Escolar Documentos

Profissional Documentos

Cultura Documentos

Summary of Case Studies

Enviado por

Howard Rivera RarangolDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Summary of Case Studies

Enviado por

Howard Rivera RarangolDireitos autorais:

Formatos disponíveis

ACCTG 116: MANAGEMENT CONSULTANCY

BS in Accounting Technology IV

Case Study on Business Ethics

Present the following cases of ethical malpractice using this outline:

I. Summary of the facts of the Case

II. Ethical issues what ethical problem arose? What particular situations caused such problems?

a. Using the IMA Statement of Ethical Professional Practice, discuss which of the ethical standards contained therein

are violated (competence, integrity, confidentiality, credibility).

b. You may frame your issues through questions, e.g. whether or not the firm should disclose the drop in share price.

c. State the decision of the company.

d. Comment on the decision.

III. Discuss how the international and domestic business community reacted to the scandal, e.g, the passage of the

Sarbanes-Oxley (SOX) Act, the addition of another set of standards, etc.

Requirements:

1. 7-minute presentation per group (+ 3-minute class interaction Q&A)

a. Use ppt presentation, max of 10 slides. Dont flash the whole paragraph, use multimedia instead (photos, videos. etc.)

2. Softcopy of report (max of 3 pages). Use Arial Narrow, 11pt. Send them via gmail randelldandalire@gmail.com. To be sent

before the scheduled report. Use Ethics Case BSAT IV; ACCTG 116 in the subject line.

3. Scheduled report: for MWF schedule, August 15 (Friday). August 14 (Thursday) for TTh sched.

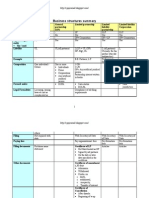

SCHEDULE GROUP

NUMBER

NAME OF COMPANY BRIEF DESCRIPTION

MWF 1-2

202 CL

1 WorldCom

The companys assets were inflated by around $11 billion with

$3.8 billion in fraudulent accounts. While the company was

purchased by Verizon Communications and was renamed

Verizon Business division, this scandal has actually had a

positive effect as the Sarbanes-Oxley Act was approved by the

senate to introduce the most sweeping new business

regulations since the 1930s.

2 Volkswagen Volkswagen was not spared after a criminal case with

Schuster, but was again in the headlines because of its

personnel manager, Klaus-Joachim Gebauer, who procured

prostitutes for the firms labor representatives under the guise

that it was in the interest of the company.

3 Siemens Siemens AG and the Greek government went under fire for

corruption and bribery, which involved the deal for the security

systems for the 2004 Summer Olympic Games in Athens and

other purchases by OTE in the 1990s. While no serious

charges have been made, it has been claimed that the bribes

may have been up to 100 million Euros.

4 Hewlett-Packard The Hewlett-Packard spying scandal was purportedly at the

behest of HP Chairwoman, Patricia Dunn. This was in

connection with an information leak where she had contracted

a team of independent security experts to investigate some

board members and several journalists by obtaining their phone

records. However, this backfired and resulted in Dunns

resignation and she was succeeded by HP CEO Mark Hurd.

5 Barings Bank Barings Bank is the oldest merchant bank in the city of London,

which was founded by the German-born Baring family. This

bank handled the Queens personal bank and was once the

financier of the Napoleonic Wars. However, the bank collapsed

in 1995 when one of its bank employees, Nick Leeson

squandered and lost 827 million ($1.3 billion) through

speculative investing, specifically in futures contracts, at the

banks Singapore office over a period of three years, which was

masked by manipulated records.

TTh 1-2:30 1 Bre-X Bre-X is a Canadian mining company that bought a purported

gold mine in Busang, Indonesia in March 1993. In 1995, the

company announced the discovery of a veritable treasure chest

that soared the companys stock prices to CAD $286.50 on the

Toronto Stock Exchange (TSX). However, this turned out to be

the worst mining scandal of all time, when it was discovered

that workers and miners falsified crushed core samples by

salting them with placer or supergene gold constitutes.

Because of this, Bre-X fell down the mine shaft after its stocks

become worthless.

2 Barclays Barclays, one of the worlds largest banks, was hammered by a

scandal involving the Libor manipulation, where banks lend

each other money at high rates. The company owned up to the

allegation that it manipulated the London Interbank Offered

Rate, which was tied to trillions of dollars worth of financial

contracts and derivatives. The issue led to the resignation of

the companys CEO, Bob Diamond, and the company was

asked to pay $450 million. Other banks like UBS were also

under investigation for the Libor-rate rigging.

3 Socit Gnrale Jerome Kerviel is a rogue trader who tripped up the worlds

financial market when his unauthorized trading in the securities

markets using the banks computers resulted in 4.9 billion

losses to the Socit Gnrale funds. The worst part of the

issue came when the banks executive tried to mask the fraud

by unwinding his trades. This resulted in trading panic all over

the Atlantic causing a decline in European markets.

4 Urban Bank This was one of the largest banks in the Philippines until it was

closed down on the basis of liquidity by the Philippine Deposit

Insurance Corp. (PDIC). However, the liquidation grounds were

not the issue here as some of Urban Banks officers were later

criminally charged with economic sabotage due to their falsified

supervision and examination sector (SES) reports to the

Monetary Board.

5 Deutsche Bank Deutsche Bank AG is a German global banking and financial

services company that was caught spying not only on its board

members, but also on the personal life of some of its investors.

This scandal hit the bank as it is was not only Germanys

largest bank, but also the largest foreign dealer in the world

with a presence in Europe, USA, Asia-Pacific, and the

emerging markets. In 2006, the bank succumbed to paranoia

when it hired an external detective agency to snoop on contacts

between board members and the Munich-based media

magnate, Leo Kirch and his associates, whom they have

litigation with. Due to the scandal, the German government

vowed to have a new privacy-protection law for workers.

6

The Bernie Madoff

Ponzi Scheme

This made the list not only for the sheer amount of money

involved (at least $65 billion in clients accounts) but because

the people he conned are some of the smartest people in the

world. People entrusted him with their charitable funds but they

were instead used for his luxurious lifestyle and personal gain.

TTh 2:30-4 1 The Stanford

Financial Fallout

This was a case of trust misplaced as Allen Stanford gained $8

billion. Stanford coaxed his clients to invest in safe Certificate of

Deposits, but the money was instead used in hedge funds that

could (and did) lose money.

2 Enron Corp. Enron was the it company at the turn of the century as it

oozed with wealth, smarts, and power. However, this Houston-

based energy company toppled into a spectacular bankruptcy

due to a painstakingly-planned accounting fraud made by its

accounting firm, Arthur Andersen. Once considered a blue-chip

stock, Enron shares dropped from $90 to $0.50, which spelled

disaster in the financial world, where thousands of employees

and investors saw their savings vanish with the company as it

filed for an earnings restatement in October 2001.

3 Arthur Andersen This Chicago-based company voluntarily relinquished its

licenses to practice as Certified Public Accountants (CPAs) in

the USA due to the Enron accounting scandal. This was a blow

considering that it is one of the worlds top five accounting firms

prior to the scandal, which resulted in the loss of 85,000 jobs

and corporate rebranding.

4 HIH Insurance Its corporate downfall can be considered the largest in

Australias history. HIH Insurance was Australias second-

largest insurance company until it entered into provisional

liquidation in 2001. It incurred losses totaling $5.3 billion where

its director, Rodney Adler, was sentenced to four and half years

of jail time due to obtaining money by false or misleading

statements, and failure to discharge his duties as a director in

good faith and in the best interests of the company.

Research further:

http://list25.com/25-biggest-corporate-scandals-ever/

Summary:

MWF Groups TTh Groups

Quiz II: Statement of Cash Flows

10items, 50points

August 8, 2014 (Friday, 2:00 PM)

Room Assignment: TBA

August 8, 2014 (Friday, 2:00 PM)

Room Assignment: TBA

Quiz III: Ethics

Application:

Individual Case Study (2 situations)

Theory:

Identification and/or Enumeration and/or

T/F

August 13, 2014 (Wednesday) August 12, 2014 (Tuesday)

Ethics Report August 15, 2014 (Friday) August 14, 2014 (Thursday)

Você também pode gostar

- Mcdonalds Franchise BookletDocumento14 páginasMcdonalds Franchise BookletMina Tadros100% (2)

- 8 Capital Structure Decision - Polaroid Corporation 1996Documento51 páginas8 Capital Structure Decision - Polaroid Corporation 1996Shelly Jain100% (2)

- AccgovDocumento11 páginasAccgovJanella Patrizia100% (2)

- Annexure To Appointment LetterDocumento4 páginasAnnexure To Appointment LetterRipunjay Mishra100% (1)

- Chapter 2 The Accounting Equation and The Double-Entry SystemDocumento24 páginasChapter 2 The Accounting Equation and The Double-Entry SystemMarriel Fate Cullano0% (1)

- Form - Cancellation, Transfer and NCD Withdrawal-1 PDFDocumento1 páginaForm - Cancellation, Transfer and NCD Withdrawal-1 PDFGambar Gambar0% (1)

- House Designs, QHC, 1950Documento50 páginasHouse Designs, QHC, 1950House Histories100% (8)

- Bain Capital's "Take Private" of China FireDocumento11 páginasBain Capital's "Take Private" of China Fireelee 14Ainda não há avaliações

- FIN320 Tutorial W2Documento4 páginasFIN320 Tutorial W2Sally OngAinda não há avaliações

- 25 Biggest Corporate Scandals EverDocumento5 páginas25 Biggest Corporate Scandals EverSilvia Ahmad KhattakAinda não há avaliações

- White Collar CrimesDocumento9 páginasWhite Collar CrimesandrewAinda não há avaliações

- Top 10 Corporate Scandals: 10. Union CarbideDocumento13 páginasTop 10 Corporate Scandals: 10. Union CarbideSandiep SinghAinda não há avaliações

- Reading Assignment 8 (Royal Bank of Scotland)Documento14 páginasReading Assignment 8 (Royal Bank of Scotland)Valentine AyiviAinda não há avaliações

- The 25 Biggest Corporate Scandals of All TimeDocumento4 páginasThe 25 Biggest Corporate Scandals of All TimeFab FiveAinda não há avaliações

- The 10 Worst Corporate Accounting Scandals of All Time..Documento5 páginasThe 10 Worst Corporate Accounting Scandals of All Time..Tamirat Eshetu Wolde100% (1)

- Current Business Affairs: Assignment-1Documento17 páginasCurrent Business Affairs: Assignment-1Salman JanAinda não há avaliações

- Muhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofDocumento3 páginasMuhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofsyahrinAinda não há avaliações

- 3.1 Case No.1 - The Downfall of Lehman Brothers, United StatesDocumento3 páginas3.1 Case No.1 - The Downfall of Lehman Brothers, United Statesjothi subraAinda não há avaliações

- Report On Corporate FraudDocumento16 páginasReport On Corporate FraudShivani SharmaAinda não há avaliações

- Compilation of Accounting ScandalsDocumento7 páginasCompilation of Accounting ScandalsYelyah HipolitoAinda não há avaliações

- After Enron - Improving Corporate Law and Modernising Securities Regulation in Europe and The USDocumento30 páginasAfter Enron - Improving Corporate Law and Modernising Securities Regulation in Europe and The USvidovdan9852Ainda não há avaliações

- EntrinaDocumento7 páginasEntrinaevemil berdinAinda não há avaliações

- Accounting ScandalsDocumento4 páginasAccounting Scandalsyakubu I saidAinda não há avaliações

- The 10 Worst Corporate Accounting Scandals of All TimeDocumento7 páginasThe 10 Worst Corporate Accounting Scandals of All TimeIan ChanAinda não há avaliações

- WorldCom Was Founded in 1983 As Long Distance Discount Services PDFDocumento3 páginasWorldCom Was Founded in 1983 As Long Distance Discount Services PDFJamilleAinda não há avaliações

- Value Creation Through Corporate GovernanceDocumento11 páginasValue Creation Through Corporate GovernanceAbdel AyourAinda não há avaliações

- The 10 Worst Corporate Accounting Scandals of All TimeDocumento4 páginasThe 10 Worst Corporate Accounting Scandals of All TimeNadie LrdAinda não há avaliações

- Assignment No.1Documento5 páginasAssignment No.1saad.addmissionsAinda não há avaliações

- Enron, Worldcom, TycoDocumento6 páginasEnron, Worldcom, TycoLealyn Martin BaculoAinda não há avaliações

- Ethical Analysis and Evaluation Enron Corporation Scandal Prepared For: Marcos A. KerbelDocumento7 páginasEthical Analysis and Evaluation Enron Corporation Scandal Prepared For: Marcos A. Kerbellcorrente12100% (1)

- Lecture 1 - The Need For Good Governance and Social ResponsibilityDocumento32 páginasLecture 1 - The Need For Good Governance and Social ResponsibilityHarry EvangelistaAinda não há avaliações

- Title PageDocumento12 páginasTitle PageJOEMARI CRUZAinda não há avaliações

- TOP 10 Corporate Scandal: Chronological OrderDocumento11 páginasTOP 10 Corporate Scandal: Chronological OrderNiken PratiwiAinda não há avaliações

- Preliminary Paper: A Case Analysis On Enron and WirecardDocumento12 páginasPreliminary Paper: A Case Analysis On Enron and WirecardThe Brain Dump PHAinda não há avaliações

- Managerial Ethics - The Ethics of Market Abuse - XLRI 2015Documento54 páginasManagerial Ethics - The Ethics of Market Abuse - XLRI 2015chinum1Ainda não há avaliações

- Enron and WorldCom ScandalDocumento5 páginasEnron and WorldCom ScandalMarc Eric RedondoAinda não há avaliações

- Case Study (Ethical Issues)Documento10 páginasCase Study (Ethical Issues)Abelle Rina Villacencio GallardoAinda não há avaliações

- The First 5 Accounting ScandalsDocumento3 páginasThe First 5 Accounting ScandalsamrithaasokanAinda não há avaliações

- Accounting Scandals Enron Scandal (2001)Documento3 páginasAccounting Scandals Enron Scandal (2001)TRÂN PHẠM NGỌC BẢOAinda não há avaliações

- Enron Scandal - CMRDocumento12 páginasEnron Scandal - CMRsruthi karthiAinda não há avaliações

- Enterprise Risk ManagementDocumento12 páginasEnterprise Risk ManagementAnoop Chaudhary67% (3)

- Summary of The VideoDocumento2 páginasSummary of The VideoKatherine Ann RonatayAinda não há avaliações

- The Enron ScandalDocumento15 páginasThe Enron ScandalBatool DarukhanawallaAinda não há avaliações

- KirtiSharma 81 CIA-I CorporateFinance (Hons.)Documento8 páginasKirtiSharma 81 CIA-I CorporateFinance (Hons.)kirti sharmaAinda não há avaliações

- Acc394 - Edited Case Study Answers 1Documento10 páginasAcc394 - Edited Case Study Answers 1api-607959293Ainda não há avaliações

- Major Corporate Scandal in India and AbroadDocumento8 páginasMajor Corporate Scandal in India and Abroadsourav panda100% (1)

- Financial Scandals of The WorldDocumento8 páginasFinancial Scandals of The WorldкатяAinda não há avaliações

- Case Study: 4.2 Enron-A Classic Corporate Governance CaseDocumento3 páginasCase Study: 4.2 Enron-A Classic Corporate Governance CaseTiago SampaioAinda não há avaliações

- Ars PDFDocumento2 páginasArs PDFThomasAdiSaputraAinda não há avaliações

- Case StudiesDocumento5 páginasCase StudiesDivesh PalrechaAinda não há avaliações

- ITAF Approach To IT Audit Advisory Services - Whpitafaas - WHP - Eng - 1020Documento13 páginasITAF Approach To IT Audit Advisory Services - Whpitafaas - WHP - Eng - 1020Ramon Ant. JorgeAinda não há avaliações

- 5457 The Lawyer As Gatekeeper Is There A Need For A Whistleblowing Securities Lawyer Recent Developments in The Us and AustraliaDocumento47 páginas5457 The Lawyer As Gatekeeper Is There A Need For A Whistleblowing Securities Lawyer Recent Developments in The Us and Australiainfra lawAinda não há avaliações

- The Fall of EnronDocumento3 páginasThe Fall of EnronSyed MerajAinda não há avaliações

- Casestudy - Lehman Brothers and The Subprime Crisis Week 2Documento2 páginasCasestudy - Lehman Brothers and The Subprime Crisis Week 2Rachita ArikrishnanAinda não há avaliações

- Corp. Gov. Lessons From Enron PDFDocumento6 páginasCorp. Gov. Lessons From Enron PDFRatnesh SinghAinda não há avaliações

- Enron: The Good, The Bad, The LessonsDocumento20 páginasEnron: The Good, The Bad, The Lessonstom2susanAinda não há avaliações

- Enron Scandal: About The CompanyDocumento5 páginasEnron Scandal: About The Companynidhi nageshAinda não há avaliações

- Five Lessons of The WorldCom DebacleDocumento3 páginasFive Lessons of The WorldCom DebacleFolke ClaudioAinda não há avaliações

- Sec. 807. Criminal Penalties For Defrauding Shareholders of Publicly Traded CompaniesDocumento6 páginasSec. 807. Criminal Penalties For Defrauding Shareholders of Publicly Traded CompaniesJungkookie BaeAinda não há avaliações

- Accounting Fraud: Learning From The Wrongs by Paul Sweeney FEI September/October 2000Documento4 páginasAccounting Fraud: Learning From The Wrongs by Paul Sweeney FEI September/October 2000priyadarshini212007Ainda não há avaliações

- Key Takeways From Enron Case.: Blessy Joyce F. de Jesus JULY 9, 2019 BSA/BAC-517/BBL Prof. Lindley MesinaDocumento6 páginasKey Takeways From Enron Case.: Blessy Joyce F. de Jesus JULY 9, 2019 BSA/BAC-517/BBL Prof. Lindley MesinaBlessy JoyceAinda não há avaliações

- Group 3 Midterm Case Studies EnronDocumento14 páginasGroup 3 Midterm Case Studies EnronWiln Jinelyn NovecioAinda não há avaliações

- Enron Scandal EssayDocumento6 páginasEnron Scandal Essayafefjetcm100% (1)

- Research Paper Enron ScandalDocumento4 páginasResearch Paper Enron Scandalafeaaawci100% (1)

- Cityam 2012-05-31Documento39 páginasCityam 2012-05-31City A.M.Ainda não há avaliações

- Enron Scandal ThesisDocumento8 páginasEnron Scandal Thesisangelicaortizpaterson100% (2)

- Aec208 FinalsDocumento6 páginasAec208 FinalsTayaban Van GihAinda não há avaliações

- Aggregate Planning: Operations Management Dr. Ron Tibben-LembkeDocumento27 páginasAggregate Planning: Operations Management Dr. Ron Tibben-LembkeHoward Rivera RarangolAinda não há avaliações

- Jérôme Kerviel Case of EthicsDocumento4 páginasJérôme Kerviel Case of EthicsHoward Rivera RarangolAinda não há avaliações

- UPVM History 1Documento9 páginasUPVM History 1Joseph Ryan LozadaAinda não há avaliações

- Tax 21 ExercisesDocumento2 páginasTax 21 ExercisesHoward Rivera RarangolAinda não há avaliações

- Technical Report On The State of The Nation Address by The Office of The PresidentDocumento51 páginasTechnical Report On The State of The Nation Address by The Office of The PresidentArangkada PhilippinesAinda não há avaliações

- Curriculum File: Year: 1Documento3 páginasCurriculum File: Year: 1Howard Rivera RarangolAinda não há avaliações

- YHANNADUDocumento2 páginasYHANNADUHoward Rivera RarangolAinda não há avaliações

- Practical Accounting 2: 2011 National Cpa Mock Board ExaminationDocumento6 páginasPractical Accounting 2: 2011 National Cpa Mock Board ExaminationMary Queen Ramos-UmoquitAinda não há avaliações

- Revised MBE SyllabusDocumento24 páginasRevised MBE SyllabusRichard GaurabAinda não há avaliações

- Stock ValuationDocumento3 páginasStock ValuationnishankAinda não há avaliações

- Greaves Cotton: Upgraded To Buy With A PT of Rs160Documento3 páginasGreaves Cotton: Upgraded To Buy With A PT of Rs160ajd.nanthakumarAinda não há avaliações

- (David L. Goetsch Stanley Davis) Introduction ToDocumento196 páginas(David L. Goetsch Stanley Davis) Introduction ToThyya Chemmuet100% (1)

- Shimell P The Universe of Risk How Top Business Leaders Cont PDFDocumento317 páginasShimell P The Universe of Risk How Top Business Leaders Cont PDFAbhilashKrishnanAinda não há avaliações

- A Beautiful Mind With A Big MouthDocumento328 páginasA Beautiful Mind With A Big MouthAbdul ArifAinda não há avaliações

- Laporan Keuangan PT Indika Energy TBK 31 Mar 2019 PDFDocumento188 páginasLaporan Keuangan PT Indika Energy TBK 31 Mar 2019 PDFMirzal FuadiAinda não há avaliações

- Disaster Risk ReductionDocumento86 páginasDisaster Risk ReductionliemorixAinda não há avaliações

- Company DetailsDocumento30 páginasCompany DetailssudehelyRAinda não há avaliações

- Financial Accounting Chapter 7Documento57 páginasFinancial Accounting Chapter 7Waqas MazharAinda não há avaliações

- Class 12 Cbse Economics Sample Paper 2012-13Documento23 páginasClass 12 Cbse Economics Sample Paper 2012-13Sunaina RawatAinda não há avaliações

- Business Structures SummaryDocumento5 páginasBusiness Structures SummaryMrudula V.100% (2)

- Current Situation: Internal Marketing Program, and in ParticularDocumento4 páginasCurrent Situation: Internal Marketing Program, and in ParticularTehreem MujiebAinda não há avaliações

- SipDocumento24 páginasSippooja36Ainda não há avaliações

- Stock MarketDocumento3 páginasStock MarketUPPULAAinda não há avaliações

- Ifrs For SmesDocumento130 páginasIfrs For SmesDharren Rojan Garvida AgullanaAinda não há avaliações

- Strategy Formulation Choice1Documento95 páginasStrategy Formulation Choice1AshLeeAinda não há avaliações

- Alfalah Education Consultant (AEC)Documento32 páginasAlfalah Education Consultant (AEC)Kim NisarAinda não há avaliações

- Apple RatiosDocumento19 páginasApple RatiosJims Leñar CezarAinda não há avaliações

- Payment OptionsDocumento2 páginasPayment OptionsDanson Githinji EAinda não há avaliações

- Sample Real Estate ServicesDocumento15 páginasSample Real Estate ServicesrubydelacruzAinda não há avaliações