Escolar Documentos

Profissional Documentos

Cultura Documentos

Where Success Follows Brilliance: Accounting and Bookkeeping Questions

Enviado por

Atul KumarDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Where Success Follows Brilliance: Accounting and Bookkeeping Questions

Enviado por

Atul KumarDireitos autorais:

Formatos disponíveis

Where Success Follows Brilliance Visit bcananded.

com

Contact us 02462-244440

1

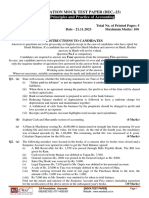

Q.1. Attempt any FOUR of the following:-

(20)

(A) Answer in One sentence only: (5)

1. What is fixed capital method?

2. What is capital expenditure?

3. What do you mean by statement of affairs?

4. What is bad debts?

5. What are installation or erection charges?

(B) Write the word/ term/ phrase which can substitute each of the following

statements:

1. The partner who contributes the capital only.

2. Fees charged by the Notary public for establishing the facts and causes of

dishonour of a bill of exchange.

3. The debit balance of an income & expenditure account.

4. A bill drawn accepted and made payable within the territory of one and the same

country.

5. The account to which the expenses paid on joint venture are credited.

(C) Match the following pairs: (5)

Group A Group B

1. Specific Fund

2. Cost of an asset

3. Joint venture

4. Central processing unit

5. Goodwill

(a) Temporary partnership

(b) Part of a computer comparable to the

brain of a man

(c) Liabilities side of Balance Sheet.

(d) Assets side of Balance sheet

(e) Purchase price plus installation charges

(f) Purchase price minus installation charges.

(g) Tangible asset.

(I) Intangible asset.

(D) Select the most appropriate alternative from those given below:

(5)

1. A debit balance of the joint venture account indicates _______________.

a) Net profit. b) Profit on joint venture

c) No profit, no loss d) Loss on joint venture.

BOOK-KEEPING & ACCOUNTANCY (50)

Time: 3 Hours (5 Pages) Max. Marks: 100

2013 07 02 BCA- XII Commerce First and Final Exam 0930 (E)

Where Success Follows Brilliance Visit bcananded.com

Contact us 02462-244440

2

2. Only _________ income and expenditures are shown in the income and expenditure

Account.

a) Revenue

b) Capital

c) Business

d) Non recurring

3. A one months bill drawn on 31

st

January 2011 will mature on _________.

a) 3

rd

March 2011 b) 28

th

February 2011

c) 27

th

February 2011 d) 2

nd

March 2011

4. Goodwill can be measured in terms of __________-

a) Kind b) Goods

c) Money d) Service

5. Brain of a comuter is ________.

a) Micro processor b) RAM

c) DRAM d) DOS.

(E) State True or False with reasons any two; (5)

1. The Receipts and payments Accounts is a Nominal Account.

2. A bill of exchange does not need acceptance.

(F) From the following details prepare a format of bill of exchange. (5)

1. Drawer : Ashok Amarchand pande, Chandni Chowk, Nanded.

2. Drawee : Ramesh Ramlal Bhosale, Vikas Bhavan Barshi Road, Latur.

3. Payee : Milind Shymrao patil, Milind Nivas M.G Road, Parbhani.

4. Period of Bill : 3 months

5. Amount of Bill : 40,000/-

6. Date of Bill : 12-11-2011.

7. Date of Accepted : 13-11-2011.

Q.2. From the following prepare Machinery Account & Depreciation Account for 3 years

i.e., 2008-09.2009-10 and 2010-11.

a) Financial year : 1

st

April to 31

st

March.

b) Method of Depreciation : fixed Installment Method

c) Rate of Depreciation : 10% p.a.

d) Purchase of machinery :

Date Amount Rs.

01.04.2008 2, 40,000

01.10.2008 60,000

e) Sale of Machinery :

Date Amount Rs.

31.03.2010 Rs. 60,000 1/3 Machinery purchased on 1-4-2008

30.09.2010 Rs. 43,000 (purchased on 01.10.2008)

Where Success Follows Brilliance Visit bcananded.com

Contact us 02462-244440

3

OR

Q.2 A) Following is the Balance Sheet of parag and pankaj who share profit & losses in

the ratio of 3:2.

Balance sheet

As on 31

st

March 2011

Liabilities Rs. Assets Rs.

Capital A/c

Paraj

Pankaj

General Reserve

Creditors

Bills payable

85,000

95,000

35,000

50,000

10,000

Plant & Machinery

Furniture

Stock

Debtors

Cash in hand

Cash at bank

Prepaid advertisement

1,30,000

20,000

15,000

70,000

10,000

25,000

5,000

2,75,000 2.75,000

The net profit of the firm for the year ended 31

st

March for last five years were-

Year Profit

2006-07 40,000

2007-08 60,000

2008-09 70,000

2009-10 40,000

2010-11 90,000

Normal rate of return for similar business was 20% and partners remuneration was

Rs.8000.

Calculate the value of goodwill of the firm at 3.5 years purchase of super profit

B) Explain the use of computer in office Administration.

Q.3. Mahesh owed Rs. 30,000 to Dinesh, hence accepted a bill drawn on him by Dinesh

at 3 months on 5 April 2011. On the same date Dinesh endorsed it to Ganesh.

On 5

th

July 2011 Mahesh requested Dinesh for the renewal of the bill.

Dinesh agreed to the

Conditions that Mahesh should pay half the amount due immediately by

cheque and should accept a bill for the balance along with interest at 10% p.a. for 2

months.

These arrangements were carried through on the same date. Dinesh sent the

new bill to the bank for collection.

On the due date, the new bill was honoured and bank charges debited were Rs. 150.

Give journal entries and show Maheshs A/c in the books of Dinesh.

OR

Journalise the following transactions in the books of Amit Agrawal. (12)

1) Bank informed that Sanjays acceptance for Rs. 10,850 sent to bank for collection

had been honoured and bank charges were Rs. 150.

2) Nitin renewed his acceptance for Rs. 15,000 by paying Rs. 5,000 in cash and

accepting a new bill for the balance plus interest at 10% p.a. for 3 months.

Where Success Follows Brilliance Visit bcananded.com

Contact us 02462-244440

4

3) Discharged our acceptance to pranay for Rs. 5,750 by endorsing prataps

acceptance to us for Rs. 5,500.

4) Nagesh who had accepted Admits bill of Rs. 20,000 was declared insolvent and

only 40% of the amount due could be recovered from his estate.

(12)

Q.4. pravin and pramod entered into a joint venture to purchase and sale of colour

televisions. They share profits and losses in the proportion of 3:2

Pravin contributed Rs. 6, 00,000 and pramod Rs. 5, 00,000. The amount was deposited

into a joint Bank.

Pravin bought 50 televisions at 20,000 each and paid for them from joint Bank Account.

Freight and insurance premium of Rs. 7,500 and Rs, 17,500 respectively were paid by

pramod from his private cash.

40 televisions were sold at a price of Rs. 25,000 each and 8 televisions which were

damaged in transit were repaired. Repairing charges Rs. 29,000 paid by pravin from the

private cash. They were sold at a price of Rs. 18,000 each and remaining two television

sets were taken over by pravin and pramod at agreed Price Rs. 15,000 each. The

proceeds were deposited into joint Bank Account.

Prepare:

Joint venture A/c, joint Bank A/c & co ventures A/c

(10)

A Q.5. Mr. Ramesh traders maintains books on single entry and gives you the

following information.

Particulars 31-3-2010

Rs.

31-3-2011

Rs.

Cash in hand

Cash at bank

Stock

Sundry debtors

Investment

Furniture

Machinery

Sundry creditors

Outstanding expenses

Bills payable

3,000

5,000

20,000

40,000

70,000

50,000

75,000

30,000

14,000

19,000

5,000

9,000

30,000

60,000

70,000

90,000

1,00,000

30,000

7,000

27,000

Where Success Follows Brilliance Visit bcananded.com

Contact us 02462-244440

5

Additional information;

1) Mr. Ramesh introduced further capital of Rs. 80,000 on 1

st

July 2010 and had

withdrawn Rs. 60,000 during the year.

2) interest on capital is allowed at 10% p.a. interest on drawings @15% and 10% interest

on investment is receivable.

3) Additions to furniture and machinery were made on 1

st

Oct 2010.

4) Write off depreciation on furniture and machinery at 10% p.a.

5) Create reserve for doubtful debts at 5% on sundry debtors.

Prepare:

a) Statement of Affairs

b) Statements of profit and loss for the year ended 312st march 2011.

(16)

Q.6. from the following Balance sheet and Receipts and payments Account of smart

Sports club, Aurangabad.

Prepare income and expenditure Accounts for the year ending 31

st

March 2011 and Balance sheet as on that date.

Balance sheet

As on 1

st

April 2010

Liabilities Rs. Assets Rs.

Capital fund (balancing figure)

Outstanding salary

61,000

1,000

Furniture

Sports Material

Investment

Cash in hand

Outstanding subscriptions

20,000

10,000

22,000

4,000

6,000

62,000 62,000

Receipts & payments Accounts

For the year ended 31

st

March 2011

Receipts Rs. Payments Rs.

To Balance b/d

To subscriptions:

2009-10 4,000

2010-11 42,000

2011-12 3,000

To Donations

To income from

cricket match

4,000

49,000

40,000

60,000

By salary (including Rs 1000 paid

for last year)

By Cricket match expenses

By sports material purchased

By sundry Expenses

By ground Rent

By Stationary

By furniture purchased

(on 1-12-2010)

By Balance c/d

11,000

40,000

30,000

2,000

6,000

5,200

40,000

18,000

1,53,000 1,53,000

Where Success Follows Brilliance Visit bcananded.com

Contact us 02462-244440

6

Adjustments:

1) Salary outstanding for current year is Rs. 2,000.

2) Sports material in hand on 31-3-2011 was valued at Rs. 22,000

3) There were 50 members of the club each paying annual subscriptions at Rs. 1,000.

4) Furniture is to be depreciated at 15% p.a.

5) Interest on investment Rs. 2,200 is receivable.

6) 50% Donations are to be capitalized.

(20)

Q.7. jay and Vijay are partners sharing profits and losses in the ratio 3:2 from the

following Trial Balance and adjustments prepare their Final Accounts:-

Trial Balance as on 31

st

March, 2011

Particulars Rs. Particulars Rs.

Drawings A/c

Jay

Vijay

Land and Building

Plant (addition 1-1-2011 Rs.

40,000)

Opening stock

Wages

Cash at Bank

Sundry Debtors

Purchases

Carriage

Furniture & fixture

Salaries

Bad debts

Office Expenses

Sales Return

5,000

7,000

1,60,000

1,40,000

25,000

13,000

18,900

60,700

95,500

2,500

35,000

8,200

1,000

3,500

3,700

Capital A/c

Jay

Vijay

Sales

Creditors

Bank overdraft

RDD

Purchase Returns

Sundry income

Pre-received rent

10% Bank loan (on 1-1-2010)

1,20,000

1,00,000

2,05,700

70,000

30,000

1,800

3,500

5,000

3,000

40,000

5,79,000 5,79,000

Adjustment:

1) closing stock was valued at

Cost price 40,000

Market price 50,000

2) Provide 10% Depreciation on-

3) Office expenses include personal expenses of Vijay Rs. 5,00

4) Write off bad debts of Rs. 700 and provide RDD at 5% on sundry Debtors.

5) Interest on partners capital at 5% p.a. was to be provided.

6) Wages Rs. 2,000 and salaries Rs. 1,800 are outstanding.

Best luck Friends

Você também pode gostar

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)No EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Nota: 5 de 5 estrelas5/5 (1)

- TaxSaleResearch OkDocumento44 páginasTaxSaleResearch OkMarlon Ferraro100% (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)No EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Nota: 5 de 5 estrelas5/5 (1)

- 01 Basilan Estate V CIRDocumento2 páginas01 Basilan Estate V CIRBasil MaguigadAinda não há avaliações

- CBSE Class 11 Accountancy Question Paper SA 2 2013 PDFDocumento6 páginasCBSE Class 11 Accountancy Question Paper SA 2 2013 PDFsivsyadavAinda não há avaliações

- QR Code SecurityDocumento6 páginasQR Code SecurityPrasad Pamidi100% (1)

- QR Code SecurityDocumento6 páginasQR Code SecurityPrasad Pamidi100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- Harshad Mehta CaseDocumento16 páginasHarshad Mehta Casegunjan67% (3)

- 14 Rules For Writing Multiple-Choice QuestionsDocumento5 páginas14 Rules For Writing Multiple-Choice Questionsapi-322360160Ainda não há avaliações

- Concept of Installment SystemDocumento5 páginasConcept of Installment Systemshambhuling ShettyAinda não há avaliações

- Acounts Papaer II Preliminary Examination 2008 - 09Documento5 páginasAcounts Papaer II Preliminary Examination 2008 - 09AMIN BUHARI ABDUL KHADERAinda não há avaliações

- Test 1Documento105 páginasTest 1PrathibaVenkatAinda não há avaliações

- Accounts Question Paper Omtex ClassesDocumento8 páginasAccounts Question Paper Omtex ClassesAmin Buhari Abdul KhaderAinda não há avaliações

- Class 11 Acc FinalDocumento3 páginasClass 11 Acc Finalmnmehta1990Ainda não há avaliações

- J.K Shah Full Course Practice Question PaperDocumento7 páginasJ.K Shah Full Course Practice Question PapermridulAinda não há avaliações

- Paper 1: AccountingDocumento30 páginasPaper 1: Accountingsuperdole83Ainda não há avaliações

- Accounts Preliminary Paper No 8Documento6 páginasAccounts Preliminary Paper No 8AMIN BUHARI ABDUL KHADERAinda não há avaliações

- Accounting Test Paper 1: Key ConceptsDocumento30 páginasAccounting Test Paper 1: Key ConceptsSatyajit PandaAinda não há avaliações

- Accountancy EngDocumento8 páginasAccountancy EngBettappa Patil100% (1)

- +1 Accountancy ONLINE Final Examination 2021Documento5 páginas+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalAinda não há avaliações

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Documento5 páginas21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitAinda não há avaliações

- Inter P-5 New Dec-10 PaperDocumento6 páginasInter P-5 New Dec-10 PaperBrowse PurposeAinda não há avaliações

- Accounts Preliminary Paper No 1 2009 - 2010Documento5 páginasAccounts Preliminary Paper No 1 2009 - 2010AMIN BUHARI ABDUL KHADERAinda não há avaliações

- Intermediate Group I Test Papers FOR 2014 DECDocumento88 páginasIntermediate Group I Test Papers FOR 2014 DECwaterloveAinda não há avaliações

- Unsolved Paper Part IDocumento107 páginasUnsolved Paper Part IAdnan KazmiAinda não há avaliações

- CA CPT June 2013 Question Paper With Answer Keys: Part A - Fundamentals of AccountingDocumento16 páginasCA CPT June 2013 Question Paper With Answer Keys: Part A - Fundamentals of AccountingIcaii InfotechAinda não há avaliações

- Accounts 11th Class Sample PaperDocumento8 páginasAccounts 11th Class Sample PaperVineet SinghAinda não há avaliações

- Class Xi Acc QPDocumento7 páginasClass Xi Acc QP8201ayushAinda não há avaliações

- Test Paper Ca FoundDocumento5 páginasTest Paper Ca FoundSarangapani KaliyamoorthyAinda não há avaliações

- Accounts Preliminary Paper No 9 PDFDocumento6 páginasAccounts Preliminary Paper No 9 PDFAMIN BUHARI ABDUL KHADERAinda não há avaliações

- Advance AccDocumento8 páginasAdvance AccjayaAinda não há avaliações

- RE Exam FA Sem I MFM MMM MHRDMDocumento4 páginasRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGAinda não há avaliações

- 438Documento6 páginas438Rehan AshrafAinda não há avaliações

- Fundamentals of Accounting Problems and SolutionsDocumento7 páginasFundamentals of Accounting Problems and SolutionsashwinAinda não há avaliações

- Tutorial 8Documento6 páginasTutorial 8Waruna PrabhaswaraAinda não há avaliações

- Practice Paper Accountancy Class - XI: Time-3 Hours MM-90 General InstructionsDocumento4 páginasPractice Paper Accountancy Class - XI: Time-3 Hours MM-90 General InstructionsSNPS BhadraAinda não há avaliações

- Omtex Classes: "The Home of Success"Documento4 páginasOmtex Classes: "The Home of Success"AMIN BUHARI ABDUL KHADERAinda não há avaliações

- Bba 3 Sem AccountsDocumento9 páginasBba 3 Sem Accountsanjali LakshcarAinda não há avaliações

- TH TH STDocumento3 páginasTH TH STsharathk916Ainda não há avaliações

- Sample Q P Set2 AccDocumento9 páginasSample Q P Set2 AccJohn JoshyAinda não há avaliações

- KVS Mumbai XI ACC SQP & SMS SET-II (Annual Exam) (22-23)Documento23 páginasKVS Mumbai XI ACC SQP & SMS SET-II (Annual Exam) (22-23)ishitaAinda não há avaliações

- ADL 03 Ver2+Documento6 páginasADL 03 Ver2+DistPub eLearning SolutionAinda não há avaliações

- P.U.C. Mid-Term Examination Accountancy QuestionsDocumento10 páginasP.U.C. Mid-Term Examination Accountancy QuestionsBest ThingsAinda não há avaliações

- Accounting concepts and principles in financial statementsDocumento6 páginasAccounting concepts and principles in financial statementskartikbhaiAinda não há avaliações

- Accounting Fundamentals Assignment SolvedDocumento2 páginasAccounting Fundamentals Assignment SolvedRajshree DewooAinda não há avaliações

- Test Papers: FoundationDocumento23 páginasTest Papers: FoundationUmesh TurankarAinda não há avaliações

- AccountancyDocumento0 páginaAccountancyJaimangal RajaAinda não há avaliações

- Accountancy Sample PaperDocumento6 páginasAccountancy Sample PaperDevansh BawejaAinda não há avaliações

- ACCOUNTANCY XI SAMPLE PAPERDocumento13 páginasACCOUNTANCY XI SAMPLE PAPERpriyaAinda não há avaliações

- Session Ending Examination 2019Documento7 páginasSession Ending Examination 2019madhudevi06435Ainda não há avaliações

- UT 1 AccountsDocumento4 páginasUT 1 Accountskarishma prabagaranAinda não há avaliações

- Accountancy Set 3 QPDocumento6 páginasAccountancy Set 3 QPKunal Gaurav100% (2)

- 650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329Documento4 páginas650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329sushil262004Ainda não há avaliações

- Accountancy Extra PointsDocumento14 páginasAccountancy Extra PointsRishav KuriAinda não há avaliações

- Caf-01 Far-I (Mah SS)Documento4 páginasCaf-01 Far-I (Mah SS)Abdullah SaberAinda não há avaliações

- Clerical Officers Proficiency Exam Paper 701 Accounts PreparationDocumento5 páginasClerical Officers Proficiency Exam Paper 701 Accounts PreparationM-mila Chepterit KenyAinda não há avaliações

- Model Question Paper: Financial Accounting (CFA510)Documento25 páginasModel Question Paper: Financial Accounting (CFA510)akshayatmanutdAinda não há avaliações

- MB-104-–BASICS-OF-ACCOUNTING-AND-FINANCE (1)Documento3 páginasMB-104-–BASICS-OF-ACCOUNTING-AND-FINANCE (1)rajeshpatnaikAinda não há avaliações

- Pccquestionpapers (2008)Documento20 páginasPccquestionpapers (2008)Samenew77Ainda não há avaliações

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Documento7 páginasCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsAinda não há avaliações

- Accountancy March 2008 EngDocumento8 páginasAccountancy March 2008 EngPrasad C M100% (2)

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportAinda não há avaliações

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionAinda não há avaliações

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionAinda não há avaliações

- IPCC Practice ManualDocumento19 páginasIPCC Practice ManualAtul KumarAinda não há avaliações

- QR Codes: Things You Should Know About..Documento2 páginasQR Codes: Things You Should Know About..iahpostmesAinda não há avaliações

- 05437537Documento2 páginas05437537Atul KumarAinda não há avaliações

- 20063ipcc Paper7A Vol1 Cp5Documento0 página20063ipcc Paper7A Vol1 Cp5Atul KumarAinda não há avaliações

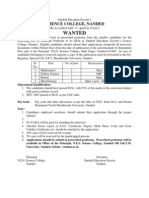

- NES Science College Faculty JobsDocumento1 páginaNES Science College Faculty JobsAtul KumarAinda não há avaliações

- Ccna InterviewDocumento29 páginasCcna Interviewvijaysingh100% (6)

- NoticepdfDocumento1 páginaNoticepdfAtul KumarAinda não há avaliações

- Configuration and Administrative Guide HOSTED SMS SERVICEDocumento10 páginasConfiguration and Administrative Guide HOSTED SMS SERVICEAtul KumarAinda não há avaliações

- Bom Probationary OfficersDocumento11 páginasBom Probationary OfficersAtul KumarAinda não há avaliações

- Combining PCR With IV Is A Clever Way of Viewing ItDocumento17 páginasCombining PCR With IV Is A Clever Way of Viewing ItKamAinda não há avaliações

- FLEXCUBE Critical Patch Advisory Jul 13 PDFDocumento14 páginasFLEXCUBE Critical Patch Advisory Jul 13 PDFTaoqir KhosaAinda não há avaliações

- AccountingDocumento2 páginasAccountingMerielle Medrano100% (2)

- ACC 570 CQ3b Practice Tax QuestionsDocumento2 páginasACC 570 CQ3b Practice Tax QuestionsMohitAinda não há avaliações

- Review ArticleDocumento20 páginasReview ArticleVira ImranAinda não há avaliações

- Fee Details Fee Details Fee DetailsDocumento1 páginaFee Details Fee Details Fee DetailsTabish KhanAinda não há avaliações

- Real Estate Presentation - Chapter 12Documento27 páginasReal Estate Presentation - Chapter 12Cedric McCorkleAinda não há avaliações

- Audit Module 3 - Financial Statements TemplateDocumento11 páginasAudit Module 3 - Financial Statements TemplateSiddhant AggarwalAinda não há avaliações

- Ifric 12Documento12 páginasIfric 12Cryptic LollAinda não há avaliações

- AHAP Insurance Financial SummaryDocumento2 páginasAHAP Insurance Financial SummaryluvzaelAinda não há avaliações

- 2026 SyllabusDocumento28 páginas2026 Syllabussatkargulia601Ainda não há avaliações

- Chapter 1 History and Development of Banking System in MalaysiaDocumento18 páginasChapter 1 History and Development of Banking System in MalaysiaMadihah JamianAinda não há avaliações

- BBA607 - Role of International Financial InstitutionsDocumento11 páginasBBA607 - Role of International Financial InstitutionsSimanta KalitaAinda não há avaliações

- Hsslive-XII-economics - Macro - EconomicsDocumento3 páginasHsslive-XII-economics - Macro - Economicscsc kalluniraAinda não há avaliações

- Managerial Economics and Organizational Architecture SolutionsDocumento3 páginasManagerial Economics and Organizational Architecture SolutionsjbyuriAinda não há avaliações

- MCTax GuideDocumento1 páginaMCTax Guidekhageshcode89Ainda não há avaliações

- Foreign Exchange Risk Management Practices - A Study in Indian ScenarioDocumento11 páginasForeign Exchange Risk Management Practices - A Study in Indian ScenariobhagyashreeAinda não há avaliações

- Balance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of AccountsDocumento27 páginasBalance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of Accountsrisc1Ainda não há avaliações

- FAUJI MEAT LIMITED CONDENSED INTERIM FINANCIAL STATEMENTSDocumento66 páginasFAUJI MEAT LIMITED CONDENSED INTERIM FINANCIAL STATEMENTSAbdurrehman ShaheenAinda não há avaliações

- Bank Reconciliation NotesDocumento3 páginasBank Reconciliation Notesjudel ArielAinda não há avaliações

- Tech UnicornsDocumento16 páginasTech UnicornsSatishAinda não há avaliações

- Yukitoshi Higashino MftaDocumento29 páginasYukitoshi Higashino MftaSeyyed Mohammad Hossein SherafatAinda não há avaliações

- Financial Times Europe - 25.11.2020Documento20 páginasFinancial Times Europe - 25.11.2020Muhammad AroojAinda não há avaliações

- FXCM Traits of Successful Traders GuideDocumento43 páginasFXCM Traits of Successful Traders GuidefizzAinda não há avaliações

- Internship Report On Grameen Bank - CompleteDocumento65 páginasInternship Report On Grameen Bank - CompleteMishu100% (2)

- Notice of Annual General Meeting: Sunil Hitech Engineers LimitedDocumento70 páginasNotice of Annual General Meeting: Sunil Hitech Engineers LimitedGaurang MehtaAinda não há avaliações

- Class 1 - Introduction The Foundation of Islamic EconomicsDocumento22 páginasClass 1 - Introduction The Foundation of Islamic EconomicsBayu MurtiAinda não há avaliações