Escolar Documentos

Profissional Documentos

Cultura Documentos

Overview of Ukrainian Pharmaceutical Market: Adam Smith Conferences The 5 CIS Pharmaceutical Forum

Enviado por

Mariana GnaskoDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Overview of Ukrainian Pharmaceutical Market: Adam Smith Conferences The 5 CIS Pharmaceutical Forum

Enviado por

Mariana GnaskoDireitos autorais:

Formatos disponíveis

Adam Smith Conferences

The 5

th

CIS Pharmaceutical Forum

Overview of Ukrainian pharmaceutical market

Gorlova Irina, CEO

February 12, 2014

Ukraine remains the 2

nd

largest market in CIS, shows

positive growth in values and still slow down in units

2

Population,

MM

CTYs MM$ Growth, %$ MM Units Growth, %Units

143 Russia* 25 800 13% 5 501 -0,72%

46 Ukraine 3 730 9% 1 260 -2%

17 Kazakhstan** 1 559 24% 660 2%

30 Uzbekistan 948 8% 603 6%

9 Belarus 933 41% 366 15%

9 Azerbaijan 650 24% 199 3%

4 Georgia 458 33% 103 3%

4 Moldova 234 11% 92 5%

5 Turkmenistan*** 200 8% 90 0%

3 Armenia 163 31% 33 19%

8 Tajikistan 110 8% 56 4%

6 Kyrgyzstan 112 21% 93 2%

283 TOTAL 35 000 9 056

Source: SMD 2012, *DSM 2012, ** Vi Ortis, ***SMD estimation

76%

10%

4%

3%

2%

2%

1%

1%

1% 0%

0%

0%

Market share of CTYs in values (USD)

Russia*

Ukraine

Kazakhstan

Uzbekistan***

Belarus

Azerbaijan

Georgia

Moldova

Turkmenistan**

Armenia

Tajikistan

Kyrgyzstan

64%

13%

7%

6%

3%

2%

1%

1%

1%

0%

1%

1%

Market share of CTYs in units

Russia*

Ukraine

Kazakhstan

Uzbekistan***

Belarus

Azerbaijan

Georgia

Moldova

Turkmenistan**

Armenia

Tajikistan

Kyrgyzstan

FY 2013 results

Per capita spending in values (USD) and units in CIS,

FY2013 results

3

Per capita consumption in units is much higher in countries, where there are prototypes of

reimbursement system and government participate in compensation of treatment for

population (Kazakhstan, Belarus)

180 81 92 32 104 72 95 59 40 54 15 19 123

38

27

39

20

41

22

26

23

18

11

7

16

32

0

5

10

15

20

25

30

35

40

45

0

20

40

60

80

100

120

140

160

180

200

R

u

s

s

i

a

U

k

r

a

i

n

e

K

a

z

a

k

h

s

t

a

n

U

z

b

e

k

i

s

t

a

n

B

e

l

a

r

u

s

A

z

e

r

b

a

i

j

a

n

G

e

o

r

g

i

a

M

o

l

d

o

v

a

T

u

r

k

m

e

n

i

s

t

a

n

A

r

m

e

n

i

a

T

a

j

i

k

i

s

t

a

n

K

y

r

g

y

z

s

t

a

n

T

o

t

a

l

C

I

S

p

e

r

c

a

p

i

t

a

i

n

u

n

i

t

s

p

e

r

c

a

p

i

t

a

i

n

$

per capita $ per capita units

Ukrainian pharma market is passing through market

redistribution due to obligatory GMP certification

4

Current Market Trends

Market is driven by out-of-pocket spending

Obligatory GMP certification market has

been cleared from products and

companies, that do not meet the

requirements

Obligatory GMP certification

concentration of sales among leading

companies and products in therapeutical

niches

Growth in segment of food supplements,

switch of products from OTC to FS

Effect of reimbursement pilot project

products against hypertension growth

in cardiology segment

Ukraine: Market Trends in Values (USD)

Source: SMD Retail & Hospital Data; includes all categories

(Rx, OTC, Food Supplements, Patient & Personal Care);

price level pharmacy purchase price for retail, tender price for

hospital data

41%

27%

21%

28%

-9%

7%

12%

16%

9%

-20%

-10%

0%

10%

20%

30%

40%

50%

0,0

0,5

1,0

1,5

2,0

2,5

3,0

3,5

4,0

4,5

5,0

2004Y 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y

G

r

o

w

t

h

i

n

V

a

l

u

e

s

(

U

S

D

)

%

S

a

l

e

s

i

n

V

a

l

u

e

s

,

B

l

n

U

S

D

5

Ukraine being the 2nd biggest market in CIS, remains

mainly out-of-pocket

Source: SMD Retail & Hospital Data; includes only medicines

Retail segment

Market size - 3 bln USD

Growth in values (USD) +9,3%

Hospital Central Budget

Market size - 0,25 bln USD

Growth in values (USD) +12%

Hospital Regional Budget

Market size - 0,28 bln USD

Growth in values (USD) +14%

Individual tender hospital

purchases

Market size - 0,16 bln USD

Growth in values (USD) - 6%

Sources of financing

81%

4%

8%

7%

Retail - Out-of-

pocket

Hospital Individual

tender purchases

Hospital Regional

Budget

Hospital Central

Budget

690 MM USD

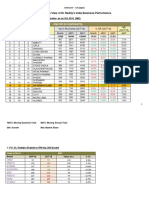

Top 20 corporations in retail segment local companies

improved position considerably

6

USD(Rank) USD(Rank) Corporation MM USD USD(%) USD(+-%) Ev Index

Y2012 Y2013 RETAIL SEGMENT 3 034 100,0% 9% 100

1 1 FARMAK 136 4,5% 4% 96

2 2 SANOFI 130 4,3% 7% 98

3 3 NOVARTIS 125 4,1% 15% 106

4 4 MENARINI GROUP 123 4,0% 15% 106

5 5 TAKEDA 108 3,6% 12% 103

6 6 TEVA 101 3,3% 10% 101

8 7 DARNITSA 93 3,1% 19% 109

7 8 SERVIER GROUP 90 3,0% 7% 98

10 9 ARTERIUM 83 2,7% 13% 103

11 10 BAYER HEALTHCARE 82 2,7% 18% 108

9 11 GLAXOSMITHKLINE 82 2,7% 10% 101

12 12 GEDEON RICHTER 73 2,4% 16% 106

13 13 KRKA 67 2,2% 14% 105

14 14 ZDOROVJE GROUP 64 2,1% 12% 102

19 15 KIEV VITAMIN FACTORY 51 1,7% 26% 115

17 16 ACTAVIS 51 1,7% 12% 102

16 17 INTERCHEM UKR 51 1,7% 7% 98

18 18 ABBOTT 50 1,6% 20% 109

20 19 BORSHCHAHIVSKY CHIMPHARM 45 1,5% 16% 106

21 20 STADA 39 1,3% 11% 101

Main trends among corporations in retail segment

Many companies lost position and some of them

almost left the market due to GMP certification

(Genom, Grindex, Belbiopharm, Mili, Apotex);

small Indian, Russian, Pakistan companies left the

market.

Some companies used opportunities and

substitute vacant niches (Kiev Vitamin factory,

Abbott, Bayer Consumer, Novartis Consumer,

Astellas, Kuzum)

Local manufacturers lost sales in antibiotic

segment, ophthalmology and antivirals.

Some foreign lost sales in cough & cold,

especially combined ones, musculoskeletal anti-

inflammatory agents and antibiotics.

7

Corporation SU MS (%) 2012Y 2013Y Grw MS

KRKA 42,8% 43,6%

SANOFI 13,6% 13,0%

ACTAVIS 1,1% 6,3%

KIEV VITAMIN FACTORY 4,9% 4,9%

FARMAK 5,4% 4,7%

ASTRAZENECA 3,7% 4,7%

RANBAXY 3,4% 2,9%

MENARINI GROUP 7,6% 2,8%

KUSUM HEALTHCARE 2,3% 2,7%

PFIZER INCORPORATED 2,1% 2,3%

DR.REDDYS LAB 1,7% 1,7%

POLPHARMA 0,9% 1,7%

GEDEON RICHTER 0,6% 1,4%

SERVIER GROUP 0,3% 0,9%

TEVA 1,2% 0,8%

Example from Statins life

Source: SMD Retail Data;

Small companies left the market. As well non-GMP factors

played role, shortage of stocks, etc.

Market results of a/hypertensive pilot project growth in

SU (Standard units) +34% vs retail market decrease (-0,2%)

7 molecules participate in project since May 2012; + 3 combinations were added since June

2013

In Y2013 state budget allocated 39 MM USD, less than half was used

The highest growth in SU was demonstrated by Lisinopril (+84%), Amlodipin (+64%) Nebivolol

(+65%), Bisosprolol (+47%)

The best results were demonstrated by Teva, KRKA, and local companies Farmak, BHFZ,

KievVitamin factory and Kusum

8

0

50 000 000

100 000 000

150 000 000

200 000 000

250 000 000

2004Y 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y

s

a

l

e

s

i

n

s

t

a

n

d

a

r

d

u

n

i

t

s

(

S

U

)

AMLODIPINE AMLODIPINE+LISINOPRIL

BISOPROLOL ENALAPRIL+HYDROCHLOROTHIAZIDE

ENALAPRILI MALEAS LISINOPRIL

LISINOPRIL+HYDROCHLOROTHIAZIDE METOPROLOL

NEBIVOLOL NIFEDIPINE

9

INN MM USD USD(+-%) Units(%) SU(+-%)

7 INNs of project since May 2012 78 23,68% 100,00% 33,86%

AMLODIPINE 14 26,76% 15,45% 64,16%

BISOPROLOL 23 23,38% 19,22% 46,97%

ENALAPRILI MALEAS 13 1,77% 35,09% 14,52%

LISINOPRIL 15 53,00% 16,35% 83,44%

METOPROLOL 3 -1,68% 4,52% 7,94%

NEBIVOLOL 8 44,83% 3,63% 65,05%

NIFEDIPINE 3 3,08% 5,74% -2,13%

Additional 3 INNs, enter project in June 2013 27 14,26% 100,00% 5,97%

AMLODIPINE+LISINOPRIL 7 13,05% 9,18% 10,48%

ENALAPRIL+HYDROCHLOROTHIAZIDE 11 5,88% 62,81% 0,45%

LISINOPRIL+HYDROCHLOROTHIAZIDE 10 25,99% 28,02% 15,64%

Source: SMD Retail Data

Market results of a/hypertensive pilot project growth in

SU (Standard units) +34% vs retail market decrease (-0,2%)

10

The fastest growing ATC3 classes cardiology and

diabetes

Units(Rank) ATC3 Name Units(%) SU(+-%)

Retail Market growth 100,0% -0,2%

6 M01A Anti-rheumatics, non-steroidal 3,5% 6%

14 C09A A inhibitors, plain 1,6% 24%

22 A05B Hepatic protectors, lipotropics 1,1% 9%

26 C07A Beta-blocking agents, plain 1,0% 25%

27 A03A Plain antispasmodics and anticholinergics 0,9% 11%

33 B01C Platelet aggregation inhibitors 0,7% 6%

38 C08A Calcium antagonists, plain 0,6% 28%

65 A10J Biguanide antidiabetics 0,3% 19%

67 A11X Other vitamins 0,3% 6%

72 N05C Tranquillisers 0,3% 5%

73 L03B Interferons 0,3% 17%

80 N07X All other CNS drugs 0,2% 9%

83 S01G Ocular anti-allergics, decongestants, antiseptics 0,2% 11%

91 C10A Cholesterol and triglyceride regulating preparations 0,2% 18%

100 R03X All other anti-asthma and copd products 0,2% 8%

102 C09D Angiotensin-II antagonists, combinations 0,2% 22%

111 C09C Angiotensin-II antagonists, plain 0,1% 16%

Source: SMD Retail Data

11

Top 20 leading products generations change on the

market. Modern and more effective come.

2004Y MM USD

Cost of pack ,

USD

2013Y MM USD

Cost of pack

, USD

ACTOVEGIN 7 11,7

ACTOVEGIN 33 23,0

ESSENTIALE FORTE N 7 6,3

CODTERPIN IC 27 1,9

MILDRONAT 6 4,9

NO SPA 19 2,9

NO SPA 6 2,4

CARDIOMAGNYL 18 3,9

NATRII CHLORIDUM 5 0,4

ESSENTIALE FORTE N 17 9,4

FESTAL 5 2,2

GROPRINOSIN 13 12,5

MEZYM FORTE 4 1,1

SPASMALGON 13 2,3

VIAGRA 4 25,2

NIMESIL 13 10,1

CAPTOPRES DARNITSA 4 0,9

NATRII CHLORIDUM 13 0,6

KETANOV 3 2,7

CITRAMON DARNITSA 13 0,3

LASOLVAN 3 3,7

CERAXON 13 41,4

PHEZAM 3 2,5

PREDUCTAL 13 12,2

PREDUCTAL 3 10,3

LINEX 12 4,8

NAPHTHYZIN 3 0,2

CARSIL 12 5,2

BISEPTOL 3 1,1

CANEPHRON N 12 8,3

GLUCOSE 3 0,5

AUGMENTIN 11 6,9

PROSTAMOL UNO 3 8,4

AMIXIN IC 11 8,4

FLUCONAZOL 3 2,4

HEPTRAL 11 46,0

CORVALOL 3 0,2

DETRALEX 11 18,7

FERVEX 3 2,0

DIABETON 10 7,8

Source: SMD Retail Data

12

1 2 3 4 5 6 7 8 9 10 11 12

OPTIMA BADM ALBA

VENTA FRA M FARMPLANETA

Leading retail wholesalers ongoing concentration

MS Y 2012 MS Y2013

OPTIMA 29% 30%

BADM 26% 29%

ALBA 18% 12%

VENTA 8% 12%

FRA M 5% 4%

FARMPLANETA 4% 2%

Retail sales during Y2013 ongoing concentration Top 6 make 89% of retail sales

Leading wholesalers have different portfolio specialization on foreign vs local products, ATC

groups, etc.

Due to obligatory GMP certification, that took place on the market in Y2013, leading wholesalers

were effected as well. As some products and companies dropped off their portfolio and should

be substituted in short time period

Source: SMD Retail Wholesalers Report

Leading wholesalers in Hospital segment level of

concentration is much less

13

Top 5 companies make 53% of hospital market

From retail wholesalers BaDM and Alba are either

strong as in retail sales

Rank

LEADING WHOLESALERS IN

HOSPITAL MARKET Y2013

USD (%)

HOSPITAL MARKET 100,0%

1 BADM 18,0%

2 ASTA 17,0%

3 ALBA 7,9%

4 MEDFARKOM CENTER 5,4%

5 FRA M 4,9%

6 LUDMILA FARM 4,5%

7 FARMADIS 4,4%

8 LINK MEDICAL 4,1%

9 BIOFARMA 3,5%

10 INDAR 3,1%

11 OPTIMA 2,6%

12 OTHERS (143) 24,5%

18,0%

17,0%

7,9%

5,4%

4,9%

24,5%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

OTHERS (143)

OPTIMA

INDAR

BIOFARMA

LINK MEDICAL

FARMADIS

LUDMILA FARM

FRA M

MEDFARKOM

CENTER

ALBA

ASTA

BADM

Source: SMD Hospital Wholesalers Report

Main trend in retail pharmaceutical chains-kiosks left the

market, number of point of sales decreased to level of 2002

Total number of point of sales decrease due to the fact that kiosks were closed

Total number of point of sales according to licenses 20,5 K 15,3K pharmacies and 4,2K

points

14

18500

19000

19500

20000

20500

21000

21500

22000

22500

23000

23500

24000

0

2000

4000

6000

8000

10000

12000

14000

16000

18000

0

1

.

0

1

.

2

0

0

2

0

1

.

0

5

.

2

0

0

2

0

1

.

0

9

.

2

0

0

2

0

1

.

0

1

.

2

0

0

3

0

1

.

0

5

.

2

0

0

3

0

1

.

0

9

.

2

0

0

3

0

1

.

0

1

.

2

0

0

4

0

1

.

0

5

.

2

0

0

4

0

1

.

0

9

.

2

0

0

4

0

1

.

0

1

.

2

0

0

5

0

1

.

0

5

.

2

0

0

5

0

1

.

0

9

.

2

0

0

5

0

1

.

0

1

.

2

0

0

6

0

1

.

0

5

.

2

0

0

6

0

1

.

0

9

.

2

0

0

6

0

1

.

0

1

.

2

0

0

7

0

1

.

0

5

.

2

0

0

7

0

1

.

0

9

.

2

0

0

7

0

1

.

0

1

.

2

0

0

8

0

1

.

0

5

.

2

0

0

8

0

1

.

0

9

.

2

0

0

8

0

1

.

0

1

.

2

0

0

9

0

1

.

0

5

.

2

0

0

9

0

1

.

0

9

.

2

0

0

9

0

1

.

0

1

.

2

0

1

0

0

1

.

0

5

.

2

0

1

0

0

1

.

0

9

.

2

0

1

0

0

1

.

0

1

.

2

0

1

1

0

1

.

0

5

.

2

0

1

1

0

1

.

0

9

.

2

0

1

1

0

1

.

0

1

.

2

0

1

2

0

1

.

0

5

.

2

0

1

2

0

1

.

0

9

.

2

0

1

2

0

1

.

0

1

.

2

0

1

3

0

1

.

0

5

.

2

0

1

3

T

O

T

A

L

#

#

O

F

P

H

A

R

M

A

C

I

E

S

,

P

O

I

N

T

S

,

K

I

O

S

K

S

TOTAL

PHARMACIES

KIOSKS

POINTS

Dynamic of licensed point of sales in Ukraine YY 2002 - 2013

Source: State Drug Authority

Main trends retail chains ongoing concentration,

nationalization, competition becomes stronger

In (N) number of oblasts, where there are point of sales

15

# REG PHARMA CHAINS POS# MS

1 UKR (26) MED SERVICE 352 2,29%

2 UKR (19) APTEKA ZDOROVJA 115 2,15%

3 UKR (16) BAZHAEMO ZDOROVJA 105 2,09%

4 UKR (7) APTEKA NIZKIH TSIN/BLAGODIYA 162 1,72%

5 UKR (18) FARMASTOR 119 1,63%

6 LUG LUGANSKAYA FARMACIA 452 1,57%

7 UKR (4) UKR PHARM HOLDING 174 1,55%

8 DON ARNIKA 129 1,32%

9 KIEV KIEV FARMACIA 164 1,19%

10 UKR (17) FALBI 188 1,09%

11 POL POLTAVAFARM 225 1,01%

12 DNE APTEKI MED ACADEMII 22 0,82%

13 UKR (8) SALVE 136 0,76%

14 UKR (2) ODESSA FARMACIA/ APT GAEVSKOGO 144 0,74%

15 UKR (2) KONEKS 64 0,68%

16 KIR LIKI KIROVOGRADSCHINI 159 0,68%

17 DON ECOILLICHPRODUCT 51 0,61%

18 DON DONBASS FARMACIA TRAIDING 117 0,59%

19 UKR (8) FAR TOP 94 0,59%

20 UKR (8) TVA GROUP 58 0,58%

Source: SMD Retail Pharmacy Chain report

Background for forecast

Potential constrains

Destabilization of internal political situation, threat of military option to resolve the

conflict

Growth of currency exchange rate and risk of hryvna devaluation

Ongoing economic recession, loss of purchasing power by population

Potential Drivers

The National Bank of Ukraine moved to a flexible exchange rate, according to

recommendations of IMF

International monetary support tranches of the credit from Russia; potential credit

line from IMF

Ongoing reimbursement in form of co-payment within pilot projects (hypertension,

oral anti-diabetic products)

16

Current economic and political situation in the country gives no hope for a speedy recovery in the

current year.

Given the high level of inertia in demand for medicines, we expect a positive rate in pharmaceutical

market dynamic in 2014 at the level of 6 - 8% in values (USD).

18

Dynamic of market in values (USD) will slow down in the

short term prospective and will come back to higher growth

with implementation of reimbursement

23,1%

22,5%

24,9%

-6,7%

6,4%

13,2%

12,4%

9,3%

7,3%

9,6%

12,0%

-10,0%

0,0%

10,0%

20,0%

30,0%

0

500 000

1 000 000

1 500 000

2 000 000

2 500 000

3 000 000

3 500 000

4 000 000

4 500 000

2006Y 2007Y 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y

Growth rate

Values (thnds

USD)

Retail market (thnds USD) Growth rate

Thank you!

Ukraine, 03680

Bojenko str., 86i, Kiev

Tel/Fax: +38 044 206 17 17/18

e-mail: office@smd.net.ua

http://www.smd.net.ua

Você também pode gostar

- Pharmaceutical Preparations World Summary: Market Values & Financials by CountryNo EverandPharmaceutical Preparations World Summary: Market Values & Financials by CountryAinda não há avaliações

- Articles of Thai AlcoholicDocumento4 páginasArticles of Thai Alcoholicsatrio_utamaAinda não há avaliações

- Mineral Classifying, Flotation, Separating, Concentrating, Cleaning Equipment World Summary: Market Sector Values & Financials by CountryNo EverandMineral Classifying, Flotation, Separating, Concentrating, Cleaning Equipment World Summary: Market Sector Values & Financials by CountryAinda não há avaliações

- Pharmaceutical Therapeutic Categories Outlook: March 2002Documento333 páginasPharmaceutical Therapeutic Categories Outlook: March 2002nergaliusAinda não há avaliações

- Medical & Diagnostic Laboratory Lines World Summary: Market Values & Financials by CountryNo EverandMedical & Diagnostic Laboratory Lines World Summary: Market Values & Financials by CountryAinda não há avaliações

- VE Weekly 100326Documento9 páginasVE Weekly 100326ValuEngine.comAinda não há avaliações

- ValuEngine Weekly NewsletterDocumento14 páginasValuEngine Weekly NewsletterValuEngine.comAinda não há avaliações

- Pharmaceuticals Project ReportDocumento27 páginasPharmaceuticals Project Reportdummy2014Ainda não há avaliações

- 1.prezentacija Seminarski Marketing U FarmacijiDocumento16 páginas1.prezentacija Seminarski Marketing U FarmacijimajamunitlakAinda não há avaliações

- Indonesia Pharma Industry OverviewDocumento6 páginasIndonesia Pharma Industry Overviewvijayendar4210% (1)

- Brean Capital Expecting Positive Panel in June Reiterates PGNX With A BUY and $11PTDocumento4 páginasBrean Capital Expecting Positive Panel in June Reiterates PGNX With A BUY and $11PTMayTepper100% (1)

- Jugoremedija AD, Zrenjanin - Company ProfileDocumento8 páginasJugoremedija AD, Zrenjanin - Company Profilejohn_tramp_1Ainda não há avaliações

- VWQECQWEWQDocumento39 páginasVWQECQWEWQEdward Roy “Ying” AyingAinda não há avaliações

- Sun Pharma, 12th February, 2013Documento11 páginasSun Pharma, 12th February, 2013Angel BrokingAinda não há avaliações

- 82081Documento17 páginas82081wpustamAinda não há avaliações

- Lupin-Case Exhibits For DistributionDocumento54 páginasLupin-Case Exhibits For DistributionRakesh Kadarkarai JAinda não há avaliações

- Fundamental Analysis:: Shareholding PatternDocumento7 páginasFundamental Analysis:: Shareholding PatternVikas SharmaAinda não há avaliações

- GSK, 20th February, 2013Documento11 páginasGSK, 20th February, 2013Angel BrokingAinda não há avaliações

- 2013-14 SPIL - Annual ReportDocumento144 páginas2013-14 SPIL - Annual ReportAnshumanSharmaAinda não há avaliações

- Global NutshellDocumento50 páginasGlobal NutshellDat Dinh QuangAinda não há avaliações

- Sanlam - Five-Year Performance 2015Documento1 páginaSanlam - Five-Year Performance 2015romeoAinda não há avaliações

- Feeding Highly Prolific Sows in Hot, Humid Climates: Prof. Dr. Bruno A. N. SilvaDocumento76 páginasFeeding Highly Prolific Sows in Hot, Humid Climates: Prof. Dr. Bruno A. N. SilvaThầy QuangAinda não há avaliações

- Equity Research On Square Pharmaceutical Limited PDFDocumento8 páginasEquity Research On Square Pharmaceutical Limited PDFNur Md Al Hossain100% (1)

- EferozDocumento57 páginasEferozMehwish QureshiAinda não há avaliações

- Daily Comment RR 13jul11Documento3 páginasDaily Comment RR 13jul11timurrsAinda não há avaliações

- Pluristem :an Erroneous Story Misrepresents The FactsDocumento6 páginasPluristem :an Erroneous Story Misrepresents The FactsmarketstockanalystAinda não há avaliações

- Part 5 (Comparative Analysis)Documento25 páginasPart 5 (Comparative Analysis)Tech InfoAinda não há avaliações

- GSK Consumer, 2Q CY 2013Documento10 páginasGSK Consumer, 2Q CY 2013Angel BrokingAinda não há avaliações

- GSK Consumer 1Q CY 2013Documento10 páginasGSK Consumer 1Q CY 2013Angel BrokingAinda não há avaliações

- Boston Scientific PrimerDocumento2 páginasBoston Scientific PrimerZee MaqsoodAinda não há avaliações

- Project On Lupin PhrmaDocumento61 páginasProject On Lupin PhrmaAshish RanjanAinda não há avaliações

- 12-Sydney Clark-OTC Market in Latin AmericaDocumento18 páginas12-Sydney Clark-OTC Market in Latin Americasmanna77Ainda não há avaliações

- AstraZeneca 2011Documento141 páginasAstraZeneca 2011vivek_arya2884Ainda não há avaliações

- Healthcare & Pharmaceutical Industry in BrazilDocumento24 páginasHealthcare & Pharmaceutical Industry in Brazilpriyankaprakash1982Ainda não há avaliações

- Weekly Apr 08 - Apr 12 12Documento9 páginasWeekly Apr 08 - Apr 12 12Safwan SaadAinda não há avaliações

- Continuous Glucose Monitoring (CGM) Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2012 - 2018Documento8 páginasContinuous Glucose Monitoring (CGM) Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2012 - 2018api-247970851Ainda não há avaliações

- Daily Market Commentary - April 19 2016Documento2 páginasDaily Market Commentary - April 19 2016NayemAinda não há avaliações

- Sun Pharma 4Q FY 2013Documento11 páginasSun Pharma 4Q FY 2013Angel BrokingAinda não há avaliações

- Azithral Marketing ProjectDocumento35 páginasAzithral Marketing ProjectShreyas Nair100% (6)

- Barclays Multi-Industry Poster 2014Documento2 páginasBarclays Multi-Industry Poster 2014athompson14Ainda não há avaliações

- Return Jan 2011Documento7 páginasReturn Jan 2011Vicky SubaramaniamAinda não há avaliações

- Korea FY08 ABP MKTG Plan - 07 06 19 (Final)Documento25 páginasKorea FY08 ABP MKTG Plan - 07 06 19 (Final)Kyungjoo ChoiAinda não há avaliações

- New Malls Contribute: Capitamalls AsiaDocumento7 páginasNew Malls Contribute: Capitamalls AsiaNicholas AngAinda não há avaliações

- Results Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYDocumento9 páginasResults Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYÁngel Josue Aguilar VillaverdeAinda não há avaliações

- Top 50 DistributorsDocumento1 páginaTop 50 Distributorswindfart911Ainda não há avaliações

- Crompton Greaves: Performance HighlightsDocumento12 páginasCrompton Greaves: Performance HighlightsAngel BrokingAinda não há avaliações

- Medical Devices Industry in Malaysia PDFDocumento28 páginasMedical Devices Industry in Malaysia PDFmangesh224100% (2)

- Healthcare &technology Investment: Vision, Strategy& OpportunitiesDocumento27 páginasHealthcare &technology Investment: Vision, Strategy& Opportunitiesmucahidkaplan1907Ainda não há avaliações

- Arcadian Finance2Documento19 páginasArcadian Finance2Marlisa Lukmana50% (2)

- World Enzymes MarketDocumento9 páginasWorld Enzymes MarketthisisamazingAinda não há avaliações

- PNL EtcDocumento7 páginasPNL EtcSanket UmredkarAinda não há avaliações

- 02 Nasir Javaid PDFDocumento33 páginas02 Nasir Javaid PDFUmer DhillonAinda não há avaliações

- Ve Weekly NewsDocumento8 páginasVe Weekly NewsValuEngine.comAinda não há avaliações

- Metabical Case SolutionDocumento8 páginasMetabical Case SolutionShelton Nazareth0% (1)

- Glaxosmithkline Pharma: Performance HighlightsDocumento11 páginasGlaxosmithkline Pharma: Performance HighlightsAngel BrokingAinda não há avaliações

- BT GT NT Industry in SeoulDocumento34 páginasBT GT NT Industry in SeoulInvestmentSeoulAinda não há avaliações

- India Pharmaceutical Market Oct 2018 Annex - 1Documento4 páginasIndia Pharmaceutical Market Oct 2018 Annex - 1pranavk_4Ainda não há avaliações

- Andhra Bank: Performance HighlightsDocumento11 páginasAndhra Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- As A Bonus To Our Free Weekly Newsletter Subscribers, We Are Now Offering A FREE DOWNLOAD of One of Our $ 25.00 Detailed Valuation ReportsDocumento9 páginasAs A Bonus To Our Free Weekly Newsletter Subscribers, We Are Now Offering A FREE DOWNLOAD of One of Our $ 25.00 Detailed Valuation ReportsValuEngine.comAinda não há avaliações

- GSK Consumer Result UpdatedDocumento9 páginasGSK Consumer Result UpdatedAngel BrokingAinda não há avaliações

- Initial Management of The Critically Ill Adult With An Unknown Overdose - UpToDateDocumento17 páginasInitial Management of The Critically Ill Adult With An Unknown Overdose - UpToDateDANIELA BOHÓRQUEZ ORTEGAAinda não há avaliações

- Prednisolone Drug StudyDocumento2 páginasPrednisolone Drug StudyKristine Acasio100% (2)

- Patofisiologi, Gambaran Klinis, Dan Tata Laksana HIV - AIDS (Dr. Kurniyanto)Documento60 páginasPatofisiologi, Gambaran Klinis, Dan Tata Laksana HIV - AIDS (Dr. Kurniyanto)OrflimeEmmyAinda não há avaliações

- Actilyse®: AlteplaseDocumento13 páginasActilyse®: AlteplaseinassAinda não há avaliações

- Preview Pages of A Practical Guide On Pharmacovigilance For BeginnersDocumento19 páginasPreview Pages of A Practical Guide On Pharmacovigilance For BeginnersdrgunasakaranAinda não há avaliações

- Drug Study CombiventDocumento3 páginasDrug Study CombiventJoshua DavantesAinda não há avaliações

- Evaluasi Keterseiaan Obat TRHP FormulariumDocumento96 páginasEvaluasi Keterseiaan Obat TRHP FormulariumAsetianiAinda não há avaliações

- Obat Wajib Apotek 1 PDF FreeDocumento4 páginasObat Wajib Apotek 1 PDF FreeMisbakhul HudaAinda não há avaliações

- Marijuana Is A WellDocumento4 páginasMarijuana Is A WellFermin Perez Fidel III100% (1)

- Synthroid (Levothyroxine)Documento2 páginasSynthroid (Levothyroxine)E100% (2)

- Drugs BipolarDocumento4 páginasDrugs BipolarSheana TmplAinda não há avaliações

- Recommendations For Management of Diabetes During Ramadan: Update 2015Documento10 páginasRecommendations For Management of Diabetes During Ramadan: Update 2015Esti KusumaAinda não há avaliações

- XXXXXXXXXXXXXXXXXXDocumento36 páginasXXXXXXXXXXXXXXXXXXkhraieric16Ainda não há avaliações

- Lect 1 SFT222 Dispensing TechniquesDocumento17 páginasLect 1 SFT222 Dispensing TechniquessamiveniAinda não há avaliações

- Pharma MCQ214324324325Documento17 páginasPharma MCQ214324324325rab yoAinda não há avaliações

- Exercise and Sport Pharmacology by Mark D. MamrackDocumento457 páginasExercise and Sport Pharmacology by Mark D. MamrackYounes Ben saidAinda não há avaliações

- Label Ing2cDocumento9 páginasLabel Ing2cSMPN 2Ainda não há avaliações

- OTC Medicines ListDocumento32 páginasOTC Medicines ListKebron DanielAinda não há avaliações

- Azilsartan Medoxomil (Edarbi)Documento15 páginasAzilsartan Medoxomil (Edarbi)nicasioaquinoAinda não há avaliações

- Methods of Determining Absorption Rate ConstantDocumento42 páginasMethods of Determining Absorption Rate ConstantFilip Ilievski50% (2)

- Stabilis Monographie Ketorolac TromethamineDocumento5 páginasStabilis Monographie Ketorolac Tromethamineintan kusumaningtyasAinda não há avaliações

- Anti Cancer DrugsDocumento56 páginasAnti Cancer DrugsTimothy David50% (2)

- Compartmental & Non-Compartmental PharmacokineticsDocumento21 páginasCompartmental & Non-Compartmental PharmacokineticsVikas JhawatAinda não há avaliações

- Unit 5 Drugs Acting On The Immune SystemDocumento30 páginasUnit 5 Drugs Acting On The Immune SystemBea Bianca Cruz100% (1)

- PharmaLite - in Pharmacy Practice (PV Publication)Documento276 páginasPharmaLite - in Pharmacy Practice (PV Publication)MD SALAHUDDIN SALAHUDDINAinda não há avaliações

- BRCSUDocumento536 páginasBRCSUKristineAinda não há avaliações

- BDocumento118 páginasBbeautifulme031690Ainda não há avaliações

- Emergency Drugs - NMMC ECARTDocumento1 páginaEmergency Drugs - NMMC ECARTKaloy KamaoAinda não há avaliações

- Drug Study - IbuprofenDocumento7 páginasDrug Study - IbuprofenajAinda não há avaliações

- ASHP PCA and Epidural StandardsDocumento20 páginasASHP PCA and Epidural StandardsJessica TorreglosaAinda não há avaliações