Escolar Documentos

Profissional Documentos

Cultura Documentos

Management Accounting

Enviado por

Parth Mehta0 notas0% acharam este documento útil (0 voto)

44 visualizações8 páginasRatio Anaylsis

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoRatio Anaylsis

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

44 visualizações8 páginasManagement Accounting

Enviado por

Parth MehtaRatio Anaylsis

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 8

Comparison & Ratio Analysis of two FMCG (Fast-Moving Consumer Goods) Companies.

1. Tarai Foods Limited.

2. Tata Global

Beverages.

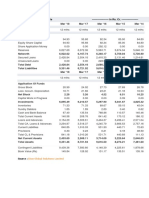

Balance Sheet of Tarai Foods (Rs. In Crores)

Mar '13 Mar '12 Mar '11 Mar '10

Sources Of Funds

Total Share Capital 14.34 14.34 14.34 14.34

Equity Share Capital 14.34 14.34 14.34 14.34

Share Application Money 0 0 0 0

Preference Share Capital 0 0 0 0

Reserves -55.13 -60.76 -59.76 -58.81

Revaluation Reserves 0 0 0 0

Networth -40.79 -46.42 -45.42 -44.47

Secured Loans 42.63 49.47 49.47 49.8

Unsecured Loans 1.43 0.56 0.56 0.56

Total Debt 44.06 50.03 50.03 50.36

Total Liabilities 3.27 3.61 4.61 5.89

Mar '13 Mar '12 Mar '11 Mar '10

Application Of Funds

Gross Block 13.98 13.98 13.97 13.97

Less: Accum. Depreciation 9.96 9.41 8.86 8.31

Net Block 4.02 4.57 5.11 5.66

Capital Work in Progress 0.13 0.13 0.13 0.13

Investments 0 0 0 0

Inventories 0.44 0.06 0.12 0.24

Sundry Debtors 0.04 0.03 0.26 0.56

Cash and Bank Balance 0.13 0.06 0.15 0.37

Total Current Assets 0.61 0.15 0.53 1.17

Loans and Advances 0.43 0.43 0.4 0.37

Fixed Deposits 0 0 0 0

Total CA, Loans & Advances 1.04 0.58 0.93 1.54

Deferred Credit 0 0 0 0

Current Liabilities 1.85 1.59 1.51 1.4

Provisions 0.07 0.08 0.05 0.05

Total CL & Provisions 1.92 1.67 1.56 1.45

Net Current Assets -0.88 -1.09 -0.63 0.09

Miscellaneous Expenses 0 0 0 0

Total Assets 3.27 3.61 4.61 5.88

Contingent Liabilities 1.3 1.3 1.31 1.31

Book Value (Rs) -23.01 -26.19 -25.62 -25.09

Tata Global Beverage (Rs. In Crores)

Mar '13 Mar '12 Mar '11 Mar '10

Sources Of Funds

Total Share Capital 61.84 61.84 61.84 61.84

Equity Share Capital 61.84 61.84 61.84 61.84

Share Application Money 0 0 0 0

Preference Share Capital 0 0 0 0

Reserves 2,256.45 2,148.27 1,972.75 1,994.14

Revaluation Reserves 0 0 21.86 21.86

Networth 2,318.29 2,210.11 2,056.45 2,077.84

Secured Loans 108.57 366.85 505.47 496.45

Unsecured Loans 75 0 0 3.21

Total Debt 183.57 366.85 505.47 499.66

Total Liabilities 2,501.86 2,576.96 2,561.92 2,577.50

Mar '13 Mar '12 Mar '11 Mar '10

Application Of Funds

Gross Block 256.85 246.21 224.39 210.89

Less: Accum. Depreciation 110.17 106.12 112.37 105.1

Net Block 146.68 140.09 112.02 105.79

Capital Work in Progress 3.77 2.69 3.03 5.57

Investments 2,225.14 2,205.70 2,290.91 2,309.05

Inventories 651.56 453.47 429.91 378.14

Sundry Debtors 109.11 90.64 101.9 116.39

Cash and Bank Balance 50.52 17.47 6.87 5.36

Total Current Assets 811.19 561.58 538.68 499.89

Loans and Advances 253.42 225.52 160.61 165.38

Fixed Deposits 0 30 0 0

Total CA, Loans & Advances 1,064.61 817.1 699.29 665.27

Deffered Credit 0 0 0 0

Current Liabilities 663.14 324.29 365.45 319.14

Provisions 275.21 264.33 177.87 189.04

Total CL & Provisions 938.35 588.62 543.32 508.18

Net Current Assets 126.26 228.48 155.97 157.09

Miscellaneous Expenses 0 0 0 0

Total Assets 2,501.85 2,576.96 2,561.93 2,577.50

Contingent Liabilities 148.39 86.61 81.18 71.1

Book Value (Rs) 37.49 35.74 32.9 332.47

Tarai Foods (Profit & Loss) (Rs. In Crores)

Mar '13 Mar '12 Mar '11 Mar '10

Income

Sales Turnover 1.68 1.38 1.21 2.65

Excise Duty 0 0 0 0

Net Sales 1.68 1.38 1.21 2.65

Other Income 5.98 0.05 0.54 0.65

Stock Adjustments 0.38 0 -0.13 -0.15

Total Income 8.04 1.43 1.62 3.15

Expenditure

Raw Materials 0.52 0.46 0.21 0.43

Power & Fuel Cost 0.77 0.74 1.06 1.5

Employee Cost 0.22 0.29 0.31 0.38

Other Manufacturing Expenses 0.09 0.09 0 0.32

Selling and Admin Expenses 0 0 0 0

Miscellaneous Expenses 0.26 0.3 0.44 0.33

Preoperative Exp Capitalised 0 0 0 0

Total Expenses 1.86 1.88 2.02 2.96

Mar '13 Mar '12 Mar '11 Mar '10

Operating Profit 0.2 -0.5 -0.94 -0.46

PBDIT 6.18 -0.45 -0.4 0.19

Interest 0 0 0 0

PBDT 6.18 -0.45 -0.4 0.19

Depreciation 0.55 0.55 0.55 0.55

Other Written Off 0 0 0 0

Profit Before Tax 5.63 -1 -0.95 -0.36

Extra-ordinary items 0 0 0 0

PBT (Post Extra-ord Items) 5.63 -1 -0.95 -0.36

Tax 0 0 0 0

Reported Net Profit 5.64 -1 -0.95 -0.37

Total Value Addition 1.34 1.42 1.81 2.52

Preference Dividend 0 0 0 0

Equity Dividend 0 0 0 0

Corporate Dividend Tax 0 0 0 0

Per share data (annualised)

Shares in issue (lakhs) 177.28 177.28 177.28 177.28

Earning Per Share (Rs) 3.18 -0.56 -0.54 -0.21

Equity Dividend (%) 0 0 0 0

Book Value (Rs) -23.01 -26.19 -25.62 -25.09

Tata Global Beverage (Profit & Loss) (Rs. In

Crores)

Mar '13 Mar '12 Mar '11 Mar '10

Income

Sales Turnover 2,326.10 2,035.29 1,792.93 1,698.76

Excise Duty 0 0 0.31 0.26

Net Sales 2,326.10 2,035.29 1,792.62 1,698.50

Other Income 130.85 177.22 148.47 377

Stock Adjustments 38.54 9.78 25.78 14.69

Total Income 2,495.49 2,222.29 1,966.87 2,090.19

Expenditure

Raw Materials 1,557.49 1,301.81 1,209.95 1,100.41

Power & Fuel Cost 27.91 25.31 20.65 17.02

Employee Cost 120.06 100.69 90.4 90.45

Other Manufacturing Expenses 0 33.71 37.28 30.83

Selling and Admin Expenses 0 0 227.01 206.66

Miscellaneous Expenses 420.67 351.78 104.56 84.36

Preoperative Exp Capitalised 0 0 0 0

Total Expenses 2,126.13 1,813.30 1,689.85 1,529.73

Mar '13 Mar '12 Mar '11 Mar '10

Operating Profit 238.51 231.77 128.55 183.46

PBDIT 369.36 408.99 277.02 560.46

Interest 32.01 27.04 38.97 56.34

PBDT 337.35 381.95 238.05 504.12

Depreciation 16.39 12.04 12.36 12.32

Other Written Off 0 0 0 0

Profit Before Tax 320.96 369.91 225.69 491.8

Extra-ordinary items 0 0 4.68 3.65

PBT (Post Extra-ord Items) 320.96 369.91 230.37 495.45

Tax 62.3 67.23 49.79 103.96

Reported Net Profit 258.65 302.68 180.59 391.47

Total Value Addition 568.64 511.48 479.9 429.32

Preference Dividend 0 0 0 0

Equity Dividend 132.96 132.96 123.68 123.68

Corporate Dividend Tax 20.68 20.7 17.86 19.45

Per share data (annualized)

Shares in issue (lakhs) 6,183.99 6,183.99 6,183.99 618.4

Earnings Per Share (Rs) 4.18 4.89 2.92 63.3

Equity Dividend (%) 215 215 200 200

Book Value (Rs) 37.49 35.74 32.9 332.47

Ratio Analysis

LIQUIDITY RATIO

A. Current Ratio

It is a liquidity ratio which signifies the ability of the firm to pay off its short term liabilities with its short term assets. The

ideal ratio being 2:1, meaning if the company has rupee 1/- liability then the firm should have 2/- rupees to pay off the

liabilities so that the firm is left with a little extra current assets.

CURRENT RATIO = (CURRENT ASSETS/CURRENT LIABILTIES)

Company/Years Mar 13 Mar 12 Mar 11 Mar 10 Average

Tarai Foods Ltd. 0.54 0.34 0.59 1.07 0.65

Tata Global Beverages 0.87 1.22 0.77 0.78 0.91

Here, Tata Global Beverages is more liquid to pay off its current liabilities.

B. Quick Ratio

Also known as Acid Test Ratio. Comparatively it is more liquid than current ratio. Higer the ratio, more the liquidity and it

will better ability to pay off its immediate liabilities when the firm is closing down.

Quick Ratio =

Current assets (stock + bills receivable + prepaid expenses)

Current Liabilities (Bills Payable + Bank Overdraft)

Company/Years Mar 13 Mar 12 Mar 11 Mar 10 Average

Tarai Foods Ltd. 0.31 0.31 0.52 0.90 0.51

Tata Global Beverages 0.42 0.59 0.48 0.53 0.50

The average of both the firms is almost same. With minor differences. The ideal ratio being 1:1, because the

goods of these firms are perishable in nature, the liquidity maintained is low. Which majorly depends on the

nature of the goods & services as well.

TURNOVER RATIOS

A.Inventory Turnover Ratio

It reflects that how fast the company is using its inventory or stock to convert it to sales. Higer the number,

better is the rolling of inventories.

Inventory turnover ratio = (Cost of goods sold/average inventory)

Company/Years Mar 13 Mar 12 Mar 11 Mar 10 Average

Tarai Foods Ltd. 3.79 24.44 10.23 10.82 12.32

Tata Global Beverages 3.57 4.49 4.48 4.71 4.31

Here, Tarai Foods has the better inventory ratio i.e 12.32 which is really good for the firm.

B. Debtors Turnover Ratio

It shows the details regarding of how efficiently the firm is using its assets.

Debtors turnover ratio = (Net credit sales/average debtors)

Company/Years Mar 13 Mar 12 Mar 11 Mar 10 Average

Tarai Foods Ltd. 48.54 9.62 2.97 3.29 16.10

Tata Global Beverages 23.29 21.14 16.42 16.31 19.29

Here, Tata Global Beverages has better debtors turnover ratio on an average as compared to Tarai Foods Ltd.

Which eventually rose drastically in 2013. Therefore, Tata has utilized its assets better than Tarai.

C. Creditors Turnover Ratio.

A measure used to determine the rate at which the firm pays the money to its creditors i.e the suppliers. Lower

payable turnover ratio is an advantage to the firm, as it can properly utilize its credit purchases.

Creditors turnover ratio = (Net credit purchases/average creditors)

Company/Years Mar 13 Mar 12 Mar 11 Mar 10 Average

Tarai Foods Ltd. 3.79 24.44 10.23 10.82 12.32

Tata Global Beverages 3.57 4.49 4.48 4.71 4.31

Here, we can interpret that Tata Global Beverages has a lower ratio on an average which is a pretty good sign

for the firm presently as well as for future.

Profitability Ratios

The basic motive of a firm is to generate profits, as they are of prime importance to the firms managers &

shareholders, as they have to show what is the profit generated by the firm to the investors.

A. Gross Profit Margin

It is calculated on the basis of the cost of goods sold by the firm or the net sales made by the firm. It considers

at how well the firm finances its inventories & the cost of production of the goods & makes a price value of the

final good/service to the customers. It is represented in percentage & the formula is

Gross Profit Margin = (Gross profit/sales)*100

Company/Years Mar 13 Mar 12 Mar 11 Mar 10 Average

Tarai Foods Ltd. -20.84 -75.85 -122.95 -38.14 -64.45

Tata Global Beverages 9.54 10.79 6.48 10.07 9.22

Tarai foods had negative gross profit margin, which is not a good sign for the firm. Which means either they

are not generating adequate sales or they have a lot of piled up inventory, which we saw above that they have

a lot of piled up inventory. Tata has maintained its G/P Margin adequately.

B. Net Profit Margin

It calculates the profits after deducting all direct & indirect expenses. The remaining is the Net Profit for the

firm which is either distributed as dividend to the shareholders or is transferred to the Reserves & Surplus a/c.

Net Profit Margin = (Net profit/sales)*100

Company/Years Mar 13 Mar 12 Mar 11 Mar 10 Average

Tarai Foods Ltd. 334.52

-70.18

-56.32

-11.18

49.21

Tata Global Beverages 10.6

14.21

9.4

21.22

13.85

Average N/P margin of Tarai was huge in 2013, which has created a lot of difference for them, in turn

increasing their average for the past 4 years. While Tata has partially maintained the N/P margin.

Financial Ratios

These ratios are used to calculate, how well the firm is performing & the areas where it can improve it financial

resources.

A.Earnings per Share (EPS)

This ratio shows how much the shareholders are liable to earn, which is to be distributed from the profits

available after paying taxes & interests.

Você também pode gostar

- in Rs. Cr.Documento19 páginasin Rs. Cr.Ashish Kumar SharmaAinda não há avaliações

- Parle Product FinanciaDocumento14 páginasParle Product FinanciaAbinash Behera100% (1)

- Ratio Analysis: Submitted To. Prof Lakshmi Chand Submitted By: Rahul Sebastian Submitted On: 10/01/2011Documento6 páginasRatio Analysis: Submitted To. Prof Lakshmi Chand Submitted By: Rahul Sebastian Submitted On: 10/01/2011Thomas RajanAinda não há avaliações

- Financial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Documento19 páginasFinancial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Vishal GuptaAinda não há avaliações

- Analysis of Working CapitalDocumento7 páginasAnalysis of Working CapitalAzfar KawosaAinda não há avaliações

- Financial Statement of RaymondsDocumento35 páginasFinancial Statement of RaymondsKevin DoshiAinda não há avaliações

- Asian Paints-Money Control - FFSDocumento10 páginasAsian Paints-Money Control - FFSKeshav Singh RathoreAinda não há avaliações

- FINANCIAL ANALYSIS of ONGCDocumento13 páginasFINANCIAL ANALYSIS of ONGCdipshi92Ainda não há avaliações

- Hindustan Unilever LTD.: Trend AnalysisDocumento7 páginasHindustan Unilever LTD.: Trend AnalysisAnkitaBansalAinda não há avaliações

- Name: Mausam Surelia BATCH: BBA 2016-2019 Subject: FinancialDocumento8 páginasName: Mausam Surelia BATCH: BBA 2016-2019 Subject: FinancialAkash MehtaAinda não há avaliações

- A Comparative Study On ITC PVT LTD and HUL PVT LTDDocumento18 páginasA Comparative Study On ITC PVT LTD and HUL PVT LTDVishal RoyAinda não há avaliações

- Bajaj Auto Fundamental Analysis: BY Sagir Kazi Submitted To:-Prof - Nitin TikkeDocumento25 páginasBajaj Auto Fundamental Analysis: BY Sagir Kazi Submitted To:-Prof - Nitin TikkeRohan NimkarAinda não há avaliações

- Industry OverviewDocumento7 páginasIndustry OverviewBathula JayadeekshaAinda não há avaliações

- Balance Sheet of Axis Bank: - in Rs. Cr.Documento37 páginasBalance Sheet of Axis Bank: - in Rs. Cr.rampunjaniAinda não há avaliações

- Lecture Common Size and Comparative AnalysisDocumento28 páginasLecture Common Size and Comparative AnalysissumitsgagreelAinda não há avaliações

- Previous Years: Bajaj Auto - in Rs. Cr.Documento10 páginasPrevious Years: Bajaj Auto - in Rs. Cr.maddikaAinda não há avaliações

- Fortis HealthcareDocumento3 páginasFortis HealthcareAnant ChhajedAinda não há avaliações

- Stock PitchDocumento8 páginasStock PitchRaksha ShettyAinda não há avaliações

- Join Stock Company Ratio AnalysisDocumento16 páginasJoin Stock Company Ratio AnalysisRahul BabbarAinda não há avaliações

- Analysis of Financial StatementsDocumento25 páginasAnalysis of Financial StatementsParas GadaAinda não há avaliações

- Shinansh TiwariDocumento11 páginasShinansh TiwariAnuj VermaAinda não há avaliações

- Aman Jot Mam Bajaj Auto LimitedDocumento5 páginasAman Jot Mam Bajaj Auto LimitedShekibaAinda não há avaliações

- Tata Steel 1Documento12 páginasTata Steel 1Dhwani ShahAinda não há avaliações

- Financial Analysis of NBFCDocumento14 páginasFinancial Analysis of NBFCPKAinda não há avaliações

- Assignment FM StarbucksDocumento13 páginasAssignment FM StarbucksAmirah AzmiAinda não há avaliações

- Aptech Equity Research: Key Financial FiguresDocumento7 páginasAptech Equity Research: Key Financial FiguresshashankAinda não há avaliações

- Ma Term Paper 20192mba0328Documento8 páginasMa Term Paper 20192mba0328Dileepkumar K DiliAinda não há avaliações

- ISC Commerce Project Swot Analysis of Tata MotersDocumento7 páginasISC Commerce Project Swot Analysis of Tata MotersAyush Kumar Vishwakarma88% (17)

- Case On UTV Software Communications LTDDocumento5 páginasCase On UTV Software Communications LTDShail MalviyaAinda não há avaliações

- Enginee Rs India: Previous YearsDocumento9 páginasEnginee Rs India: Previous YearsArun KanadeAinda não há avaliações

- Introduction of DLF LimitedDocumento15 páginasIntroduction of DLF LimitedArun Kumar SinghAinda não há avaliações

- Sources of Funds: Balance Sheet - in Rs. Cr.Documento10 páginasSources of Funds: Balance Sheet - in Rs. Cr.mayankjain_90Ainda não há avaliações

- Asset Liability Management at HDFC BankDocumento31 páginasAsset Liability Management at HDFC BankwebstdsnrAinda não há avaliações

- HDFC Bank - FM AssignmentDocumento9 páginasHDFC Bank - FM AssignmentaditiAinda não há avaliações

- Case 2 Industry Level Strategy and Ratio Analysis Case ReportDocumento3 páginasCase 2 Industry Level Strategy and Ratio Analysis Case ReportRaymond GongAinda não há avaliações

- Indian Oil Corporation Project 2Documento30 páginasIndian Oil Corporation Project 2Rishika GoelAinda não há avaliações

- Antony Waste Handling Cell Ltd. Company OverviewDocumento19 páginasAntony Waste Handling Cell Ltd. Company OverviewSarthak TinguriyaAinda não há avaliações

- Balance Sheet of Bombay Dyeing and Manufacturin G Company - in Rs. Cr.Documento14 páginasBalance Sheet of Bombay Dyeing and Manufacturin G Company - in Rs. Cr.Shashank PatelAinda não há avaliações

- HCL Technologies: Balance Sheet - in Rs. Cr.Documento20 páginasHCL Technologies: Balance Sheet - in Rs. Cr.Kuldeep SinghAinda não há avaliações

- Equities and Liabilities Shareholders FundsDocumento5 páginasEquities and Liabilities Shareholders Fundsshiv mehraAinda não há avaliações

- AccountsDocumento6 páginasAccountshoney SoniAinda não há avaliações

- Bajaj Auto Financial AnalysisDocumento16 páginasBajaj Auto Financial AnalysisprachimadaanAinda não há avaliações

- Book 1Documento18 páginasBook 1Ankit PichholiyaAinda não há avaliações

- Master of Business Administration: Accounting For ManagerDocumento19 páginasMaster of Business Administration: Accounting For ManagerDeep saliyaAinda não há avaliações

- Divi's Laboratories LTD: Finanance For Managers Activity 2Documento10 páginasDivi's Laboratories LTD: Finanance For Managers Activity 2Madhan kumarAinda não há avaliações

- Accounts AssignmentDocumento7 páginasAccounts AssignmentHari PrasaadhAinda não há avaliações

- 17 - Manoj Batra - Hero Honda MotorsDocumento13 páginas17 - Manoj Batra - Hero Honda Motorsrajat_singlaAinda não há avaliações

- Balance Sheet: Hindalco IndustriesDocumento20 páginasBalance Sheet: Hindalco Industriesparinay202Ainda não há avaliações

- Balance Sheet of TV18 BroadcastDocumento6 páginasBalance Sheet of TV18 BroadcastrotiAinda não há avaliações

- JFHFFDocumento18 páginasJFHFFUjjwal SharmaAinda não há avaliações

- Balance Sheet of Indiabulls - in Rs. Cr.Documento3 páginasBalance Sheet of Indiabulls - in Rs. Cr.MubeenAinda não há avaliações

- Shipping Corp - Comparative StatementDocumento3 páginasShipping Corp - Comparative StatementAkshay SinghAinda não há avaliações

- Apollo TyresDocumento4 páginasApollo TyresGokulKumarAinda não há avaliações

- Balance Sheet Basics: AssetsDocumento8 páginasBalance Sheet Basics: AssetsManish KumarAinda não há avaliações

- 6189 Management Account ProjectDocumento7 páginas6189 Management Account ProjectGauri SalviAinda não há avaliações

- Havells Balance Sheet (4 Years)Documento15 páginasHavells Balance Sheet (4 Years)Tamoghna MaitraAinda não há avaliações

- FRA ProjectDocumento30 páginasFRA ProjectkillsrockAinda não há avaliações

- Guide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionNo EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionAinda não há avaliações

- Guide to Management Accounting CCC (Cash Conversion Cycle) for ManagersNo EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for ManagersAinda não há avaliações

- Ipo-ZataDocumento8 páginasIpo-ZatajohnweakAinda não há avaliações

- Finance Simulation: M&A in Wine Country: How To PlayDocumento13 páginasFinance Simulation: M&A in Wine Country: How To Playmayukh mukhopadhyay100% (1)

- Gat Subject Management - Sciences Finance mcqs51 100 PDFDocumento5 páginasGat Subject Management - Sciences Finance mcqs51 100 PDFSamia Khalid0% (1)

- Musa Moshref and Shaniqua Hollins Have Operated A Successful FirmDocumento2 páginasMusa Moshref and Shaniqua Hollins Have Operated A Successful FirmMuhammad ShahidAinda não há avaliações

- OTC Exchange of IndiaDocumento2 páginasOTC Exchange of Indiaarshad89057Ainda não há avaliações

- Handout 2 ResponseDocumento2 páginasHandout 2 ResponseireneAinda não há avaliações

- Intl LiquidityDocumento3 páginasIntl LiquidityAshneet BhasinAinda não há avaliações

- syllabusIME611Spring20 PDFDocumento4 páginassyllabusIME611Spring20 PDFAbhishek aryaAinda não há avaliações

- Assignment #1 Jordan Hardware & Construction SupplyDocumento9 páginasAssignment #1 Jordan Hardware & Construction SupplyME Valleser100% (1)

- FINANCIAL LIABILITY AT AMORTIZED COSTS - Bonds Payable-Compound Fin Instruments-Debt Restructuring (20231016164208)Documento3 páginasFINANCIAL LIABILITY AT AMORTIZED COSTS - Bonds Payable-Compound Fin Instruments-Debt Restructuring (20231016164208)ocampojohnoliver1901182Ainda não há avaliações

- Nifty Doctor Simple SystemDocumento5 páginasNifty Doctor Simple SystemPratik ChhedaAinda não há avaliações

- BNP Paribas Inflation Linked MarketsDocumento72 páginasBNP Paribas Inflation Linked Marketsk121212Ainda não há avaliações

- KEYDocumento7 páginasKEYMinh Thuy NguyenAinda não há avaliações

- CA. Ranjay Mishra (FCA)Documento14 páginasCA. Ranjay Mishra (FCA)ZamanAinda não há avaliações

- ACC 430 Assignment 2 SU12020Documento2 páginasACC 430 Assignment 2 SU12020Shannon100% (1)

- A. Liquid AssetDocumento3 páginasA. Liquid AssetRafsun HimelAinda não há avaliações

- Marginal Productivity TheoryDocumento5 páginasMarginal Productivity TheoryPranjal BariAinda não há avaliações

- Accounting P1 May-June 2023 EngDocumento12 páginasAccounting P1 May-June 2023 EngKaren ErasmusAinda não há avaliações

- Geethendar KumarDocumento11 páginasGeethendar KumarkhayyumAinda não há avaliações

- Investment Analysis and Lockheed Tri StarDocumento13 páginasInvestment Analysis and Lockheed Tri StarShivamAinda não há avaliações

- Barry Computer Company: Balance Sheet As of December 31, 2015 ($.000)Documento11 páginasBarry Computer Company: Balance Sheet As of December 31, 2015 ($.000)Akuw AjahAinda não há avaliações

- Full Download Test Bank For Information Technology Auditing 3rd Edition Hall PDF Full ChapterDocumento36 páginasFull Download Test Bank For Information Technology Auditing 3rd Edition Hall PDF Full Chapternearness.oynoun70w8h100% (17)

- PR - Order in The Matter of M/s. Phenix Properties LimitedDocumento2 páginasPR - Order in The Matter of M/s. Phenix Properties LimitedShyam SunderAinda não há avaliações

- Financial Reporting Quality PPT - DONEDocumento33 páginasFinancial Reporting Quality PPT - DONEpamilAinda não há avaliações

- Day 1 - Overview of The SAP FI-CO Module PDFDocumento13 páginasDay 1 - Overview of The SAP FI-CO Module PDFkyushineAinda não há avaliações

- Practice Questions 3-11 - 2020Documento12 páginasPractice Questions 3-11 - 2020MUHAMMAD AZAMAinda não há avaliações

- Tutorial 2 A192 QuestionDocumento9 páginasTutorial 2 A192 QuestionMastura Abd HamidAinda não há avaliações

- Mid CORFINDocumento16 páginasMid CORFINRichard LazaroAinda não há avaliações

- Effective Regulation Part 5Documento20 páginasEffective Regulation Part 5MarketsWikiAinda não há avaliações

- Chap2 Case 1Documento1 páginaChap2 Case 1Xyza Faye RegaladoAinda não há avaliações