Escolar Documentos

Profissional Documentos

Cultura Documentos

Transition To Retirement (TTR) Allocated Pension. Obtain Tax-Free Income From Age 60.

Enviado por

Australian Catholic SuperannuationTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Transition To Retirement (TTR) Allocated Pension. Obtain Tax-Free Income From Age 60.

Enviado por

Australian Catholic SuperannuationDireitos autorais:

Formatos disponíveis

Tax savings with

a Transition to

Retirement (TTR)

Allocated Pension

Account

can be significant.

Find out how Andrew saved so

much money in superannuation tax

1

2

DISCLAIMER

This presentation has been prepared by SCS Super Pty Ltd (ABN 74 064 712 607, AFSL 23055,

RSE L0002264), the trustee of the Australian Catholic Superannuation & Retirement Fund

ABN 24 680 629 023, RSE R1055436.

Any advice contained in this presentation is of a general nature only, and does not take into

account your personal objectives, financial situation or needs. Prior to acting on any information

in this presentation, you need to take into account your own financial circumstances, consider

the Product Disclosure Statement for any product you are considering, and seek independent

financial advice if you are unsure of what action to take.

The material contained in this presentation is based on information received in good faith from

sources within the market and on our understanding of the legislation at this time.

Financial planning services are provided under an arrangement with Industry Fund Services Pty

Ltd (IFS) (AFSL 232514).

A transition to retirement pension may not be suitable for all members.

All references to pension in this document refer to the Australian Catholic Superannuation &

Retirement Fund allocated pension.

Q: How did Andrew

save so much money

in super tax?

3

Q: How did Andrew

save so much money

in super tax?

A: He moved his

super savings into

an Australian Catholic

Superannuation Transition to

Retirement (TTR) Allocated

Pension Account, while he

continues to work

4

What is a

Transition to

Retirement

(TTR) Allocated

Pension

Account?

5

6

A transition to retirement (TTR) allocated pension is an

account based income stream that involves drawing down a

pension from your superannuation.

You can set up a transition to retirement (TTR) allocated

pension once you reach preservation age (55 for many

people), even if you are still working.

Once set up you can withdraw a maximum of 10% of the

pension balance each year, while you continue to work.

catholicsuper.com.au/allocatedpension

Once your superannuation (and other) savings are moved into a

pension account, you pay no tax on investment earnings:

7

Savings in a

Super Account

Same savings in a

Pension Account

up to 15% tax paid on

investment earnings

0% tax paid on

investment earnings

catholicsuper.com.au/allocatedpension

Once your superannuation (and other)savings are moved into a

pension account, you pay no tax on investment earnings:

8

Savings in a

Super Account

Same savings in a

Pension Account

up to 15% tax paid on

investment earnings

0% tax paid on

investment earnings

Click here for more information on tax

and allocated pension accounts

catholicsuper.com.au/allocatedpension

The difference

could save you

thousands in tax

each year!

=

9

10

The tax you save in a pension account is money that could

be adding to your retirement savings

catholicsuper.com.au/allocatedpension

11

The tax you save in a pension account is money that could

be adding to your retirement savings, year after year

catholicsuper.com.au/allocatedpension

12

The tax you save in a pension account is money that could

be adding to your retirement savings, year after year

as you continue working.

catholicsuper.com.au/allocatedpension

13

The tax you save in a pension account is money that could

be adding to your retirement savings, year after year

as you continue working.

Plus Salary sacrificing some of your regular income into your

superannuation account and using pension income as

replacement income can boost your retirement balance even

more.

catholicsuper.com.au/allocatedpension

14

The tax you save in a Pension Account is money that could

be adding to your retirement savings, year after year

as you continue working.

Plus Salary sacrificing some income into your superannuation

account and using pension income as replacement income can

boost your retirement balance even more.

Click here, read how Anne used Salary Sacrifice to

boost retirement savings and reduce income tax.

catholicsuper.com.au/allocatedpension

MEET ANDREW

15

catholicsuper.com.au/allocatedpension

Andrew, age 55, wants to

increase his superannuation

savings ahead of retirement

and plans to continue working

full-time for several more

years.

He has been saving in three

different superannuation

accounts but he feels he could

be doing better.

Andrew met with a financial

planner at Australian Catholic

Superannuation and was

advised to do two things:

1. Consolidate: his three super

accounts into one account with

Australian Catholic Superannuation

2. Convert: most of his newly

combined superannuation balance

into a Transition to Retirement (TTR)

Allocated Pension Account.

catholicsuper.com.au/allocatedpension

19

Andrew starts an Australian Catholic Superannuation

Transition to Retirement (TTR) Allocated Pension Account with

$350,000 (leaving $5,000 in his super account).

He chooses to receive the allowed maximum $35,000 pa

(10% of his new pension account balance) as a monthly

pension paid into his bank account.

In doing this Andrew saves tax because investment earnings

on his $350,000 in the pension account are now tax-free.

catholicsuper.com.au/allocatedpension

The tax saved provides a boost to Andrews retirement savings.

20

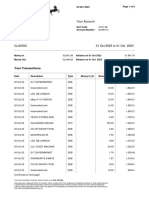

$350,000 balance

in a super

account

$350,000 balance

in a pension

account

Investment return* - assume 6% pa

after fees and charges but before tax

$21,000 $21,000

Tax on investment earnings* - Year 1

Up to 15%, or

$3,150

NIL

Earnings available to compound As low as $17,850 $21,000

* This is an example only. Actual investment returns and taxes vary depending on the investment option selected.

catholicsuper.com.au/allocatedpension

Plus, using his monthly pension income, Andrew can afford to

salary sacrifice into his super account, increasing his retirement

savings while reducing his taxable income!

21

Read more about salary sacrifice and superannuation.

Click here

catholicsuper.com.au/allocatedpension

Are you 55+,

still working

and want to

maximise your

retirement

savings?

22

You too could benefit

from an Australian Catholic

Superannuation Transition to

Retirement (TTR) Allocated

Pension!

The independent superannuation

monitor, SuperRatings, has rated

our pension as Platinum level,

the highest rating available.

23

catholicsuper.com.au/allocatedpension

So you can be

confident knowing

that our pension is

rated so highly!

24

catholicsuper.com.au/allocatedpension

25

What to do next

Read more on our website, here

Book an appointment to meet with a financial planner to

discuss your situation on 1300 658 776 or click here for

more information.

Attend a free retirement planning seminar

catholicsuper.com.au/allocatedpension

26

@AusCathSuper

Australian Catholic Superannuation

pinterest.com/AusCathSuper

CONNECT NOW

27

CONTACT US

T 1300 658 776

W www.catholicsuper.com.au

E fundoffice@catholicsuper.com.au

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Methods of Note IssueDocumento8 páginasMethods of Note IssueNeelabh KumarAinda não há avaliações

- BillDocumento7 páginasBillstanciucorinaioanaAinda não há avaliações

- Indwdhi 20231031Documento2 páginasIndwdhi 20231031nor nurul maisitahAinda não há avaliações

- China S Stock Market VolatilityDocumento8 páginasChina S Stock Market Volatilitygabriel chinechenduAinda não há avaliações

- Research-Driven Value Investing StrategyDocumento2 páginasResearch-Driven Value Investing StrategyAxelrod GaoAinda não há avaliações

- Assessing Early Warning SystemsDocumento45 páginasAssessing Early Warning SystemspasaitowAinda não há avaliações

- PledgeDocumento14 páginasPledgeShareen AnwarAinda não há avaliações

- Exam Notification DEC 14Documento1 páginaExam Notification DEC 1409itm6832mbaAinda não há avaliações

- Sevket - Pamuk - Prices in The Ottoman Empire - 1469-1914Documento18 páginasSevket - Pamuk - Prices in The Ottoman Empire - 1469-1914Hristiyan AtanasovAinda não há avaliações

- ABRISH Final NEWDocumento40 páginasABRISH Final NEWGetachew AliAinda não há avaliações

- Shapiro CHAPTER 3 Altered SolutionsDocumento17 páginasShapiro CHAPTER 3 Altered Solutionsjimmy_chou1314100% (1)

- Clearing-Settlement and Risk Management of BATS at ISLAMABADDocumento4 páginasClearing-Settlement and Risk Management of BATS at ISLAMABADhafsa1989Ainda não há avaliações

- Derivatives Lecture Futures ForwardsDocumento32 páginasDerivatives Lecture Futures ForwardsavirgAinda não há avaliações

- Oppstar - Prospectus (Part 2)Documento204 páginasOppstar - Prospectus (Part 2)kokueiAinda não há avaliações

- PG-QP-44: Question Booklet No.Documento12 páginasPG-QP-44: Question Booklet No.nayan pareekAinda não há avaliações

- FAChapter 12Documento3 páginasFAChapter 12zZl3Ul2NNINGZzAinda não há avaliações

- Lecture Course Week 2Documento61 páginasLecture Course Week 2juanpablooriolAinda não há avaliações

- Lecture 1 - 2Documento70 páginasLecture 1 - 2premsuwaatiiAinda não há avaliações

- Registration With SEBI As Merchant Banker and Other MaterialDocumento5 páginasRegistration With SEBI As Merchant Banker and Other Materialapi-3727090100% (3)

- Anchor Bank Shanghai Branch Income Tax ExclusionDocumento8 páginasAnchor Bank Shanghai Branch Income Tax ExclusiongraceAinda não há avaliações

- Uts Epii 2022Documento17 páginasUts Epii 2022Ranessa NurfadillahAinda não há avaliações

- IB - Sessions Private EquityDocumento4 páginasIB - Sessions Private EquityDivya Jain50% (2)

- How COVID Will Reshape Zimbabwe PropertyDocumento9 páginasHow COVID Will Reshape Zimbabwe PropertyROMEO BONDEAinda não há avaliações

- GSPC BillDocumento1 páginaGSPC BillGauravSaxenaAinda não há avaliações

- Ipr & Technology Bulletin Technology and Electronic Payment System in IndiaDocumento7 páginasIpr & Technology Bulletin Technology and Electronic Payment System in IndiaVivek DubeyAinda não há avaliações

- Differences Between A Central Bank and Commercial BankDocumento4 páginasDifferences Between A Central Bank and Commercial BankMuhammadZariyan AsifAinda não há avaliações

- Lloyds Bank 1Documento8 páginasLloyds Bank 1KabanAinda não há avaliações

- Banking Basics: Understanding Commercial BanksDocumento136 páginasBanking Basics: Understanding Commercial BanksAppleAinda não há avaliações

- IBS Hyderabad MBA Financial Management Course HandoutDocumento4 páginasIBS Hyderabad MBA Financial Management Course HandoutApoorva PattnaikAinda não há avaliações

- Bachelor'S Degree Programme Term-End Examination December, 2017 Elective Course: Commerce Eco-011: Elements of Income TaxDocumento6 páginasBachelor'S Degree Programme Term-End Examination December, 2017 Elective Course: Commerce Eco-011: Elements of Income TaxAnkit KumarAinda não há avaliações