Escolar Documentos

Profissional Documentos

Cultura Documentos

Electronic Banking System

Enviado por

Francis Njihia Kaburu0 notas0% acharam este documento útil (0 voto)

74 visualizações14 páginasElectronic Banking Kenya

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOC, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoElectronic Banking Kenya

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOC, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

74 visualizações14 páginasElectronic Banking System

Enviado por

Francis Njihia KaburuElectronic Banking Kenya

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOC, PDF, TXT ou leia online no Scribd

Você está na página 1de 14

ELECTRONIC PAYMENT SYSTEMS

A CRITIQUE OF THE LEGAL ASPECTS AND REGULATORY FRAMEWORK IN KENYA

BY

VAYONDA SIRMA

AND

HENRY OGUTU

LECTURER: DR. DAVID GACHUKI

ABSTRACT

This paper seeks to investigate the impact and implications of Kenyan legislation on electronic payment

services; which are increasingly being adopted by consumers of banking services as the preferred mode of

effectuating payment. It discusses the various forms of electronic payments; their legal and regulatory

framework; and the consumers privacy and security concerns. The investigation reveals that not only does

the legal and regulatory framework not provide sufficient safeguards for consumers but also that it does

not clear up the ambiguities arising from a combination of rapidly changing technologies and the !urisdiction

ambiguities regarding the responsibilities of the different sector players. "oreover electronic payment

services #as they are based on technologies designed to e$tend the geographical reach of banks and

customers% e$pose both customers and banks to legal risks associated with non&compliance with different

national laws and regulations including consumer protection laws record keeping and report re'uirements.

(ur study reveals that the current and proposed law do not address the multitude of these issues.

)

CHAPTER ONE

FORMS OF ELECTRONIC PAYMENT SERVICES

INTRODUCTION

*lectronic payment services refer to a cluster of technologies that allow for the electronic e$ecution of

financial transactions without reference to the traditional paper-based settlement modes. +ince electronic

payment services are a new and evolving technology whose full impacts are unknown they have given rise

to a number of concerns , their efficacy privacy systems security and consumer protection , which are the

main issues that this paper focuses on. The main push for electronic payment services by consumers and

banking institutions alike is as a response to the dynamic interaction of the economic environment

increasing consumer sophistication increased participation by thrift industries in the financial services

sector and their cost efficiency. -owever the legal and regulatory framework in respect of these services in

Kenya has not faced up to the increasing consumer&protection challenges that these services evoke. These

challenges can be surmised into privacy and security within conte$t of inade'uate protections afforded by

the law to consumers of banking services.

.oosely defined electronic payment services #/*0+1% consists of a group of technologies that electronically

facilitate financial transactions. "essages sent by several forms of electronic communication cause the

transfer of funds from one financial account to another substituting the direct e$change of currency or

signed che'ues that would bring about the same transfer. The term *0+ has also come to include transfer

of information critical to such transactions without an immediate transfer of funds; for e$ample

authori2ation of credit cards telephone&bill payments or validation of financial transactions by

telecommunication

3

. In Kenya some of these services are decentralized and are provided directly to the

consumer at retail. They consist of transactions that may involve an individual and one or more providers

of financial services. In some cases as in the use of automated teller machines the transfer is immediate.

1

*lectronic payment services can be clustered into decentrali2ed or customer&oriented services and centrali2ed or institutional&

oriented services. 4ecentrali2ed services are further categori2ed into services that facilitate the transfer of information #such as

che'ue and credit authori2ation account status in'uiry che'ue verification% and electronic services that involve direct money

transfer. 5entrali2ed services include direct deposit payroll pre&authori2ed debit services corporate cash management #including

automated clearing houses interbank and intrabank transfers% and interbank settlements and clearings.

6

In others #such as che'ue verification services% value is conveyed by a paper instrument such as a

che'ue while the electronic service provides information to the recipient that funds are being conveyed.

+ometimes the consumer operates a machine that is used to provide an *0+ service whilst in other cases

the consumer gains access to the service through an intermediary.

1.1 AUTOMATED TELLER MACHINES (ATMS)

The most common form of *0+ services that has been readily accepted and used by most consumers of

financial services is the 7T". 8uintessentially they provide the banking services used most often by

consumers #e$cept loans%. "ost transactions can be accomplished faster and more conveniently than with

human tellers and its main attraction is its availability twenty #)9% hours a day

)

. Indicatively 7T"s allow

deposits to and withdrawals from customers accounts transfer between these accounts and accounts

balances 'ueries. They also permit the use of credit cards for cash advances as well as overdraft privileges

for particular customers. 5ash disbursements are usually limited to a predefined amount and the 7T"s

facilitate the daily updating of customers accounts. In most instances the debit card used to activate the

7T" is proprietary to the bank and its usage is effectuated by a personal identification number that is only

supposed to be accessible by the customer card&holder. 7T" networks may be proprietary to one institution

or they may be operated on behalf of multiple institutions by consortia or by third party operators

6

.

1. POINT!OF!SALE (POS)

0(+ is a payment service deployed in supermarkets department stores and other commercial facilities

which offer several kinds of services:

#a% 5redit card authori2ation and validation;

#b% 4irect transfer of funds from a customers accounts to the merchants account by means of a

debit card; and

#c% 5ertain banking services: i.e.; direct withdrawal of currency from #or deposit in% a depository

account using the merchants cash drawer and sales personnel.

2

7lthough customers who rely on this feature are on occasion seriously inconvenienced by finding the machines inoperative at

critical moments.

3

In Kenya these operation platforms are offered by PesaPoint and Kenswitch.

9

0(+ services employ a terminal operated by the merchant and a telecommunication link to customer

information files within banking and financial institutions.

1.". TELEPHONE BILL PAYMENT (TBS)

TB+ services allow customers to pay bills using a home telephone to instruct their banks to transfer money

from their accounts to that of a creditor. It is one of the *0+ services that is being phased out by the rapidly

evolving technology and was widely used in 7merica and *urope in the 3;<=s and 3;>=s. TB+ involved the

recording of the customers verbal instructions on a tape or through the intervention of human operators to

facilitate the processing of the customers instructions. (ne of its ma!or drawbacks was that the customer

had no proof that instructions for payment had been given until he?she had received a monthly statement;

which provided the customers only proof of payment

9

.

1.# WIRE TRANSFER

@ire transfers are the earliest form of *0+ and are chiefly responsible for the transfer of large sums of

money. Its current forms are embodied in the *lectronic Aunds Transfer #/*AT1% and Bapid Transfer Cross

+ettlement #/BTC+1%

D

.

1.$. CREDIT CARDS

4

Thus the customer often found it very difficult to substantiate his claims in case of a dispute in respect of his instructions to the

bank.

5

In Kenya BTC+ is effectuated through the Kenya *lectronic 0ayment and +ettlement +ystem #K*0++%. It was launched on Euly

); )==D in line with the Covernment of Kenya and 5entral Bank of KenyaFs moderni2ation initiatives for the countryFs Gational

0ayment +ystem. K*0++ has en!oyed tremendous growth in its value and volume throughout; attributable to the ever increasing

awareness by the public that K*0++ is a more safe and efficient system for settling high value and time critical payments and

the Covernments decision to stop using che'ues and process all its payments electronically through K*0++ with effect from

Govember )==;.

D

5redit card services are offered by banking and financial institutions to their customers on post-payment

basis for which the customers pay a certain premium on top of what the amounts that they spent through

that card every month. 5redit card authori2ation services are operated by card providers through electronic

terminals to determine whether a card should be honored for a particular transaction or not. There are two

kinds of credit card authori2ation and validation services;

a% Those that have direct access to the customers account #positive files%; and

b% Those that depend on information gathered from a variety of other sources #referred to as negative

files as they contain only information that is used to disallow transactions%. These sources include

records of a customers transactions with the system and data reported by participation institutions

and not on actual records

H

.

1.%. DEBIT CARDS

4ebit cards could be considered as the most successful *0+ in the Kenyan market to date particularly

when coupled with the proliferation of 7T"s networks across the entire country. They are considered as a

convenient substitute to hard currency or che'ues.

1.&. AUTOMATED CLEARINGHOUSES (ACH)

75- comprise a centrali2ed *0+ service that serves institutions rather than individuals. Instead of having

che'ues sorted and physically dispatched to the debiting bank an 75- receives sorts and distributes

payment information electronically which instructs banks to debit and credit accounts at specific times.

1.'. N() S())*(+(,) I,-)./0)12,- (NSI)

6

This type of validation usually through credit reference bureaus is more prevalent in *urope and the I+7.

H

G+I refers to an account transfer involving multiple debits and credits initiated by a J net settlement system

to settle net obligations arising from the conduct of a payment clearing system such as che'ue clearing or

0(+ clearing. Isually G+I is a discretionary operation of the bank without much involvement of their

customers and this portends a gray area when considered in light of the privacy and security concerns.

CHAPTER TWO

PRIVACY3 SECURITY AND LAW RELATING TO ELECTRONIC PAYMENTS SERVICES IN KENYA

INTRODUCTION

<

The principal concerns that have arisen about *0+ relate to the e$tent to which personal data might be

disclosed to third parties by banking and financial institutions the possibility of unwarranted government or

private surveillance through *0+ systems and data files and the right of consumers to see challenge and

correct personal data that might be used to their disadvantage. 0articular concerns abound that with the

increased adoption and use of *0+ consumers privacy will likely to be violated. This is due to the fact that

most of the *0+ services use online terminals making intrusive surveillance a more credible possibility.

"oreover there is a higher risk of dissemination of incorrect or inaccurate data concerning consumers

accounts even if safeguards to correct these inaccuracies are facilitated. "oreover the 5onstitutions clear

recognition of the right to privacy despite a lacuna in the e$isting laws and regulations legitimi2es these

privacy concerns. This necessitates more comprehensive *0+ privacy protection whether through new

legislation modification of e$isting law administrative procedures and regulations and enhanced industry

standards.

+ecurity in respect of *0+ relates to the protection of the integrity of *0+ systems and their information

from illegal and unauthori2ed use. The need for stringent security in *0+ systems has been propelled by

the inherent vulnerabilities in *0+ systems such as:

#a% *0+ systems have many access and terminal points where transactions can be effectuated in

unauthori2ed ways because of direct customer involvement with the dynamics of the system

and the way in which data relating to customers accounts is aggregated and transmitted

between institutions;

#b% *0+ crime is usually difficult to detect because funds?data can be removed by instructions

hidden in comple$ computer software beyond the purview of customers; and

(c) 7rguably *0+ systems reduce the effectiveness of some of the traditional methods of

controlling and auditing access to customers accounts.

7n interview with a senior manager at one of Kenyas commercial banks revealed that *0+ systems

security violations is difficult to assess because there is underreporting of *0+ systems crime a paucity of

information about *0+ systems security and a general lack of informed public discussion. @hile players in

the banking industry feel that there is a danger in e$acerbating these concerns by giving them a higher

visibility through public discussion. Gonetheless the public is entitled to know what risks they are e$posed

in using *0+ services and banking institutions and law enforcement agencies would also benefit by sharing

information about vulnerabilities defense strategies and security&enhancing technologies.

>

.1 PRIVACY AND SECURITY

"uch as it is difficult to define privacy in a precise and concise fashion it could be reduced to the ability to

keep certain kinds of personal information from other people or restrict its use e$cept as one freely

chooses to permit its disclosure or use. The (*54 Cuidelines on 0ersonal 0rivacy states that there may

be many reasons why privacy is such a paramount concern to consumers who may wish to withhold

information about themselves other than their concerns about possible government encroachments on their

civil liberties

<

. 0articularly because information may e$pose them to censure or threaten their reputation

social status , and more so with regards to information concerning their finances.

.1.1 P.14506 5,7 -(0/.1)6 .(*5)1,8 )2 F1,5,015* T.5,-50)12,-

Indeniably only transactions in which currency is the medium of payment can be accomplished with some

degree of anonymity. In *0+ systems privacy is violated when data is without the sub!ects consent made

available to and used by those not a party to the transaction for purposes other than those necessary to

accomplish the transaction. Those other purposes could range from organi2ed market campaigns to

intrusive surveillance to blackmail. If a person has neither e$plicitly nor implicitly consented to disclosure

and use of information for a given purpose personal privacy is considered to have been violated even if the

same information was willingly provided by that person or to the same party for a different purpose.

7dditionally there is also the obverse of unauthori2ed disclosure of information to third parties; namely the

ability of the individual to know what personal information has been collected and how it is being used.

5onse'uently there is the greater concern about privacy in *0+ systems due to the following reasons;

#a% *0+ systems make it easier to collect organi2e store and access large amounts of data;

#b% "ore data are electronically readable and processable making them easier to manipulate and

aggregate; and

#c% The large number of points at which data is retained making it susceptible to unwarranted

access and use by third parties.

7

(*54 Cuidelines on the 0rotection of 0rivacy and Transborder Alows of 0ersonal 4ata #3;>=%

;

The 'uestion of *0+ systems security is closely related to the concerns of privacy. Isers of banking

products want to be assured of the confidentiality of the information relating to their accounts , with the

assurance that it will be aggregated and used only for purposes integral to the payment system and

necessary to the carrying out of the necessary instructions as intended by the customer. This assurance

rests on the confidence both in the intent of the financial institution and in its ability to protect the

information and limit access to the institutions authori2ed agents. If security is breached the institution

cannot provide this protection and the users privacy may be violated. It should also be noted that some

means of increasing security especially through audit trails increase the possibility that privacy may be

infringed because additional copies of data are created at various points in an electronic payment system.

. L(85* 5,7 R(8/*5)2.6 E,41.2,+(,) 29 E*(0).2,10 P56+(,)- S(.410(-

+ection 9 7 3#d% of the 5entral Bank of Kenya 7ct empowers the 5entral Bank of Kenya to formulate and

implement such policies as best promote the establishment regulation and supervision of efficient and

effective payment clearing and settlement systems. In view of this enabling statute the 5entral Bank of

Kenya has directed great effort to the moderni2ation of the payment systems in the last two decades.

Initially the ob!ective of the moderni2ation process was to systematically and continuously implement

policies that would ultimately enable the countrys payment system to attain international standards and

ensure that Kenya becomes a financial hub in the region as well as the preferred investment destination.

The fundamental policy ob!ective for payments moderni2ation was the achievement of safety efficiency and

effectiveness of the countrys payment.

..1. T:( C(,).5* B5,; 29 K(,65 5,7 ):( ;(6 +1*(-)2,(- 1, ):( +27(.,1<5)12, =.20(-- 29 =56+(,)

-(.410(- 1, K(,65

The first milestone of the moderni2ation process was reali2ed in 3;;> with the automation of the Gairobi

5learing -ouse that saw the reduction of the che'ue clearing cycle from fourteen days to four days. This

was facilitated by the adoption of the "agnetic Ink 5haracter Becognition #"I5B% technology and

*lectronic Aunds Transfer #*AT% system.

3=

The second important milestone was the amendment of the 5entral Bank of Kenya 7ct in )==6 that

introduced +ection 97 3#d% into the 7ct which provided a strong basis upon which the Bank could promote

moderni2ation of payment clearing and settlement systems including the continuing innovations in the

retail payment arena.

The third key milestone was the implementation of the K(,65 E*(0).2,10 P56+(,)- 5,7 S())*(+(,)

S6-)(+ (KEPSS)3 the countrys Beal Time Cross +ettlement #BTC+% +ystem in Euly )==D. K*0++

implementation facilitated the mitigation of risks associated with the previous paper&based inter&bank

settlement system; transformed the management of li'uidity in the banking industry; reduced the systemic

importance of the 7utomated 5learing -ouse #75-%; and enhanced financial stability while providing an

efficient mechanism for monetary policy transmission.

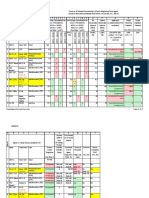

The fourth ma!or milestone was the facilitation of +2>1*( >5-(7 9/,7- transfer payments system. This

notable innovation in Kenyas payments system environment has provided greater access and increased

convenience to many low income households and micro&enterprises in Kenya including those in rural

areas who do not have access to conventional banking. The phenomenal growth in the transaction volumes

and values since the rollout of the first mobile money transfer system in )==< underlines the popularity and

usage of mobile money transfer platforms as indicated in the chart below. In view of their depth and

outreach mobile payment platforms have become an integral part of the national payments system as their

scope in terms of number of transactions is wider than that of the large value payment systems

>

.

Aifthly in (ctober )==; the 5entral Bank of Kenya in con!unction with the Kenya Bankers 7ssociation and

in liaison with the "inistry of Ainance implemented the value capping policy

;

. The policy stopped the

processing of high value payments using che'ues and *lectronic Aunds Transfers of Kenya +hillings one

#3% million and above through the Gairobi 7utomated 5learing -ouse. +uch high value transactions are now

processed through K*0++.

8

+ome of the players in mobile money transfers arena include; M-Pesa, Airtel Money, yuCash, Orange Money, and angaza,

among others

9

The value capping policy also affected other currency transactions such as the dollar euro and sterling pound.

33

+i$thly an important ongoing initiative is the C:(?/( T./,05)12, P.2@(0)

1A

3 which seeks to reduce che'ue

handling costs provide superior customer service levels improve risk management reduce li'uidity risk

and improve efficiency of our payment systems by streamlining the processing of che'ues. Gotably this will

remove the need to physically send bank representatives to the 5learing -ouse while at the same time

settlement certificates will be distributed electronically and all che'ues deposited will be stored at the point

of deposit.

7t a regional level the 5entral Bank of Kenya is working in collaboration with the other *ast 7frican 5entral

Banks to implement the *ast 7frica 0ayments +ystem #*70+% which is intended to facilitate real time

settlement of financial transactions among commercial banks in *ast 7frica using the five *ast 7frican

currencies. *70+ which is an integration of the BTC+ systems in *ast 7frica is e$pected to be operational

in the course of the year. The payment systems moderni2ation achievements include:

i%. 0romotion of greater efficiency and effectiveness of the payment clearing and settlement

systems;

ii%. 0rovision of an enabling environment for the development of various instruments and

mechanisms for an integrated modern and technologically sound payment system for transfer of

funds between transacting parties;

iii%. Aacilitation of irrevocability of payment and finality of settlement arrangements;

iv%. Beduction in the length of payment cycles for high value payments to +ame&4ay settlement.

... EB1-)1,8 5,7 =.2=2-(7 *5C- 5,7 .(8/*5)12,-

The 5entral Bank #/5BK1% under its mandate under +ection 9 #7% 3#d% of the 5entral Bank of Kenya 7ct

has drafted the Gational 0ayments +ystem Bill whose ob!ective is to enhance the Banks oversight role

over 0ayment +ystems in Kenya. @ith regards to *0+ the 5BK recently launched the draft Begulations for

the 0rovision of *lectronic Betail Transfers and *lectronic "oney. The regulations are aimed at giving

certainty in the operation and regulation of the retail payment industry.

10

This will become operational by 3

st

Eune )=33.

3)

7dditionally for *0+ systems the national I5T policy vide its Kenya Ca2ette Gotice )==H recogni2es the

current body of laws relating to banking and financial institutions are inade'uate in dealing with the privacy

and security concerns identified in the issues pertaining to electronic commerce. It also recognises the

need for a comprehensive policy legal and regulatory framework in order to:

#a% support I5T development investment and application;

#b% promote competition in the industry where appropriate;

#c% address issues of privacy e&security I5T legislation cyber crimes ethical and moral

conduct; and

#d% copyrights intellectual property rights and piracy.

The Kenya 5ommunications #7mendment% Bill )==> which was to amend the Kenya 5ommunications 7ct

3;;> and address some of the challenges cited by the Gational I5T policy as indicated above came into

operation in Eanuary )==;. (ne of the key sections is 0art KII on electronic transactions #e&transactions%.

Though it outlines what involves electronic transactions it insufficiently caters for the privacy and security

concerns for such type of transactions.

36

39

Você também pode gostar

- Extradition of Okemo and GichuruDocumento2 páginasExtradition of Okemo and GichuruFrancis Njihia Kaburu100% (1)

- IMF and AML PDFDocumento3 páginasIMF and AML PDFFrancis Njihia KaburuAinda não há avaliações

- Fighting Money Laundering in AfricaDocumento12 páginasFighting Money Laundering in AfricaFrancis Njihia KaburuAinda não há avaliações

- Kenya Land Policy AnalysisDocumento51 páginasKenya Land Policy AnalysisFrancis Njihia KaburuAinda não há avaliações

- The Concept of Land Ownership: Islamic PerspectiveDocumento20 páginasThe Concept of Land Ownership: Islamic Perspectivemohkim100% (1)

- Money Laundering Methods in East and Southern Africa PDFDocumento20 páginasMoney Laundering Methods in East and Southern Africa PDFFrancis Njihia KaburuAinda não há avaliações

- Chapter 4 - Money Laundering in KenyaDocumento92 páginasChapter 4 - Money Laundering in KenyaFrancis Njihia KaburuAinda não há avaliações

- Swynnerton Plan 1954Documento2 páginasSwynnerton Plan 1954OnyangoVictor71% (7)

- Tackling Money Laundering in East and Southern AfricaDocumento73 páginasTackling Money Laundering in East and Southern AfricaFrancis Njihia KaburuAinda não há avaliações

- Misuse of NGOs For Money LaunderingDocumento6 páginasMisuse of NGOs For Money LaunderingFrancis Njihia KaburuAinda não há avaliações

- Land Ownership in IslamDocumento17 páginasLand Ownership in IslamFrancis Njihia KaburuAinda não há avaliações

- Land Grabbing Cost Kenya BillionsDocumento32 páginasLand Grabbing Cost Kenya Billionsjaffar s m100% (1)

- Grabbing of Beach Plots in KenyaDocumento3 páginasGrabbing of Beach Plots in KenyaFrancis Njihia Kaburu100% (2)

- Concept of Land Ownership in KenyaDocumento14 páginasConcept of Land Ownership in KenyaFrancis Njihia KaburuAinda não há avaliações

- Regulation of Use of Private Land in KenyaDocumento24 páginasRegulation of Use of Private Land in KenyaFrancis Njihia Kaburu100% (1)

- Retail Price Maintenance - Leggin CaseDocumento55 páginasRetail Price Maintenance - Leggin CaseFrancis Njihia KaburuAinda não há avaliações

- Land Titles at Kenyan CoastDocumento41 páginasLand Titles at Kenyan CoastFrancis Njihia KaburuAinda não há avaliações

- Colony and Protectorate of Kenya Land Tenure CommissionDocumento12 páginasColony and Protectorate of Kenya Land Tenure CommissionFrancis Njihia KaburuAinda não há avaliações

- LSK Conditions of SaleDocumento13 páginasLSK Conditions of SaleFrancis Njihia Kaburu0% (1)

- Squatters at CoastDocumento135 páginasSquatters at CoastFrancis Njihia KaburuAinda não há avaliações

- INSANITY DEFENCE EXPLAINEDDocumento13 páginasINSANITY DEFENCE EXPLAINEDFrancis Njihia KaburuAinda não há avaliações

- Endorois DecisionDocumento80 páginasEndorois DecisionFrancis Njihia KaburuAinda não há avaliações

- Decentralization in Africa ReportDocumento46 páginasDecentralization in Africa ReportFrancis Njihia KaburuAinda não há avaliações

- Criminal Law II Homicide Offences ExplainedDocumento20 páginasCriminal Law II Homicide Offences ExplainedFrancis Njihia Kaburu75% (4)

- Devolution in Kenya Setting The Agenda e VersionDocumento54 páginasDevolution in Kenya Setting The Agenda e VersionSamuel Ngure100% (1)

- Kenya Tourism Act 2011Documento72 páginasKenya Tourism Act 2011Francis Njihia KaburuAinda não há avaliações

- Self Regulation in Capital MarketsDocumento12 páginasSelf Regulation in Capital MarketsFrancis Njihia Kaburu0% (1)

- Kenya Wildlife Conservation and Management Act 2013Documento116 páginasKenya Wildlife Conservation and Management Act 2013Francis Njihia KaburuAinda não há avaliações

- Refusal To Deal in The EUDocumento32 páginasRefusal To Deal in The EUFrancis Njihia KaburuAinda não há avaliações

- Kenya National Tourism Srategy 2013 - 2018Documento46 páginasKenya National Tourism Srategy 2013 - 2018Francis Njihia Kaburu67% (3)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Florence Walking Tour MapDocumento14 páginasFlorence Walking Tour MapNguyễn Tấn QuangAinda não há avaliações

- Ecole Polytechnique Federale de LausanneDocumento44 páginasEcole Polytechnique Federale de LausanneSyed Yahya HussainAinda não há avaliações

- NameDocumento5 páginasNameMaine DagoyAinda não há avaliações

- Tygon S3 E-3603: The Only Choice For Phthalate-Free Flexible TubingDocumento4 páginasTygon S3 E-3603: The Only Choice For Phthalate-Free Flexible TubingAluizioAinda não há avaliações

- AE-Electrical LMRC PDFDocumento26 páginasAE-Electrical LMRC PDFDeepak GautamAinda não há avaliações

- Emergency Room Delivery RecordDocumento7 páginasEmergency Room Delivery RecordMariel VillamorAinda não há avaliações

- PC November 2012Documento50 páginasPC November 2012bartekdidAinda não há avaliações

- Jazan Refinery and Terminal ProjectDocumento3 páginasJazan Refinery and Terminal ProjectkhsaeedAinda não há avaliações

- Cinema 4D ShortcutsDocumento8 páginasCinema 4D ShortcutsAnonymous 0lRguGAinda não há avaliações

- Corn MillingDocumento4 páginasCorn Millingonetwoone s50% (1)

- Single-Phase Induction Generators PDFDocumento11 páginasSingle-Phase Induction Generators PDFalokinxx100% (1)

- Clean Agent ComparisonDocumento9 páginasClean Agent ComparisonJohn AAinda não há avaliações

- Development of Rsto-01 For Designing The Asphalt Pavements in Usa and Compare With Aashto 1993Documento14 páginasDevelopment of Rsto-01 For Designing The Asphalt Pavements in Usa and Compare With Aashto 1993pghasaeiAinda não há avaliações

- Lecture 4Documento25 páginasLecture 4ptnyagortey91Ainda não há avaliações

- Cianura Pentru Un Suras de Rodica OjogDocumento1 páginaCianura Pentru Un Suras de Rodica OjogMaier MariaAinda não há avaliações

- Impact of Bap and Iaa in Various Media Concentrations and Growth Analysis of Eucalyptus CamaldulensisDocumento5 páginasImpact of Bap and Iaa in Various Media Concentrations and Growth Analysis of Eucalyptus CamaldulensisInternational Journal of Innovative Science and Research TechnologyAinda não há avaliações

- WassiDocumento12 páginasWassiwaseem0808Ainda não há avaliações

- Living Nonliving DeadDocumento11 páginasLiving Nonliving DeadArun AcharyaAinda não há avaliações

- Class Ix - Break-Up SyllabusDocumento3 páginasClass Ix - Break-Up Syllabus9C Aarib IqbalAinda não há avaliações

- Elmeasure Solenoid Ates CatalogDocumento12 páginasElmeasure Solenoid Ates CatalogSEO BDMAinda não há avaliações

- Afu 08504 - International Capital Bdgeting - Tutorial QuestionsDocumento4 páginasAfu 08504 - International Capital Bdgeting - Tutorial QuestionsHashim SaidAinda não há avaliações

- FALL PROTECTION ON SCISSOR LIFTS PDF 2 PDFDocumento3 páginasFALL PROTECTION ON SCISSOR LIFTS PDF 2 PDFJISHNU TKAinda não há avaliações

- Um 0ah0a 006 EngDocumento1 páginaUm 0ah0a 006 EngGaudencio LingamenAinda não há avaliações

- Empowerment Technology Reviewer: First SemesterDocumento5 páginasEmpowerment Technology Reviewer: First SemesterNinayD.MatubisAinda não há avaliações

- Brain, Behavior, and Immunity: Alok Kumar, David J. LoaneDocumento11 páginasBrain, Behavior, and Immunity: Alok Kumar, David J. LoaneRinaldy TejaAinda não há avaliações

- Postnatal Assessment: Name Date: Age: D.O.A: Sex: Hospital: Marital Status: IP .NoDocumento11 páginasPostnatal Assessment: Name Date: Age: D.O.A: Sex: Hospital: Marital Status: IP .NoRadha SriAinda não há avaliações

- SQL Server 2008 Failover ClusteringDocumento176 páginasSQL Server 2008 Failover ClusteringbiplobusaAinda não há avaliações

- Insize Catalogue 2183,2392Documento1 páginaInsize Catalogue 2183,2392calidadcdokepAinda não há avaliações

- Guide to Fair Value Measurement under IFRS 13Documento3 páginasGuide to Fair Value Measurement under IFRS 13Annie JuliaAinda não há avaliações

- Doe v. Myspace, Inc. Et Al - Document No. 37Documento2 páginasDoe v. Myspace, Inc. Et Al - Document No. 37Justia.comAinda não há avaliações