Escolar Documentos

Profissional Documentos

Cultura Documentos

August 2007 CPPA

Enviado por

Ahmed Raza Mir0 notas0% acharam este documento útil (0 voto)

103 visualizações19 páginasPast Exam papers

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoPast Exam papers

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

103 visualizações19 páginasAugust 2007 CPPA

Enviado por

Ahmed Raza MirPast Exam papers

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 19

NOTES

Candidates should answer all three Questions in Section A and

two Questions from Section B.

All Questions carry equal marks.

SMA TABLES ARE PROVIDED

TIME ALLOWED:

3.5 hours, plus 10 minutes to read the paper.

INSTRUCTIONS:

During the reading time you may write notes on the examination paper but you may not commence

writing in your answer book.

Marks for each question are shown. The pass mark required is 50% in total over the whole paper.

Start your answer to each question on a new page.

You are reminded that candidates are expected to pay particular attention to their communication skills

and care must be taken regarding the format and literacy of the solutions. The marking system will take

into account the content of the candidates' answers and the extent to which answers are supported with

relevant legislation, case law or examples where appropriate.

List on the cover of each answer booklet, in the space provided, the number of each question(s)

attempted.

STRATEGIC MANAGEMENT ACCOUNTING

PROFESSIONAL 1 EXAMINATION - AUGUST 2007

The Institute of Certified Public Accountants in Ireland, 9 Ely Place, Dublin 2.

THE INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS IN IRELAND

STRATEGIC MANAGEMENT ACCOUNTING

PROFESSIONAL 1 EXAMINATION - AUGUST 2007

Time Allowed: 3.5 hours, plus 10 minutes to read the paper. Answer all three Questions from Section A

and any two Questions from Section B.

Section A - Questions 1, 2 and 3 are all compulsory

1. Cavan Ltd. manufactures two models of heavy-duty cooking rack suitable for use in restaurant kitchens and

similar commercial environments. Both models use the same types of raw materials and direct labour. No

stocks are held. The sales budget for the first quarter of this year was as follows:

Model A Model B

Budget sales units 1,800 600

Budget selling prices 150 per unit 105 per unit

This sales budget was based on an assumption that Cavan Ltd.s total sales units would amount to a 40%

share of the market in which it operates.

The company operates a standard variable costing system, and the following is a calculation of the standard

variable cost of each product:

Model A Model B

Raw materials 4 kg. @ 15 per kg. = 60 3kg. @ 15 per kg. = 45

Direct labour 2 hours @ 12 per hour = 24 1hour @ 12 per hour = 12

Variable overheads 2 direct labour hours @ 10 1 direct labour hour @ 10

per hour = 20 per hour = 10

Totals: 104 67

The actual results for the quarter were as follows:

Model A Model B

Sales 1,320 units @ 150 per unit 880 units @ 105 per unit

= 198,000 = 92,400

Raw materials 5,500 kg. @ 15 per kg. 2,700 kg. @ 15 per kg.

= 82,500 = 40,500

Direct labour 2,600 hours @ 12.50 per hour 900 hours @ 12.50 per hour

= 32,500 = 11,250

Variable overheads 36,000 6,350

Contribution 47,000 34,300

Published industry data indicated that, in the first quarter of this year, a total of 5,400 heavy-duty cooking

racks were sold in the market in which Cavan Ltd. operates.

Page 1

REQUIREMENT:

(a) Calculate the following variances:

G

Sales mix variance.

G

Sales quantity variance.

G

Market share variance.

G

Market size variance.

(8 marks)

(b) Using your answer to part (a), and such additional variance calculations as you consider necessary,

present a reconciliation of the budgeted and actual total company contribution. (A breakdown by

product is not required).

(6 marks)

(c) Provide clear explanations of the significance of each of the four variances which you calculated in

your answer to part (a).

(6 marks)

[Total: 20 marks]

Page 2

2. Down Ltd. plans to open a new factory where two products (A and B )will be manufactured using a single

set of production facilities. Engineers have estimated that the inputs required to manufacture a unit of

product in respect of A and B will be as follows:

Product A Product B

Direct labour hours 4 7

Machine hours 16 12

Raw materials 50 60

The factory manager estimates that, during the first month of production, the average time elapsing between

production and sale of each unit of product will be 10 days in the case of Product A and 15 days in the case

of Product B. She also estimates that 40% of units of Product Aand 20% of units of Product B will fail quality

control tests at the end of the production process and will therefore need to be immediately repaired. The

inputs required to repair a unit of each product will be:

Product A Product B

Direct labour hours 3 5

Machine hours 6 4

Raw materials 20 25

Output in the first month will be 20,000 units of Product A and 25,000 units of Product B, and the factorys

machine capacity will be fully utilised at this level of output. The factorys energy costs are variable in

proportion to the number of machine hours worked and are estimated at 550,400 per month when the

factory is operating at full capacity. Direct labour is available in any desired quantity at a wage rate of 10

per hour.

Storage of products between production and sale is subcontracted to a local warehouse which charges

Down Ltd. in accordance with the quantity and duration of goods stored. Down Ltd. estimates that it will

incur storage charges of 345,000 during the first month of production.

Selling prices per unit are 200 per unit for Product A and 230 per unit of Product B.

REQUIREMENT:

(a) For each of the two products, calculate the contribution per unit of output during the first month of

production.

(9 marks)

(b) Senior management at Down Ltd. are committed to implementing Just-In-Time production (JIT) and

Total Quality Management (TQM) insofar as possible.

To this end, the company expects that in the second month of production the average times elapsing

between production and sale of units of each product will be only half of the corresponding times in

the first month. It is also expected that, in the second month of production, 15% of the output of

each product will fail quality control tests at the end of the production process.

In the second month, the factory will produce at least 20,000 units of product A and 25,000 units of

product B (i.e. the same quantities in the previous month). However, there is substantial unfulfilled

demand for both products and any additional machine hours which become available as a result of

the decrease in the rate of quality control failures will be used in the most profitable way possible.

Calculate the increase in total monthly contribution (i.e. between the first and second months)

which will result from the implementation of these changes.

(7 marks)

(c) In the context of quality management, give two examples of appraisal costs and discuss the likely

trend in appraisal costs during the implementation of a total quality management programme.

(4 marks)

[Total: 20 marks]

Page 3

3. Donegal Ltd. manufactures a wide variety of products at its factory in Letterkenny. The company operates

an activity based costing system, and has made the following estimates of the factorys overhead costs (and

related cost driver activities) for next month:

Cost pool Cost driver activity Total costs in pool

Production line set-up 400 set-ups 336,000

Product & equipment testing 5,000 tests 1,000,000

Customer order processing & deliveries 6,000 customer orders 1,440,000

Fixed factory overhead NONE 906,000

Because no cost driver activity can be identified for fixed factory overhead, this cost is allocated to products

on a direct labour hour basis. Total direct labour hours in the factory next month are estimated at 300,000.

One of the companys products (Pro-1) is manufactured in batches of 500 units per production run. A total

of 3 tests are carried out during each production run to ensure that quality standards are achieved. It is

estimated that, next month, the company will receive a total of 2,000 customer orders for Pro-1 (consisting of 800

orders for 100 units per order and a further 1,200 orders for 40 units per order).Production of a unit of Pro-1

requires raw materials costing 2.50 as well as one and a half hours of direct labour.

All direct labour in Donegal Ltd. is paid at a rate of 9 per hour. The selling price of each product is

calculated as the full cost of production (including all overhead allocations) plus a 25% markup.

The company operates a just-in-time system. Therefore, no stocks are held and all goods are produced in

response to customer orders and are immediately delivered to customers.

REQUIREMENT:

(a) Calculate the unit cost of Pro-1 (in accordance with Donegal Ltd.s costing system) and the selling

price per unit.

(10 marks)

(b) Estimate the incremental contribution which Donegal Ltd. would earn from each of the following

opportunities:

G

250 extra orders for 40 units of Pro-1 per order.

G

100 extra orders for 100 units of Pro-1 per order.

N.B.: In answering this part, take each of these two opportunities separately. Assume that the selling

price per unit would be the same as in part (a).

(5 marks)

(c) Explain what is meant by Customer Profitability Analysis, and discuss why an activity based costing

system is necessary in order to implement meaningful customer profitability analysis.

(5 marks)

[Total: 20 marks]

Page 4

Section B - Answer any two Questions

4. Fermanagh Manufacturing PLC is a divisionalised company. Jack Maguire is the manager of the

companys Textiles Division and he is considering the introduction of a new product line. This would require

an immediate investment of 1,000,000 in new fixed assets plus 500,000 in additional working capital.

The fixed assets would have a useful life of four years, and the product line would be discontinued at the

end of that time.

During each of the four years, 150,000 units of the product would be produced and sold at a price of 18

each. Variable costs of production would be 12 per unit and fixed costs (other than depreciation) would

amount to 500,000 per annum. It is believed that a cash sum of 200,000 would be received when the

fixed assets are sold for scrap at the end of their four year life. However, in accordance with the companys

standard accounting practices, the full purchase cost of the fixed assets would be depreciated on a straight

line basis over their useful life (i.e. a zero residual value would be assumed in the calculation of the annual

depreciation charge). The working capital investment would be recovered in full at the end of the projects

life.

The performance of the Textiles Division is measured each year on the basis of Return On Investment (ROI).

For this purpose, profit is defined to include any gains or losses on fixed asset disposals and the investment

base is defined as working capital investment plus the net book value of fixed assets at the beginning of the

year.

Jack Maguire is paid a bonus each year which is linked to the extent by which his divisions actual ROI

exceeds the divisions required (or target) ROI. The required rate of return for the Textiles Division is 10%

per annum, and this is also the divisions cost of capital. Jacks own financial forecasts indicate that (in the

absence of the proposed investment in the new product line) the Textiles Division will earn a ROI of 15% per

annum for the next five years.

Jack plans to leave his current employment within the next two to three years and set up in business as a

consultant to manufacturing companies who could benefit from his experience and advice.

REQUIREMENT:

Note: Present value and annuity tables are available with this paper.

(a) Calculate the ROI of the proposed investment in each of the next four years. Then, explain whether or

not Jack is likely to accept this proposed investment, assuming that he acts to maximise his own self-

interest.

(10 marks)

(b) Calculate the net present value of the proposed investment.

(4 marks)

(c) The use of ROI as a performance measure does not necessarily ensure that a division manager will

take decisions which are in shareholders best interests. Give three examples of why this so, using the

case of Fermanagh Manufacturing PLC to illustrate.

(6 marks)

[Total: 20 marks]

Page 5

5. Monaghan Ltd. manufactures advanced technical components for the computer hardware industry.

The companys Unu Division manufactures a special subcomponent at a variable cost of 70 per unit. This

divisions maximum monthly production capacity is 27,000 units, but its actual production each month is

25,000 units. Of this actual monthly production, 15,000 units are sold to external customers (at a price of

100 each) while the remaining 10,000 units are transferred to the companys Du Division at the same

price.

The Du Divisions maximum production capacity is 13,500 units per month. However, market demand for

the divisions product is only 10,000 units and therefore production is carried out at this level. In producing

one unit of its product, Du Division uses one unit of the subcomponent purchased from Unu Division and

incurs additional variable costs of 90 per unit. The selling price of Du Divisions product is 200 per unit.

The Du Division recently received an enquiry from a new customer, who has offered to purchase 3,000 units

of that divisions product each month at a price of 185 per unit.

REQUIREMENT:

(a) Prepare calculations to indicate the increase in the monthly profits of Monaghan Ltd., if the new

customers offer is accepted.

(7 marks)

(b) Prepare calculations to indicate whether the existing transfer pricing arrangements would motivate

each of the two divisions to cooperate in transferring the 3,000 subcomponents needed in order to

manufacture the new customers order.

(6 marks)

(c) Identify the minimum transfer prices which would be acceptable to Unu Division and identify the

maximum transfer prices which would be acceptable to Du Division. Then, suggest a transfer price

per unit for the 3,000 subcomponents which would achieve the following:

G

The incremental profits from doing business with the new customer are to be shared equally

between the two divisions.

G

The same transfer price per unit is to apply to all units transferred.

(7 marks)

[Total: 20 marks]

Page 6

6. Tyrone Ltd. manufactures specialised engineering products. The items produced are of high quality but

are fragile by nature and therefore the packaging process must be carried out with some care.

The companys product development staff recently completed design work on a new product (the TLX).

Comparison with competitors products indicates that 20 per unit is a realistic selling price for the TLX. The

company requires a 35% margin on selling price from all products in order to ensure an adequate company-

wide return on investment. Production and sales of TLX are estimated at 13,000 units per annum.

According to the design specifications, the TLX is to be produced in batches of 500 units and packaged in

batches of 25 units. Overhead costs amount to 2,000 for each batch of 500 units produced and a further

125 for each batch of 25 units packaged.

The design specifications also indicate that the manufacture of each unit of TLX will require 3 units of

Component #1 and 5 units of Component #2. Component #1 is a new item which Tyrone Ltd. will have to

manufacture at a cost of 0.20 (variable) each plus 4,000 for each batch of 10,000 units of this component.

Component #2 is used regularly by the company and can be purchased in any desired quantity from a

reliable supplier for 0.55 each. The labour cost of fitting these components in the manufacture of TLX is

estimated at 0.45 per unit of Component #1 and 0.15 per unit of Component #2.

REQUIREMENT:

(a) Prepare calculations to indicate whether Tyrone Ltd. will achieve the target cost for the TLX on the

basis of the data provided.

(8 marks)

(b) Now assume that a target costing task force has suggested the following changes in order to help

reduce the cost of the TLX:

G

Increase the production batch size so that each years total output of TLX would be produced in

just 24 batches;

G

Increase the packaging batch size to 75 units of TLX;

G

Modify the design of the TLX, such that 2 units of Component #1 would be replaced by the same

number of units of Component #2 in each TLX.

Calculate the total annual cost savings if all of these changes are implemented, and indicate whether

the target cost would be achieved.

(8 marks)

(c) The Managing Director points out that no consideration has been given to the cost of delivering the

product to customers. Discuss whether the company needs to give consideration to delivery costs as

part of the target costing exercise. (N.B. Calculations are not required in your answer to this part).

(4 marks)

[Total: 20 marks]

END OF PAPER

Page 7

STRATEGIC MANAGEMENT ACCOUNTING

PROFESSIONAL 1 EXAMINATION - AUGUST 2007

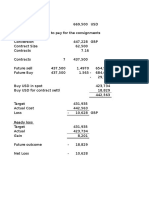

Solution 1: Cavan Ltd.

(a)

Sales mix variance

AQ in AM AQ in SM Standard Contribution Variance

A 1,320 1,650 46 15,180 U

B 880 550 38 12,540 F

2,200 2,200 2,640 U

Sales quantity variance

G

Weighted average contribution per unit = (75% * 46) + (25% * 38) = 44.

G

SQV = (2,200 2,400) * 44 = 8,800 U.

Market size variance

G

Actual market size = 5,400 units.

G

Budget market size = 2,400 / 40% = 6,000 units.

G

MSZV = (5,400 6,000) * 40% * 44 = 10,560 U.

Market share variance

G

Actual sales = 2,200 units.

G

Standard share of actual market = 5,400 * 40% = 2,160 units.

G

MSHV = (2,200 2,160) * 44 = 1,760 F.

(b)

Materials use variance

G

Actual quantity = 5,500 + 2,700 = 8,200 kg.

G

Standard quantity = (1,320 * 4) + (880 * 3) = 7,920 kg.

G

MUV = (8,200 7,920) * 15 = 4,200 U.

Labour efficiency variance

G

Actual hours = 2,600 + 900 = 3,500.

G

Standard hours = (1,320 * 2) + (880 * 1) = 3,520.

G

LEV = (3,500 3,520) * 12 = 240 F.

Labour rate variance = 3,500 * (12.50 - 12) = 1,750 U.

Variable overhead efficiency variance = (3,500 LH 3,520 LH) * 10 = 200 F.

Variable overhead spending variance

G

Actual VO expenditure = 36,000 + 6,350 = 42,350.

G

Standard VO expenditure for actual labour hours = (3,500 * 10) = 35,000

G

VOSV = 42,350 - 35,000 = 7,350 U.

Page 8

SUGGESTED SOLUTIONS

RECONCILIATION

Budget profit: (1,800 * 46) + (600 * 38) 105,600

Sales mix variance 2,640 U

Market size variance 10,560 U

Market share variance 1,760 F

Sales quantity variance ------------ 8,800 U

Materials use variance 4,200 U

Labour efficiency variance 240 F

Labour rate variance 1,750 U

Variable overhead efficiency variance 200 F

Variable overhead spending variance 7,350 U

Actual profit: 47,000 + 34,300 81,300

(c)

G

The cause of the unfavourable sales mix variance is that the product with the higher contribution per unit

(Model A, at 46) actually accounted for a lower proportion of sales units (60%) than budgeted (75%).

Conversely, in the case of the higher-contribution product (Model B), its actual sales quantities accounted

for a higher percentage of sales units (40%) than budgeted (25%).

G

The unfavourable sales quantity variance shows the decrease in total contribution resulting from the

increase in total sales quantity from 2,400 to 2,200, ignoring the changing in the sales mix (i.e., holding

the sales mix constant at its budgeted 75%:25% level).

G

Together, the market share and market size variances make up the sales quantity variance (1,760 F +

10,560 U = 8,800 U).

G

The unfavourable market size variance of 10,560 is the loss of contribution which Cavan Ltd. would

have suffered because of the increase in the total market size from 6,000 to 5,400 units, if the company

had achieved only a 40% market share as budgeted.

G

The favourable market share variance of 1,760 is the amount of additional contribution earned by

Cavan Ltd. as a result of increasing its market share from a budgeted 40% to an actual 44.4%.

Tutorial notes:

G

Purpose of question: To test candidates ability to calculate and explain advanced sales and marketing

variances, including advanced materials variances, and to identify which other variances are also

necessary in order to complete a variance reconciliation. (Topic 3).

G

Links: None.

G

Options: Textbooks (and therefore candidates) are likely to differ somewhat in the precise methods used

to calculate variances in parts (a) and (b), although all should arrive at the same answer.

G

Essential components: Candidates need to be able to perform the calculations required for parts (a) and

(b), and to identify which variances are required for part (b). In part (c), candidates are expected to

provide a thorough (and not merely superficial) explanation of the meanings of the variances.

Page 9

Solution 2: Down Ltd.

(a)

G

Energy costs per MH:

Total MH = (20,000 * 16) + (25,000 * 12) + (20,000 * 40% * 6) + (25,000 * 20% * 4) = 688,000.

Energy cost per MH = 550,400 / 688,000 = 0.80 per MH.

G

Storage costs per day:

Total storage days = (20,000 * 10) + (25,000 * 15) = 575,000.

Storage cost per day = 345,000 / 575,000 = 0.60 per day.

G

Average cost per unit:

Product A Product B

Production: labour 4 * 10 = 40 7 * 10 = 70

Production: energy 16 * 0.80 = 12.80 12 * 0.80 = 9.60

Production: materials 50 60

Storage 10 days * 0.60 = 6 15 days * 0.60 = 9

Repair: labour 40% * 3 * 10 = 12 20% * 5 * 10 = 10

Repair: energy 40% * 6 * 0.80 = 1.92 20% * 4 * 0.80 = 0.64

Repair: materials 40% * 20 = 8 20% * 25 = 5

Total cost per unit 130.72 164.24

G

Contribution per unit:

Product A Product B

200 - 130.72 = 69.28 230 - 164.24 = 65.76

(b)

G

Extra MH available = (40% - 15% * 20,000 * 6) + (20% - 15% * 25,000 * 4) = 35,000 MH.

G

Revised costs per unit:

Product A Product B

Production: labour (as before) 40 70

Production: energy (as before) 12.80 9.60

Production: materials (as before) 50 60

Storage 5 days * 0.60 = 3 7.5 days * 0.60 = 4.50

Repair: labour 15% * 3 * 10 = 4.50 15% * 5 * 10 = 7.50

Repair: energy 15% * 6 * 0.80 = 0.72 15% * 4 * 0.80 = 0.48

Repair: materials 15% * 20 = 3 15% * 25 = 3.75

Total cost per unit 114.02 155.83

G

Contribution per unit of scarce resource (MH):

Product A Product B

Contribution per unit 200 - 114.02 = 85.98 230 - 155.83 = 74.17

Average MH per unit 16 + (15% * 6) = 16.9 MH 12 + (15% * 4) = 12.6 MH

Contribution per MH 5.09 5.89

G

Hence: Optimal use of additional hours is to increase production of B by (35.000 MH / 12.6 MH) = 2,777

units.

Page 10

G

Change in total contribution:

Contribution (Month 2) (20,000 * 85.98) + (27,777 * 74.17) = 3,779,820

Contribution (Month 1) (20,000 * 69.28) + (25,000 * 65.76) = 3,029,600

Increase in contribution 750,220

(c)

G

Example 1: Costs of quality control sampling at the end of the production staff (e.g., salaries paid to

quality control inspectors).

G

Example 2: Costs of periodic testing of production equipment, to determine whether it is calibrated with

sufficient accuracy.

G

In the earliest stages of a total quality management (TQM) programme, appraisal costs often increase as

management take steps to identify any defective output produced by existing production facilities and

prevent if from leaving the factory. In the longer term, however, it is a fundamental tenet of TQM that

quality should be designed in and not inspected out. For example, by increasing its expenditure on

preventive maintenance and staff training, a manufacturing firm can significantly reduce the probability of

defective output being produced. In these circumstances, appraisal becomes less necessary and

therefore appraisal costs can be expected to decrease.

Tutorial notes:

G

Purpose of question: To test candidates ability to identify and calculate relevant information for decision-

making including the effect of a limiting factor (Topic 2), and to prepare calculations and explanations in

the context of cost of quality management (Topic 5).

G

Links: One effect of part (b) is to highlight the high opportunity cost (Topic 2) of low quality levels.

G

Options: There are many valid examples which could be given in answer to part (c). In parts (a) and (b),

the precise sequence of calculations may vary somewhat although candidates should ultimately arrive at

the answers presented here.

G

Essential components: Candidates need to be able to identify and calculate relevant costs in parts (a)

and (b), not forgetting about the significant impact of repair costs. Also, candidates must know how to

identify the optimal use of a single limiting factor in part (b). Finally, in part (c), candidates must

understand appraisal costs including their likely trend in the context of TQM.

Page 11

Solution 3: Donegal Ltd.

(a)

G

Cost driver rates:

Set-up: 336,000 / 400 = 840 per set-up.

Testing: 1,000,000 / 5,000 = 200 per test.

Customer order processing & delivery: 480,000 / 2,000 = 240 per order.

G

Fixed overhead allocation rate: 906,000 / 300,000= 3.02 per DLH.

G

Activity levels for Pro-1:

Total output = (800 * 100) + (1200 * 40) = 128,000 units.

Number of set-ups = 128,000 / 500 = 256.

Number of tests = 256 * 3 = 768.

Number of customer orders = 800 + 1,200 = 2,000.

G

Activity-based overhead cost levels for Pro-1:

Set-up 256 * 840 = 215,040

Test 768 * 200 = 153,600

Customer order processing 2,000 * 240 = 480,000

Total 848,640

G

Cost and selling price per unit:

Raw materials 2.50

Direct labour 1.5 DLH * 9 = 13.50

Activity based overheads 848,640 / 128,000 = 6.63

Fixed factory overhead 1.5 DLH * 3.02 = 4.53

Total cost per unit 27.16

Selling price 27.16 plus 25% = 33.95

(b)

G

Activity levels for Opportunity #1:

Total output = (250 * 40) = 10,000 units.

Number of set-ups = 10,000 / 500 = 20.

Number of tests = 20 * 3 = 60.

Number of customer orders = 250.

G

Incremental costs & contribution for Opportunity #1:

Set-up 20 * 840 = 16,800

Test 60 * 200 = 12,000

Customer order processing 250 * 240 = 60,000

Raw materials 10,000 * 2.50 = 25,000

Direct labour 10,000 * 13.50 = 135,000

Total costs 233,680

Total sales 10,000 * 33.95 = 339,500

Total incremental contribution 90,700

G

Activity levels for Opportunity #2:

Total output = (100 * 100) = 10,000 units, i.e., the same as Opportunity #1. Hence, activity & incremental

costs are the same as for Opportunity #1, except that:

- Number of customer orders = 100

- Hence, cost of order processing = 100 * 240 = 24,000.

Page 12

G

Hence: Incremental contribution for Opportunity #2:

Incremental contribution for Opportunity #1 90.700

Saving in customer order processing costs 60K - 24K = 36K

Incremental contribution for Opportunity #2 126,700

(c)

G

Customer profitability analysis typically involves calculating the profit which a firm earns from its

relationships with each of its major customers. The objective is to identify the most profitable customers so

that the relationship can be carefully nurtured and maintained, and also to identify unprofitable customers

so that steps can be taken to improve the profitability of such relationships.

G

Activity based costing is essential for meaningful customer profitability analysis. Without ABC, it would

not be possible to trace costs accurately to individual customers to identify their profitability. For

example, customers can be expensive to serve because they order in small quantities (as the example in

part (b) illustrates) or require a lot of pre- or post-sales support.

G

Customers often differ in the mix of products which they buy. Therefore, the profit calculation for each

customer should include an accurate, activity-based figure for the cost of goods sold to that customer.

This requires that product costs have been calculated using activity based costing insofar as possible.

Tutorial notes:

G

Purpose of question: To test candidates to perform and interpret activity-based costing calculations

(Topic 1).

G

Links: Part (b) involves a relevant cost calculation (Topic 2).

G

Options: In part (c) there are several possible examples to explaining why ABC information is a

prerequisite for customer profitability analysis.

G

Essential components: Part (a) requires an ability to accurately perform ABC and cost-based pricing

calculations. Part (b) requires an ability to distinguish between incremental and non-incremental costs.

In part (c) candidates need to explain what customer profitability analysis is and why ABC is essential for

its implementation.

Page 13

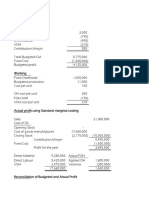

Solution 4: Fermanagh Manufacturing PLC

(a)

Profit:

Y1, Y2, Y3 Y4

Sales: 150,000 @ 18 2,700,000 2,700,000

VC: 150,000 @ 12 1,800,000 1,800,000

FC (excl. depreciation) 500,000 500,000

Depreciation: 1,000,000 / 4 250,000 250,000

Gain on disposal 200,000

Profit 150,000 350,000

Investment base:

Y1 Y2 Y3 Y4

FA @ beginning of year 1,000,000 750,000 500,000 250,000

Working capital 500,000 500,000 500,000 500,000

Total 1,500,000 1,250,000 1,000,000 750,000

ROI:

Y1 Y2 Y3 Y4

10% 12% 15% 46.7%

Jack is unlikely to accept the proposed investment. His division earns 15% without it, so acceptance will

reduce the average ROI during the timeframe of Jacks intended remaining employment with the company, and

thus adversely affect his bonus.

(b)

Cash flows:

Y) Y1, Y2, Y3 Y4

Operating cash flows (2.7M - 1.8M - 0.5M) 400,000 400,000

Purchase and sale of fixed assets (1,000,000) 200,000

Working capital (500,000) 500,000

Net cash flow (1,500,000) 400,000 1,100,000

NPV @ 10% = - 1.5M + (400K * 2.487) + (1.1M * 0.683) = 246,000.

(c)

Examples:

1. ROI includes a depreciation charge. NPV calculations do not, because depreciation is not a cash flow.

2. ROI is a year-by-year calculation, so the managers reaction to it depends on his time horizon (e.g., Jack does

not plan to stay long enough with Fermanagh Manufacturing for the high ROI in Year 4 to be of any benefit to

him). By contrast, NPV involves evaluating a project over its whole life.

3. NPV calculations enable a project to be judged in isolation. It is possible to see whether (as in this case) the

project would increase shareholders wealth. By contrast, managers tend to react to the ROI of an individual

project in terms of how it will affect their division average ROI and this can lead to dysfunctional decisions (e.g.,

Jack is unlikely to accept this project because it would reduce his existing high average ROI).

Page 14

Tutorial notes:

G

Purpose of question: To test candidates ability to calculate ROI (Topic 4) and NPV (Topic 3) and their

ability to identify how the performance evaluation method used is likely to affect a managers reaction to a

project (Topic 4).

G

Links: Part (b) requires an ability to identify incremental cash flows (Topic 2).

G

Options: In part (c) there is scope for variation, as candidates are free to use any three valid examples.

G

Essential components: In part (a) candidates need to be able to calculate ROI and assess the managers

likely reaction to the situation. Part (b) requires the ability to identify and discount incremental cash flows.

To answer part (c), candidates must give examples as to why the use of ROI as a performance measure

does not necessarily guarantee goal congruence.

Page 15

Solution 5: Monaghan Ltd.

(a)

G

Spare capacity in Unu Division = (27,000 15,000 10,000) = 2,000 units.

G

Spare capacity in Du Division = (13,500 10,000) = 3,500 units.

G

Effect on profits of accepting the new order:

Price paid by customer 3,000 * 185 = 555,000

Lost external sales in Unu (3,000 2,000 = 1,000 units) * 100 = 100,000

Incremental variable costs in Unu 2,000 * 70 = 140,000

Incremental variable costs in Du 3,000 * 90 = 270,000

Incremental profit 45,000

(b)

G

Unu Division:

- First 2,000 units: In favour. Incremental profit on units transferred = (100 - 70) * 2,000 = 60,000.

- Next 1,000 units: Indifferent, as internal transfer is at the same price as the displaced external sale

(100).

G

Du Division:

- Unwilling to accept the transfer. Incremental loss on units transferred = (185 - 100 - 90 = 5 per

unit) * 3,000) = 15,000.

G

Hence, although Unu would be willing to make the transfer, it will not take place because it is unacceptable to

Du.

(c)

G

Minimum prices acceptable to Unu:

- First 2,000 units: 70 (i.e., marginal cost).

- Next 1,000 units: 100 (i.e., external market price).

G

Maximum prices acceptable to Du:

- All units: 185 - 90 = 95 per unit.

G

Transfer price in accordance with criteria:

- At transfer price of 95 per unit, Dus profit is nil (see above).

- To give Du half of the total incremental profit, decrease this transfer price by:

Half of total profit Decrease in transfer price per unit

45,000 / 2 = 22,500 22,500 / 3,000 = 7.50

- Hence: transfer price of 95 - 7.50 = 87.50 per unit.

- Dus incremental profit = 3,000 * (185 - 90 - 87.50) = 22,500.

- Unus incremental profit = (3,000 * 87.50) (1,000 * 100) (2,000 * 70) = 22,500.

Page 16

Tutorial notes:

G

Purpose of question: To test candidates ability to appraise and identify transfer pricing arrangements

which will motivate goal congruent behaviour. (Topic 4).

G

Links: The question asks candidates to identify goal congruent transfer pricing arrangements, and this

necessitates (especially in part (a)) an ability to identify the relevant costs and revenue for decision-

making (Topic 2) from shareholders perspective.

G

Options: The scope for variation in answers is limited. However, it should be noted that the solution to

part (c) above is slightly longer than strictly necessary. Specifically, the question does not ask candidates

to prove that the proposed transfer pricing scheme gives equal profits (22,500) to each division.

G

Essential components: In all three parts, candidates need to be able to perform the calculations as

required. Some explanations would help the flow of the answers in most parts, but is not strictly

necessary given the wording of the question.

Page 17

Solution 6: Tyrone Ltd.

(a)

G

Target cost = 20 less 35% = 13.

G

Component costs:

- To buy & fit one unit of Component #1: 0.20 + (4,000 / 10,000 = 0.40) + 0.45 = 1.05.

- To buy & fit one unit of Component #2: 0.55 + 0.15 = 0.70.

G

Expected cost per unit of TLX:

Component #1: 3 units @ 1.05 3.15

Component #2: 5 units @ 0.70 3.50

Production overheads: 2,000 / 500 units 4.00

Packaging overheads: 125 / 25 units 5.00

TOTAL 15.65

G

Hence, on this basis, the target cost will not be achieved.

(b)

G

Reduction in numbers of batches:

- Production: (13,000 / 500 = 26) 24 = 2.

- Packaging: (13,000 / 25 = 520) - (13,000 / 75 = 173.33) = 346.67.

G

Annual expected cost savings:

Production overheads: 2 * 2,000 4,000

Packaging overheads: 346.67 * 125 43,333

Substitution of components: 13,000 * 2 * (1.05 - 0.70) 9,100

TOTAL COST SAVINGS 56,433

(c)

G

The question of whether delivery cost needs to be considered hinges on whether or not customers

expect the product price charged to include the cost of delivery.

G

If competitive conditions are such that customers expect the cost of delivery to be included in the product

price, then the target costing group should allow for delivery costs in their calculations as to whether or

not the target cost will be achieved. In addition, the search for cost reduction ideas should include ways

of reducing delivery costs (e.g., by redesigning the product to make it lighter or otherwise easier to

transport), since such cost savings directly benefit the company.

G

On the other hand, if competitive conditions are such that customers expect to be charged separately for

delivery, then the target costing group will pay less attention to these costs as they are not borne by the

company. Nevertheless, it should be remembered that the companys products will enjoy a competitive

advantage if they are designed so that the cost to customers of transporting them is low.

Tutorial notes:

G

Purpose of question: To test candidates ability to apply their knowledge of target costing, including both

the calculation aspects and the identification of cost reduction opportunities. (Syllabus topic 2).

G

Links: The question also involves some very basic cost driver calculations.

G

Options: There is scope for variation in the sequence of calculations in parts (a) and (b), and in the

precise points made in part (c).

G

Essential components: Candidates need to be able to perform the calculations required for parts (a) and

(b) accurately. In part (c) candidates need to address both sides of the delivery costs issue (i.e., the

relevance of these costs depends on whether or not they are included in the price charged to the

customer).

Page 18

Você também pode gostar

- ACC1115 Mock Exam 2 2015 - 16Documento7 páginasACC1115 Mock Exam 2 2015 - 16Andres172Ainda não há avaliações

- Exam OC MAC Period 1 OC104E72.1 October 2012Documento5 páginasExam OC MAC Period 1 OC104E72.1 October 2012Azaan KaulAinda não há avaliações

- Aqa Acc7 W QP Jun08Documento8 páginasAqa Acc7 W QP Jun08Aimal FaezAinda não há avaliações

- Quiz Finals CostDocumento3 páginasQuiz Finals CostALLYSON BURAGAAinda não há avaliações

- Module Code: PMC Module Name: Performance Measurement & Control Programme: MSC FinanceDocumento9 páginasModule Code: PMC Module Name: Performance Measurement & Control Programme: MSC FinanceRenato WilsonAinda não há avaliações

- MA Exam Paper May 2010Documento23 páginasMA Exam Paper May 2010MsKhan0078Ainda não há avaliações

- Practice Exam 2019Documento10 páginasPractice Exam 2019Leon CzarneckiAinda não há avaliações

- Tutorial Questions: Pricing DecisionDocumento5 páginasTutorial Questions: Pricing Decisionmarlina rahmatAinda não há avaliações

- Actg 10 - MAS Midterm ExamDocumento24 páginasActg 10 - MAS Midterm Examjoemel091190100% (1)

- Cost Volume Profit Analysis For Paper 10Documento6 páginasCost Volume Profit Analysis For Paper 10Zaira Anees100% (1)

- Cost Accounting: Level 3Documento18 páginasCost Accounting: Level 3Hein Linn KyawAinda não há avaliações

- 2 Fmaf: Management Accounting FundamentalsDocumento52 páginas2 Fmaf: Management Accounting Fundamentalsdigitalbooks100% (1)

- Take Home Quiz UasDocumento6 páginasTake Home Quiz UasNadya Priscilya HutajuluAinda não há avaliações

- ADL 56 Cost & Management Accounting V2Documento8 páginasADL 56 Cost & Management Accounting V2solvedcareAinda não há avaliações

- 2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersDocumento15 páginas2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersHon Loon SeumAinda não há avaliações

- ACC103 Assignment January 2019 IntakeDocumento8 páginasACC103 Assignment January 2019 IntakeReina TrầnAinda não há avaliações

- Tutorial 4Documento6 páginasTutorial 4FEI FEIAinda não há avaliações

- Kompilasi Tugas Mandiri Bagian 2Documento4 páginasKompilasi Tugas Mandiri Bagian 2Januar Ashari0% (1)

- 97 ZaDocumento7 páginas97 ZaMeow Meow HuiAinda não há avaliações

- ABC TutotialDocumento6 páginasABC TutotialChandran PachapanAinda não há avaliações

- QuestionsDocumento10 páginasQuestionsYat Kunt ChanAinda não há avaliações

- Epektos Part 1Documento4 páginasEpektos Part 1Melvin MendozaAinda não há avaliações

- 2-4 2005 Jun QDocumento10 páginas2-4 2005 Jun QAjay TakiarAinda não há avaliações

- QuestionsDocumento7 páginasQuestionsTsiame Emmanuel SarielAinda não há avaliações

- 8508 Managerial AccountingDocumento10 páginas8508 Managerial AccountingHassan Malik100% (1)

- Cima C1Documento52 páginasCima C1hopeaccaAinda não há avaliações

- AccountingDocumento9 páginasAccountingVaibhav BindrooAinda não há avaliações

- Acca f2 Management Accountant Topicwise Past PapersDocumento44 páginasAcca f2 Management Accountant Topicwise Past PapersIkram Naguib100% (2)

- May Exam 2021 Asb4007Documento10 páginasMay Exam 2021 Asb4007Submission PortalAinda não há avaliações

- Contribution Analysis and Limiting Factors-6Documento9 páginasContribution Analysis and Limiting Factors-6tugaAinda não há avaliações

- 30784rtpfinalnov2013 5Documento0 página30784rtpfinalnov2013 5kamlesh1714Ainda não há avaliações

- PM Sect B Test 6Documento5 páginasPM Sect B Test 6FarahAin FainAinda não há avaliações

- Quiz - Joint and by Products Costing ABC SystemDocumento11 páginasQuiz - Joint and by Products Costing ABC Systempaolo pallesAinda não há avaliações

- Byproduct and Joint Cost ExercisesDocumento4 páginasByproduct and Joint Cost ExercisesMary Grace Ofamin0% (2)

- Cost FM Sample PaperDocumento6 páginasCost FM Sample PapercacmacsAinda não há avaliações

- Cma612s - Cost Management Accounting - 1st Opp - Nov 2019Documento7 páginasCma612s - Cost Management Accounting - 1st Opp - Nov 2019Nolan TitusAinda não há avaliações

- Cga-Canada Management Accounting Fundamentals (Ma1) Examination March 2014 Marks Time: 3 HoursDocumento18 páginasCga-Canada Management Accounting Fundamentals (Ma1) Examination March 2014 Marks Time: 3 HoursasAinda não há avaliações

- AC2097 AC2097 Management Accounting Summer 2020 Online Assessment GuidanceDocumento13 páginasAC2097 AC2097 Management Accounting Summer 2020 Online Assessment Guidanceduong duongAinda não há avaliações

- t4 2008 Dec QDocumento8 páginast4 2008 Dec QShimera RamoutarAinda não há avaliações

- ACCA F 2 Managment Accountant Topic Wise Q A PDFDocumento44 páginasACCA F 2 Managment Accountant Topic Wise Q A PDFSaurabh KaushikAinda não há avaliações

- Managerial Acc QnaireDocumento5 páginasManagerial Acc QnaireMutai JoseahAinda não há avaliações

- F5 CKT Mock1Documento8 páginasF5 CKT Mock1OMID_JJAinda não há avaliações

- Budget: Profit Planning and Control System: Learning ObjectivesDocumento16 páginasBudget: Profit Planning and Control System: Learning ObjectivesFayz Sam0% (1)

- Singapore Institute of Management: University of London Preliminary Exam 2015Documento10 páginasSingapore Institute of Management: University of London Preliminary Exam 2015Pei TingAinda não há avaliações

- BEA2008T Tutorial 9 Questions ELEDocumento4 páginasBEA2008T Tutorial 9 Questions ELEnicksilvester1991Ainda não há avaliações

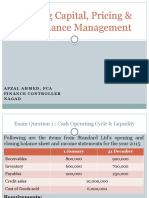

- Working Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadDocumento26 páginasWorking Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadsajedulAinda não há avaliações

- Cost Accounting RTP CAP-II June 2016Documento31 páginasCost Accounting RTP CAP-II June 2016Artha sarokarAinda não há avaliações

- Costing Prob FinalsDocumento52 páginasCosting Prob FinalsSiddhesh Khade100% (1)

- Factory OverheadDocumento2 páginasFactory Overheadenchantadia0% (1)

- F5 Question ACCADocumento8 páginasF5 Question ACCARaymond RayAinda não há avaliações

- Crc-Ace Review School, Inc.: Management Accounting Services (1-40)Documento8 páginasCrc-Ace Review School, Inc.: Management Accounting Services (1-40)LuisitoAinda não há avaliações

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesAinda não há avaliações

- Practice Questions for UiPath Certified RPA Associate Case BasedNo EverandPractice Questions for UiPath Certified RPA Associate Case BasedAinda não há avaliações

- Practical Guide To Production Planning & Control [Revised Edition]No EverandPractical Guide To Production Planning & Control [Revised Edition]Nota: 1 de 5 estrelas1/5 (1)

- Clay Refractory Products World Summary: Market Sector Values & Financials by CountryNo EverandClay Refractory Products World Summary: Market Sector Values & Financials by CountryAinda não há avaliações

- Takt Time: A Guide to the Very Basic Lean CalculationNo EverandTakt Time: A Guide to the Very Basic Lean CalculationNota: 5 de 5 estrelas5/5 (2)

- NPV-IRR NewDocumento39 páginasNPV-IRR NewAhmed Raza MirAinda não há avaliações

- IFRS 10 Consolidated Financial IFRS 11 Joint Arrangements and IFRS 13 Fair ValueDocumento24 páginasIFRS 10 Consolidated Financial IFRS 11 Joint Arrangements and IFRS 13 Fair ValueAhmed Raza MirAinda não há avaliações

- Ifrs11 Joint ArrangementsDocumento1 páginaIfrs11 Joint ArrangementsAhmed Raza MirAinda não há avaliações

- As Nov Dec 2017Documento5 páginasAs Nov Dec 2017Ahmed Raza MirAinda não há avaliações

- Ifrs11 Joint Arrangements PDFDocumento15 páginasIfrs11 Joint Arrangements PDFAhmed Raza MirAinda não há avaliações

- Advanced Accounting and Financial ReportingDocumento6 páginasAdvanced Accounting and Financial ReportingAhmed Raza MirAinda não há avaliações

- FAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsDocumento32 páginasFAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsAhmed Raza MirAinda não há avaliações

- Lecture4 Inv f06 604-InventoryDocumento63 páginasLecture4 Inv f06 604-InventoryRandy CavaleraAinda não há avaliações

- Grant Thornton Ifrs 10 Financial StatementsDocumento104 páginasGrant Thornton Ifrs 10 Financial StatementsAhmed Raza MirAinda não há avaliações

- Ifrs11 Joint Arrangements PDFDocumento15 páginasIfrs11 Joint Arrangements PDFAhmed Raza MirAinda não há avaliações

- p4 Summary BookDocumento35 páginasp4 Summary BookAhmed Raza MirAinda não há avaliações

- Section F - AnswersDocumento9 páginasSection F - AnswersAhmed Raza MirAinda não há avaliações

- Practical Guide Ifrs10 and 12Documento33 páginasPractical Guide Ifrs10 and 12Ahmed Raza MirAinda não há avaliações

- Financial AccountingDocumento42 páginasFinancial AccountingAhmed Raza MirAinda não há avaliações

- Aik Aur OptionDocumento35 páginasAik Aur OptionAhmed Raza MirAinda não há avaliações

- WaccDocumento44 páginasWaccAhmed Raza MirAinda não há avaliações

- 289214169 عمرو اور سلیمانی خزانہ PDFDocumento235 páginas289214169 عمرو اور سلیمانی خزانہ PDFAhmed Raza MirAinda não há avaliações

- Share-Based Payment: IFRS Standard 2Documento42 páginasShare-Based Payment: IFRS Standard 2Teja JurakAinda não há avaliações

- Q6 Costing Today PaperDocumento2 páginasQ6 Costing Today PaperAhmed Raza MirAinda não há avaliações

- FR 2 QuizDocumento14 páginasFR 2 QuizAhmed Raza MirAinda não há avaliações

- PracticeDocumento6 páginasPracticeAhmed Raza MirAinda não há avaliações

- Section e - AnswersDocumento7 páginasSection e - AnswersAhmed Raza MirAinda não há avaliações

- Section e - QuestionsDocumento4 páginasSection e - QuestionsAhmed Raza MirAinda não há avaliações

- E Voting Guide (ICAP - Overseas Members)Documento10 páginasE Voting Guide (ICAP - Overseas Members)Ahmed Raza MirAinda não há avaliações

- AssertionsDocumento2 páginasAssertionsAhmed Raza MirAinda não há avaliações

- Stock ValuationDocumento2 páginasStock ValuationAhmed Raza MirAinda não há avaliações

- Section F - QuestionsDocumento2 páginasSection F - QuestionsAhmed Raza MirAinda não há avaliações

- PC EDocumento24 páginasPC EAhmed Raza MirAinda não há avaliações

- Solution: Part (A)Documento12 páginasSolution: Part (A)Ahmed Raza MirAinda não há avaliações

- Solution: Part (A)Documento12 páginasSolution: Part (A)Ahmed Raza MirAinda não há avaliações

- Halsey Premium Plan: SolutionDocumento4 páginasHalsey Premium Plan: SolutionSilpashree MandalAinda não há avaliações

- PPLCDocumento5 páginasPPLCarjun SinghAinda não há avaliações

- ReviewDocumento8 páginasReviewCrystal PadillaAinda não há avaliações

- 2nd Exam Review - Solution FileDocumento21 páginas2nd Exam Review - Solution FileJuvee GonzalezAinda não há avaliações

- Questions A B C D SolutionDocumento3 páginasQuestions A B C D SolutionNIDHI KOTIANAinda não há avaliações

- Costs and Resources - Informatics Project ManagementDocumento32 páginasCosts and Resources - Informatics Project ManagementJulio FAinda não há avaliações

- Module 5 - Factory Overhead VarianceDocumento73 páginasModule 5 - Factory Overhead VarianceCristineAinda não há avaliações

- Management Accounting QBDocumento31 páginasManagement Accounting QBrising dragonAinda não há avaliações

- Detailed Unit Price AnalysisDocumento7 páginasDetailed Unit Price AnalysisreynoldAinda não há avaliações

- Factor Kappa (198058)Documento16 páginasFactor Kappa (198058)fdorojrAinda não há avaliações

- Plant Design Lecture NotesDocumento70 páginasPlant Design Lecture NotesMhelvene100% (1)

- Cost Accounting: Sixteenth EditionDocumento18 páginasCost Accounting: Sixteenth EditionHIMANSHU AGRAWALAinda não há avaliações

- Classification of CostsDocumento51 páginasClassification of CostssaloniAinda não há avaliações

- Multi Purpose HallDocumento12 páginasMulti Purpose HallKeeperAinda não há avaliações

- Problem: Regular Model Advanced Model Deluxe ModelDocumento8 páginasProblem: Regular Model Advanced Model Deluxe ModelExpert Answers100% (1)

- 8508 Managerial AccountingDocumento10 páginas8508 Managerial AccountingHassan Malik100% (1)

- Variable and Fs AnalysisDocumento8 páginasVariable and Fs AnalysisChristian Rey Sandoval DelgadoAinda não há avaliações

- Chapter 1 Managerial Accounting Business EnvironmentDocumento4 páginasChapter 1 Managerial Accounting Business EnvironmentAbd MuizAinda não há avaliações

- ASsignemts SCIDocumento25 páginasASsignemts SCIPedro PelaezAinda não há avaliações

- MBA Assignment Question BankDocumento37 páginasMBA Assignment Question BankAiDLo100% (1)

- HACC416 or HSPAC 411 - TUTORIAL QUESTIONS - 064542Documento42 páginasHACC416 or HSPAC 411 - TUTORIAL QUESTIONS - 064542Tarisai KwarambaAinda não há avaliações

- A) Meaning of "Management Accounting"Documento3 páginasA) Meaning of "Management Accounting"RA T ULAinda não há avaliações

- Cost Concepts 05032023 095733pmDocumento51 páginasCost Concepts 05032023 095733pmnida amanAinda não há avaliações

- How Factory Overhead Cost Is Calculated in Garment Export Business - Online Clothing Study PDFDocumento7 páginasHow Factory Overhead Cost Is Calculated in Garment Export Business - Online Clothing Study PDFtaqi1122Ainda não há avaliações

- CH 17 Rel Cost PotpourriDocumento4 páginasCH 17 Rel Cost PotpourrialiAinda não há avaliações

- Full Cost Accounting Guidebook Solid Waste MGMTDocumento53 páginasFull Cost Accounting Guidebook Solid Waste MGMTAnonymous 9RhA3qOZrLAinda não há avaliações

- MAC3701 Question Bank 2016Documento65 páginasMAC3701 Question Bank 2016Blessings MunkuliAinda não há avaliações

- SAP CostingDocumento297 páginasSAP CostingNetaji Dasari100% (13)

- Assesment 7 (Week 8)Documento6 páginasAssesment 7 (Week 8)hannaniAinda não há avaliações

- Chapter 26 Managing Accounting in A Changing Environment: EssayDocumento68 páginasChapter 26 Managing Accounting in A Changing Environment: Essayjanine0% (1)

![Practical Guide To Production Planning & Control [Revised Edition]](https://imgv2-2-f.scribdassets.com/img/word_document/235162742/149x198/2a816df8c8/1709920378?v=1)