Escolar Documentos

Profissional Documentos

Cultura Documentos

Land Laws 2

Enviado por

Mania1710100%(1)100% acharam este documento útil (1 voto)

168 visualizações13 páginas- An easement is a right to use another's land for a specific purpose, such as access. It differs from ownership of the land.

- There are various types of easements including apparent, continuous, implied by prior use, and those attached to particular properties (appurtenant).

- Easements can be created, transferred, altered or removed but generally must be in writing. They run with ownership of the dominant estate which benefits from the easement.

Descrição original:

Land laws

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documento- An easement is a right to use another's land for a specific purpose, such as access. It differs from ownership of the land.

- There are various types of easements including apparent, continuous, implied by prior use, and those attached to particular properties (appurtenant).

- Easements can be created, transferred, altered or removed but generally must be in writing. They run with ownership of the dominant estate which benefits from the easement.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

100%(1)100% acharam este documento útil (1 voto)

168 visualizações13 páginasLand Laws 2

Enviado por

Mania1710- An easement is a right to use another's land for a specific purpose, such as access. It differs from ownership of the land.

- There are various types of easements including apparent, continuous, implied by prior use, and those attached to particular properties (appurtenant).

- Easements can be created, transferred, altered or removed but generally must be in writing. They run with ownership of the dominant estate which benefits from the easement.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 13

LAND LAWS

Easement act, 1882

Easement" defined-

An easement is a right which the owner or occupier of certain land possesses, as such, for the beneficial

enjoyment of that land, to do and continue to do something, or to prevent and continue to prevent

something being done, in or upon, or in respect of, certain other land not his own.

An Easement is the right or freedom to do something or the right to prevent someone else from doing

something over the real property of another. It is a right, which the owner of a particular land enjoys

over an adjacent property, which he does not possess. At the common law, an easement came to be

treated as a property right in itself and is still treated as a kind of property by most jurisdictions. The

right is often described as the right to use the land of another for a special purpose. Unlike a lease, an

easement does not give the holder a right of "possession" of the property, only a right of use. It is

distinguished from a licence that only gives one a personal privilege to do something even more limited

on the land of another.

Illustrations

A, as the owner of a certain house, has a right of way over his neighbour B land for purposes

connected with the beneficial enjoyment of the house. This is an easement.

A, as the owner of a certain house, has the right to go on his neighbour Bs land, and to take

water for the purposes of his household out of a spring therein. This is an easement.

A, as the owner of a certain house and farm, has the right to graze a certain number of his own

cattle on Bs field, or to take, for the purpose of being used in the house, by himself, his family,

guests, lodgers and servants, water or fish out of Cs tank, or timber out of Ds wood, or to use,

for the purpose of manuring his land, the leaves which have fallen from the trees on Es land.

These are easements.

A dedicates to the public the right to occupy the surface of certain land for the purpose of

passing and re-passing. This right is not an easement.

Dominant and Servient heritages and owners.

The land for the beneficial enjoyment of which the right exists is called the dominant heritage, and the

owner or occupier thereof the dominant owner; the land on which the liability is imposed is called the

servient heritage, and the owner or occupier thereof the servient owner.

Illustrations

X owns a piece of land. Y has the right of way over it. Here X is the servient owner and has the servient

heritage. Y is the dominant owner and he has the dominant heritage.

Easements are either continuous or discontinuous, apparent or non-apparent:-

A continuous easement is one whose enjoyment is, or may be, continual without the act of man.

Illustration: A right annexed to Bs house to receive light by the windows without obstruction by his

neighbour A. This is a continuous easement.

A discontinuous easement is one that needs the act of man for its enjoyment.

Illustration: A right of way annexed to As house over Bs land. This is a discontinuous easement.

An apparent easement is one the existence of which is shown by some permanent sign which, upon

careful inspection by a competent person, would be visible to him.

Illustration: Rights annexed to A's land to lead water thither across B's land by an aqueduct and to draw

off water thence by a drain. The drain would be discovered upon careful inspection by a person

conversant with such matters.

These are apparent easements.

A non-apparent easement is one that has no such sign.

Illustration: A right annexed to A's house to prevent B from building on his own land. This is a non-

apparent easement.

An easement may be permanent, or for a term of years or other limited period, or subject to periodical

interruption, or exercisable only at a certain place, or at certain times, or between certain hours, or for a

particular purpose, or on condition that it shall commence or become void or voidable on the happening

of a specified event or the performance or non-performance of a specified Act.

Easements are restrictions of one or other of the following rights (namely):-

Exclusive right to enjoy-The exclusive right of every owner of immovable property (subject to

any law for the time being in force) to enjoy and dispose of the same and all products there of

and accessions thereto.

Rights to advantages arising from situation-The right of every owner of immovable property

(subject to any law for the time being in force) to enjoy without disturbance by another the

natural advantages arising from its situation.

Illustrations:

a. The exclusive right of every owner of land in a town to build on such land, subject to any municipal

law for the time being in force.

b. The right of every owner of land that the air passing thereto shall not be unreasonable polluted by

other persons.

c. The right of every owner of a house that his physical comfort shall not be interfered with materially

and unreasonably by noise or vibration caused by any other person.

Different types of Easements:

Private versus public easements:

Specific persons or entities enjoy the benefit of private easement. For instance the owner of the land

locked parcel may enjoy the right of pathway over the neighboring land leading to the public road.

On the other hand the public at large or a large group of persons enjoy the benefit of public easement.

Public easements are conservation easements for ecological preservation and historic preservation

easements, to indicate a few.

Appurtenant easement versus easement in gross:

Easement appurtenant runs with the land. Concerned land can be transferred only along with the

easement in place, which cannot be detached from the parcel. Particular persons or entities are only

entitled to the benefits of an easement in gross. Earlier such easement was neither transferable nor

heritable. For instance the right of pathway given to the earlier neighbor does not go to the next or new

buyer of the said same adjoining land. Easement in gross can either be personal or commercial in

nature. At present commercial easement in gross such as utility easements including easements for

electrical line, gas line, communication line, telephone line etc. are transferable.

Prescriptive easements:

Prescriptive easements are implied easements that give the easement holder the right to use the

property of another for the purpose the easement holder has been using the same for a minimum

specified number of years, which varies from state to state. Prescriptive easements are implied since

these are not expressly created but arise through continuous usage without consent for at least a

specified period of years.

Express versus Implied easements:

An express may be granted or reserved by inclusion in any written document or deed or subdivision/

partition plan. An express easement may also be a covenant in a house owners association agreement.

On the contrary an implied easement arises when reasonably necessary under the circumstances.

Prescriptive easement, as above, is implied one.

Easement by necessity:

The most common example of an easement of necessity is a landlocked property enjoying the right of

way through an adjoining plot to the public road. Creation of an easement does not mean transfer of

property. In the same manner, surrendering an easement right does not imply transfer of property.

Easement can be made, altered and released. Easement right cannot be created or modified orally. It

must be in a written form. However, easements by prescription and custom need not be in writing.

Who may impose Easements?

An easement may be imposed by any one in the circumstances, and to the extent, in and to which he

may transfer his interest in the heritage on which the liability is so imposed.

Illustrations

a. A is a tenant of Bs land under a lease for an unexpired term of twenty years, and has power to

transfer his interest under the lease. A may impose an easement on the land to continue during the time

that the lease exists or for any shorter period.

b. A, B and C are co-owners of certain land. A cannot, without the consent of B and C, impose an

easement on the land or on any part thereof.

1. Servient owners

Subject to the provisions of section 8, a servient owner may impose on the servient heritage any

easement that does not lessen the utility of the exiting easement. But he cannot, without the consent of

the dominant owner, impose an easement on the servient heritage which would lessen such utility.

Illustrations

A has, in respect of his house, a right of way over Bs land. B may grant to C, as the owner of

neighbouring farm, the right to feed his cattle on the grass growing on the way: PROVIDED that As right

of way is not thereby obstructed.

2. Lessor and Mortgagor

A lessor may impose, on the property leased, any easement that does not derogate from the rights of

the lessee as such, and a mortgagor may impose, on the property mortgaged, any easement that does

not render the security insufficient. But a lessor or mortgagor cannot, without the consent of the lessee

or mortgagee, impose any other easement on such property, unless it be to take effect on the

termination of the lease or the redemption of the mortgage.

3. Lessee

No lessee or other person having a derivative interest may impose on the property held by him as such

an easement to take effect after the expiration of his own interest, or in derogation of the right of the

lessor or the superior proprietor.

Who may acquire Easements?

An easement may be acquired by the owner of the immovable property for the beneficial enjoyment of

which the right is created, or on his behalf, by any person in possession of the same.

One of two or more co-owners of immovable property may, as such, with or without the consent of the

other or others, acquire an easement for the beneficial enjoyment of such property.

No lessee of immovable property can acquire, for the beneficial enjoyment of other immovable property

of his own, an easement in or over the property comprised in his lease.

Bar to use unconnected with enjoyment

An easement must not be used for any purpose not connected with the enjoyment of the dominant

heritage.

Illustrations

a. A, as owner of a farm Y, has right of way over B's land to Y. Lying beyond Y, A has another farm Z, the

beneficial enjoyment of which is not necessary for the beneficial enjoyment of Y. He must not use the

easement for the purpose of passing to and from Z.

b. A, as owner of a certain house, has a right of way to and from it. For the purpose of passing to and

from the house, the right may be used, not only by A, but by the members of his family, his guests,

lodgers, servants, workmen, visitors and customers; for this is a purpose, connected with the enjoyment

of the dominant heritage. So, if A lets the house, he may use the right of way for the purpose of

collecting the rent and seeing the house is kept in repair.

Easement lasts only as long as the absolute necessity existed and such legal extinction could not apply to

acquisition by grant.

Extinction of Easement

a) Extinction by dissolution of right of servient owner

When, from a cause which preceded the imposition of an easement, the person by whom it was

imposed ceases to have any right in the servient heritage, the easement is extinguished.

Illustrations

A and B, tenants of C, have permanent transferable interests in their respective holdings. A imposes on

his holding an easement to draw water from a tank for the purpose of irrigating B?s land. B enjoys the

easement for twenty years. Then A?s rent fall into arrear and his interest is sold. B?s easements is

extinguished.

b) Extinction by Release

An easement is extinguished when the dominant owner releases it, expressly or impliedly, to the

servient owner

c) Extinction by revocation

An easement is extinguished when the servient owner, in exercise of power reserved in this behalf,

revokes the easement.

d) Extinction on termination of necessity

An easement of necessity is extinguished when the necessity comes to an end.

Illustrations

A grants B a field inaccessible except by passing over A's adjoining land. B, afterwards purchases a part

of that land over which he can pass to his field. The right of way over A's land which B has acquired is

extinguished.

e) Extinction by non-enjoyment

A continuous easement is extinguished when it totally ceases to be enjoyed as such for an unbroken

period of twenty years.

A discontinuous easement is extinguished when, for a like period, it has not been enjoyed as such.

Exception:

- where the cessation is in pursuance of a contract between the dominant and servient owners;

- where the dominant heritage is held in co-ownership, and one of the co-owners enjoys the easement

within the said period; or

- where the easement is necessary easement.

Easements also differ from licences in that most easements ("easements appurtenant") are attached to

and benefit another parcel of land, not a specific person. This means that a property that enjoys an

easement over another will continue to enjoy the easement even if the property gets transferred to a

different owner.

Registration Act 1908:

What is registration?

Registration means recording of the contents of a document with a Registering Officer and preservation

of copies of the original document.

Purpose

The purpose of this Act is the conservation of evidence, assurances of title, publication of documents

and prevention of fraud. It details the formalities for registering an instrument. Instruments which

require mandatory registration include:

Registration helps an intending purchaser to know if the title deeds of a particular property have been

deposited with any person or a financial institution for the purpose of obtaining an advance against the

security of that property.

Documents of which Registration Is Compulsory;

Section 17 of the Registration Act, 1908 lays down different categories of documents for which

registration is compulsory. The documents relating to the following transactions of immovable

properties are required to be compulsorily registered;

i. Instruments of Gift of Immovable Property

ii. Other non-testamentary instruments which purport or operate to create, declare, assign, limit or

extinguish, whether in present or in future, any right, title or interest whether vested or contingent, of

the value of one hundred rupees and upwards, to or in immovable property

iii. non-testamentary instruments which acknowledge the receipt or payment of any consideration on

account of the creation, declaration, assignment, limitation or extinction of any such right, title or

interest; and

iv. leases of immovable property from year to year, or for any term exceeding one year, or reserving a

yearly rent;

v. non-testamentary instruments transferring or assigning any decree or order of a court or any award

when such decree or order or award purports or operates to create, declare, assign, limit or extinguish,

whether in present or in future, any right, title or interest, whether vested or contingent, of the value of

one hundred rupees and upwards, to or in immovable property Sales, leases, mortgages (other than by

way of deposit of title deeds) and exchanges of immovable property are required to be registered by

virtue of the Transfer of Property Act. So all the above documents have to be in writing.

Documents of which Registration Is Optional;

Section 18 of the Act lays down the instruments of which registration is optional. Some of these

instruments are listed as under :-

a) Instruments ( other than instruments of gifts and wills) relating to the transfer of an immovable

property, the value of which is less than one hundred rupees.

b) Instruments acknowledging the receipt or payment of any consideration.

c) Lease of an immovable property for a term not exceeding one year.

d) Instruments transferring any decree or order of a court where the subject matter of such decree or

order is an immovable property, the value of which is less that one hundred rupees.

e) Wills.

Procedure followed at the time of lodging a document for Registration

For registration of any instrument, the original document which should be typed/printed on one side

only along with two photocopies of the original have to be submitted to the Registering Officer. The

copies are required to be photocopied only on one side of the paper and there has to be a butter paper

between the two photocopies papers. This is done so as to prevent the typed matter from getting spoilt.

The registration procedure also requires the presence of two witnesses and the payment of the

appropriate registration fees.

On completion of the procedure, a receipt bearing a distinct serial number is issued. The following

requirements completing the registration are usually stated on the receipt:

a) Market Value of the property;

b) Urban Land Ceiling declarations of the transferor/s and the transferee/s. (applicable in States where

ULC Act exists) Earlier Income Tax clearance certificate under Section 230A of the Income Tax Act, 1961

that dealt with restrictions on registration of transfer of immovable property was required to be

produced at the time of registration but this has been omitted by the Finance Act, 2001, with effect

from June 1, 2001.

Section 21 of the Act deals with the provisions relating to the description of an immovable property

alongwith maps or plans. It is always necessary, with a view to identify the property involved in a

document, that the description of the property is mentioned in a separate schedule, preferable with

maps or plans, so as to enable the Registering Authority to make notes in the books to be preserved.

The description should mentioned the area of the property, the number of the property, the boundaries

of the property, the streets on which it is situated, along with the name of the village, Taluka, district.

The city Survey Number, with Hissa Number if any, should also be mentioned. It is the discretion of the

registering officer to refuse to accept a document if the description of the immovable property is not

sufficient to identify the property correctly.

The doctrine of part performance dealt with under Section 53 A of the Transfer of Property Act and the

provision of Section 49 of the Registration Act (which provide that an unregistered document cannot be

admissible as evidence in a court of law except as secondary evidence under the Indian Evidence Act)

together protect the buyer in possession of an unregistered sale deed and cannot be dispossessed. The

net effect has been that a large number of property transactions have been accomplished without

proper registration.

Instruments such as Agreement to Sell, General Power of Attorney and Will have been indiscriminately

used to effect change of ownership. Therefore, investors in real estate have to be careful in their due

diligence.

Time for presenting document:

No document other than a will shall be accepted for registration unless presented for that purpose to

the proper officer within four months from the date of its execution As per the provisions of Section 25

of the Indian Registration Act, 1908 if a document is not presented for registration within the prescribed

time period of four months, and if in such a case the delay in presentation of the document does not

exceed a subsequent period of four months, then the parties to the agreement can apply to the

Registrar, who may direct that on payment of a fine not exceeding ten times the proper registration

fees, such a document should be admitted for registration. If the delay goes even beyond these

additional four months, the concerned parties should then execute a Deed of Confirmation confirming

that the main deed is valid and binding upon them.

Place for registering document relating to land:

A document relating to an immovable property can be executed in or out of India but every such

document shall be presented for registration in the office of a Sub-Registrar within whose sub-district

the whole or some portion of the property to which such document relates is situated.

Persons to present documents for registration:

a) the concerned person himself/herself

b) by the representative or assign of such person, or

c) by the agent of such person, representative or assign, duly authorised by power of attorney executed

and authenticated in manner hereinafter mentioned. The passport size photographed and fingerprints

of each buyer and seller of such property mentioned in the document shall also be affixed to the

document.

Under what circumstances the registration of document is refused

The normal grounds for non-registration of document/s are :-

a) Document is opposed to public policy.

b) Parties have not complied with the formalities as laid by the Registration Act and by any reasons by

which registering authority is not satisfied.

c) The Survey No. Of the property is not mentioned in the document/s.

d) The language in which the document is executed is not in the language that is normally prevalent in

the area where the office of the registering authority is situated.

Stamp Act, 1899

Stamp Duty is one type of tax that has to be paid to the state government. It is payable on instruments

and not on transactions. The term instrument refers to Agreements, Exchanges, Gifts, Certificates of

Sale, Deeds of Partition, Power of Attorney to sell immovable property when given for consideration,

Deeds of Settlement and Transfer of Lease by way of assignment, etc.

Since its inception in 1899 in India, it has been a significant source of revenue for most State

governments. Under the Constitution of India, the power to levy Stamp Duties is divided between the

Centre and the States. Rates prescribed by State Government will prevail in that State. State

Government can make law for other aspects of stamp duty also (i.e. matters other than quantum of

duty). However, if there is conflict between State law and Union law, the Union law prevails [Article 254

of Constitution]. Thus, the power of the Union extends to the whole field of Stamp duties, except that as

regards rates of Stamp duty in the States, it is confined to the specified documents. It is plenary as

regards machinery provisions

Purpose:

The basic purpose of Indian Stamp Act, 1899 is to raise revenue to Government. However, over a period

of time, the stamped document has obtained so much value that a stamped document is considered

much more authentic and reliable than an un-stamped document. A stamp duty paid

instrument/document is considered a proper and legal instrument/document and as such gets

evidentiary value and is admitted as evidence in courts.

Applicability:

Extends to the whole of India except the State of Jammu and Kashmir The Indian Stamp Act, 1899 has

been adopted by various states with suitable amendments. Maharashtra, Gujarat, Karnataka, Kerala and

Rajasthan, however, have enacted their own stamp duty legislations as shown in the following table;

Maharastra Bombay Stamp Act,1958

Karnataka Karnataka Stamp Act,1957

Rajasthan Rajasthan Stamp Act,1998

Kerala Kerala Stamp Act,1959

The Bombay Stamp Act, 1958 is applicable in Gujarat State as amended from time to time by the Gujarat

Government. Every state has a Stamp Act which lays down the stamp duty that should be paid for a

particular transaction, the mode of stamping etc. The stamp duty for property transactions may be

prescribed EITHER as a percentage of the market value of the property involved OR as a fixed amount

for a particular kind of transaction.

Instruments chargeable with Stamp duty:

Instruments include every document by which any right or liability is or purports to be created,

transferred, limited, extended, extinguished or recorded but does not include a bill of exchange, cheque,

promissory note, bill of lading, letter of credit, policy of insurance, transfer of shares, debentures proxy

and receipt (which is charged under Indian Stamp Act, 1899). Except transfer by will (or by original

nomination in a co-operative society) all transfer documents including agreements to sell, conveyance

deed, gift deed, mortgage deed, exchange deed, deed of partition, power of attorneys, leave and licence

agreement, agreement of tenancy, lease deeds, power of attorney to sell for consideration etc. have to

be properly stamped. When a nominee transfers the flat subsequently in the name of legal heir, such

transfer also requires stamp duty.

Stamp Duty can be paid by;

1. Using Stamp paper

2. Using adhesive stamps

3. Franking

Stamp Papers are required to be purchased in the name of one of the parties to the instrument.

Who is liable to pay Stamp Duty

As per the provisions of Section 30 of Bombay Stamp Act, 1958, the onus of payment of Stamp duty in

the absence of an agreement to the contrary, shall be borne by;

- the grantee in the case of conveyance,

- the lessee in the case of a Lease deed,

- in equal share by both parties in the case of exchange of property

- the parties thereto in proportion to their respective shares in case of partition,

Time Duration for Payment of Stamp Duty

It is payable either before execution of the document/instrument or on the day of execution of

document/instrument or on the next working day of executing such instrument/document. Execution of

document/ instrument means putting signatures on the instrument by persons executing the

instrument/s. Delay in payment of stamp duty attracts penalty at 2% per month, subject to maximum

penalty of 200% of the deficit amount of stamp duty. Documents lodged with the subregistrar/

superintendent of stamps prior to any amnesty scheme attract a lump sum reduced penalty. Documents

not properly stamped are not admitted in court as evidence.

Stamp duty payable in case of exchange of properties

It is payable only on the value of that property, among the two properties exchanged, whose value is

higher Stamp Duty Ready Reckoner The amount of stamp duty needed to pay for a property depends on

the market value of the concerned property. The rate also varies according to the location and the

nature of real estate transaction. The stamp duty ready reckoner acts as a complete guide to help you

know the current rates and other charges as per the location and type of the property in question. Use

the C.S./C.T.S. number of the concerned property and the name of the division or village where it is

located to search specific information from the ready reckoner. Thus, the current market value of the

concerned property can be identified. The ready reckoner also helps you know the current registration

charges per square meter depending upon the location of the real estate property. The ready reckoner

rates are revised on a every year.

Stamp Duty across Indian States

India has one of the highest levels of stamp duty in the world. In contrast the maximum rate levied in

most developed markets whether in Singapore or Europe is in the range of 1-2 per cent. The Stamp Duty

in UK is even more rationalized for first time house buyers; the stamp duty rate is 0% for first time home

buyer upto consideration value of 250,000. Unlike in India, stamp duty is hardly considered a burden in

the UK, and there is no attempt to evade the duty by under-valuation. An important feature of the

British stamp law is the frequent changes in the structure of duties and constant efforts at

rationalization in response to public demand and market forces. In Australia, stamp duty rates on

instruments are either very low or have been exempted.

Country Stamp Duty/ Registration Tax

Malaysia 1 % on first RM 4,00,000; 3 % on the remaining market value

Hong Kong 3.75 % on the market value of the property

Thailand 0.5 % except in cases where the seller is subject to a specific Business Tax + 2%

transfer Fee and 0.5 % stamp Duty

Philippines 1.5 % on the consideration paid or the fair mkt. value (whichever is higher)

+0.75 % of gross selling price as Transfer Tax.

Singapore 1 % on first S $ 1,80,000; 2 % on next S $ 1,80,000; thereafter 3 %

Korea 3.6 % Registration Tax + 2.2 % Property Acquisition Tax (both on the acquisition

value)

US 0.003%

UK 0.5%

Implications of High Stamp Duty:

- Its discourage land transactions, and as a consequence, reduce the supply of land to the market.

Besides, there is gross under-declaration of the real value of land.

- Adversely affects the possibility of using land as collateral for construction financing or other economic

activities.

- High Stamp Duty rates inhibit prospective purchasers from registering their properties to avoid

payment of high duty and understate sale proceeds.

- Normally sale proceeds are stated at par with the running Jantri price or the circle rate for the area

which actually much lower than the prevailing market price; thus creating black money.

- Similarly capital gains tax is avoided resulting into creation of black money in the system.

- High rates of stamp duty lead to undervaluation of properties, resulting in substantial loss of revenue

to the states and the ULBs. Undervaluation of properties is commonly observed and is the main source

of corruption and black money in the country. Jnnurm has recommended States to lower the stamp duty

rates to 5% or less under the land reforms. The reduction in Stamp Duty may encourage more

registration of transaction thereby increasing the revenue for the State and reduce Black Money

generation. Even the National Housing and Habitat Policy, 1998, recommended a stamp duty rate of 2-3

per cent. The temporary loss in revenue from stamp duties, if it occurs, shall be compensated by better

valuation, checking of non-registration of property transfers, and increase in the volume of registered

documents.

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Car Ownership Transfer in The PhilippinesDocumento8 páginasCar Ownership Transfer in The PhilippinesKian Beltran100% (1)

- 52 Formats of Power of AttorneyDocumento2 páginas52 Formats of Power of AttorneyJit100% (2)

- Grant DeedDocumento3 páginasGrant DeedRocketLawyer100% (4)

- Certificate of Acknowledgment of DeedDocumento4 páginasCertificate of Acknowledgment of Deedharoldebeale100% (5)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Legal Notice Formates & TypesDocumento12 páginasLegal Notice Formates & TypesAdv Sheetal Saylekar100% (1)

- Indian Stamp Act, 1899Documento27 páginasIndian Stamp Act, 1899Cliffton KinnyAinda não há avaliações

- Deed - Trust Transfer Deed (YEAR)Documento2 páginasDeed - Trust Transfer Deed (YEAR)crystalAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Conveyance Deed Importance and Documents RequiredDocumento6 páginasConveyance Deed Importance and Documents RequiredHemant Sudhir Wavhal0% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Land Titles SummaryDocumento15 páginasLand Titles SummaryApril Grace GrandeAinda não há avaliações

- GR No 122191 Saudi Arabian Airlines Vs Ca FactsDocumento20 páginasGR No 122191 Saudi Arabian Airlines Vs Ca FactsJennica Gyrl G. DelfinAinda não há avaliações

- Urban Planning in IndiaDocumento46 páginasUrban Planning in Indiasainath01075% (4)

- National Building Code 2005Documento1.161 páginasNational Building Code 2005api-2617216889% (47)

- Anthropology: PDF Generated At: Thu, 17 May 2012 02:47:08 UTCDocumento112 páginasAnthropology: PDF Generated At: Thu, 17 May 2012 02:47:08 UTCMania1710100% (6)

- Deed of UsufructDocumento4 páginasDeed of Usufructruel fernandezAinda não há avaliações

- Asset Privatization Trust v. T.J. Enterprises.Documento5 páginasAsset Privatization Trust v. T.J. Enterprises.Jude Raphael S. FanilaAinda não há avaliações

- Dizon vs. CA - GR No. 101929 - Case DigestDocumento2 páginasDizon vs. CA - GR No. 101929 - Case DigestAbigail Tolabing100% (1)

- Deed of Donation and AcceptanceDocumento2 páginasDeed of Donation and Acceptancejames johnAinda não há avaliações

- ARCHDocumento7 páginasARCHPunith S MurthyAinda não há avaliações

- Arra Realty Corp v. GDCIA and PealozaDocumento8 páginasArra Realty Corp v. GDCIA and Pealozalevi lomuntadAinda não há avaliações

- Villaflor Vs CA and NasipitDocumento16 páginasVillaflor Vs CA and NasipitJhudith De Julio BuhayAinda não há avaliações

- 100 Keyboard Shortcuts For Moving Faster in Windows 7Documento5 páginas100 Keyboard Shortcuts For Moving Faster in Windows 7Umi Ghozi-gazaAinda não há avaliações

- Imp SitesDocumento10 páginasImp SitesMania1710Ainda não há avaliações

- Bahaus School Architects WorksDocumento67 páginasBahaus School Architects WorksAr Parth Jain100% (1)

- Zoning CodeDocumento273 páginasZoning CodeMania1710Ainda não há avaliações

- All UniversityDocumento21 páginasAll UniversitySangram PandaAinda não há avaliações

- Adolf LoosDocumento14 páginasAdolf LoosAr Parth JainAinda não há avaliações

- Andagere Associates Code No. A030Documento3 páginasAndagere Associates Code No. A030Mania1710Ainda não há avaliações

- ValuationDocumento10 páginasValuationMania17100% (1)

- ACD Calender 2014-2015Documento1 páginaACD Calender 2014-2015Mania1710Ainda não há avaliações

- S7 ConsultantsDocumento58 páginasS7 ConsultantsMania1710Ainda não há avaliações

- Auroville Awareness ProgrammesDocumento2 páginasAuroville Awareness ProgrammesMania1710Ainda não há avaliações

- Post Graduate: Diploma Programme in Design (Documento5 páginasPost Graduate: Diploma Programme in Design (Akhil MohananAinda não há avaliações

- Time Management PDFDocumento12 páginasTime Management PDFBesart KryeziuAinda não há avaliações

- Arup JournalDocumento80 páginasArup JournalMania1710Ainda não há avaliações

- Efficient Outdoor LightingDocumento3 páginasEfficient Outdoor LightingMania1710Ainda não há avaliações

- Creative Synergies PosterDocumento1 páginaCreative Synergies PosterMania1710Ainda não há avaliações

- Landscape Lighting: Pond & GardenDocumento12 páginasLandscape Lighting: Pond & GardenMania1710Ainda não há avaliações

- Jog Caterers Menu CardDocumento6 páginasJog Caterers Menu CardMania1710Ainda não há avaliações

- Park FinalDocumento1 páginaPark FinalMania1710Ainda não há avaliações

- TN Vision 2023Documento68 páginasTN Vision 2023Firstpost100% (1)

- SALES Torcuator v. BernabeDocumento6 páginasSALES Torcuator v. BernabeHannah MedesAinda não há avaliações

- Sale Deed For Floor of A House To Woman in Delhi: Form No. 14Documento4 páginasSale Deed For Floor of A House To Woman in Delhi: Form No. 14Sudeep SharmaAinda não há avaliações

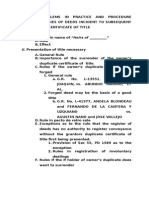

- Common Problems in Practice and Procedure Before Registries of Deeds Incident To Subsequent RegistrationDocumento11 páginasCommon Problems in Practice and Procedure Before Registries of Deeds Incident To Subsequent Registrationjuliepis_ewAinda não há avaliações

- Indemnity Bond For Title TransferDocumento1 páginaIndemnity Bond For Title TransferHatakesh PotnuruAinda não há avaliações

- Section 51-59 of PD 1529Documento4 páginasSection 51-59 of PD 1529Manu SalaAinda não há avaliações

- Echavez v. Dozen ConstructionDocumento4 páginasEchavez v. Dozen ConstructiontheagAinda não há avaliações

- Endaya v. Villaos - Case Digest - Mirabuena, Kim Colleen G.Documento1 páginaEndaya v. Villaos - Case Digest - Mirabuena, Kim Colleen G.KIM COLLEEN MIRABUENAAinda não há avaliações

- Banco Filipino v. CADocumento7 páginasBanco Filipino v. CAJui Aquino ProvidoAinda não há avaliações

- Property Law - 190101146 - SIDHANT KAMPANIDocumento21 páginasProperty Law - 190101146 - SIDHANT KAMPANIKampani SidhantAinda não há avaliações

- Temporary Restraining Order Blocking Gadsden Airport Authority From Selling PropertyDocumento8 páginasTemporary Restraining Order Blocking Gadsden Airport Authority From Selling PropertyUSA TODAY NetworkAinda não há avaliações

- Suit For Reinstatement by Specific Performance and Arrears of Back Wages (Or Salary)Documento8 páginasSuit For Reinstatement by Specific Performance and Arrears of Back Wages (Or Salary)kinnari bhutaAinda não há avaliações

- Corporate Warranty DeedDocumento2 páginasCorporate Warranty Deedkatherine lillyAinda não há avaliações

- Bescom Form 13 Transfer of InstallationDocumento10 páginasBescom Form 13 Transfer of Installationroopesh2190% (1)

- Sales Last Week-MidtermsDocumento70 páginasSales Last Week-MidtermsSometimes goodAinda não há avaliações