Escolar Documentos

Profissional Documentos

Cultura Documentos

Sample Term Sheet

Enviado por

Anonymous 4rMVkArDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Sample Term Sheet

Enviado por

Anonymous 4rMVkArDireitos autorais:

Formatos disponíveis

Business | Technology & IP | Employment & Immigration | Taxation

mbbp.com

781-622-5930

Term Sheet for Series A Round

of Financing of XCorp

By Jeffrey P. Steele

mbbp.com

Reservoir Place

1601 Trapelo Road, Suite 205

Waltham, MA 02451

781-622-5930

Business | Technology & IP | Employment & Immigration | Taxation

2010 Morse, Barnes-Brown & Pendleton, PC 781-622-5930 mbbp.com

3

TERM SHEET

FOR SERIES A ROUND OF FINANCING OF XCORP

Amount of Investment: $3,000,000

Investors: ABC Ventures; XYZ Capital

Type of Security: Series A Convertible Preferred Stock

Premoney Valuation: $7,000,000

1

Capital Structure Following Series A Round: Existing holders of Common Stock 55%

Option Pool 15%

2

Holders of Series A Preferred Stock 30%

Total 100%

Use of Proceeds: The Company shall use the proceeds from this fnancing for working capital pur-

poses.

Dividends: The Company will not pay dividends on its shares of Common Stock or any other

stock which is junior to the Series A Preferred Stock unless a like dividend is paid on all shares of Series A Pre-

ferred Stock on a pro rata as converted basis.

3

The following annotations are by Jeffrey Steele, a partner with the law frm Morse Barnes-Brown & Pendleton P.C.: Certain of the annotations and some

of the language in this model term sheet (including the veto rights) are borrowed from the NVCA model legal documents. The NVCA model legal docu-

ments are important as they represent an effort on the part of the National Venture Capital Association (the NVCA) to standardize the form of defnitive

documents used fro venture capital transactions involving its members. To date, the NVCA forms have achieved some measure of success as the stan-

dard forms used by venture capital frms and their legal counsel in preparing the defnitive documents for venture capital fnancings. However, there are

exceptions (perhaps growing) with some law frms (again) attempting to distinguish their service offering in this area by producing their own propri-

etary forms which are marketed as superior to the NVCA forms in some way(s).

1. Equals the value the new investors are placing on the enterprise prior to their investment. Usually, all of the outstanding stock of the company, together

with any outstanding options and warrants or other rights to buy stock of the company and any additional shares which may be reserved under the option pool,

will be included in this premoney valuation.

2. The size of the option pool that venture capital investors will look for tends to range between 15% and 30% of the capital structure of the company. This

percentage is calculated including the shares of Series A Preferred Stock being sold in the fnancing. The actual size of the pool can depend on a number of

things, including the industry that the company is in, but is primarily related to the number and types of hires that the company will need to make in the fore-

seeable future. Thus, a company that has a complete management team at the time of the Series A round will likely need a smaller pool than a company that

has one or more top management hires to make (each of whom may cost the company a signifcant amount of options or stock from the pool).

3. Often, venture capital investors also ask for an accruing dividend of between 8% and 10% or so per annum. This dividend accrues and is not payable

unless (i) declared by the Board, (ii) there is a liquidation event (a sale of the company is considered a liquidation event, but an IPO usually isnt), or (iii) the

preferred stock is redeemed. The accruing dividend is a protective device intended to provide a minimum rate of return but is usually forfeited in the event of

an IPO or otherwise upon conversion of the preferred stock to common stock. (The theory is that in such cases the return on the investment will be more than

the minimum which the accruing dividend provides. Therefore, the protection is not needed and is forfeited). There are a number of varieties of accruing divi-

dends, including those that are payable in cash and those payable in additional shares of preferred stock. Also, although a basic accruing dividend involves

a simple interest calculation, dividends may also involve compound interest-like calculations (dividends calculated upon not only the original investment

amount but also upon the amount of prior accrued but unpaid dividends). Finally, dividends may also be cumulative or non-cumulative (with the absence

of designation generally meaning that the dividend is non-cumulative). Under Delaware law, the cumulative concept is important as, without it, unpaid

dividends would not carry over from year to year to be paid later. Rather, any accrued dividend from a particular year would need to be paid within that year

or be forfeited. Thus, if the idea is that investors are to receive some minimum annual dividend from the time of their investment to the sale of the company

with payment of the aggregate amount of such dividend upon sale, such dividend would need to be cumulative. In such event, if the dividend were not

cumulative, the only dividend payable would be such as had accrued during the year of sale.

2010 Morse, Barnes-Brown & Pendleton, PC 781-622-5930 mbbp.com

4

Conversion: Each share of Series A Preferred Stock shall be convertible, at any time, at the

option of the holder, into shares of Common Stock, at an initial conversion ratio of one share of Common Stock

for each share of Series A Preferred Stock. Mandatory conversion of the Series A Preferred Stock upon the

effectiveness of a registration statement covering a frmly and fully underwritten public offering of Common

Stock of the Company by a reputable underwriter acceptable to the Investors at a price which equals or exceeds

fve times the purchase price per share of the Series A Preferred Stock and where the aggregate gross proceeds

received by the Company exceeds $25 million (a Qualifed Public Offering).

4

Antidilution: The terms of the Series A Preferred Stock will contain standard weighted aver-

age antidilution protection with respect to the issuance by the Company of equity securities at a price per share

less than the applicable conversion price then in effect, subject to standard and customary exceptions.

5

The

conversion rate of the Series A Preferred Stock into common stock will be adjusted appropriately to account for

any stock splits, recapitalizations, mergers, combinations and asset sales, stock dividends, and similar events.

Antidilution protection shall not be triggered by the issuance of up to 1,000,000 shares of Common Stock (or

options therefor) issued in accordance with the Companys Stock Option Plan.

Voting Rights: On all matters submitted for stockholder approval, each share of Series A Pre-

ferred Stock shall be entitled to such number of votes as is equal to the number of shares of Common Stock into

which such shares are convertible. In addition, the Company shall not, either directly or indirectly by amend-

ment, merger, consolidation or otherwise

6

, without the prior consent of the holders of at least a majority of the

then issued and outstanding Series A Preferred Stock, voting as a separate class:

a) liquidate, dissolve or wind-up the business and affairs of the Corporation, effect

any Deemed Liquidation Event, or consent to any of the foregoing;

b) amend, alter or repeal any provision of the Certifcate of Incorporation or

Bylaws of the Corporation in a manner that adversely affects the powers, preferences or rights of the Series A

Preferred Stock

7

;

c) create, or authorize the creation of, or issue or obligate itself to issue shares of,

any additional class or series of capital stock unless the same ranks junior to the Series A Preferred Stock with

respect to the distribution of assets on the liquidation, dissolution or winding up of the Corporation, the payment

of dividends and rights of redemption, or increase the authorized number of shares of Series A Preferred Stock

4. Preferred stock should convert into common stock automatically at the companys IPO. The special rights generally accorded to preferred stock sold to

early-stage investors could create problems for a public company.

5. These provisions are designed to protect an investor against equity dilution (later sales of stock at a price lower than what the investor paid). Although

the weighted average version is the most common, an alternative is full ratchet antidilution protection. Full-ratchet antidilution protection is far more ad-

vantageous to the investor (but punitive to the company) than weighted average, but it is usually reserved for very early-stage deals or other situations where

there is signifcant concern as to whether the valuation will hold up over the long term. Put simply, weighted-average antidilution protection accounts more

accurately for the actual dilutive effect which a particular issuance has on the investors equity position in the company. Full-ratchet antidilution protection, on

the other hand, treats all later stock issuances below the investors purchase price as if they were the same, regardless of the number of shares issued.

6. The either directly or indirectly language is important and is included as a result of a Delaware case involving the venture frm Benchmark Capital and

one of its portfolio companies Juniper Financial Corp. Although Benchmark had the beneft of a veto right over any charter amendment adversely affecting

Benchmarks series of preferred stock, Juniper took advantage of the opportunity to accomplish the effect of a charter amendment by means of a parent-sub-

sidiary merger, end-running Benchmarks veto right. Litigation ensued with a result not sympathetic to Benchmark. The court took a very literal view of the

language of the veto rights and pointed out that Benchmark and its counsel could have been more vigilant in preventing any such end run. Since this decision,

this language has been a staple in any sophisticated venture capital documentation dealing with veto rights.

7. Under Delaware law, the authorization of another series of Preferred Stock with rights senior to those of the Series A Preferred Stock as to dividends, liqui-

dation and redemption would generally not constitute an amendment that adversely affects the Series A Preferred Stock.

2010 Morse, Barnes-Brown & Pendleton, PC 781-622-5930 mbbp.com

5

or increase the authorized number of shares of any additional class or series of capital stock unless the same

ranks junior to the Series A Preferred Stock with respect to the distribution of assets on the liquidation, dissolu-

tion or winding up of the Corporation, the payment of dividends and rights of redemption;

d) (i) reclassify, alter or amend any existing security of the Corporation that is pari

passu with the Series A Preferred Stock in respect of the distribution of assets on the liquidation, dissolution or

winding up of the Corporation, the payment of dividends or rights of redemption, if such reclassifcation, altera-

tion or amendment would render such other security senior to the Series A Preferred Stock in respect of any

such right, preference or privilege, or (ii) reclassify, alter or amend any existing security of the Corporation that

is junior to the Series A Preferred Stock in respect of the distribution of assets on the liquidation, dissolution or

winding up of the Corporation, the payment of dividends or rights of redemption, if such reclassifcation, altera-

tion or amendment would render such other security senior to or pari passu with the Series A Preferred Stock in

respect of any such right, preference or privilege;

e) purchase or redeem (or permit any subsidiary to purchase or redeem) or pay

or declare any dividend or make any distribution on, any shares of capital stock of the Corporation other than

(i) redemptions of or dividends or distributions on the Series A Preferred Stock as expressly authorized herein,

(ii) dividends or other distributions payable on the Common Stock solely in the form of additional shares of

Common Stock and (iii) repurchases of stock from former employees, offcers, directors, consultants or other

persons who performed services for the Corporation or any subsidiary in connection with the cessation of such

employment or service at the lower of the original purchase price or the then-current fair market value thereof

[or (iv) as approved by the Board of Directors, including the approval of at least one Series A Director]

8

;

f) create, or authorize the creation of, or issue, or authorize the issuance of any

debt security, or permit any subsidiary to take any such action with respect to any debt security [, if the ag-

gregate indebtedness of the Corporation and its subsidiaries for borrowed money following such action would

exceed $_____] [other than equipment leases or bank lines of credit] [unless such debt security has received the

prior approval of the Board of Directors, including the approval of [at least one] Series A Director];

g) create, or hold capital stock in, any subsidiary that is not wholly owned (either

directly or through one or more other subsidiaries) by the Corporation, or sell, transfer or otherwise dispose of

any capital stock of any direct or indirect subsidiary of the Corporation, or permit any direct or indirect subsid-

iary to sell, lease, transfer, exclusively license or otherwise dispose (in a single transaction or series of related

transactions) of all or substantially all of the assets of such subsidiary; or

h) increase or decrease the authorized number of directors constituting the Board

of Directors.

Liquidation Preference: The holders of Series A Preferred Stock shall have preference upon liquidation

over all holders of Common Stock and over the holders of any other class or series of stock that is junior to the

Series A Preferred Stock for an amount equal to the greater of (i) amount paid for such Series A Preferred Stock

plus any declared or accrued but unpaid dividends, and (ii) the amount which such holder would have received

if such holders shares of Series A Preferred Stock were converted to Common Stock immediately prior to

8. The requirement that board approval include approval by a Series A Director is a compromise between requiring approval of the holders of Series A Pre-

ferred Stock and just requiring board approval. The primary difference here is that board level approval of the Series A Director (as opposed to stockholder

approval by the holders of Series A Preferred Stock) will be in such directors capacity as a member of the board of directors and therefore subject to such

directors fduciary duties to the Corporation.

2010 Morse, Barnes-Brown & Pendleton, PC 781-622-5930 mbbp.com

6

such liquidation. Thereafter, the holders of Common Stock will be entitled to receive the remaining assets. For

purposes of this section, a merger, consolidation, sale of all or substantially all of the Companys assets, or other

corporate reorganization shall constitute a liquidation, unless the holders of at least a majority of the Series A

Preferred Stock vote otherwise.

9

Board of Directors: The Board of Directors of the Company shall be comprised of fve members. Of

these fve members, the holders of the Series A Preferred Stock shall have the right to designate two directors

(one of such two directors to be designated by ABC Ventures, the other by XYZ Capital), and the founders of

the Company shall have the right to designate two directors. The remaining director shall be designated by such

four directors.

10

Options and Vesting: All stock and options held by founders, management, and employees shall vest

over a four-year period. Stock currently held by founders will be considered to be 25% vested as of the closing

of this fnancing with the balance to vest in equal monthly installments over four years. All others shall vest in

equal monthly installments over four years with a one-year cliff at the beginning of the vesting term. Change of

control provisions to provide for no more than an additional 50% for founders and select management and one

year for all others.

11

Registration Rights: Commencing on the earlier of three years from the closing or six months after the

effective date of the Companys frst public offering, holders of shares of Series A Preferred Stock or shares of

Common Stock issued upon conversion thereof (Registrable Stock) shall have the right to demand two S-1

registrations with aggregate gross offering price in excess of $10,000,000, upon customary terms and condi-

tions.

The holders of Series A Preferred Stock will also be entitled to piggyback registration rights on Company

registrations.

The holders of Series A Preferred Stock will also be entitled to unlimited registrations on Form S-3 with at least

$1,000,000 in aggregate gross offering price, on customary terms and conditions.

The Company will bear all expenses related to all registrations and underwritings.

Affrmative Covenants: While any Series A Preferred Stock is outstanding, the company will:

a) maintain adequate property and business insurance.

9.This is a so-called straight liquidation preference. An alternative is the double dip or participating liquidation preference, which provides that the

preferred stock get an amount equal to its money back (plus any accrued dividends if there is an accruing dividend) and then participates with common stock

on an as converted basis. A double-dip liquidation preference is a pricing term most often seen in early-stage deals or in down rounds.

10 Working out what the Board will look like following the Series A round will be one of the most important matters to deal with. Generally, the Series A

investors will ask for and receive representation on the board. The questions will be how many seats do they get and what effect will that have on the found-

ers and managements board representation. In the end, everybody involved will need to participate in, and be satisfed with, the decisions regarding board

structure.

11 Venture capital investors will likely impose a vesting schedule on stock and options held by founders, management, and employees as a condition to invest-

ment. If shares or options are not yet vested, they are subject to being lost if the person ceases to work for the company for any reason. Venture capital inves-

tors impose such vesting requirements in order to provide the companys people with a reason to stay with the company. Also, if a person ceases to work for

the company for any reason, the nonvested shares are available for grant to his or her replacement. The theory here is, of course, that the best business plan is

worth nothing without the people to execute it.

2010 Morse, Barnes-Brown & Pendleton, PC 781-622-5930 mbbp.com

7

b) comply with all laws, rules, and regulations.

c) preserve, protect, and maintain its corporate existence; its rights, franchises,

and privileges; and all properties necessary or useful to the proper conduct of its business.

d) submit all reports required under Section 1202(d)(1)(C) of the Internal Rev-

enue Code and the regulations promulgated thereunder.

e) cause all key employees to execute and deliver noncompetition, nonsolicita-

tion, nonhire, nondisclosure, and assignment of inventions agreements for a term of their employment with the

Company plus one year in a form reasonably acceptable to the Board of Directors.

f) not enter into related party transactions without the consent of a majority of

disinterested directors.

g) reimburse all reasonable out-of-pocket travel-related expenses of the Series A

Preferred Stock directors.

12

Financial Statements

and Reporting: The Company will provide all information and materials, including, without

limitation, all internal management documents, reports of operations, reports of adverse developments, copies

of any management letters, communications with shareholders or directors, and press releases and registration

statements, as well as access to all senior managers as requested by holders of Series A Preferred Stock. In ad-

dition, the Company will provide the holders of Series A Preferred Stock with unaudited monthly and quarterly

and audited yearly fnancial statements, as well as an annual budget.

Redemption: Commencing with the date that is fve years from the date of closing and on each

one-year anniversary of such date thereafter, holders of at least a majority of the then issued and outstanding

shares of Series A Preferred Stock may request the Company to redeem their shares at a price equal to the origi-

nal purchase price for such shares plus any declared but unpaid dividends, with 1/3 of the shares to be redeemed

shall be redeemed within sixty days of such redemption date, an additional 1/3 on the date that is one year from

such date, and the remaining 1/3 on the date that is two years from such date.

13

Right of First Refusal: Holders of Series A Preferred Stock shall have a pro rata right, based on

their percentage of fully diluted equity interest in the company, with an undersubscription right up to the total

number of shares being offered, to participate in subsequent stock issuances.

14

12 This list includes items frequently looked for by venture capital frms, but is not exhaustive. A particular fnancing may have more or less or simply differ-

ent covenants.

13 This is simply a right to achieve liquidity in the event that the company does not otherwise reach a sale or IPO by the end of the selected time period. Since

the company cannot redeem stock if to do so would render the company insolvent, this right is useful only in situations in which the company has become

some sort of a sideways play. Usually the redemption price is the price paid for the stock plus the accruing dividend, if there is one. Occasionally, venture

capital frms will request that the redemption price be at the greater of such price and the then fair market value of the stock. The only thing to watch out for

here is to make sure that the company can pay the redemption out over time. (In my experience, three payments over two years are common.)

14 While this is generally asked for and received by venture capital investors (who can give you a yes or no quickly without the need for elaborate disclosure

documents to comply with the securities laws), a company should, in my opinion, think about resisting this request if it comes from individual investors.

2010 Morse, Barnes-Brown & Pendleton, PC 781-622-5930 mbbp.com

8

Right of First Refusal

and Cosale: In the event that any of the Founders and existing executive management propose

to sell their stock to third parties, the Company shall have the frst right to purchase the securities on substantial-

ly the same terms as the proposed sale; the Series A Preferred Stockholders shall next have said right according

to respective percentage ownership of Series A Preferred Stock or to sell proportionate percentage pursuant to

cosale rights. Such rights shall terminate upon a Qualifed Public Offering.

Other Provisions: The purchase agreement shall include standard and customary representations and

warranties of the Company, and the other agreements prepared to implement this fnancing shall contain other

standard and customary provisions. Defnitive agreements will be drafted by counsel to the Investors. This term

sheet is intended by the parties to be nonbinding.

15

Expenses: The Company will reimburse the holders of Series A Preferred Stock for reason-

able legal fees in connection with the transaction, payable at closing and only in the event that the transactions

contemplated by this term sheet are consummated, up to a limit of $20,000.

16

Conditions to Closing: Closing shall be subject to the standard and customary conditions, including the

completion of due diligence and the delivery to the investors of a legal opinion of counsel to the Company,

regarding standard and customary matters and satisfactory to the Investors and their legal counsel.

17

By: By:

15 The term sheet should be nonbinding (with the exception only of the exclusivity provision, if there is one, and any provisions regarding confdentiality).

16 The amount of expenses included in this provision depends on where the lawyers are from. Make sure that there is a cap. You may also want to resist any

request to pay ongoing fees for the cost of complying with requests for waivers, etc., after the closing (except to the extent to which the investors incur fees

because the company breaches its obligations to them).

17 Be on the lookout for any exclusivity provisions in this clause. Usually, such exclusivity provisions require the company to refrain from taking an invest-

ment from anyone else for a set period of time after the term sheet is signed. While an exclusivity provision may be acceptable (and is often imposed), be

sure to pay attention to the time period. It should be no longer than is necessary to complete the transaction, with a little extra time for possible delays. In my

opinion, 30 days should be acceptable in most instances; 60 days is pushing it in most instances; and 90 days is probably unreasonable in almost all cases.

Also, make sure that the exclusivity period automatically ends in the event that the deal is called off before the period expires.

Você também pode gostar

- Draft Term Sheet for Angel Seed RoundDocumento7 páginasDraft Term Sheet for Angel Seed RoundSiddharth SrinivasanAinda não há avaliações

- Term Sheet Series A Template 1Documento11 páginasTerm Sheet Series A Template 1David Jay Mor100% (1)

- TechStars Bridge Term Sheet-2Documento3 páginasTechStars Bridge Term Sheet-2Josh WestermanAinda não há avaliações

- Sample Investment AgreementDocumento4 páginasSample Investment AgreementJeyaramAinda não há avaliações

- 10.3 Term Sheet For Equity InvestmentDocumento12 páginas10.3 Term Sheet For Equity InvestmentMarius AngaraAinda não há avaliações

- Share VestingDocumento8 páginasShare VestingJorge Yamada Junior100% (1)

- Convertible Note Financing Term SheetDocumento2 páginasConvertible Note Financing Term Sheet4natomas100% (1)

- Sample CADocumento3 páginasSample CAVita DepanteAinda não há avaliações

- Sample Subscription AgreementDocumento19 páginasSample Subscription AgreementLonny Bernath100% (2)

- Spartina Convertible Note MemoDocumento6 páginasSpartina Convertible Note MemospartinaAinda não há avaliações

- TechStars Bridge Term Sheet1Documento3 páginasTechStars Bridge Term Sheet1Marius AngaraAinda não há avaliações

- Convertible Debt Term Sheet SummaryDocumento3 páginasConvertible Debt Term Sheet SummaryholtfoxAinda não há avaliações

- Convertible Note Term SheetDocumento2 páginasConvertible Note Term SheetVictorAinda não há avaliações

- Term Sheet for Allied Company InvestmentDocumento7 páginasTerm Sheet for Allied Company InvestmenteemiaroseAinda não há avaliações

- Decoding Term Sheets & iSAFE NotesDocumento17 páginasDecoding Term Sheets & iSAFE NotesMehta SubscriptionsAinda não há avaliações

- Convertible Note Bridge Financing Term SheetDocumento2 páginasConvertible Note Bridge Financing Term Sheetwchiang1226Ainda não há avaliações

- Vesting AgreementDocumento3 páginasVesting AgreementMarcelo AsamuraAinda não há avaliações

- Option AgreementDocumento6 páginasOption AgreementedallmightyAinda não há avaliações

- Term SheetDocumento3 páginasTerm SheetSam AltmanAinda não há avaliações

- Term Sheet With AnnotationDocumento8 páginasTerm Sheet With Annotationapi-3764496100% (1)

- Strategic Alliance Agreement Between Righthaven and Stephens MediaDocumento17 páginasStrategic Alliance Agreement Between Righthaven and Stephens Mediawww.righthavenlawsuits.com100% (1)

- PiVentures-Term Sheet - TemplateDocumento7 páginasPiVentures-Term Sheet - TemplateTanmay AgnaniAinda não há avaliações

- Share Holding AgreementDocumento41 páginasShare Holding AgreementKirthi Srinivas GAinda não há avaliações

- Term Sheet for Potential Equity Investment in TextcentricDocumento6 páginasTerm Sheet for Potential Equity Investment in TextcentricRecklessgod100% (1)

- Term Sheet EquityDocumento8 páginasTerm Sheet EquitygargramAinda não há avaliações

- E V C T S: Valuating Enture Apital ERM HeetsDocumento21 páginasE V C T S: Valuating Enture Apital ERM Heetsviktor0% (1)

- CIIE Term Sheet TemplateDocumento9 páginasCIIE Term Sheet TemplateSURAJ SINGHAinda não há avaliações

- Startup Founders AgreementDocumento13 páginasStartup Founders AgreementPm SpontanzAinda não há avaliações

- Convertible Loan Term SheetDocumento8 páginasConvertible Loan Term SheetMarius Angara0% (1)

- Convertible NoteDocumento7 páginasConvertible NoteLegal Forms100% (2)

- BVCA Model Term Sheet For A Series A Round - Sept 2015Documento15 páginasBVCA Model Term Sheet For A Series A Round - Sept 2015GabrielaAinda não há avaliações

- Basic Term SheetDocumento6 páginasBasic Term SheetDheeraj MalhotraAinda não há avaliações

- Advisor AgreementDocumento5 páginasAdvisor AgreementMykola KomarevskyyAinda não há avaliações

- ChelseaFund - TermSheet - May 10-VMADocumento2 páginasChelseaFund - TermSheet - May 10-VMAMarius AngaraAinda não há avaliações

- Convertible Note Term Sheet Word TemplateDocumento3 páginasConvertible Note Term Sheet Word TemplateGFSDGDSFGAinda não há avaliações

- Sample Discount Convertible Note TermsDocumento2 páginasSample Discount Convertible Note TermsNathaniel RobinsonAinda não há avaliações

- Sample Warrant Convertible Note TermsDocumento3 páginasSample Warrant Convertible Note TermsMark Israelsen100% (1)

- Founders AgreementDocumento14 páginasFounders AgreementKimberly Shane AnasariasAinda não há avaliações

- Sample LP agreement summaryDocumento70 páginasSample LP agreement summaryectrimbleAinda não há avaliações

- Fort Lauderdale Hotel Confidentiality AgreementDocumento1 páginaFort Lauderdale Hotel Confidentiality AgreementPatrick SullivanAinda não há avaliações

- VC Term SheetDocumento9 páginasVC Term Sheetapi-3764496100% (2)

- Convertible Loan Agreement (US)Documento9 páginasConvertible Loan Agreement (US)Cari Mangalindan Macaalay100% (1)

- Template For A Business Transfer AgreementDocumento6 páginasTemplate For A Business Transfer AgreementKaran LakhaniAinda não há avaliações

- Convertible Note Financing Term Sheet Seed Stage StartupDocumento8 páginasConvertible Note Financing Term Sheet Seed Stage Startuprituraj mathurAinda não há avaliações

- Founders Agreement Template - 1Documento5 páginasFounders Agreement Template - 1David Jay Mor100% (5)

- Private Equity and Fund RaisingDocumento4 páginasPrivate Equity and Fund RaisingKedar ParabAinda não há avaliações

- Founder Stock Purchase Agreement-Template-1Documento10 páginasFounder Stock Purchase Agreement-Template-1David Jay Mor100% (2)

- TechStars Bridge Forms - Convertible Note1Documento5 páginasTechStars Bridge Forms - Convertible Note1joessAinda não há avaliações

- ILPA Model LPA Term Sheet WOF VersionDocumento15 páginasILPA Model LPA Term Sheet WOF VersionlaquetengoAinda não há avaliações

- Form of Advisor Agreement (Cooley)Documento3 páginasForm of Advisor Agreement (Cooley)pyrosriderAinda não há avaliações

- 22 Power of Ideas Term Sheet EssentialsDocumento1 página22 Power of Ideas Term Sheet Essentialssantosh kumar pandaAinda não há avaliações

- Stock Option Agreement Long Form)Documento7 páginasStock Option Agreement Long Form)Legal FormsAinda não há avaliações

- Stock Option AgreementDocumento11 páginasStock Option AgreementkiranrauniyarAinda não há avaliações

- Top Ten Term Sheet TricksDocumento25 páginasTop Ten Term Sheet TrickslancertwiastAinda não há avaliações

- Series Seed Term Sheet (v2)Documento2 páginasSeries Seed Term Sheet (v2)zazenAinda não há avaliações

- Founder's AgreementDocumento6 páginasFounder's AgreementJyoti SinghAinda não há avaliações

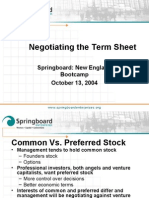

- Negotiating The Term SheetDocumento21 páginasNegotiating The Term SheetDaniel100% (6)

- Beijing Capital Growth Fund Private Placement Memorandum SummaryDocumento111 páginasBeijing Capital Growth Fund Private Placement Memorandum SummaryRangaraja IyengarAinda não há avaliações

- Mergers, Acquisitions, and Corporate RestructuringsNo EverandMergers, Acquisitions, and Corporate RestructuringsAinda não há avaliações

- Master service agreement The Ultimate Step-By-Step GuideNo EverandMaster service agreement The Ultimate Step-By-Step GuideAinda não há avaliações

- Someone Is Sitting in The Shade Today Because Someone Planted A Tree A Long Time Ago. - Warren BuffetDocumento20 páginasSomeone Is Sitting in The Shade Today Because Someone Planted A Tree A Long Time Ago. - Warren BuffetAnonymous 4rMVkArAinda não há avaliações

- Account Statement G P Trading CompanyDocumento2 páginasAccount Statement G P Trading CompanyAnonymous 4rMVkArAinda não há avaliações

- Swachch Bharat Mission GuideLinesDocumento57 páginasSwachch Bharat Mission GuideLinespankujrajvermaAinda não há avaliações

- Narayana Teer ThaDocumento13 páginasNarayana Teer ThaAnonymous 4rMVkArAinda não há avaliações

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- How and Where To Get MUDRA LoanDocumento3 páginasHow and Where To Get MUDRA LoanHiAinda não há avaliações

- IT Firms in TrichyDocumento2 páginasIT Firms in TrichyAnonymous 4rMVkArAinda não há avaliações

- Going Beyond Google AgainDocumento193 páginasGoing Beyond Google AgainAnonymous 4rMVkArAinda não há avaliações

- The Lessons of Oil - Unlocked Howard MarksDocumento7 páginasThe Lessons of Oil - Unlocked Howard MarksValueWalkAinda não há avaliações

- Perfecting Your PitchDocumento9 páginasPerfecting Your Pitchrahulniist26Ainda não há avaliações

- Sample Series A TermsheetDocumento13 páginasSample Series A TermsheetAnonymous 4rMVkArAinda não há avaliações

- Angel Guidebook - Term Sheet 1Documento13 páginasAngel Guidebook - Term Sheet 1Anonymous 4rMVkArAinda não há avaliações

- Elements of Pipe DesignDocumento49 páginasElements of Pipe DesignAnonymous 4rMVkArAinda não há avaliações

- Options Premium CalculatorDocumento2 páginasOptions Premium CalculatorAnonymous 4rMVkArAinda não há avaliações

- SlokaDocumento11 páginasSlokaAnonymous 4rMVkArAinda não há avaliações

- Public Private Partnership in Teacher Education: Its Prospect and StrategiesDocumento3 páginasPublic Private Partnership in Teacher Education: Its Prospect and StrategiesIOSRjournal100% (1)

- 07 Task Performance 1 - FinmarDocumento2 páginas07 Task Performance 1 - FinmarJen DeloyAinda não há avaliações

- Portrait of Lombard Odier - enDocumento2 páginasPortrait of Lombard Odier - enjackAinda não há avaliações

- Dividend PolicyDocumento9 páginasDividend Policyjimmy rodolfo LazanAinda não há avaliações

- Engineering Economic ExercisesDocumento5 páginasEngineering Economic ExercisesAuliaMukadisAinda não há avaliações

- Insider TradingDocumento32 páginasInsider TradingShreya Singh100% (4)

- Promoting Global Financial Stability: 2021 FSB Annual ReportDocumento37 páginasPromoting Global Financial Stability: 2021 FSB Annual ReportTom BaetensAinda não há avaliações

- Ratio Analysis PDFDocumento3 páginasRatio Analysis PDFABINASHAinda não há avaliações

- CoinMetro PresentationDocumento22 páginasCoinMetro PresentationteardroprainAinda não há avaliações

- Advances in Strategic Management Strategy Beyond Markets PDFDocumento539 páginasAdvances in Strategic Management Strategy Beyond Markets PDFrezasattari100% (1)

- Unit.3. Corporate Governance & Other StakeholdersDocumento9 páginasUnit.3. Corporate Governance & Other StakeholdersRajendra SomvanshiAinda não há avaliações

- Ernst & Young's 2010 EAS Waking Up To The New EconomyDocumento48 páginasErnst & Young's 2010 EAS Waking Up To The New EconomyMihai CosticaAinda não há avaliações

- Minor Project Report ON Life Insurance Corporation of IndiaDocumento52 páginasMinor Project Report ON Life Insurance Corporation of Indiamss_sikarwar3812100% (3)

- Mutual Fund PresentationDocumento14 páginasMutual Fund PresentationHetal ShahAinda não há avaliações

- Company Law and Sustainability 2015Documento374 páginasCompany Law and Sustainability 2015mamahannatuadamuAinda não há avaliações

- AQR - Chasing Your Own Tail RiskDocumento9 páginasAQR - Chasing Your Own Tail RiskTimothy IsgroAinda não há avaliações

- Building upon our strengthsDocumento65 páginasBuilding upon our strengthsgeopan88Ainda não há avaliações

- Capital Protection On EUR/CHF Foreign Exchange RateDocumento1 páginaCapital Protection On EUR/CHF Foreign Exchange Rateapi-25889552Ainda não há avaliações

- A Guide To Best Practices in Documentary Crediting: Created and Recommended by The Documentary Producers Alliance (DPA)Documento14 páginasA Guide To Best Practices in Documentary Crediting: Created and Recommended by The Documentary Producers Alliance (DPA)El DivulgadorAinda não há avaliações

- A Halted OTCBB From Vancouver Preys On US Investors With Dreams of Turning Air Into WaterDocumento8 páginasA Halted OTCBB From Vancouver Preys On US Investors With Dreams of Turning Air Into Waterinfitialis1100% (1)

- The Intelligent Investor Chapter 4Documento3 páginasThe Intelligent Investor Chapter 4Michael PullmanAinda não há avaliações

- PetrenDocumento55 páginasPetrenJoanna PiekarskaAinda não há avaliações

- Fromagerie Bel AnalyseDocumento41 páginasFromagerie Bel AnalyseMichaelCaroAinda não há avaliações

- GMMFDocumento2 páginasGMMFHussein NazzalAinda não há avaliações

- MoneyWalks SimpliedChinese Part IDocumento210 páginasMoneyWalks SimpliedChinese Part IXiaowei Chen100% (2)

- 2 Financial Services AssignmentDocumento10 páginas2 Financial Services AssignmentajayAinda não há avaliações

- African Review October 2017Documento70 páginasAfrican Review October 2017Anh ThànhAinda não há avaliações

- 12 New Trends in ManagementDocumento18 páginas12 New Trends in ManagementSaqib IqbalAinda não há avaliações

- Stock Market CrashDocumento15 páginasStock Market CrashsdaminctgAinda não há avaliações

- EY Funding For Growth The EY Guide To Going PublicDocumento2 páginasEY Funding For Growth The EY Guide To Going PublicAayushi AroraAinda não há avaliações