Escolar Documentos

Profissional Documentos

Cultura Documentos

Snapshot

Enviado por

ossa123Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Snapshot

Enviado por

ossa123Direitos autorais:

Formatos disponíveis

Aditya Birla Nuvo Limited

_________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 1

Aditya Birla Nuvo Limited

Fast Facts

Headquarters Address 4th Floor, 'A' Wing, Mumbai, 400 030,India

Telephone + 91 22 24995000

Fax + 91 22 66525821

Website www.adityabirlanuvo.com

Ticker Symbol, Stock Exchange ABRL, National Stock Exchange of India

Number of Employees 19,750

Fiscal Year End March

Revenue (in US$ million) 4,836

Financial Snapshot

Operating Performance

The company reported revenue of US$4,836 million

during the fiscal year 2013 (2013). The company's

revenue grew at a CAGR of 14.16% during 2009

2013, with an annual growth of 16.71% over 2012. In

2013, the company recorded an operating margin of

5.90%, as against 5.54% in 2012.

Revenue and Margins

Liquidity Position

The company reported a current ratio of 1.11 in 2013,

as compared to its peers, Gujarat State Fertilizers &

Chemicals Limited, GHCL Limited and Religare

Enterprises Limited, which recorded current ratios of

1.72, 0.83 and 1.30 respectively. As of March 2013,

the company recorded cash and short-term

investments of worth US$1,276 million, against

US$485 million current debt. The company reported a

debt to equity ratio of 1.99 in 2013 as compared to its

peers, Gujarat State Fertilizers & Chemicals Limited,

GHCL Limited and Religare Enterprises Limited,

which recorded debt to equity ratios of 0.38, 2.75 and

4.25 respectively.

Aditya Birla Nuvo Limited

_________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 2

TABLE OF CONTENTS

1 Business Analysis ................................................................................................................................... 5

1.1 Company Overview ................................................................................................................................................ 5

1.2 Major Products and Services ................................................................................................................................. 6

2 Analysis of Key Performance Indicators ............................................................................................... 7

2.1 Five Year Snapshot: Overview of Financial and Operational Performance Indicators .......................................... 7

2.2 Key Financial Performance Indicators ................................................................................................................. 10

2.2.1 Revenue and Operating Profit ......................................................................................................................... 10

2.2.2 Asset and Liabilities ......................................................................................................................................... 11

2.2.3 Net Debt vs. Gearing Ratio .............................................................................................................................. 12

2.2.4 Operational Efficiency ...................................................................................................................................... 13

2.2.5 Solvency .......................................................................................................................................................... 14

2.2.6 Valuation .......................................................................................................................................................... 15

2.3 Competitive Benchmarking .................................................................................................................................. 16

2.3.1 Market Capitalization ....................................................................................................................................... 17

2.3.2 Efficiency .......................................................................................................................................................... 18

2.3.3 Turnover Inventory and Asset ....................................................................................................................... 19

2.3.4 Liquidity ............................................................................................................................................................ 20

3 Recent Developments ........................................................................................................................... 21

4 Key Employees ...................................................................................................................................... 22

5 Locations and Subsidiaries .................................................................................................................. 23

5.1 Head Office .......................................................................................................................................................... 23

5.2 Other Locations and Subsidiaries ........................................................................................................................ 23

6 Appendix ................................................................................................................................................ 24

6.1 Methodology ......................................................................................................................................................... 24

6.2 Ratio Definitions ................................................................................................................................................... 24

6.3 Disclaimer ............................................................................................................................................................. 28

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 3

List of Tables

Table 1: Major Products and Services.................................................................................................................................... 6

Table 2: Key Ratios - Annual .................................................................................................................................................. 7

Table 3: Key Ratios - Interim .................................................................................................................................................. 9

Table 4: Key Capital Market Indicators .................................................................................................................................. 9

Table 5: Key Employees ....................................................................................................................................................... 22

Table 6: Subsidiaries ............................................................................................................................................................ 23

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 4

List of Figures

Figure 1: Revenue and Operating Profit ............................................................................................................................... 10

Figure 2: Financial Position .................................................................................................................................................. 11

Figure 3: Net Debt vs. Gearing Ratio ................................................................................................................................... 12

Figure 4: Operational Efficiency ........................................................................................................................................... 13

Figure 5: Solvency ................................................................................................................................................................ 14

Figure 6: Valuation ............................................................................................................................................................... 15

Figure 7: Market Capitalization ............................................................................................................................................. 17

Figure 8: Efficiency ............................................................................................................................................................... 18

Figure 9: Turnover Inventory and Asset ............................................................................................................................ 19

Figure 10: Liquidity ............................................................................................................................................................... 20

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 5

1 Business Analysis

1.1 Company Overview

Aditya Birla Nuvo Limited (ABNL) is a diversified company, based in India. The company operates its business in the

areas of financial services, telecom, fashion and lifestyle, IT-ITeS and manufacturing businesses worldwide. Its financial

products include life insurance, wealth insurance, health insurance and retirement plans. In addition, ABNL offers financial

services, such as asset management, private equity transaction, equity and commodity broking service, wealth

management and insurance advisory services. The company markets its products under the rband names of ADITYA

BIRLA Minacs, BIRLA CARBON, Aditya Birla Finance, Aditya Birla Insurance Brokers, Aditya Birla Money and others. It

operates through its joint ventures and subsidiaries such as Birla Sun Life Insurance Company Limited, Birla Sun Life

Asset Management Company Limited, Aditya Birla Capital Advisors Private Limited and Aditya Birla Money Limited,

among others. ABNL is headquartered in Mumbai, Maharashtra, India.

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 6

1.2 Major Products and Services

ABNL is a diversified company. Key products and services offered by the company include the following:

Table 1: Major Products and Services

Products:

Life insurance

Wealth insurance

Health insurance

Retirement plans

Loan

Deposit

Mutual fund

Services:

Asset management

Private equity transaction

Equity and commodity broking service

Wealth management

Insurance advisory services

Marketing

Finance

Accounting

Procurement

IT solutions

Source: World Market Intelligence

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 7

2 Analysis of Key Performance Indicators

2.1 Five Year Snapshot: Overview of Financial and Operational Performance Indicators

The company reported revenue of US$4,836 million during the fiscal year 2013 (2013). The company's revenue grew at a

CAGR of 14.16% during 20092013, with an annual growth of 16.71% over 2012. During 2013, operating margin of the

company was 5.90% in comparison with operating margin of 5.54% in 2012. In 2013, the company recorded a net profit

margin of 4.10% compared to a net profit margin of 4.02% in 2012.

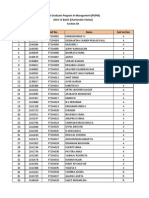

Table 2: Key Ratios - Annual

Key Ratios Unit/Currency 2013 2012 2011 2010 2009

Equity Ratios

EPS (Earnings per Share) INR 91.50 78.36 75.74 14.80 -46.28

Dividend per Share INR 6.50 6.00 5.50 5.00 4.00

Dividend Cover Absolute 14.08 13.06 13.77 2.96 -11.57

Book Value per Share INR 780.60 662.17 586.10 529.00 601.70

Profitability Ratios

Gross Margin % 65.27 68.60 72.90 75.78 76.62

Operating Margin % 5.90 5.54 5.93 1.00 -3.95

Net Profit Margin % 4.10 4.02 4.47 0.98 -3.13

Profit Markup % 203.15 237.49 292.50 349.02 300.52

PBT Margin (Profit Before Tax) % 5.90 5.54 5.93 1.00 -3.95

Return on Equity % 11.28 11.84 12.31 2.82 -7.59

Return on Capital Employed % 3.68 3.68 3.58 0.54 -2.31

Return on Assets % 1.85 1.97 2.08 0.48 -1.62

Return on Fixed Assets % 3.85 3.85 3.81 0.59 -2.59

Return on Working Capital % 85.97 85.34 59.76 7.33 -21.32

Growth Ratios

Sales Growth % 16.62 19.96 17.08 8.25 26.25

Operating Income Growth % 24.43 12.38 592.42 -463.03

EBITDA Growth % 21.68 14.10 98.42 599.63 -78.38

Net Income Growth % 18.96 8.28 431.90 -388.98

EPS Growth % 7.11 2.04 470.71 -391.18

Working Capital Growth % 23.52 -21.31 -15.01 -16.63 14.38

Cost Ratios

Operating Costs (% of Sales) % 94.10 94.46 94.07 99.00 103.95

Administration Costs (% of Sales) % 51.60 49.46 14.98 16.60 19.87

Liquidity Ratios

Current Ratio Absolute 1.11 1.12 1.20 1.64 1.84

Quick Ratio Absolute 1.00 1.01 1.07 1.37 1.57

Cash Ratio Absolute 0.44 0.43 0.57 0.22 0.50

Leverage Ratios

Debt to Equity Ratio Absolute 1.99 1.65 1.39 1.37 1.55

Net Debt to Equity Absolute 2.02 1.73 1.39 1.41 1.63

Debt to Capital Ratio Absolute 0.45 0.37 0.30 0.26 0.38

Efficiency Ratios

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 8

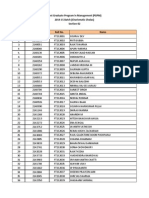

Table 2: Key Ratios - Annual

Key Ratios Unit/Currency 2013 2012 2011 2010 2009

Asset Turnover Absolute 0.45 0.49 0.46 0.49 0.52

Fixed Asset Turnover Absolute 3.09 2.96 2.46 2.26 2.24

Inventory Turnover Absolute 4.58 4.69 3.72 3.79 4.25

Current Asset Turnover Absolute 1.48 1.66 1.68 2.85 2.47

Capital Employed Turnover Absolute 2.75 2.95 2.76 2.88 2.42

Working Capital Turnover Absolute 14.57 15.42 10.08 7.34 5.40

Revenue per Employee INR 13,252,868.00

Net Income per Employee INR 557,311.00

Capex to Sales % 6.42 7.54 15.66 9.30 16.85

R&D to Sales % 0.01 0.01

Source: World Market Intelligence

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 9

Table 3: Key Ratios - Interim

Key Ratios Unit/Currency Jun-2013 Mar-2013 Dec-2012 Sep-2012

Equity Ratios

Interim EPS (Earnings per Share) INR 27.23 13.48 28.45 26.78

Book Value per Share INR 780.60 748.61

Profitability Ratios

Gross Margin % 79.48 69.24 70.12 70.87

Operating Margin % 7.41 3.38 7.17 6.96

Net Profit Margin % 5.67 2.06 5.05 5.00

Profit Markup % 446.78 246.25 256.32 268.41

PBT Margin (Profit Before Tax) % 7.41 3.38 7.17 6.96

Cost Ratios

Operating Costs (% of Sales) % 92.59 96.62 92.83 93.04

Administration Costs (% of Sales) % 32.43 25.17 29.52 27.67

Liquidity Ratios

Current Ratio Absolute 1.11 1.17

Quick Ratio Absolute 1.00 1.02

Leverage Ratios

Debt to Equity Ratio Absolute 1.71 1.51

Net Debt to Equity Absolute 1.80 1.66

Debt to Capital Ratio Absolute 0.39 0.35

Source: World Market Intelligence

Table 4: Key Capital Market Indicators

Key Ratios 30-Oct-2013

P/E (Price/Earnings) Ratio 13.27

EV/EBITDA (Enterprise Value/Earnings Before Interest, Taxes, Depreciation and Amortization) 10.92

Enterprise Value/Sales 1.19

Enterprise Value/Operating Profit 20.19

Enterprise Value/Total Assets 0.54

Dividend Yield 0.01

Note: Above ratios are based on share price as of 30-Oct-2013. The above ratios are absolute numbers.

Source: World Market Intelligence

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 10

2.2 Key Financial Performance Indicators

2.2.1 Revenue and Operating Profit

The consolidated group revenue of the company for 2013 stood at US$4,836 million, which corresponds to a growth rate

of 16.71% over the previous year. The operating margin of the company was 5.90% in 2013, an increase of 36.00 basis

points over the previous year.

Figure 1: Revenue and Operating Profit

Source: World Market Intelligence

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 11

2.2.2 Asset and Liabilities

The company's assets grew 26.45% over the previous year to US$10,681 million in 2013. The company's liabilities grew

26.78% over the previous year to US$8,926 million in 2013. In 2013, the companys asset to liability ratio remained

unchanged at 1.20.

Figure 2: Financial Position

Source: World Market Intelligence

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 12

2.2.3 Net Debt vs. Gearing Ratio

The company recorded higher net debt of US$3,497 million at the end of fiscal year 2013 when compared to the previous

year's net debt of US$2,314 million. The company's gearing ratio for the year 2013 was 0.95, which was higher when

compared to the previous year's gearing ratio of 0.70. The gearing ratio remained higher in 2013 due to higher debt

funding activities over equity.

Figure 3: Net Debt vs. Gearing Ratio

Source: World Market Intelligence

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 13

2.2.4 Operational Efficiency

The company's working capital turnover for 2013 declined to 14.57, from the previous year's working capital turnover of

15.42. In 2013, the company's asset turnover declined to 0.45 from the previous year's asset turnover of 0.49.

Figure 4: Operational Efficiency

Source: World Market Intelligence

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 14

2.2.5 Solvency

In 2013, the company's current ratio declined to 1.11 from the previous year's current ratio of 1.12. The companys quick

ratio declined to 1.00 in 2013 from the previous year's quick ratio of 1.01. In 2013, the companys debt ratio increased to

0.33 from the previous year's debt ratio of 0.27.

Figure 5: Solvency

Source: World Market Intelligence

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 15

2.2.6 Valuation

As of 30-Oct-2013, the company recorded an EV/EBIT of 20.19, EV/Total Assets of 0.54 and EV/Sales of 1.19.

Figure 6: Valuation

Source: World Market Intelligence

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 16

2.3 Competitive Benchmarking

The following companies are the major competitors of Aditya Birla Nuvo Limited:

Canara Bank Limited (Ticker: CANBK)

GHCL Limited (Ticker: GHCH)

Gujarat State Fertilizers & Chemicals Limited (Ticker: GSFC)

Himatsingka Seide Ltd. (Ticker: 514043)

Religare Enterprises Limited (Ticker: RELIGARE)

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 17

For competitive benchmarking, latest financial results are considered. Following are the key performance indicators

against which the companies have been benchmarked:

2.3.1 Market Capitalization

As of 30-Oct-2013, the company recorded a market capitalization of US$3,178 million, higher than its close competitors

GHCL Limited (Ticker: GHCH), Gujarat State Fertilizers & Chemicals Limited (Ticker: GSFC) and Religare Enterprises

Limited (Ticker: RELIGARE) which recorded market capitalizations of US$67 million, US$501 million and US$1,058

million respectively. The company recorded earnings per share of US$1.99 in 2013, which has led to a price/earnings

ratio (P/E ratio) of 13.27. This was higher than the P/E ratios of its peers GHCL Limited (Ticker: GHCH) and Gujarat State

Fertilizers & Chemicals Limited (Ticker: GSFC), which recorded P/E ratio of 4.31 and 4.45 respectively.

Figure 7: Market Capitalization

Source: World Market Intelligence

Note: Company names are represented by ticker symbols

Bubble size represents Market Capitalization US$ Million

For those data points with negative values, bubbles will not be displayed.

Where the market cap is disproportionately smaller, a bubble may not be displayed.

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 18

2.3.2 Efficiency

The company recorded an operating margin of 5.90% in 2013. This was higher than the operating margins of its peers,

GHCL Limited (Ticker: GHCH) and Religare Enterprises Limited (Ticker: RELIGARE), which recorded the margins of

4.24% and -7.39% respectively. In terms of revenues, the company is 11.35 times of GHCL Limited (Ticker: GHCH),

4.04 times of Gujarat State Fertilizers & Chemicals Limited (Ticker: GSFC), and 7.41 times of Religare Enterprises

Limited (Ticker: RELIGARE).

Figure 8: Efficiency

Source: World Market Intelligence

Note: Company names are represented by ticker symbols

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 19

2.3.3 Turnover Inventory and Asset

In 2013, the company reported an inventory turnover of 4.58, higher than that of its peers: during the same period, GHCL

Limited (Ticker: GHCH) and Religare Enterprises Limited (Ticker: RELIGARE), recorded inventory turnovers of 3.33 and

0.00 respectively. The companys asset turnover in 2013 was 0.45, lower than that of its peers: during the same period,

GHCL Limited (Ticker: GHCH) and Gujarat State Fertilizers & Chemicals Limited (Ticker: GSFC) recorded asset

turnovers of 0.79 and 0.92 respectively.

Figure 9: Turnover Inventory and Asset

Source: World Market Intelligence

Note: Company names are represented by ticker symbols

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 20

2.3.4 Liquidity

The company reported a current ratio of 1.11 in 2013, lower than that of its peers: during the same period, Gujarat State

Fertilizers & Chemicals Limited (Ticker: GSFC) and Religare Enterprises Limited (Ticker: RELIGARE) recorded current

ratios of 1.72 and 1.30 respectively In 2013, the company's debt to equity ratio was 1.99, lower than that of its peers:

during the same period, GHCL Limited (Ticker: GHCH) and Religare Enterprises Limited (Ticker: RELIGARE) recorded

debt to equity ratios of 2.75 and 4.25 respectively.

Figure 10: Liquidity

Source: World Market Intelligence

Note: Company names are represented by ticker symbols

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 21

3 Recent Developments

Aditya Birla Nuvo Limited - Van Heusen launches innovative campaign using LinkedIn's APIs to search for the most

fashionable professional

Van Heusen, the countrys numero uno professional fashion-wear brand is now on LinkedIn, the worlds largest professional

networking site.

Published Date : 7/1/2013 12:00:00 AM

Aditya Birla Nuvo reports results for the year ended 31 March 2013

Given the testing macro-economic scenario and earnings pressure in some of its businesses, Aditya Birla Nuvo Limited (ABNL) has

posted strong earnings. The company is competitively well placed in most of its businesses.

Published Date : 5/31/2013 11:26:04 AM

Aditya Birla Nuvo Limited-Louis Philippe is the top selling brand at shopping chains

Department chains Shoppers Stop, Pantaloons and Lifestyle International may fiercely compete with each other to court customers,

but they all swear by a common brand as their largest money-spinner.

Published Date : 5/30/2013 12:00:00 AM

Aditya Birla Nuvo Limited-Financial services, branded apparel, telecom buoy Aditya Birla Nuvo

Aditya Birla Nuvo Ltd reported growth in profitability for the fourth consecutive quarter on the back of robust growth in the financial

services business, which offset poor performance in the insurance and agricultural business.

Published Date : 5/29/2013 12:00:00 AM

Source: World Market Intelligence

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 22

4 Key Employees

Table 5: Key Employees

Name Job Title Board Level Since Age

B. L. Shah Director Non Executive Board

B. R. Gupta Director Non Executive Board

Devendra Bhandari Secretary Senior Management

G. P. Gupta Director Non Executive Board 2005 71

Himanshu Kapania Head - Telecom Senior Management

Kumar Mangalam Birla Chairperson Executive Board 45

Manoj Kedia Deputy Chief Financial Officer Senior Management 46

P. Murari Director Non Executive Board 78

Pranab Barua

Head - Fashion And Lifestyle - Branded

Apparels

Senior Management

Rajashree Birla Director Non Executive Board 66

Rakesh Jain Director, Managing Director Executive Board 2009

S. C. Bhargava Director Non Executive Board 2011 66

Sushil Agarwal Director, Chief Financial Officer Executive Board 2011

Tapasendra

Chattopadhyay

Director Non Executive Board 2011 61

Tarjani Vakil Director Non Executive Board 75

Thomas Varghese Head - Textile Senior Management

Source: World Market Intelligence

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 23

5 Locations and Subsidiaries

5.1 Head Office

Aditya Birla Nuvo Limited

4th Floor, 'A' Wing

Mumbai

Zip: 400 030

India

Tel: + 91 22 24995000

Fax: + 91 22 66525821

5.2 Other Locations and Subsidiaries

Table 6: Subsidiaries

Aditya Birla Money Ltd.

India

Aditya Birla Commodities Broking Ltd.

India

Aditya Birla Money Insurance Advisory Services Ltd.

India

Birla Sun Life Insurance Company Limited

5th and 6th Floor G-corp Tech park

Ghodbunder Road

Thane

Zip: 400601

India

Tel: + 91 22 39963800

Aditya Birla Minacs Worldwide Ltd.

180 Duncan Mills Road

Toronto

Zip: M3B 1Z6

Canada

Tel: + 1 416 380 3800

Fax: + 1 416 380 3830

Aditya Birla Financial Shared Services Ltd.

India

Aditya Birla Money Mart Ltd.

India

Aditya Birla Financial Services Pvt. Ltd.

India

Aditya Birla Trustee Company Pvt. Ltd.

India

Aditya Birla Capital Advisors Pvt. Ltd.

India

Source: World Market Intelligence

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 24

6 Appendix

6.1 Methodology

World Market Intelligence company reports are based on a core set of research techniques which ensure the best

possible level of quality and accuracy of data. The key sources used include:

Company Websites

Company Annual Reports

SEC Filings

Press Releases

Proprietary Databases

Notes

Financial information of the company is taken from the most recently published annual reports or SEC filings

The financial and operational data reported for the company is as per the industry defined standards

Revenue converted to US$ at average annual conversion rate as of fiscal year end

6.2 Ratio Definitions

Capital Market Ratios

Capital Market Ratios measure investor response to owning a company's stock and also

the cost of issuing stock.

Price/Earnings Ratio (P/E)

Price/Earnings (P/E) ratio is a measure of the price paid for a share relative to the annual

income earned per share. It is a financial ratio used for valuation: a higher P/E ratio

means that investors are paying more for each unit of income, so the stock is more

expensive compared to one with lower P/E ratio. A high P/E suggests that investors are

expecting higher earnings growth in the future compared to companies with a lower P/E.

Price per share is as of previous business close, and EPS is from latest annual report.

Formula: Price per Share / Earnings per Share

Enterprise Value/Earnings

before Interest, Tax,

Depreciation &

Amortization (EV/EBITDA)

Enterprise Value/EBITDA (EV/EBITDA) is a valuation multiple that is often used in parallel

with, or as an alternative to, the P/E ratio. The main advantage of EV/EBITDA over the PE

ratio is that it is unaffected by a company's capital structure. It compares the value of a

business, free of debt, to earnings before interest. Price per share is as of previous

business close, and shares outstanding last reported. Other items are from latest annual

report.

Formula: (Market Cap + Debt + Preferred Stock - Cash & Cash Equivalents) / (Net

Income + Interest + Tax + Depreciation + Amortization)

Enterprise Value/Sales

Enterprise Value/Sales (EV/Sales) is a ratio that provides an idea of how much it costs to

buy the company's sales. EV/Sales is seen as more accurate than Price/Sales because

market capitalization does not take into account the amount of debt a company has, which

needs to be paid back at some point. Price per share is as of previous business close,

and shares outstanding last reported. Other items are from latest annual report.

Formula: (Market Cap + Debt + Preferred Stock - Cash & Cash Equivalents) / Sales

Enterprise

Value/Operating Profit

Enterprise Value/Operating Profit measures the company's enterprise value to the

operating profit. Price per share is as of previous business close, and shares outstanding

last reported. Other items are from latest annual report.

Formula: (Market Cap + Debt + Preferred Stock - Cash & Cash Equivalents) / Operating

Income

Enterprise Value/Total

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 25

Assets Enterprise Value/Total Assets measures the company's enterprise value to the total

assets. Price per share is as of previous business close, and shares outstanding last

reported. Other items are from latest annual report.

Formula: (Market Cap + Debt + Preferred Stock - Cash & Cash Equivalents) / Total

Assets

Dividend Yield

Dividend Yield shows how much a company pays out in dividends each year relative to its

share price. In the absence of any capital gains, the dividend yield is the return on

investment for a stock.

Formula: Annual Dividend per Share / Price per Share

Equity Ratios

These ratios are based on per share value.

Earnings per Share (EPS)

Earnings per share (EPS) is the portion of a company's profit allocated to each

outstanding share of common stock. EPS serves as an indicator of a company's

profitability.

Formula: Net Income / Weighted Average Shares

Dividend per Share

Dividend is the distribution of a portion of a company's earnings, decided by the board of

directors, to a class of its shareholders.

Dividend Cover

Dividend cover is the ratio of company's earnings (net income) over the dividend paid to

shareholders.

Formula: Earnings per share / Dividend per share

Book Value per Share

Book Value per Share measure used by owners of common shares in a firm to determine

the level of safety associated with each individual share after all debts are paid

accordingly.

Formula: (Shareholders Equity - Preferred Equity) / Outstanding Shares

Cash Value per Share

Cash Value per Share is a measure of a company's cash (cash & equivalents on the

balance sheet) that is determined by dividing cash & equivalents by the total shares

outstanding.

Formula: Cash & equivalents / Outstanding Shares

Profitability Ratios

Profitability Ratios are used to assess a company's ability to generate earnings, based on

revenues generated or resources used. For most of these ratios, having a higher value

relative to a competitor's ratio or the same ratio from a previous period is indicative that

the company is doing well.

Gross Margin

Gross margin is the amount of contribution to the business enterprise, after paying for

direct-fixed and direct variable unit costs.

Formula: {(Revenue-Cost of revenue) / Revenue}*100

Operating Margin

Operating Margin is a ratio used to measure a company's pricing strategy and operating

efficiency.

Formula: (Operating Income / Revenues) *100

Net Profit Margin

Net Profit Margin is the ratio of net profits to revenues for a company or business segment

- that shows how much of each dollar earned by the company is translated into profits.

Formula: (Net Profit / Revenues) *100

Profit Markup

Profit Markup measures the company's gross profitability, as compared to the cost of

revenue.

Formula: Gross Income / Cost of Revenue

PBIT Margin (Profit Before

Interest & Tax)

Profit Before Interest & Tax Margin shows the profitability of the company before interest

expense & taxation.

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 26

Formula: {(Net Profit + Interest + Tax) / Revenue} *100

PBT Margin (Profit Before

Tax)

Profit Before Tax Margin measures the pre-tax income over revenues.

Formula: {Income Before Tax / Revenues} *100

Return on Equity

Return on Equity measures the rate of return on the ownership interest (shareholders'

equity) of the common stock owners.

Formula: (Net Income / Shareholders Equity)*100

Return on Capital

Employed

Return on Capital Employed is a ratio that indicates the efficiency and profitability of a

company's capital investments. ROCE should always be higher than the rate at which the

company borrows; otherwise any increase in borrowing will reduce shareholders'

earnings.

Formula: EBIT / (Total Assets Current Liabilities)*100

Return on Assets

Return on Assets is an indicator of how profitable a company is relative to its total assets,

the ratio measures how efficient management is at using its assets to generate earnings.

Formula: (Net Income / Total Assets)*100

Return on Fixed Assets

Return on Fixed Assets measures the company's profitability to its fixed assets (property,

plant & equipment).

Formula: (Net Income / Fixed Assets) *100

Return on Working Capital

Return on Working Capital measures the company's profitability to its working capital.

Formula: (Net Income / Working Capital) *100

Cost Ratios

Cost ratios help to understand the costs the company is incurring as a percentage of

sales.

Operating costs (% of

Sales)

Operating costs as percentage of total revenues measures the operating costs that a

company incurs compared to the revenues.

Formula: (Operating Expenses / Revenues) *100

Administration costs (% of

Sales)

Administration costs as percentage of total revenue measures the selling, general and

administrative expenses that a company incurs compared to the revenues.

Formula: (Administrative Expenses / Revenues) *100

Interest costs (% of Sales)

Interest costs as percentage of total revenues measures the interest expense that a

company incurs compared to the revenues.

Formula: (Interest Expenses / Revenues) *100

Leverage Ratios

Leverage ratios are used to calculate the financial leverage of a company to get an idea of

the company's methods of financing or to measure its ability to meet financial obligations.

There are several different ratios, but the main factors looked at include debt, equity,

assets and interest expenses.

Debt to Equity Ratio

Debt to Equity Ratio is a measure of a company's financial leverage. The debt/equity ratio

also depends on the industry in which the company operates. For example, capital-

intensive industries tend to have a higher debt equity ratio.

Formula: Total Liabilities / Shareholders Equity

Debt to Capital Ratio

Debt to capital ratio gives an idea of a company's financial structure, or how it is financing

its operations, along with some insight into its financial strength. The higher the debt-to-

capital ratio, the more debt the company has compared to its equity. This indicates to

investors whether a company is more prone to using debt financing or equity financing. A

company with high debt-to-capital ratios, compared to a general or industry average, may

show weak financial strength because the cost of these debts may weigh on the company

and increase its default risk.

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 27

Formula: {Total Debt / (Total assets - Current Liabilities)}

Interest Coverage Ratio

Interest Coverage Ratio is used to determine how easily a company can pay interest on

outstanding debt, calculated as earnings before interest & tax by interest expense.

Formula: EBIT / Interest Expense

Liquidity Ratios

Liquidity ratios are used to determine a company's ability to pay off its short-terms debts

obligations. Generally, the higher the value of the ratio, the larger the margin of safety that

the company possesses to cover short-term debts. A company's ability to turn short-term

assets into cash to cover debts is of the utmost importance when creditors are seeking

payment. Bankruptcy analysts and mortgage originators frequently use the liquidity ratios

to determine whether a company will be able to continue as a going concern.

Current Ratio

Current Ratio measures a company's ability to pay its short-term obligations. The ratio

gives an idea of the company's ability to pay back its short-term liabilities (debt and

payables) with its short-term assets (cash, inventory, receivables). The higher the current

ratio, the more capable the company is of paying its obligations. A ratio under 1 suggests

that the company would be unable to pay off its obligations if they came due at that point.

Formula: Current Assets / Current Liabilities

Quick Ratio

Quick ratio measures a company's ability to meet its short-term obligations with its most

liquid assets.

Formula: (Current Assets - Inventories) / Current Liabilities

Cash Ratio

Cash ratio is the most stringent and conservative of the three short-term liquidity ratio. It

only looks at the most liquid short-term assets of the company, which are those that can

be most easily used to pay off current obligations. It also ignores inventory and

receivables, as there are no assurances that these two accounts can be converted to

cash in a timely matter to meet current liabilities.

Formula: {(Cash & Bank Balance + Marketable Securities) / Current Liabilities)}

Efficiency Ratios

Efficiency ratios measure a company's effectiveness in various areas of its operations,

essentially looking at maximizing its use of resources.

Fixed Asset Turnover

Fixed Asset Turnover ratio indicates how well the business is using its fixed assets to

generate sales. A higher ratio indicates the business has less money tied up in fixed

assets for each currency unit of sales revenue. A declining ratio may indicate that the

business is over-invested in plant, equipment, or other fixed assets.

Formula: Net Sales / Fixed Assets

Asset Turnover

Asset turnover ratio measures the efficiency of a company's use of its assets in

generating sales revenue to the company. A higher asset turnover ratio shows that the

company has been more effective in using its assets to generate revenues.

Formula: Net Sales / Total Assets

Current Asset Turnover

Current Asset Turnover indicates how efficiently the business uses its current assets to

generate sales.

Formula: Net Sales / Current Assets

Inventory Turnover

Inventory Turnover ratio shows how many times a company's inventory is sold and

replaced over a period. A low turnover implies poor sales and, therefore, excess

inventory. A high ratio implies either strong sales or ineffective buying.

Formula: Cost of Goods Sold / Inventory

Working Capital Turnover

Working Capital Turnover is a measurement to compare the depletion of working capital

to the generation of sales. This provides some useful information as to how effectively a

company is using its working capital to generate sales.

Formula: Net Sales / Working Capital

Capital Employed

Aditya Birla Nuvo Limited

__________________________________________________________________________________________

___________________________________________________________________________________________

Aditya Birla Nuvo Limited - Company Capsule Page 28

Turnover Capital employed turnover ratio measures the efficiency of a company's use of its equity

in generating sales revenue to the company.

Formula: Net Sales / Shareholders Equity

Capex to sales

Capex to Sales ratio measures the company's expenditure (investments) on fixed and

related assets' effectiveness when compared to the sales generated.

Formula: (Capital Expenditure / Sales) *100

Net income per Employee

Net income per Employee looks at a company's net income in relation to the number of

employees they have. Ideally, a company wants a higher profit per employee possible, as

it denotes higher productivity.

Formula: Net Income / No. of Employees

Revenue per Employee

Revenue per Employee measures the average revenue generated per employee of a

company. This ratio is most useful when compared against other companies in the same

industry. Generally, a company seeks the highest revenue per employee.

Formula: Revenue / No. of Employees

Efficiency Ratio

Efficiency Ratio is used to calculate a bank's efficiency. An increase means the company

is losing a larger percentage of its income to expenses. If the efficiency ratio is getting

lower, it is good for the bank and its shareholders.

Formula: Non-interest expense / Total Interest Income

Source : World Market Intelligence

6.3 Disclaimer

All Rights Reserved

No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means,

electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, World Market

Intelligence.

The data and analysis within this report is driven by World Market Intelligence from its own primary and secondary

research of public and proprietary sources and does not necessarily represent the views of the company profiled.

The facts of this report are believed to be correct at the time of publication but cannot be guaranteed. Please note that the

findings, conclusions and recommendations that World Market Intelligence delivers will be based on information gathered

in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As

such World Market Intelligence can accept no liability whatever for actions taken based on any information that may

subsequently prove to be incorrect.

Reproduced with permission of the copyright owner. Further reproduction prohibited without

permission.

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Sources of Information PDFDocumento91 páginasSources of Information PDFworseukAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Accounts Receivable Audit Report SummaryDocumento28 páginasAccounts Receivable Audit Report Summaryviswaja100% (2)

- Marketing Management MCQDocumento44 páginasMarketing Management MCQeffendyAinda não há avaliações

- What Is Sales ManagementDocumento44 páginasWhat Is Sales ManagementProfessor Sameer Kulkarni99% (188)

- ESG Risk FrameworkDocumento15 páginasESG Risk Frameworkamoghkanade100% (1)

- The Weighted Average Cost of CapitalDocumento5 páginasThe Weighted Average Cost of CapitalJorge Garcés AlvearAinda não há avaliações

- Michael 3Documento2 páginasMichael 3ossa123Ainda não há avaliações

- Resume Writing GuidelinesDocumento9 páginasResume Writing GuidelinesSuhana ShabnamAinda não há avaliações

- SwotDocumento9 páginasSwotossa123Ainda não há avaliações

- Avbirlagroup 140106080050 Phpapp02Documento56 páginasAvbirlagroup 140106080050 Phpapp02ossa123Ainda não há avaliações

- RWP13 019 ScherermpDocumento35 páginasRWP13 019 Scherermpossa123Ainda não há avaliações

- Marketing Plan: Your NameDocumento17 páginasMarketing Plan: Your NameFabiola SalinasAinda não há avaliações

- Integer Programming Formulation: C, T C, T IntDocumento10 páginasInteger Programming Formulation: C, T C, T Intossa123Ainda não há avaliações

- NewDocumento3 páginasNewossa123Ainda não há avaliações

- Maruti Suzuki Kizashi Marketing PlanDocumento43 páginasMaruti Suzuki Kizashi Marketing Planossa123Ainda não há avaliações

- NewDocumento3 páginasNewossa123Ainda não há avaliações

- NewDocumento3 páginasNewossa123Ainda não há avaliações

- Section 03Documento3 páginasSection 03ossa123Ainda não há avaliações

- Health 1Documento2 páginasHealth 1ossa123Ainda não há avaliações

- PCR Report on India's Small- and Medium-Scale Industries ProjectDocumento34 páginasPCR Report on India's Small- and Medium-Scale Industries ProjectsanthoshkumarkrAinda não há avaliações

- Harmonising SME accounting standardsDocumento144 páginasHarmonising SME accounting standardsJahde GoncalvesAinda não há avaliações

- Chapter 4Documento3 páginasChapter 4Angeline SarcenoAinda não há avaliações

- ISO 9001:2015 CS 9 Raising NC - 2017Documento5 páginasISO 9001:2015 CS 9 Raising NC - 2017YasirdzAinda não há avaliações

- Problems and challenges facing small scale industriesDocumento12 páginasProblems and challenges facing small scale industriesNaruChoudharyAinda não há avaliações

- HSE Engineer - Job Description TemplateDocumento2 páginasHSE Engineer - Job Description Templatefazalkhan1111Ainda não há avaliações

- 15CS51 MODULE I Notes PDFDocumento39 páginas15CS51 MODULE I Notes PDFVishnu EdakkanaAinda não há avaliações

- Information Management PRELIM QUIZ 1Documento8 páginasInformation Management PRELIM QUIZ 1Nicoco LocoAinda não há avaliações

- Marketing Management With Dr. Rizwan Ali: The University of LahoreDocumento21 páginasMarketing Management With Dr. Rizwan Ali: The University of LahoreAqib LatifAinda não há avaliações

- Shivani TA ResumeDocumento2 páginasShivani TA Resumesabkajob jobAinda não há avaliações

- Expert Economy Offers New Way to Monetize Knowledge and ExperienceDocumento20 páginasExpert Economy Offers New Way to Monetize Knowledge and Experienceaishwarya bawaAinda não há avaliações

- Supply and DemandDocumento6 páginasSupply and DemandJanina Camille D. BrolagdaAinda não há avaliações

- Colony Textile Mills Limited Internship Report On Colony Textile Mills LimitedDocumento41 páginasColony Textile Mills Limited Internship Report On Colony Textile Mills Limitedqaiser mehmood100% (2)

- IMC - Module 1Documento71 páginasIMC - Module 1jameskuriakose24_521Ainda não há avaliações

- FINANCIAL STATEMENT ANALYSIS OF Nokia Inc LTDDocumento4 páginasFINANCIAL STATEMENT ANALYSIS OF Nokia Inc LTDROHIT SETHI100% (2)

- Women Entrepreneurship For Economic Growth and DevelopmentDocumento1 páginaWomen Entrepreneurship For Economic Growth and DevelopmentDeeptiAinda não há avaliações

- Loreal RisksDocumento16 páginasLoreal RisksSofi_Smith100% (2)

- Introduction To Entrepreneurship: Bruce R. Barringer R. Duane IrelandDocumento41 páginasIntroduction To Entrepreneurship: Bruce R. Barringer R. Duane IrelandHoussem DenguirAinda não há avaliações

- 04 Planning Business MessagesDocumento52 páginas04 Planning Business MessagesThùy DươngAinda não há avaliações

- Development of Unconventional TrademarkDocumento2 páginasDevelopment of Unconventional TrademarkAyush Kumar SinghAinda não há avaliações

- RMT 531Documento11 páginasRMT 531Aaron Buii BuiiAinda não há avaliações

- ĐỀ TOEIC READING - TỪ MS HOA TOEICDocumento43 páginasĐỀ TOEIC READING - TỪ MS HOA TOEICTrang NguyễnAinda não há avaliações

- Chapter 3Documento3 páginasChapter 3Mariya BhavesAinda não há avaliações

- Accounts PDFDocumento46 páginasAccounts PDFArushi Singh100% (1)

- 2021 05 EN Ulkomaalaisena Tyontekijana Suomessa PDFDocumento20 páginas2021 05 EN Ulkomaalaisena Tyontekijana Suomessa PDFSt JakobAinda não há avaliações