Escolar Documentos

Profissional Documentos

Cultura Documentos

CASH FLOW ANALYSIS

Enviado por

Pinky AggarwalDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

CASH FLOW ANALYSIS

Enviado por

Pinky AggarwalDireitos autorais:

Formatos disponíveis

ESTD 1948

GAUHATI UNIVERSITY

A training report submitted in partial fulfillment of the requirement for the award of

degree of Bachelor Business Administration (Industry Integrated), Gauhati University

on

CASH FLOW ANALYSIS AND WORKING CAPITAL OF YARN DIVISION

IN

SATISH KUMAR MITTAL &CO.

UNDER ORGANISATION GUIDANCE OF: UNDER INSTITUTIONAL GUIDANCE OF:

MR.AJAY PROF.S.MOOKHERJEE

Account Mana!" HIMS

Sat#$% Ku&a" M#tta' ()o&.

P"!*a"!+ an+ Su,&#tt!+ -./

P#n0.G.U. R!#$t"at#on No. 11.. o2 341453416

Page

)ERTIFI)ATE

his is to certify that !in"y Aggarwal, a student of the Gauhati university has

prepared her raining report entitled #)ASH F7O8 ANA7YSIS AND 8ORKING

)APITA7 OF YARN DIVISION$ under my guidance% she has fulfilled all

requirements under the regulations of the &BA (II!) and BBA (II!) Gauhati

University, leading to the BBA (II!) degree% his wor" is the result or his own

investigation and the pro'ect( neither as a whole nor any part of it was submitted to

any other University or )ducational Institution for any research or diploma%

I wish her all success in life%

P"o2. S MOOKHERJEE

D#"!cto"

HIMS9 D!'%#

Page

STUDENTS DE)7ARATION

I hereby declare that the raining *eport conducted at

+AI+, -U&A* &IA. / 01&%

2)3 4).,I

Under the supervision of

M". A:a.

+ubmitted in !artial fulfillment of the requirements for the

4egree of

BA0,).1* 15 BU+I2)++ A4&I2I+*AI12

(Industry Integrated)

1

GAUHATI UNIVERSITY9 GU8AHATI

Is my original wor" and the same has not been submitted

for the award of any other 4egree6diploma6fellowship

or other similar titles or pri7es%

!lace8 !in"y%

4ate8 *eg% 2o%8999%%

Page

A)KNO87EDGEMENT

5irstly, I would li"e to than" MR. AJAY (Accou!"! M""#$%& and a sincere than"s

to all other staff members of . SATISH KUMAR MITTA7 ()O. who have helped

me directly or indirectly in my difficulties%

I wish to e:press my deepest and most sincere than"s to my 5aculty Guide, P%o'. S.

Moo()$%*$$ for their invaluable guidance / support throughout the completion of my

pro'ect%

.ast but not least, I am than"ful to all my family for cooperating with me at every

stage of the pro'ect% hey acted as a continuous source of inspiration and motivated

me throughout the duration of the pro'ect helping me a lot in completing this pro'ect%

Page

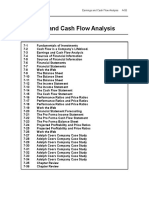

)ONTENTS/

)HAPTER 1 INTRODU)TION

;%; General Introduction about the sector

;%< Industry profile

a) 1rigin and development of the industry

b) Growth and present status of the industry

c) 5uture of industry

)HAPTER 3 PROFI7E OF THE ORGANI;ATION

<%; 1rigin of the 1rgani7ation

<%<Growth and development of the 1rgani7ation

<%= !resent status of the 1rgani7ation

<%> 5unctional 4epartments of the 1rgani7ation

)%a*t!" 6 D#$cu$$#on on T"a#n#n

=%; +tudent?s wor" profile (*ole and responsibilities), tools and echniques

used

=%< -ey learning?s

)%a*t!" 4 Stu+. o2 S!'!ct!+ R!$!a"c% P"o,'!&

>%; +tatement of research problem

>%< +tatement of research ob'ectives

>%= *esearch design and ðodology

)%a*t!" < Ana'.$#$

Page

@%; Analysis of data

)%a*t!" = Su&&a". an+ )onc'u$#on

A%; +ummary of .earning ):perience

A%< 0onclusions and *ecommendations

Bibliography

c%a*t!" 1 Int"o+uct#on

8%at I$ A )a$% F'o> Stat!&!nt?

0omplementing the balance sheet and income statement, the cash flow statement

(05+), a mandatory part of a company?s financial reports since ;BCD, records the

amounts of cash and cash equivalents entering and leaving a company% he 05+

allows investors to understand how a company?s operations are running, where its

money is coming from, and how it is being spent% ,ere you will learn how the 05+ is

structured and how to use it as part of your analysis of a company

T%! St"uctu"! o2 t%! )FS

he cash flow statement is distinct from the income statement and balance sheet

because it does not include the amount of future incoming and outgoing cash that has

been recorded on credit% herefore, cash is not the same as net income, which, on the

income statement and balance sheet, includes cash sales A24 sales made on credit%

0ash flow is determined by loo"ing at three components by which cash enters and

leaves a company8 core operations, investing and financing,

O*!"at#on$

&easuring the cash inflows and outflows caused by core business operations, the

operations component of cash flow reflects how much cash is generated from a

company?s products or services% Generally, changes made in cash, accounts

receivable, depreciation, inventory and accounts payable are reflected in cash from

operations%

Page

0ash flow is calculated by ma"ing certain ad'ustments to net income by adding or

subtracting differences in revenue, e:penses and credit transactions (appearing on the

balance sheet and income statement) resulting from transactions that occur from one

period to the ne:t% hese ad'ustments are made because nonEcash items are calculated

into net income (income statement) and total assets and liabilities (balance sheet)% +o,

because not all transactions involve actual cash items, many items have to be reE

evaluated when calculating cash flow from operations%

5or e:ample, depreciation is not really a cash e:pense( it is an amount that is deducted

from the total value of an asset that has previously been accounted for% hat is why it

is added bac" into U for calculating cash flow% he only time income from an asset is

accounted for in 05+ calculations is when the asset is sold%

0hanges in accounts receivable on the balance sheet from one accounting period to

the ne:t must also be reflected in cash flow% If accounts receivable decreases, this

implies that more cash has entered the company from customers paying off their

credit accounts E the amount by which A* has decreased is then added to net sales% If

accounts receivable increase from one accounting period to the ne:t, the amount of

the increase must be deducted from net sales because, although the amounts

represented in A* are revenue, they are not cash%

An increase in inventory, on the other hand, signals that a company has spent more

money to purchase more raw materials% If the inventory was paid with cash, the

increase in the value of inventory is deducted from net sales% A decrease in inventory

would be added to net sales% If inventory was purchased on credit, an increase in

accounts payable would occur on the balance sheet, and the amount of the increase

from one year to the other would be added to net sales%

he same logic holds true for ta:es payable, salaries payable and prepaid insurance% If

something has been paid off, then the difference in the value owed from one year to

the ne:t has to be subtracted from net income% If there is an amount that is still owed,

then any differences will have to be added to net earnings%

INVESTING

0hanges in equipment, assets or investments relate to cash from investing% Usually

Page

cash changes from investing are a Fcash outF item, because cash is used to buy new

equipment, buildings or shortEterm assets such as mar"etable securities% ,owever,

when a company divests of an asset, the transaction is considered Fcash inF for

calculating cash from investing%

FINAN)ING

0hanges in debt, loans or dividends are accounted for in cash from financing%

0hanges in cash from financing are Fcash inF when capital is raised, and they?re Fcash

outF when dividends are paid% hus, if a company issues a bond to the public, the

company receives cash financing( however, when interest is paid to bondholders, the

company is reducing its cash%

Ana'.@#n an EAa&*'! o2 a )FS

.et?s ta"e a loo" at this 05+ sample8

5rom this 05+, we can see that the cash flow for 5G <HH= was I;,@<<,HHH% he bul"

of the positive cash flow stems from cash earned from operations, which is a good

Page

sign for investors% It means that core operations are generating business and that there

is enough money to buy new inventory% he purchasing of new equipment shows that

the company has cash to invest in inventory for growth% 5inally, the amount of cash

available to the company should ease investors? minds regarding the notes payable, as

cash is plentiful to cover that future loan e:pense%

1f course, not all cash flow statements loo" this healthy, or e:hibit a positive cash

flow% But a negative cash flow should not automatically raise a red flag without some

further analysis% +ometimes, a negative cash flow is a result of a company?s decision

to e:pand its business at a certain point in time, which would be a good thing for the

future% his is why analy7ing changes in cash flow from one period to the ne:t gives

the investor a better idea of how the company is performing, and whether or not a

company may be on the brin" of ban"ruptcy or success%

T.#n t%! )FS >#t% t%! -a'anc! S%!!t an+ Inco&! Stat!&!nt

As we have already discussed, the cash flow statement is derived from the income

statement and the balance sheet% 2et earnings from the income statement is the figure

from which the information on the 05+ is deduced% As for the balance sheet, the net

cash flow in the 05+ from one year to the ne:t should equal the increase or decrease

of cash between the two consecutive balance sheets that apply to the period that the

cash flow statement covers%

)onc'u$#on

A company can use a cash flow statement to predict future cash flow, which helps

with matters in budgeting% 5or investors, the cash flow reflects a company?s financial

health8 basically, the more cash available for business operations, the better% ,owever,

this is not a hard and fast rule% +ometimes a negative cash flow results from a

company?s growth strategy in the form of e:panding its operations%

By ad'usting earnings, revenues, assets and liabilities, the investor can get a very clear

picture of what some people consider the most important aspect of a company8 how

much cash it generates and, particularly, how much of that cash stems from core

operations%

Page

)ASH F7O8 STATEMENT )AN -E PREPARED -Y THE

FO77O8ING METHODS

aB D#"!ct &!t%o+

,B In+#"!ct &!t%o+ CAS56B

D#"!ct &!t%o+

1B P"o2#t an+ 'o$$ a**"o*"#at#on$ account C2o"&atB

4ate !articulars Amount 4ate !articu

lars

Amount

To ,a'anc! ,D+ (last years

debit balance if any)

o transfer to

;% general reserve

<% sin"ing fund

=% capital redemption

reserve

>% debenture

redemption

reserve

@% dividend

equali7ation fund

to interim dividend paid

to proposed dividend

to provision for income ta:

-. ,a'anc!

,D+ (last years

credit balance

if any)

-. a#n on

$a'! o2 2#A!+

a$$!t$

-. FFO

Cfunds 2"o&

o*!"at#on$B

Page

to bonus to equity

shareholders a6c

to loss on sale of fi:ed assets

to goodwill written off

to depreciation

to preliminary e:penses

written off

to .51 ('o$$ from

operations)

8o"0#n '!+!"$ "!Eu#"!+

1B P'ant an+ &ac%#n!". aDc

3B P"oF#$#on 2o" +!*"!c#at#on aDc

6B P"oF#$#on 2o" taA aDc

Fo"&at$ o2 >o"0#n '!+!"$

1B P'ant an+ &ac%#n!". aDc

4ate !articulars amount 4ate particulars amount

o balance b6d By depreciation

Page

o !6. a6c ( profit

on sale)

o ban" (purchase)

By !6. a6c (loss on

sale)

By ban" a6c (sale)

By balance c6d

3B P"oF#$#on 2o" +!*"!c#at#on aDc

4ate !articulars amount 4ate particulars amount

o plant a6c

o balance c6d

By balance b6d

By profit and loss

a6c

6B P"oF#$#on 2o" taA aDc

4ate !articulars amount 4ate particulars amount

o ban" a6c(ta:

paid)

o balance c6d

By balance b6d

By profit and loss

a6c

Page

<) 0alculation of cash from operations (051)

5unds from operations

J 4ecrease in current assets (e:cept cash and ban")

J Increase in current liability

E Increase in current assets (e:cept cash and ban")

E 4ecrease in current liability

K 0ash from operations

6B )a$% 2'o> $tat!&!nt C2o"&atB

+ources of funds Amounts Applications of funds Amounts

Page

Issue of shares

*eceipts of loans

+ale of assets

051 ( 0A+, 5*1&

1!)*AI12+)

!urchase of assets

!ayment of loans

!ayment of ta:

!ayment of dividend

!urchase of goodwill

*edemption of preference

shares

In+#"!ct &!t%o+ CAS56B

his includes three activities namely

;% 1perating activities

<% Investment activities

=% 5inancing activities

+tatement under this can be shown as follows8

O*!"at#n act#F#t./

!rofit after ta:es

J proposed dividend

Page

J provision for ta:

J goodwill written off

J preliminary e:penses written off

J premium paid on redmption of preference shares

J transfer to general reserve

J depreciation

J interim dividends

J loss on sale of fi:ed assets

E profit on sale of fi:ed assets

K profit before wor"ing capital change

J decrease in current assets

J increase in current liability

E increase in current assets

E decrease in current liability

K operating profit

E payment of ta:es

K cash flow from (used) operating activity GAH

InF!$t&!nt act#F#t#!$

+ale of fi:ed assets

+ale of investments

(!urchase of fi:ed assets)

Page

(!urchase of investments)

K cash flow from (used) investing activity G-H

F#nanc#n act#F#t#!$

Issue of equity shares

(*edemption of debentures)

(*edemption of preference shares)

issue of debentures

issue of preference shares

receipt of term loans

repayment of term loans

payment of dividends

payment of interim dividends

K cash flow from (used) financing activity G)H

GAI-I)H J n!t #nc"!a$! o" +!c"!a$! #n ca$% an+ ca$%

!Eu#Fa'!nt$

I o*!n#n ca$% an+ ca$% !Eu#Fa'!nt$

J c'o$#n ca$% an+ ca$% !Eu#Fa'!nt$

Page

8ORKING )APITA7

INTRODU)TION TO 8ORKING )APITA7

3or"ing 0apital is life blood and nerve centre of a business% Lust as circulation of

blood is essential for the survival of the human being similarly wor"ing capital is

necessary for the survival of every business organi7ation, whether it is a small

organi7ation or a big organi7ation%

)very business needs funds for two purposesEfor the establishment and to carry out its

day to day operations% .ong terms funds are required to create production facilities

through purchase of fi:ed assets such as plant / machinery, land / building, furniture

/ fi:tures etc% Investments in these assets the present that part of the firmMs capital,

which is bloc"ed on a permanent or fi:ed basis and is called fi:ed capital% 5unds are

also needed for shortEterm purposes as for the purchase of raw material, payment of

wages / other day to day e:penses etc% these funds are "nown as wor"ing capital%

Before discussing about the wor"ing capital management of NA*4,&A2

)OI.)+ .I&I)4, we should "now the meaning, definition and different

concepts of wor"ing capital%

MEANING OF 8ORKING )APITA7

In simple words, wor"ing capital refers to that part of the firmMs capital which is

required for financing short term or current assets such as, cash, mar"etable securities,

debtors, and inventories or in other words the wor"ing capital is the e:cess of current

assets over current liabilities%

)7ASSIFI)ATON OR KINDS OF 8ORKING )APITA7

3or"ing capital may be classified in two ways8

a) On the basis of concept

b) On the basis of time

Page

On T%! -a$#$ O2 )onc!*t

1n the basis of concept, wor"ing capital is classified as gross wor"ing capital and net

wor"ing capital% his classification is important from the point of view of the

financial manager%

G"o$$ >o"0#n ca*#ta'8 E

1. Cash in hand and Bank

2. Bill Receivables

3. Sundry ebtors

!. Short "erm #oan $ %dvances

&. 'nventory of Stock

(. )repaid e*penses

ON THE +ASIS OF TIME, WORKING CAPITAL MAY +E CLASSIFIED AS:

)ermanent or fi*ed +orkin, capital

"emporary or variable +orkin, capital

PERMANENT OR FIKED 8ORKING )APITA7/

TEMPORARY OR VARIA-7E 8ORKING )APIA7/

FA)TORS DETERMINING THE 8ORKING )APITA7

-ature and character of business.

Si.e of business/scale of operation.

)roduction policy.

Page

Gross Working Capital = Total Current

Assets

0anufacturin, process/len,th of production cycle.

Seasonal variation.

1orkin, capital cycle.

Rate of stock turnover.

Credit policy

Business cycle.

Rate of ,ro+th of business.

2arnin, capacity and dividend policy.

)rice level chan,es.

IMPOTAN)E OF ADELUATE 8ORKING )APITA7

3or"ing 0apital is the blood and the nerve centre of business% Lust as the blood

circulation is essential in the human bodies for maintaining life, wor"ing capital is

very important to maintain the running of business% 2o business can run successfully

without an adequate amount of wor"ing capital%

T%! a+Fanta!$ a"! a$ 2o''o>$/

So-.$c/ o' !)$ 0u12$11. Adequate wor"ing capital helps in maintaining

solvency of the business by providing uninterrupted flow of production%

Goo342--. +ufficient wor"ing capital enables a business concern to ma"e

prompt payments%

E"1/ -o". A concern having adequate wor"ing capital high solvency and

good credit standing can arrange loans from ban"s and others on easy terms%

C"1) 321cou!1% Adequate wor"ing capital also enables a concern to avail cash

discounts on the purchase and hence it reduces costs%

Page

R$#u-"% 5"/6$!1 o' 1"-"%2$1, 4"#$1 "3 o!)$% 3"/ !o 3"/ co662!6$!1. A

company which has adequate wor"ing capital can ma"e regular payments of

salaries, wages and other day to day commitments with raises the morale of its

employees, increases their efficiency, reduces wastages and enhances

production and profits%

E75-o2!"!2o o' '".o%"0-$ 6"%($! co32!2o1% 1nly concerns with adequate

wor"ing capital can e:ploit favorable mar"et conditions such as purchasing its

requirement in bul" when the prices are lower and holding its inventory for

higher prices%

A02-2!/ !o '"c$ c%21$1% Adequate wor"ing capital enables the concern face

business crises in emergencies such as depression because during such

periods, generally, there is much pressure on wor"ing capital

THE NEED OF 8ORKING )APITA7

>o"0#n ca*#ta' #$ n!!+!+ 2o" t%! 2o''o>#n *u"*o$!$/

3or the purchase of ra+ materials4 components and spares.

"o pay +a,es and salaries.

"o incur day5to5day e*penses and overhead costs such as fuel4 po+er and

office e*penses etc.

"o meet the sellin, costs as packin,4 advertisin,4 etc.

"o maintain the inventories of ra+ material4 +ork5in5pro,ress4 stores and

spares and finish stock.

"o provide credit facilities to the customers.

OPERATING )Y)7E OF SATISH KUMAR MITTA7 ( )OM.

he operating cycle refers to the length of the length of time between the firms paying

the cash for the material, entering into the production processPstoc" and the inflow of

cash from debtors% here is a complete cycle from cash to cash where in cash gets

Page

converted into raw material, wor"EinEprogress, finished goods debtors and finally in

cash% +hortEterm funds are required to meet the requirements of the funds during this

time period this time period depends on the length of time within which the original

cash gets converted into cash again% he determination of wor"ing capital cycle helps

in the forecast, control and management of wor"ing capital% It indicates the total time

lag and the relative significance of constituent parts%

THE OPERATING )Y)7E )ONSISTS OF FO77O8ING EVENTS9 8HI)H

)ONTINUES THROUGHOUT THE 7IFE OF -USINESS.

0onversion of cash to raw material%

0onversion of raw material to wor" in progress%

0onversion of wor" in progress into finished goods%

0onversion of finished goods into accounts receivable%

0onversion of accounts receivable into cash%

Page

WORK-IN-PROGRES

DEBTORS

CASH

RAW MATERIAL

FINISHED GOODS

FINAN)ING -Y THE 8ORKING )APITA7 RELUIRMENTS -Y -ANKS

he ban" credit is the primary institutional source of wor"ing capital finance% he

ban" provides finance through loan agreements, overdrafts, cash credit, purchasing of

bills, and term loans% Ban"s have been certain norms in granting wor"ing capital

finance to companies% hese norms have been greatly influenced by the

recommendation of various committee appointed by *)+)*N) BA2- 15 I24IA

from time to time%

+AI+, -U&A* &IA./ 01&% finance his wor"ing capital from the different

ban"s li"e I)I)I -ANK9 STATE -ANK OF INDIA9 A77AHA-AD

-ANK9PUNJA- NATIONA7 -ANK% 0ompany finances the amount according to

its need according to its need of wor"ing capital requirement%

NET 8ORKING )APITA7

2et wor"ing capital is the difference between the current assets and the current

liabilities% herefore it is called net wor"ing capital% 3hen current assets e:ceed

current liabilities then the wor"ing capital is positive otherwise negative% ):amples of

current liabilities%

Bill )ayable

Sundry creditors

Outstandin, e*penses

Short term loans

ividend payable

Bank overdraft

Page

)HAPTER 3 PROFI7E OF THE ORAGNI;ATION

+atish "umar mittal / comis a ma'or integrated te:tile producer in India% he Group

was setup in ;BA@ at .udhiana, 2orthern India% +ince then, the Group has e:panded

manifold and is today, one of the largest te:tile conglomerates in India% he Group

portfolio includes &anufacturing and mar"eting of Garns, 5abrics, +ewing hreads,

5iber and Alloy +teel% he group started its corporate 'ourney with an installed

capacity of AHHH spindles in ;BA@ under the flagship company +atish "umar mittal /

com+pinning / General &ills .imited (now "nown as +atish "umar mittal /

com,oldings .imited and is an investment arm of the Group) in .udhiana% 1ver the

years the group has e:panded its spinning capacities besides adding new businesses%

he group has also diversified into yarn processing, weaving, And +ewing hread,

fabric processing, acrylic fiber manufacturing and into special6 alloy steels% oday,

close to <H,HHH people are the 1rgani7ation is most important asset its human capital

T%! Sat#$% 0u&a" &#tta' ( co&"ou* co&*"#$!$ o2 t%"!! '#$t!+ an+ t>o un'#$t!+

co&*an#!$5

7#$t!+ co&*an#!$

+atish "umar mittal / come:tiles .imited (formerly &ahavir +pinning &ills

.imited)

+atish "umar mittal / comAcrylics .imited

+atish "umar mittal / com,oldings .imited; (formerly +atish "umar mittal /

com+pinning / General &ills .imited)

Page

Unlisted 0ompanies

N& +pinning 0ompany .imited

+atish "umar mittal / comhreads .imited

.1G1 15 +AI+, -U&A* &IA. / 01&G*1U!

he #5lame$ signifies growth i%e% growth of the company along with the growth of

each and every individual associated with it whether he6she is a wor"er , a white

collar employee, a shareholder or a customer%

he #+tic"$ symboli7es cotton that is the basic raw material of the core product of

Nardhman% he #N$ stands for the +atish "umar mittal / comGroup

,I+1*G

Page

he industrial city of .udhiana, located in fertile &alwa region of central !un'ab is

"nown as the #&A20,)+)* 15 I24IA$% 3ithin the precincts of the city is

located

he corporate head quarters of +atish "umar mittal / comgroup, A household name in

northern India% he +atish "umar mittal / comgroup , born in ;BA@ under the

entrepreneurship of late .ala *attan 0hand 1swal has today blossoms into the one of

the larger te:tile business houses in India %

At its inception, satish "umar mittal / comhas installed capacity of ;>HHH spindles%

oday8 its capacity has increase multifold to over @%@ lacs spindles% In ;BC< the group

enters sewing threads mar"et in company, which was the forward integration of

business% In ;BBH, it undertoo" yet another diversification Q this time into the weaving

business% he grey fabric weaving unit at Baddi, commissioned in ;BBH with a

capacity of <H,HHH meters per day , has already made its mar" as a quality producer of

grey poplin, sheeting, shirting in the domestic as well as foreign mar"et % his was

followed by entry into fabric processing by setting up of AU*1 )OI.)+ at

BA44I, which currently has a processing of ;,HH,HHH meters per day% In the year

;BBB, the group has added yet another feather to its cap with a setting of +AI+,

-U&A* &IA. / 01&A0*G.I0+ .4 in% he company also has a strong

presence in the mar"ets of LA!A2, ,12G -12G, -1*)A, and U- / )U*1!) in

addition to the domestic mar"et% Adherence to systems / true dedication to quality

has resulted in obtaining the coveted I+1 BHH<6I+1 ;>HH< quality awards which is the

first in te:tileindustry%

Page

PHI7OSHOPHY

5aith in bright future of Indian te:tile industry / hence continues e:pansion

areas #which we "now best$%

otal customer focus in all operational areas

!roducts to be of best available quality for premium mar"et segments through

R& / S)*1 4)5)0 implementation in all functional areas%

Global orientation targetingE at least <HT production for e:ports%

Integrated diversification6 product range e:pansion

3orld class manufacturing facilities with most modern */4 / process

technology

5aith in individual potential respect for human values

)ncouraging innovation for constant improvements to achieve e:cellence in

all functional areas

Appreciating our role as a responsible corporate citi7en%

MISSION

+AI+, -U&A* &IA. / 01&aims to be a 31*.4 0.A++ )OI.)

organi7ation producing diverse range of products for the global te:tile mar"et%

+AI+, -U&A* &IA. / 01&see"s to achieve customer delight through

e:cellence in manufacturing / customer service based on creative combination

of stateE of Q theE art technology / human resources% +AI+, -U&A*

&IA. / 01&is committed to be responsible corporate citi7en

-OARD OF DIRE)TORS

Sat#$% 0u&a" &#tta' ( co&T!At#'!$ 7#&#t!+

+,% +,*I !AU. 1+3A. U 0hairman / &anaging 4irector

+&% A&IA 2A*AI2 U (2ominee of I4BI)

+,% A*U2 -U&A* !U*3A*

+,% !*A5U.. A2UB,AI

+,% +UBA+, -,A20,A24 BIL.A2I

+,% A+,1- -U&A* -U24*A

+,% 4A*+,A2 .A. +,A*&A

+,% +,*ANA2 A.3A*

+,% +A0,I LAI2 U ):ecutive 4irector

+&% +U0,IA LAI2 U ):ecutive 4irector

+,% 2))*AL LAI2 U ):ecutive 4irector

0G& (5I2A20), A001U2+ / AOAI12)

+,% *AL))N ,A!A*

01&!A2G +)0*)A*G

+,% NI!I2 GU!A

BA2-)*+

+A) BA2- 15 !AIA.A,

A..A,ABA4 BA2-,

I0I0I BA2- .4%,

!U2LAB 2AI12A. BA2-,

+A) BA2- 15 I24IA,

BA2- 15 BA*14A

01*!1*AI12 BA2-,

U2I12 BA2- 15 I24IA

0A2A*A BA2-,

+A24A*4 0,A*)*)4 BA2-

BA2RU) 2AI12A.) 4) !A*I+

O"an#$at#ona' %#!"a"c%. c%a"t

)HAIRMAN M)UM5MANGING DIRE)TOR

)ORPORATE GENERA7 MANAGERS

VI)E PRESIDENT

MANAGERS CM15M4B

EKE)UTIVES CE15E3B

OFFI)ERS CO15O3B

STAFF CS15S4B

SU-STAFF

A8ARDS AND A)HIEVEMENTS

+atish "umar mittal / com+pinning and General &ills .td% was the ;st te:tile

company to be awarded I+1EBHH< and I+1E;>HH< certificate in 1996.

't is the lar,est manufacturer and e*porter of cotton yarn from 'ndia.

't is the second lar,est producer of se+in, threads in 'ndi

't is a lar,er producer of acrylic fiber and finished fabrics

T!At#'! EA*o"t P"o&ot#on )ounc#' 3446544

6old trophy in 2O782)9 for e*port of cotton yarn

T!At#'! EA*o"t P"o&ot#on )ounc#' 3446544

Bron.e trophy in mill fabric e*porter cate,ory

T!At#'! EA*o"t P"o&ot#on )ounc#' 3443546

6old "rophy in 2O782)9 for e*port of cotton yarn

T!At#'! EA*o"t P"o&ot#on )ounc#' 1998599

Silver "rophy

T!At#'! EA*o"t P"o&ot#on )ounc#' 199N598

Bron.e "rophy

T!At#'! EA*o"t P"o&ot#on )ounc#' 199=59N

Silver "rophy

GoFt. o2 In+#a A>a"+ 19945<9 199<59=

%+ard of 0erit

T!At#'! EA*o"t P"o&ot#on )ounc#' 1996594

CM!"c%ant EA*o"t )at!o". 2o" Fa,"#c$B

Bron.e "rophy

T!At#'! EA*o"t P"o&ot#on )ounc#' 1996594

CM!"c%ant EA*o"t )at!o". 2o" Fa,"#c$B

6old "rophy

-USINESS OF VARIOUS ITEMS

-USINESS OF SATISH KUMAR MITTA7 ( )OMGROUP

+atish "umar mittal / comGroup consists of @ +BUs spread across B

manufacturing locations

+ +teel

G Garn

0 0otton Garn

5 5abric

S*#nn#n -u$#n!$$ CYB

Sat#$% 0u&a" &#tta' ( co&S*#nn#n ( G!n!"a' M#''$ 7u+%#ana9 Pun:a,

Au"o S*#nn#n -a++#9 HP

A"#%ant S*#nn#n Ma'!"0ot'a9 Pun:a,

A"#$%t S*#nn#n -a++#9 HP

Ga$ M!"c!"#$!+ Ya"n -u$#n!$$ Ho$%#a"*u"9 Pun:a,

Au"o D.!#n -a++#9 HP

Anant S*#nn#n Man+#+!!*9 MP

Sat#$% 0u&a" &#tta' ( co&S*#nn#n ( G!n!"a' M#''$ CEA*o"t O"#!nt!+

Un#tB -a++#9 HP

VMT -a++#9 HP

Sat#$% 0u&a" &#tta' ( co&Ya"n$ Sat'a*u"9 MP

Fa,"#c -u$#n!$$ C)B

Au"o 8!aF#n -a++#9 HP

MSM7 T!At#'!$ D#F#$#on -a++#9 HP

Au"o T!At#'!$ -a++#9 HP

Sat#$% 0u&a" &#tta' ( co&Fa,"#c$ -u+%n#9 MP

S!>#n T%"!a+ -u$#n!$$ CSTB

ST5I Ho$%#a"*u"9 Pun:a,

ST5II 7u+%#ana9 Pun:a,

ST5III P!"un+u"a#9 TN

Sat#$% 0u&a" &#tta' ( co&T%"!a+$ 7#&#t!+ -a++#9 HP

Sat#$% 0u&a" &#tta' ( co&S*!c#a' St!!'$ CSB 7u+%#ana9 Pun:a,

Sat#$% 0u&a" &#tta' ( co&Ac".'#c$ 7#&#t!+ CFB -%a"uc%9 Gu:a"at

PRODU)T RANGE

Y"%1

he group is one of the largest spinning group of the country with a spindlier

of over

@, @H,HHH% he group has ;< production plants located in the states of !un'ab,

,imachal !radesh and &adhya !radesh% In many of the yarn mar"et segments,

+atish "umar mittal / comholds the position of mar"et leader besides being a

large and reliable supplier in the country%

+atish "umar mittal / comis also the largest e:porter of yarn from India% he

group yarn e:ports amount to over U+I ;HH million covering the most quality

conscious mar"ets in theworld% he total e:port of 0otton yarn of the group is

about AT of total e:port of cotton yarn from the country%

S$42# T)%$"31

+atish "umar mittal / comentered the +ewing thread business in ;BC< as a

forward integration to its yarn business% he group had to struggle for survival

being pitted against a large multinational organi7ation% oday with

appro:imately <@ metric tonne6per day of sewing thread manufacturing

capacity in its plant at ,oshiarpur, .udhiana, Baddi / !erundurai%

+atish "umar mittal / comthreads have emerged as second largest sewing

thread brand in the country%

P%oc$11$3 F"0%2c

In its quest for further value addition +atish "umar mittal / comstarted fabric

processing in ;BBB%

+atish "umar mittal / comestablished a modern fabric process house in ;BBB

with a capacity of =H million meters per annum% his capacity has been

e:panded to >< meters per annum in

5G <HH@EHA% A +atish "umar mittal / comfabric is dedicated to meet customer

demand for top quality finished fabric through product innovation, world class

quality, stateEofEart technology and e:cellence in service%

F20%$

In ;BBB the group set up an Acrylic staple fibre plant at Bharuch in Gu'arat in

collaboration with &arubeni and Lapan ):lan of Lapan% he plant has annual

capacity of ;C@HH metric tonnes per annum%

S!$$-

he steel business was setup in ;BD= as diversification with a capacity of

=@HHH million tones per annum% .ater on group acquired a steel plant from

&ohta Group of Industries in ;BCC and converted this loss ma"ing unit into a

profitable business in first year of operation with the Group% +ubsequently the

steel mill has been moderni7ed and e:panded to a capacity of ;HHHHH million

tonnes per annum% 0atering to high technology Ruality conscious alloy steel

segment, the unit has a reputation of being a dependable source of supply of

special and alloy steel to Indian6International standards%

YARN

he +AI+, -U&A* &IA. / 01&range of yarn was a humble

beginning% ree decades of hard wor", commitment and constant innovation

have resulted in well earn trust and goodwill of our customers across the

globe%

At +AI+, -U&A* &IA. / 01&we move with a notion that customer

serves is a way of life% 3e strive to provide our customers delight with =!

service Q!*1&!, !1.I) /!)*+12A.IS)4

It today have a capacity of over half a million spindles along with two dyeing

plants bearing a capacity of more than <D tones yarn / << tones fibers per day%

1ur goal, therefore calls for serving our customers with multiple of products

meeting the most diverse of requirement% his, infect has position +AI+,

-U&A* &IA. / 01&as a$ +U!)* &A*-) of high quality yarn$%

YARN PRODU)TION )APA)ITY

+AI+, -U&A* &IA. / 01&G*1U! has installed capacity of more

than half a million spindles / out of it about ;,D>,HHH spindles are fully

dedicated to e:ports only%

,aving built GIA2 capacity in term of more than half million spindles

spanned over ;@ units out of > units are dedicated to e:ports only ()1U) ,

state Q of QtheE art technology% 4e:trose hands capable of plain rhythm with

machines sourced from best available around the world has made +AI+,

-U&A* &IA. / 01&a gallery of variety of world 0.A++ yarns%

)1UE;HHT dedicated to e:port only

212 )1U Q produce for domestic as well as for e:port mar"et%

YARN OPERATIONS

he unique combination of man / machine, competing / supplementing each

other with continuos increase in productivity has enable +AI+, -U&A*

&IA. / 01&to de:terously ripe the fruit of economies of scale / process

variety of raw material required for variety of end products to te:tiles%

)venness results falls in @T to ;@T of user standards achieved through

P"o*!" $!'!ct#on o2 "a> &at!"#a'$

D

8o"'+ c'a$$ P"! $*#nn#n an+ S*#nn#n Fac#'#t#!$

D

T!c%#nca' Kno> Ho>

D

Hu&an S0#''$

D

144O Lua'#t. A$$u"anc! S.$t!&

A001U2I2G !*)0U4U*) 51* 0U+1&)* 01..)0I12 (GA*2+)

here are three types of collections

omestic collections

Collection under C0S

Collection throu,h letter of credit #8C

DOMESTIC COLLECTION

4omestic collection means collection, which are collected by .udhiana branch

and corporate centrali7ed mar"et yarns department% in this system they collect

the cheque or demand draft from the yarns customers and handed over it over

to the centrali7ed accounting cell for the depositing the same in to the ban" on

daily basis% After receiving all cheque on a particular day the e centrali7ed

accounting cell deposit the instruments in to the ban" for clearing%

After depositing the collections into the ban", the A0* section account for the

same in respective customerMs accounts on basis of advise sent to ban" on day

Eto Eday basis%

CASH MANAGEMENT SERVICES

0ash management means the proper use of an entityMs cash resources % it

serves as a means to "eep an organi7ation functioning by ma"ing th best use of

cash or liquid resources of the organi7ation % at the same time the organi7ation

have the responsibility to use timely , reliable and comprehensive financial

information system %

Cash mana,ement helps the or,ani.ation in:

2liminatin, idle cash balances

0onitorin, e*posure and reducin, the e risk

2nsurin, timely deposit of collections

)roperly timely the disbursements

COLLECTION THROUGH LETTER OF CREDIT (L8C&

A letter of credit is a document issued mostly by financial institutions which

usually provides an irrevocable payment underta"ing to a beneficiary against

complying documents as stated in the credit%

)%a*t!" 6 D#$cu$$#on on T"a#n#n

Stu+!ntP$ 8o"0 P"o2#'!

&y wor" profile is in +AI+, &IA./ 01&%

% as Internal Auditor and 0onsultant with 0orporate Account !roblems%

8%at t%! an Int!"na' Au+#to" can +o

3ith the enlarged mandate and given the scope, ob'ectives and functions of

IA3 under the 0GAMs organi7ation internal audit in Government today is of

critical value for several reasons all of which are well "nown to us8

It is potentially of ma'or importance as an effective internal audit

system leads to improved accountability, ethical and professional practices%

It can improve the quality of output, support decision ma"ing and

performance trac"ing%

It has the potential to act as an independent and ob'ective appraisal

mechanism within the organi7ation whose findings and recommendations can

act as a tool enabling the ministry or department within which it functions, to

ta"e suitable corrective action with respect to service delivery and also

procedures%

It can be used to e:amine and evaluate activities, as a service to the

organi7ation promoting effective control at a reasonable cost%

If internal audit can become an inherent part of management reporting

by suggesting remedies for the problem areas identified, it can truly fit into the

fundamental and critical area of financial reform which focuses on outcomes,

of ob'ectives being achieved at a reasonable cost% It will integrate internal

auditing with the ongoing public financial management reforms%

8%at $!t$ GoF!"n&!nt Au+#t A*a"t?

It is necessary to bring out the differences that e:ist between auditing in the

government sector, and auditing in the private sector%

he environment of the audited government organi7ation is vastly

different from what e:ists in the private sector, and is a significant reason for

the difference between the two% he government audit is carried out in an

environment determined by legal rules and a great deal of importance is

attached to lawful and rightful conduct within the governments flowing from

the need for governments to act in accordance with laws and regulations laid

down by the government itself

In the public sector moreover, the auditorMs opinion serves the interest

of the public in general and is not confined to only providing a full and fair

view to the sta"eholders as is the case with the private sector audit%

By e:tension therefore, the primary purpose of an auditorMs opinion is

to serve in the formal discharging procedure in the democratic process%

)ffectively then, the sta"eholders are many in case of the government audit

It is also a fact that the decision ma"ing process in government is much

more comple: when compared to the private sector where decisions are

predominantly determined by technical and scientific factors concerning the

primary processes of the entity and the economically limiting conditions %

In the government arena, success cannot be translated in terms of the

bottom line of income and e:penditure account but rather needs other criteria

as a measure of performance%

he auditing of the accounting system of a government organi7ation is

important not only as a trac" to the financial report but also because the

accounts contain important information which is vital for the process of

decision ma"ing which in the government sector, by its very nature, has wider

implications%

Auditing in the government sector therefore has a substantive

importance% Attention for the processes li"e acquisition of resources

(economy), use of resources (efficiency), satisfaction of needs of society

(effectiveness) which implies that audit of financial management as such,

including compliance of laws and regulations in the rightfulness audit, is often

defined as a substantive ob'ect of audit in the audit assignment%

5inancial reporting in the public sector is also different from that in the

private sector because the laws and regulations regarding financial reporting in

the public sector are different on account of the need for transparency on part

of the government regarding the governmentMs plans and the resource

allocations% herefore the laws and regulations on financial reporting in the

public sector start with regulating the procedure of the budgeting process and

the structure of the presentation of information in the budget documents%

5urthermore, as far as the government is concerned, its primary goal is

not to earn a profit over and above the cost of production as is the case with

private entities% *ather the goal of government is to reali7e the ma:imal

possible usefulness for society from a limited amount of resources and the

performance indicators are also different since the success of government

entities is not e:pressed only in financial terms%

Too'$ An+ T!c%n#Eu!$

Lournal voucher%

.edger

+ubsidiary Boo"s (sales boo", purchase boo", cash boo", and many

more)

rial Balance%

5inancial +tatement (rading and !/l A6c, Balance +heet)

*atio Analysis

0ash 5low and 5und 5low Analysis

3or"ing 0apital +tatement%

0ost Analysis

Budgeting

And &any &ore

K!. 7!a"n#n/

1rgani7ational independence%

A formal mandate%

Unrestricted access%

+ufficient funding%

0ompetent leadership%

0ompetent staff%

+ta"eholder support%

!rofessional audit standards

)%a*t!" 4 Stu+. o2 S!'!ct!+ R!$!a"c% P"o,'!&

O-JE)TIVES OF THE PROJE)T

o study the wor"ing of yarn division%

)fficient use of resources%

o study of inflow and outflow of cash%

3hat factors that considers their wor"ing capital requirement%

3or"ing 0apital !olicies%

o operate the wor"ing capital cycle of the management%

RESEAR)H METHODO7OGY

*esearch comprises of defining / redefining problems, formulating

hypothesis or suggested solutions, collecting, organi7ing / evaluating data,

ma"ing deductions / reaching conclusions% In research design we decide

about8

ype of data

5rom whom to get data

About sample si7e

,ow to analy7e data

,ow to ma"e report

DATA TYPE

4ata collected was both !rimary and +econdary in nature

SAMP7E SI;E

he sample si7e for the study of the pro'ect was yarn division of

NA*4,&A2 G*1U! .4%

RESEAR)H DESIGN

STEP 1E o study the balance sheet of yarn division

STEP 3 Q understanding various methods used for analysis cash flow

statement to study procedure followed for cash flow statement in Nardhman

STEP 6 Q 4ata Analysis of wor"ing capital through *atios

DATA )O77E)TION

he information is collected through the PRIMARY SOUR)ES li"e8

al"ing with the employees of the department%

Getting information by observations e%g% in manufacturing processes%

4iscussion with the head of the department%

4ata was collected from following SE)ONDARY SOUR)ES li"e

;% 0orporate department

a) &ar"eting department

b) 5inance department

<% A0* reports

=% &I+ 4epartment

"he collected information +as edited $ tabulated for the purpose of analysis.

TOO7S USED FOR PROJE)T

3hile ma"ing the pro'ect file various tools were used% hese tools helped in

doing the wor"% hese are8E

&icrosoft ):cel

&icrosoft 3ord

Narious analysis tools li"e Bar Graphs, !ie Graphs, tables

7IMITATIONS OF STUDY

In the due course time, the main limitation was with searching the data% he

data was not completed in the main files of +AI+, &IA./ 01&% he

training period of si: wee"s was to short to study the organi7ation in detail% In

some cases budgets are available but actual figures are not available for

comparison%

)%a*t!" < Ana'.$#$

;% 5I2A20IA. *)+U.+8

he 5inancial *esults for the year are as under 8E (*s% in 0rore)

!A*I0U.A*+ <HHBE<H;H <HHCE

<HHB

urnover <,DAD%<< <>B@%=C

!B4I @B>%A= =D;%=D

Interest and 5inancial e:penses CA%D= ;H<%=>

!rofit before 4epreciation and a: @HD%CB <AB%H=

4epreciation <<H%CD <HD%=<

!rofit before a: (!B) <CD%H< A;%D;

!rovision for a: E 0urrent @A%D@ H%;D

E 5ringe Benefit a: E H%B;

E 4eferred a:

(2et of Ad'ustment) ;A%@; ==%<C

!rofit after a: <;=%DA <D%=@

!rofit on sale of discontinued operations E E ;;=%><

Add8 4ebenture *edemption *eserve E E

0orporate 4ividend a: written bac" ;%B@ ;%<@

Balance brought forward AH%C@ @D%=>

Balance available for appropriation <DA%@A

;BB%=A

Appropriations8

!roposed 4ividend on8

E )quity shares ;D%== ;;%@@

E 0orporate 4ividend a: <%CC ;%BA

<H%<; ;=%@;

;<@%HH ;<@%HH

ransfer to General *eserve ;=;%=@ AH%C@

+urplus carried to Balance +heet <DA%@A ;BB%=A

)arnings per share (*s%)

E Basic =D%HH <>%=D

E 4iluted =;%C= ;C%>C

4ividend per share (*s%) =%HH <%HH

&A2AG)&)2 4I+0U++I12 A24 A2A.G+I+ *)!1*8

A) e:tile Business8

3orld economy has shown initial indications of recovery after a severe spell

of recession% he world economy is e:pected to grow by >%< percent in <H;H

and pro'ected to maintain the growth momentum in the ne:t @ years% ,owever,

the consumer confidence in ma'or importing countries li"e U+A and )U has

been lagging behind economic growth pro'ections and may

ta"e some more time before showing any convincing revival% hough some

growth has been seen in the world trade of te:tile and clothing especially post

+ept% <HHB% he U+A te:tile and clothing imports, which declined by ;=

percent in <HHB over <HHC has increased by ; percent during LanE5eb <H;H%

he partial

e:planation of increase in te:tile and clothing imports may be attributed to the

pressure on retailers caused by very low inventory levels% It has resulted into

creation of demand for te:tile and clothing products in international mar"et%

he domestic mar"et is also showing some signs of improvement leading to

overall increase in te:tile manufacturing in the country% he industry has

attracted investment to the tune of *s% < lacs crore under U5 for capacity

e:pansion and moderni7ation, which has started paying yield% It is evident

from the increased te:tile manufacturing in the country in the form of

increased spun yarn production% he spun yarn production is e:pected to

increase at about ><HH mn "g in <HHBE;H and e:pected to grow by about CT

to >@HH mn "g in <H;HE;;% he domestic deliveries of spun yarn has also been

growing consistently showing increased activities in the entire te:tile value

chain%

B) +teel business8

1ur steel business is dependent on demand for auto and other related users%

he demand in auto industry which was suppressed because of global

economic slow down has now revived since third quarter of <HHBE;H%

+imultaneously, their has been a steep rise in raw material cost li"e shredded

scrap, sponge iron etc% because of which there is more mar"et driven

pressure on pricing of finished steel% ,owever, the auto industry is pro'ecting

healthy growth during <H;HE;; and it is e:pected that the demand shall remain

firm enabling steel plants in India to utili7e their installed capacity in full% he

0ompany is also considering to structure this business and have appointed the

e:ternal advisors to help e:amine various options to restructure the same%

0) 5inancial Analysis and *eview of 1perations8

V !*14U0I12 / +A.)+ *)NI)38

4uring the year under review, your company has registered a turnover of *s%

<,DAD%<< crore as compared to *s% <,>B@%=C crore showing an increase of

;H%CBT over the previous year turnover% he e:port of the 0ompany increased

from *s% A<D%H> crore to *s% DH>%HH crore, showing an increase of ;<%<DT

over the previous year owing to enhanced production and better

product6mar"et penetration% he business wise performance is as under8E

a)% Garn8

he production of Garn increased from ;;@,CCC & to ;<A,;>A & during

<HHBE<H;H%he sales revenue of yarn increased from *s% ;,=<>%D< crore to *s%

;,>DA%BB crore during the year under review%

b)% +teel8

4uring the year, the production of steel ingots6billets has been A<,;;H &

compared to @=,HDC & of the previous year and that of *olled products has

been @A,@C; & compared to @;,>D; & of the previous year% he sales

revenue of the division has been *s% <DA%=C crore (!revious Gear *s% =<;%D>

crore)%

c)% 5abric8

4uring the year, the production of processed fabric increased from @;%=@

million meter to AH%DC million meter, showing an increase of ;C%=AT over the

previous year% he sales revenue of the processed fabric also increased from

*s% >C<%;D crore to *s% @@A%@< crore showing an increase of ;@%><T over the

previous year%

V !*15IABI.IG8

he 0ompany earned profit before depreciation, interest and ta: of *s% @B>%A=

crore as against *s% =D;%=D crore in the previous year% After providing for

depreciation of *s% <<H%CD crore, (!revious year *s% <HD%=< crore), interest of

*s% CA%D= (!revious Gear ;H<%=> crore), provision for current ta: *s% @A%D@

crore (!revious year *s% H%;D crore), provision for deferred ta: (net of

ad'ustments), *s% ;A%@; crore (previous year *s% ==%<C crore), and provision

for 5ringe Benefit a: of *s 2I. (!revious Gear *s% H%B; crore) the net profit

from operations wor"ed out to *s% <;=%DA crore as compared to *s% <D%=@

crore in the previous year%

V *)+1U*0)+ UI.I+AI128

a)% 5i:ed Assets8

he gross fi:ed assets (including wor"EinEprogress) as at =;

st

&arch, <H;H

were *s% =,A;;%A@ crore as compared to *s% =,>;>%<D crore in the previous

year%

b)% 0urrent Assets8

4ebtors outstanding for more than si: months were *s% ;=%HH crore as

compared to *s% <<%CD crore in the previous year% he net current assets as on

=;

st

&arch, <H;H were *s% ;,DAB%@< crore as against *s% ;=DH%=H crore in the

previous year% Inventory

level was at *s% ;,;HD%>A crore as compared to the previous year level of *s%

A<H%;H crore%

V 5I2A20IA. 0124II12+ / .IRUI4IG8

he 0ompany en'oys a rating of FAAEF with stable outloo" and F!;JF from

0redit *ating Information +ervices of India (0*I+I.) for long term and short

term borrowings respectively% &anagement believes that the 0ompany?s

liquidity and capital resources should be sufficient to meet its e:pected

wor"ing capital needs and other anticipated cash requirements%

he position of liquidity and capital resources of the 0ompany is given

below8E

(*s% in crore)

<HHBE<H;H <HHCE<HHB

0ash and 0ash equivalents8

Beginning of the year =@D%<;

A<%DH

)nd of the year <<<%HD

=@D%<;

2et cash provided (used) by8

1perating Activities (DB%D<)

>>D%H>

Investing Activities (BD%HA)

(;<@%@=)

5inancial Activities >;%A>

(<A%BB)

Nardhman Garns / hreads .imited (NG.)

his subsidiary of the 0ompany which is a Loint Nenture with American /

)ffird Inc% (A/)) which is second largest global player in hreads

&anufacturing and 4istribution with a partnership of @;8>B is engaged in the

business of hreads &anufacturing and 4istribution% 4uring the year under

review, the gross sales of this 0ompany were *s% =DD%;A crore and the !rofit

after ta: was *s% >;%=D crore%

4INI4)248

he Board of 4irectors of your 0ompany has recommended a dividend of *s%

=6E per share on the 5ully !aidEup )quity +hares of the 0ompany%

7IMITATIONS

3or"ing capital is powerful tool of determining companyMs strength and

wea"ness% But the analysis is based on the information available in the

financial statements, which are as follows8

't is only a study of interim report.

1orkin, capital study is only based upon monetary information and

non5monetary factors are i,nored.

't does not consider chan,e in price level.

%s +orkin, capital is prepared on the basis of ,oin, concern4 it does

not ,ive e*tract position. "hus accountin, concept and conventions

causes a serious limitation to financial analysis.

%nalysis is only a mean and not an end in itself. "he analyst has to

make interpretation and dra+ his8her conclusion. ifferent people may

interpret the same analysis in different +ays.

.

)%a*t!" = Su&&a". an+ )onc'u$#on

)ON)7USION

he sale of +AI+, -U&A* &IA./01&%Group is more in .udhiana

mar"et in comparison to other mills% he customers are giving faith in its

quality% 1swal, &alwa / +harman respectively stand in close competition

with Nardhman% he price of Nardhman for all yarns are the highest because of

its high quality standards and their e:pense on e:tensive sales promotion% he

other factors that contribute for its ma:imum sales are its timely supply

without much problems and its cordial relations with dealers%

In this pro'ect we have discussed what is 0A+, 5.13 and wor"ing capital

and help in analysis short term financial position of company

0omplementing the balance sheet and income statement, the cash flow

statement (05+), a mandatory part of a company?s financial reports since

;BCD, records the amounts of cash and cash equivalents entering and leaving a

company% he 05+ allows investors to understand how a company?s

operations are running, where its money is coming from, and how it is being

spent% ,ere you will learn how the 05+ is structured and how to use it as part

of your analysis of a company

8o"0#n )a*#ta' is the lifeline of every industry, irrespective of whether itMs a

manufacturing industry, services industry% 3or"ing 0apital is the prime and

most important requirement for carrying out the day to day operations of the

business% 3or"ing 0apital gives the muchEneeded liquidity to the business%

3or"ing 0apital 5inance reduces the overall fund requirement, required to

build up the 0urrent Assets, which in turn help you improve your urn 1ver

*atio%

In the end I would say that it was great wor"ing with +AI+, -U&A*

&IA./ 01&%

SUGGESTIONS

he prices should be less to reEestablish the mar"et for Garn%

+ince the customer is very specific in terms of value so the company can

introduce new and alternative products whenever possible by ad'usting

the rawEmaterial mi:ing as a result achieve better profitability%

As far as accounting is concerned, although the entire system is

computeri7ed, but there still involves lots of paperwor"% +o this should

be minimi7ed b acquiring more advanced accounting software

2ot only for yarn customers but for other product customer dealing

under letter of credit should done

.60 period should also increased

0ompany should put more efforts to improve its liquidity position

0ompany should stretch the credit period given by the suppliers%

0ompany should improve the inflow and outflow of cash%

0ompany should use the capital in efficient manner%

St"!nt%$

!ositive Attitude

5le:ibility%

,ard wor" with smartness%

Good in 0omputer wor"%

-nowledge of Accouts and 5inance%

8!a0n!$$!$

)motional Behaviour%

.a"e of 0oncentrate%

0hange of place%

O**o"tun#t#!$

Growing +ector

.earning 1pportunities%

Improve -nowledge of 5inance%

T%"!at$

.a"e in "nowledge of 5inance

Nery Big 5inance +ector

Bibliography

REFEREN)E TO A -OOK

Gupta - +hashi , +harma *%- (< HH=), 0ana,ement %ccountin, %nd

business 3inance , -alyani !ublishers ,2ew 4elhi

REFEREN)E FOR ARTI)7ES

;% Bergami *obert, (<HHB), #3ill the U0! AHH !rovide +olutions to

.etter of 0redit ransactionsWQ 'nternational Revie+ of Business

Research )apers9Nol%= 2o%<, Lune <HHD, !p% >; E @=

<% 4olan Lohn, (<HHB),$ ,) .A3 15 .))*+ 15 0*)4I$

"he 1ayne State 7niversity #a+ School #e,al Studies Research4

Nol ;, April <HHD, p;>B

=% !adachi -esseven, (<HHC), #rends in 3or"ing 0apital

&anagement and its Impact on 5irms !erformance8 An Analysis

of &auritian +mall &anufacturing 5irms$, 'nternational Revie+

of Business Research )apersNol%< 2o% <% 1ctober <HHA, !p% >@

E@C

>% -lien 0arter, (<HHA), RUsing .etters of 0redit to +ecure .ease

1bligations$, #a+ ;ournal -e+sletter ,Nol ;C, 2o > , +eptember

<HH@, p% @C@

@% .a7aridis 4r Ioannis, ryfonidis 4imitrios, (<HHA), #he

relationship between wor"ing capital management and

profitability of listed companies in the Athens +toc" ):change$4

7niversity of 0acedonia 46reece4 Nol <C, 2oDC,1ctober ,

pp;H;=%

A% +chelin Lohan (<HH@), R.etter of credit and doctrine of strict

compliance$, University of Uppsala, Nol% >, 2o% =,, Lanuary, pp

<D Q =>

D% +helton 5red (<HH>), #3or"ing capital and constructions

industry$, ;ournal of construction accountin, and ta*ation,

4ecember, pp% >@E@A%

C% 3einraub ,erbert, Nisscher +ue (<HHH), #Industry practices

relating to aggressive conservative wor"ing capital policies$,

<ournal of 3inancial and Strate,ic ecisions4 Nol ;; 2o <,

2ovember, pp% DDHEDD>%

B% &ills Geofrey (<HH;), #he Impact of inflation on capital

budgeting and wor"ing capital$, <ournal Of 3inancial %nd

Strate,ic ecisions4 Nol B 2o ; ,1ctober, pp% <AE=<%

8E- PAGES

www%google%com

http866en%widipedia%org6wi"i6.ettersXofXcredit

www%vardhman%com

Você também pode gostar

- Analyzing Financial Performance of Bata BangladeshDocumento54 páginasAnalyzing Financial Performance of Bata BangladeshCarbon_AdilAinda não há avaliações

- Earnings Per Share: Accounting Standard (AS) 20Documento27 páginasEarnings Per Share: Accounting Standard (AS) 20Akshay JainAinda não há avaliações

- SM Chapter 06Documento42 páginasSM Chapter 06mfawzi010Ainda não há avaliações

- FinancialPerformance 20130515061932.387 XDocumento81 páginasFinancialPerformance 20130515061932.387 Xprannoy60Ainda não há avaliações

- Thesis On IFIC BANK BangladeshDocumento94 páginasThesis On IFIC BANK BangladeshjilanistuAinda não há avaliações

- Front To Table of ContentDocumento6 páginasFront To Table of Contentronu_5507Ainda não há avaliações

- FINANCIAL MANAGEMENT PART 2 CAPITAL BUDGETING DECISIONSDocumento7 páginasFINANCIAL MANAGEMENT PART 2 CAPITAL BUDGETING DECISIONSQueenielyn TagraAinda não há avaliações

- Accounting Information SystemDocumento55 páginasAccounting Information SystemMd. Nurunnabi SarkerAinda não há avaliações

- Assignment Guide Title PageDocumento19 páginasAssignment Guide Title PageAli NAAinda não há avaliações

- Finance Statement AnalysisDocumento76 páginasFinance Statement AnalysisFinexFinexAinda não há avaliações

- Security AnalysisDocumento87 páginasSecurity AnalysislakshmanlakhsAinda não há avaliações

- ProjectDocumento6 páginasProjectRohit GuptaAinda não há avaliações

- Mutual Fund ProjectDocumento78 páginasMutual Fund ProjectVarun JainAinda não há avaliações

- Solution 2011Documento16 páginasSolution 2011Krutika MehtaAinda não há avaliações

- ACC561 Final ExamDocumento7 páginasACC561 Final ExamRogue PhoenixAinda não há avaliações

- Starting A Business - Davao CityDocumento15 páginasStarting A Business - Davao CityKimberly BlackAinda não há avaliações

- Iat ManualDocumento8 páginasIat Manualpraboda1991Ainda não há avaliações

- The Advantages of Cash Flow: DOB AMO PN CFDocumento6 páginasThe Advantages of Cash Flow: DOB AMO PN CFSorina Mihaela PopescuAinda não há avaliações

- Balance Sheet StatementDocumento8 páginasBalance Sheet StatementsantasantitaAinda não há avaliações

- Final Report Mutual Fund Valuation and Accounting 1Documento69 páginasFinal Report Mutual Fund Valuation and Accounting 1Neha Aggarwal AhujaAinda não há avaliações

- FM StudyguideDocumento18 páginasFM StudyguideVipul SinghAinda não há avaliações

- Notes On Project FinanceDocumento60 páginasNotes On Project FinanceJas SudanAinda não há avaliações

- AccountingDocumento13 páginasAccountingArjun SrinivasAinda não há avaliações

- Income Statement & Cash Flows Chapter 5Documento101 páginasIncome Statement & Cash Flows Chapter 5Joey LessardAinda não há avaliações

- Working Capital ManagementDocumento78 páginasWorking Capital ManagementPriya GowdaAinda não há avaliações

- Methodsof Estimationof Working Capital RequirementDocumento10 páginasMethodsof Estimationof Working Capital Requirementanindita sahooAinda não há avaliações

- Final Post Evaluation of Capital BudgetingDocumento72 páginasFinal Post Evaluation of Capital BudgetingNaresh NaniAinda não há avaliações

- Performance Evaluation of Mutual Funds in IndiaDocumento40 páginasPerformance Evaluation of Mutual Funds in IndiafathimathabasumAinda não há avaliações

- Project DhanaDocumento87 páginasProject DhanacursorkkdAinda não há avaliações

- Earnings and Cash Flow Analysis: SlidesDocumento6 páginasEarnings and Cash Flow Analysis: Slidestahera aqeelAinda não há avaliações

- Solution For The Analysis and Use of Financial Statements (White.G) ch03Documento50 páginasSolution For The Analysis and Use of Financial Statements (White.G) ch03Hoàng Thảo Lê69% (13)

- The word formed is "RE-ELECTDocumento5 páginasThe word formed is "RE-ELECTOlga VlahouAinda não há avaliações

- FIN619 Project VUDocumento84 páginasFIN619 Project VUsunny_fzAinda não há avaliações

- Starting A Business - Marikina CityDocumento16 páginasStarting A Business - Marikina Cityraighnejames19Ainda não há avaliações

- Solution Audit and Internal Review Nov Ember2010Documento9 páginasSolution Audit and Internal Review Nov Ember2010samuel_dwumfourAinda não há avaliações

- Financial Ratios Analysis Report-SKSDocumento6 páginasFinancial Ratios Analysis Report-SKSRamendra KumarAinda não há avaliações

- Budgetary ControlDocumento81 páginasBudgetary ControlVirendra JhaAinda não há avaliações

- RAK International UniversityDocumento5 páginasRAK International UniversityZubaidahAinda não há avaliações

- Shiv PackagingDocumento65 páginasShiv PackagingDharmik MoradiyaAinda não há avaliações

- Credit Appraisal Techniques ExplainedDocumento35 páginasCredit Appraisal Techniques ExplainedDilip RkAinda não há avaliações

- MRK Spring2011 FINI619 BankofPunjabDocumento61 páginasMRK Spring2011 FINI619 BankofPunjabArslan_Ahmed002Ainda não há avaliações

- Group Accounting Consolidation F3Documento5 páginasGroup Accounting Consolidation F3salehin1969Ainda não há avaliações

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocumento12 páginasCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085Ainda não há avaliações

- Project On Kotak Mahindra BankDocumento67 páginasProject On Kotak Mahindra BankMitesh ShahAinda não há avaliações

- Accounting for Agency and Trust FundsDocumento20 páginasAccounting for Agency and Trust FundstrinhbangAinda não há avaliações

- A Study of The Challenges and Prospects of The Vat Service in Ghana (A Case Study of The Kumasi Metropolis)Documento70 páginasA Study of The Challenges and Prospects of The Vat Service in Ghana (A Case Study of The Kumasi Metropolis)John Bates BlanksonAinda não há avaliações

- Chapter 04 - AnswerDocumento9 páginasChapter 04 - AnswerCrisalie Bocobo0% (1)

- RINL Working Capital Management StudyDocumento98 páginasRINL Working Capital Management StudySrinivas PalukuriAinda não há avaliações

- Mba Faa I UnitDocumento8 páginasMba Faa I UnitNaresh GuduruAinda não há avaliações

- Small Business AccountingDocumento5 páginasSmall Business AccountingSDaroosterAinda não há avaliações

- International Finance AnalysisDocumento20 páginasInternational Finance AnalysisPARTH KHANNAAinda não há avaliações

- Certificate: Mr. Neeraj Gupta "Financial Performance Analysis of NTPC"Documento17 páginasCertificate: Mr. Neeraj Gupta "Financial Performance Analysis of NTPC"ajaynegi71Ainda não há avaliações

- Finl Reliance ProjectDocumento70 páginasFinl Reliance Projectankitverma9716Ainda não há avaliações

- Chapter08 KGWDocumento24 páginasChapter08 KGWMir Zain Ul HassanAinda não há avaliações

- The Entrepreneur’S Dictionary of Business and Financial TermsNo EverandThe Entrepreneur’S Dictionary of Business and Financial TermsAinda não há avaliações

- International Financial Statement Analysis WorkbookNo EverandInternational Financial Statement Analysis WorkbookAinda não há avaliações

- Statement of Cash Flows: Preparation, Presentation, and UseNo EverandStatement of Cash Flows: Preparation, Presentation, and UseAinda não há avaliações

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19No EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Ainda não há avaliações

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsAinda não há avaliações

- Job DescriptionDocumento2 páginasJob DescriptionGagandeep S ChawlaAinda não há avaliações

- 2 EPRG, International OrientationDocumento15 páginas2 EPRG, International OrientationPinky AggarwalAinda não há avaliações

- Pinky Project Bba 4 SamDocumento64 páginasPinky Project Bba 4 SamPinky AggarwalAinda não há avaliações

- Project Repot On Deposit SchemeDocumento7 páginasProject Repot On Deposit SchemePinky AggarwalAinda não há avaliações

- Project Repot On Deposit SchemeDocumento7 páginasProject Repot On Deposit SchemePinky AggarwalAinda não há avaliações

- Capital Structure DecisionDocumento58 páginasCapital Structure DecisionPinky AggarwalAinda não há avaliações

- Global InnovationDocumento12 páginasGlobal InnovationPinky AggarwalAinda não há avaliações

- DOS DOCUMENTATIONDocumento74 páginasDOS DOCUMENTATIONPinky AggarwalAinda não há avaliações

- Project Report of Compititve AnalysisDocumento62 páginasProject Report of Compititve AnalysisPinky AggarwalAinda não há avaliações

- Competitive AnalysisDocumento75 páginasCompetitive AnalysisPinky AggarwalAinda não há avaliações

- Trends in It IndustryDocumento25 páginasTrends in It IndustryGurvinder SinghAinda não há avaliações

- Chap 001Documento55 páginasChap 001Titima LachguerAinda não há avaliações

- Project SelectionDocumento16 páginasProject SelectionPinky AggarwalAinda não há avaliações

- Consumer Behaviour Theory ConceptsDocumento56 páginasConsumer Behaviour Theory ConceptsjayaniAinda não há avaliações

- Project SelectionDocumento16 páginasProject SelectionPinky AggarwalAinda não há avaliações

- Project Report Final On DepositeDocumento84 páginasProject Report Final On DepositePinky AggarwalAinda não há avaliações

- Entrepreneurial Development PDFDocumento66 páginasEntrepreneurial Development PDFKajal ChaudharyAinda não há avaliações

- Project Report Final On DepositeDocumento84 páginasProject Report Final On DepositePinky AggarwalAinda não há avaliações

- Full Project of BRDocumento40 páginasFull Project of BRPinky AggarwalAinda não há avaliações

- Deposite Scheme Projec T From Net NiceDocumento72 páginasDeposite Scheme Projec T From Net NicePinky AggarwalAinda não há avaliações

- Basic Management SkillsDocumento241 páginasBasic Management SkillsPinky Aggarwal100% (1)

- Link of Comodity Agrement Unit - 3Documento1 páginaLink of Comodity Agrement Unit - 3Pinky AggarwalAinda não há avaliações

- Date Sheet-Final Theory MBA (Regular, FM & IB)Documento3 páginasDate Sheet-Final Theory MBA (Regular, FM & IB)poojamittal_26Ainda não há avaliações

- Project Report Final On DepositeDocumento84 páginasProject Report Final On DepositePinky AggarwalAinda não há avaliações

- Capacity PlanningDocumento7 páginasCapacity PlanningPinky AggarwalAinda não há avaliações

- Capacity PlanningDocumento7 páginasCapacity PlanningPinky AggarwalAinda não há avaliações

- Date Sheet-Final Theory MBA (Regular, FM & IB)Documento3 páginasDate Sheet-Final Theory MBA (Regular, FM & IB)poojamittal_26Ainda não há avaliações

- Bba - Vi (Ib) (Gu)Documento60 páginasBba - Vi (Ib) (Gu)Pinky AggarwalAinda não há avaliações

- Bba - Vi (Ed) (Gu)Documento28 páginasBba - Vi (Ed) (Gu)Pinky AggarwalAinda não há avaliações

- Risk Management - WikipediaDocumento1 páginaRisk Management - WikipediaLikeKangen LoveWaterAinda não há avaliações

- Cost Estimation: (CHAPTER-3)Documento43 páginasCost Estimation: (CHAPTER-3)fentaw melkieAinda não há avaliações

- CKSBDocumento23 páginasCKSBayushiAinda não há avaliações

- Teamwork For Ibl1201Documento16 páginasTeamwork For Ibl1201Thanh Phat Nguyen MyAinda não há avaliações

- Change Management EssayDocumento5 páginasChange Management EssayAvinashAinda não há avaliações

- Freay Hans BillDocumento1 páginaFreay Hans BillJohn Bean100% (2)

- Peer Review Report Phase 1 CuraçaoDocumento91 páginasPeer Review Report Phase 1 CuraçaoOECD: Organisation for Economic Co-operation and DevelopmentAinda não há avaliações

- Md. Ahsan Ullah - International Trade Finance and Role of BanksDocumento34 páginasMd. Ahsan Ullah - International Trade Finance and Role of Banks12-057 MOHAMMAD MUSHFIQUR RAHMANAinda não há avaliações

- Joinpdf PDFDocumento1.043 páginasJoinpdf PDFOwen Bawlor ManozAinda não há avaliações

- Final Exam-Auditing Theory 2015Documento16 páginasFinal Exam-Auditing Theory 2015Red YuAinda não há avaliações

- Importance of TaxDocumento6 páginasImportance of Taxmahabalu123456789Ainda não há avaliações

- CRYPTO TRADING GUIDEDocumento46 páginasCRYPTO TRADING GUIDELudwig VictoryAinda não há avaliações

- HEIRS OF DR. INTAC vs. CADocumento3 páginasHEIRS OF DR. INTAC vs. CAmiles1280100% (3)

- The WheelDocumento6 páginasThe Wheeldantulo1234Ainda não há avaliações

- Adani Bill JADHAVDocumento5 páginasAdani Bill JADHAVsupriya thombreAinda não há avaliações

- UK FATCA Self Certification FormDocumento10 páginasUK FATCA Self Certification Formlito77Ainda não há avaliações

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocumento3 páginasTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceNishi GuptaAinda não há avaliações

- Induction Training Report - Planning Division: AcknowledgementDocumento44 páginasInduction Training Report - Planning Division: AcknowledgementasamselaseAinda não há avaliações

- Aeropostale Checkout ConfirmationDocumento3 páginasAeropostale Checkout ConfirmationBladimilPujOlsChalasAinda não há avaliações

- Tutorial 2 Eco411 2013Documento4 páginasTutorial 2 Eco411 2013Mohamad Izzuddin ZakariaAinda não há avaliações

- Account Determination MM en USDocumento81 páginasAccount Determination MM en USkamal_dipAinda não há avaliações

- IIBPS PO DI English - pdf-38 PDFDocumento11 páginasIIBPS PO DI English - pdf-38 PDFRahul GaurAinda não há avaliações

- Supergrowth PDFDocumento9 páginasSupergrowth PDFXavier Alexen AseronAinda não há avaliações

- Accounting Principles Question Paper, Answers and Examiners CommentsDocumento24 páginasAccounting Principles Question Paper, Answers and Examiners CommentsRyanAinda não há avaliações

- Revision Question Topic 3,4Documento4 páginasRevision Question Topic 3,4Nur Wahida100% (1)

- Employee Loan ApplicationDocumento2 páginasEmployee Loan Applicationdexdex110% (1)

- Asset Liability Management in BanksDocumento8 páginasAsset Liability Management in Bankskpved92Ainda não há avaliações

- 02 Phi LarpDocumento133 páginas02 Phi LarpSteven Joseph IncioAinda não há avaliações

- Ad 5933Documento2 páginasAd 5933Kaustuv MishraAinda não há avaliações