Escolar Documentos

Profissional Documentos

Cultura Documentos

Review of India's Government Accounting Classification Structure

Enviado por

Anonymous j8laZF8Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Review of India's Government Accounting Classification Structure

Enviado por

Anonymous j8laZF8Direitos autorais:

Formatos disponíveis

C ont roller General of Acc ount s

Report of the C ommittee Constituted to Review the List of Major and Minor Heads of Accounts (LMMHA) of

Union and S tates

EX EC UTIVE S UMMARY

l

l

In the wake of emerging requirements for more effective Management

Information S ystem to be used for better planning and resource allocation

process, more effective monitoring of application of resources in

G overnment S chemes and a more robust Public Financial Management by

G overnment, a need has been felt for quite some time to review the present

classification of government transactions which is the basic tool for

capturing the Budgeting and accounting data. It was felt that the existing

C lassification structure has some inadequacies which pose limitations on

its effectiveness in capturing relevant budgeting and accounting data

required to cope up with the new challenges in the area of Public Financial

Management and a system better suited to display the nature and objective

of G overnment expenditure needs to be developed.

With these objectives in mind, the Government of India has constituted

a committee under the chairmanship of Controller General of Accounts to:

C onduct a comprehensive review of the existing system of

expenditure and receipt classification as contained in the List of

Major and Minor Heads and to evolve a system which could cater to

the requirements for policy formulation, allocation of resources

among sectors, compliance with legislative authorizations,

accountability, policy review and performance analysis, and

S uggest a new list of accounting heads in replacement of the existing

List of Major and Minor Heads keeping in view the needs for

simplification, rationalization, and standardization across national

and sub-national governments, and improved reporting of transfer

payments from one level of governance to another.

The C ommittee had representation from the Budget Division,

Ministry of Finance, Planning C ommission, the C omptroller and Auditor

G eneral of India, S tate G overnments of Assam, Tamilnadu, and

Maharashtra, and National Institute for Public Finance and Policy

(NIPFM).

7

C ont roller General of Acc ount s

Report of the C ommittee Constituted to Review the List of Major and Minor Heads of Accounts (LMMHA) of

Union and S tates

The Office order constituting the C ommittee, its membership and

terms of reference is placed at Annexure 'A'.

The Office of the C ontroller General of Accounts provided the

technical and secretarial assistance to the C ommittee.

A brief account of the existing structure, the underlying reasons for

need of its amendment, the major deviations from the existing structure in

the proposed classification structure and the benefits to be accrued from it

8

Box-1

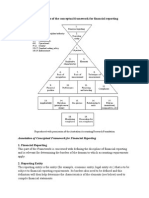

The existing system of classification in the G overnment of India follows a six-tier

hierarchical structure which is:

1. Major Head (4 digits)-representing a major function of the government.

2. S ub-Major Head (2 digits) - representing a sub-function of the government.

3. Minor Head (3 digits)- representing a programme of the government.

4. S ub Head (2 digits)- representing a scheme.

5. Detailed Head(2 digits) - representing a sub-scheme and;

6. Object head (2 digits)- representing economic nature of expenditure.

Expenditures are classified according to the function, programme, and their

economic nature using a fifteen digit numerical code. Receipts are classified

according to their nature and source. The classification system also applies to the

State Governments, with the exception that they are given the flexibility to open their

own heads below the third tier in the six tier hierarchy as per their respective needs.

The present classification system poses a few limitations. The main weaknesses/

issues pointed out by the various agencies can be summarized as follows:

l There is opaqueness in data on transfers to states. The S tate-wise details of

transfers, information on releases to states under the various functional heads

are not captured.

l There is lack of standardization of scheme classification. Plan schemes are not

captured uniformly at one level.

l Major Heads, which are supposed to represent government functions do not

reflect true functional character of expenditures and do not correspond to

Heads of development used in the planning and resource allocation process.

C ont roller General of Acc ount s

Report of the C ommittee Constituted to Review the List of Major and Minor Heads of Accounts (LMMHA) of

Union and S tates

l Breakup of central transfers into constituent flows such as Finance

C ommission grants, Normal C entral Assistance, Additional C entral Assistance,

S pecial Central Assistance etc. are not captured.

l There are emerging special requirements such as gender budgeting, budgeting

for S C/S T, North Eastern Region (NER), that are not very well catered to by the

existing system.

The proposed classification structure is a multi-segment structure developed

mainly by rationalizing and reorganizing the information content of the existing

six tier hierarchical structure into separate logical dimensions. It has following

seven mutually exclusive segments with their own individual hierarchical

structures.

1. Administrative S egment

2. Function S egment

3. Programme cum S cheme S egment

4. Recipient S egment

5. Target segment

6. Economic S egment

7. G eographic S egment

The mutually exclusive nature of the segments means that the various constituents

of the system are standardized. Each item is classified only once in the system and is

identifiable with a unique code.

In brief, the main benefits perceived from the new C lassification structure proposed

by the C ommittee are as under:

l It would allow capturing of almost the entire spectrum of data attributes on

public financial operations

l It would facilitate financial reporting in a variety of ways for meeting

information requirements of different stakeholders.

l It would greatly simplify classification and presentation of budget.

l It would be computer friendly and open the accounting database to complete

slicing and dicing. The retrieval of information from the system will be easier

and reporting will be more flexible.

l Maintenance of the Code directory would be far more easier.

9

C ont roller General of Acc ount s

Report of the C ommittee Constituted to Review the List of Major and Minor Heads of Accounts (LMMHA) of

Union and S tates

is given in the Box below.

The report of the C ommittee is organized in two parts.

Part I contains the main report of the C ommittee.

Part II contains the document named as "The C ompendium of

Accounting C lassification C odes". It has nine sections; S ection I contains

G eneral Directions for the proposed structure, S ection II contains the list of

Major, sub-Major and S cheme Heads, S ection III to IX contains the

Programme C odes, list of S chemes, Administrative, Recipients, Object

(Economic), Target and G eographical C odes.

The recommendations contained in the report are the outcome of

several rounds of discussion among the C ommittee members,

consultations with various stakeholders and in-depth study of specific

issues related to budgeting, accounting and views of earlier C ommittees on

various aspects of classification.

The proposed classification structure is a multi-segment structure

developed mainly by rationalizing and reorganizing the information content

of the existing six tier hierarchical structure into separate logical

dimensions. It has the following seven mutually exclusive segments with

their own individual hierarchical structures.

1. Administrative S egment

2. Function S egment

3. Programme cum S cheme S egment

4. Recipient S egment

5. Target segment

6. Economic S egment

7. G eographic S egment

The mutually exclusive nature of the segments means that the

10

C ont roller General of Acc ount s

Report of the C ommittee Constituted to Review the List of Major and Minor Heads of Accounts (LMMHA) of

Union and S tates

various constituents of the system are standardized. Each item is classified

only once in the system and is identifiable with a unique code.

The structure is in line with the recommendation of the Expert group

constituted to review the classification system for G overnment

Transactions also known as 'Lahiri C ommittee' which recommended

adoption of a multidimensional classification structure with linkages

between the accounting classification and standard classification systems

such as G overnment Finance S tatistics(G FS ) and system of National

Accounts.

The proposed independent segments of the proposed structure and

the intended benefits are summarized as follows:

Administ rat ive S egment : This segment is intended to identify the

administrative responsibility for expenditures. It would strengthen

the accountability arrangements for public spending by attributing

each budget line to an administrative authority.

F unc t i on segment : This s egment is meant to classify functions

of G overnment. The existing functional class ification s tructure

has been realigned to Heads of Development being u sed by

Planning C ommission. This will enable the Fu nctional heads to

be u sed as a very effective tool for macro level planning and

sectoral analys is.

Programme c um S c heme S egment : This S egment is meant for

classifying all Programmes and Plan and Non-plan S chemes/ S ub-

schemes of G overnment with standard codes for each of them. A

programme could be defined as a set of activities that are required to

achieve a defined objective. They are important tools for policy and

political intervention and are, therefore, of great importance to the

legislature, the executive and the beneficiaries. C lassification of

l

l

l

11

C ont roller General of Acc ount s

Report of the C ommittee Constituted to Review the List of Major and Minor Heads of Accounts (LMMHA) of

Union and S tates

expenditure by programs is also necessary for development of an

Outcome oriented budget. This standardization would facilitate

linking expenditure under a programme and scheme across different

levels of administration and establishing trails from the Union

G overnment to the lowest level, which would be particularly useful in

case of multi-layered transfers. The S chemes and S ub-schemes are

grouped into suitable category of programmes. It is important to

clarify that the term 'S cheme C ategory' not only connotes the

development schemes of the G overnment but also covers the Receipts

and Public Account transactions which are represented by the 'Minor

Head' of the existing List of Major and Minor Heads of Accounts

(LMMHA).

Rec ipient S egment : This segment is proposed to recognize the

external agencies and entities that are recipients of public funds as

instruments and channels of public policy delivery. S uch entities

would include sub-national governments and other public and

private agencies. The main benefit of using this segment is that it

would make it possible to assign unique codes to each such entity.

With the standardization of coding, it should be possible to extract

and compile information on allocations/transfer of resources to each

such agency under different government schemes and heads. It

would also facilitate tracking of flow of funds under a scheme from

one level to another.

Target segment : This segment would be used to identify

expenditures targeted at special policy objectives. At present at least

five such requirements are identified, viz. Women C entric (WC )

expenditures, expenditures targeted at development of hill areas,

expenditures targeted at development of S chedule C astes (S C ),

expenditures targeted at development of S chedule Tribes (S T), and

expenditure targeted at Below Poverty Line (BPL) population. This

l

l

12

C ont roller General of Acc ount s

Report of the C ommittee Constituted to Review the List of Major and Minor Heads of Accounts (LMMHA) of

Union and S tates

would enable the capturing of Budget and accounting data pertaining

to emerging special requirements such as gender budgeting,

budgeting for S C /S T, that are not very well catered to by the existing

system.

Ec onomi c S egment : This segment covers the list of object heads

being used in the existing system of Budget and accounts to

capture the economic nature of expenditure. The object

classification is currently applied only to expenditure transactions.

Receipt and Public Account heads do not use object codes. It is

proposed to develop the current Object list into a full-fledged

financial classification indicated by the proposed 'Economic

S egment', which could be applied to all transactions. The Economic

S egment has been largely developed on the lines of classification

prescribed in the IMF G FS Manual 2001, with the exception that it

would be tailored to the present cash based accounting and

budgeting system.

Geographic al segment : The G eographic segment would identify the

physical location of the transaction and allow for inter-regional

comparisons of public spending. This classification identifies such

pol i t i c o- geogra ph i c a l di vi s i on s a s s t a t es , di s t ri c t s a n d

towns/villages.

Budget present at ion:

In the proposed structure, it is envisaged that the budget

provisions would now be attributed directly to the schemes and

administrative units responsible for implementing/executing those

schemes. All budget lines would necessarily have three attributes -

administrative units, programmes and schemes [Plan or Non-Plan], and

economic object. If the budget provision is meant for transfer payment,

l

l

13

C ont roller General of Acc ount s

Report of the C ommittee Constituted to Review the List of Major and Minor Heads of Accounts (LMMHA) of

Union and S tates

[such as grants, subsidies, contributions, loans etc. ] the entity receiving

the transfer would also be recognized to the extent possible at the budget

stage. S imilarly, expenditure provisions targeted at certain identifiable

groups, such as women, S C , S T etc. would be suitably flagged to identify

the target group. If the expenditure is meant for any special area or a

region, [such as North East Region, Bundelkhand, Bodoland, etc. ] the

area/region would also be recognized at the Budget stage. Besides, the

G eographical segment could also be used to capture the geographical

location of an expenditure item.

To sum up, the new C lassification structure aims to address all the issues

related to critical information requirement of the G overnment and would

be a very effective tool for establishing a very robust Public Financial

Management. The structure can be applied to S tate G overnments as well.

The mutually exclusive structure would provide enough flexibility to the

S tate G overnments to add or drop a segment or two should it be

considered necessary for their local information requirements. S tates

would also have the flexibility to add more levels in any of the segment

below those provided for in this structure. More importantly, the top

three layers of the existing system have not been dislocated fully. They

have been realigned with some additions and new set of standard codes.

This would make the transition to this new system from the exiting one a

less arduous task.

**************

14

C ont roller General of Acc ount s

Report of the C ommittee Constituted to Review the List of Major and Minor Heads of Accounts (LMMHA) of

Union and S tates

C HAPTER-1

INTRODUC TION

1. 1 Article 150 of the C onstitution provides for maintenance of the

G overnment accounts "in such form as the President may, on the advice of

the Comptroller & Auditor G eneral, prescribe". The executive powers to

prescribe the form and content of accounts are delegated to the C ontroller

G eneral of Accounts, Ministry of Finance under the Allocation of Business

Rules. In exercise of these powers, the List of Major & Minor Heads (LMMH),

containing the accounting classification of receipts and disbursements, is

maintained by the C ontroller G eneral of Accounts on the advice of the

C omptroller & Auditor G eneral of India.

1. 2 The existing system of classification in the G overnment of India

follows a six-tier hierarchical structure. Expenditures are classified

according to the function, programme, and their economic nature using a

fifteen digit numerical code. Receipts are classified according to their nature

and source. The classification system also applies to the S tate

G overnments, with the exception that they are given the flexibility to open

their own heads below the third tier in the six tier hierarchy as per their

respective needs.

1. 3 The present classification structure was introduced in the year 1974

on the recommendations of a committee headed by S h. Mukherji, the then

Deputy C omptroller and Auditor G eneral. It was reviewed in 1987 by

another committee under the chairmanship of S h. R C G hai, J oint

C ontroller G eneral of Accounts. The classification system has remained

unchanged since then.

1. 4 There have been concerns expressed from time to time that this

classification system is no longer adequately serving the changing

15

Você também pode gostar

- Budget HeadsDocumento30 páginasBudget HeadsAnonymous cRMw8feac8Ainda não há avaliações

- Psa522 Group 6 - Liyana 2017525427Documento32 páginasPsa522 Group 6 - Liyana 2017525427Liyana IzyanAinda não há avaliações

- Introduction to FGE Accounting and Financial ManagementDocumento61 páginasIntroduction to FGE Accounting and Financial ManagementGirma100% (4)

- Revised Object Heads For Govt of A.P. 2019Documento30 páginasRevised Object Heads For Govt of A.P. 2019YadamsatishAinda não há avaliações

- Appraisal of The Accounting System in Nigerian Public Sector (A Case Study of Selected Government Establishment in Enugu)Documento62 páginasAppraisal of The Accounting System in Nigerian Public Sector (A Case Study of Selected Government Establishment in Enugu)Babah Silas VersilaAinda não há avaliações

- Unit V Reporting To Management Objectives of The StudyDocumento32 páginasUnit V Reporting To Management Objectives of The StudyShinchana KAinda não há avaliações

- STRATEGIES TO IMPROVE LOCAL AUTHORITY PERFORMANCEDocumento9 páginasSTRATEGIES TO IMPROVE LOCAL AUTHORITY PERFORMANCEcholaAinda não há avaliações

- Government Accounting in BangladeshDocumento20 páginasGovernment Accounting in BangladeshMohammad Saadman100% (3)

- (IMF Working Papers) Introducing Financial Management Information Systems in Developing CountriesDocumento25 páginas(IMF Working Papers) Introducing Financial Management Information Systems in Developing Countriesstratmen.sinisa8966Ainda não há avaliações

- FGE Module I NewDocumento93 páginasFGE Module I NewGedion100% (3)

- Unified Account Code SystemDocumento5 páginasUnified Account Code SystemHanz paul IguironAinda não há avaliações

- BLGF SRE Manual 2015 PDFDocumento120 páginasBLGF SRE Manual 2015 PDFBench Bayan100% (1)

- Guide On in - Year Management, Monitoring and ReportingDocumento49 páginasGuide On in - Year Management, Monitoring and ReportingriaanAinda não há avaliações

- Generic Chart of AccountsDocumento38 páginasGeneric Chart of AccountsAndy WynneAinda não há avaliações

- Introduction to FGE AccountingDocumento28 páginasIntroduction to FGE Accountingsamuel debebeAinda não há avaliações

- Methods of Preparing and Keeping Government Accounts 2Documento6 páginasMethods of Preparing and Keeping Government Accounts 2James UgbesAinda não há avaliações

- Historical overview of Ethiopian Government Accounting SystemDocumento20 páginasHistorical overview of Ethiopian Government Accounting Systemnegamedhane58Ainda não há avaliações

- A Science-Based Approach To The Conceptual Framework For General Purpose Financial Reporting by Public Sector EntitiesDocumento19 páginasA Science-Based Approach To The Conceptual Framework For General Purpose Financial Reporting by Public Sector EntitiesInternational Consortium on Governmental Financial ManagementAinda não há avaliações

- Summary of New CF 2018Documento23 páginasSummary of New CF 2018Ashraf Uz ZamanAinda não há avaliações

- Government's unified accounts code structure (UACS) explainedDocumento5 páginasGovernment's unified accounts code structure (UACS) explainedRuiz, CherryjaneAinda não há avaliações

- Contabilidad Del Gobierno y El Uso de Las Bases DevengadasDocumento10 páginasContabilidad Del Gobierno y El Uso de Las Bases DevengadasDayanna Marcela Saza RojasAinda não há avaliações

- Name: - Section: - Schedule: - Class Number: - DateDocumento9 páginasName: - Section: - Schedule: - Class Number: - DateChristine Nicole BacoAinda não há avaliações

- Ethiopian Gov't AssignmentDocumento7 páginasEthiopian Gov't AssignmentHasen Yib0% (1)

- Budget Manual 2016Documento175 páginasBudget Manual 2016Mostfa KayedAinda não há avaliações

- Rep HleDocumento102 páginasRep HleblaiseinfoAinda não há avaliações

- The New Government Accounting S Stem of The Philippines: .... B Flerida V. CreenciaDocumento6 páginasThe New Government Accounting S Stem of The Philippines: .... B Flerida V. CreenciachekuhakimAinda não há avaliações

- Public Assignment TwoDocumento6 páginasPublic Assignment TwoHabtemichael ShimalesAinda não há avaliações

- HR Internal Audit ReportDocumento26 páginasHR Internal Audit ReportMohamed EmadAinda não há avaliações

- Budget - Meaning, Characteristics, Functions and Classification.Documento10 páginasBudget - Meaning, Characteristics, Functions and Classification.Learner8479% (14)

- Government Accounting Objectives and Responsibility CentersDocumento18 páginasGovernment Accounting Objectives and Responsibility Centers143incomeAinda não há avaliações

- IASB publishes Exposure Draft on revised Conceptual FrameworkDocumento4 páginasIASB publishes Exposure Draft on revised Conceptual FrameworkananiculaeAinda não há avaliações

- Designing a Balanced Scorecard for Local Authority EvaluationDocumento16 páginasDesigning a Balanced Scorecard for Local Authority EvaluationSagar BhandariAinda não há avaliações

- Mawlana Bhashani Science and Technology UniversityDocumento20 páginasMawlana Bhashani Science and Technology UniversitySabbir Ahmed100% (1)

- Topic 1. Regulatory Frameworks PDF-1Documento36 páginasTopic 1. Regulatory Frameworks PDF-1Frank AlexanderAinda não há avaliações

- If There Is Government Accounting, Why Are Still Their Fraudulent Report?Documento3 páginasIf There Is Government Accounting, Why Are Still Their Fraudulent Report?Charlotte PalmaAinda não há avaliações

- 2013 Afr Goccs Volume II-ADocumento456 páginas2013 Afr Goccs Volume II-AjunmiguelAinda não há avaliações

- Budgetary Control in TNB's Retail DivisionDocumento12 páginasBudgetary Control in TNB's Retail DivisionWan KhaidirAinda não há avaliações

- Governmental Accounting 1 - 1Documento12 páginasGovernmental Accounting 1 - 1as7487419Ainda não há avaliações

- Chart of AccountsDocumento6 páginasChart of Accountssundar kaveetaAinda não há avaliações

- Training Material On West Bengal Financial Rules and Office ProceduresDocumento150 páginasTraining Material On West Bengal Financial Rules and Office Proceduresswarnendu_janaAinda não há avaliações

- Conceptual Framework - AccountingDocumento3 páginasConceptual Framework - Accountingxxvoxx100% (1)

- Government Accounting and Budgeting Module at Don Mariano Marcos Memorial State UniversityDocumento36 páginasGovernment Accounting and Budgeting Module at Don Mariano Marcos Memorial State UniversityErika MonisAinda não há avaliações

- Fge Group Assignment No.1&2Documento6 páginasFge Group Assignment No.1&2Emebet TesemaAinda não há avaliações

- Improve Government and Nonprofit Financial ReportingDocumento7 páginasImprove Government and Nonprofit Financial Reportingmanita jainAinda não há avaliações

- Improve Government and Nonprofit Financial ReportingDocumento7 páginasImprove Government and Nonprofit Financial Reportingmanita jainAinda não há avaliações

- Chievementof Auditor Opinion Through Application of Government Accounting Standards and Effectiveness Ofthe Internal Control SystemDocumento12 páginasChievementof Auditor Opinion Through Application of Government Accounting Standards and Effectiveness Ofthe Internal Control SystemAJHSSR JournalAinda não há avaliações

- 02 - Overview of Audit Mechanisms 2015Documento7 páginas02 - Overview of Audit Mechanisms 2015sajedulAinda não há avaliações

- A Conceptual Framework For Financial Accounting and ReportingDocumento70 páginasA Conceptual Framework For Financial Accounting and ReportingAyesha ZakiAinda não há avaliações

- MGT AC Notes - Unit I, II - CGDocumento17 páginasMGT AC Notes - Unit I, II - CGVISHAGAN MAinda não há avaliações

- Aa 4102 Hand Outs Part 1Documento12 páginasAa 4102 Hand Outs Part 1Ace Hulsey TevesAinda não há avaliações

- Actividad 3.4.FinancialAccountingStandardsBoardsDocumento10 páginasActividad 3.4.FinancialAccountingStandardsBoardsLIGIA MENDEZ SANCHEZAinda não há avaliações

- GovtcoaDocumento76 páginasGovtcoaice_heatAinda não há avaliações

- Chapter 1Documento6 páginasChapter 1Dùķe HPAinda não há avaliações

- CMA IFRS Statements February09Documento6 páginasCMA IFRS Statements February09osogboandrew_9480574Ainda não há avaliações

- Operational Framework of Accrual Basis of Accounting in Governments in IndiaDocumento19 páginasOperational Framework of Accrual Basis of Accounting in Governments in Indiasas examAinda não há avaliações

- NGASDocumento30 páginasNGASGlaiza GiganteAinda não há avaliações

- Baps 09 Block 03 IDocumento63 páginasBaps 09 Block 03 IMd ShamiAinda não há avaliações

- Tool Kit for Tax Administration Management Information SystemNo EverandTool Kit for Tax Administration Management Information SystemNota: 1 de 5 estrelas1/5 (1)

- The Essentials of Finance and Accounting for Nonfinancial ManagersNo EverandThe Essentials of Finance and Accounting for Nonfinancial ManagersNota: 5 de 5 estrelas5/5 (1)

- MGP 2018 Batch eDocumento8 páginasMGP 2018 Batch ederconator3783Ainda não há avaliações

- Reason in Human AffairsDocumento6 páginasReason in Human AffairsAnonymous j8laZF8Ainda não há avaliações

- Get TRDocDocumento70 páginasGet TRDocAnonymous j8laZF8Ainda não há avaliações

- Social Security Schemes in India An Overview - Team IIIDocumento49 páginasSocial Security Schemes in India An Overview - Team IIIAnonymous j8laZF8Ainda não há avaliações

- Name Correction FormateDocumento1 páginaName Correction FormateAnonymous j8laZF8Ainda não há avaliações

- MP Society EngDocumento13 páginasMP Society EngAnonymous j8laZF8Ainda não há avaliações

- Name Correction Formate PDFDocumento1 páginaName Correction Formate PDFAnonymous j8laZF8Ainda não há avaliações

- New Microsoft Office PowerPoint PresentationDocumento1 páginaNew Microsoft Office PowerPoint PresentationabdiiriAinda não há avaliações

- CPA Is BackDocumento13 páginasCPA Is BackAnonymous j8laZF8Ainda não há avaliações

- Policy Analysis SummaryDocumento12 páginasPolicy Analysis SummaryAnonymous j8laZF8Ainda não há avaliações

- NSAP Provides Social Security for Elderly, Poor HouseholdsDocumento11 páginasNSAP Provides Social Security for Elderly, Poor HouseholdsAnonymous j8laZF8Ainda não há avaliações

- India Growth Story - Mislead or MisunderstoodDocumento4 páginasIndia Growth Story - Mislead or MisunderstoodAnonymous j8laZF8Ainda não há avaliações

- Policy Science - 06 - Chapter 1 - ShodhGangaDocumento34 páginasPolicy Science - 06 - Chapter 1 - ShodhGangaAnonymous j8laZF8Ainda não há avaliações

- NPM - A Critical TheoryDocumento21 páginasNPM - A Critical TheoryAnonymous j8laZF8Ainda não há avaliações

- Approaches To Policy For EvaluationDocumento17 páginasApproaches To Policy For EvaluationAnonymous j8laZF8Ainda não há avaliações

- Priyanka Shukla - CEO RajnandgaonDocumento3 páginasPriyanka Shukla - CEO RajnandgaonAnonymous j8laZF8Ainda não há avaliações

- Seeds of Distress - FrontlineDocumento4 páginasSeeds of Distress - FrontlineAnonymous j8laZF8Ainda não há avaliações

- Geetanee Napal - An Assessment of The Ethical Dimensions of CorruptionDocumento5 páginasGeetanee Napal - An Assessment of The Ethical Dimensions of CorruptionGaruda Sade WibowoAinda não há avaliações

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- How to Write a Good EssayDocumento5 páginasHow to Write a Good Essayfelixrajas100% (2)

- Essay Compulsory 2012-1993Documento21 páginasEssay Compulsory 2012-1993karnatisharathAinda não há avaliações

- APFC 2012 Question Paper Series DDocumento29 páginasAPFC 2012 Question Paper Series DHarman VishnoiAinda não há avaliações

- Upsc Syllabus FlowchartDocumento19 páginasUpsc Syllabus FlowchartabhijeetAinda não há avaliações

- Upsc Syllabus FlowchartDocumento19 páginasUpsc Syllabus FlowchartabhijeetAinda não há avaliações

- Tiket Kemahasiswaan Makasar1Documento4 páginasTiket Kemahasiswaan Makasar1BLU UnramAinda não há avaliações

- Canons of ST Basil The GreatDocumento67 páginasCanons of ST Basil The Greatparintelemaxim100% (1)

- Culturally Appropriate Communication in Malaysia Budi Bahasa As Warranty Component in Malaysian DiscourseDocumento15 páginasCulturally Appropriate Communication in Malaysia Budi Bahasa As Warranty Component in Malaysian DiscourseNur FarihaAinda não há avaliações

- Maguindanao MassacreDocumento3 páginasMaguindanao MassacreMa. Jenelyn DelegenciaAinda não há avaliações

- Matrix of Activities For The Submission of Tasks For ResearchDocumento5 páginasMatrix of Activities For The Submission of Tasks For ResearchJAY LORRAINE PALACATAinda não há avaliações

- The Night Artist ComprehensionDocumento6 páginasThe Night Artist ComprehensionDana TanAinda não há avaliações

- Intercape Sleepliner Ticket from Cape Town to JohannesburgDocumento1 páginaIntercape Sleepliner Ticket from Cape Town to JohannesburgRobert Bailey100% (1)

- 1.1.a New Attitude For A New YearDocumento8 páginas1.1.a New Attitude For A New YearMatthew LopezAinda não há avaliações

- Questions of ValueDocumento2 páginasQuestions of ValueRockyAinda não há avaliações

- Chap 1 ScriptDocumento9 páginasChap 1 ScriptDeliza PosadasAinda não há avaliações

- Common Law MarriageDocumento3 páginasCommon Law MarriageTerique Alexander100% (1)

- (123doc) - New-Tuyen-Chon-Bai-Tap-Chuyen-De-Ngu-Phap-On-Thi-Thpt-Quoc-Gia-Mon-Tieng-Anh-Co-Dap-An-Va-Giai-Thich-Chi-Tiet-Tung-Cau-133-TrangDocumento133 páginas(123doc) - New-Tuyen-Chon-Bai-Tap-Chuyen-De-Ngu-Phap-On-Thi-Thpt-Quoc-Gia-Mon-Tieng-Anh-Co-Dap-An-Va-Giai-Thich-Chi-Tiet-Tung-Cau-133-TrangLâm Nguyễn hảiAinda não há avaliações

- University Student Council: University of The Philippines Los BañosDocumento10 páginasUniversity Student Council: University of The Philippines Los BañosSherwin CambaAinda não há avaliações

- Project On-Law of Torts Topic - Judicial and Quasi Judicial AuthoritiesDocumento9 páginasProject On-Law of Torts Topic - Judicial and Quasi Judicial AuthoritiesSoumya Shefali ChandrakarAinda não há avaliações

- Municipal Best Practices - Preventing Fraud, Bribery and Corruption FINALDocumento14 páginasMunicipal Best Practices - Preventing Fraud, Bribery and Corruption FINALHamza MuhammadAinda não há avaliações

- Prospects For The Development of Culture in UzbekistanDocumento3 páginasProspects For The Development of Culture in UzbekistanresearchparksAinda não há avaliações

- List of Solar Energy Operating Applications 2020-03-31Documento1 páginaList of Solar Energy Operating Applications 2020-03-31Romen RealAinda não há avaliações

- English 7 WorkbookDocumento87 páginasEnglish 7 WorkbookEiman Mounir100% (1)

- Soal Pas SMKDocumento3 páginasSoal Pas SMKsofiAinda não há avaliações

- Lost Spring exposes lives of povertyDocumento5 páginasLost Spring exposes lives of povertyvandana61Ainda não há avaliações

- Blades of Illusion - Crown Service, Book 2 First Five ChaptersDocumento44 páginasBlades of Illusion - Crown Service, Book 2 First Five ChaptersTerah Edun50% (2)

- Powerpoint of Verbal Communication: The Way People SpeakDocumento15 páginasPowerpoint of Verbal Communication: The Way People SpeakRisa Astuti100% (1)

- Development of Financial Strategy: Chapter Learning ObjectivesDocumento6 páginasDevelopment of Financial Strategy: Chapter Learning ObjectivesDINEO PRUDENCE NONG100% (1)

- Fundamentals of Accountancy, Business and Management 1 (FABM1)Documento9 páginasFundamentals of Accountancy, Business and Management 1 (FABM1)A.Ainda não há avaliações

- 01082023-Stapled Visa ControversyDocumento2 páginas01082023-Stapled Visa Controversyakulasowjanya574Ainda não há avaliações

- Career Lesson Plan Cheat SheetDocumento2 páginasCareer Lesson Plan Cheat Sheetapi-278760277Ainda não há avaliações

- Tourism and Hospitality LawDocumento4 páginasTourism and Hospitality LawSarah Mae AlcazarenAinda não há avaliações

- Kythera S-1 Ex. 99.1Documento471 páginasKythera S-1 Ex. 99.1darwinbondgrahamAinda não há avaliações

- Food Takila & Restaurant AgreementDocumento6 páginasFood Takila & Restaurant AgreementExcalibur OSAinda não há avaliações

- Lupo Lupangco Vs CA G.R. No. 77372 April 29, 1988 160 SCRA 848Documento2 páginasLupo Lupangco Vs CA G.R. No. 77372 April 29, 1988 160 SCRA 848Emil Bautista100% (2)