Escolar Documentos

Profissional Documentos

Cultura Documentos

Reading August1.2014

Enviado por

Nadya ZambranoDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Reading August1.2014

Enviado por

Nadya ZambranoDireitos autorais:

Formatos disponíveis

1 AUGUST 2014 VOL 345 ISSUE 6196 519 SCIENCE sciencemag.

org

T

he global locus of manufacturing has

been changing dramatically over the

last three decades, driven by indus-

trializing nations, most prominently

China. Classical economics suggests

that global productivity gains achieved

by shifting the location of manufacturing

will outweigh the losses ( 1). But shifts in the

global locus of manufacturing may affect not

just production costs, but the nature and

pace of technological change.

Moving manufacturing to a different na-

tion might hinder innovation at home: in-

creased distance, electronic dependence,

time zone changes, and national

differences reduce knowledge

flows ( 2, 3). Firms can benefit by

locating near one another ( 4), and this com-

mons can be industry specific. Once a criti-

cal mass of supplier and producer firms in an

industry moves overseas, domestic manufac-

ture is less likely to be competitive ( 5).

When manufacturing moves offshore,

will research and development (R&D) fol-

low? Evidence suggests that, although some

middle-stage innovation may move, to date,

the leading edge of innovation in most indus-

tries has remained in the United States ( 6, 7).

Further, economic theory suggests that shifts

in manufacturing may hurt wages in nations

that lose manufacturing, but global innova-

tion and productivity gains will not suffer ( 8).

However, recent work shows that moving

the locus of manufacturing

overseas, in particular to

developing countries, may

reduce innovation, domesti-

cally and globally, at least in

the short to medium term

( 9 11). Production char-

acteristics (wages, yields,

downtimes, materials, and

organization of production)

can differ greatly across

nations (and in particular

between developed and

developing ones), chang-

ing which product develop-

ments are profitable for firms to pursue. In

two casesautomobile bodies and high-end

optoelectronic components for communica-

tionswhen U.S. firms shifted production to

developing East Asia, products developed in

the U.S. based on the most advanced technol-

ogies were no longer immediately profitable.

The overseas firms stopped producing these

advanced products and, in optoelectron-

ics, also stopped innovation in the most ad-

vanced products overseas and in the United

States ( 9 11).

NOT ALL TECHNOLOGIES ARE CREATED

EQUAL. The impact of manufacturing loca-

tion on global technology development is

shaped by three constraints: (i) the largest

number of manufacturing facilities economi-

cally sustainable for a firm; (ii) the location of

design expertise and whether the designers

need to experiment regularly on and be phys-

ically present at the production line; and (iii)

the importance, security, and enforcement of

intellectual property rights.

The manufacture of high-end optoelec-

tronic components for communications

shows how policy can shape cutting-edge

technologies for firms facing the most con-

straints. First, manufacturing and product

innovation are bound together. Production

yields are low, and the process is more an

art than a science, with engineers regularly

called to the shop floor. Second, the market

is small relative to the production volumes

required to achieve economies of scale.

Firms can afford only one manufacturing

facility, and there are not enough engineers

in developing East Asia with capabilities to

support local production of the new technol-

ogy. Therefore, firms must choose between

producing the most advanced technology in

the United States or older technology in de-

veloping East Asia (see the chart). Expected

changes in technology and production in the

two regions over the short to medium term

have typically increased the cost advantage

of the old technology produced in developing

East Asia over all other options ( 9).

Challenges from low yields and separat-

ing design from manufacturing are common

for early-stage products in such industries

as semiconductors ( 12), specialty chemicals,

and pharmaceuticals, in which product inno-

vations are fundamentally linked to advances

in manufacturing. A small market compared

with the production required for economies

of scale is also common for such firms. These

c o n s t r a i n ts a f f e c t a s u b s e t o f e a r l y - s t a g e

high-technology start-ups.

The United States continues to lead inno-

vation in many technologies. However, with

the decline of U.S. corporate R&D laborato-

ries and large firms increased reliance on in-

novations of small- and medium-sized firms,

long-term research faces new challenges. In

the case of high-end components, the major-

ity of manufacturers have gone offshore and

abandoned production of the most advanced

technology products, despite their promise

for accessing new, larger markets. All public

firms that remained active in the industry

moved offshore. The firms that stayed on-

shore and pursued the most advanced tech-

nology were privately owned and venture-or

government-backed ( 11). These findings com-

plement evidence that private equity may

have positive effects on firms innovation

( 13); public firms may be less innovative ( 14).

Certain factorssuch as the ability to

separate design from manufacturing, mini-

mum efficient plant size,

and transportation costs

are largely technically deter-

mined. Other factorssuch

as market size, number of

competitors, and the het-

erogeneity of consumer

marketsare shaped by

other social, political, and

economic forces. Govern-

ments levers to influence

constraints faced by firms

include funding of early-

stage start-ups (shaping

market forces within the in-

dustry), procurement (shap-

ing market size), workforce

education (shaping the locus

of knowledge), and funding

Global manufacturing and

the future of technology

By Erica R. H. Fuchs

Where you manufacture changes what you get

ECONOMICS

Department of Engineering and Public

Policy, Carnegie Mellon University,

Pittsburgh, PA 15213, USA. erhf@

andrew.cmu.edu

I

L

L

U

S

T

R

A

T

I

O

N

:

E

S

E

N

K

A

R

T

A

L

/

I

S

T

O

C

K

V

E

C

T

O

R

S

/

G

E

T

T

Y

I

M

A

G

E

S

POLICY

Published by AAAS

o

n

A

u

g

u

s

t

4

,

2

0

1

4

w

w

w

.

s

c

i

e

n

c

e

m

a

g

.

o

r

g

D

o

w

n

l

o

a

d

e

d

f

r

o

m

o

n

A

u

g

u

s

t

4

,

2

0

1

4

w

w

w

.

s

c

i

e

n

c

e

m

a

g

.

o

r

g

D

o

w

n

l

o

a

d

e

d

f

r

o

m

INSIGHTS | PERSPECTIVES

sciencemag.org SCIENCE 520 1 AUGUST 2014 VOL 345 ISSUE 6196

of R&D (shaping those constraints that are

technologically determined). The time scale

by which these levers can affect change varies

substantially.

Some government actions, such as those

related to the market, can have immediate

ramifications. Government funding of highly

constrained start-ups can help alleviate mar-

ket pressures. For example, because of needs

within the Department of Defense, the U.S.

Defense Advanced Research and Develop-

ment Agency (DARPA) funded companies to

develop and, it was hoped, subsequently to

produce the most advanced optoelectronic

communication technologies.

Government funding of workforce educa-

tion and technological advancement takes

longer to have an effect, and outcomes are

uncertain. There are, however, historical

precedents. DARPA, the National Science

Foundation, and the Office of Naval Research

played critical roles ( 15) in facilitating the

separation of central processing unit (CPU)

design and manufacturing in the semicon-

ductor industry, which enabled university

researchers to develop new designs without

having an expensive fabrication facility. It

eventually enabled production to move over-

seas to emerging markets. However, even in

semiconductors, design and manufacturing

are integrated when changes are introduced

in the nanoscale devices (e.g., transistors)

that comprise the CPUs or when changes re-

quire coordination between device or mate-

rial improvements and CPU architecture.

Increased global participation in manufac-

turing need not be universally detrimental for

innovation. In less-constrained cases, global

manufacturing can increase opportunities

and incentives to innovate. For example,

automotive manufacturers have found pro-

duction sufficiently standardized to separate

design of advanced automobile bodies from

manufacturing, and composite-materials ex-

pertise is available outside the United States.

The plant size required for economies of

scale allows automobile manufacturers to ef-

ficiently produce for regional markets. Auto-

mobile bodies high transportation costs and

global market heterogeneity build on these

incentives to produce regionally for regional

markets. Policies that constrain choices of

body manufacturing locations would reduce

opportunities and incentives for innovation.

To take advantage of economies of scale in

both production and R&D, companies with

multiple product offerings develop plat-

forms consisting of a series of parts shared

across larger families of products. For ex-

ample, one-quarter of the worlds vehicles

are made in China ( 16) where, since 2009,

automobile sales have exceeded those in the

United States. Chinese consumers may have

a greater willingness to pay for electrified ve-

hicles than consumers in the United States,

given regulatory and physical infrastructure

in both countries ( 17). Technologies designed

for sale in China are unlikely to be used only

in China. Because of these platform econo-

mies, the global shift in the locus of produc-

tion and demand for personal vehicles may

lead to greater economic incentives and op-

portunities for electric vehicles globally. This

has potential to enhance economic growth,

increase national energy security (through

reduced oil use), and (depending on efforts to

reduce air emissions from electricity genera-

tion) improve the global environment.

TECHNOLOGICALLY NUANCED POLICY.

It will be critical to avoid a onesize-fits-

all policy approach, both across technolo-

gies and across nations, because policies

that enhance one sector can undermine

another. One important issue, especially for

advanced technologies, is integrating tech-

nical and industry expertise into govern-

ment decision-making. DARPA, for example,

brings technical experts from academia and

industry into limited, 3- to 5-year positions

as program managers, from which they fund

new technology directions in academia and

industry ( 18). In the Semiconductor Research

Corporation (a U.S. public-private partner-

ship), industry articulates its performance

needs, finds supporting government fund-

ing, and funds academics to develop new

technologies to achieve these goals ( 19). With

manufacturing continuing to shift to devel-

oping nations, and with the global future of

technology at stake, nations have reason to

act for themselves and multilaterally.

REFERENCES AND NOTES

1. D. Ricardo, in The Works and Correspondence of David

Ricardo, P. Sraffa, Ed. (Univ. of Cambridge Press, Cambridge,

1953).

2. C. Gibson, J. Gibbs, Adm. Sci. Q. 51, 451 (2006).

3. J. N. Cummings et al., Inf. Syst. Res. 20, 420 (2009).

4. A. Marshall, Principles of Economics (Macmillan, London,

1890).

5. G. Pisano, W. Shih, Producing Prosperity (Harvard Business

Review Press, Cambridge, MA, 2012).

6. J. Macher, D. Mowery, Innovation in Global Industries

(National Academies Press, Washington, DC, 2008).

7. L. Branstetter, G. Li, F. Veloso, in The Changing Frontier:

Rethinking Science and Innovation Policy, A. Jaffe and B.

Jones, Eds. (forthcoming Univ. of Chicago Press, Chicago,

n.d.), chap. 1; http://papers.nber.org/books/jaff13-1.

8. P. Samuelson, J. Econ. Perspect. 18, 135 (2004).

9. E. R. H. Fuchs, R. E. Kirchain, Manage. Sci. 56, 2323 (2010).

10. E. R. H. Fuchs et al., Int. J. Prod. Econ. 132, 79 (2011).

11. C. Yang, R. Nugent, E. Fuchs, Gains from OthersLosses

(Carnegie Mellon Univ. working paper, Pittsburgh,

PA, 2013); http://papers.ssrn.com/sol3/papers.

cfm?abstract_id=2080595.

12. C. Lecuyer, Making Silcon Valley (MIT Press, Cambridge, MA,

2005).

13. J. Lerner et al., J. Finance 66, 445 (2011).

14. S. Bernstein, Does going public affect innovation? (Research

paper no. 2126, Stanford Graduate School of Business,

Stanford, CA, 2012).

15. National Research Council, Funding a Revolution:

Government Support for Computing Research (National

Academies Press, Washington, DC, 1999).

16. International Organization of Motor Vehicle Manufacturers

(OICA), World Motor Vehicle Production by Country and Type

(2013); www.oica.net/category/production-statistics/.

17. J. Helveston et al., Will subsidies drive electric vehicle adop-

tion in China and the United States?(Carnegie Mellon Univ.

working paper, Pittsburgh, PA, 2013); www.cmu.edu/me/

ddl/publications/2014-WP-Helveston-etal-EVs-in-China.

pdf.

18. E. Fuchs, Res. Policy 39, 1133 (2010).

19. R. Burger, Cooperative Research: The New Paradigm

(Semiconductor Research Corporation, Research Triangle

Park, NC, 2014); www.src.org/about/p001960.pdf.

ACKNOWLEDGMENTS

E.R.H.F. is funded by the NSF Science of Science and Innovation

Policy Program, DARPA, and the National Institute of Standards

and Technology. E.R.H.F. thanks D. Andersen, D. Hounshell,

G. Morgan, and anonymous reviewers for feedback.

300

400

500

600

0 50 100 150 200

Annual production volume (thousands/year)

Current product technology U.S. production

Next-gen product technology U.S. production

Current product technology

developing East Asia production

High-end communications component production

in the U.S. vs. China

Unit cost

Lines shown represent average capabilities across firms in the industry. [Adapted from ( 9)]

10.1126/science.1250193

Published by AAAS

Você também pode gostar

- Science Technology Society 1996 Hill 51 71Documento22 páginasScience Technology Society 1996 Hill 51 71Leo AlvarezAinda não há avaliações

- GU 02 Globalization and Its Effect On Global Supply Chain ManagementDocumento4 páginasGU 02 Globalization and Its Effect On Global Supply Chain ManagementTanmayAinda não há avaliações

- Microsoft Word Forging 1000 Venture S... Ion Economy - Campbell Falcão 004Documento17 páginasMicrosoft Word Forging 1000 Venture S... Ion Economy - Campbell Falcão 004Aaron AppletonAinda não há avaliações

- Americas Real Manufacturing AdvantageDocumento14 páginasAmericas Real Manufacturing AdvantageToey BayAinda não há avaliações

- 0015 1947 Article A004 enDocumento3 páginas0015 1947 Article A004 enTan Chea ShenAinda não há avaliações

- Bell and Pavitt 1993 Technological Accumulation and Industrial GrowthDocumento54 páginasBell and Pavitt 1993 Technological Accumulation and Industrial GrowthAna Paula Azevedo100% (2)

- BELL - & - PAVITT - Technological Accumulation and Industrial GrowthDocumento54 páginasBELL - & - PAVITT - Technological Accumulation and Industrial GrowthJasar GraçaAinda não há avaliações

- The Economics of Technology Diffusion: Implications For Greenhouse Gas Mitigation in Developing CountriesDocumento10 páginasThe Economics of Technology Diffusion: Implications For Greenhouse Gas Mitigation in Developing CountriesCesar OsorioAinda não há avaliações

- Firm Innovation Jan NanDocumento51 páginasFirm Innovation Jan NanshahraashidAinda não há avaliações

- National Technology Policy in Global MarketDocumento22 páginasNational Technology Policy in Global MarketJoey NguyenAinda não há avaliações

- DryingDocumento16 páginasDryingJiral PatelAinda não há avaliações

- A Literature Review of Advanced Manufacturing Technology and Its Application in Small Scale Manufacturing IndustriesDocumento9 páginasA Literature Review of Advanced Manufacturing Technology and Its Application in Small Scale Manufacturing Industriesnemi90Ainda não há avaliações

- 06 R&DMGMT Editorial Towards An AgendaDocumento6 páginas06 R&DMGMT Editorial Towards An AgendaHamza Faisal MoshrifAinda não há avaliações

- Globalisation and Its Effects On SCM Operational Strategies: Athar Amin, MBA 3 Sem StudentDocumento10 páginasGlobalisation and Its Effects On SCM Operational Strategies: Athar Amin, MBA 3 Sem StudentsachinmanjuAinda não há avaliações

- The National Academies Press: Retooling Manufacturing: Bridging Design, Materials, and Production (2004)Documento4 páginasThe National Academies Press: Retooling Manufacturing: Bridging Design, Materials, and Production (2004)S B MALLURAinda não há avaliações

- Electro-Air Pad: Solar Charging StationDocumento28 páginasElectro-Air Pad: Solar Charging StationBUSN460Ainda não há avaliações

- Time-Based Competition in Multistage Manufacturing: Stream-of-Variation Analysis (SOVA) Methodology-ReviewDocumento34 páginasTime-Based Competition in Multistage Manufacturing: Stream-of-Variation Analysis (SOVA) Methodology-Reviewcclan05Ainda não há avaliações

- 16 003Documento29 páginas16 003jorgebritto1Ainda não há avaliações

- Additive Manufacturing.......Documento35 páginasAdditive Manufacturing.......aviraj2006Ainda não há avaliações

- Editorial Opening Up The Innovation Process: Towards An AgendaDocumento6 páginasEditorial Opening Up The Innovation Process: Towards An AgendaSaverio VinciguerraAinda não há avaliações

- Importance Innovation ProductivityDocumento58 páginasImportance Innovation ProductivityIRONGCAinda não há avaliações

- Technological EnvironmentDocumento6 páginasTechnological EnvironmentOrlando Bernard RodriguesAinda não há avaliações

- The ICT RevolutionDocumento26 páginasThe ICT Revolutionlouis_alfaAinda não há avaliações

- 1 Why Manufacturing Matters - Unit Manufacturing Processes - Issues and Opportunities in Research - The National Academies PressDocumento4 páginas1 Why Manufacturing Matters - Unit Manufacturing Processes - Issues and Opportunities in Research - The National Academies PressVenkata DineshAinda não há avaliações

- LopezDocumento76 páginasLopezfederico stezanoAinda não há avaliações

- R&D, Innovation and The Total FactorDocumento35 páginasR&D, Innovation and The Total Factor654501Ainda não há avaliações

- Background Report For World Development Report 2000/2001Documento11 páginasBackground Report For World Development Report 2000/2001Michel Monkam MboueAinda não há avaliações

- The Global Semiconductor Industry Teaching NoteDocumento7 páginasThe Global Semiconductor Industry Teaching NoteAngel Chiang100% (3)

- Innovation in Manufacturing: The Role of Foreign Technology Transfer and External NetworkingDocumento31 páginasInnovation in Manufacturing: The Role of Foreign Technology Transfer and External NetworkingJuanJulio GutierrezAinda não há avaliações

- Presentation On InnovationDocumento4 páginasPresentation On InnovationMoon AdhikariAinda não há avaliações

- American Economic AssociationDocumento19 páginasAmerican Economic AssociationgovindmanianAinda não há avaliações

- Innovating Together: Improving Bilateral Research Collaboration For DevelopmentDocumento17 páginasInnovating Together: Improving Bilateral Research Collaboration For DevelopmentIsraelDevAinda não há avaliações

- Manufacturing Trends Globalization1Documento15 páginasManufacturing Trends Globalization1Rogers PalamattamAinda não há avaliações

- Adding It Up. The Economic Impact of AMDocumento24 páginasAdding It Up. The Economic Impact of AMJorge OliveiraAinda não há avaliações

- Informs: INFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Operations ResearchDocumento20 páginasInforms: INFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Operations ResearchImad BaberAinda não há avaliações

- What Are The Significant TrendsDocumento85 páginasWhat Are The Significant TrendsJames WinstonAinda não há avaliações

- Tech-Spillover-Cash - Apple Vs SamsungDocumento52 páginasTech-Spillover-Cash - Apple Vs Samsung123qwe99Ainda não há avaliações

- The Open Manufacturer - Harinderpal HanspalDocumento21 páginasThe Open Manufacturer - Harinderpal HanspalHarinderpal (Hans) HanspalAinda não há avaliações

- Strategic Management in ConstructionDocumento21 páginasStrategic Management in ConstructiongokulvasuAinda não há avaliações

- J Technovation 2007 07 010Documento13 páginasJ Technovation 2007 07 010K59 Nguyen Thai AnhAinda não há avaliações

- Klepper 1996Documento23 páginasKlepper 1996Hương NuAinda não há avaliações

- Product Development The Industry: in World AutoDocumento53 páginasProduct Development The Industry: in World Autoranawaleed mahmudAinda não há avaliações

- 3 Demand-Pull Energy Technology Policies DiffusionDocumento57 páginas3 Demand-Pull Energy Technology Policies DiffusionbacnmichaelAinda não há avaliações

- Trouble in The Making The Future of ManufacturingDocumento29 páginasTrouble in The Making The Future of ManufacturingKim Premier MLAinda não há avaliações

- Future Manufacturing Project ReportDocumento250 páginasFuture Manufacturing Project Reportabalone789Ainda não há avaliações

- Semiconductor Capabilities in The U.S. and Industrializing AsiaDocumento29 páginasSemiconductor Capabilities in The U.S. and Industrializing AsiaMohammed MouftiAinda não há avaliações

- 1 Chapter OneDocumento14 páginas1 Chapter OneFiraol TayeAinda não há avaliações

- Arup - Rethinking The FactoryDocumento60 páginasArup - Rethinking The Factoryivo100% (1)

- Investing in Ideas Business Innovation PoliciesDocumento57 páginasInvesting in Ideas Business Innovation PoliciesYorka SánchezAinda não há avaliações

- Processor Problems - An Economic Analysis of The Ongoing Chip ShorDocumento23 páginasProcessor Problems - An Economic Analysis of The Ongoing Chip ShorHoury GostanianAinda não há avaliações

- George Mason-Armstrong-Loew-Aff-UMW-Round3Documento80 páginasGeorge Mason-Armstrong-Loew-Aff-UMW-Round3Sarah PinkerAinda não há avaliações

- 1.global Supply Chains in A Post-Pandemic WorldDocumento11 páginas1.global Supply Chains in A Post-Pandemic WorldSuraiya SuroveAinda não há avaliações

- Semiconductors As Natural Resources - Exploring The National Security Dimensions of U.S.-China Technology CompetitionDocumento7 páginasSemiconductors As Natural Resources - Exploring The National Security Dimensions of U.S.-China Technology CompetitionchriscottrellAinda não há avaliações

- European Journal of Operational Research: Chialin Chen, Jun Zhang, Ruey-Shan GuoDocumento13 páginasEuropean Journal of Operational Research: Chialin Chen, Jun Zhang, Ruey-Shan GuoelnazAinda não há avaliações

- Global Production SharingDocumento40 páginasGlobal Production SharingAlexandra RonaldinHaAinda não há avaliações

- Ijm 10 06 059Documento9 páginasIjm 10 06 059Nagarajan TAinda não há avaliações

- Rothwell Towards The Fifth GenerationDocumento25 páginasRothwell Towards The Fifth GenerationLiga Valko100% (2)

- Dissertation Technology TransferDocumento4 páginasDissertation Technology TransferWhatAreTheBestPaperWritingServicesCanada100% (1)

- EXPORTS OF MANUFACTURES BY DEVELOPING COUNTRIES - EMERGING PATTERNS OF TRADE AND LOCATION Author(s) - SANJAYA LALL (1998)Documento21 páginasEXPORTS OF MANUFACTURES BY DEVELOPING COUNTRIES - EMERGING PATTERNS OF TRADE AND LOCATION Author(s) - SANJAYA LALL (1998)abhinavAinda não há avaliações

- SP - 15180 - 180605 TurbinaDocumento457 páginasSP - 15180 - 180605 Turbinajavier rangelAinda não há avaliações

- Westinghouse WGen7500DF Spec SheetDocumento2 páginasWestinghouse WGen7500DF Spec SheetgusmilexaAinda não há avaliações

- Nha Balut Tondo Manila - Less 1tDocumento20 páginasNha Balut Tondo Manila - Less 1tTechnical Unit SjmdoAinda não há avaliações

- Airport Qualification and Familiarization ChartsDocumento3 páginasAirport Qualification and Familiarization Chartsjackygdp645Ainda não há avaliações

- Workshop ToolsDocumento2 páginasWorkshop ToolsKwee AryaAinda não há avaliações

- Getting Grounded On AnalyticsDocumento31 páginasGetting Grounded On AnalyticsIvan Jon Ferriol100% (2)

- Switch 3COM 2952Documento4 páginasSwitch 3COM 2952Fabio de OliveiraAinda não há avaliações

- Q2 Electronics Module 5Documento34 páginasQ2 Electronics Module 5Roniese MamaedAinda não há avaliações

- EnglishDocumento10 páginasEnglishAnonymous KYw5yyAinda não há avaliações

- Another Smart BookDocumento22 páginasAnother Smart BookKeshav PAinda não há avaliações

- Core Java Vol 1 2 For The Impatient and Effective Pack 12Th Ed Cay S Horstmann Full ChapterDocumento51 páginasCore Java Vol 1 2 For The Impatient and Effective Pack 12Th Ed Cay S Horstmann Full Chapterkatherine.whipkey756100% (8)

- Compiling A C Program - Behind The ScenesDocumento2 páginasCompiling A C Program - Behind The ScenesKrishanu ModakAinda não há avaliações

- XP Installation 34 Minute HiccupDocumento1 páginaXP Installation 34 Minute HiccupSam Njuba JrAinda não há avaliações

- Daily Reports Postilion: Alarms - A05W063Documento8 páginasDaily Reports Postilion: Alarms - A05W063dbvruthwizAinda não há avaliações

- CV WiraDocumento3 páginasCV WiraNi Komang Utari YulianingsihAinda não há avaliações

- Chapter 1Documento6 páginasChapter 1Bhuvaneswari TSAinda não há avaliações

- Empowerment Technology/ Prelim: 11-A, B, AND C Nadia G. Refil 09464199149Documento44 páginasEmpowerment Technology/ Prelim: 11-A, B, AND C Nadia G. Refil 09464199149John Carlo Cabiles MellizaAinda não há avaliações

- EnCase Forensics Edition Primer - Getting StartedDocumento37 páginasEnCase Forensics Edition Primer - Getting StartedJason KeysAinda não há avaliações

- Intership SeminarDocumento18 páginasIntership SeminarChandan K HAinda não há avaliações

- Gambia ICT - Final - WebDocumento77 páginasGambia ICT - Final - Webabey.mulugetaAinda não há avaliações

- DSE335 Operators ManualDocumento90 páginasDSE335 Operators ManualcarlosrmtzAinda não há avaliações

- 19BCG1077 - Swarup DebDocumento1 página19BCG1077 - Swarup DebUX ༒CONQUERERAinda não há avaliações

- Python OS Module - 30 Most Useful Methods From Python OS ModuleDocumento5 páginasPython OS Module - 30 Most Useful Methods From Python OS ModuleRajaAinda não há avaliações

- OFBS Enrollment Form v.2Documento2 páginasOFBS Enrollment Form v.2Abrera ReubenAinda não há avaliações

- The Effect of Heavy Equipment Management On The PeDocumento8 páginasThe Effect of Heavy Equipment Management On The PeGary NashAinda não há avaliações

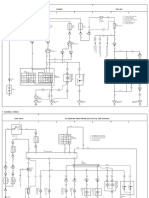

- Avanza Xenia Wiring DiagramDocumento5 páginasAvanza Xenia Wiring DiagramFazri Putugerah100% (2)

- Bizmanualz ISO 90012015 Quality Procedures SampleDocumento7 páginasBizmanualz ISO 90012015 Quality Procedures SampleSamsung Joseph0% (1)

- AnthropometricsDocumento5 páginasAnthropometricsNoel Dela CruzAinda não há avaliações

- HT2524 Satellite Router: Technical SpecificationsDocumento1 páginaHT2524 Satellite Router: Technical SpecificationszakaAinda não há avaliações

- Sony Education Projectors 2019Documento60 páginasSony Education Projectors 2019alanAinda não há avaliações