any condition.

Ex. I hereby institute Versace as my

heir.

2. Conditional- that which is subject to a

condition.

Ex. I hereby institute Versace as my heir

to my house and lot if he passes the

bar.

3. Institution with a Term- that which is

subject to a term.

Ex. I hereby institute Versace as my heir

so that when Lacoste died, Versace will

get my car. (Death of Lacoste is the

term)

4. Modal Institution- that which is for a

certain purpose or cause or that which is

provided under Art.882 and Art.883.

Ex. I give to Versace 1M so that he may

use it in the bar operations for the CJC

Bar aspirants this September.

CONDITION(Succession)

A future or uncertain event or past event

unknown to the parties upon which the

acquisition or extinguishment of a right under

testamentary disposition is made subject.

Case: Morente vs De La Santa (refer to Paras

Book, p.263, 2013 Ed.)

Art. 872. The testator cannot impose any

charge, condition, or substitution

whatsoever upon the legitimes

prescribed in this Code. Should he do

so, the same shall be considered as not

imposed.

Rule:

No burden, substitution, condition, charge

should be imposed upon the legitime.

Effect of violation: the BSCoCha are considered

not written

Exception: Testator can validly impose

prohibition against partition of the legitime not

exceeding 20 years.Example(in your book):

A son was informed by father in a will

that he would get the legitime only if he pass the

bar. The Son failed in the bar.

Q: Is he entitled to his legitime?

A: YES, his father had no right to impose in any

condition on his legitime. Condition here is

considered not imposed.

Art. 873. Impossible conditions and

those contrary to law or good customs

shall be considered as not imposed and

shall in no manner prejudice the heir,

even if the testator should otherwise

provide. (792a)

IMPOSSIBLE CONDITIONS:

Review: In OBbliCon: when the condition

imposed is illegal or impossible, both the

obligation and condition are void.

In Succession: The institution is still valid just

disregard the impossible or illegal condition.

Reason: There is presumption in Succession

that the underlying reason for the institution is

the liberality of the testator not the illegal or

impossible condition.

Note: The reckoning point as to the legality or

illegality of condition is at the time when the

condition is to be performed. (Miciano vs Brimo)

Articles 864-875: Fideicommissary and Conditional Testamentary Dispositions Prepared by: P.A. Canada

5

Art. 874. An absolute condition not to

contract a first or subsequent marriage

shall be considered as not written unless

such condition has been imposed on the

widow or widower by the deceased

spouse, or by the latter's ascendants or

descendants.

Nevertheless, the right of usufruct, or an

allowance or some personal prestation

may be devised or bequeathed to any

person for the time during which he or

she should remain unmarried or in

widowhood. (793a)

RELATIVE PROHIBITION- This is allowed.

But if this would amount to an absolute

prohibition like not to marry for 60 years

then it is not allowed.

Ex. Prohibited to marry a particular person

or prohibited to marry in a particular time.

ABSOLUTE PROHIBITION- Not allowed.

Ex. I hereby institute Derek Ramsey as my

heir provided he will not marry at all

otherwise he will forfeit the inheritance.

Exceptions:

1. When the condition is imposed upon

the spouse by a deceased spouse

2. If imposed by the ascendants or

descendants of a deceased spouse

to the spouse of the deceased

spouse.

Ex.: C and D are parents of

B. A and B are husband and

wife. B is now dead. C

provided in his will I institute

A as my heir but if A will re-

marry then she will forfeit her

inheritance.

2

nd

par.: I hereby institute my friend Jennifer

Garner as heir to my properties and because

she is an heir she will enjoy the use and

possession of my properties. But if she will

marry she will forfeit my property. this is

allowed.

But remember par.2, the heir already

enjoys the property unlike 1

st

par. The property

is not yet enjoyed. Here in 2

nd

par. Enjoyed na

meron syang usufruct or allowance or some

personal prestation like free service to parlor ng

testator. That is allowed and to provide that the

heir will forfeit the usufruct, allowance or

personal prestation that may be valid.

Take note|: Limited lang sa USUFRUCT,

ALLOWANCE or PERSONAL PRESTATION. If

hindi mag fall amone these three it is not

considered valid prohibition.

Reason for Article 874: Public Policy. The law

provide that marriage is an inviolable social

instiution. So the law really looks at marriage as

sacred and it should be preserve as much as

possible.

Art. 875. Any disposition made upon the

condition that the heir shall make some

provision in his will in favor of the

testator or of any other person shall be

void. (794a)

DISPOSITION CAPTATORIA

Example: I hereby institute Billl Gates as

my heir provided that he will also institute

me as his heir. Or , provided that he will

institute my son or my friend or anybody as

his own heir.

Reason of prohibition: Because the

controlling motive or the main consideration

in Succession is the liberality of the testator.

If this is allowed, then you are making

testamentary privilege as contractual

privilege. You are turning your will into a

contract.

Q: What if not in the will but the heir just

execute a Deed of Donation in favor of the

testator or some of other person. Can you

call that analogous to Disposition

Captatoria.

A: No because the law says WILL. So if is in

a Deed of Donation then there is no

Disposition Captatoria.

END HERE

Você também pode gostar

- Paras Chapter 2 Testamentary Succession Section 3 Substitution of HeirsDocumento4 páginasParas Chapter 2 Testamentary Succession Section 3 Substitution of HeirsEllen Glae Daquipil100% (2)

- SuccessionDocumento3 páginasSuccessionEKANGAinda não há avaliações

- Collector of Internal Revenue vs. Anglo California National Bank (Crocker-Anglo National Bank), As Treasurer For Calamba Sugar Estate, Inc. G.R. No. L-12476 January 29, 1960 FactsDocumento4 páginasCollector of Internal Revenue vs. Anglo California National Bank (Crocker-Anglo National Bank), As Treasurer For Calamba Sugar Estate, Inc. G.R. No. L-12476 January 29, 1960 FactsJem PagantianAinda não há avaliações

- BusOrg Partnership Case CompilationDocumento87 páginasBusOrg Partnership Case CompilationpandaAinda não há avaliações

- Canons 12 Ans 13 Bar QuestionsDocumento5 páginasCanons 12 Ans 13 Bar QuestionsR Ann JSAinda não há avaliações

- Legal Ethics and Practical Exercises I TRUE or FALSE. Answer TRUE If The Statement Is True, or FALSE If The Statement Is False. ExplainDocumento6 páginasLegal Ethics and Practical Exercises I TRUE or FALSE. Answer TRUE If The Statement Is True, or FALSE If The Statement Is False. Explainzhoy26Ainda não há avaliações

- Guidelines in Imposition of Community Service ActDocumento7 páginasGuidelines in Imposition of Community Service ActKobe Lawrence VeneracionAinda não há avaliações

- Outline 328 Special Laws (VI) 1 Of10: 2020-2021) CommercialDocumento10 páginasOutline 328 Special Laws (VI) 1 Of10: 2020-2021) CommercialQueenVictoriaAshleyPrietoAinda não há avaliações

- D.3.1. G.R. No. 173864 November 23, 2015 Bangko Sentral NG Pilipinas, Petitioner, v. AGUSTIN LIBO-ON, Respondent. FactsDocumento2 páginasD.3.1. G.R. No. 173864 November 23, 2015 Bangko Sentral NG Pilipinas, Petitioner, v. AGUSTIN LIBO-ON, Respondent. FactsEmmanuel Princess Zia SalomonAinda não há avaliações

- MCIAA V Heirs of Marcelino SetoDocumento3 páginasMCIAA V Heirs of Marcelino SetoNLainie OmarAinda não há avaliações

- Art. 845-854Documento20 páginasArt. 845-854Liz ZieAinda não há avaliações

- In Re: Chanliongco - Digested By: Rikka Cassandra J. Reyes Doctrine of The CaseDocumento2 páginasIn Re: Chanliongco - Digested By: Rikka Cassandra J. Reyes Doctrine of The CaseRikka ReyesAinda não há avaliações

- Pastor, Jr. vs. Court of AppealsDocumento22 páginasPastor, Jr. vs. Court of AppealsMinorka Sushmita Pataunia Santoluis0% (1)

- Succession Digests Part 2Documento57 páginasSuccession Digests Part 2cmv mendoza100% (3)

- Special Commercial Law Lecture Notes Philord Aranda Letters of CreditDocumento8 páginasSpecial Commercial Law Lecture Notes Philord Aranda Letters of CreditFiels GamboaAinda não há avaliações

- Chiong Joc Soy V VanoDocumento2 páginasChiong Joc Soy V Vanocraftersx100% (1)

- 2020-4-20 Resolution - Amadea AquinoDocumento8 páginas2020-4-20 Resolution - Amadea AquinoMichelle Fajardo100% (2)

- Tamano V Ortiz Et Al, GR No 126603, 06-29-1998Documento4 páginasTamano V Ortiz Et Al, GR No 126603, 06-29-1998Angeline Samonte-AlcayagaAinda não há avaliações

- PolicyDocumento17 páginasPolicyowen100% (1)

- LTD Cases 7 - RemediesDocumento41 páginasLTD Cases 7 - RemediesJalieca Lumbria GadongAinda não há avaliações

- People Vs CamposDocumento1 páginaPeople Vs Camposracrabe0% (1)

- Conflicts of Law 1st ExamDocumento53 páginasConflicts of Law 1st ExamjaneAinda não há avaliações

- Legacies and DevicesDocumento29 páginasLegacies and DevicesLatjing SolimanAinda não há avaliações

- Diaz V de Leon, 43 Phil 413Documento11 páginasDiaz V de Leon, 43 Phil 413angelo6chingAinda não há avaliações

- Sajonas v. CA, GR 102377, July 5, 1996, 285 SCRA 79Documento1 páginaSajonas v. CA, GR 102377, July 5, 1996, 285 SCRA 79Gia Dimayuga100% (1)

- Requirement For Provisional RemedyDocumento5 páginasRequirement For Provisional RemedyEdsel Ian S. FuentesAinda não há avaliações

- Capacity To Succeed by Will or by IntestacyDocumento3 páginasCapacity To Succeed by Will or by IntestacyKara Russanne Dawang Alawas100% (2)

- 140.national Investment and Development Corp. vs. AquinoDocumento18 páginas140.national Investment and Development Corp. vs. Aquinovince005Ainda não há avaliações

- Succession Law NotesDocumento28 páginasSuccession Law NotesJan Jason Guerrero LumanagAinda não há avaliações

- Salao SyllabusDocumento22 páginasSalao SyllabusOtep de MesaAinda não há avaliações

- Institution of HeirsDocumento10 páginasInstitution of HeirsRosanna Sigua Espino100% (1)

- Gruba Transfer Tax NotesDocumento30 páginasGruba Transfer Tax NoteskennethAinda não há avaliações

- Dorotheo vs. CA 330 SCRA 12 DigestDocumento2 páginasDorotheo vs. CA 330 SCRA 12 DigestManz Edam JoverAinda não há avaliações

- Third Division: Notice NoticeDocumento5 páginasThird Division: Notice NoticeKarl PunzalAinda não há avaliações

- Benedicto V IACDocumento4 páginasBenedicto V IACjohnmiggyAinda não há avaliações

- Property Case Digest DonationDocumento13 páginasProperty Case Digest DonationXing Keet LuAinda não há avaliações

- Pale Midterm Exam PartDocumento2 páginasPale Midterm Exam PartChristalyn CasilAinda não há avaliações

- Legal Ethics Case AnalysisDocumento2 páginasLegal Ethics Case AnalysisRayBradleyEduardoAinda não há avaliações

- Usufruct CasesDocumento24 páginasUsufruct CasesMay AnascoAinda não há avaliações

- McCarty vs. LangdeauDocumento1 páginaMcCarty vs. LangdeauCindee YuAinda não há avaliações

- Case Digests Discovery: Montealto - 1Documento12 páginasCase Digests Discovery: Montealto - 1Ruby ReyesAinda não há avaliações

- Digest On Natres CasesDocumento43 páginasDigest On Natres CasesRimvan Le SufeorAinda não há avaliações

- 2022 Bar Exam Questions On Remedial Law 1Documento4 páginas2022 Bar Exam Questions On Remedial Law 1Sirc LabotAinda não há avaliações

- Course Outline - Agency, Trusts & Partnership (SY 2021-22)Documento5 páginasCourse Outline - Agency, Trusts & Partnership (SY 2021-22)Mary.Rose RosalesAinda não há avaliações

- Vacancies in Succession, How To Fill Up Such Vacancy, and Intestate SuccessionDocumento31 páginasVacancies in Succession, How To Fill Up Such Vacancy, and Intestate SuccessionShasharu Fei-fei Lim100% (1)

- Banco Filipino Savings and Mortgage Bank v. CA, GR 143896, July 8, 2005, 463 SCRA 64Documento1 páginaBanco Filipino Savings and Mortgage Bank v. CA, GR 143896, July 8, 2005, 463 SCRA 64Gia DimayugaAinda não há avaliações

- Villa Rey Transit vs. Ferrer DigestDocumento2 páginasVilla Rey Transit vs. Ferrer Digestw8ndblid100% (1)

- Norkis Trading Vs NLRC Labor DigestDocumento2 páginasNorkis Trading Vs NLRC Labor Digestlucas0% (1)

- Course Syllabus in Wills and SuccessionDocumento8 páginasCourse Syllabus in Wills and SuccessionKier SinghAinda não há avaliações

- 1.castillo VS Ca 205 Scra 529Documento4 páginas1.castillo VS Ca 205 Scra 529Lord AumarAinda não há avaliações

- RRSV TortsDocumento14 páginasRRSV TortsQueen Alipayo100% (1)

- Case 2: Vs - Sandiganbayan (Fourth Division), Jose LDocumento3 páginasCase 2: Vs - Sandiganbayan (Fourth Division), Jose Lidmu bcpo100% (1)

- Acquisition of Properties Subject of LitigationDocumento15 páginasAcquisition of Properties Subject of Litigationgalaxy82yngelAinda não há avaliações

- 11 Baltazar vs. LaxaDocumento1 página11 Baltazar vs. LaxaJoshua Erik MadriaAinda não há avaliações

- Capistrano & Capistrano For Appellants. Quirino D. Carpio For Petitioners-Intervenors. Vicente C. Feria and Nicolas E. Adamos in Their Own BehalfDocumento11 páginasCapistrano & Capistrano For Appellants. Quirino D. Carpio For Petitioners-Intervenors. Vicente C. Feria and Nicolas E. Adamos in Their Own BehalfMargreth MontejoAinda não há avaliações

- Montinola-Sanson vs. CADocumento1 páginaMontinola-Sanson vs. CANiel Alen BallezaAinda não há avaliações

- Subsequent RegistrationDocumento12 páginasSubsequent RegistrationAnnHopeLoveAinda não há avaliações

- Rule 114, 115 & 116 CasesDocumento41 páginasRule 114, 115 & 116 CasesfatimasenAinda não há avaliações

- Succession Notes - Finals - 2018Documento30 páginasSuccession Notes - Finals - 2018Michael Vincent BautistaAinda não há avaliações

- Quiz 20 Past QuizzesDocumento23 páginasQuiz 20 Past QuizzesSarah Joy Corpuz-Cabasag100% (1)

- Mwa 2 - The Legal MemorandumDocumento3 páginasMwa 2 - The Legal Memorandumapi-239236545Ainda não há avaliações

- Prime White Cement vs. Iac Assigned CaseDocumento6 páginasPrime White Cement vs. Iac Assigned CaseStephanie Reyes GoAinda não há avaliações

- Capstone Report FormatDocumento11 páginasCapstone Report FormatAnkush PalAinda não há avaliações

- Report Body of IIDFC - 2Documento120 páginasReport Body of IIDFC - 2Shanita AhmedAinda não há avaliações

- MOtivating Your Teenager PDFDocumento66 páginasMOtivating Your Teenager PDFElleMichelle100% (1)

- Comfrey Materia Medica HerbsDocumento17 páginasComfrey Materia Medica HerbsAlejandra Guerrero100% (1)

- Ivler vs. Republic, G.R. No. 172716Documento23 páginasIvler vs. Republic, G.R. No. 172716Joey SalomonAinda não há avaliações

- Designing A Peace Building InfrastructureDocumento253 páginasDesigning A Peace Building InfrastructureAditya SinghAinda não há avaliações

- NetStumbler Guide2Documento3 páginasNetStumbler Guide2Maung Bay0% (1)

- Economic Value Added in ComDocumento7 páginasEconomic Value Added in Comhareshsoni21Ainda não há avaliações

- Hero Cash Cash Lyrics - Google SearchDocumento1 páginaHero Cash Cash Lyrics - Google Searchalya mazeneeAinda não há avaliações

- Errol PNP Chief AzurinDocumento8 páginasErrol PNP Chief AzurinDarren Sean NavaAinda não há avaliações

- Evidentiary Value of NarcoDocumento2 páginasEvidentiary Value of NarcoAdv. Govind S. TehareAinda não há avaliações

- D5 PROF. ED in Mastery Learning The DefinitionDocumento12 páginasD5 PROF. ED in Mastery Learning The DefinitionMarrah TenorioAinda não há avaliações

- Aff Col MA Part IIDocumento90 páginasAff Col MA Part IIAkanksha DubeyAinda não há avaliações

- 2019 Ulverstone Show ResultsDocumento10 páginas2019 Ulverstone Show ResultsMegan PowellAinda não há avaliações

- Accountancy Department: Preliminary Examination in MANACO 1Documento3 páginasAccountancy Department: Preliminary Examination in MANACO 1Gracelle Mae Oraller0% (1)

- Measuring Trend and TrendinessDocumento3 páginasMeasuring Trend and TrendinessLUCKYAinda não há avaliações

- Conversational Maxims and Some Philosophical ProblemsDocumento15 páginasConversational Maxims and Some Philosophical ProblemsPedro Alberto SanchezAinda não há avaliações

- Talent Development - FranceDocumento6 páginasTalent Development - FranceAkram HamiciAinda não há avaliações

- Global Marketing & R&D CH 15Documento16 páginasGlobal Marketing & R&D CH 15Quazi Aritra ReyanAinda não há avaliações

- Summar Training Report HRTC TRAINING REPORTDocumento43 páginasSummar Training Report HRTC TRAINING REPORTPankaj ChauhanAinda não há avaliações

- SPQRDocumento8 páginasSPQRCamilo PeraltaAinda não há avaliações

- Nespresso Case StudyDocumento7 páginasNespresso Case StudyDat NguyenAinda não há avaliações

- Ad1 MCQDocumento11 páginasAd1 MCQYashwanth Srinivasa100% (1)

- (U) Daily Activity Report: Marshall DistrictDocumento6 páginas(U) Daily Activity Report: Marshall DistrictFauquier NowAinda não há avaliações

- Kodak Case StudyDocumento8 páginasKodak Case StudyRavi MishraAinda não há avaliações

- RBMWizardDocumento286 páginasRBMWizardJesus EspinozaAinda não há avaliações

- CopacabanaDocumento2 páginasCopacabanaNereus Sanaani CAñeda Jr.Ainda não há avaliações

- Dan 440 Dace Art Lesson PlanDocumento4 páginasDan 440 Dace Art Lesson Planapi-298381373Ainda não há avaliações