Escolar Documentos

Profissional Documentos

Cultura Documentos

Senior Investment Strategist Portfolio Manager in Detroit MI Resume Clarence Lewis

Enviado por

ClarenceLewis0 notas0% acharam este documento útil (0 voto)

246 visualizações2 páginasClarence Lewis is an entrepreneurial executive skilled in deploying sophisticated investor strategies to expand revenue growth for institutional asset managers. He is open to relocation for the right opportunity.

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoClarence Lewis is an entrepreneurial executive skilled in deploying sophisticated investor strategies to expand revenue growth for institutional asset managers. He is open to relocation for the right opportunity.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

246 visualizações2 páginasSenior Investment Strategist Portfolio Manager in Detroit MI Resume Clarence Lewis

Enviado por

ClarenceLewisClarence Lewis is an entrepreneurial executive skilled in deploying sophisticated investor strategies to expand revenue growth for institutional asset managers. He is open to relocation for the right opportunity.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 2

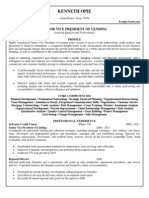

CLARENCE LEWIS, JR.

Detroit, MI 48207 248.789.7245 c.lewis@nextgenmanagement.net

EXECUTIVE SUMMARY

INVESTMENT MANAGEMENT | PORTFOLIO MANAGEMENT

EXECUTIVE LEADERSHIP | CLIENT SERVICE | BUSINESS DEVELOPMENT |INVESTMENT CONSULTING | CAPITAL MARKETS

Entrepreneurial executive skilled in deploying sophisticated investor strategies to expand revenue growth for

institutional asset managers. Uniquely qualified leader with hybrid skill set spanning portfolio management/trading,

relationship management, business development, corporate finance, due diligence, and asset allocation. Seasoned

investment professional adept at building enterprise-wide relationships across financial intermediary platforms.

CORE COMPETENCIES

Investment: Expertise in traditional, alternative and real assets as well as derivatives and portable alpha

Finance: Fluent understanding of asset management, investment banking, liquidity management, asset and

liability management, and global strategic/tactical asset allocation

Communications: Impactful presenter able to interface with C-level executives, consultants and trustees to

retain/grow profitable relationships

Leadership: Team-focused leader working closely with sales/trading, commercial/investment bank, legal,

finance, senior management, and capital market groups

PROFESSIONAL EXPERIENCE

Business Development Executive, June 2012 2014

Public Pension Plan Consultant, 2010 -2012

Next Generation Management, LLC, Detroit, MI

Sourced and secured seed capital from lead investor for first-time Green Real Estate Operating Fund. Built and

executed companys marketing, sales and fund-raising strategies. Consulted defined benefit public pension fund

client with $750M+ in assets. Developed and executed a liquidity and funding strategy. Quantified left tail portfolio

risk, style and capitalization biases that led to achieving portfolio optimization and downside protection.

Key Accomplishments:

Expanded pool of prospective investors beyond traditional public fund, eleemosynary, Taft Hartley, and

corporate sector to include impact investors, family office, high-net-worth, private equity, and consultants

Improved risk adjusted returns by lowering portfolio volatility, harvesting volatile assets, improving relative

performance, consolidating highly correlated assets, and recommending assets with lower correlations

Generated portfolio gains and cost savings that resulted in ~$21.25 million of net income in 12 months

Conducted manager searches and due diligence that led to the hiring and termination of investment managers

Client Advisor, 2004 2010

JPMorgan Asset Management, Detroit, MI

Interfaced with middle and large-market institutional clients to assess, analyze and translate needs into portfolio

and product solutions. Launched, sold and closed traditional, alternative, liquidity, absolute return and portable

alpha strategies. Facilitated multi-touch point service to clients to meet and exceed client goals and objectives.

Key Accomplishments:

Generated ~25% growth in book of business through development of creative and customized solutions

Retained ~ 90% of the assigned book of business through merger and transition of accounts

Investment Manager, 1998 2004

Bank One Investment Advisors, Detroit, MI

Executed investment management processes for assigned book of business in Georgia, Florida, Nevada, North

Carolina, Maryland, Michigan, and New York.

Key Accomplishments:

Increased AUM from ~$1.5B to $3.5B with 40-60 institutional clients that generated ~$2.2M in fees

Led and captured $1B+ in AUM via direction of public fund, Eleemosynary, and Taft Hartley initiatives

CLARENCE LEWIS, JR., PAGE 2

EARLY CAREER

Senior Portfolio Manager, First Chicago NBD, Chicago, IL

Inherited book of transitioned accounts across institutional market segments

Grew book to $750M over 3-year period

Portfolio Manager, Alpha Capital Management, Detroit, MI

Managed Fixed Income Portfolios, supported Equity and Balanced Portfolio Manager, marketed GARP and

Core Bond strategies, and managed firm compliance needs

Added three new accounts in 12 months and increased profitability by expanding existing relationships

Commissioned Bank Examiner, Federal Reserve Bank of Chicago, Chicago, IL

Lead examiner on multi-national examinations of holding companies and large commercial banks

Selected for international assignments; spearheaded various capital market examinations in Michigan

Portfolio Manager / Trader, Trustcorp, Inc., Toledo, OH

Managed 7 out of 13 bank investment portfolios approximating $550M; supported lead portfolio manager on

the remaining investment portfolios approximating $1.5B

Generated ~$1.8M in trading profits over 3-year period

TECHNICAL EXPERTISE

Bloomberg, FactSet, Barclays Yield Book, Thomson Reuters, Knight Ridder, Barra, Zephyr, Lipper, IPS Sendero, Value

Line, Morningstar, Money Market Directory, e-Vestment, Pertrac, INDATA, Ibbotson, Preqin, PERE, Microsoft Office

Suite and Database Tools

EDUCATION

BS, Business Administration, Florida Agricultural and Mechanical University School of Business and Industry

TRAINING & LICENSURE

J.P. Morgan Asset Management internal and external product and sales training

Completed Level 1 Chartered Financial Analyst Program

American Bank Association Professional Development Courses

Funds Management School, Chase Manhattan, London, UK

Commercial Lending School, University of Oklahoma

Options Institute, Chicago Board Options Exchange

FINRA Series 63, 65, and 7 licenses and NFA series 3 (has passed)

PROFESSIONAL AFFILIATIONS

International Foundation of Employee Benefit Plans

Michigan Association of Pension Employees and Retirement Systems

Municipal Treasurers Association

National Association of Securities Professionals

Government Finance Officers Association

Você também pode gostar

- Director Investment Banking in NYC NY Resume Pascal KabembaDocumento2 páginasDirector Investment Banking in NYC NY Resume Pascal KabembaPascalKabemba100% (1)

- Director VP Finance Controller FP&A Auditing in Indianapolis Resume Thomas KaehrDocumento3 páginasDirector VP Finance Controller FP&A Auditing in Indianapolis Resume Thomas KaehrThomasKaehrAinda não há avaliações

- Jaime Cooper Consulting (Business Development Resume)Documento2 páginasJaime Cooper Consulting (Business Development Resume)jcooper_bostonAinda não há avaliações

- Executive Corporate Finance ResumeDocumento2 páginasExecutive Corporate Finance ResumeMohit KumarAinda não há avaliações

- Managing Director Private Equity in NYC Resume Stephen PecaDocumento3 páginasManaging Director Private Equity in NYC Resume Stephen PecaStephenPecaAinda não há avaliações

- Vice President Equity in Dallas TX Resume Shawn RielyDocumento3 páginasVice President Equity in Dallas TX Resume Shawn RielyShawnRielyAinda não há avaliações

- Senior Vice President Lending in Dallas FT Worth TX Resume Kenneth OpieDocumento2 páginasSenior Vice President Lending in Dallas FT Worth TX Resume Kenneth OpieKennethOpieAinda não há avaliações

- Investor Relations Communications Director in USA Resume Brad MillerDocumento3 páginasInvestor Relations Communications Director in USA Resume Brad MillerBradMillerAinda não há avaliações

- Finance Manager in Atlanta GA Resume Benjamin HughesDocumento3 páginasFinance Manager in Atlanta GA Resume Benjamin HughesBenjaminHughesAinda não há avaliações

- Rob Brown, PHD, Cfa 5054 Evanwood AvenueDocumento4 páginasRob Brown, PHD, Cfa 5054 Evanwood Avenuekurtis_workmanAinda não há avaliações

- Chief Executive Officer CEO COO in North America Resume Christopher MoritzDocumento2 páginasChief Executive Officer CEO COO in North America Resume Christopher MoritzChristopherMoritzAinda não há avaliações

- Sample CEO ResumeDocumento2 páginasSample CEO ResumeAnonymous gf7D0nAinda não há avaliações

- Strategic Asset Allocation & Private Banking AnalysisDocumento36 páginasStrategic Asset Allocation & Private Banking Analysisarpitt_4Ainda não há avaliações

- NavDocumento2 páginasNavFaisal ZaheerAinda não há avaliações

- VP Strategy Strategic Planning Resume Columbus OH Gerald NanningaDocumento3 páginasVP Strategy Strategic Planning Resume Columbus OH Gerald NanningaGerald NanningaAinda não há avaliações

- Chief Executive Officer Resume SampleDocumento2 páginasChief Executive Officer Resume Sampleharshnvicky123100% (1)

- Practical Portfolio Performance Measurement - Why Measure Portfolio PerformanceDocumento4 páginasPractical Portfolio Performance Measurement - Why Measure Portfolio PerformanceNic San JuanAinda não há avaliações

- FM AnalysisDocumento62 páginasFM AnalysisSofiya BayraktarovaAinda não há avaliações

- Interview Questions of FinanceDocumento126 páginasInterview Questions of FinanceAnand KumarAinda não há avaliações

- Investment BankingDocumento52 páginasInvestment BankingShera BhaiAinda não há avaliações

- Business Consultant MBA CV Resume TemplateDocumento2 páginasBusiness Consultant MBA CV Resume TemplateMike Kelley100% (1)

- Helpful WSO PostsDocumento23 páginasHelpful WSO PostsalbertAinda não há avaliações

- CH Capital Credit Risk AnalysisDocumento35 páginasCH Capital Credit Risk Analysissokcordell69Ainda não há avaliações

- Empirical Studies in FinanceDocumento8 páginasEmpirical Studies in FinanceAhmedMalikAinda não há avaliações

- Leveraged Buy Outs and Buy Ins: DR Clive Vlieland-BoddyDocumento37 páginasLeveraged Buy Outs and Buy Ins: DR Clive Vlieland-Boddyjturner19742Ainda não há avaliações

- CFO VP Finance Administration in Pittsburgh PA Resume Matthew BurlandoDocumento2 páginasCFO VP Finance Administration in Pittsburgh PA Resume Matthew BurlandoMatthew BurlandoAinda não há avaliações

- Into To Treasury & Risk Management - FinalDocumento21 páginasInto To Treasury & Risk Management - FinalGaurav AgrawalAinda não há avaliações

- Risk Management Resume SampleDocumento2 páginasRisk Management Resume SampleGovind AgarwalAinda não há avaliações

- VP Corporate Finance CFO in Dallas Fort Worth TX Resume Joe RenfroeDocumento2 páginasVP Corporate Finance CFO in Dallas Fort Worth TX Resume Joe RenfroeJoeRenfroeAinda não há avaliações

- Senior Financial Analyst in Philadelphia PA Resume Diego SfercoDocumento2 páginasSenior Financial Analyst in Philadelphia PA Resume Diego SfercoDiegoSfercoAinda não há avaliações

- II. Trade Finance Methods and Instruments: An Overview: A. IntroductionDocumento11 páginasII. Trade Finance Methods and Instruments: An Overview: A. IntroductionSandeep SinghAinda não há avaliações

- Lesson1 Topic 2 Credit and Financial Analysis-NotesDocumento16 páginasLesson1 Topic 2 Credit and Financial Analysis-Notesshantam singhAinda não há avaliações

- Credit AnalysisDocumento3 páginasCredit AnalysisLinus ValenciaAinda não há avaliações

- Katie Rogers ResumeDocumento3 páginasKatie Rogers ResumeDave RogersAinda não há avaliações

- Credit Analyst Resume Samples - Velvet Jobs1Documento140 páginasCredit Analyst Resume Samples - Velvet Jobs1poseiAinda não há avaliações

- CFO VP Director Finance in Houston TX Resume Michelle BakerDocumento3 páginasCFO VP Director Finance in Houston TX Resume Michelle BakerMichelleBakerAinda não há avaliações

- Succeeding in An Investment Banking Interview by Jared HaftelDocumento1 páginaSucceeding in An Investment Banking Interview by Jared HafteljaflorentineAinda não há avaliações

- Investment Manager Research - Wells FargoDocumento5 páginasInvestment Manager Research - Wells FargoMarshay HallAinda não há avaliações

- JP Morgan Investment Competition ResourcesDocumento7 páginasJP Morgan Investment Competition ResourcesAnil KiniAinda não há avaliações

- CamelDocumento43 páginasCamelsuyashbhatt1980100% (1)

- CFO Finance Director Controller in Los Angeles CA Resume Keith RowlandDocumento2 páginasCFO Finance Director Controller in Los Angeles CA Resume Keith RowlandKeithRowlandAinda não há avaliações

- Three Principles of Transportation OptimizationDocumento18 páginasThree Principles of Transportation OptimizationJeevandeep Singh DulehAinda não há avaliações

- Example - Complete Model of Eng Management ReportDocumento38 páginasExample - Complete Model of Eng Management ReportSyah RullacmarAinda não há avaliações

- Credit Suisse S&T Cover Letter 1Documento1 páginaCredit Suisse S&T Cover Letter 1Dylan AdrianAinda não há avaliações

- VP Strategic Business Development in USA Resume Manlio HuacujaDocumento2 páginasVP Strategic Business Development in USA Resume Manlio HuacujaManlioHuacujaAinda não há avaliações

- Lecture 1: Overview of Financial Statement AnalysisDocumento17 páginasLecture 1: Overview of Financial Statement AnalysisTrang Bùi HàAinda não há avaliações

- Investment Risk and Return AnalysisDocumento20 páginasInvestment Risk and Return AnalysisravaladityaAinda não há avaliações

- Argenti A ScoreDocumento1 páginaArgenti A Scoremd1586100% (1)

- Managing Investment Firms - PQ VersionDocumento15 páginasManaging Investment Firms - PQ VersionCoventryNickAinda não há avaliações

- Senior HR Business Partner in NYC Resume Elizabeth MacKayDocumento2 páginasSenior HR Business Partner in NYC Resume Elizabeth MacKayElizabethMacKayAinda não há avaliações

- Procedure of Credit RatingDocumento57 páginasProcedure of Credit RatingMilon SultanAinda não há avaliações

- Managing Director Insurance M&A Advisory in Hong Kong Resume John SpenceDocumento3 páginasManaging Director Insurance M&A Advisory in Hong Kong Resume John SpenceJohnSpence2Ainda não há avaliações

- Senior Corporate Real Estate in AZ Resume Donald BeckaDocumento3 páginasSenior Corporate Real Estate in AZ Resume Donald BeckaDonaldBeckaAinda não há avaliações

- Strategic Business Unit A Complete Guide - 2020 EditionNo EverandStrategic Business Unit A Complete Guide - 2020 EditionAinda não há avaliações

- A. Saffer: RobertDocumento5 páginasA. Saffer: Robertashish ojhaAinda não há avaliações

- Investment Equity Research Analyst in Portland OR Resume Tammi OrtegaDocumento2 páginasInvestment Equity Research Analyst in Portland OR Resume Tammi OrtegaTammiOrtegaAinda não há avaliações

- Relationship Manager in Dallas TX Resume Diane CiomperlikDocumento1 páginaRelationship Manager in Dallas TX Resume Diane CiomperlikDianeCiomperlikAinda não há avaliações

- Patricio Caceres MBA ResumeDocumento2 páginasPatricio Caceres MBA Resumeashish ojhaAinda não há avaliações

- SVP Commercial Lending Manager in Jacksonville FL Resume Steven KelleyDocumento2 páginasSVP Commercial Lending Manager in Jacksonville FL Resume Steven KelleyStevenKelleyAinda não há avaliações

- Financial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessNo EverandFinancial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessAinda não há avaliações

- Dividends and Dividend Policy: Mcgraw-Hill/IrwinDocumento24 páginasDividends and Dividend Policy: Mcgraw-Hill/IrwinKafil MahmoodAinda não há avaliações

- Business Finance Module3Documento5 páginasBusiness Finance Module3Colene Anne R. SantosAinda não há avaliações

- September 2016 Anglican LifeDocumento20 páginasSeptember 2016 Anglican LifeAnglicanLifeNLAinda não há avaliações

- KFC Holding (M) BHD: Share Split, Bonus and Free Warrants Issue - 23/6/2010Documento3 páginasKFC Holding (M) BHD: Share Split, Bonus and Free Warrants Issue - 23/6/2010Rhb InvestAinda não há avaliações

- 01.is Alpha Just Beta Waiting To Be DiscoveredDocumento16 páginas01.is Alpha Just Beta Waiting To Be DiscoveredLiou Kevin100% (1)

- JPM Fixed inDocumento236 páginasJPM Fixed inMikhail ValkoAinda não há avaliações

- An Initial Investment Is Also Called StartDocumento2 páginasAn Initial Investment Is Also Called StartDagnachew Amare DagnachewAinda não há avaliações

- Blackrock Smart Beta Guide en Au PDFDocumento68 páginasBlackrock Smart Beta Guide en Au PDFdehnailAinda não há avaliações

- Investors Attitude Towards Online and Offline TradingDocumento6 páginasInvestors Attitude Towards Online and Offline TradingYasser AhmedAinda não há avaliações

- FAQ-AIF-SMF FundDocumento10 páginasFAQ-AIF-SMF FundadithyaAinda não há avaliações

- Tyco Scandal (2002) : (Acc C607-302A Auditing and Good Governance)Documento20 páginasTyco Scandal (2002) : (Acc C607-302A Auditing and Good Governance)Jericho Dupaya100% (2)

- PMM - Assignment (AutoRecovered)Documento16 páginasPMM - Assignment (AutoRecovered)phonemyint myatAinda não há avaliações

- Unlimited FundingDocumento46 páginasUnlimited FundingObrienFinancial88% (8)

- Journal Article Analyzes Pre-Announcement and Event-Period Private InformationDocumento25 páginasJournal Article Analyzes Pre-Announcement and Event-Period Private InformationKomang Aryagus WigunaAinda não há avaliações

- Stock Market CrashDocumento15 páginasStock Market CrashsdaminctgAinda não há avaliações

- Assessment 2 - Group ProjectDocumento4 páginasAssessment 2 - Group ProjectMoony TamimiAinda não há avaliações

- B042 Investment Law ICA-Rhea ShahDocumento14 páginasB042 Investment Law ICA-Rhea ShahRheaAinda não há avaliações

- Service Delivery Process - An Analysis Through Service Blueprinting at IL&FS Invest SmartDocumento37 páginasService Delivery Process - An Analysis Through Service Blueprinting at IL&FS Invest Smartsam_max_bladerunner100% (2)

- The Philippine Stock ExchangeDocumento23 páginasThe Philippine Stock Exchangetelos12281149Ainda não há avaliações

- Learningteam5 - 27474604 - 127156531 - Eatigo Guide Questions - Learning Team 5Documento4 páginasLearningteam5 - 27474604 - 127156531 - Eatigo Guide Questions - Learning Team 5Marcus McWile Morningstar100% (1)

- An Investor's Due DiligenceDocumento3 páginasAn Investor's Due DiligenceNamtien UsAinda não há avaliações

- Bcom 203Documento134 páginasBcom 203Dharmesh GoyalAinda não há avaliações

- Ecoworld International BHDDocumento3 páginasEcoworld International BHDAnonymous yeECki7hxAinda não há avaliações

- Indian Institute of Banking & Finance: Advanced Wealth ManagementDocumento13 páginasIndian Institute of Banking & Finance: Advanced Wealth ManagementMohitAhujaAinda não há avaliações

- Calculating Incremental ROIC's: Corner of Berkshire & Fairfax - NYC Meetup October 14, 2017Documento19 páginasCalculating Incremental ROIC's: Corner of Berkshire & Fairfax - NYC Meetup October 14, 2017Anil GowdaAinda não há avaliações

- The Fundamental Analysis of Indonesian Stock Return (Case Study: Listed Public Companies in Sub Sector Food and Beverage For The Period 2003 2012)Documento10 páginasThe Fundamental Analysis of Indonesian Stock Return (Case Study: Listed Public Companies in Sub Sector Food and Beverage For The Period 2003 2012)WENING RESTIYANIAinda não há avaliações

- Initial Public Offering (Ipo)Documento59 páginasInitial Public Offering (Ipo)Arun Guleria85% (40)

- SMEs - Key Differences Between Full PFRS and PFRS for SMEsDocumento17 páginasSMEs - Key Differences Between Full PFRS and PFRS for SMEsDesai SarvidaAinda não há avaliações

- Case Company Traveloka - RevisedDocumento2 páginasCase Company Traveloka - RevisedHendraAinda não há avaliações

- Chap 003Documento18 páginasChap 003van tinh khuc100% (2)