Escolar Documentos

Profissional Documentos

Cultura Documentos

Major Changes in New Form 3CD (Tax Audit Report Format) #SIMPLETAXINDIA

Enviado por

శ్రీనివాసకిరణ్కుమార్చతుర్వేదుల0 notas0% acharam este documento útil (0 voto)

233 visualizações4 páginasMajor Changes in New Form 3CD (Tax Audit Report Format ) #SIMPLETAXINDIA

Título original

Major Changes in New Form 3CD (Tax Audit Report Format ) #SIMPLETAXINDIA

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoMajor Changes in New Form 3CD (Tax Audit Report Format ) #SIMPLETAXINDIA

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

233 visualizações4 páginasMajor Changes in New Form 3CD (Tax Audit Report Format) #SIMPLETAXINDIA

Enviado por

శ్రీనివాసకిరణ్కుమార్చతుర్వేదులMajor Changes in New Form 3CD (Tax Audit Report Format ) #SIMPLETAXINDIA

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 4

Major changes in new Form 3CD (Tax Audit report Format )

on Tuesday, July 29, 2014

The CBDT has notied Income-tax (7th

amendment) Rules, 2014 which

substitutes the existing Form No. 3CD

with a new form. The new Form 3CD

prescribes certain new reporting

clauses and substitutes some existing

clauses with new ones. The new form

requires tax auditor to furnish more

and detailed information in the new

form for tax audit report.

Unlike old form 3CD which required

auditor to report only those

inadmissible payments which were

debited to Prot and loss account, the

new Form 3CD requires reporting of all

disallowable payments even if they are not debited to prot and loss account.

CBDT has withdrawn E ling utility for form 3CA 3CD based on old format with immediate eect.

With the substitution of Form No. 3CD, reporting in the new form would be a time taking job for

the Chartered Accountants. Here is the list of additional reporting requirements as prescribed in

the new Form No. 3CD:

(1) Registration number in case of indirect tax liability:

Assessees liable to pay indirect taxes (like excise duty, service tax, sales tax, customs

duty, etc.) shall furnish their registration number or any other identification number

allotted to them[clause 4 of Part A].

(2) Relevant clauses of section 44AB:

The relevant clauses of section 44AB shall be reported under which audit has been

conducted[clause 8 of Part A].

(3) Location at which books of account are kept:

New Form seeks details of the address at which books of account of assessee have

been kept[clause 11(b) of Part B].

(4) Nature of documents examined by the auditor:

The auditor is required to specify the nature of documents examined by him in the

course of tax audit[clause 11(c) of Part B].

(5) Change in method of accounting/stock valuation:

A tabular format is specified for reporting of financial impact of changes in method

of accounting and method of stock valuation[clause 13 and clause 14 of Part B].

(6) Transfer of land/building for less than stamp duty value:

Details of land or building transferred by assessee for less than stamp duty value

(under section 43CA or under section 50C) shall be reported in new Form

3CD [clause 17 of Part B].

(7) Deduction allowable under Sections 32AC/35AD/35CCC/35D:

Deductions allowable under sections 32AC, 35AD, 35CCC and 35DDD are also

required to be reported in revised Form No. 3CD[clause 19 of Part B].

(8) Disallowances:

Old Form3CD required reporting of inadmissible payments only when they were

debited to Profit and loss account. However, the new Form 3CD requires reporting of

following disallowable payments, even if they are not debited to profit and loss

Custom Search Custom Search

DUE DATE TO FILE ITR AY 14-15 DUE DATE TO FILE ITR AY 14-15

WHICH ITR FORM YOU SHOULD FILE WHICH ITR FORM YOU SHOULD FILE

MANDATORY E FILING FY 13-14 MANDATORY E FILING FY 13-14

DOWNLOAD ITR FORM FY 13-14 DOWNLOAD ITR FORM FY 13-14

PENALTY ON LATE FILING OF ITR PENALTY ON LATE FILING OF ITR

SUBSCRIBE FREE EMAIL, JOIN OUR COMMUNITY SUBSCRIBE FREE EMAIL, JOIN OUR COMMUNITY

INCOME TAX RETURN FY 2014-15 INCOME TAX RETURN FY 2014-15

Flat 15% Off

Dove & TRESemme

HOME BUDGET-14 SALARY ITAX ITR-14-15 DEDUCTIONS TDS HOW TO PAN SERVICE TAX CHALLAN HP CG EXCEL TALLY

Major changes in new Form 3CD (Tax Audit report Format ) #SIMPLET... http://www.simpletaxindia.net/2014/07/major-changes-in-new-form-3cd-t...

1 of 4 26/08/2014 2:29 PM

(ii) Disallowance for cash payments under section 40A(3)

(iii) Disallowance for provision for gratuity under section 40A(7)

(iv) Disallowance under Section 40A(9)

(v) Particulars of any liability of a contingent nature

(vi) Amount of deduction inadmissible under section 14A

(vii) Interest inadmissible under the proviso to section 36(1)(iii)

(9) Deemed income under Section 32AC:

Section 32AC of the Act provides for investment allowance of 15% for investment in

plant and machinery. New form provides for reporting of deemed income which

results from sale or transfer of new asset, (if asset was acquired and installed by the

assessee for the purpose of claiming deductions under Section 32AC) within a period

of five years from the date of its installation[clause 24 of Part B].

(10) Receipt of unlisted shares:

A new clause is inserted in the Form 3CD which requires reporting of all unlisted

shares which were received by assessee either for inadequate consideration or

without consideration in view of section 56(2)(viia)[clause 28 of Part B].

(11) Issue of shares above fair market value:

A new clause is inserted in the Form 3CD which requires reporting of all

transactions of issue of shares where consideration received by assessee exceeds its

fair market value in view of section 56(2)(viib)[clause 29 of Part B].

(12) Speculation losses:

New Form No. 3CD provides for reporting of losses from speculation business as

referred to in Section 73[clause 32(c) of Part B].

(13) Losses from business specified under section 35AD:

Assessee shall furnish details of losses incurred as referred to in Section 73A in

respect of specified businesses mentioned in Section 35AD[clause 32(d) of Part B].

(14) Reporting of deductions claimed under Sections 10A and 10AA:

If any deduction has been claimed by assessee under Sections 10A and 10AA then it

shall be reported in new Form No. 3CD[clause 33 of Part B].

(15) Compliance with TCS provisions:

Old Form 3CD required reporting on compliance with TDS provisions only. However,

New Form No. 3CD requires reporting on compliance with TCS provisions as

well[clause 34(a) of Part B].

(16) Filing of TDS/TCS statements:

The tax auditor shall report on the compliance by the assessee with the provision of

furnishing of TDS or TCS statement within prescribed time[clause 34(b) of Part B].

(17) Assessee-in-default:

If assessee is deemed as an assessee-in-default and he is liable to pay interest under

Section 201(1A) or 206C(7), the tax auditor shall furnish the TAN of assessee,

interest payable and interest actually paid[clause 34(c) of Part B].

(18) Dividend Distribution Tax:

Revised Form No. 3CD requires reporting of following reductions as referred to in

clause (i) and clause (ii) of Section 115-O(1A)[clause 36 of Part B]:

i) Dividend received by domestic company from its subsidiary, and

ii) The amount of dividend paid to any person for or on behalf of the New Pension

System Trust referred to in Section 10(44).

(19) Audits:

(i) Cost audit: Old Form No. 3CD required reporting only when statutory cost audit

was carried out under Section 233A of the Companies Act, 1956. However, the

revised Form No. 3CD specifies reporting requirement even when cost audit has been

carried out voluntarily. The requirement of attachment of copy of cost audit report

along with Form has been substituted with reporting of qualifications in cost audit

report[clause 37 of Part B].

(ii) Cost Audit under Central Excise Act: The requirement of attachment of copy of

cost audit report along with Form has been substituted with reporting of

qualifications in cost audit report [clause 38 of Part B].

(iii) Special Audit under Service Tax: If any service-tax audit is carried out in

relation to valuation of taxable services, the tax auditor shall report any

qualifications made in relation to valuation of taxable services[clause 39 of Part B]

(20) Ratios:

Unlike old form which required reporting of certain ratios pertaining to current year

only, the new Form requires reporting of ratios of preceding financial year as well.

Further, total turnover is to be reported for the previous year as well as for preceding

financial year[clause 40 of Part B].

87A RS 2000 ADDITIONAL REBATE 87A RS 2000 ADDITIONAL REBATE

KNOW YOUR PAN,VERIFY PAN,NAME BY KNOW YOUR PAN,VERIFY PAN,NAME BY

PAN,PAN CARD STATUS ONLINE PAN,PAN CARD STATUS ONLINE

KNOW DEALERS DETAIL BY TIN (VAT) KNOW DEALERS DETAIL BY TIN (VAT)

NUMBER OR BY NAME NUMBER OR BY NAME

Due Date To File Income Tax Return Assessment Due Date To File Income Tax Return Assessment

Year 2014-15 Year 2014-15

ITR -3 ITR-4 ITR-5 ITR-6 ITR-7 NOTIFIED FOR ITR -3 ITR-4 ITR-5 ITR-6 ITR-7 NOTIFIED FOR

ASSESSMENT YEAR 2014-15 ASSESSMENT YEAR 2014-15

Relief U/s 89(1) On Gratuity Received In FY Relief U/s 89(1) On Gratuity Received In FY

2010-11 2010-11

Employer Can Limit EPF Continuation Up To Employer Can Limit EPF Continuation Up To

12% On 6,500 Per Month : EPFO Clarification 12% On 6,500 Per Month : EPFO Clarification

New 3CA 3CB 3CD (Audit Report Format) New 3CA 3CB 3CD (Audit Report Format)

Notified Applicable Wef 25.07.2014 Notified Applicable Wef 25.07.2014

PENALTY ON LATE FILING OF INCOME TAX PENALTY ON LATE FILING OF INCOME TAX

RETURN AY 2014-15 FY 2013-14 RETURN AY 2014-15 FY 2013-14

CBDT Withdraw Form 3CD-3CB-3CA (Audit CBDT Withdraw Form 3CD-3CB-3CA (Audit

Report) Old Utility With Immediate Effect Report) Old Utility With Immediate Effect

KNOW YOUR AO CODE ,INCOME TAX KNOW YOUR AO CODE ,INCOME TAX

WARD/CIRCLE PAN NAME WITH PAN WARD/CIRCLE PAN NAME WITH PAN

NUMBER NUMBER

August August (40) (40)

2014 2014 (332) (332)

2013 2013 (422) (422) 2012 2012 (540) (540) 2011 2011 (462) (462)

2010 2010 (407) (407) 2009 2009 (127) (127) 2008 2008 (90) (90)

2007 2007 (53) (53)

POPULAR POSTS POPULAR POSTS

BLOG ARCHIVE BLOG ARCHIVE

HOME BUDGET-14 SALARY ITAX ITR-14-15 DEDUCTIONS TDS HOW TO PAN SERVICE TAX CHALLAN HP CG EXCEL TALLY

Major changes in new Form 3CD (Tax Audit report Format ) #SIMPLET... http://www.simpletaxindia.net/2014/07/major-changes-in-new-form-3cd-t...

2 of 4 26/08/2014 2:29 PM

You might also like

3

3CD 44AB new limit AMENDED 3CD AUDIT REPORT

(other than Income Tax Act, 1961 and Wealth Tax Act, 1957) along with details of

relevant proceedings[clause 41 of Part B].

Source:Taxmann

Custom made t shirts Web hosting services Sales Tax Application Form

Calculator Popular Posts Form 3cd Tax Calculator New Form

MICROSOFT EXCEL USEFUL COMMAND GUIDE TIPS SHORT CUTS

10 TAX RATE CHART UNDER INCOME TAX FY 2014-15 AFTER BUDGET 2014

DIRECT TAXES READY RECKONER FY 2014-15 TAXMANN PUBLICATION 25 % DISCOUNT CCH 33

% DISCOUNT

TAX AUDIT MANDATORY EVEN IF TURNOVER OF BUSINESS UPTO 1 CRORE?

WHAT TO DO IN CASE OF TDS MISMATCH?

CBDT WITHDRAW FORM 3CD-3CB-3CA (AUDIT REPORT) OLD UTILITY WITH IMMEDIATE EFFECT

KNOW YOUR PAN NAME VERIFY PAN FREE CHECK NAME BY PAN

DRAFT RESOLUTIONS FOR PROFESSIONALS UNDER COMPANIES ACT

TALLY SHORT CUTS-TIPS -USE TALLY IN SIMPLE WAY-SERIES III

REVISED 3CD AND VARIOUS ISSUE OF 3CD

Recommended by

0 comments:

Jul 31 Jul 31 (5) (5)

Major changes in new Form 3CD (Tax Major changes in new Form 3CD (Tax

Audit report Fo... Audit report Fo...

CBDT withdraw Form 3CD-3CB-3CA CBDT withdraw Form 3CD-3CB-3CA

(audit report) Old... (audit report) Old...

PENALTY ON LATE FILING OF PENALTY ON LATE FILING OF

INCOME TAX RETURN AY 201... INCOME TAX RETURN AY 201...

Jul 29 Jul 29 (3) (3)

Jul 28 Jul 28 (2) (2) Jul 27 Jul 27 (2) (2)

Jul 26 Jul 26 (3) (3) Jul 25 Jul 25 (2) (2)

Jul 24 Jul 24 (2) (2) Jul 23 Jul 23 (3) (3)

Jul 22 Jul 22 (1) (1) Jul 18 Jul 18 (5) (5)

Jul 17 Jul 17 (1) (1) Jul 16 Jul 16 (3) (3)

Jul 15 Jul 15 (2) (2) Jul 14 Jul 14 (4) (4)

Jul 13 Jul 13 (4) (4) Jul 12 Jul 12 (2) (2)

Jul 11 Jul 11 (5) (5) Jul 10 Jul 10 (13) (13)

Jul 09 Jul 09 (3) (3) Jul 08 Jul 08 (3) (3)

Jul 07 Jul 07 (4) (4) Jul 06 Jul 06 (1) (1)

Jul 05 Jul 05 (3) (3) Jul 04 Jul 04 (4) (4)

Jul 03 Jul 03 (2) (2) Jul 02 Jul 02 (4) (4)

June June (45) (45) May May (21) (21) April April (34) (34)

March March (36) (36) February February (35) (35)

January January (35) (35)

27 Like Like

27 Recommend Recommend

Follow

NEXT

RECENT UPDATES IN DIRECT & INDIRECT

TAXES AND IN OTHER AREAS OF

PROFESSIONAL INTEREST

PREVIOUS

CBDT withdraw Form 3CD-3CB-3CA

(audit report) Old Utility with Immediate

effect

44

4

5

88

5592

44

4

5

0

Tumblr

HOME BUDGET-14 SALARY ITAX ITR-14-15 DEDUCTIONS TDS HOW TO PAN SERVICE TAX CHALLAN HP CG EXCEL TALLY

Major changes in new Form 3CD (Tax Audit report Format ) #SIMPLET... http://www.simpletaxindia.net/2014/07/major-changes-in-new-form-3cd-t...

3 of 4 26/08/2014 2:29 PM

Post a Comment

Comment as:

Publish

The contents of this page are solely for The contents of this page are solely for

informational purpose. It does not constitute informational purpose. It does not constitute

professional advice or recommendation of professional advice or recommendation of

Simple Tax India/Author. Neither the authors Simple Tax India/Author. Neither the authors

nor simple tax India and its affiliates accepts nor simple tax India and its affiliates accepts

any liabilities for any loss or damage of any any liabilities for any loss or damage of any

kind arising out of any information in this kind arising out of any information in this

document nor for any actions taken in document nor for any actions taken in

reliance thereon. reliance thereon.

Readers are advised to consult the Readers are advised to consult the

professional for understanding applicability professional for understanding applicability

of this newsletter in the respective scenarios. of this newsletter in the respective scenarios.

While due care has been taken in preparing While due care has been taken in preparing

this document, the existence of mistakes and this document, the existence of mistakes and

omissions herein is not ruled out. No part of omissions herein is not ruled out. No part of

this document should be distributed or copied this document should be distributed or copied

(except for personal, non-commercial use) (except for personal, non-commercial use)

without our written permission. without our written permission.

Disclaimer Disclaimer

Home TDS Rates 13-14 HRA calculation KNOW YOUR PAN KNOW YOU TIN PAN APPLICATION STATUS KNOW YOU EPF BALANCE

Copyright 2012 Max Mag Theme. Designed by Templateism

HOME BUDGET-14 SALARY ITAX ITR-14-15 DEDUCTIONS TDS HOW TO PAN SERVICE TAX CHALLAN HP CG EXCEL TALLY

Major changes in new Form 3CD (Tax Audit report Format ) #SIMPLET... http://www.simpletaxindia.net/2014/07/major-changes-in-new-form-3cd-t...

4 of 4 26/08/2014 2:29 PM

Você também pode gostar

- Taxmann's Analysis - Changes Introduced in Guidance Note On Tax AuditDocumento27 páginasTaxmann's Analysis - Changes Introduced in Guidance Note On Tax AuditS M SHEKAR AND COAinda não há avaliações

- Understanding On: Tax Audit U/s 44AB of I.T. ActDocumento29 páginasUnderstanding On: Tax Audit U/s 44AB of I.T. Actspchheda4996Ainda não há avaliações

- Income Tax Audit ReportDocumento7 páginasIncome Tax Audit ReportMy NameAinda não há avaliações

- KPMG - Change in Tax Audit ReportDocumento5 páginasKPMG - Change in Tax Audit ReportDhananjay KulkarniAinda não há avaliações

- Tax AuditDocumento3 páginasTax AuditForam ShahAinda não há avaliações

- 1.gnutti Carlo - Tax Audit - 2023 - 27.10.2023Documento30 páginas1.gnutti Carlo - Tax Audit - 2023 - 27.10.2023ssb.corporateteamAinda não há avaliações

- Tax Audit ReportDocumento18 páginasTax Audit ReportNeha DenglaAinda não há avaliações

- All About GST Annual ReturnsDocumento9 páginasAll About GST Annual ReturnsinfoAinda não há avaliações

- GST Automated NoticesDocumento6 páginasGST Automated NoticesMaunik ParikhAinda não há avaliações

- Form No. 3Cb (See Rule 6G (1) (B) )Documento12 páginasForm No. 3Cb (See Rule 6G (1) (B) )Jay MogradiaAinda não há avaliações

- Final Tax Audit-JigarDocumento20 páginasFinal Tax Audit-JigarJigar MehtaAinda não há avaliações

- Tax Audit PresentationDocumento12 páginasTax Audit PresentationChirag KarmadwalaAinda não há avaliações

- Securities and Exchange Commission (SEC) - Formn-QDocumento4 páginasSecurities and Exchange Commission (SEC) - Formn-QhighfinanceAinda não há avaliações

- Input Tax Credit 36. Documentary Requirements and Conditions For Claiming Input Tax Credit.Documento22 páginasInput Tax Credit 36. Documentary Requirements and Conditions For Claiming Input Tax Credit.KaranAinda não há avaliações

- 2017 Amendments To The Tax Code by The TRAIN LawDocumento28 páginas2017 Amendments To The Tax Code by The TRAIN LawScarlette CooperaAinda não há avaliações

- Form No. 3CD Format in ExcelDocumento41 páginasForm No. 3CD Format in ExcelranjitAinda não há avaliações

- Draft Refund RulesDocumento7 páginasDraft Refund RulessridharanAinda não há avaliações

- GSTR 9 9C FY 22 23 DUE 31st December 2023 1694345252Documento7 páginasGSTR 9 9C FY 22 23 DUE 31st December 2023 1694345252RajatAinda não há avaliações

- VARIOUS FORMs OBJECTIVE QUESTIONs CMA FINAL DT DEC 2021 EXAMDocumento6 páginasVARIOUS FORMs OBJECTIVE QUESTIONs CMA FINAL DT DEC 2021 EXAMidealAinda não há avaliações

- Itr-7 FaqDocumento14 páginasItr-7 FaqAshwin KumarAinda não há avaliações

- Chapter - Tax Audit & Ethical CompliancesDocumento106 páginasChapter - Tax Audit & Ethical CompliancessayanghoshAinda não há avaliações

- GST Audit Vis A Vis Annual ReturnDocumento30 páginasGST Audit Vis A Vis Annual ReturnchariAinda não há avaliações

- 06 A Idt Ammentments 2 in 1Documento33 páginas06 A Idt Ammentments 2 in 1Venkat RamanaAinda não há avaliações

- TaxMarvel - Modifications in Form GSTR 3B and New Disclosure RequirementsDocumento5 páginasTaxMarvel - Modifications in Form GSTR 3B and New Disclosure RequirementsAmit AgrawalAinda não há avaliações

- Form No. 3CB (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961, in The Case of of A Person Referred To in Clause (B) of Sub - Rule (1) of The Rule 6GDocumento13 páginasForm No. 3CB (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961, in The Case of of A Person Referred To in Clause (B) of Sub - Rule (1) of The Rule 6GKhehracybercafe SahnewalAinda não há avaliações

- Securities and Exchange Commission (SEC) - Form10-KsbDocumento11 páginasSecurities and Exchange Commission (SEC) - Form10-KsbhighfinanceAinda não há avaliações

- Securities and Exchange Commission (SEC) - Form10-KDocumento12 páginasSecurities and Exchange Commission (SEC) - Form10-KhighfinanceAinda não há avaliações

- Form 3CDDocumento8 páginasForm 3CDmahi jainAinda não há avaliações

- CGST Act 16-21Documento37 páginasCGST Act 16-21Dasari NareshAinda não há avaliações

- Overview of The Amendments-Train LawDocumento23 páginasOverview of The Amendments-Train LawCha GalangAinda não há avaliações

- Note On Tds ReportingDocumento3 páginasNote On Tds ReportingRajunish KumarAinda não há avaliações

- Audited Accounts - Taxguru - inDocumento3 páginasAudited Accounts - Taxguru - inMj VarmaAinda não há avaliações

- Audit Under Fiscal Laws - NotesDocumento17 páginasAudit Under Fiscal Laws - NotesabhiAinda não há avaliações

- Revenue Regulations No. 34-2020Documento3 páginasRevenue Regulations No. 34-2020zelayneAinda não há avaliações

- Form 3CD FinalDocumento7 páginasForm 3CD FinalMOHANA PRIYA.J 19BCO828Ainda não há avaliações

- Form No. 3Cd: Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961Documento9 páginasForm No. 3Cd: Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961sanket shahAinda não há avaliações

- RahulDocumento38 páginasRahulJignesh PatelAinda não há avaliações

- Release NotesDocumento12 páginasRelease NotesCharles De Saint AmantAinda não há avaliações

- Form 10-K: United States Securities and Exchange Commission Washington, D.C. 20549Documento13 páginasForm 10-K: United States Securities and Exchange Commission Washington, D.C. 20549how toAinda não há avaliações

- Tax Audit Plan and ProgrammeDocumento39 páginasTax Audit Plan and Programmepradhan13Ainda não há avaliações

- Key Features FVU 3.8Documento2 páginasKey Features FVU 3.8Apoorv AroraAinda não há avaliações

- Supplementary Guidance Note On Tax Audit Under Section 44AB of The Income-Tax Act, 1961Documento38 páginasSupplementary Guidance Note On Tax Audit Under Section 44AB of The Income-Tax Act, 1961Honey AgarwalAinda não há avaliações

- Cir 170 02 2022 CGSTDocumento7 páginasCir 170 02 2022 CGSTTushar AgrawalAinda não há avaliações

- New Form 16 AY 11 12Documento4 páginasNew Form 16 AY 11 12Sushma Kaza DuggarajuAinda não há avaliações

- Form No. 3Cd: Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961Documento9 páginasForm No. 3Cd: Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961shaikhAinda não há avaliações

- Form No. 3Cd: Part ADocumento8 páginasForm No. 3Cd: Part Aravibhartia1978Ainda não há avaliações

- Form No. 3Cd: Part ADocumento8 páginasForm No. 3Cd: Part Aravibhartia1978Ainda não há avaliações

- Revised Form 3CD in Excel FormatDocumento11 páginasRevised Form 3CD in Excel FormatshamitdsAinda não há avaliações

- Tax Audit Checklist For The Revised Form 3CD: Part ADocumento36 páginasTax Audit Checklist For The Revised Form 3CD: Part AKoolmindAinda não há avaliações

- Income-Tax Rules, 1962Documento17 páginasIncome-Tax Rules, 1962mohd aslamAinda não há avaliações

- Assignment On VAT 23.11.2020Documento12 páginasAssignment On VAT 23.11.2020Brohi ZamanAinda não há avaliações

- Tax Audit Clauses PDFDocumento13 páginasTax Audit Clauses PDFSunil KumarAinda não há avaliações

- Tax Audit GN 2023Documento3 páginasTax Audit GN 2023amanAinda não há avaliações

- 003 ITC Mismatch in GSTR 2A Vs 2BDocumento7 páginas003 ITC Mismatch in GSTR 2A Vs 2BAman GargAinda não há avaliações

- Returns: FAQ'sDocumento25 páginasReturns: FAQ'smun1barejaAinda não há avaliações

- Guidance Note On Tax Audit-Exposure DraftDocumento248 páginasGuidance Note On Tax Audit-Exposure DraftPiyush KumarAinda não há avaliações

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ADocumento16 páginasForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - AVidhi MiraniAinda não há avaliações

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ADocumento16 páginasForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - Ak.leela.kAinda não há avaliações

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24No EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24Ainda não há avaliações

- Form E.R.-8 Original/DuplicateDocumento4 páginasForm E.R.-8 Original/Duplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Invoice: Original Duplicate Triplicate QuadruplicateDocumento2 páginasInvoice: Original Duplicate Triplicate Quadruplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Before The Customs and Central Excise Settlement Commission - Bench at - Form of Application For Settlement of A Case Under Section 32EDocumento3 páginasBefore The Customs and Central Excise Settlement Commission - Bench at - Form of Application For Settlement of A Case Under Section 32Eశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Registration Form: Dr. Radha RaghuramapatruniDocumento2 páginasRegistration Form: Dr. Radha Raghuramapatruniశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Cenvat Credit: V S DateyDocumento44 páginasCenvat Credit: V S Dateyశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Formats & Procedures: Import of Capital GoodsDocumento16 páginasFormats & Procedures: Import of Capital Goodsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Materials ManagementDocumento3 páginasMaterials Managementశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Explanation of CBEC and Non-CBEC Currency CalculationsDocumento28 páginasExplanation of CBEC and Non-CBEC Currency Calculationsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- CLM-Logistics at LargeDocumento21 páginasCLM-Logistics at Largeశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Ebrc'-Faqs: S Questions GuidelinesDocumento7 páginasEbrc'-Faqs: S Questions Guidelinesశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

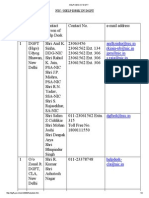

- Anilksinha@nic - in Rkjain-Ub@nic - in Jpm@nic - in S.raja@nic - in Rnyadav@nic - inDocumento2 páginasAnilksinha@nic - in Rkjain-Ub@nic - in Jpm@nic - in S.raja@nic - in Rnyadav@nic - inశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Cold ChainDocumento7 páginasCold Chainశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Electronic Fund Transfer HelpDocumento11 páginasElectronic Fund Transfer Helpశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Export Procedures in India - Export Documents Required, Documents Required For ExportDocumento2 páginasExport Procedures in India - Export Documents Required, Documents Required For Exportశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Tufsbookletsection4 Annex1Documento38 páginasTufsbookletsection4 Annex1శ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Modified TufsDocumento114 páginasModified Tufsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులAinda não há avaliações

- Form No. 16: Part ADocumento8 páginasForm No. 16: Part AParikshit ModiAinda não há avaliações

- NEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsDocumento168 páginasNEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsAkash MalikAinda não há avaliações

- Sohrabi 2019Documento42 páginasSohrabi 2019Brayan TillaguangoAinda não há avaliações

- Rey-Annjoysemacio: Page1of4 16lacewoodstsouthhillstisalabangon 9 7 9 9 - 2 4 8 7 - 1 1 Cebuprovincecebucity 6 0 0 0Documento4 páginasRey-Annjoysemacio: Page1of4 16lacewoodstsouthhillstisalabangon 9 7 9 9 - 2 4 8 7 - 1 1 Cebuprovincecebucity 6 0 0 0Reyann SemacioAinda não há avaliações

- 11.25.2017 Accounting For Income TaxDocumento5 páginas11.25.2017 Accounting For Income TaxPatOcampo0% (1)

- Example, Straight Line DepreciationDocumento12 páginasExample, Straight Line DepreciationKhadija Karim100% (2)

- Perpetual Inventory SystemDocumento8 páginasPerpetual Inventory SystemChristianne Joyse MerreraAinda não há avaliações

- GloPAC Program 16 11 2023Documento10 páginasGloPAC Program 16 11 2023ElvisPresliiAinda não há avaliações

- Accounting For Income TaxDocumento14 páginasAccounting For Income TaxJasmin Gubalane100% (1)

- Country Wide Litigation Database 01072007Documento15 páginasCountry Wide Litigation Database 01072007Carrieonic100% (1)

- Detailed MBA CourseStructureDocumento132 páginasDetailed MBA CourseStructureanchals_20Ainda não há avaliações

- (Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in HedgingDocumento79 páginas(Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in Hedgingsarvesh dhatrakAinda não há avaliações

- Deber 3Documento5 páginasDeber 3MartinAinda não há avaliações

- Ihsedu Itoh Green Chemicals Marketing Pvt. LTD 8 Annual Report 2017-18Documento50 páginasIhsedu Itoh Green Chemicals Marketing Pvt. LTD 8 Annual Report 2017-18William Veloz DiazAinda não há avaliações

- 7th CPC Pay Matrix Table For Central Government EmployeesDocumento8 páginas7th CPC Pay Matrix Table For Central Government EmployeesChellappa Gangadhar KAinda não há avaliações

- Geometric SequencesDocumento11 páginasGeometric SequencesDania Sonji0% (1)

- Exhaustive List of Analytics Companies in IndiaDocumento4 páginasExhaustive List of Analytics Companies in IndiagoodthoughtsAinda não há avaliações

- Suryaa Hotel Bal SheetDocumento3 páginasSuryaa Hotel Bal Sheetarjun chauhan100% (1)

- Admission of PartnersDocumento30 páginasAdmission of Partnersvansh gandhiAinda não há avaliações

- Beauhurst Crowdfunding Index Q1 2017Documento5 páginasBeauhurst Crowdfunding Index Q1 2017CrowdfundInsiderAinda não há avaliações

- 1000 Assets: Account # Account NameDocumento24 páginas1000 Assets: Account # Account NameGomv ConsAinda não há avaliações

- Bpi FormatDocumento3 páginasBpi FormatJoanne JaenAinda não há avaliações

- Testing Point FigureDocumento4 páginasTesting Point Figureshares_leoneAinda não há avaliações

- HRMM GuidenceDocumento6 páginasHRMM GuidencenadliesaAinda não há avaliações

- Film CoDocumento4 páginasFilm CoLeone BertozoAinda não há avaliações

- Bank Guarantee 1Documento3 páginasBank Guarantee 1Yomero Romero75% (4)

- MIS ReportDocumento15 páginasMIS ReportMuhammad RizwanAinda não há avaliações

- Weighted Average Cost of Capital (WACC) GuideDocumento5 páginasWeighted Average Cost of Capital (WACC) GuideJahangir KhanAinda não há avaliações

- Deposit SlipDocumento2 páginasDeposit Slipsoly2k12Ainda não há avaliações

- Joint Stock CompaniesDocumento16 páginasJoint Stock CompaniesJoynul Abedin100% (8)