Escolar Documentos

Profissional Documentos

Cultura Documentos

Hype Cycle For Procurement 2 217670

Enviado por

krismmmmTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Hype Cycle For Procurement 2 217670

Enviado por

krismmmmDireitos autorais:

Formatos disponíveis

This research note is restricted to the personal use of mark.robichaux@itc.hctx.

net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

G00217670

Hype Cycle for Procurement, 2011

Published: 14 November 2011

Analyst(s): Deborah R Wilson

Procurement spans a rich and diverse range of activities. The variety of tools

available that supports and enables procurement activities continues to

expand and mature.

Table of Contents

Analysis.................................................................................................................................................. 2

What You Need to Know.................................................................................................................. 2

The Hype Cycle................................................................................................................................ 3

The Priority Matrix.............................................................................................................................8

Off the Hype Cycle........................................................................................................................... 9

On the Rise.................................................................................................................................... 10

Social Procurement Tools......................................................................................................... 10

Mobile Procurement Applications............................................................................................. 11

Services Procurement.............................................................................................................. 12

Source-to-Pay BPO..................................................................................................................13

MDM of Purchased Parts..........................................................................................................15

MDM of Supplier Data.............................................................................................................. 17

Multienterprise Business Process Platform............................................................................... 18

Supply Base Management........................................................................................................21

At the Peak.....................................................................................................................................22

E-Invoicing................................................................................................................................22

Indirect-Procurement BPO........................................................................................................26

Business Process Networks..................................................................................................... 27

Procure-to-Pay Solutions..........................................................................................................31

Vendor Risk Management.........................................................................................................32

Source-to-Settle Solutions........................................................................................................34

Sliding Into the Trough....................................................................................................................35

Procurement Networks.............................................................................................................35

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Supplier Portals........................................................................................................................ 36

Contingent Workforce Management......................................................................................... 37

Contract Life Cycle Management..............................................................................................39

Sourcing Optimization...............................................................................................................41

Climbing the Slope......................................................................................................................... 43

Spending Analysis.................................................................................................................... 43

Strategic Sourcing Suites..........................................................................................................44

Online Supplier Directories........................................................................................................45

Information Exchanges and Global Data Synchronization..........................................................47

Procurement E-Catalog Management Solutions....................................................................... 49

Entering the Plateau....................................................................................................................... 50

E-Procurement......................................................................................................................... 50

SaaS Procurement Applications............................................................................................... 51

Telecom Expense Management................................................................................................53

Travel Expense Management....................................................................................................54

Appendixes.................................................................................................................................... 58

Hype Cycle Phases, Benefit Ratings and Maturity Levels.......................................................... 58

Recommended Reading.......................................................................................................................60

List of Tables

Table 1. Hype Cycle Phases................................................................................................................. 58

Table 2. Benefit Ratings........................................................................................................................59

Table 3. Maturity Levels........................................................................................................................ 59

List of Figures

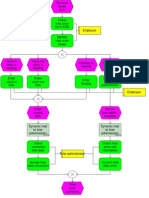

Figure 1. Hype Cycle for Procurement, 2011.......................................................................................... 7

Figure 2. Priority Matrix for Procurement, 2011.......................................................................................8

Analysis

What You Need to Know

Procurement technologies, when paired with process improvement and staff development, are

delivering step changes in procurement process productivity and effectiveness.

Page 2 of 61 Gartner, Inc. | G00217670

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Innovation continues in procurement technology, as evidenced by the significant number of

solution types on the initial slope before the Peak of Inflated Expectations. Some of the most

promising newer technologies include supply base management, multienterprise business

process platforms and social collaboration tools.

An increasing number of procurement applications, including strategic sourcing applications

and Web-to-print solutions, have entered the Plateau of Productivity as they stabilize, mature

and gain market traction. However, many technology solution types are first-generation or

second-generation applications subject to evolving requirements, and so will have gaps in

functionality.

With a few notable exceptions (such as SAP and Oracle), specialty vendors dominate the

procurement solutions market.

The Hype Cycle

The 2011 Procurement Hype Cycle, an update of our 2009 research, reveals a market that

continues to offer a rich and diverse set of solutions to support the various processes and activities

related to procurement. We are now roughly midway through what is shaping up to be a 25-year

evolution that is fundamentally changing the way procurement operates. When the evolution is

complete, procurement professionals across industries, geographies and organization sizes will

have most of the capabilities discussed in this research as a part of their standard application

portfolio.

Specialty vendors have been the primary drivers of innovation in this market, although some ERP

vendors (including SAP and Oracle) have reasonable to very competitive offerings in several

procurement technologies. The market continues to be geographically fragmented, because of

differences in regulations and the make-up of participating supplier communities. Demand for

enterprise-level solutions that support shared services is pushing the market toward an inevitable

consolidation, and to global networks.

Notable trends illustrated in this Hype Cycle include:

Innovation: Technology Triggers, such as the improved graphics renderings on mobile devices

and the growing popularity of social websites like Facebook, are likely to facilitate useful

features for procurement solutions, and thus appear early on the Hype Cycle.

Hype: Vendor risk management solutions are the most overhyped offering as buying

organizations seek a means to reduce supply risks (such as from events like natural disasters,

security breaches and vendor bankruptcies). Solution vendors have responded to the demand

with sometimes scarcely credible claims of how their solutions can help.

Unforeseen barriers to adoption: Trying to leverage the various modes for supplier

collaboration is an area of frustration for clients, and thus a major theme in this market.

Unanticipated adoption issues and business model problems are graphically depicted by both

the supplier portal and procurement network being moved backward from the Slope of

Gartner, Inc. | G00217670 Page 3 of 61

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Enlightenment to before the Trough of Disillusionment. We also lengthened the anticipated time

to mainstream adoption for these technologies.

Maturing solutions: Meanwhile, the movement of key solutions such as e-procurement and

strategic sourcing applications to at or near the Slope of Enlightenment means that

organizations have an increasing number of mature solution types to choose from to support

procurement activities.

Since our last Hype Cycle for Procurement, some technologies have progressed along the adoption

curve very slowly, while others have moved toward mass adoption more quickly.

Slow-moving technologies include:

Services procurement, because service transactions (such as contingent worker hires versus

statement-of-work-based agreements) are highly differentiated in terms of process steps and

process flow, and so a single solution does not necessarily work well for all service types.

Multienterprise business process platforms (ME-BPPs), due to buying organizations' preference

for more-mature collaboration offerings, such as procurement networks and the complexity of

the ME-BPPs.

Master data management (MDM) of purchased parts and supplier data inched ahead as difficult

economic conditions stifled platform architecture-level investments. This issue also incited us to

delay the expected time to mainstream adoption for MDM of supplier data.

Procure-to-pay solutions remained stuck near the Peak of Inflated Expectations as buyers

demand and vendors market complete solutions; however, the reality is that buyers purchase

scanning and e-invoicing network services, rather than support requisition through payment via

a single tool.

Contract life cycle management (CLM) solutions made slow progress, because of the lack of

hard-dollar ROI, an issue in strained economic times. Also, recent CLM clients have tended to

focus on implementing just the basic functionality, which means vendors don't get the feedback

they need to hone full solutions.

We lengthened the expected time to mainstream adoption for spending analysis, because

getting good results is ending up to be more challenging than initially thought (see "Spend

Analysis Best Practices").

E-procurement and travel and expense (TEM) solutions inched toward full maturity as they

entered the mainstream market.

Fast-moving technologies include:

Web-to-print applications, which reached maturity when successfully positioned as a solution

for printers, rather than for buying organizations.

Supply base management solutions vaulted up the initial slope toward the Peak of Inflated

Expectations as many strategic sourcing suite vendors realized that RFI functionality could be

positioned as supplier information management.

Page 4 of 61 Gartner, Inc. | G00217670

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Contingent workforce management solutions flew from the Trough of Disillusionment to the

Slope of Enlightenment, driven by organizations' use of temporary workers instead of

permanent employees to reduce the risk of excess head count in these economically

challenging times.

There were also several changes in the composition of procurement technology profiles covered

since our 2009 research.

New Profiles:

Telecom expense management was added as a result of procurement having greater

involvement in telecom category management. Evidence of this trend is Emptoris' acquisition of

Rivermine in January 2011.

Vendor risk management is a newer technology aimed specifically at IT vendor risk

management. Vendor risk management can be classified as a special-purpose supply base

management solution.

Social procurement was added as a brand new technology for adding Facebook-like

capabilities to procurement solutions.

Mobile procurement applications is another new technology and a capability recently being

offered by some procurement solution vendors.

Procurement e-catalog management solutions were added to highlight an option to supplier

portals and procurement networks for e-procurement solution content provisioning.

Deleted Technology Profiles:

Tactical sourcing is no longer listed separately. As predicted, it has become a feature of other

solutions, such as e-procurement and contingent workforce management, rather than a viable

stand-alone offering.

Extended purchasing suites are no longer a distinct offering from procure-to-pay solutions, and,

therefore, are not listed as a separate profile.

Secure Web stores, Web-to-print and strategic sourcing applications have reached the Plateau

of Productivity and are no longer listed on the Hype Cycle.

Other Changes:

Procurement business process outsourcing (BPO) has been split into indirect procurement BPO

and source-to-pay BPO, because the characteristics of the offerings are differentiated.

Enterprise contract management has been renamed CLM, the more broadly accepted name in

the market.

Services e-procurement is renamed services procurement to reflect the most common name in

the market.

Gartner, Inc. | G00217670 Page 5 of 61

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Global data synchronization is renamed information exchanges and global data synchronization

to reflect a broader scope of solutions.

For advice on how to approach and order investments in procurement technologies, see

"Understanding Your Top Procurement Processes" and "Use Gartner's Pace Layers Model to

Structure Your Procurement Applications Portfolio."

Page 6 of 61 Gartner, Inc. | G00217670

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Figure 1. Hype Cycle for Procurement, 2011

Technology

Trigger

Peak of

Inflated

Expectations

Trough of

Disillusionment

Slope of Enlightenment

Plateau of

Productivity

time

expectations

Years to mainstream adoption:

less than 2 years 2 to 5 years 5 to 10 years more than 10 years

obsolete

before plateau

As of November 2011

Services Procurement

Source-to-Pay BPO

MDM of Purchased Parts

MDM of Supplier Data

Multienterprise Business Process

Platform

Supply Base Management

E-Invoicing

Indirect-Procurement BPO

Business Process Networks

Procure-to-Pay

Solutions

Vendor Risk Management

Source-to-Settle Solutions

Supplier Portals

Contingent Workforce Management

Contract Life Cycle Management

Sourcing Optimization

Spending Analysis

Strategic Sourcing Suites

Online Supplier Directories

Information Exchanges and Global Data Synchronization

Procurement E-Catalog Management Solutions

E-Procurement

SaaS Procurement Applications

Telecom Expense Management

Travel Expense Management

Social Procurement Tools

Mobile Procurement

Applications

Procurement Networks

Source: Gartner (November 2011)

Gartner, Inc. | G00217670 Page 7 of 61

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

The Priority Matrix

All organizations buy goods and services to support operations. Technologies that enable

procurement to improve productivity and effectiveness can, therefore, deliver significant benefits in

terms of cost savings and process improvements.

The procurement technologies that deliver significant benefits are those that can reliably support all

or most types of spending. Moderate-benefit technologies are solutions that support a particular

category of spending or a single mode for supplier collaboration, are too immature at this time to

deliver reliable ROI, or are capabilities that we eventually expect to be features of broader solutions.

We do not list any procurement technologies as transformational because, despite its potentially

important contribution to the organization, procurement does not by itself enable a business to

dramatically alter its overall business proposition.

The time-to-mainstream adoption of the various technologies in the procurement solutions market

is well-distributed during the next 10 years. Although we do expect continued innovation in this

market through Technology Triggers and improved offerings, it's likely that, during the next five to

10 years, many of the procurement solutions in this Hype Cycle will be as commonly deployed as

accounts payable solutions in organizations with $1 billion or more in revenue.

Figure 2. Priority Matrix for Procurement, 2011

benefit years to mainstream adoption

less than 2 years 2 to 5 years 5 to 10 years more than 10 years

transformational

high

E-Procurement

SaaS Procurement

Applications

Telecom Expense

Management

Contract Life Cycle

Management

E-Invoicing

Sourcing Optimization

Spending Analysis

Strategic Sourcing Suites

Multienterprise Business

Process Platform

Procurement Networks

Supply Base Management

moderate

Travel Expense

Management

Business Process

Networks

Contingent Workforce

Management

Online Supplier

Directories

Procurement E-Catalog

Management Solutions

Source-to-Settle Solutions

Supplier Portals

Vendor Risk Management

Indirect-Procurement BPO

Information Exchanges

and Global Data

Synchronization

MDM of Supplier Data

Mobile Procurement

Applications

Procure-to-Pay Solutions

Social Procurement Tools

Source-to-Pay BPO

low

As of November 2011

Source: Gartner (November 2011)

Page 8 of 61 Gartner, Inc. | G00217670

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Off the Hype Cycle

Three procurement technologies that were listed in the 2009 Procurement Hype Cycle are not listed

on the 2011 Hype Cycle, because they have reached the Plateau of Productivity:

Secure Web stores: The Secure Web store is a B2B, customer-specific, supplier-hosted

Internet site that provides product/service catalog content, customer-specific pricing, account-

level reporting, support for multiple users and customer branding. Secure Web stores are most

often deployed as customer-specific Web stores accessed via the Internet or as a "punchout"

website that provides content for a buyer-deployed e-procurement solution. E-Commerce

solution vendors, such as Adobe, Allurent, Amazon, Bazaarvoice, eBay, Google, IBM, Microsoft,

Oracle, PowerReviews and SAP, deliver secure Web store functionality as a feature.

Strategic sourcing applications: Strategic sourcing applications enable buyers to establish

sources of supply for direct materials, indirect materials and services through online RFIs, RFPs

and reverse auctions. These applications also help buyers compare and evaluate the resulting

bids, and they notify participating suppliers of event results. Vendors include Ariba, SAP,

Emptoris, BravoSolution and Curtis Fitch.

Web-to-print applications: Web-to-print applications (which technology providers sometimes

refer to as print e-procurement) are a specialized class of e-commerce solutions that support

the unique and complex specification development and RFP process associated with buying

printed materials and services. This technology is used by printing companies involved with

B2B and retail consumer (business-to-consumer [B2C]) sales. Vendors include EFI's Digital

StoreFront and Bitstream.

Four procurement technologies have been fully mature for some time and, therefore, have not

appeared on recent Hype Cycles:

Purchasing applications: the traditional purchasing module of an ERP or financial system that

creates purchase orders, blanket orders and change orders. Purchasing applications also

generally enable receiving. For communicating orders to suppliers, purchasing applications

typically offer hard-copy printouts, automatic email and/or autofax. Virtually all ERP and

financial suite vendors include a purchasing application in their offerings.

Procurement cards: special-purpose credit cards that are issued to individuals to make

purchases on behalf of the organization (see "The Role of Procurement Cards in EIPP" and

"Turbo- Charge Procurement Value-Add With Consumption Management" [Note: This

document has been archived; some of its content may not reflect current conditions.]). Most

major banks offer procurement card programs.

E-notification solutions: applications that allow public-sector organizations to publicly post

opportunities for tender (bid) on a central website. The purpose of the technology is to create a

fair and open venue for any interested party to participate in larger government opportunities.

Sample commercial off-the-shelf (COTS) vendors include Mediagrif, BidSync and Vortal.

Acquisition management: specialized solutions for U.S. federal-level procurement. Functionality

includes building acquisition plans, obtaining and documenting plan approvals, budget

Gartner, Inc. | G00217670 Page 9 of 61

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

encumbrance, contract assembly, bid solicitation, award documentation, and change order

management. Vendors include Oracle, SAP, Compusearch and CGI.

On the Rise

Social Procurement Tools

Analysis By: Deborah R Wilson

Definition: As social networking sites become increasingly significant in the personal lives of

procurement solution users, it has become clear that some social networking features could be

useful in procurement processes. Social procurement tools are procurement application features

that mimic the capabilities of popular social websites, such as eBay, Facebook and LinkedIn.

Sample capabilities being created by procurement solution vendors include detailed user profiles,

the ability to gain access to information by joining a group and embedded activity "walls" that

provide a chronological listing of events related to a particular topic. Facebook-like walls can

provide a useful place in a sourcing suite for a virtual team to document the activities and team

member comments associated with a particular sourcing project. Another way social functionality

can be leveraged is to enable requisitioners to rate products and services listed in the corporate e-

catalog, as is done on popular e-commerce websites.

Social collaboration for procurement is being developed and offered as a feature of procurement

applications, rather than as stand-alone solutions, because they leverage the documents and data

in the procurement application. For example, although procurement organizations could use third-

party tools such as SharePoint to create virtual team spaces for a sourcing project, the RFP,

contract and supplier contact data already exists in the sourcing solution, and it would be inefficient

to replicate and maintain these project artifacts elsewhere.

Position and Adoption Speed Justification: Procurement technology vendors will continue to

focus primarily on stabilizing customer requirements and refining the functionality of the solutions

that help organizations accomplish such tasks as placing orders and managing contracts. Because

of this focus and the moderate value that social features offer in procurement, we expect the

movement of this technology along the Hype Cycle to be relatively slow.

User Advice: Organizations should look to their procurement solution vendors for social technology

to enhance the procurement experience for casual users and professionals. Expect most solution

vendors to eventually add such capabilities as team spaces, extended user profiles and simple

ratings to their procurement suites.

Business Impact: Social procurement tools promise the benefit of helping virtual teams get to

know each other better and work more efficiently. The reasonable hope of this technology is that

greater familiarity and easier access to what's going on will improve the efficiency and effectiveness

of these virtual teams. Social features such as user ratings can improve procurement effectiveness

by enabling user feedback on product and supplier performance.

Benefit Rating: Moderate

Page 10 of 61 Gartner, Inc. | G00217670

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Market Penetration: Less than 1% of target audience

Maturity: Embryonic

Sample Vendors: Fullstep Networks; Pool4Tool; Vortal

Recommended Reading: "Social Infrastructure"

Mobile Procurement Applications

Analysis By: Deborah R Wilson

Definition: Mobile applications are procurement solution extensions that run on mobile devices

such as the iPhone, BlackBerry, Droid or iPad. These applications can use HTML5 applications that

support multiple mobile devices, or they could be native applications for a specific device, such as

iOS solutions for Apple products.

Position and Adoption Speed Justification: Mobile devices are playing an increasingly significant

role in the personal lives of business professionals, providing access to business applications off-

hours and while traveling. So far, mobile device support has been informally delivered for

procurement solutions, and for e-procurement applications in particular, by enabling managers to

review and approve requisitions through email. Seventy-one percent of the 32 vendors profiled in

our recent report "E-Procurement Market and Vendor Landscape" said that approvals can be done

directly in an email, without a separate log-in to the e-procurement application. Beyond this,

procurement solutions have historically offered little or nothing for functionality tailored to PDAs. For

example, in the same study, only 28% of the vendors said they currently have a native application

for a mobile device, and telecom expense management solution vendors have been slow to launch

mobile clients.

Gartner expects native mobile applications for procurement to progress steadily along the Hype

Cycle curve because user demand for native applications is strong, and providing elegant native

PDA clients can provide meaningful differentiation. Advances will occur in waves. First-generation

solutions will address low-hanging fruit such as approvals with more content than a simple email.

The second generation will take advantage of device-specific capabilities such as location

capabilities. The third generation, which will take five-plus years to reach mainstream, will be role-

specific applications that take advantage of unique device capabilities.

It is possible, however, that the mobile procurement application will never reach the Plateau of

Productivity, because in the next few years mobile devices may evolve to the point where they are

no longer distinct offerings from the PC.

User Advice: Procurement solution users tend to be heavy users of mobile technologies, and

robust mobile procurement applications may improve user experience and adoption rates. Choose

procurement solution vendors that acknowledge this trend, and that make appropriate investments

in native or HTML5 mobile procurement applications.

Gartner, Inc. | G00217670 Page 11 of 61

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Business Impact: Procurement applications are often viewed as clunky, difficult-to-use solutions

that sometimes impede, rather than enhance, productivity. The rich and compelling graphics and

user experience offered by mobile applications have the potential to make interactions with

enterprise applications more appealing and impactful, which may improve user adoption. Mobile

applications will also provide better access to procurement applications for individuals on the go.

Benefit Rating: Moderate

Market Penetration: 1% to 5% of target audience

Maturity: Emerging

Sample Vendors: Basware; BirchStreet Systems; Coupa; Hubwoo; IQNavigator; Ivalua; Oracle;

Paperless Business Systems; Puridiom; SAP; Wallmedien; Wax Digital

Recommended Reading: "Separating Enterprise Tablet Applications From Consumer Apps"

"Hype Cycle for Wireless Devices, Software and Services, 2011"

Services Procurement

Analysis By: Deborah R Wilson

Definition: A services procurement solution is a software application tailored to handle the

requisitioning and purchase of all services, including legal, consulting, construction, contingent

worker services and maintenance payments. Services procurement solutions are often delivered as

an element of a broader e-procurement suite.

Position and Adoption Speed Justification: Most specialized services procurement solutions in

the market today were originally created eight to 10 years ago, but have attracted only a few dozen

clients. The problem is that services are not a homogeneous spend type in terms of requisition and

payment profile. Services can be payable by the hour, milestone or annual fee; requisitions must

often include special information, such as work instructions or a job description; and actual prices

for services rendered often vary significantly from estimated costs. These characteristics have made

it difficult for a single, specialized solution to successfully support all service spend types.

The market has evolved to address these issues. Contingent workforce management vendors have

added functionality to their solutions to make them more suitable for supporting statement-of-work-

based services. Accounts payable invoice automation vendors, such as Readsoft and Kofax, have

provided functionality to allow managers to use invoice approval as proof of service delivery,

although this is not an ideal solution. The net result is that the specialty services procurement

solution has been marginalized and as a separate solution and no longer attracts many new

customers.

User Advice: Services procurement solutions have not proved robust enough to deliver real

benefits to organizations' buying services. To improve and support services procurement

processes, look to e-procurement, purchasing and contingent workforce solutions to deliver results.

Page 12 of 61 Gartner, Inc. | G00217670

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Business Impact: Specialty services procurement solutions are struggling to deliver ROI. We

predict that vendors with services procurement solutions will eventually deliver services

procurement functionality as a feature of other applications, such as e-procurement and contingent

workforce management solutions.

Benefit Rating: Low

Market Penetration: Less than 1% of target audience

Maturity: Emerging

Sample Vendors: Ariba; Emptoris; Oracle; SAP

Source-to-Pay BPO

Analysis By: Cathy Tornbohm

Definition: Gartner defines source-to-pay (S2P) business process outsourcing (BPO) as the

provision of the full end-to-end outsourced service of sourcing of direct or indirect goods, the

administration of purchasing services, and accounts payable services. In BPO, the focus for service

offerings is shifting from departmental boundaries toward end-to-end processes. The end-to-end

process of S2P BPO, therefore, incorporates sourcing goods and services, procuring them, and

providing accounts payable services that prepare the invoice for payment.

The word "procurement" has assumed a new dual meaning. Although it can still mean the entire

purchasing department where goods and services are bought, BPO providers are increasingly using

it as a term for which procurement is defined as the activity that follows sourcing of actually buying

goods and/or services and tracking those purchases prior to the accounts-payable activity.

The word "sourcing" means the process of selection of a supplier, although sourcing is still a

subcomponent of the procurement department. Therefore, as BPO providers increase their scope

of offering to include both project sourcing (for terms, conditions and pricing of goods and services)

mainly for indirect goods, the term and scope of "procure to pay" is moving to "source to pay." The

sourcing definition is for strategic and tactical buying, but the word procurement now typically

means only the administration related to the purchase order.

Position and Adoption Speed Justification: Sourcing and procurement BPO services have had

relatively limited adoption over the past 10 years, but it is the indirect procurement area that is,

goods and services that are not directly accounted for in the cost of goods sold that have mostly

been outsourced. Direct goods and materials are the sourced items in the supply chain, and these

are rarely outsourced. However, the administration of the accounts payable may already be

outsourced because the finance and accounting (F&A) aspect of this activity has been outsourced

to a great deal and is a fairly mature offering.

User Advice: There are multiple ways in which an organization can address its S2P requirements;

therefore, multiple types of competitors present themselves along the end-to-end activity. Because

the term "source-to-pay service" is relatively new, leaders will be set apart by an ability to be

Gartner, Inc. | G00217670 Page 13 of 61

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

flexible in offering all, or part, of the S2P process, an ability to communicate the service to clients,

and offering insightful analytics capabilities and a global network of buyers, support staff and

offshore delivery centers.

Clearly evaluate what strengths the providers of this service have. The different backgrounds, either

providers of F&A BPO services or others from a sourcing specialism both have gaps in their

offerings from an end-to-end perspective. Providers of F&A BPO have spent the past few years

slowly providing more procurement support, especially the services of procurement data

management and indirect sourcing services. This is exemplified by the recent acquisition of Ariba's

sourcing services business by Accenture, Capgemini's acquisition of IBX, and IBM's acquisition of

Key MRO. Sourcing specialists are also extending consultancy services to longer-term outsourcing

relationships and partnering with F&A BPO providers, as seen with ICG Commerce's partnership

with Genpact.

Business Impact: Many providers have specialized in sourcing and procurement outsourcing

services with a range of business models, from services that are heavily consultancy-based to

business marketplaces. The clearly delineated lines that have long separated sourcing/procurement

from accounts payable outsourcing have rapidly blurred in a logical if less-mature market of

multidomain S2P BPO. Few businesses have a clear view of their end-to-end process, and BPO

can be a way to support attaining this visibility and control. This would allow organizations to

address the issue that they are not designed or organized to optimally manage the end-to-end

process, from sourcing and procurement, through to accounts payable. Typically, no single buyer or

service owner is apparent; therefore, engaging a service provider for the whole service helps clarify

what steps are really necessary in the end-to-end process.

Benefit Rating: Moderate

Market Penetration: Less than 1% of target audience

Maturity: Emerging

Sample Vendors: Accenture; Capgemini; Genpact; HP; IBM; ICG Commerce; Infosys; Tata

Consultancy Services; Wipro

Recommended Reading: "Magic Quadrant for Comprehensive Finance and Accounting BPO,

Global"

"Competitive Landscape: The Source-to-Pay BPO Tide Rises as New Entrants Flood the Market"

"2010 Gartner FEI Technology Study: Planned Shared Services and Outsourcing to Increase"

"Serco Plans to Acquire Intelenet to Boost Global BPO Capabilities"

"EXL Service to Acquire OPI to Enhance F&A BPO Offerings"

"Case Study: Pricing Model Challenges Moving from an Internal Finance or Shared-Service

Organization to BPO"

"Outsourcing Advisory: Pricing Options and Trends in BPO"

Page 14 of 61 Gartner, Inc. | G00217670

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

"What Is 'Platform BPO' and When Would You Use It?"

"Six Best Practices When Using Offshore BPO"

MDM of Purchased Parts

Analysis By: Mickey North Rizza; Andrew White

Definition: Procurement-centric master data management (MDM) technology has been split into

two pieces: MDM of purchased parts and MDM of supplier data. This reflects the fact that the use

cases, vendors and audiences for the two types of MDM differ.

MDM of purchased parts enables organizations to cleanse, identify, link, consolidate, enrich,

maintain, publish and protect master data for common-item parts. This is done by creating and

managing a system of record founded on a database, typically by the ERP system, procurement or

PLM solution, and by enabling the delivery of a single view of purchased parts data across systems,

across lines of business and/or by commodity. MDM of purchased parts, including catalog and

fabricated components and subassemblies, facilitates an organization's ability to leverage parts

numbers across product lines, inventory assets, distribution and service inventory, and it facilitates

parts reuse strategies in new product designs for economies of scale. These benefits are rarely

sought together and are often only tackled opportunistically and separately. This helps explain why

this technology is both splintered from core MDM and also (the now-revised) slow to mature/adopt

along the MDM Hype Cycle.

MDM of purchased parts is a specialized case of MDM and is relevant to industries that maintain

item parts masters, such as manufacturing and supply chains (for direct materials), and oil and gas,

for maintenance, repair and operating (MRO) items. MDM of purchased parts solutions publish

and/or coordinate data across ERP solutions, product life cycle management applications,

procurement, inventory, installation/service and other applications. Retailers and wholesalers use

specialized applications, often offered as a part of a merchandising or private-label sourcing

solution. (These are not covered here.) Most MDM of purchased parts solutions use third-party

content to cleanse, normalize and validate descriptions.

Position and Adoption Speed Justification: Procurement is typically a center-led organization that

is closely tied to the local supply chain and accounting systems of the divisions, operating units or

locations, and is further disaggregated by many active decades of acquisition and divestiture. This

has left most larger organizations with multiple item parts masters, which stifle the ability to

promote reuse in design, substitute parts and source purchased parts by leveraging volume at the

enterprise level. The economic downturn of the past few years has moved more companies to SKU

rationalization exercises, which have forced the consolidation of products, parts numbers and

inventory. This, in turn, forces them to look at what items are required for current products, sunset

products and new products. It requires more visibility for purchased parts in terms of new product

design, where to buy, how to buy and from whom. Purchased parts MDM solutions facilitate this

process by establishing a means to coordinate design and leverage parts numbers, commodity

types and components, inventory management, and purchase activity across the organization.

Gartner, Inc. | G00217670 Page 15 of 61

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Vendors of MDM of product data have been responding to the resulting demand for solutions,

because the functionality required to support MDM of purchased parts is similar.

However, formal purchased part MDM tools have been inhibited by several factors. MDM

techniques offer clearer and stronger return on investment (ROI), when applied to customer and

product data. Because this use can grow top-line revenue, most MDM activity has focused there

first. However, this has started to change with the SKU rationalization activities of the past few

years. Governance issues related to who owns the purchased parts record (engineering, operations

or procurement) have been an obstacle, but this has subsided because of the economic importance

and benefit for organizations. MDM of purchased parts solutions can help organizations identify

similar or like parts in other divisions or locations; improve working capital with substitute like or

similar parts (use current inventory/avoid a purchase); consolidate multiple manufacturers' catalog

parts numbers into one brand owner part; consolidate duplicate brand owner parts numbers and

supply contracts; and pinpoint opportunities for rationalization. The economies of scale and

collaborative visibility are the reasons to make MDM of purchased parts mandatory, and enable

bottom-line contribution.

User Advice: This technology is applicable to organizations with:

Multiple divisions buying similar items and/or sharing common inventory across multiple

locations

ERP consolidation efforts looking to develop a centralized procurement function

Local procurement processes with global manufacturing processes

Such organizations (public sector or private) should consider MDM purchased parts tools, but

should also expect to serve as early-stage adopters of this technology. Users should compare and

contrast a domain-specific effort like this versus the broader effort and greater value from a

multidomain MDM program. Thus, you should include concrete plans in your project for

collaboration on like and similar purchased parts, and link these to internal parts numbers to

improve visibility in parts selection and inventory across the enterprise.

Business Impact: The business impact of MDM of purchased parts is significant when

organizations consider its use for commodity-sourcing leverage and in SKU rationalization, and

moderate for current center-led organizations with multiple divisions or locations designing with

and/or buying the same or similar parts. If there has been lots of M&A activity, then the value of this

program may increase due to the fragmented nature of the data. Organizations have started to

understand that MDM of purchased parts can assist with working capital initiatives and supplier

collaboration activities. Once the vendors in this market connect the dots to SKU rationalization

activities, working capital initiatives and supply chain partner collaboration, the products will gain in

demand. However, the vendors in this market need to innovate to provide additional application

functionality and services that connect supplier collaboration information to brand owner forecasts

and demand management.

Benefit Rating: Moderate

Market Penetration: 1% to 5% of target audience

Page 16 of 61 Gartner, Inc. | G00217670

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Maturity: Emerging

Sample Vendors: iTradeNetwork; Oracle; PartMiner; Riversand; Zynapse

Recommended Reading: "Vendor Guide: Master Data Management, 2009"

"Should Organizations Using ERP 'Do' Master Data Management?"

"The Differences, and Similarities, Between Operational MDM and Analytical MDM"

MDM of Supplier Data

Analysis By: Deborah R Wilson

Definition: Master data management (MDM) of supplier data is a technology-enabled discipline in

which business and IT work together to ensure the uniformity, accuracy, stewardship, semantic

consistency and accountability of supplier data. The typical MDM of supplier data solution includes:

E-forms for requesting a new supplier

Workflow for new and updated data gathering and approval

A link with one or more third-party content providers, such as D&B, for identifying and/or

validating related suppliers

A data repository for storing the master data

A means to receive and publish the appropriate data to subscribing systems

Position and Adoption Speed Justification: Only a few hundred technology-based MDM of

supplier data programs have been undertaken during the past 10 years, because of the cost,

complexity and immaturity associated with initiatives of this type, and because most organizations

tackle MDM of product and customer data first. The worldwide economic recession of 2009 to 2010

stymied further adoption of MDM of supplier data. With the global financial outlook getting better,

and companies' increased interest is becoming "socially aware" and green, we are seeing renewed

interested in MDM of supplier data, so its position on the Hype Cycle has advanced slightly.

User Advice: An MDM of supplier data technology strategy should be scoped as an element of a

wider, multidomain MDM strategy (for example, encompassing customer, product, employee,

location, asset and financial master data). Begin an MDM of supplier data program by cleaning up

current files and implementing strong supplier master file governance and control policies. Explore

spending analysis, enterprise contract management and/or supply base management (SBM)

technologies as logical extensions to traditional MDM of supplier data prior to making investments.

Business Impact: Most organizations pursue MDM of supplier data programs to prepare for an

ERP implementation or an ERP consolidation project. This type of MDM program is most commonly

achieved with business consulting services, rather than purely an investment in technology.

Gartner, Inc. | G00217670 Page 17 of 61

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

MDM of supplier data is increasingly contemplated, however, to enhance the organization's ability

to analyze spending, to enforce compliance with contractual terms and conditions (such as

payment terms across multiple business units), and/or to maintain cleaned-up master data from

being recorrupted. These use cases involve implementing a solution, but have proved somewhat

problematic for delivering business impact, because the expense of these systems often outweigh

the benefits, and because the solutions available have not provided an effective means to keep

ever-changing supplier data up to date.

A newer technology is altering these dynamics. Supplier information management (SIM) is a new

class of applications that enables suppliers to maintain their own business data, as well as update

content such as equipment lists, insurance certificates and signed codes of conduct. Putting

suppliers in charge of keeping their data up-to-date simultaneously reduces the burden of data

management on the buyer and keeps information current enough to be more useful. Some SIM

vendors are building and/or leveraging shared databases and document repositories, so suppliers

can update multiple customers at once, which can further reduce costs. Data collected and

updated in an SIM solution can be published to an MDM solution, or, in some cases, the SIM

solution can serve as an MDM solution. As a result of this development in the market, we are

increasing the benefit rating for MDM for supplier data from Low to Moderate this year.

Benefit Rating: Moderate

Market Penetration: Less than 1% of target audience

Maturity: Emerging

Sample Vendors: Aravo; GXS; Oracle; Pool4Tool; Riversand Technologies; SAP; Xcitec; Zynapse

Recommended Reading: "Governance of Master Data Starts With the Master Data Life Cycle"

"The Supply Base Management Application Market and Vendor Landscape"

"Toolkit: Supply Base Management Vendor Evaluation Tool"

"GE Lights Up Supplier Management With Aravo"

Multienterprise Business Process Platform

Analysis By: Andrew White; Deborah R Wilson; Benoit J. Lheureux

Definition: A multienterprise business process platform (ME-BPP) is Gartner's high-level

conceptual model of a multistakeholder environment, where multiple businesses' operational

processes that model multienterprise business processes are governed. The ME-BPP is a

combined set of shared IT and shared solutions and services that enables multienterprise process

design, modeling, improvement, composition, execution and management. The business services

repository (BSR) portion of an ME-BPP exposes automated business functionality as reusable

software services to be used in complex multienterprise process compositions. This differs from a

BPP, which focuses on governance of information and application assets for enterprise-centric

business processes.

Page 18 of 61 Gartner, Inc. | G00217670

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

When participating in an ME-BPP, the following technologies and assets will be governed in a

shared fashion: B2B data and application integration technologies and a range of packaged

business application solutions, coupled with technology services related to (supply chain) visibility,

business intelligence, analytics, performance management, workflow, business process

management technology, multienterprise master data management, multienterprise security and

governance, supplier community management services and portals. A BSR will be used and

implemented in a shared environment, where reusable services are exposed to support composition

and integration.

An ME-BPP supports the consumption of packaged business processes as well as packaged

integration, along with the ability to design and implement custom integration and business

applications for specific business processes. The delivery (or access) of an ME-BPP is always via an

on-demand and software as a service model, so it lends itself to a cloud-based approach, though

does not require it. An ME-BPP is not a technology, but is more a commitment by an organization

to govern the many tools, applications and data services it uses for all its B2B interactions with

external parties, through a single lens, in order to rationalize and simplify the previously many

moving parts. Newly emerging cloud services brokers may play a key role in the formation of ME-

BPPs.

Position and Adoption Speed Justification: The issue that is driving increased interest in ME-

BPPs is the question that many large and some midsize organizations are asking of their technology

providers: "Why do I have so many different vendors to support all my different interactions with my

trading community?" These users are looking to rationalize their investments into a fewer number of

moving parts. The focus on the cloud in 2011, however, is not yet providing a new answer to this

question; it is really changing the way the current set of services are being consumed. Longer-term,

the increased adoption of cloud services brokerages (CSBs) may provide a suitable commercial

rallying point and just the level of flexibility needed by organizations to make an ME-BPP more likely

and sustainable. Regardless, ME-BPP has emerged as a result of the inherent complexity of

implementing complex multienterprise processes, and almost with exasperation users have sought

a suitable approach to addressing the requirement. However, no single vendor supports a complete

ME-BPP, yet. Since 2009, however, numerous vendors have been emerging and/or evolving across

many fronts, toward the same general direction of an ME-BPP, perhaps oriented around a

transaction type or business process category, industry or set of similar services. There are some

business process hubs (BPHs) and business process networks (BPNs) with a combination of

technology and methodologies in varying stages of evolution (notably Ariba, E2open,

iTradeNetwork, Perfect Commerce, Elemica, Hubwoo, GHX and e-Builder, which are converging

toward an ME-BPP). More recently, the formation of CSBs (from some of the same providers, as

well as system integrators and other IT services organizations) seems to provide a more flexible way

for users to access large swathes of services, and these too may start to form into something larger,

like an ME-BPP. Some vendors might be more focused on multienterprise integration (BPNs) and

others on multienterprise business applications (BPHs). None has unified BPN and BPH technology

with metadata-driven process modeling and service-oriented architecture, and the sufficient

community management and performance management infrastructure needed to fully qualify as

supporting the needs of an ME-BPP. Due to the poor economic climate, adoption of this technology

has not continued to evolve, as many organizations have focused on cost optimization rather than

Gartner, Inc. | G00217670 Page 19 of 61

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

longer-term strategic investment. Anemic economic growth will likely continue to inhibit hype and

investment in long-term initiatives such as ME-BPP.

Users will have to continue to look opportunistically for ME-BPP-like offerings among the multitude

of BPHs, BPNs and CSBs offered in the market. The barriers that are slowing the adoption and

development of ME-BPPs are gradually eroding, and include lack of maturity in infrastructure,

trading partners not at the same stage of IT maturity or readiness, insufficient use of metadata-

driven approaches to master data and application modeling, a lack of shared-governance models

(although industry- and community-based process and data standards will help) and inertia (current

investment plans have a return on investment target that still has to be met). ME-BPPs are less

hyped (so far) than the enterprise "version," BPP, which matured as a discipline earlier, since it is

older in concept and pertinent to every enterprise. It is quite likely that the hype related to ME-BPP

will always be less than its enterprise-oriented version.

User Advice: To gain a good understanding of their multienterprise processes, clients should create

a multienterprise process architecture that identifies needs for differentiating multienterprise

processes; needs for standardized, enterprise-oriented business processes would be governed

internally with a BPP, not via a shared ME-BPP. Business process analysts should focus on

designing the differentiating multienterprise processes for change, and on working with their own

and partner IT organizations to implement the first iteration of such processes, including a strategy

and plan for ongoing changes to keep them differentiating, or to move them gradually into the core

as competitors catch on and copy their approach. Users there might conclude that they need to

simplify their overall B2B complexity, but you won't be able to deploy an ME-BPP without the

necessary leadership, investment and organizational maturity to drive adoption of something as

forward-looking as an ME-BPP.

Leverage emerging component parts or delivery vehicles for your current B2B strategy (BPHs,

BPNs and CSBs) that are building toward an ME-BPP offering, to implement configurable,

extendable, shared multienterprise processes. Recognize that an ME-BPP is part technology and

part application infrastructure design concept, with methodologies to support a multistakeholder-

governed infrastructure. An ME-BPP supports a business strategy enabled by technology that

involves communities of interest (business relationships), communities of trust, shared infrastructure

(including integration as a service), and shared or multienterprise business applications. Develop a

multienterprise strategy involving a "portfolio approach" of B2B interactions that might, over time,

rationalize a move toward fewer methods. Seek to consolidate separate B2B projects on one

infrastructure; incorporate your B2B integration strategy into your business application strategy, and

establish clear metrics for tracking the success of your multienterprise projects.

Business Impact: Initial impact is being seen in a number of areas, notably global trade, third-party

logistics, distributed order fulfillment, procure to pay and multienterprise collaboration. In the longer

term, we expect to see more adoption across widespread deployed business processes, such as

those found in application domains, such as CRM, ERP, procurement, product life cycle

management and supply chain management, as well as industry-specific applications.

Benefit Rating: High

Market Penetration: Less than 1% of target audience

Page 20 of 61 Gartner, Inc. | G00217670

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Maturity: Emerging

Sample Vendors: Ariba; Capgemini Ernst & Young; e-Builder; E2open; Elemica; GHX; Hubwoo;

Perfect Commerce; SciQuest; Sterling Commerce

Recommended Reading: "Findings: Ownership of Processes Distinguishes Internal BPP From

Multienterprise BPP"

"The Emergence of the Multienterprise Business Process Platform"

"Best Practices: Checklist for Issues to Consider in Multienterprise Collaboration"

"Examining the Embedded Multienterprise Integration Market"

Supply Base Management

Analysis By: Deborah R Wilson

Definition: Supply base management (SBM) applications improve the ability of procurement

organizations to proactively and effectively manage supplier performance, information and risk by

providing a means and a place to assemble, organize and leverage enterprise supplier data, such as

performance scorecards, capability summaries, risk assessments and credential documents. Data

sources for SBM include suppliers, third-party vendors and internal systems. Through self-service,

embedded portal functionality or procurement networks, suppliers maintain contact information,

firmographic data (company size, location, etc.), equipment lists, capabilities summaries and

credential documents, such as signed codes of conduct and insurance certificates.

Third-party information can be pulled into the application via Web services or batch file upload, and

can include financial performance data, news and public registry information, such as export filings.

Internal data is generated and maintained by the buying organization, and can include user/

requisitioner surveys, supplier audit records, supplier performance scorecards and supplier ideas

programs. The SBM application unites this information to create a single, enterprise record for

suppliers, and it enables organizations to track their responses to that data. For example, an SBM

application will map risks to remediations and track action plans to address performance issues.

SBM solutions are a superset of supplier information management (SIM), supplier performance

management (SPM), vendor risk management (VRM), and supplier risk model map and track

solutions.

Position and Adoption Speed Justification: As a result of significant market growth last year, and

because the hype surrounding these solutions has greatly increased, the SBM solution has

progressed toward the Peak of Inflated Expectations. Several of the vendors we rated in last year's

"The Supply Base Management Application Market and Vendor Landscape" have since been

acquired, because larger suite vendors do not want to be left behind in this hot market by newer

best-of-breed providers. This includes Emptoris, which acquired Xcitec in May 2011; SciQuest,

which acquired AECsoft USA in January 2011; and GXS, which acquired Rollstream in April 2011.

Gartner, Inc. | G00217670 Page 21 of 61

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

User Advice: Consider SBM solutions, rather than SIM, SPM or supplier relationship management

point solutions. These subtypes are rapidly converging in the market. Invest cautiously in this

market segment; however, because requirements are still evolving, applications are new and the

solutions are likely to have gaps in functionality. Don't expect solutions to provide a complete

picture of supplier performance. Most buyers are early adopters helping vendors identify issues,

correct deficits and innovate.

Business Impact: In terms of profitability and agility, organizations that holistically track their

suppliers and leverage their data to achieve a best-in-class supply base will significantly outperform

organizations that don't.

Benefit Rating: High

Market Penetration: Less than 1% of target audience

Maturity: Emerging

Sample Vendors: Aravo Solutions; Archer (EMC/RSA); Ariba; BravoSolution; Curtis Fitch; CVM

Solutions; Decideware; D&B; Emptoris; Fullstep; GEP; GXS; Hiperos; Ivalua; MetricStream; Oracle;

Pool4Tool; SAP; SciQuest; Upside Software; Vortal

Recommended Reading: "The Supply Base Management Application Market and Vendor

Landscape"

"Toolkit: Supply Base Management Vendor Evaluation Tool"

"Understanding Your Top Procurement Processes"

At the Peak

E-Invoicing

Analysis By: Paolo Malinverno

Definition: Electronic invoicing (e-invoicing) cuts through many disciplines, requires a lot of

knowledge (spanning business, regulations and IT) and involves a lot of complexity. A good

definition of e-invoicing is "the interchange and storage of legally valid invoices in electronic format

only among trading partners." See "Cost Savings Finally Make the (European) E-Invoicing

Steamroller Pick Up Speed" for more details.

The interchange does not use or require paper-based invoices. E-invoices have legal validity, and

can be used to prove compliance or as tax originals. In general, most considerations for e-invoicing

apply whether you are sending e-invoices or receiving them. Operationally:

The seller must ensure that the invoice contains the correct data and is authentic.

The buyer must verify the authenticity of the invoice, match it to goods or services received, and

execute payment.

Page 22 of 61 Gartner, Inc. | G00217670

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Both the seller and the buyer (or a third party on their behalf) must store the readable and

authentic invoice (this comes with a lot of added strong security) for a period of time, and must

make it available to a tax authority on request.

Position and Adoption Speed Justification: E-invoicing touches internal business processes,

mutual agreements among business partners, financial transactions, tax and legal implications, and

a lot of the IT infrastructure that supports all that. Several studies and surveys are available on the

current e-invoicing uptake, and on the projected growth of the market in the next few years. So, e-

invoicing is possible, viable and beneficial today, not only in Europe, but also across the world; in

some cases (such as Mexico and Brazil), it is even mandatory.

Normative standards abound across the world, and they keep coming; as always happens in B2B,

standards accumulate, and too many standards means that there is no standard at all. In Europe,

the EU issued a directive in 2001, and has revised it twice since, with a view to "simplifying,

modernizing and harmonizing the conditions laid down for invoicing with respect to the value-added

tax in the EU" for all member states. A core theme of the directive was to promote the efficient

cross-border creation, transmission, acceptance, storage and retrieval of invoices. To allow for

technological differences among all member states, and to stay technology-neutral, the directive

enabled several ways of meeting conditions for e-invoicing. For example, the requirements to

ensure authenticity and integrity can be met either through advanced or qualified electronic

signatures, or through electronic data interchange (EDI) with contractual security measures.

Unfortunately, this technological flexibility has led member states to adopt state-specific versions of

the directive that have disparate requirements for meeting the functional objectives. These

requirements, in turn, have led to more-stringent or less-stringent controls, depending on the

member state. Several governments in Europe (and other governments around the world, especially

in South America) mandate the use of e-invoicing for government agencies, and more are likely to

follow suit in the next year or two.

Many intricacies are associated with cross-country e-invoicing projects (supplier e-invoicing and

generic e-invoicing projects with all business partners in one country are considerably easier). There

are several axes of variance for e-invoicing requirements (internal and multienterprise business

processes, IT infrastructures, and law and security, to name a few), and they cause many

differences from the seller's and the buyer's perspectives; frequently, for example, different laws

apply to buyers and to sellers. This is, by far, the most common source of difficulties in e-invoicing

projects, and is compounded by continuously evolving regulations and general requirements.

Another complication is that most requirements, in practice, are not properly published by member

states, and are extremely difficult or expensive for businesses to obtain, interpret and monitor.

The European Association of Corporate Treasurers identified the average processing cost of a

paper invoice across Europe to be around 30. It also determined that, by using e-invoicing, an

80% cost savings is possible. Confirming that data, initial case studies also indicate that e-invoicing

has been proved to reduce the cost of processing a single invoice to less than 7. E-invoicing offers

a range of potential benefits, including improvements in accounts payable (AP) processes by

reducing invoice processing time and minimizing manual intervention, thus leading to a reduction in

operating expenses. This fact alone has prompted some companies to start e-invoicing projects; it

makes many others look deeper into the e-invoicing conundrum.

Gartner, Inc. | G00217670 Page 23 of 61

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

However, after a few dormant years, e-invoicing adoption is finally taking off. None of the following

reasons in isolation is enough to warrant continued growth, but all of them together are driving and

will drive more widespread adoption:

Strong user demand, because of the benefits, especially savings

Increasing supply, and an associated increase in the maturity and effectiveness of e-invoicing

solutions; in particular, several banks are promoting e-invoicing in their strategies (especially in

Spain, Scandinavia and Switzerland)

More governments mandating e-invoicing, especially in the EU and South America

Increasing availability of viable (and compelling) e-invoicing references and case studies as

more companies adopt e-invoicing

E-invoicing will grow steadily in the next few years, despite all the difficulties associated with it,

simply because the momentum of the four factors noted above is stronger than the decelerating

force of the difficulties. However, many difficulties are associated with normative functions in

different countries, so we do not expect e-invoicing to reach the Plateau of Productivity before two

to four years.

User Advice: Calculate your current average invoice processing cost, and confirm it with the

business. Focus your initial e-invoicing projects in countries where B2B and invoice exchange are

already happening and maturing, such as Scandinavia, Brazil, Mexico, Spain, Singapore, South

Korea, Germany, Poland, France and the U.K. Be aware of the further constraints and limitations

based on where the countries you do e-invoicing to and from allow e-invoices to be stored.

E-invoicing services are sprawling across the world, especially in Europe and South America, so

make sure the solution you choose addresses internal and multienterprise business processes, IT

infrastructures, laws, and security, and that it's certified by tax auditors for as many countries as

possible, especially those where you have a steady flow of invoices to and from that connect with

other service providers, certified e-invoice networks and banks.

Multicountry e-invoicing projects last years, so don't sell the benefits internally to your company too

quickly. In a large project, if you make 50% of your invoicing traffic electronic in two years, you're

doing great. Never underestimate the consequences of the diversity of regulations across countries;

work with your auditors and process architects, because e-invoicing is cross-functional by nature.

Research and track, on an ongoing basis, the value-added tax (VAT) laws and e-invoice

requirements in each country, or make sure your e-invoicing solution supplier does that.

Implement e-invoicing in conjunction with e-procurement or another procure-to-pay or B2B

infrastructure, if possible, to leverage purchase order information for a higher match rate to the

invoice.

No matter what vertical or financial shape your company is in, start looking for e-invoicing project

savings opportunities now. Don't hold out for regulations and interoperability to get better; you can

reap good benefits from e-invoicing today.

Page 24 of 61 Gartner, Inc. | G00217670

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Business Impact: Plan your e-invoicing projects according to how many invoices you can process

automatically in the countries the invoices will progressively touch; plan globally from the start, even

if you are starting to execute locally. The faster you build critical mass, the greater the difference to

your company's bottom line.

Current case studies indicate that you can quantify e-invoicing savings in many ways: the cost per

invoice, the total savings due to reduced number of resources and computing power (60% to 80%,

compared with paper invoice processing), or a percentage of a midsize to large company's turnover

(around 1%). Whichever way you put it, the clear indication from case studies is that the savings for

companies that have to deal with a large volume of invoices (more than 100 per day, inbound and

outbound) are significant (see "Supplier E-Invoicing Networks"), because of the economies of scale

obtained by aligning technical, business and compliance strategies.

Other benefits of e-invoicing, when implemented through e-invoicing networks or as part of a

broader B2B solution with ad hoc applications, include:

Better spending analysis, leading to some spending reduction

Faster processing times and payment cycles

Enhanced contract performance analysis

Better tracking and enforcing of trading partner compliance with commercial terms