Escolar Documentos

Profissional Documentos

Cultura Documentos

2014-09-02 Final Order - in Re International Textile Merger Litigation

Enviado por

william_herlong0 notas0% acharam este documento útil (0 voto)

202 visualizações49 páginasThis is the final order in the class and derivative action brought against Wilbur Ross and his company regarding the merger in October 2006 between two companies which were majority owned by his funds - International Textile Group and Safety Components International. The allegation was that Mr. Ross and his fellow board members and controlling shareholders violated their fiduciary duties to the acquiring company and its minority shareholders.

Título original

2014-09-02 Final Order - In re International Textile Merger Litigation

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThis is the final order in the class and derivative action brought against Wilbur Ross and his company regarding the merger in October 2006 between two companies which were majority owned by his funds - International Textile Group and Safety Components International. The allegation was that Mr. Ross and his fellow board members and controlling shareholders violated their fiduciary duties to the acquiring company and its minority shareholders.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

202 visualizações49 páginas2014-09-02 Final Order - in Re International Textile Merger Litigation

Enviado por

william_herlongThis is the final order in the class and derivative action brought against Wilbur Ross and his company regarding the merger in October 2006 between two companies which were majority owned by his funds - International Textile Group and Safety Components International. The allegation was that Mr. Ross and his fellow board members and controlling shareholders violated their fiduciary duties to the acquiring company and its minority shareholders.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 49

FORM4

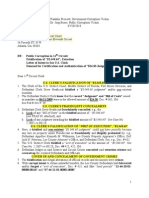

STATE OF SOUTH CAROLINA JUDGMENT IN A CIVIL CASE

COUNTY OF Greenville

IN THE COURT OF COMMON PLEAS F ,' L [ [) _ ,.., 1 f/9 2009 CP-23-03346

"-....t \vi- COURT

\;I 0

1

.. - ' ,... 1"\

In re International Textile Group Merger Litigation F ' 1 1 - ' v.

, ' . '

Submitted by: Chris topher D. King

NEXSEN PRUET, LLC

or

D Defendant

55 E. Camperdown Way, Suite 400

Greenville, SC 29601

D Self-Represented Litigant

(864) 370-2211

DISPOSITION TYPE (CHECK ONE)

D JURY VERDICT. This action came before the court for a trial by jury. The issues

have been tried and a verdict rendered.

[8] DECISION BY THE COURT. This action came to trial or hearing before the court.

The issues have been tried or heard and a decision rendered. [8J See Page 2 for additional information.

0 ACTION DISMISSED (CHECK REASON): 0 Rule 12(b), SCRCP; 0 Rule 4l(a),

SCRCP (Vol. Nonsuit); D Rule 43(k), SCRCP (Settled); D Other

D ACTION STRICKEN (CHECK REASON): D Rule 40(j), SCRCP; D Bankruptcy;

D Binding arbitration, subject to right to restore to confirm, vacate or modify

arbitration award; D Other

0 DISPOSITION OF APPEAL TO THE CIRCUIT COURT (CHECK APPLICABLE BOX):

D Affirmed; D Reversed; D Remanded; D Other

NOTE: ATIORNEYS ARE RESPONSIBLE FOR NOTIFYING LOWER COURT, TRIBUNAL, OR

ADMINISTRATIVE AGENCY OF THE CIRCUIT COURT RULING IN THIS APPEAL.

IT IS ORDERED AND ADJUDGED: [8J See attached order (formal order to follow) D Statement of Judgment

by the Court:

ORDER INFORMATION

This order [8J ends D does not end the case.

Additional Information for the Clerk:

INFORMATION FOR THE JUDGMENT INDEX

Complete this section below when the judgment affects title to real or personal property or if any amount

should be enrolled. If there is no judgment information, indicate " N/ A" in one of the boxes below.

Judgment in Favor of Judgment Against Judgment Amount To be Enrolled

(List name(s) below) (List name(s) below) (List amount(s) below)

(see Final Order and Judgment) $

$

$

If applicable, describe the property, including tax map information and address, referenced in the order:

The judgment information above has been provided by the submitting party. Disputes concerning the amounts contained in this

form may be addressed by way of motion pursuant to the SC Rules of Civil Procedure. Amounts to be computed such as interest

or additional taxable sts not available at the time the form and fi nal order are submitted to the judge may be provided to the

clerk. Note: Title ab. actors and re. archers should refer to the official court order for judgment details.

Circuit Court Judge Judge Code

For Clerk of Court Office Use Only

SCRCP Form 4C (03/2013) Page 1

..

?l .

This judgment was entered on the fill day of t v ~ f

placed in the appropriate attorney's box on this \ A ~ day of

to parties (when appearing prose) as follows:

, 2014 and a copy mailed first class or

5:epf-- , 2014 to attorneys of record or

Christopher D. King, Esq.

Burl Williams, Esq.

P.O. Box 10648

Greenville, SC 29603

William Herlong, Esq.

P.O. Box 2003

Greenville, SC 29602

Russell T. Burke

P.O. Box 2426

Columbia, SC 29202

Thomas Stephenson

207 Whitsett Street

Greenville, SC 29601

SCRCP Form 4C (03/2013)

Lucas W. Andrews

Jean-Paul Boulee

Michael McConnell

Mark Weintraub

1420 Peachtree Street NE, Suite 800

Atlanta, GA 30309

W. Howard Boyd, Jr.

P.O. Box 10589

Greenville, SC 29603

Jeffry P. Dunlaevy

Phillip W. Kilgore

Madison Baker Wyche III

P.O. Box 2757

Greenville, SC 29602

Arthur Felsenfeld

Cassandra Porsch

Lynne Uniman

450 Lexington Ave.

New York, NY 10017

Michael Giese

T. Foster Haselden

P.O. Box 87

Greenville, SC 29602

Mason Goldsmith

P.O. Box 1887

Greenville, SC 29602

Peter Ladig

Lewis Lazarus

Brett McCartney

500 Delaware Ave. Suite 1500

Wilmington, DE 19801

H. Sam Mabry, III

J. Derrick Quattlebaum

P.O. Box 2048

Greenville, SC 29602

George T. Manning

2727 North Harwood Street

Dallas, TX 75201

Matthew Smith

555 17'h Street Suite 3200

Denver, CO 80202

David Stecfel

1700 Lincon Street, Ste. 4 700

Denver, CO 80203

Myron Steele

1313 North Market Street, 6'h Floor

Wilmington, DE 19801

Page 2

ATIORNEY(S) FOR THE PLAINTIFF(S)

Court Reporter:

Donald J. Wolfe Jr.

P.O. Box 951

Wilmington, DE 19801

ATIORNEY(S) FOR THE DEFENDANT(S)

CLERK OF COURT

ADDITIONAL INFORMATION REGARDING DECISION BY THE COURT AS REFERENCED ON

PAGEl.

This action came to trial or hearing before the court. The issues have been tried or heard and a decision rendered.

See Final Order and Judgment.

SCRCP Form 4C (03/2013) Page3

***********************************

FORM 4C INSTRUCTIONS-JUDGMENT IN A CIVIL CASE

(Instructions for Information Only-Not to be filed with Form 4C)

1. Form 4C-Judgment in a Civil Case has been modified to add order information and

enrollment instructions for the clerk of court. The purpose of Form 4 has not changed

with the exception that judgment information is provided when applicable.

2. Please note that the Form 4C must be attached to all orders that include information to

enroll in the judgment index. The clerk will not be responsible for reading the order to

determine enrollment information.

The attorney or prevailing party will prepare and attach the Form 4C when submitting the

proposed order that includes judgment enrollment information for the judgment index.

The judge will review and sign Form 4C when he or she signs an order that includes

judgment enrollment information for the judgment index.

3. Form 4C is not required to be submitted to the Court with orders that do not include

information to enroll in the judgment index. If the clerk receives such an order without

Form 4C attached, the clerk should enter and process the order pursuant to Rule 58 and

Rule 77(d), SC Rules of Civil Procedure (i.e., the clerk should serve notice of entry of the

judgment by mail or provide the attorneys with copies of the signed order by other

means).

4. The "Information for the Judgment Index" section should be completed when the

judgment affects title to real or personal property or if any amount should be enrolled. In

the "Judgment in Favor of' column, enter the name of the party to whom the judgment is

awarded. In the "Judgment Against" column, enter the name of the person to whom the

judgment is against. The judgment amount to be enrolled should be noted in the

"Judgment Amount" column. As necessary, describe any property referenced in the

order if it is to be enrolled in the judgment index. If there is no judgment information to

enroll, indicate "N/A" in one of the boxes in this section of the form.

5. To enter information to accommodate multiple parties, additional Form 4Cs may be used

as necessary. Additional space may be inserted on the form as necessary.

6. The section "For the Clerk of Court Office Use Only" should be completed by the clerk

as it has been with the previous version of Form 4.

7. If the matter is on appeal to the Circuit Court, then the parties on the form should be

changed from Plaintiff and Defendant to Appellant and Respondent.

8. If an arbitrator prepares an order after arbitration, the arbitrator should strike through

"Circuit Court Judge" and indicate "Arbitrator" in the signature block.

SCRCP Form 4C (03/2013) Page 4

9. If a Special Circuit Court Judge, Master in Equity, or Special Referee prepares an order

after hearing a Circuit Court matter, then he or she should strike through the title "Circuit

Court Judge" below the signature line and indicate the appropriate title.

10. When an Order of Foreclosure is filed, neither the parties or debt owed should be listed in

the Information for the Judgment Index Section, unless the foreclosure order specifically

requires entry of the full judgment amount before the foreclosure sale, pursuant to

Section 29-3-650 of the SC Code.

11. If the deficiency judgment is waived in a Foreclosure action, indicate N/A in the

"Judgment Amount To Be Enrolled" box.

12. Foreclosure actions should be ended by the Clerk of Court upon receipt of the Order of

Foreclosure. Subsequent information, including deficiency judgments, can be added to

the action after the case is ended. The Master in Equity should end the action in the MIE

system upon the receipt of the Order of Foreclosure.

13. When judgment enrollment information is included in the Information for the Judgment

Index Section (for example, when there is a deficiency judgment), only the parties who

the judgment is for and against should be included in the Section. Subordinate parties

and lienholders should not be included in the box if there is not a judgment amount

specifically for or against them.

14. Form 4C is not required to be attached to Transcripts of Judgment and Confession of

Judgment.

SCRCP Form 4C (03/2013) Page 5

STATE OF SOUTH CAROLINA )

COUNTY OF GREENVILLE

) IN THE COURT OF COMMON PLEAS

)

In re International Textile Group Merger ) C.A. No. 2009-CP-23-3346

Litigation )

FINAL ORDER AND JUDGMENT

Pursuant to Paragraph 2 of the Order Preliminarily Approving Class Action and

Derivative Settlement and Establishing Schedule for Procedures to Consider Final Approval,

entered February 19, 2014 (the "Preliminary Approval Order") and subsequent comrn_unications, '""

( . .:...: --

, _ _. ..,..,.. (., r-

_c --1 rr1

a Settlement Hearing was held before this Court on June 26, 2014, starting at 9:0Q-,a.m. thea

r t l r ! 1

- u ._, <.>

Greenville County Courthouse, to: (1) determine whether the Settlement should be approved

f'-) --,

the Court as fair, just, reasonable, and adequate; (2) determine the award of fees and r:;

::3 ' -11

costs to Class/Derivative Counsel; (3) consider entry of Final Judgment on the Claims;

.) c.:

:- :xJ

and ( 4) any related matters as described in the Parties' Stipulation and Settlement -j

filed February 19, 2014 (the "Stipulation").

1

After careful consideration of the entire record,

based on the Court 's experience with the Actions to date, all papers fi led in the Actions, and the

presentations made by Counsel, the Court finds as follows:

I. SUMMARY OF LITIGATION. CERTIFICATION OF THE CLASS. AND

SETTLEMENT

These consol idated cases

2

involve a shareholder action (the "Class Action") and a

derivative action (the " Derivative Action") against the same Defendants challenging the fairness

of the 2006 merger between Safety Components, Inc. ("SCI") and the former International

Textile Group, Inc. ("FITG"). Plaintiffs allege that SCI and FITG were controlled by Wilbur L.

1

Capitalized terms not otherwise defined in this Order have the meanings ascribed to them in the

Preliminary Approval Order and/or the Stipulation.

2

This case was consolidated by order of this Court along with Case Nos. 2008-CP-23-270 l and

2009-CP-23-7320.

Ross, Jr., his investment company, W.L. Ross & Co., LLC, and his affiliates. After the merger,

SCI was renamed the new International Textile Group, Inc. ("NITG").

Plaintiffs allege that, among other things, the merger was not entirely fair to the SCI

minority shareholders and that Mr. Ross and his affiliates breached their fiduciary duties to SCI's

minority shareholders, and/or aided and abetted others in breaching their fiduciary duties to

SCI's minority shareholders. Plaintiffs also allege gross negligence and aiding and abetting

breach of fiduciary duty against RSM EquiCo Capital Markets LLC ("RSM"), which served as

the financial advisor to SCI's special committee charged with determining whether the proposed

merger was fair. Plaintiffs further allege that certain defendants were unjustly enriched by the

merger. The same claims were made in the Class Action and on behalf of NITG itself in the

Derivative Action.

Defendants

3

denied all material allegations against them, and asserted various affirmative

defenses in the Action.

After extensive discovery, the Court certified the Class in this case by Order entered

January 10, 2013 (the "Class Certification Order"), which also denied Defendants' motions to

disqualify Plaintiffs as derivative representatives. There was no collusion in the formation of the

Class. The issues of class certification and derivative status were vigorously contested by

Defendants, as shown by the Parties' discovery efforts and the extensive briefing by the Parties

on these issues. The Court incorporates herein by reference its findings and conclusions in the

Class Certification Order and, no new evidence having been presented, specifically finds again

that Plaintiffs and Class/Derivative Counsel are adequate representatives .of the Class and of

NITG. The Class as defined in the Class Certification Order and in Paragraph 33H of the

3

For convenience, the Defendants other than RSM are referred to herein as the "WLR

Defendants."

2

Stipulation is held to be the final settlement Class in this matter. For the reasons previously

discussed and analyzed in the Court's Class Certification Order, the Court finds that the final

Class meets all of the requirements of Rule 23(a), SCRCP.

Potential Class Members were notified of the Class Action pursuant to that Order, and

given the opportunity to opt out of the Class. No potential Class Member elected to opt out.

After additional discovery and motions practice, and after appointment of a Special

Litigation Committee ("SLC") by NITG to investigate and analyze the case, the Parties and the

SLC agreed to settle the case on the basis of an arm's-length negotiation process that lasted for

several months and concluded just before trial was to begin in September 2013. The Parties and

the SLC signed a Memorandum of Understanding on September 30, 2013, and, after several

more months of negotiations, signed a Stipulation and Settlement Agreement on February 19,

2014 (a copy of which is attached to the February 19, 2014, Preliminary Approval Order) ("the

Stipulation").

As to the Class Action, the Parties agreed that in exchange for a complete release, the

Defendants would pay Ten Million ($10,000,000.00) Dollars to the Claims Administrator, Rust

Consulting, Inc. ("Rust"), for distribution to Class Members who filed valid claim forms in

accordance with the Stipulation, less any attorneys' fees and costs awarded by the Court and

Rust's expenses.

As to the Derivative Action, the Parties agreed that in exchange for a complete release,

the Defendants would pay Twenty-six Million ($26,000,000.00) Dollars (the "Derivative Action

Settlement Cash Consideration"") to Rust, and further, that certain WLR entities would forgive

certain debt owed by NITG and cancel preferred shares in NITG in the face amount of

approximately $291,325,000.00 (the "Derivative Action Settlement Non-Cash Consideration").

In the Stipulation the Parties (excluding RSM) specifically agreed that the "actual economic

value" of the non-cash consideration was $45 million. Stipulation, n37 and 42. The total of the

cash and non-cash consideration in the Derivative Action was therefore $71 million.

By Order dated February 19, 2014, the Court preliminarily approved the Settlement (the

"Preliminary Approval Order"). As discussed more fully below, pursuant to the Preliminary

Approval Order, Rust mailed Notice of the Settlement on March 5 and 6, 2014, to Class

Members and to current shareholders of record of NITG. Among other things, the notice stated

that Class and Derivative Counsel would seek an attorneys' fee award of35% of the recovery for

the Class and for NITG, plus costs pro-rated between the cases totaling $2,621,601.22. No Class

Member objected to the fee request in the Class Action. The SLC and the WLR Defendants,

however, objected to the fee request in the Derivative Action, but took no position on the fee

request in the Class Action.

II. PERSONAL .JURISDICTION OVER PLAINTIFF CLASS MEMBERS

A. Introduction

In Phillips Petroleum Co. v. Shutts, 472 U.S. 797 (1985), the United States Supreme

Court held that a court may exercise jurisdiction over an absent class action plaintiff "even

though that plaintiff may not possess the minimum contacts with the forum which would support

personal jurisdiction over a defendant." Shutts, 472 U.S. at 811. In order to exercise personal

jurisdiction over a plaintiff class member, due process requires the class member:

Must receive notice plus an opportunity to be heard and participate in the

litigation, whether in person or through counsel. The notice must be the

best practicable, "reasonably calculated, under all the circumstances, to

apprise interested Parties of the pendency of the action and afford them an

opportunity to present their objections." The notice should describe the

action and the [class member's] rights in it. Additionally, ... due process

requires at a minimum that an absent plaintiff [class member] be provided

with an opportunity to remove himself from the class by executing and

returning an "opt out" or "request for exclusion" form to the court. Finally,

the Due Process Clause of course requires that the named plaintiff at all

times adequately represent the interests of the absent class members.

4

Id at 812 (citations omitted).

If the due process requirements of (I) notice; (2) opportunity to "opt out"; (3) opportunity

to be heard; and (4) adequate representation are met, a court properly asserts personal

jurisdiction over Class Members. See, e.g., Doe v. Bishop of Charleston, 407 S.C. 128, 754

S.E.2d 494 (2014); Hospitality Mgmt. Assoc., Inc. v. Shell Oil Co., 356 S.C. 644, 591 S.E.2d

611, 616 (2004). Here, each of the four requirements imposed by due process has not only been

met, but has been exceeded, so that this Court has personal jurisdiction over all persons falling

within the "Class" as defined in Paragraph 33.H of the Stipulation.

B. Notice

Due process requires that absent Class Members be given notice. However, notice does

not have to be perfect. A court does not lack personal jurisdiction over Class Members because

some Class Members did not get actual notice of the litigation. Notice must be "the best

practicable, reasonably calculated, under all the circumstances, to apprise interested Parties of

the pendency of the action and afford them an opportunity to present their objections." Shutts,

472 U.S. at 812 (quoting Mullane v. Central Hanover Bank and Trust Co., 339 U.S. 306, 314-15

(1950) (internal quotation marks omitted)).

]-Jere, two notices were sent to the Class Members: (I) the Notice advising Class

Members that the Class had been certified and that they had the right to exclude themselves from

the Class; and (2) the Notice of Settlement to Class Members and NITG shareholders that the

Actions had been settled and that they had the right to object to the Settlement. As discussed

below, these Notices to Class Members met and far exceeded the requirements of due process.

5

~ l t < f

1. The First Notice

In the Class Certification Order, this Court approved a written Legal Notice to be mailed

to Class Members and a Legal Publication Notice of Class Certification. The Notices were

written in plain English and specifically advised Class Members of:

I. The pendency of the Class Action and the fact the Class had been certified

by the Court;

2. A general description of what the Class Action was about;

3. The specific Class definition contained in the Court's Certification Order;

4. The Class Member's options, including the right to retain their own

counsel and the right of a Class Member to exclude themselves from the

Class and how and the deadline to do so; and

5. The names and addresses of Class Counsel.

Class Members were expressly given until March 25, 2013, to exclude themselves from (to opt

out of) the Class. Importantly, Class Members were told that, "if you decide not to exclude

yourself [from the Class] all further actions in this lawsuit will bind you." The First Notice

provided Class Members with accurate, fair, and reasonable information regarding the Actions,

the Class, and Class Members' right to opt out.

The Court finds that, on February 7, 2013, the Legal Notice was sent, by First Class

United States Mail, to the last known address of persons falling within the Class definition.

Williams Aff. 2. Along with the Legal Notice, Class Members were also mailed, by First Class

Mail, a written form to use to exclude themselves from the Class if they wished to do so. Id, Ex.

A. The Court finds that the Legal Publication Notice was published in The Wall Street Journal

on February 9, 16, and 23, 2013. Id 3. Publication in this manner assured due process notice

even to Class Members who were not reasonably identifiable or for whom the Parties did not

have an accurate mailing address. Additionally, a website and toll-free number were set up to

provide information about the Actions to Class Members and interested persons.

2. The Second Notice

Pursuant to Rules 23(b)(l) and (c), SCRCP, this Court's Preliminary Approval Order

directed that the Claims Administrator cause a Notice of Settlement, in a form approved by the

Court, to be mailed by First Class United States Mail to Class Members and Shareholders of

NITG as provided in the Stipulation. See February 19, 2014 Order, 'If 8 at 3-4. This Notice of

Settlement was a comprehensive, 32-page document and included, inter alia, the following

information:

o A description of the nature ofthe Actions;

o The definition of the Class certified;

o The class claims, issues, or defenses;

o That a Class Member or NITG shareholder may enter an appearance

through an attorney if the member so desires;

o That Class Members and NITG shareholders must submit any objections

by June 12, 2014 (which was seven business days before the originally

scheduled date for the Settlement Hearing);

That the judgment will have a binding effect and constitutes a release of

and bar of the assertion of Settled Claims; and

o A reasonable description of the benefits to be made available to the Class

Member and the procedures for applying for same.

Additionally, the beginning of the Notice of Settlement included a 2-page "Dear Shareholder"

section from the Court which summarized the Actions and the major aspects of the Class Action

and Derivative Action Settlements. The Class, and NITG shareholders, were clearly provided

sufficient information about the Actions to enable them to make an informed decision about

whether to object to the Settlement. See Manual for Complex Litigation (Fourth), 21.311 at 289

(2004). The Second Notice provided Class Members and NJTG shareholders with accurate, fair,

and reasonable information regarding the Actions, the Settlement, and their rights under the

7

~ I t

Settlement.

Based on the uncontested Affidavit of Jason Rabe, a Senior Project Administrator with

Rust, the Claims Administrator, the Court finds that the Notice of Settlement described above

was mailed to Class Members and NITG shareholders, by First Class United States Mail, on

March 5, 2014, and March 6, 2014. See Rabe Aff. ~ ~ 7, 9. Additionally, Rust received from

brokerage firms, banks, institutions and other nominees an additional 31 0 names and addresses

of potential Class Members who were also mailed notice packets. !d. ~ I 0. In instances where

notice packets were returned as undeliverable, Rust made substantial efforts to locate new

addresses through LEXIS NEXIS and notice packets were promptly mailed to potential Class

Members at the updated addresses. d . ~ 12. As of June 8, 2014, almost 1,500 notice packets had

been mailed pursuant to the Preliminary Approval Order. A Summary Notice of Class and

Derivative Action Settlement was published in Investor's Business Daily and transmitted over

PR Newswire on April 8, 2014. !d. ~ 14. Finally, a website and toll-free hotline were created by

Rust to provide information to Class Members, NITG shareholders, and interested persons

concerning the Settlement. d . ~ ~ 16-17.

3. The Charles Schwab Names

On July 23, 2014, the Court entered an order supplementing the notice requirements set

forth in the Preliminary Approval Order (the "Order Regarding Supplemental Notice") to address

potential newly identified names that were mentioned by Class/Derivative Counsel at the end of

the June 26, 2014 Settlement Hearing. Pursuant to the Order Regarding Supplemental Notice, the

Court directed the Claims Administrator to send via First Class United States mail a copy of the

Notice of Settlement (the Second Notice) to three shareholders who held shares ofNITG through

Schwab on or about February 19, 2014, and to communicate to them that they may file

8

1-tt-<t

objections to the Settlement by August 25, 2014 [over 30 days after the mailing].

4

In a

Supplemental Affidavit, the Claims Administrator confirmed that it complied with the

requirements of the Order Regarding Supplemental Notice. As of August 25,2014, none of these

shareholders filed an objection to the Settlement.

4. Summary

The notice program to the Class Members and NITG shareholders was the absolute best

notice practical under the circumstances, especially given the size of the Class and the number of

NJTG shareholders. The program used every modern means of communication available except

direct telephone calls, which would have been impracticable and excessively expensive. The

notice program, which was put together with careful thought by the Claims Administrator and

the Parties, included: (I) mailing the two Notices to each identifiable Class Member by First

Class United States Mail; (2) publishing the Notices of Class Certification and the Settlement in

newspapers with nationwide circulation; (3) establishing and maintaining websites with detailed

information on the Actions and the Settlement, including all pertinent pleadings and orders; and

(4) establishing and maintaining toll-free numbers where Class Members, NITG shareholders, or

4

The Second Notice specifically instructed holders of shares to forward the Notice to beneficial

owners. The mailing of the Notice of Settlement, particularly when considered with the Publication

Notice of the Settlement provided here, clearly complied with due process. There was no requirement

under Delaware law, South Carolina law or due process that any additional efforts be made to send the

Notice of Settlement (the Second Notice) to the shareholders whose shares were held by Schwab. See

American Hardware v. Savage Arms, 136 A.2d 690, 692 (Del. 1957) (holding "[i]f an owner of stock

chooses to register his shares in the name of a nominee, he takes the risks attendant upon such an

arrangement, including the risk that he may not receive notice of corporate proceedings ... . ");Preston v.

Allison, 650 A.2d 646, 649 (Del. 1994) (holding "[i]f a beneficial shareholder is disenfranchised because

of the record stockholder's failure to follow instructions no relief is afforded in the usual

case"). Nevertheless, the Court ordered re-mailing of the Notice of Settlement (the Second Notice) to the

three NJTG shareholders who may not have been directly mailed the Notice of Settlement by the Claims

Administrator and gave these three shareholders additional time to object to the Settlement.

interested persons could call to request information on the Actions or the Settlement.

5

The procedures utilized to advise Class Members of the Class Action, their right to

exclude themselves from the Class, their rights under the Settlement (including the right to

present objections and attend the Settlement Hearing) were extensive, well-reasoned, and easily

exceeded the requirements of due process. Similarly, the procedures followed to notify NITG

shareholders of the Derivative Action Settlement complied with Rule 23(b)(l), SCRCP, and with

due process. Each step of the Notice process was specifically approved and ordered by this

Court. All available, reasonable means of communication to convey notice to Class Members

and to NITG shareholders were used. The means of disseminating notice was, under the

circumstances, the best practical notice, reasonably calculated under all the circumstances to

apprise interested persons of: the pendency of Actions; the certification of the Class and each

Class Member's right to opt out; the proposed Settlement and Class Members' rights under that

Settlement and the way for a Class Member to submit a claim for Settlement benefits; and the

rights of the Class Members and NITG shareholders to object to the Settlement.

5

The original Legal Notice of class certification (the First Notice) was mailed to Class Members

using the names and addresses contained in NITG's shareholder records. See Instar Corp. v. Senouj, 535

A.2d 1351, 1355 (Del. 1997) (stating corporation is entitled to rely on its own stockholder list); American

Hardware v. Savage Arms, 136 A.2d 690 (Del. 1957) (holding corporation has ordinarily discharged its

obligations under Delaware law when it mails notice to the record owners). It appears that 32 of the First

Notice packets to Class Members were returned as undeliverable. However, as described above, the

Publication Notice of class certification, which was published in The Wall Street Journal for

approximately one month in January 2013, more than complied with South Carolina law and due process

to provide notice to Class Members who did not receive the mailed First Notice. Further, these 32 Class

Members were also mailed the Notice of Settlement (the Second Notice) by the Claims Administrator in

February 2014, at the same address used for sending the First Notice. It appears that 12 of the 32 Class

Members received the Notice of Settlement as only 20 of these Notices were returned to the Claims

Administrator as undeliverable. The Claims Administrator updated the addresses for these 20 people and

re-sent the Notice of Settlement (the Second Notice). After re-mailing, only six of the Notices of

Settlement sent to these 32 Class Members came back to the Claims Administrator as undeliverable. None

of these 32 Class Members objected to the Settlement or tried to opt out of the Class. The Court

specifically finds that the notice procedures used to notify these 32 Class Members of the certification of

the Class, their right to opt out of the Class, the Settlement and their right to object to the Settlement more

than complied with Delaware law, South Carolina law and due process.

10

C. Opportunity to Opt Out

The Class Certification Order and the First Notice to Class Members specifically notified

Class Members of their right to request exclusion from the Class. Class Members had over a

month from the date the First Notice was mailed and published to make a decision on whether to

opt out of the Class. The time period provided for Class Members to make a decision on whether

to exclude themselves from the Class was more than adequate to allow for Class Members to

investigate the issues and to make an informed decision and, thus, complied with due process.

Class Members were even provided a form on which to exercise their right to exclude

themselves from the Class. No Class Member timely opted out of the Class. In fact, no Class

Member has attempted to opt out of the Class whether on a timely or untimely basis.

Consistent with the Preliminary Approval Order, the Court finally finds and concludes

that Class Members were not required to be given a second opportunity to opt out of the Class

after the Parties reached a settlement in this matter. As previously mentioned, when the Court

certified the Class in January 2013, Class Members were mailed a written notice and given the

right to opt out of the Class in accordance with South Carolina law and due process. The written

notice expressly advised: "If you decide not to exclude yourself, all further actions in this lawsuit

will bind you." No Class Member opted out of the class. The Settlement does not change the

definition of the Class from the definition originally certified by the Court. Neither South

Carolina law nor due process requires that Class Members be given a second opt-out period to

exclude themselves from the settlement of a previously certified class action. Although Federal

Rule of Civil Procedure 23(e)(4) provides a federal district court the discretion to allow a second

opt-out period, no such provision appears in Rule 23, SCRCP. Based on the omission of such

provision, it appears the drafters of Rule 23, SCRCP, did not intend to permit a second or

subsequent opt-out period. See Salmonsen v. CGD, Inc., 377 S.C. 442, 448-52, 661 S.E.2d 81,

85-87 (2008) (finding the drafters' decision to exclude from Rule 23, SCRCP, a provision

II

f-ut

contained in Fed. R. Civ. P. 23 allowing for immediate interlocutory appeal of a class

certification order supported the conclusion that no such right to an immediate appeal was

intended in South Carolina state court); Littlefield v. South Carolina Forestry Comm 'n, 337 S.C.

348, 354, 523 S.E.2d 781, 784 (1999) ("Our state class action rule differs significantly from its

federal counterpart."). Moreover, even in federal district court, a subsequent right to opt out of a

settlement class is not required or mandated. See, e.g., Comer v. Life Ins. Co. of Ala., No. 08-CV-

228-JFA, 2011 U.S. Dis!. LEXIS 36042, *5 (D.S.C. Mar. 31, 2011) ("Because a full and

complete Class Notice as required by Rule 23 has already been provided to each Class Members,

no additional opt-out period is required for purposes of the pending settlement.").

D. Opportunity To Be Heard

Class Members were clearly given the right to be heard in this case. The Notice to Class

Members and NITG shareholders specifically gave them the right to submit written objections to

the proposed Settlement in the Actions and/or to appear at the Settlement Hearing. No Class

Member submitted a written objection to the Settlement and no Class Member submitted a

written notice to appear at the Settlement Hearing. No NITG shareholder objected to the

Settlement. The fact that there were no objectors demonstrates the Class as a group has no

objection to the Settlement in this matter. Flinn v. FMC Corp., 328 F.2d 1169, 1173 (4th Cir.

1975); Brunson v. Louisiana-Pacific Corp., 818 F. Supp. 2d 922, 927 (D.S.C. 2011); see also

Stoetzner v. United States Steel Corp., 897 F.2d 115, 118-19 (3d Cir. 1990) (finding the fact only

10% of class objected "strongly favors settlement"); Boyd v. Bechtel Corp., 485 F. Supp. 610,

624 (N.D. Cal. 1979) (finding the fact only 16% of class objected deemed "persuasive" on

adequacy of settlement).

E. Adequacy of Representation

Finally, due process requires that the Plaintiffs and their counsel at all times adequately

12

frt-r

represent the interest of the Class Members. Adequacy requires an examination into the capacity

of the Plaintiffs to act on behalf of the Class they seek to represent and into the competency and

conflicts of Class/Derivative Counsel. See AmChem Products, 521 U.S. at 625-26.

In its Class Certification Order, the Court previously conducted a preliminary

examination of the adequacy of representation in this case, both as to Named Plaintiffs and

Class/Derivative Counsel, and preliminarily found both the Plaintiffs and Class/Derivative

Counsel would be adequate representatives in this case. There has been no evidence introduced

in the record since this Court's Class Certification Order undermining these findings. The

Settlement in this case was negotiated in good faith through arms-length, non-collusive

negotiations. The Plaintiffs are members of the Settlement Class they purport to represent. The

SLC, and its own retained counsel, acted as an independent body vigorously looking out for the

interests ofNITG.

The Court has conducted a full and complete review of the Stipulation, the underlying

facts and the pleadings in the case and has concluded that the Class Settlement and Derivative

Settlement are, individually and jointly, fair, adequate and reasonable to the beneficiaries of

those Settlements. The Settlement itself adequately compensates Class Members for their.

individual damages. Moreover, there is absolutely no evidence in the record of any conflict of

interest between Class/Derivative Counsel and the Class or that Class/Derivative Counsel at any

time acted in conflict with or contrary to the interests of the Class. Class/Derivative Counsel

obtained a fair settlement for the Class, particularly given the hotly disputed procedural, legal

and factual issues in the Actions. Further, even after the Settlement was reached,

Class/Derivative Counsel spent and will spend significant periods of time to ensure that the

Settlement itself is administered fairly for the benefit of the Class and individual Class Members.

13

/n<t-

Two specific questions of adequacy/conflict were raised in the Actions which will be

addressed here. First, an issue was raised concerning whether the claims asserted in the Actions

could be maintained simultaneously as class claims on behalf of legacy SCI shareholders and as

derivative claims on behalf of NITG. The Court addresses this concern here only to the extent

the simultaneous pursuit of these claims creates an alleged conflict between the Class and NITG.

The Court finds this alleged conflict does not undermine the adequacy of representation provided

by Plaintiffs or Class/Derivative Counsel to either the Class or NITG. Class/Derivative Counsel

vigorously represented the interests of the Class and obtained a fair, adequate, and reasonable

settlement for the Class Members given the liability issues and the projected damages of the

Class. Class/Derivative Counsel did not put the interests ofNITG over those of the Class and the

Class did not obtain less in the Settlement because Class/Derivative Counsel was also

pursuing derivative claims for NITG. The Settlement does not prefer the Class Action over the

Derivative Action or vice versa. Indeed, the record demonstrates that simultaneous maintenance

of the claims benefited both the Class Action claims and the Derivative Action claims. Plaintiffs,

many of whom are sophisticated investors, also acted without conflict in approving the

Settlement for the Class. Similarly, NITG was represented by the SLC with its own independent

retained counsel who approved the terms of the Derivative Action Settlement as fair, adequate

and reasonable from the standpoint of NITG. Finally, the Court would note that a common

Notice of Settlement, which set forth the details of both the Class Action Settlement and

Derivative Action Settlement and the settlement funds being allocated to each Settlement, was

approved by the Court and mailed to Class Members and NITG shareholders. This Notice

included a two-page "Dear Shareholder" summary from the Court which clearly and plainly

discussed the financial aspects of the Class Action Settlement and Derivative Action Settlement.

No Class Member or NITG shareholder complained about or objected to any aspect of either

Settlement.

Second, on July 31, 2013, the WLR Entity Defendants filed a Motion to decertify the

Class and disqualify Attorney William Herlong on the grounds of a conflict created by Mr.

Herlong representing the Class and his prior/continuing representation of Brian Menezes. This

Motion had not been addressed by the Court at the time the Actions were tentatively settled and

the Parties' Memorandum of Understanding was executed in late September 2013. The Court has

carefully reviewed the Motion and denies the Motion. The grounds raised in the Motion do not

furnish a basis for the Court to conclude there is any conflict between Mr. Herlong's

representation of Mr. Menezes and the interests of the Class especially in light of the fact that an

independent Special Litigation Committee represented the interests of NITG, the holder of the

derivative claim, in connection with the settlement discussions. The Court finds any such alleged

conflict did not affect the fairness, adequacy or reasonableness of the Settlement negotiated on

behalf of the Class. Further, in addition to Mr. Herlong, the Class was represented by two other

law firms who did not have the disqualifying conflict alleged against Mr. Herlong.

III. FAIRNESS AND ADEQUACY OF SETTLEMENT

The next issue to be considered when a Court reviews a class action or derivative action

settlement is whether the settlement is fair, just, adequate, and reasonable. In deciding whether to

approve such a settlement, this Court is required to ensure that the agreement is not the product

of fraud or collusion and that, taken as a whole, the settlement is fair, just, adequate, and

reasonable to the Class as a whole and to NITG. Christina A. ex. Rel. Jennifer A. v. Bloomberg,

315 F.3d 990, 992 (8th Cir. 2003); Oslan v. Law Offices of Mitchell N. Kay, 232 F.Supp.2d 436,

440 (E.D. Pa. 2002). This Court must examine the settlement in its entirety, rather than isolating

individual components for analysis. Reed v. Rhodes, 869 F. Supp. 1274, 1282 (N.D. Ohio 1994);

Reynolds v. King, 790 F. Supp. 1101, 1108 (N.D. Ala. 1990) (holding that if"claims presented

and the relief afforded are homogenous, then settlement is an intrinsically class decision in which

majority sentiments should be given great weight" (internal quotation marks omitted)).

In Flinn v. FMC Corp., 528 F.2d 1169, 1173-74 (4th Cir. 1975), the Fourth Circuit set

forth several factors which should be considered when a court reviews a class action settlement

under former Rule 23(e) of the Federal Rules which is similar to Rule 23(c), SCRCP: (I) the

probabilities of ultimate success should the case be litigated; (2) the complexity, expense and

likely duration of the case if the case is not settled and litigation is pursued; (3) the stage of the

proceedings when the case is settled; (4) the lack of collusion in the Settlement between

plaintiffs and defendants; (5) the reaction of the plaintiff class to the Settlement; and (6) the

experience of counsel who have represented the plaintiffs and their opinion regarding the

Settlement. See also Brunson v. Louisiana-Pacific Corp., 818 F. Supp. 2d 922, 927 (D.S.C.

2011). Here, these factors, when considered both separately and together, demonstrate that the

Settlement in this case is fair, adequate, just, and reasonable to the Class as a whole and to NITG.

The likelihood of ultimate success if the Actions were fully litigated was uncertain.

Although Plaintiffs survived the Defendants' motions for summary judgment on some liability

issues, the law is well settled in South Carolina that denial of a motion for summary judgment is

not a ruling on the merits and merely allows the case to proceed to trial. The Actions would have

been extremely complex and expensive to litigate further and potentially difficult to try. The

amount of damages was uncertain. The Actions were certainly sufficiently well advanced,

however, that there was sufficient development of the facts to permit a reasonable and informed

judgment by Class/Derivative Counsel on the possible merits and the complexity of litigating the

matters further. The Settlement was reached without collusion and in good faith during arms-

length negotiations. No Class Member or NJTG shareholder has objected to the Settlement. The

Class and NITG were represented by competent and experienced counsel, including independent

counsel for the SLC, all of whom approve of the Settlement.

Substantial cash is being paid to the Class to settle the Class Action and substantial cash

and non-cash benefits are being paid to NITG to settle the Derivative Action. The Stipulation,

which is being finally approved by this Court, provides for a $10 million settlement fund to

which Class Members can make a claim for benefits and from which attorneys' fees and

expenses for the Class Action will be paid. The Stipulation provides for $26 million in cash

consideration and $45 million in non-cash consideration for the Derivative Action Settlement,

from which attorneys' fees and expenses for the Derivative Action will be paid. All Parties,

including the SLC acting for NITG, have stipulated that the non-cash consideration has an actual

economic value to NITG of $45 million. There is substantial evidence in the record that the non-

cash consideration has an actual economic value to NITG of $45 million and, based on its own

independent review of the evidence, the Court so finds. The Settlement affords a substantial and

immediate remedy for the Class Members and NITG, while obviating the need for a lengthy and

uncertain trial and potential appeals after trial.

IV. AWARD OF ATTORNEYS FEES AND COSTS

Class/Derivative Counsel petitioned the Court for an award of reasonable attorneys' fees

and costs in the amount of one-third of the settlement value in both the Class and Derivative

Actions, plus pro-rated expenses in each case. The attorneys' fee petition was supported by a

lengthy memorandum, affidavits from counsel and experts, and exhibits.

6

No Class Member

6

The SLC filed but has subsequently withdrawn a Motion to Alter or Amend Judgment Pursuant

to Rule 59(e) concerning the Court's denial of the SLC's "motion to compel production of items

identified as numbers 8 and 9 in the Subpoenas duces tecum." (SLC Rule 59( e) Motion at 1). The SLC's

Subpoenas duces tecum sought, at paragraphs 8 and 9, documents concerning paragraph 19 of the

affidavit of William B. Chandler Ill (appearing on page 17 of the appendix to Class/Derivative Counsel's

(footnote continued)

17

filed any objection to the proposed one-third attorneys' fee award plus pro-rated costs.

7

The

WLR Defendants and the SLC objected to the attorney fee petition in the Derivative Action only,

and served lengthy memoranda, affidavits, and exhibits in opposition. RSM took no position

concerning the fee petition. Class/Derivative Counsel thereafter filed a reply brief, with

supporting affidavits. The Court held a hearing on the fee petition on June 26, 2014, and has

carefully considered the arguments and memoranda submitted by counsel.

A. Choice of Law

Both the Class and Derivative Actions alleged a breach of fiduciary duty against the

WLR Defendants under Delaware law, unjust enrichment against all defendants under South

Carolina law, and aiding and abetting breach of fiduciary duty and gross negligence against RSM

under South Carolina law. The parties disagree as to whether Delaware or South Carolina law

should govern the attorneys' fee award.

As discussed below, the methodology for determining a reasonable fee from a common

fund is nearly identical in South Carolina and Delaware. Both states employ a factorial analysis

and do not employ per se rules or mechanical guidelines for a proper percentage award. See, e.g.,

brief in support of its petition to approve the settlement and for an award of fees and costs), and

paragraphs 5-6 of the affidavit of Russell T. Burke appearing at pages 249-251 ofthe same appendix).

The Court has not relied on the averments that were referenced by paragraphs 8 and 9 of the

SLC's Subpoenas duces tecum in reaching its decision granting an award of fees and costs here.

Similarly, the Court has not relied upon the evidence identified in Paragraphs 1-8 of the SLC's Motion to

Strike or Exclude Affidavits. As discussed below, the Court has considered the Affidavit of Eric A.

Powers, which is the subject of Paragraph 9 of the motion to strike, only to the extent that it supports the

parties' stipulation that the value ofthe non-cash consideration portion of the Derivative Settlement is $45

million.

The Court has, as discussed below, considered Counsel's averments concerning hours worked

and hourly rates. Such evidence is routinely introduced at the fee application stage, which is the first stage

in the case at which it becomes relevant.

7

The notice to the class stated that Class Counsel would seek 35% of the $10 million settlement

fund, plus costs, pursuant to their fee agreement with the class representatives. In the fee petition to this

Court, the request was reduced to one-third (33.333%), plus costs and expenses

Americas Mining Corp. v. Theriault, 51 A.3d 1213, 1261 (Del. 2012) ("[t]he adoption of a

mandatory methodology or particular mathematical model for determining attorney's fees in

common fund cases would be the antithesis of the equitable principles from which the concept of

such awards originated"). Therefore, based on the Court's review of South Carolina and

Delaware attorneys' fee decisions, the Court finds that its determination of a reasonable

attorneys' fee award in both the Class and the Derivative Actions is consistent with the law of

both states.

B. The Common Fund Doctrine

The Court finds that under both South Carolina and Delaware law, Class and Derivative

Counsel are entitled to an award of attorneys' fees in both cases under the common fund

doctrine. First Union Nat'/ Bank of S.C. v. Soden, 333 S.C. 554, 573-574, 511 S.E.2d 372, 382

(Ct. App. 1998); see also Tandycrafts, Inc. v. Initio Partners, 562 A.2d 1162, 1164-65

(Del.l989) (common fund doctrine applies to both derivative and class action cases); Americas

Mining Corp. v. Theriault, 51 A.3d 1213, 1252-53 (Del. 2012) (common fund doctrine applied in

derivative case). There is no dispute that Class/Derivative Counsel's efforts have led directly to

the creation of a $71 million common fund benefit for NITG, and the creation of a $10 million

common fund benefit for the Class. Therefore, Class/Derivative Counsel are entitled to

percentages of each of those funds as an award of reasonable attorneys' fees and costs.

C. Determination of Reasonable Attorneys' Fees

1. Legal Framework

The Court has broad discretion to determine the amount of a reasonable fee award from

the common fund created in the Class Action and the Derivative Action. Condon v. State, 354

S.C. 634, 643, 583 S.E.2d 430, 435 (2003) (circuit court's factual finding in awarding fee upheld

unless not supported by "any competent evidence.") (emphasis in original); Americas Mining, 51

19

f-r;r

A.3d at 1255, 1261 ("[t]he detennination of any attorney fee award is a matter within the sound

judicial discretion of the Court of Chancery"; "[t]he percentage awarded as attorneys' fees from

a common fund is committed to the sound discretion of the Court of Chancery.").

In common fund cases, "[m]ost courts utilize the percentage method for determining the

fee - that is, they award counsel a percentage of the fund as their fee - and most then apply a

series of factors to ensure that the resulting percentage is reasonable." Newberg on Class Actions

14.6 (2013); see also Federal Judicial Center, Manual for Complex Litigation, Fourth, 14.121

at 187 (2004). This percentage of recovery methodology has been used in both South Carolina

and Delaware for the determination of reasonable attorneys' fees from a common fund. See

Condon v. State, 345 S.C. 634, 643, 583 S.E.2d 430, 435 (2003) (common fund case approving

percentage of recovery method used by the court below); Layman v. State, 376 S.C. 434,452-54,

658 S.E.2d 320, 330 (2008) (noting that the lodestar method is used in statutory fee-shifting

cases, but the percentage of recovery method is often used in common fund cases); Americas

Mining Corp., 51 A.3d at 1252-54.

The factors used to determine a reasonable fee award are almost identical in South

Carolina and in Delaware. In particular, South Carolina courts have identified the following,

non-exclusive list of factors:

I) the nature, extent, and difficulty of the case;

2) the time necessarily devoted to the case;

3) professional standing of counsel;

4) contingency of compensation;

5) the beneficial results obtained; and

6) the customary legal fees for similar services.

20

frrr

Condon, 345 S.C. at 643, 583 S.E.2d at 435 (common fund case approving factors set forth in

Jackson v. Speed, 326 S.C. 289, 308, 486 S.E.2d 750, 760 (1997)). In Delaware, the courts

analyze the following factors set forth in Sugar/and Indus., Inc. v. Thomas, 420 A.2d 142 (Del.

1980):

1)

2)

3)

4)

5)

the results achieved;

the time and effort of counsel;

the relative complexities of the litigation;

any contingency factor; and

the standing and ability of counsel involved.

Americas Mining, 51 A. 3d at 1254 (citing Sugar/and).

The only Jackson v. Speed factor not specifically identified in Sugar/and is "the

customary legal fees for similar services." Nonetheless, Delaware courts routinely look to fee

awards granted in analogous cases to inform their judgments. See, e.g., Americas Mining, 51

A.3d at 1259-1260. Further, in Delaware, the primary factor in awarding attorneys' fees is the

beneficial results achieved. !d. at 1254.

Each factor is analyzed below.

2. Application of Jackson v. Speed and Sugar/and Factors to this Case

a. The nature, extent, and difficult of the case

The Court finds that the Class and Derivative Actions were extremely complicated and

involved novel issues under Delaware law as well as difficult valuation issues. The complexity

of the factual issues is amply demonstrated by the 83 single-spaced First Amended Complaint,

which amounts to a synopsis of nearly I 00 days of depositions, over a million pages of

documents produced in discovery, and 45 expert reports.

21

b. The time necessarily devoted to the case

The Court finds that Class/Derivative Counsel spent nearly six years prosecuting these

cases. There are very few, if any, reported decisions in South Carolina or Delaware, in which

plaintiffs' counsel devoted as much time and effort as was invested in these cases. The cases

required extensive discovery, multiple expert reports, dozens of depositions, and voluminous

motion practice. Class/Derivative Counsel aver they invested approximately 30,000 hours in the

two cases, which the Court finds easily believable, given the vigorous defense mounted in these

cases by multiple law firms. The enormous effort, as well as the thousands of hours, expended by

Class/Derivative Counsel prosecuting these cases easily support substantial fee awards to be paid

out ofthe common fund benefits created for the Class and NITG, respectively.

c. Professional standing of counsel

The Court finds that Class and Derivative Counsel enjoy a high standing in the bar. All

have significant experience working on both class action and complex business litigation cases.

In particular, Mr. Chandler served as Vice-Chancellor and Chancellor of the Delaware Court of

Chancery for twenty-two years, authoring many of the opinions relevant to this litigation.

d. Contingency of compensation

The Court finds that this case was taken on a fully contingent basis and fully litigated for

nearly six years before the parties settled it on the eve of trial. Class and Derivative Counsel were

fully at risk of receiving no compensation whatsoever throughout these cases.

e. The beneficial results obtained

This factor is of primary importance in the Delaware decisions, and it is also important in

South Carolina cases. See, e.g., Condon v. State, 345 S.C. 634, 643, 583 S.E.2d 430, 435 n.S

(2003). The Court finds that the beneficial results are substantial for both the minority

shareholders of SCI in the Class Action, and for NITG in the Derivative Action.

22

1-o-.Y

As for the recovery in the Class Action, the settlement amounts to $7.79/share for all

minority shareholders of SCI (excluding Mr. Menezes), which is nearly 60% of the $13.25/share

price of SCI at the time of the merger. The Court finds as a matter of fact that the Class Action

Settlement provides a substantial benefit to the Class Members.

As for the recovery in the Derivative Action, the settlement consisted of the cash

component of $26 million, and the noncash component consisting of the forgiveness of NITG

debt and the cancellation of NITG preferred shares (including future interest) with an aggregate

face value of $291.3 million. The SLC, the WLR Defendants, and Class/Derivative Counsel

stipulated that the economic value of the non-cash consideration was $45 million to NITG. The

Court finds as a matter of fact that the non-cash consideration is worth $45 million, and therefore

the total settlement value of the Derivative Action to NITG is $71 million.

8

The Court finds as a

matter of fact that based on the undisputed facts of the case and the legal issues presented, the

derivative settlement provides a substantial benefit to NITG.

f. The customary legal fees for similar services

It is the Court's responsibility and duty to ensure that the fee award is reasonable, and

examining fee awards in similar cases is designed to foster uniformity in fee decisions. Condon

v. State, 354 S.C. 634, 583 S.E.2d 430, 435 n.8 (2003) (noting the lengthy analysis by the circuit

court of fee awards in other cases, as opposed to the contingency fee agreement itself, was

"particularly persuasive"). Although this factor from Jackson v. Speed is not listed in Sugar/and,

8

This Court is not bound to accept the parties' stipulation that the noncash consideration was

worth $45 million. Plaintiffs' counsel therefore submitted the expert report on the valuation of Dr. Eric

Powers of USC's Moore School of Business. Dr. Powers opined that the actual value of the noncash

portion of the derivative settlement was between $74.4 million and $109 million. No contrary estimate

was submitted, although Defendants and the SLC objected to the admissibility of the report. The Court

has not considered the Powers report, except to the extent that it supports the parties' stipulation that the

derivative settlement is worth $71 million. Even in the absence of the Powers report, the Court finds that

the parties stipulated value of $71 million is a reasonable estimation of the value of the derivative

settlement.

23

the Delaware courts routinely consider awards in other common fund cases, and award higher

percentages the longer a case has progressed before being resolved. See, e.g., Americas Mining,

51 A.3d at 1259-1260.

9

A survey of attorneys' fee awards nationally reveals that courts have awarded a wide

percentage range in common fund cases, and that a one-third fee award is common in class

actions:

No general rule can be articulated on what is a reasonable percentage of a

common fund. A district court may use its discretionary powers to determine what

is a reasonable and fair award from a common fund, where the fund itself

represents the benchmark from which reasonableness is measured. Most courts

utilize the percentage method for determining the fee - that is, they award counsel

a percentage of the fund as their fee - and most then apply a series of factors to

ensure that the resulting percentage fee is reasonable ....

Usually 50 per cent of the fund is the upper limit on a reasonable fee award from

a common fund, in order to assure that fees do not consume a disproportionate

part of the recovery obtained for the class, though somewhat larger percentages

are not unprecedented. In the normal range of common fund recoveries in

securities and antitrust suits, common fee awards fall in the 20 to 33 per cent

range ....

Empirical studies show that, regardless whether the percentage method or

the lodestar method is used, fee awards in class actions average around one-

third of the recovery.

4 Newberg on Class Actions 14:6 at 1-2 (4th ed.) (footnotes omitted, emphasis added).

There are also numerous decisions from both the South Carolina Circuit Court

10

and the

Delaware Court of Chancery awarding fees of thirty percent or more.

11

Likewise, the South

Carolina federal district court has awarded fees of 30% or more.

12

9

Although Class/Derivative Counsel maintained that the fee agreement of 35% plus costs should

be the starting point of the analysis, the Court has not considered the fee agreements here.

10

See, e.g., Edwards v. SunCom, 2008 WL 4897935 (S.C. Ct. Com. Pl. May 5, 2008) (one-third

of the fund, plus costs); Lackey v. Green Tree Fin. Corp., C.A. No. 96-CP-06-073 (S.C. Ct. Com. Pl. July

24, 2000) (one-third fee award); Bazzle v. Green Tree Fin. Corp., C.A. No. 97-CP-18-258 (S.C. Ct. Com.

Pl. July 24, 2000) (one-third fee award); Fairey v. Exxon Corp., C.A. No. 94-CP-38-118 (S.C. Ct. Com.

Pl. Oct. 9, 2003) (noting fee range in federal securities cases of 19% to 45%, and awarding 40% of $30

(footnote continued)

24

There are, however, South Carolina and Delaware cases that have awarded fees less than

30% of the common fund, especially in settlement cases.

13

As noted by the Delaware Supreme

Court:

Delaware case law supports a wide range of reasonable percentages for attorneys'

fees, but 33% is "the very top of the range of percentages." The Court of

Chancery has a history of awarding lower percentages of the benefit where cases

have settled before trial. When a case settles early, the Court of Chancery tends to

award I 0-15% of the monetary benefit conferred. When a case settles after the

plaintiffs have engaged in meaningful litigation efforts, typically including

multiple depositions and some level of motion practice, fee awards in the Court of

million, plus costs); Global Prot. Corp. v. Halbersberg, 332 S.C. 149, 161, 503 S.E.2d 483, 489 (App.

1998) (approving one-third fee award and noting that the "typical range" of contingent fee arrangements

used "in complex cases ... [is] one-third to one-half the recovery").

11

See, e.g., In re Rural/Metro Corp. S'holders Litig., Del. Ch., C.A. No. 6350 (Nov. 19, 2013)

(TRANSCRIPT & ORDER) (fees and costs amounting to 36.17%); Gatz v. Ponsoldt, 2009 WL 1743760

(Del. Ch. June 12, 2009) (33% fee award); In re Intek Global Corporation Shareholders Litigation, Del.

Ch., C.A. No. 17207 (April24, 2000) (33%); In re Telecommunications, Inc., Del. Ch., C.A. No. 16470

(Feb. 1, 2007) (30%, plus costs); In re Te/ecorp PCS, Inc. Shareholders Litig., Del. Ch., C.A. No. 19260

(Aug. 20, 2003) (TRANSCRIPT at 91-104) (30%); In re USA Cafes, L.P. Litig., Cons. C.A. No. 11146

(Del. Ch. June 22,1994) (33%); Ryan v. Gifford, 2009 WL 18143 (Del. Ch. Jan. 2, 2009) (33%); In re

Genentech, Inc. Shareholders Litig., Del. Ch., C.A. No. 14625 (Aug. 26, 1996) (33%); Boyer v.

Wilmington Materials, Inc., 1999 Del. Ch. LEXIS 81, 20-22 (Del. Ch. May 17, 1999) (33% of the

derivative recovery, plus costs); Mayfield v. Western Wireless Corp., Del. Ch., C.A. No. 18717 (Oct. 21,

2002) (33%).

12

See, e.g., Cent. Wesleyan Call. v. W.R. Grace & Co., C.A. No. 2:87-1860-8 (D.S.C. Oct. 22,

2008) (30% award on a $35.5 million settlement) (Blatt, J.); Temp. Servs., Inc. v. Am. In!' I Group, Inc.,

2012 WL 2370523, at *9 (D.S.C. 2012) ("A one-third fee award from the common fund in this case is

consistent with, if not below, what is routinely privately negotiated in contingency fee litigation.");

Montague v. Dixie Nat'/ Life Ins. Co., 2011 WL 3626541 (D.S.C. Aug. 17, 2011) (33.3%) (citing

numerous federal cases, including Allapattah Serv., Inc. v. Exxon Corp., 454 F.Supp.2d 1185, 1212 (S.D.

Fla. 2006) (noting one-third fee is typical)); Savani v. URS Prqf'l Solutions LLC, 2014 WL 172503 at *4

(D.S.C. Jan. 15, 2014) (noting fee awards range from 20-40%) (citing Thomas Willging, et al., Empirical

Study of Class Actions in Four Federal District Courts: Final Report to the Advisory Committee on Civil

Rules 69 (Federal Judicial Center 1996)).

13

Littlejohn v. State, 2002 WL 34454074 (S.C. Ct. Com. Pl. April 23, 2002) (28% fee award, plus

costs), aff'd sub nom. Condon v. State, 354 S.C. 634, 643, 583 S.E.2d 430, 435 (2003) (28% award, and

noting a Ninth Circuit opinion finding that fees ordinarily range from 20% to 30% of the common fund);

Americas Mining, 51 A.3d 1213 (Del. 2012) (15% of$2.0316 billion judgment); Berger v. Pubco Corp.,

2010 WL 2573881, *I (Del. Ch. June 23, 2010) (awarding 26% and noting that the award was "at the

bottom of the 25-33% range that is found in many Court of Chancery cases"); Teachers Retirement Sys. of

La. v. Greenberg, C.A. No. 20106-VCS (Del. Ch. Dec. 17, 2008) (22.5%, plus costs; consistent with fee

agreement); In reEl Paso Corp. S'holder Litig., C.A. No. 6949-2012 WL 6057331 (Del. Ch. Dec. 3,

2012) (23.6%); In reNews Corp. S'holder Deriv. Litig., C.A. No. 6285-VCN (Del. Ch. 2013) (20%); In

re Emerson Radio S'holder Derivative Litig., 2011 WL 1135006, *4 (Del. Ch. Feb. 6, 1997) (25%).

Chancery range from 15-25% of the monetary benefits conferred. "A study of

recent Delaware fee awards finds that the average amount of fees awarded when

derivative and class actions settle for both monetary and therapeutic consideration

is approximately 23% of the monetary benefit conferred; the median is 25%."

Higher percentages are warranted when cases progress to a post-trial adjudication.

Americas Mining, 51 A.3d at 1259-1260 (footnotes omitted, but citing two settlement cases that

awarded 33%) (quoting Richard A. Rosen, David C. McBride & Danielle Gibbs, Settlement

Agreements in Commercial Disputes: Negotiating, Drafting and Enforcement, 27.1 0, at 27-

100 (2010)). The "meaningful litigation" described in the cases noted in Americas Mining was

not nearly as extensive as the litigation in this case.

14

The Court of Chancery has awarded

percentages higher than 25% for cases that settled on the eve of trial. New Jersey Carpenters

Pension Fund v. Infogroup, Inc., C.A. No. 5334-VCN (Del. Ch. Apri130, 2014) (TRANSCRIPT

at 29-30) ("Where there has been extensive and serious motion practice and discovery over a

period of years, especially where there has been a preliminary injunction process, the fee would

normally be something above 25 percent.")

Finally, although some courts have employed a so-called "megafund rule" in awarding

lower fee percentages for substantial recoveries, even in jurisdictions where it may apply,

"megafund" cases are generally defined as those involving recoveries of $100 million or more.

15

14

See, e.g., Gatz v. Ponsoldt, 2009 WL 1743760 (Del. Ch. June 12, 2009) (33% award; plaintiffs'

counsel had appealed dismissals in federal and state court, but had less than l 0,000 hours in the case, had

reviewed only thousands of documents, and class had not been certified); Ryan v. Gifford, 2009 WL

18143 (Del. Ch. Jan. 2, 2009) (33% award; plaintiffs' counsel had logged less than 8,000 hours and

deposed only six witnesses before settlement); In re Emerson Radio S'holder Deriv. Litig., 2011 WL

1135005 (Del. Ch. Mar. 28, 2011) ("meaningful litigation" included "some level of motion practice";

plaintiffs' counsel had 2,136 hours in the case and had not conducted expert discovery; court found this

was "mid-stage" and granted 25% fee award).

15

Americas Mining notes cases in which fee percentages drop when the recovery is over $5 00

million. Professor Newburg notes the declining percentages in megafund cases, listing 24 cases involving

over $300 million in recovery. 4 Newberg on Class Actions 14:6 at 2-3 (4th ed.) Older cases place the

megafund bar at $100 million. See, e.g., In re Ikon Office Solutions, Inc. Sec. Litig., 194 F.R.D. 166, 195

(E.D.Pa. 2000) ("$100 million seems to be the informal marker of a 'very large' settlement"); In re

(footnote continued)

26

Further, the Delaware Supreme Court has expressly rejected this concept as a per se rule in

Delaware. Americas Mining, 51 A.3d at 1258. No South Carolina appellate decision has

addressed the "megafund" declining percentage rule.

Therefore, case law in both South Carolina and Delaware concerning fee awards paid out

of common funds generally support a reasonable fee percentage range between the 20%

suggested by the SLC on the low end and the 33.3% suggested by Class/Derivative Counsel on

the high end for pre-trial settlements.

16

More specifically, cases in Delaware that have

progressed beyond the "meaningful litigation" stage mentioned in Americas Mining support a fee

award of greater than 25%.

3. Fees and Cost Awards in the Class and Derivative Actions

a. The Class Action

Class Counsel petitioned the Court for a one-third fee award ($3,333,333 .33), plus pro-

rated costs ($323,654.48), in the Class Action. That percentage is lower than the 35% (plus

costs) identified in settlement notice, and no Class Member objected to the settlement notice or

the actual fee petition. Neither the SLC nor any Defendant has taken a position with respect to

the fee request in the Class Action.

Based upon the Jackson v. Speed and Sugar/and factors listed above and in particular the

beneficial results obtained for the class, Class Counsel's fee petition is therefore GRANTED.

Cendant Corp. Derivative Litig., 232 F. Supp. 2d 327, 337 (D. N.J. 2002) (application of megafund rule

"generaiJy require[s] awards of at least $100 miiJion.")

16

Condon v. State, 345 S.C. 634, 643, 583 S.E.2d 430, 435 (2003) (fees ordinarily range from

20% to 30%); Americas Mining, 51 A .3d at 1259-1260 and n. 114 (noting increasing percentage range up

to 33%, and a median of25%); Ryan v. Gifford, 2009 WL 18143 (Del.Ch. Jan. 2, 2009) (awarding 33%

of cash amount where plaintiffs' counsel engaged in "meaningful discovery," survived "significant, hard

fought motion practice" and incurred nearly $400,000 in expenses); Berger v. Pubco Corp., 20 I 0 WL

2573881, *I (Del. Ch. June 23, 2010) (noting 26% award was "at the bottom of the 25-33% range that is

found in many Court of Chancery cases.").

27

b. The Derivative Action

In the Derivative Action, counsel also petitioned for a one-third fee, plus pro-rated costs.

This request amounts to $23.6 million in fees, plus $2,297,946.82 in costs, for a total of

$25,946,613.48, slightly less than the $26 million cash settlement. The SLC and the WLR

Defendants argued that the percentage awarded should be lower for the noncash portion of the

settlement than for the cash portion of the settlement, and also that such an award would be

unprecedented because it would deprive NITG essentially of the cash benefit of the settlement.

The Court finds these arguments unavailing.

Both the SLC and the WLR Defendants agreed that the "economic value of the benefit to

NITG from the Derivative Action Settlement shall be the amount of the Derivative Action

Settlement Cash Consideration ($26 million) plus the economic value of the Derivative Action

Settlement Non-Cash Consideration ($45 million), without reduction ... " Stipulation, 'lf42. Thus,

the economic value of the entire settlement was $71 million dollars, without any distinction in

the method of monetary valuation between the cash and non-cash components of the settlement.

The Non-Cash consideration, according to the Stipulation, is therefore the same as cash in the

amount of $45 million. Given that, the Court finds that there is no logical basis for awarding a

lesser percentage of the $71 million recovery merely because a portion of that value will be paid

to the Company other than in cash.

17

17

Similarly, there is no legal basis for the SLC's argument. The SLC argues that in Condon v.

State, the Court awarded 28% of the up-front cash portion of the settlement, but did not award any

amount for the future benefits that would result, which were allegedly of equal value to the up-front cash

portion. Thns, according to the SLC, the overall percentage award in Condon was 14% of the total

benefits created. In Condon, however, any fees on the future benefits created by the relief obtained in the

case would necessarily have been paid by class members, even though those future benefits would have

flowed to non-class members. Here the situation is different: NITG will receive the full measure of both

the cash consideration and the non-cash consideration obtained through the derivative settlement. It is

therefore reasonable to award fees based on a percentage of the full value obtained by the Company,