Escolar Documentos

Profissional Documentos

Cultura Documentos

8/20/14 Macro Trading Simulation

Enviado por

Paul Kim0 notas0% acharam este documento útil (0 voto)

17 visualizações5 páginas8/20/14 Macro Trading Simulation

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documento8/20/14 Macro Trading Simulation

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

17 visualizações5 páginas8/20/14 Macro Trading Simulation

Enviado por

Paul Kim8/20/14 Macro Trading Simulation

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 5

August 20, 2014 (Wednesday)

Since Inception - June 18

,

2014:

Equity/Futures Account: +2.51%

FX Currency Account: +9.16%

Benchmark: S&P 500: +1.37%

8/20/14 Commentary

Added long USD/JPY position based on the U.S. dollar strength and technical breakout of over 103-level. Given

how long it has consolidated within a trading range, like a coiled spring, it will likely retest and close higher above

the previous high of 105.43.

To reflect the growing uneasiness, Ive decided to trim my positions down to a few (from 14 positions to 5) that I

have the most conviction in and so that I could be more nimble and more mindful of risk.

1) Short EUR/USD it has been the most highly concentrated position since I began this trading simulation. The

position has always been large, but it has certainly grown in size with each technical level and data point hurdle

that it cleared that has made me comfortable enough to add more to the trade.

The short EUR/USD trade is one of the few macro trades where all elements of the trade (historical analysis, policy

analysis, economic data, trends/technicals and etc) all line up favorably to be short.

2) Long US Treasury continuing with the deteriorating Eurozone macro theme, in which the ECB will be expanding

its LTRO for the second time in three years, the difference in yield between the German Bund and a lack of

alternative for global investors has created a force large enough to push U.S. yields lower. Also, emerging market

central banks have bought U.S. treasuries in concert to keep their own economies stable by keeping U.S. rates low.

And finally, theres the likelihood that the U.S Federal Reserve will be dovish for a longer period than people

expect.

3) Short Gold golds reputation/status as a safe haven asset has suffered in recent years. Ive been bearish when

it broke the major support of $1600 in early 2013 and I believe gold still hasnt proved its purpose or worth.

For one, it fails to be insurance when theres a geopolitical issue. Two, the U.S. dollars ascent on the backdrop of

the declining Euro will continue to be a headwind for gold. Third, gold doesn't yield anything thus in a search-for-

yield environment, gold is not attractive especially if Europe and other parts of the world show signs of deflation.

Fourth, on the other hand, if rates do normalize and Fed policy becomes more hawkish, gold once again wont

have a leg to stand because it doesn't yield anything.

4) Short German DAX (EWG) I flipped my position and shorted the DAX as insurance against Putin (a peace deal

where Putin washes his hands clean of Ukraine goes against all that I know about Russian history and the man I

studied in college) and against continuing deterioration in economic conditions in the Eurozone. The bet is that it is

more likely for the DAX to break 9000 than it is likely to hold the line.

5) US Equities (SPY) ???? I wrote a question mark because I don't have the answer, and am rather confused

about risk/reward nature of U.S. equity market. With my mind leaning more on the negative side, I have initiated a

small short position on the S&P 500. But overall, my view on equities as of today is a work-in-progress.

6) Long USD/JPY on the backdrop of dollar strength, more easing also might be just around the corner given the

continued lukewarm data points in Japan. Kuroda maybe publicly positive and excited about Japans growth

prospect, but inspiring confidence is part of his job as he is trying to amplify the effect of his policy if he was

downbeat, that would have the opposite effect.

Positions:

1) Short Euro against U.S. Dollar (spot)

2) Short Gold (via ETF: GLD)

3) Short equities via S&P 500 (ETF: SPY)

4) Long treasuries (via ETF: TLT)

5) Short German DAX (via ETF: EWG)

6) Long U.S. Dollar against Japanese Yen (spot)

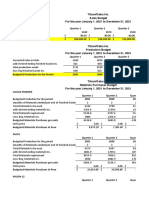

8/20/14 Platform Snapshot (Optimized for viewing on iPhone, iPad, or Android)

Trading Account Rules:

1) Starting Account Size:

a. Cash equities/futures/option: $10million

b. Forex: $10million

2) For the cash account (non-forex), macro views will be reflected using listed equity ETFs with deep liquidity/volume and net assets

of $1 billion or greater in order to best represent the odds of the strategy being scalable.

3) Most of the speculative positions can also be accurately expressed using futures, but because the volume is more constrained at

different times and because the platform fails to take volume into consideration (hence the trades' impact on the actual price),

the use of futures will be limited. Positions that I deem to be core/longer-term would be better expressed via equities. But for

commodities such as crude oil, silver, copper, etc., they will solely be expressed through the futures contract market due to

contango/decay issues that most commodities ETFs suffer.

4) The overall goal is to identify attractive opportunities with goals of holding the positions for multi-week/month periods.

Importance will always be put on liquidity and risk exposure. Also, being able to realistically liquidate all positions by end of

trading day or vice versa, scale up risk, will be an advantage of the strategy.

5) Daily updates will be simple and short, as youll receive a time-stamped screenshot of the account summary where detailed

positions and P/L will be all within a single image.

6) Leverage for spot currency position will be used sparingly with average position being 2.5x the underlying cash value with

stringent risk management in mind.

Você também pode gostar

- Investing in a Volatile Stock Market: How to Use Everything from Gold to Daytrading to Ride Out Today's Turbulent MarketsNo EverandInvesting in a Volatile Stock Market: How to Use Everything from Gold to Daytrading to Ride Out Today's Turbulent MarketsAinda não há avaliações

- Nervous About The Market It Might Be Time For This StrategyDocumento6 páginasNervous About The Market It Might Be Time For This StrategyAndrey YablonskiyAinda não há avaliações

- Seasonal PatternsDocumento14 páginasSeasonal PatternsHồng NgọcAinda não há avaliações

- Inner Circle Trader - TPDS 5Documento18 páginasInner Circle Trader - TPDS 5Felix Tout Court100% (1)

- List of SAP Status CodesDocumento19 páginasList of SAP Status Codesmajid D71% (7)

- GST Proposal Presentation 1Documento47 páginasGST Proposal Presentation 1pmenocha879986% (7)

- GBP USD PersonalityDocumento13 páginasGBP USD PersonalityRieyz ZalAinda não há avaliações

- Barclays Global FX Quarterly Fed On Hold Eyes On GrowthDocumento42 páginasBarclays Global FX Quarterly Fed On Hold Eyes On GrowthgneymanAinda não há avaliações

- BNP FX WeeklyDocumento22 páginasBNP FX WeeklyPhillip HsiaAinda não há avaliações

- Design and Implementation of Real Processing in Accounting Information SystemDocumento66 páginasDesign and Implementation of Real Processing in Accounting Information Systemenbassey100% (2)

- Lazaro Vs SSSDocumento2 páginasLazaro Vs SSSFatima Briones100% (1)

- Bank Al Habib Effective AssignmentDocumento35 páginasBank Al Habib Effective AssignmentAhmed Jan DahriAinda não há avaliações

- 8/19/14 Macro Trading SimulationDocumento6 páginas8/19/14 Macro Trading SimulationPaul KimAinda não há avaliações

- 8/21/14 Macro Trading SimulationDocumento7 páginas8/21/14 Macro Trading SimulationPaul KimAinda não há avaliações

- 8/22/14 Macro Trading SimulationDocumento6 páginas8/22/14 Macro Trading SimulationPaul KimAinda não há avaliações

- 8/25/14 Macro Trading SimulationDocumento6 páginas8/25/14 Macro Trading SimulationPaul KimAinda não há avaliações

- 8/26/14 Macro Trading SimulationDocumento6 páginas8/26/14 Macro Trading SimulationPaul KimAinda não há avaliações

- 10/2/14 Global-Macro Trading SimulationDocumento17 páginas10/2/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 10/1/14 Global-Macro Trading SimulationDocumento15 páginas10/1/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 11/14/14 Global-Macro Trading SimulationDocumento17 páginas11/14/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 9/22/14 Global-Macro Trading SimulationDocumento10 páginas9/22/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 9/30/14 Global-Macro Trading SimulationDocumento13 páginas9/30/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 9/29/14 Global-Macro Trading SimulationDocumento12 páginas9/29/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- Market Commentary 4/25/2012Documento1 páginaMarket Commentary 4/25/2012CJ MendesAinda não há avaliações

- 11/11/14 Global-Macro Trading SimulationDocumento20 páginas11/11/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- Edition 10 - Chartered 7th July 2010Documento9 páginasEdition 10 - Chartered 7th July 2010Joel HewishAinda não há avaliações

- 11/6/14 Global-Macro Trading SimulationDocumento18 páginas11/6/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 11/13/14 Global-Macro Trading SimulationDocumento17 páginas11/13/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- Eric Parnell Getting Defensive With Utilities, Consumer Staples, Precious Metals, TIPS, Agency MBS - SeekinDocumento16 páginasEric Parnell Getting Defensive With Utilities, Consumer Staples, Precious Metals, TIPS, Agency MBS - Seekinambasyapare1Ainda não há avaliações

- 10/15/14 Global-Macro Trading SimulationDocumento22 páginas10/15/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- Paul Gallacher, Technical Analysis, November 3Documento64 páginasPaul Gallacher, Technical Analysis, November 3api-87733769Ainda não há avaliações

- If LearningsDocumento2 páginasIf LearningsRaghu Kumar ReddyAinda não há avaliações

- Top Trading Opportunities 2017Documento35 páginasTop Trading Opportunities 2017Max KennedyAinda não há avaliações

- 11/4/14 Global-Macro Trading SimulationDocumento20 páginas11/4/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 2/12/15 Macro Trading SimulationDocumento12 páginas2/12/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 1.20.15 Macro Trading SImulationDocumento19 páginas1.20.15 Macro Trading SImulationPaul KimAinda não há avaliações

- Examen GFCM ModelDocumento4 páginasExamen GFCM ModelnkvkdkmskAinda não há avaliações

- 12/5/14 Global-Macro Trading SimulationDocumento15 páginas12/5/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 23 Feb 2024 FridayDocumento13 páginas23 Feb 2024 FridaytanmaymaltarAinda não há avaliações

- 11/3/14 Global-Macro Trading SimulationDocumento20 páginas11/3/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- LINC Week 6Documento9 páginasLINC Week 6TomasAinda não há avaliações

- CH 7Documento12 páginasCH 7Mohd Shahid ShamsAinda não há avaliações

- Put Futures Credit Spread Out-Of-The-Money DownsideDocumento8 páginasPut Futures Credit Spread Out-Of-The-Money Downsidemm1979Ainda não há avaliações

- Economist Insights 20120514Documento2 páginasEconomist Insights 20120514buyanalystlondonAinda não há avaliações

- 5 FPMarkets Fundamental TradingDocumento13 páginas5 FPMarkets Fundamental TradingLouisAinda não há avaliações

- To: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: April 24, 2012 ReDocumento10 páginasTo: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: April 24, 2012 RepolandspringsAinda não há avaliações

- 1/6/15 Macro Trading SimulationDocumento18 páginas1/6/15 Macro Trading SimulationPaul KimAinda não há avaliações

- Stock Market TrendsDocumento11 páginasStock Market TrendsPhilonious PhunkAinda não há avaliações

- 11/24/14 Global-Macro Trading SimulationDocumento15 páginas11/24/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- FX Weekly Commentary July 17 - July 23 2011 - Elite Global TradingDocumento4 páginasFX Weekly Commentary July 17 - July 23 2011 - Elite Global TradingJames PutraAinda não há avaliações

- 2011 12 06 Migbank Daily Technical Analysis ReportDocumento15 páginas2011 12 06 Migbank Daily Technical Analysis ReportmigbankAinda não há avaliações

- Option Trading Playbook Prior To ExpirationDocumento2 páginasOption Trading Playbook Prior To ExpirationRavi RamanAinda não há avaliações

- 1/15/15 Macro Trading SimulationDocumento21 páginas1/15/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 12:1:14 Global-Macro Trading SimulationDocumento16 páginas12:1:14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- Top Trading Opportunities FOR 2020: Dailyfx Research TeamDocumento35 páginasTop Trading Opportunities FOR 2020: Dailyfx Research Teammytemp_01Ainda não há avaliações

- Top Trading OpportunitiesDocumento25 páginasTop Trading Opportunitiestanyan.huangAinda não há avaliações

- FX Weekly Commentary - Nov 13 - Nov 19 2011Documento5 páginasFX Weekly Commentary - Nov 13 - Nov 19 2011James PutraAinda não há avaliações

- Aileron Market Balance: Issue 18Documento6 páginasAileron Market Balance: Issue 18Dan ShyAinda não há avaliações

- Derivative SeiesDocumento18 páginasDerivative SeiesCourage Craig KundodyiwaAinda não há avaliações

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocumento6 páginasShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahAinda não há avaliações

- Third Q Uarter R Eport 2010Documento16 páginasThird Q Uarter R Eport 2010richardck50Ainda não há avaliações

- 12/8/14 Global-Macro Trading SimulationDocumento15 páginas12/8/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- Thursday 1 October 2009Documento6 páginasThursday 1 October 2009ZerohedgeAinda não há avaliações

- 10-Step Inflation Survival Guide (11.05.10)Documento3 páginas10-Step Inflation Survival Guide (11.05.10)rjcantwellAinda não há avaliações

- 2011 12 05 Migbank Daily Technical Analysis ReportDocumento15 páginas2011 12 05 Migbank Daily Technical Analysis ReportmigbankAinda não há avaliações

- 2/12/15 Macro Trading SimulationDocumento12 páginas2/12/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 2/26/15 Trading SimulationDocumento10 páginas2/26/15 Trading SimulationPaul KimAinda não há avaliações

- 2/12/15 Macro Trading SimulationDocumento12 páginas2/12/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 2/12/15 Macro Trading SimulationDocumento12 páginas2/12/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 2/12/15 Macro Trading SimulationDocumento12 páginas2/12/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 2/24/15 Macro Trading SimulationDocumento12 páginas2/24/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 1/29/15 Macro Trading SImulationDocumento15 páginas1/29/15 Macro Trading SImulationPaul KimAinda não há avaliações

- 2/9/15 Macro Trading SimulationDocumento15 páginas2/9/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 2/11/15 Macro Trading SimulationDocumento14 páginas2/11/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 2/5/15 Macro Trading SimulationDocumento14 páginas2/5/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 2/6/15 Macro Trading SimulationDocumento14 páginas2/6/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 12/5/14 Global-Macro Trading SimulationDocumento15 páginas12/5/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 2/9/15 Macro Trading SimulationDocumento15 páginas2/9/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 1/30/15 Macro Trading SimulationDocumento16 páginas1/30/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 1/6/15 Macro Trading SimulationDocumento18 páginas1/6/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 1/23/15 Macro Trading SimulationDocumento18 páginas1/23/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 1/27/15 Macro Trading SimulationDocumento15 páginas1/27/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 1/9/15 Macro Trading SimulationDocumento18 páginas1/9/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 1/14/15 Macro Trading SimulationDocumento21 páginas1/14/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 1/15/15 Macro Trading SimulationDocumento21 páginas1/15/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 1/5/15 Global-Macro Trading SimulationDocumento18 páginas1/5/15 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 2014 Macro Year End ResultDocumento16 páginas2014 Macro Year End ResultPaul KimAinda não há avaliações

- 12/23/14 Macro Trading SimulationDocumento15 páginas12/23/14 Macro Trading SimulationPaul KimAinda não há avaliações

- 1.20.15 Macro Trading SImulationDocumento19 páginas1.20.15 Macro Trading SImulationPaul KimAinda não há avaliações

- 1/8/15 Macro Trading SimulationDocumento18 páginas1/8/15 Macro Trading SimulationPaul KimAinda não há avaliações

- 12/8/14 Global-Macro Trading SimulationDocumento15 páginas12/8/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 12/9/14 Global-Macro Trading SimulationDocumento15 páginas12/9/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 12:1:14 Global-Macro Trading SimulationDocumento16 páginas12:1:14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 12/5/14 Global-Macro Trading SimulationDocumento15 páginas12/5/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- 12/3/14 Global-Macro Trading SimulationDocumento16 páginas12/3/14 Global-Macro Trading SimulationPaul KimAinda não há avaliações

- Web Based Crime Management SystemDocumento22 páginasWeb Based Crime Management SystemZain Ul Abedin SaleemAinda não há avaliações

- 2189XXXXXXXXX316721 09 2019Documento3 páginas2189XXXXXXXXX316721 09 2019Sumit ChakrabortyAinda não há avaliações

- International Commodity Traders (ICT LLC) & World Gold CouncilDocumento1 páginaInternational Commodity Traders (ICT LLC) & World Gold CouncilPratik MishraAinda não há avaliações

- PGEresponseDocumento37 páginasPGEresponseABC10Ainda não há avaliações

- OM Question BankDocumento5 páginasOM Question BankViraja GuruAinda não há avaliações

- DP World Internship ReportDocumento40 páginasDP World Internship ReportSaurabh100% (1)

- Start A New Challenge - FXIFYDocumento1 páginaStart A New Challenge - FXIFYSähïl GäjëräAinda não há avaliações

- Acctg 202 Di Pa FinalDocumento10 páginasAcctg 202 Di Pa FinalJoshua CabinasAinda não há avaliações

- LBO ModelingDocumento31 páginasLBO Modelingricoman1989Ainda não há avaliações

- InvoiceDocumento1 páginaInvoicetanya.prasadAinda não há avaliações

- Paper Automation Service CEU - Optimization Service - EN - RevUKDocumento38 páginasPaper Automation Service CEU - Optimization Service - EN - RevUKjohnAinda não há avaliações

- Shivani Singhal: Email: PH: 9718369255Documento4 páginasShivani Singhal: Email: PH: 9718369255ravigompaAinda não há avaliações

- TVE Phase-1 Addendum No 8Documento1 páginaTVE Phase-1 Addendum No 8Anonymous Un3Jf6qAinda não há avaliações

- FEB 599 CAT 2015-2016 First SemesterDocumento2 páginasFEB 599 CAT 2015-2016 First SemesterlucyAinda não há avaliações

- Sales - Cases 2Documento106 páginasSales - Cases 2Anthea Louise RosinoAinda não há avaliações

- Best Practices Guide For IT Governance & ComplianceDocumento14 páginasBest Practices Guide For IT Governance & ComplianceAnonymous 2WKRBqFlfAinda não há avaliações

- TOA Reviewer (UE) - Bank Reconcilation PDFDocumento1 páginaTOA Reviewer (UE) - Bank Reconcilation PDFjhallylipmaAinda não há avaliações

- Chapter 1 Global ServiceDocumento23 páginasChapter 1 Global ServiceRandeep SinghAinda não há avaliações

- Database PanteneDocumento4 páginasDatabase PanteneYahya CahyadiAinda não há avaliações

- World Airports Freighters: FreighDocumento16 páginasWorld Airports Freighters: FreighBobbie KhunthongchanAinda não há avaliações

- Marketing IndividualDocumento2 páginasMarketing Individualsinyi0Ainda não há avaliações

- Xavier University - Ateneo de Cagayan School of Business AdministrationDocumento4 páginasXavier University - Ateneo de Cagayan School of Business AdministrationApril Mae DensingAinda não há avaliações

- Roles & Responsibilities of A Maintenance Engineer - LinkedInDocumento4 páginasRoles & Responsibilities of A Maintenance Engineer - LinkedInEslam MansourAinda não há avaliações

- Business Viability CalculatorDocumento3 páginasBusiness Viability CalculatorKiyo AiAinda não há avaliações

- Comparing FTTH Access Networks Based On P2P and PMP Fibre TopologiesDocumento9 páginasComparing FTTH Access Networks Based On P2P and PMP Fibre TopologiesWewe SlmAinda não há avaliações