Escolar Documentos

Profissional Documentos

Cultura Documentos

Mcqs On Ratio Analysis (Financial Management-Module-C)

Enviado por

Sohaib HassanDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Mcqs On Ratio Analysis (Financial Management-Module-C)

Enviado por

Sohaib HassanDireitos autorais:

Formatos disponíveis

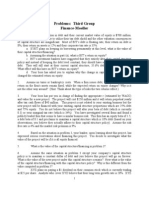

MCQs on Ratio Analysis (Financial management-module-c)

1) In the Balance sheet of a firm,the debt equity ratio is 2:1.The amount of long term

sources is Rs.12 lac.What is the amount of tangible net orth of the firm!

a) Rs.12 lac. b) Rs.8 lac c) Rs." lac. d) Rs.2 lac.

2) #ebt $quity Ratio is %:1,the amount of total assets Rs.2& lac,current ratio is 1.':1

and oned funds Rs.% lac.What is the amount of current asset!

a) Rs.' lac b) Rs.% lac c) Rs.12 lac d)none of the abo(e.

%) Ban)s generally *refer #ebt $quity Ratio at :

a) 1:1 b) 1:% c)2:1 d) %:1

") If a com*any re(alues its assets,its netorth :

a) Will impo!e b) Will remain same c) Will be *ositi(ely affected d) +one of

the abo(e.

') If a com*any issues bonus shares the debt equity ratio ill

a) Remain unaffected b) Will be affected c) Will impo!e d) none of the abo(e.

,) -n asset is a

a) .ource of fund b) "se o# #und c) Inflo of funds d) none of the abo(e.

/) In the balance sheet amount of total assets is Rs.1& lac, current liabilities Rs.' lac

0 ca*ital 0 reser(es are Rs.2 lac .What is the debt equity ratio!

a)111 b) 1.':1 c)2:1 d)none o# t$e a%o!e.

2) The long term use is 12&3 of long term source.This indicates the unit has

a) current ratio 1.2:1 b) +egati(e T+W c)4o ca*itali5ation d)&egati!e &WC.

6) In last year the current ratio as %:1 and quic) ratio as 2:1.7resently current ratio

is %:1 but quic) ratio is 1:1.This indicates com*arably

a) high liquidity b) $ig$e stoc' c) loer stoc) d) lo liquidity

1&) -uthorised ca*ital of a com*any is Rs.' lac,"&3 of it is *aid u*.4oss incurred

during the year is Rs.'&,&&&.-ccumulated loss carried from last year is Rs.2

lac.The com*any has a Tangible +et Worth of

a) +il b) Rs.2.'& lac c) (-)Rs.()*))) d) Rs.1 lac.

11) The degree of sol(ency of to firms can be com*ared by measuring

a) +et orth b) Tangible +et Worth c) -sset co(erage ratio d) +ol!ency Ratio.

12) 7ro*erietory ratio is calculated by

a) Total assets8Total outside liability b) Total outside liability8Total tangible assets

c) 9i:ed assets84ong term source of fund d) ,opeietos-Funds./otal

/angi%le Assets.

1%) ;urrent ratio of a concern is 1,its net or)ing ca*ital ill be

a) 7ositi(e b) +egati(e c) &il d) +one of the abo(e

1") ;urrent ratio is ":1.+et Wor)ing ;a*ital is Rs.%&,&&&.9ind the amount of current

-ssets.

a) Rs.1&,&&& b) Rs.0)*))) c) Rs.2",&&& d) Rs.,,&&&

1') ;urrent ratio is 2:'.;urrent liability is Rs.%&&&&.The +et or)ing ca*ital is

a) Rs.12,&&& b) Rs."',&&& c) Rs.<=) "',&&& d) Rs.(-)18)))

1,) >uic) assets do not include

a) ?o(t.bond b) Boo) debts c) -d(ance for su**ly of ra materials d)

1n!entoies.

1/) The ideal quic) ratio is

a) 2:1 b) 1:1 c) ':1 d) +one of the abo(e

12) - (ery high current ratio indicates

a) @igh efficiency b) flabby in(entory c) *osition of more long term funds

d) % o c

16) 9inancial le(erage means

a) "se o# moe de%t capital to incease po#it b) @igh degree of sol(ency

c) 4o ban) finance d) +one of the abo(e

2&) The ca*ital gearing ratio is high for a com*any.It indicates a *osition of

a) 4o debts b) high *reference ca*ital c) high equity d) lo debt equity

ratio.

Você também pode gostar

- FM MCQDocumento2 páginasFM MCQujjwalAinda não há avaliações

- MCQ - RatiosDocumento2 páginasMCQ - RatiosLalitAinda não há avaliações

- ATTEMP ALL QUESTIONS: Circle Only The Correct AnswerDocumento8 páginasATTEMP ALL QUESTIONS: Circle Only The Correct AnswerPrince Tettey NyagorteyAinda não há avaliações

- Financial RatioDocumento3 páginasFinancial RatioSheed ChiuAinda não há avaliações

- Banking TermsDocumento86 páginasBanking TermsumaannamalaiAinda não há avaliações

- SGV Cup Level 2Documento6 páginasSGV Cup Level 2Nicolette DonovanAinda não há avaliações

- Liquidity Ratio 001Documento4 páginasLiquidity Ratio 001Anurag SahrawatAinda não há avaliações

- Xii Mcqs CH - 15 Ratio AnalysisDocumento6 páginasXii Mcqs CH - 15 Ratio AnalysisJoanna GarciaAinda não há avaliações

- Running Head: Financial AnalysisDocumento11 páginasRunning Head: Financial AnalysisputtingitonlineAinda não há avaliações

- Chapter 3: Ratio Analysis: Management AccountingDocumento7 páginasChapter 3: Ratio Analysis: Management Accountingnavin_raghuAinda não há avaliações

- CF1 Homework 3Documento2 páginasCF1 Homework 3Klaus MikaelsonAinda não há avaliações

- Time Value of MoneyDocumento23 páginasTime Value of Moneyaer14Ainda não há avaliações

- Assignment Drive Program Semester Subject Code & Name Bba203 & Financial Accounting BK Id Credit & MarksDocumento4 páginasAssignment Drive Program Semester Subject Code & Name Bba203 & Financial Accounting BK Id Credit & MarksSmu DocAinda não há avaliações

- 311FA07 Midterm 1Documento13 páginas311FA07 Midterm 1Akshay AgarwalAinda não há avaliações

- MS4 Accounting and Finance For ManagersDocumento10 páginasMS4 Accounting and Finance For ManagersAnonymous UjEPpvYDAinda não há avaliações

- Winter 2007 Final ExamDocumento15 páginasWinter 2007 Final Examupload55Ainda não há avaliações

- CAIIB Financial Module D MCQDocumento7 páginasCAIIB Financial Module D MCQRahul GuptaAinda não há avaliações

- Amity AssignmentDocumento16 páginasAmity AssignmentAnkita SrivastavAinda não há avaliações

- Each Question Carries Mark: Objective TypeDocumento10 páginasEach Question Carries Mark: Objective TypeSyed Fawad MarwatAinda não há avaliações

- CH02 ProblemsDocumento10 páginasCH02 ProblemsHaley Ann Martens100% (1)

- Question Bank-MCQ FM&CF (KMBN, KMBA 204)Documento27 páginasQuestion Bank-MCQ FM&CF (KMBN, KMBA 204)Amit ThakurAinda não há avaliações

- Homework Set # 2 Econ 102 Fall03 ZahuiDocumento11 páginasHomework Set # 2 Econ 102 Fall03 ZahuiNgoc NguyenAinda não há avaliações

- Problems: Third Group Finance-MoellerDocumento4 páginasProblems: Third Group Finance-MoellerEvan BenedictAinda não há avaliações

- Working Capital Policy and ManagementDocumento64 páginasWorking Capital Policy and ManagementsevillaarvinAinda não há avaliações

- Present Value of The Investment Project Assuming The Company Has An 8% Hurdle RateDocumento15 páginasPresent Value of The Investment Project Assuming The Company Has An 8% Hurdle RategerralanuzaAinda não há avaliações

- CA CPT Question Paper 2018Documento31 páginasCA CPT Question Paper 2018Gaurav JainAinda não há avaliações

- Profit (50:50 Split) 16: RealisationDocumento3 páginasProfit (50:50 Split) 16: Realisationzahid_mahmood3811Ainda não há avaliações

- Jnu - Solved - Paper (1) - 1 PDFDocumento193 páginasJnu - Solved - Paper (1) - 1 PDFparas hasijaAinda não há avaliações

- Cost of Capital ReviewDocumento7 páginasCost of Capital ReviewGanesh AroteAinda não há avaliações

- Finance Mid TermDocumento4 páginasFinance Mid TermbloodinawineglasAinda não há avaliações

- Practicequestions Mt3a 625Documento25 páginasPracticequestions Mt3a 625sonkhiemAinda não há avaliações

- FM11 CH 16 Mini-Case Cap Structure DecDocumento11 páginasFM11 CH 16 Mini-Case Cap Structure DecAndreea VladAinda não há avaliações

- Revision 2 - Investment AppraisalDocumento35 páginasRevision 2 - Investment Appraisalsamuel_dwumfourAinda não há avaliações

- Capital Budgeting: Exclusive Projects or Independent ProjectsDocumento6 páginasCapital Budgeting: Exclusive Projects or Independent ProjectsMaria TariqAinda não há avaliações

- Gat Subject Management Sciences Finance Mcqs1 50Documento5 páginasGat Subject Management Sciences Finance Mcqs1 50Muhammad NajeebAinda não há avaliações

- Macro Term Test 1415 Oct (Final)Documento7 páginasMacro Term Test 1415 Oct (Final)Nicholas Giovanna ChongAinda não há avaliações

- Jaiib Af Mcqs Mod CDocumento6 páginasJaiib Af Mcqs Mod CdarshitAinda não há avaliações

- Quiz 5 Equity Valuation M7 AnswerDocumento63 páginasQuiz 5 Equity Valuation M7 AnswerPrabu PrabaAinda não há avaliações

- Revision II (Ratio Analysis)Documento6 páginasRevision II (Ratio Analysis)Allwin GanaduraiAinda não há avaliações

- MAA Sample QPDocumento8 páginasMAA Sample QPankitAinda não há avaliações

- R3 Page5Documento1 páginaR3 Page5Benjamin ChillamAinda não há avaliações

- Paper 14 - Strategic Financial Management MCQs - Multiple Choice Questions (MCQ) - StepFly (VXRD040821)Documento34 páginasPaper 14 - Strategic Financial Management MCQs - Multiple Choice Questions (MCQ) - StepFly (VXRD040821)Sreeharan MP100% (1)

- Stock ValuationDocumento6 páginasStock ValuationrinaawahyuniAinda não há avaliações

- Chapter 14 Capital Structure and Financial Ratios: Answer 1Documento12 páginasChapter 14 Capital Structure and Financial Ratios: Answer 1samuel_dwumfourAinda não há avaliações

- PS04 MainDocumento8 páginasPS04 MainBenjamin Ford100% (1)

- Drill 2 Working Capital Current Liabilities ANSWERS PDFDocumento7 páginasDrill 2 Working Capital Current Liabilities ANSWERS PDFjustinnAinda não há avaliações

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsAinda não há avaliações

- CPA Review Notes 2019 - BEC (Business Environment Concepts)No EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Nota: 4 de 5 estrelas4/5 (9)

- Corporate Finance Formulas: A Simple IntroductionNo EverandCorporate Finance Formulas: A Simple IntroductionNota: 4 de 5 estrelas4/5 (8)

- Screening Tool for Energy Evaluation of Projects: A Reference Guide for Assessing Water Supply and Wastewater Treatment SystemsNo EverandScreening Tool for Energy Evaluation of Projects: A Reference Guide for Assessing Water Supply and Wastewater Treatment SystemsAinda não há avaliações

- Leveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteNo EverandLeveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteAinda não há avaliações

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportAinda não há avaliações

- Financing Disaster Risk Reduction in Asia and the Pacific: A Guide for Policy MakersNo EverandFinancing Disaster Risk Reduction in Asia and the Pacific: A Guide for Policy MakersAinda não há avaliações

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)No EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Nota: 5 de 5 estrelas5/5 (1)

- The Entrepreneur’S Dictionary of Business and Financial TermsNo EverandThe Entrepreneur’S Dictionary of Business and Financial TermsAinda não há avaliações

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)No EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Nota: 4.5 de 5 estrelas4.5/5 (5)

- Sta630 Final Mega FileDocumento110 páginasSta630 Final Mega FileSohaib HassanAinda não há avaliações

- Supply Chain ManagementDocumento15 páginasSupply Chain ManagementSohaib Hassan50% (2)

- Supply Chain ManagementDocumento15 páginasSupply Chain ManagementSohaib Hassan50% (2)

- Trial BalanceDocumento21 páginasTrial BalanceRiza JauferAinda não há avaliações

- State Street Press Awards WinnersDocumento4 páginasState Street Press Awards Winnerskaren_cooper412Ainda não há avaliações

- Agriculture InsuranceDocumento9 páginasAgriculture InsuranceYogesh WadhwaAinda não há avaliações

- 17 People v. TibayanDocumento11 páginas17 People v. TibayanStephanie SerapioAinda não há avaliações

- TikTok SlidesDocumento17 páginasTikTok SlidesCelebiAinda não há avaliações

- Vizag-Chennai Industrial Corridor - Full ReportDocumento388 páginasVizag-Chennai Industrial Corridor - Full ReportPrasad GogineniAinda não há avaliações

- 31-The Forex GambitDocumento6 páginas31-The Forex Gambitlowtarhk100% (1)

- ICE # 4 - WebDocumento12 páginasICE # 4 - WebLauren KlaassenAinda não há avaliações

- Principles of Accounting Chapter 1 QuestionsDocumento45 páginasPrinciples of Accounting Chapter 1 Questionsahmed156039Ainda não há avaliações

- Audit of Property, Plant and EquipmentDocumento7 páginasAudit of Property, Plant and EquipmentclintonAinda não há avaliações

- Kathmandu Financial Group Case Study AnalysisDocumento7 páginasKathmandu Financial Group Case Study Analysisjayan_unnithan2265Ainda não há avaliações

- Advanced Financial Accounting 7e (Baker Lembre King) .Chap009Documento74 páginasAdvanced Financial Accounting 7e (Baker Lembre King) .Chap009low profileAinda não há avaliações

- Module 5 - EVALUATION OF SINGLE PROJECTDocumento28 páginasModule 5 - EVALUATION OF SINGLE PROJECTAron H OcampoAinda não há avaliações

- The Investment Function in BankingDocumento21 páginasThe Investment Function in Bankingcyclone man100% (1)

- SWETA SAH - SIP On WIPRO & INFOSYS LIMITED 2Documento63 páginasSWETA SAH - SIP On WIPRO & INFOSYS LIMITED 2Sweta sahAinda não há avaliações

- Delta Hedging PDFDocumento29 páginasDelta Hedging PDFLê AnhAinda não há avaliações

- Hindustan Biosynth Limited: A Project Report ONDocumento60 páginasHindustan Biosynth Limited: A Project Report ONArchita ParikhAinda não há avaliações

- Polar Power Investor Presentation - September 2019 PDFDocumento42 páginasPolar Power Investor Presentation - September 2019 PDFmayurbuddyAinda não há avaliações

- Comparison and Usage of The Boston Consulting Portfolio and The McKinsey Portfolio Maximilian BäuerleDocumento24 páginasComparison and Usage of The Boston Consulting Portfolio and The McKinsey Portfolio Maximilian BäuerleEd NjorogeAinda não há avaliações

- Project Proposal by Nigah-E-Nazar FatimiDocumento8 páginasProject Proposal by Nigah-E-Nazar Fatiminazarfcma5523100% (3)

- From Help Desk To Service DeskDocumento57 páginasFrom Help Desk To Service DeskteacherignouAinda não há avaliações

- Accounting Rate of ReturnDocumento16 páginasAccounting Rate of Returnshanky631Ainda não há avaliações

- Sri Lanka Real Estate Market Brief Jan 2012 (Softcopy)Documento10 páginasSri Lanka Real Estate Market Brief Jan 2012 (Softcopy)nerox87Ainda não há avaliações

- Section 112 - Tax On Long-Term Capital GainsDocumento2 páginasSection 112 - Tax On Long-Term Capital GainsParth UpadhyayAinda não há avaliações

- IFRS 5 Non-Current Assets Held For SaleDocumento25 páginasIFRS 5 Non-Current Assets Held For SaleziyuAinda não há avaliações

- CT8 Financial Economics PDFDocumento6 páginasCT8 Financial Economics PDFVignesh SrinivasanAinda não há avaliações

- IAS OUR DREAM NOTES COMPILATION PART 3 (17 - 23rd Nov.2013)Documento45 páginasIAS OUR DREAM NOTES COMPILATION PART 3 (17 - 23rd Nov.2013)Swapnil Patil50% (2)

- GMOMelt UpDocumento13 páginasGMOMelt UpHeisenberg100% (2)

- Abolition of Zamindari SystemDocumento5 páginasAbolition of Zamindari SystemAvilash KumbharAinda não há avaliações

- International Financial Management PPT Chap 1Documento26 páginasInternational Financial Management PPT Chap 1serge folegweAinda não há avaliações

- The Joyful Heart by Schauffler, Robert Haven, 1879-1964Documento68 páginasThe Joyful Heart by Schauffler, Robert Haven, 1879-1964Gutenberg.orgAinda não há avaliações